Is sick leave paid for individual entrepreneurs?

An individual entrepreneur pays insurance premiums to the Social Insurance Fund only for employees, and when they are not there, the individual entrepreneur does not interact with the Fund and is not considered an insured person. But what if the entrepreneur himself falls ill, is it worth waiting for monetary compensation for days of downtime?

An individual entrepreneur can receive hospital benefits for illness, as well as for pregnancy and childbirth, only after concluding an appropriate agreement with the Social Insurance Fund.

Temporary disability benefits are available to all citizens of the Russian Federation insured by the Social Insurance Fund.

After an individual entrepreneur enters into an agreement with the Social Insurance Fund and complies with all its conditions for payments and reporting for at least one year, he can receive benefits:

- Due to his illness;

- To care for a child or other relative in need;

- For pregnancy and childbirth.

Route. How to create a citizen account on the State Services portal

Before creating a “Personal Account” for an individual entrepreneur/legal entity on the “State Services” portal, the manager must register on it as a citizen and confirm his account.

1.

Register a simplified account.

Click the “Register” button on the main page of the “State Services” portal (on the blue background on the right). Enter your details: last name, first name, mobile phone and email address.

Click on the registration button and you will receive an SMS with a confirmation code.

2. Create a standard account.

Your user profile has become available to you. Fill it out - indicate SNILS and passport details. They will be checked by the Russian Federal Migration Service and the Russian Pension Fund. This may take from several hours to several days. But, as a rule, in practice the verification takes no more than an hour. A notification of its completion will be sent to you by email.

3. Account confirmation.

An account on the State Services portal can be confirmed in several ways.

- Personally. Take your passport and SNILS to the nearest Service Center.

- Online. The service is available to those who use Internet banking of Sberbank, Pochta Bank and Tinkoff Bank.

- By mail. Order to receive a confirmation code by mail.

How to draw up an agreement with the Social Insurance Fund

If an individual entrepreneur decides to enter into a contractual relationship with the Social Insurance Fund and voluntarily pay insurance premiums for himself, he will have to perform the following actions.

Step 1. Collect and provide a package of documents (copies).

- passport (photocopies of the first two pages);

- TIN;

- OGRNIP;

- extract from the Unified State Register of Individual Entrepreneurs.

You can transfer papers to the Social Insurance Fund in person; then, in addition to copies, you must take with you the originals of all documents. Or by mail, in which case the copies sent will have to be first certified by a notary.

Step 2: Receive notification.

It should arrive within a few days, on average 5 working days.

Step 3. Pay insurance premiums.

This must be done before the last working day of the current calendar year. Otherwise (if the full amount has not been paid by the end of December), the voluntary insurance contract will be cancelled. Even if the application was submitted in the middle of the year, you will have to pay for the entire 12 months from January to December.

If all contributions are made correctly, the agreement will come into force on January 1 of the following year. You can pay for the whole year at once or in installments - the entrepreneur has the right to choose the option that is convenient for himself.

Voluntary insurance premiums for entrepreneurs are calculated using the formula: minimum wage * 2.9% * 12. , where 2.9% is the insurance premium rate

Step 4. Reporting.

Submission of reports in Form 4a-FSS has been canceled since 2020. (see Order of the Ministry of Labor of the Russian Federation No. 213n dated May 4, 2016), therefore the individual entrepreneur no longer represents her.

What is the insurance premium?

The amount of the annual contribution to the insurance fund is directly dependent on the established minimum wage. Accordingly, it changes slightly every year and in each region.

From May 1, 2020, the national minimum wage was increased to 11,163 rubles. In some regions of Russia, this rate is even higher, since local authorities have the right to set it independently - they just cannot lower it below the all-Russian level.

How to calculate the amount of insurance premium based on the minimum wage

For this, a special formula was developed: minimum wage x TARIFF x 12 .

The tariff depends on the entrepreneur’s turnover. For individual entrepreneurs whose annual income does not exceed 300,000 rubles, the rate is set at 2.9%.

Accordingly, if an entrepreneur lives and works in a region with a standard minimum wage and receives no more than 300,000 rubles per year, he will have to pay a contribution in the following amount: 11,163 x 2.9% x 12 = 3,885 rubles per year .

The contribution can be paid in one lump sum for the entire year no later than December 31. But reporting in Form 4-FSS must be submitted every quarter, and no later than the 15th day of the last month of each reporting period. If you do not do this on time, problems may arise with sick leave payment.

How to get sick leave

To declare his intention to receive sick leave benefits, an individual entrepreneur must provide the FSS:

- Certificate from the clinic confirming temporary disability. The attending physician must issue it at the request of the patient; during hospitalization, the sheet is issued at the time of discharge.

- Application for payment of sick leave to the bank account of an individual entrepreneur. It is written in free form. In the application, you must refer to Federal Law N255, indicate the details of the individual entrepreneur, his full name, TIN, address, telephone number and the desired method of receiving benefits (bank account number).

- Copies of receipts for payment of insurance premiums.

Individual entrepreneurs' sick leave benefits are accrued within 10 days.

The doctor at the clinic begins filling out the form, the employer continues, and in our situation the individual entrepreneur himself (or with the help of an accountant). You must fill out the temporary disability form carefully. Gross mistakes may result in denial of benefits.

The basic rules are:

- Write in block letters with a black gel pen.

- Do not go beyond the fields.

- Don't make corrections. If the correction or mistake was made by the doctor himself, it is necessary to request that he issue a duplicate of the sick leave certificate. A document with an error may not be accepted - it does not matter who made the error.

