The second part of the article lists all types of passive income “as is”, “without water”. But first, forgive me, dear reader, a little poetry, a little about my personal experience of creating sources of passive income. I can't resist, sorry, please...

I first learned about the idea of passive income many years ago from Robert Kiyosaki’s book “Rich Dad Poor Dad,” I was immediately hooked on the idea, and since then I’ve been investing my hard-earned money in a variety of sources of passive income.

And guess what? It turns out that many types of passive income aren't really that passive after all. And some of them once almost ruined me. For example, I lost more than a million rubles trading shares.

In the end, I came to the conclusion that Kiyosaki, yes, needs to be listened to, but from a critical angle, and real passive income doesn’t really exist.

Passive income is a utopia.

It's like a perpetual motion machine or the elixir of eternal life. Like Aladdin's lamp, Tablecloth Samobranka or Goldfish.

But I talked about this in detail in the article “Passive income is a carrot for stupid donkeys.”

In this article we will talk about all kinds of passive income options. Well, all income options that can be considered passive.

I tried to collect here everything, absolutely every passive income idea. If I missed something, please write in the comments.

Well. Let's start from the very beginning.

Try index funds

Index funds allow you to earn income from investing in the stock market completely passively. For example, if you invest in a fund based on the S&P 500 index, your money will be invested in the overall market, and you won't have to worry about how to manage your money or whether to sell or buy shares of certain companies. All these points will be managed by the fund, which forms its investment portfolio depending on the state of a particular index.

You can also choose a fund that covers any index. There are funds involved in various business sectors - energy, precious metals, banking, emerging markets and others. All you have to do is decide for yourself that this is what you want to do, then invest the money and relax. From now on, your stock portfolio will run on autopilot.

Where can you invest to get passive income?

There are many investment options, and they all differ in the degree of risk and investment volume. Let's look at the most popular ones.

Bank deposit: any entry threshold

The good old bank deposit is the leader of passive income in Russia. Even a first grader will understand the income scheme. You keep the money in the bank, and he uses it for his needs. And as a reward for the service, it charges you interest.

Almost every citizen of our country has some type of deposit - most often with a minimum of 1-2% interest on the balance. If you want more, you will have to move towards the bank - deposit no less than the established amount and freeze it for a period of 6 months to several years.

Pros: Stability and reliability. Even if the bank goes bankrupt, the deposit insurance system will return you up to ₽1.5 million.

Cons: Low profitability. And if you withdraw the money ahead of schedule, you will lose interest. Here are the deposit conditions offered by the most popular bank in Russia, Sberbank, in mid-2020:

Something at the level of official inflation, and maybe even lower.

Promotions: any entry threshold

Over the years of the existence of stock exchanges, the purchase of shares has acquired a separate romantic aura. Films have been made and books have been written about Wall Street sharks. And no wonder. After all, by buying shares, you become a partner of large businesses and join a very interesting game.

Share income scheme: you give money to companies, they invest it in the business - you receive dividends as a reward for the service. In addition to dividends, you can receive income from the sale of increased shares if your companies are doing well.

Pros: Greater income from dividends than from deposits and other low-risk instruments. A chance to earn even more on a successful resale.

Cons: High risks. With shares, you need to keep your finger on the pulse at all times: if the company falls in price, goes bankrupt or reduces dividends, you will have nothing to object to.

Bonds: entry threshold ₽1000

Bonds are promissory notes issued by eminent borrowers. In this way, states, municipalities and large companies borrow from investors. A bond has a known maturity and a known yield to maturity.

Income scheme: you give a loan - it is returned to you along with interest. As with stocks, there is an opportunity to make money on the rise in the price of a bond by selling it ahead of schedule. Here's the yield on corporate bonds for comparison. Interestingly, by purchasing a Sberbank bond, you will receive a 2.5 times higher return than by putting money on deposit in the same Sberbank:

Let's look at the pros and cons of bonds:

Pros: Low risks of being left without income. For government bonds - almost zero. Opportunity to receive risk-free income +₽52 thousand per year deducted from IIS.

Cons: If we are talking about OFZs, then the yield on them is not much more profitable than the interest on the deposit. If we talk about corporate bonds, then in cases of bankruptcy of your debtor, no one will return the money. Bonds do not provide insurance.

Mutual funds: any entry threshold

A mutual fund is a fund that forms a portfolio of bonds, stocks and other assets with the money of private investors. others. You can buy a piece of a portfolio - it's called a share. This way you will become a co-investor of the fund, but no one will allow you to manage the assets.

