How to create a portfolio that will consistently bring in money? Are you constantly worried about how to pay all your bills and have a large income? If so, then you should look into income investing.

This is a long-forgotten practice, but over the past twenty years the stock market has taught everyone that the only good investment is that if you invest ten dollars, you will get twenty. Although income investing is not widely accepted, the practice is still used in many of the offices of the most prestigious wealth management firms in the world.

To be successful in income investing, you must better understand the process, what types of assets may be considered suitable for those who want to follow the philosophy, and the most known risks that can derail an otherwise successful investment portfolio. At the very least, you need to be armed with some knowledge before approaching a broker.

Definition of income

Before we begin, let's define investing income so we have exactly an understanding of what it is. The art of earning good returns from investing involves a collection of assets, such as stocks, bonds, mutual funds and real estate, that generate the highest possible annual return with the lowest possible risk. Most of this income is paid to the investor so that he can use it in his daily life to buy clothes, pay a deposit, cover living expenses, contribute to charity or anything else.

Individual investment account - guaranteed 13%

Let us immediately make a reservation that this is not an investment product, but rather an investment instrument. However, it allows you to get real and quite high, relative to the market average, income, and therefore is worthy of consideration.

An individual investment account (IIA) is a special type of brokerage account. It appeared in Russia quite recently, in 2015, but in three years the number of open IIAs has already approached 300,000. Such high interest is due to government support for private investors who have opened IIAs. From the amount by which the account was replenished during the calendar year, you can return 13%. And this refund applies on an annual basis.

There are several restrictions:

- availability of paid personal income tax for the year;

- keeping funds in the account for 3 years;

- The maximum refund amount is 52 thousand rubles per year.

An individual investment account becomes much more attractive if the money is not just kept in it, but invested. IIS is the same brokerage account, and the person who opens it has access to the entire list of financial instruments: stocks, bonds, currency, mutual funds, complex investment proposals, derivatives. Even if the investor is as conservative as possible and agrees only to a risk-free rate of 7-8% per annum, then in total with a deduction of 13% the final return looks much more interesting.

How the social unrest of the 20th century gave birth to income investing

Despite the nostalgia of the 19th and 20th centuries, society was truly disordered. I'm not talking about the lack of instant news, video chats, on-demand music, convenience stores and modern cars.

What we're saying is that if you were Jewish or Irish most companies wouldn't hire you, if you were gay or lesbian you'd be sent to electroshock therapy, black men and women would face the constant threat of lynching mobs and violence, people believed that all Catholics are controlled by the Pope, and if you were a woman, you could not get a job that did anything more than type, for which you would be paid a fraction of the amount offered to a person for a similar job. Oh, and there were no Social Security plans or company pension plans, leaving the majority of older people living in extreme poverty.

What does this have to do with income investing? All. These are the circumstances that have led to the rise in equity investments, and when you dive into it, it won't be hard to see why.

For all but a small circle, decent paid labor markets were effectively closed. If you owned stocks and bonds in companies like Coca-Cola or PepsiCo, you received dividends and interest throughout the year based on the total amount of your investment and how successful the company was. That is why an iron rule appeared that as soon as money appeared, the only acceptable option was investing in income.

An example of calculating ROI using the formula

The above formula has sufficient flexibility, so the calculation can and should be detailed. In other words, ROI can be calculated:

- For a separate advertising channel (for example, Yandex Direct).

- For a set of promotion channels (for example, advertising on the Internet).

- For a single product (for example, a high-margin product).

- For a specific product category (for example, children's clothing).

For example, let's take an online store of large plush toys in Moscow, which sells plush Panda, Bear and Hare. For each product, Yandex Direct has its own advertising campaign. Subsequently, the number of orders for each of them was calculated. The data is presented below:

Substituting data on orders for the product “Panda” into the formula, we will calculate ROI :

ROI=(1000-600)*8/2670*100%=119.9%

The same goes for other products. As a result, despite the fact that the margin on the sale of Bears is higher, as is the number of orders, the advertising campaign “Search for a Bear” is on the verge of return on investment. But plush Pandas with the lowest margin showed the best results.

To calculate ROI, fixed cost and sales revenue were used, that is, the retail price of plush toys.

Each of you can make similar calculations and identify the strengths and weaknesses of certain types of advertising or products, especially since Direct now uses payment currencies: rubles, hryvnias, and so on. For all blog readers, I have prepared an Excel table with various formula options. After downloading, all you have to do is enter your data. The return on investment percentage will be calculated automatically. The file is uploaded to Yandex.Disk.