- The full name of the entrepreneur is indicated in the “Employer” column. For a self-employed individual entrepreneur, this column will coincide with the patient’s name, and this should not cause any problems in the future.

It is necessary to apply to the Social Insurance Fund within six months after the end of sick leave, as well as the end of “maternity leave” or the child reaching the age of 1.5 years. Otherwise, it will not be possible to achieve payments. In rare individual situations, the period of permissible treatment may be extended.

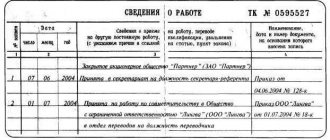

Filling out sick leave for individual entrepreneurs

Rules for filling out sick leave for individual entrepreneurs:

- To issue a temporary disability certificate for an individual entrepreneur, only a strict reporting form is used. A special form is intended to record cases of illness of both employees and entrepreneurs themselves.

- You can fill out the sick leave form only with a black pen (for filling out manually). Currently, medical institutions use the printing method (running the form through a regular printer).

- The text part of the temporary disability certificate must be filled out in block letters only.

- The name of the entrepreneur on sick leave will appear several times, in the columns for the name of the organization, recipient and manager.

Sick leave calculation

The amount of sick leave benefits for an individual entrepreneur, as well as for an employee, is largely dependent on the length of service. All periods when the citizen received contributions to the Social Insurance Fund are taken into account. It doesn’t matter whether he was in the status of an individual entrepreneur, a hired employee, or a military man.

| Experience | Benefit |

| Less than 5 years | 60% |

| 5-8 years | 80% |

| More than 8 years | 100% |

For calculations, it is not the individual entrepreneur’s revenue that is taken, but the minimum wage. From January 1, 2020, it is equal to 11,280 rubles.

Contributions for the previous two years are taken into account when calculating benefits. Therefore, if an individual entrepreneur made insurance payments for himself for the first time in January of the current year, and fell ill in March, he cannot apply for benefits.

Individual entrepreneur's sick leave benefit = (minimum wage * 24 / 730) * interest rate corresponding to length of service * number of days of incapacity for work, or divided by 731 if the billing year is a leap year.

If the employer pays part of the sick leave for an employee, then an individual entrepreneur who works for himself receives full compensation from the Social Insurance Fund.

When an individual entrepreneur is an employee

In practice, situations are possible when an individual entrepreneur not only conducts his own activities, but also works under a part-time employment contract. What happens to sick leave in this case?

| Situation | Payment of sick leave for individual entrepreneurs |

| The individual entrepreneur has been working part-time for three years and running his own business. He entered into an agreement with the Social Insurance Fund and makes insurance contributions for himself. At the same time, the employer also makes contributions for his employee. | An individual entrepreneur can receive sick leave benefits from two places at once |

| An individual entrepreneur works under a company employment contract and conducts his own activities, but does not pay insurance premiums for himself. | The individual entrepreneur receives benefits from his last place of work |

| For more than two years, the individual entrepreneur collaborated with the Social Insurance Fund and various employers | An individual entrepreneur can choose where to receive benefits (from self-contributions, or from the last employer) |

Child care benefits for individual entrepreneurs

The government has slightly different views regarding female entrepreneurs. And benefits, for example, maternity benefits, are formed based on a fixed rate, and not calculated using a formula. So, for those who regularly paid contributions, for one hundred and forty days of maternity leave there is a payment in the amount of 27,455 rubles.

There is also an increase in the amount if complications arise or several children are born. And if a female entrepreneur registers with an antenatal clinic before the twelfth week of pregnancy, she will be able to receive another one-time payment in the amount of 544 rubles.

Here, as we see, the situation with the profitability of payments is not so sad. Especially, for example, if a spouse is absent. Indeed, in this case, the opportunity to receive any income is temporarily deprived.

As you can see, filing a sick leave to receive payments from the Social Insurance Fund has its own subtleties, which every entrepreneur should think carefully about before actually filing a sick leave. Of course, there are cases when sick leave will be the only solution, and first of all, we are talking about the inability to receive income from other sources.

Sick leave for pregnancy and childbirth

This benefit is available to all pregnant women who have consistently made contributions to the Social Insurance Fund and have been registered there for at least a year. It is too late to enter into an agreement with the Fund and start making insurance payments after pregnancy, because you can only claim benefits next year.

The amount of “maternity leave” is calculated based on the minimum wage, and its minimum amount today is:

| Period | Sum |

| Maternity leave (140 days) | RUB 51,918.80 |

| Registration before 12 weeks of pregnancy | RUB 655.49 |

*Payments for early registration are fixed.

The payment may be increased if the pregnancy is multiple or has serious complications.

You can apply for sick pay for pregnancy no later than six months after it ends.

Why should an individual entrepreneur register with the FSS?

Registration with the Social Insurance Fund for an individual entrepreneur is purely voluntary. No one can force an individual entrepreneur to pay contributions to the Social Insurance Fund if he does not want to. But then you will have to endure sick leave on your feet or pay for tests and medications out of your own pocket. But during an illness, an individual entrepreneur falls out of business processes for a while, may suffer unexpected losses and lose speed in doing business. So compensation from the state in this case will be very helpful.

The amount of disability benefits, of course, is small and can serve as a pleasant bonus that will slightly brighten up painful everyday life, rather than as a full replacement for official income. However, it may well be enough to pay for tests and medications needed, for example, for a common cold or mild flu.

Thus, registering with the Social Insurance Fund is worthwhile for entrepreneurs who want to be able to calmly take sick leave and not think about how to endure an illness on their feet. In addition, women entrepreneurs who are planning a pregnancy should contact the Social Insurance Fund. Then they will be able to receive compensation for 140 days of maternity leave.