Income scheme: mutual fund money is managed by professional investors - fund managers. If they get smart and increase the price of the portfolio, your piece also increases in price. You can sell your shares and make money. Some mutual funds, but not all, pay periodic income to shareholders.

Pros: Income can exceed your investment many times over if the fund managers do their job correctly.

Cons : You may lose some of your invested money if fund managers do not do their job properly.

Real estate: entry threshold from ₽500 thousand.

There are several ways to make money on real estate, even if you only have ₽1 million of free money. You can buy a new building for resale, a room or an apartment hotel room for rent. The income pattern needs no explanation.

Pros: Real estate most often increases in price. Or at least it doesn't fall much. It cannot depreciate to zero - there is insurance in case of an apocalypse.

Cons: High entry threshold. Plus, property maintenance requires constant additional expenditure of money, time and effort.

High-risk (venture) investments: entry threshold is ₽1 million, and it may not be enough

Venture Capital - You're looking for a company that can theoretically scale 10x to 1000x in 10 years with founders who plan to take over the world. You give her money at the start, while there is no money yet. Then you do not take part in management, but just wait.

Income pattern: somewhat reminiscent of pure luck, but with a dash of business analytics. In a great case, if you find a new Amazon or Facebook, in 5-7 years you will receive a share and provide for yourself until old age.

Pros: The most profitable way of passive income in the world. Thousands of percent of profits are real only in venture.

Cons: The most high-risk way to make money in the world. Every venture investor, giving money, is ready to never see it again.

Gold and precious metals: any entry threshold

It may come as a surprise to some, but gold is still an investment asset. Gold is a commodity that is traded on markets, just like currency. Gold mining is becoming more expensive every year. And prices are correspondingly rising slowly but steadily.

Income Scheme: You can earn recurring income from gold by investing in gold mining stocks or ETFs. Or grow money over the long term by buying gold in real commodity units.

Pros: Resistance even to financial apocalypse. Easy to sell at any time. Large selection of instruments tied to gold.

Cons: You will feel a significant increase in income in 10-15 years.

OFZ: entry threshold from ₽1000

Beginning investors are often advised to start with OFZs - federal loan bonds. Here you lend to the state, and it is almost guaranteed to return the money to you.

Income scheme. just like with regular bonds. Currently, about 40 types of OFZ are traded on the stock exchange. You can choose what you like and earn a little higher than the average deposit. The risks will be just as low.

Pros: High reliability and liquidity. OFZs are easiest to sell if desired. You can get a risk-free deduction for IIS of ₽52 thousand per year. Cons: Yield to maturity is around 5-7%, which is often lower than corporate bonds and stocks.

Make videos for YouTube

This area is developing very quickly. You can make videos of absolutely any category - music, educational, comedy, movie reviews - anything... and then post it on YouTube. Then you can connect Google AdSense to these videos, and automatic advertising will appear in them. When viewers click on these ads, you will earn money from Google AdSense.

Your main task is to create decent videos, promote them on social networks and maintain a sufficient number of them to provide yourself with income from several clips. Shooting and editing a video is not that easy, but once done, you will have a source of completely passive income that can last for a very long time.

Not sure you'll succeed on YouTube? Michelle Phan combined her love of makeup and drawing with video production, gained more than 8 million subscribers, and now launched her own company with a capitalization of $800 million.

Photo: Michelle Phan

Real examples and secrets

Let's look at 3 cases of how you can create a “passive” from scratch.

Example No. 1 . Marina V. bought a women's website on the telderi exchange for 900,000 rubles with a profit of 45,000 rubles per month. It costs about 8,000 rubles per month to fill the portal with new articles (about 20 texts per month) and the services of a content manager. Hosting costs 250 rubles per month. In total, her net liability is 37,000 rubles. In addition, as new content appears, traffic increases, as a result, profits grow by about 5-10% per month.

Example 2 . Dmitry S. On July 1, 2020, he invested 800,000 rubles in GAZPROM shares. He reinvested the dividends received into the purchase of shares. Over 3 years, his total profit amounted to 457,599 rubles.

Example 3 . Anatoly M. Invested 400,000 rubles in mutual funds of Sberbank. Over 1.5 years, the value of the share increased by 15%. After the sale of shares and payment of personal income tax (13%) and the management commission (1%), his income amounted to 44,718 rubles.

Example 4 . Alexey I. created a YouTube channel on automotive topics. He spent all his free time (weekends and evenings after work) creating new videos. As a result, in a year he managed to gain 200 thousand subscribers, and his videos receive 500 thousand views per month, which provides him with a “liability” of $520 from advertising, and the profit grows every month as the YouTube channel develops. The initial investment in the purchase of equipment for video filming cost 100 thousand rubles. The investment paid off in 3 months.