The widow's briefcase comes on stage

Previously, women were considered by society to be helpless without men. Until the 1980s, the "widow's briefcase" was popular. Bank officials used the widow's life insurance money from her husband's death to buy stocks, bonds, and other assets that would provide enough monthly income for her to pay bills, keep a home, and raise her children. In other words, the goal was not to get rich, but to do everything possible to maintain a certain level of income that would remain stable.

All this seems strange to us. We live in a world where women have careers just like men, and because of this they can earn very well. However, if a spouse died in the 1950s, women had little chance of earning the same income for the family. This is why income investing was a must. Those days are gone. After all, when was the last time you heard AT&T referred to as "widow's stock," which might very well have been its second name a generation or two ago.

Why does an investor need this?

Investment is not a magic wand that will constantly bring you profits without requiring anything from you. It is important that accounting should be constant, but control should not. Anyone can keep track of investments, even if you had big problems with math at school and you never remember how much money you have on your cards and in your wallet in the form of cash. In fact, there are 2 methods by which each of your investments will be under strict control:

- In writing - the old fashioned way in a notebook based on several formulas;

- Using special programs or a basic office Excel program, proprietary calculators of organizations or projects.

I would like to note that for the convenience of monitoring each investment and assessing its profitability, there is an investment portfolio on the GQ Blog Monitor, which allows you to assess the situation in detail and without unnecessary hassle and see how much you have earned for a specific period or with a specific project. At the time of writing, the services and simplicity of the crypto portfolio were experienced by 460 investors.

From my own experience, I can say that this is extremely convenient, since investments from various HYIPs are tied into it, plus you can also take into account work on the cryptocurrency exchange. And if you are new to this financial area, the material on the blog will help you familiarize yourself in detail with the intricacies of the work.

Don’t let money go to waste, but don’t control every penny. Money loves accounting, but it doesn't love fear. And not only fiat, but also cryptocurrency.

If you are a connoisseur of classical work with money, then it’s time to replenish your body of knowledge with certain formulas that will help you calculate in advance whether it is profitable or not profitable to invest in a project.

How much money should you expect from your investment portfolio?

The rule of thumb for income investing is that if you don't want to lose all your money, then you charge 4% on your annual balance. This is commonly referred to on Wall Street as the 4% rule.

Let's look at an example. If you manage to save $350,000 by retiring at age 65 (which would require only $146 per month from the time you turn 25 and earn 7% per year), you should be able to make annual payments of $14,000 without any money. That works out to a DIY retirement fund of about $1,166 per month before taxes.

If you're an average retired worker, you've received $1,346 in Social Security benefits as of 2016. Multiply by two and you have a monthly cash income of $2,512, or $30,152 per year. All other things being equal, an investment portfolio structured this way would be out of money whether you lived to age 67 or 110. By the time you retire, you probably own your own home. You can easily add another $5,000 or $6,000 to your annual income by doing a part-time job in the community.

If you're willing to risk money earlier, you can speed up your withdrawal. If you doubled your withdrawal rate to 8% and your investment earned 6% with inflation at 3%, you would actually lose 5% of the account's value per year in real terms. This will be exaggerated if the market crashes and you are forced to sell investments when stocks and bonds are low. However, over 20 years you can withdraw between $500 and $600 per month compared to only $300 today.

For deposits

This may sound sad to some, but it is also necessary to pay income tax on the income received from the deposit. True, there is one small but very important subtlety in this matter: you will have to pay tax only on income received from a deposit of more than 1 million rubles. That is, if the amount in the deposit account does not exceed 1 million rubles. and amounts to, for example, 800 thousand rubles, you will not have to pay tax on the interest received.

It should be noted that this measure will only take effect in 2021 and you don’t have to worry about it for now.

There is one more detail that should not be forgotten. If the deposit rate exceeds the key rate of the Central Bank of the Russian Federation by five or more points, then the tax rate will already be 35%. Considering the size of the key rate (6.25-6.5%), we can safely assume that deposits with such a yield are not found in our country. Therefore, only a very rare “lucky” person will have to pay tax at this rate.

The situation is similar for foreign currency deposits. To the delight of all investors, no tax will be charged on exchange rate differences, regardless of its impact on the amount. The return on the deposit is calculated daily, minimizing the error of currency rate fluctuations. The 35% rate applies to those deposits where the current rate exceeds the key rate by 9 points. Considering the size of deposit rates in foreign currency, a personal income tax of 35% can be considered something bordering on fantasy.

What types of investments are best to keep in an income portfolio?

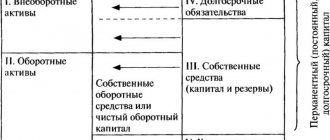

When you build your investment portfolio, you will have three major sources of potential investments.

- Dividend Paying Shares: Includes both common stock and preferred stock. These companies pass on a portion of their profits to shareholders based on the number of shares they own. You want to choose companies that have safe dividend payout ratios, meaning that they only distribute 40%-50% of annual profits, reinvesting the rest back into the business to keep it growing. In today's market, a dividend yield of 4% to 6% is generally considered good.

- Bonds: Your choices when it comes to bonds are extensive. You can own government bonds, agency bonds, municipal bonds, savings bonds, etc. Whether you buy corporate or municipal bonds depends on your personal taxable equivalent yield. You shouldn't buy bonds with maturities longer than 5-8 years because you have lifetime risk, which means bonds can fluctuate wildly like stocks in response to changes in interest rates controlled by the Federal Reserve.

- Real estate: You can rent or invest in real estate yourself. Real estate has its own tax rules, and some people are more relaxed about it because it naturally protects you from high inflation. Many investment portfolios have a heavy real estate component because the tangible nature allows the people living in the investment portfolio to manage the property, see that it still exists, and even if the market falls, they still own the property. Psychologically, this can give them the necessary peace of mind to hold on and stick to their financial plan during turbulent times.

Let's take a closer look at each category to get a better idea of the appropriate investments for investment-investment portfolios.

From foreign exchange transactions

Transactions with currency belong to one of the subtypes of property transactions. Therefore, they are subject to an income deduction, and if they own the currency for more than 3 years, it is not subject to tax.

It is important to know that for foreign exchange transactions the investor himself is the tax agent, so he must declare income independently. Despite a possible fine and even criminal liability (if income exceeds 600 thousand rubles), many investors continue to ignore the need to submit reports, for which they are most often held liable.

What to Look for in Dividend Stocks for Income

Personal investment portfolios should include dividend stocks that have several characteristics:

- The dividend payout ratio is 50% or less and the rest is returned to the company's business for future growth. If a business pays out too much of its profits, it can harm the firm's competitive position. According to some academic studies, the credit crisis that occurred between 2007-2009 and changed Wall Street forever could have been avoided if banks had lowered their dividend payout ratios.

- Dividend yield from 2% to 6%. This means that if a company has a share price of $30, it pays a dividend for the year of between $0.60 and $1.80 per share.

- The company must have earned positive income without losses every year for the past three years, at a minimum. Income investing is about protecting your money, not hitting the ball out of the park with risky stock picks.

- Proven track record of dividend growth. If management is shareholder friendly, they will be more interested in returning excess cash to shareholders than in expanding their empire, especially in companies that don't have much room for growth.

- High return on equity, or ROE, with little or no corporate debt. If a company can earn a high return on equity with little or no debt, then it is a better than average business. This can provide more cushion against a recession and help track ongoing dividend payments.

What does “risk-free investment” mean?

Risks can only be understood as the probability of losing the initial capital or part of it, or it can be understood as the probability of not making a profit while maintaining the safety of the invested amount. Depending on this, the list of financial instruments suitable for an investor may differ.

“Risk-free investments” are characterized by:

- guaranteed profit, usually at a fixed level;

- high liquidity of the asset or assets underlying the investment;

- low or average profitability.

There is a concept in finance - the risk-free interest rate. This is the level of profit that can be achieved through a financial instrument with zero risk or through an asset with the highest degree of reliability (the risk of bankruptcy of such an asset is minimal).

The risk-free rate can be considered as a reference point by most private investors, bearing in mind that if an investment portfolio assumes a return below the level of this rate, then such a portfolio is ineffective.

There are several ways to calculate the risk-free rate, but for national currencies they usually use calculations based on the key rate, the yield on deposits, or the yield on securities issued by the government.

Bonds in the investment portfolio

Bonds are often considered the cornerstone of income investing because they typically fluctuate much less than stocks. A bond provides money to the company or government that issues it. The potential return on bonds is much more limited, but in the event of bankruptcy there is a greater chance of recouping the investment.

This doesn't mean bonds are risk-free. In fact, bonds have a unique set of risks for income investors. When choosing, you should adhere to the following rules:

- The choice should include bonds such as municipals that offer tax advantages. To learn more, read the safety tests for municipal bonds, which will explain some things that will be helpful in choosing individual bonds for your portfolio.

- One of the biggest risks is something called connection duration. When building an income investing portfolio, you shouldn't buy bonds that take more than 5 to 8 years to mature because they could lose value if interest rates rise sharply.

- It is also necessary to avoid using foreign bonds as they pose real risks if there is no understanding of the currency.