2 approaches to creating cash flow

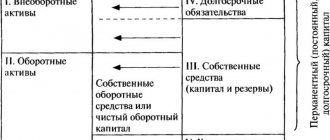

There is an opinion that earning passive income is possible without any effort. This is wrong. It is the result of correctly created assets. You must know where to invest your money. Regardless of the type of asset, there are only two ways to create it:

| Invest money | Invest your time and effort |

Having your own funds, you can always invest them in some business. Most often, investing doesn't require much effort on your part. Examples:

| But if you don't have the finances, you'll have to put in some effort to create assets. Here are examples:

|

Try Affiliate Marketing and Start Selling

This is a passive income technique that is more suitable for owners of blogs and active Internet sites. You can start promoting any products on your website and receive a fixed fee or a percentage of sales.

Making money this way is not as difficult as you might think because many companies are interested in selling their products in as many places as possible.

You can find partnership offers either by contacting manufacturers directly or on specialized websites. It is best if the advertised product or service is interesting to you or matches the theme of the site.

What kind of income can be called passive

The understanding of what passive income is was revealed to me by the parable about the plumbing from Robert Kiyosaki’s book “The Cash Flow Quadrant”. Since then, all I have been doing is creating such streams of money in my life.

Passive income is income that does not depend on daily activities. Such income includes interest on deposits, dividends, rental payments, affiliate commissions, advertising fees, royalties from sales of intellectual property and patents.

And active income is the payment you receive when performing some action or from selling your services.

There are hundreds of ways to earn money passively. Let me tell you in more detail using specific examples.

Make your photos profitable online

Do you like photography? If so, you may be able to turn this into a source of passive income. Stock photo sites like Shutterstock and iStockphoto can provide you with a platform to sell your photos. You will receive a percentage or flat rate for each photo sold to a website client.

In this case, each photo represents a separate source of income that can work over and over again. All you need to do is create a portfolio, upload it to one or more platforms, and that's where your active work will end. All technical issues of photo sales are resolved using the web platform.

Save money in a bank deposit

I created my first source of passive income when I was still working as an installer and receiving a salary of 20,000 rubles. I just started saving a small part of my active monthly earnings for a deposit in the bank. So I began to receive money every month, in the form of interest from my savings.

From the book you will learn how the world of profitable investing works.

Then this source seemed ridiculous and cheap, devoured by frightening inflation, but now it has turned into capital of several million, which brings tens of thousands of rubles monthly and is reinvested in more profitable instruments. The money started working.

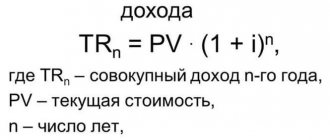

I recommend you read my article about the power of compound interest. You will learn how money can increase tenfold over time and turn into huge capital.

If, from today, you start putting aside 1,000 rubles each month at an interest rate of 7%, then:

| Time | Your investments | Total savings | Monthly passive income |

| After 5 years | 59 000 | 72 020,73 | 425,65 |

| After 10 years | 119 000 | 174 133,24 | 1 029,14 |

| In 20 years | 239 000 | 524 198,61 | 3 098,05 |

| After 40 years | 479 000 | 2 643 313,04 | 15 622,16 |

I think everyone can save 1,000 rubles a month and invest it in capital accumulation, even with a small salary and during a crisis. In the future, you will be able to invest part of the accumulated funds in more profitable areas at a higher interest rate.

Most of the methods that I will talk about next require financial investment, so if you want to create one, then start saving money.

Buy high-yield stocks

By creating a portfolio of high-yield stocks, you will receive a source of regular passive income with an annual interest rate that is much higher than the interest on bank deposits.

Don't forget that high-yielding stocks are still stocks, so there's always the possibility of capital overvaluation. In this case, you will receive profit from two sources - from dividends and return on invested capital. To purchase these shares and complete the appropriate forms, you will need to create a brokerage account.

Create an information site

Essentially, the site is the same as YouTube, only instead of videos you publish articles. Like the one you are currently reading.

Users find an article in a search, go to the site, read and sometimes click on an advertisement. The user received a solution to his problem, and the webmaster did not waste his time. Everyone is happy.

I have already talked more than once about ways to make money on the site and how it brings passive income around the clock.

Investments are minimal. To launch a website you will need less than 1,000 rubles. My course “How to create your own information website” will help you with this. Then all that remains is to regularly update it with articles. In a year or two it will begin to generate good profits.