- Calculating the percentage of a portfolio to invest in bonds requires following an age-old standard, which, according to Burton Malkiel, famous author of "Random Street Down Wall Street," is the age of the buyer. If the investor is 30, then 30% of the portfolio should be in bonds.

For bonds

Tax calculations for bond transactions are even more interesting. Each situation has its own system. Moreover, for the first two cases, holding bonds for a period of more than 3 years exempts investors from taxation.

- If the bonds were purchased at a cost below par and were held in hand until maturity, then the tax base will be the amount of the difference between the purchase price and the redemption amount at par.

- If the bonds were purchased at a price below par and were sold before maturity, then the tax base will be the difference between the purchase and sale prices, taking into account the accumulated coupon income.

- If coupon income on a bond was received, then the tax will be calculated from its amount. It is worth considering that it is withheld even before the coupon is paid out.

There are bonds that are completely tax exempt. These include: OFZ and corporate bonds (if the rate on them does not exceed the key rate of the Central Bank of the Russian Federation + 5 points). To be fair, it is worth noting that the profitability of the listed securities is not very high.

How Real Estate Can Help You Double Your Withdrawal Rate

Real estate can be an excellent investment for those who want to earn a regular income. This is especially true if you are looking for passive income that will fit into your investment portfolio.

The main choice is whether to buy real estate directly or invest through a REIT, which is not an option for trust in real estate investing. Both have their advantages and disadvantages, but each can have a place in a well-constructed investment portfolio.

One of the main advantages of real estate is the comfort of using debt; you can dramatically increase your withdrawal rate as the real estate itself will keep pace with inflation. This method is not without risk, but for those who know their local market, can value the home and have other income, cash savings and reserves to protect it, if the property remains vacant for an extended period of time or loses value, it is possible to effectively double the volume monthly income.

If real estate offers a higher return on investment, why not just go 100% into the property?

This question is often asked when people see that they can double or even triple the monthly cash flow they earn by buying real estate instead of stocks or bonds, using bank mortgages to purchase more houses, apartments or land than they could otherwise afford. .

3 reasons not to invest all your money in real estate:

- If the real estate market declines, the losses are amplified by leverage.

- Real estate requires more work than stocks and bonds due to claims, maintenance, taxes, insurance, etc.

- On an inflation-adjusted basis, long-term stock price growth has always distorted real estate.

Investments with risk, but with the possibility of high income

Despite the relevance of risk-free projects, sometimes it is worth taking a risk and earning more. The percentage of risk on different projects varies, but can guarantee not only saving money, but also increasing it.

Digital projects

Most companies invest in technology, training and new methods. However, return on investment requires a comprehensive, focused approach. Understand the risk associated with developments and invest in what you will need to succeed in the future.

Take a broader view of processes, technologies and work styles, and develop a technology, infrastructure and people roadmap that allows for flexibility and agility over the next few years.

The national project “Digital Economy” plans to attract private investment in “end-to-end” digital technologies in Russia:

- in 2020 they should be at least 50 billion rubles;

- by 2022 - at least 120 billion rubles.

The Deputy Minister of Digital Development, Communications and Mass Media of the Russian Federation believes that achieving these indicators is realistic. “Most of the support measures in the program directly provide for co-financing of projects for the implementation of ready-made solutions from businesses in the amount of 50 percent.”

The provided support measures also include preferential lending. “Here, for 1 budget ruble we plan to receive up to 10 extra-budgetary rubles,” he clarified.

Venture funds/investments (startups)

Venture capital (VC) is a special type of direct investment.

Venture capital funds invest in projects in the early stages of development that promise to grow quickly. Because the market is not yet obvious, 7 out of 10 startups usually fail. Unlike PEFs, for a venture fund, write-offs (complete or significant loss of money) are par for the course.

Venture capital is capital provided by investors for various companies. As a rule, investments are made at the very first stage of the organization’s formation, and this stage is considered promising, but high-risk, since no one knows whether the product will be successful or will remain unnoticed in the market.

Investment capital is usually attracted by startups. Such companies have no collateral for loans, they have no history, and the only option for them to raise funds is a venture. An alternative could also be:

- ICO;

- crowdfunding.

ICO is usually used to invest in projects based on blockchain technology. Such startups also have risks, and quite large ones at that.

Blockchain is an information system in which data storage devices are not connected to a common server; the database stores an ever-growing list of ordered records (blocks).

In 2020, the Russian venture market grew in volume: according to DSight and E&Y, investments in startups exceeded $868 million. But in 2020, the industry is likely to decline: due to the pandemic, which has paused many business processes, investment activity has also decreased.