Write a real book and get royalties

Just like writing an e-book, there's a lot of work involved at first. But when the work is completed and the book goes on sale, it will become a completely passive source of income.

This is especially true if you manage to sell your book to a publisher who will pay you a royalty on the sales. You will receive a percentage of each copy sold, and if the book is popular, these percentages can add up to significant amounts. Moreover, these payments can last for years.

Mike Piper of ObviousInvestor.com recently did just that. He wrote a book, Investing Plain, which was sold only on Amazon. The first book became so profitable that he created a whole series. These books collectively bring him six figures annually.

Why is it so important to have a stable passive income?

By creating sources of passive income, you can gain financial independence and absolute freedom: you can go on vacation whenever you want, or even sail around the world, enroll in fine arts courses, master playing musical instruments and learn a foreign language you like. Regardless of location and type of activity, money will continue to work for you and generate even greater profits.

Passive income will provide you with the life of your dreams and will allow you to break away forever from the “rat race” in which the majority of citizens of our country are forced to participate. As long as you only have active income, you get money when you do the work, and are left with nothing when you are unable or simply don't want to do it. In such a system, you yourself are the weakest link. For this reason, people who work in the hiring or freelancing system, as well as those who have their own business, very often think about sources of passive income.

Passive income gives you the opportunity to solve your financial problems and choose the lifestyle you want. Not only millionaires are capable of receiving such income: every person with an average salary can count on receiving passive income if he takes care of his future in time, chooses a strategy and works in accordance with it for several years. If you start working in this direction right now, you can soon become financially independent once and for all.

Depending on the strategies chosen, creating passive sources of income can take several months, and sometimes several years. Many people think that this is a long time for them. But do not forget that the age of human working capacity is approximately 35 - 40 years. When this time passes, people are left with the only source of income - a penny pension. It is wiser to spend several years creating a source of passive income than to find yourself on the brink of survival in 15–20 years.

Sell your own products online

The possibilities in this area are endless: you can sell almost any product or service. It could be something you created and made yourself, or it could be a digital product (software, DVDs, or instructional videos)

For trading, you can use a specialized resource, if suddenly you do not have your own website or blog. In addition, you can enter into a partnership agreement by offering goods to sites on relevant topics or using platforms like ClickBank (an American marketplace for selling digital information products - editor's note).

You can learn how to sell products online and earn quite a lot from it. This may not be completely passive income, but it is certainly more passive than a regular job that you have to go to every morning.

Where to buy a website with passive income

Of course, when you start to be interested in the topic of passive income, an idea comes to mind: why create it, you can buy passive income. You can buy a ready-made business or a website that generates income. Yes, you can! I've been through it all.

I'll tell you about the sites.

Before you buy a site with passive income, I want to warn you once again that free cheese only comes in a mousetrap.

If you yourself have not yet created and promoted websites, if you do not understand this, then it is better for you not to buy a website with income. Why? Because no one will sell a good website with constantly growing traffic and income.

Usually they sell sites with which the owner has failed, he does not believe in success and he himself does not want to do it anymore. 99% of websites for sale have hidden defects and problems that no one will directly tell you about.

In addition, keep in mind that if all the site traffic comes from Yandex and Google search, then Yandex and Google often change algorithms, and after the next algorithm change you may completely lose all traffic and income. Also, the site may be under a Yandex or Google filter, and no matter what you do, traffic from search engines will not increase, but will fall.

If you still want to buy a site, then you can buy a site with passive income here:

- Telderi,

- Flippa.

Telderi website is the largest in Russia and, it seems to me, the most convenient. On this site you can buy not only a ready-made website with income, but also a group on VK, a channel on Telegram, Instagram, and YouTube with subscribers. You can also buy the Yandex Zen channel there.

Flippa site is one of the largest sites for selling income-generating sites on the English-speaking Internet. But it is for those who know English.

Again.

I really don’t advise you to buy a website with income if you don’t understand this. As a last resort, contact me, and for a small fee I will help you assess all your risks when purchasing a site.

Invest in real estate

This method falls more into the category of semi-passive income, since investing in real estate involves at least a small level of activity. However, if you have a property that you're already renting out, it's mostly just a matter of maintaining it.

Additionally, there are professional property managers who can manage your property for a commission of approximately 10% of the rent. Such professional managers help make the process of receiving profits from such investments more passive, but they will take part of it.

Another way to invest in real estate is to pay off a loan. If you take out a loan to buy a property that you will rent out, your tenants will pay off that debt a little each month. When the full amount is paid, your profits will increase dramatically, and your relatively small investment will turn into a full-fledged program for quitting your day job.