Mutual Funds and PAMMs

UIF (Unit Investment Fund) operates at the expense of investments (investments) of shareholders. Shareholders, who are also members of the fund, invest money under certain conditions and make subsequent profits.

A PAMM account is one of the types of managed trading accounts on Forex, where the managing trader has the opportunity to use attracted funds from investors in trading.

If you invest money in mutual funds in a normal management company (and there are quite a lot of them), then the only risk you have is the possibility of a fall in the value of the share. In the long term, the value of any share increases.

In the case of investing in PAMMs, finding a normal management company is quite difficult - due to the lack of Russian legislation in this area of money management. Risks:

- you have to invest money in foreign management companies;

- there is a possibility of the account being drained - this means that after the actions of the manager, the amount of money in the account may significantly decrease, or the account will be completely reset.

Key points you should pay attention to in order to choose the best PAMM accounts of 2020:

- Account age. The longer the better.

- Drawdowns, balance curve. Nothing strengthens faith in success more than a smooth, systematic increase in the amount of money in your account.

- Profit.

- Conditions: investment amount;

- minimum investment period;

- manager's share;

- agent fees.

Microfinance organizations (MFOs) and crowdlending

During 2020, rates on the MFO market continued to fall, following the key rate of the Central Bank, the profitability of bank deposits and other financial instruments. Although a year ago experts predicted that rates would likely increase across the board—a surge in inflation was expected due to the VAT increase.

The surge did indeed occur, but it was not strong and short-lived. At the beginning of 2020, inflation, according to preliminary data from Rosstat, fell to 3%. And along with it - the profitability of various ruble investment instruments.

According to the index of profitability of investments in MFOs, which is calculated by the portal MfoGuru.com, by the beginning of 2020, the average maximum investment rate in MFOs fell by almost 1.5% points - to 17.68%.

Some companies have in principle suspended accepting investor funds:

- FastMoney;

- MFC "Vzaimno", etc.

And others set prohibitive rates at the level of 13-14% per annum “dirty”:

- Mig Credit;

- Money Man;

- Creditech Rus;

- Before Salary.

Another part of the companies with high rates dropped out of the race due to exclusion from the MFO register:

- Money Fanny;

- Credit 911;

- City Savings Bank;

- Greenmoney.

Some - because they decided to downgrade their status to a microcredit company, which by law does not have the right to work with private investors - this is what Platiza did, for example.

Investing in Structured Programs

In simple terms, structured financial products are a ready-made investment portfolio, one part of which (the protective part) is always larger than the other. The choice of strategy determines the proportion in which these parts will be distributed and how risks are diversified.

There are programs with a guarantee of full return of the initial capital (however, not a single program will protect against exchange rates or inflation).

For example, 10% falls on assets such as a stock, option, index, currency (underlying asset), and the rest is invested in bonds or a deposit with a fixed return of 10%. There can be a huge number of combinations.

When investing in a joint venture, it is important to consider the two most important components - the profit sharing ratio and the level of capital protection. These parameters are related to each other: the higher the CG (participation coefficient), the higher the level of risk.

Investing in cryptocurrency with hedging

Cryptocurrencies are unusually volatile financial assets. This is to the advantage of the trader, since the high amplitude of price fluctuations creates maximum opportunities for concluding profitable transactions. Earning money on bitcoins can be done in several ways:

- mining;

- trading futures, options on BTC coins;

- purchasing binary options on cryptocurrencies;

- raiding with cryptocurrency pairs on Forex.

Strategy for making money on Bitcoins:

- Distribute your investment capital into several parts, depending on how many financial assets you plan to use.

- Launch the trading terminal , and then open the charts of two currency pairs, for example, EUR/BTC and BTC/USD. You can use not only these pairs, but also other assets that include cryptocurrencies: Ripple, Ethereum, Litecoin, etc. The number of available coins largely depends on the broker with whom the investor cooperates.

- Open trading operations for two selected financial assets. Remember that you can make money both on the fall and on the rise of Bitcoin.

EURBTC quotes are sliding down, but at the same time BTC/USD is growing, close the losing trade, and gradually move the profitable position to a break-even position. Trading cryptocurrencies on Forex is a more profitable way to earn money than buying Bitcoins on the exchange.

Currency trading on Forex is a speculative type of earnings on Bitcoins; investors have a real chance to maximize profits and expand their deposits in a relatively short period of time.

By purchasing cryptocurrency at a low price on the exchange, investors hope that they will be able to sell Bitcoins at a higher price in the future. This is a long-term investment that requires huge investments and a lot of time.

Starting a business

Investments in business are one of the most common options for obtaining a stable flow of money. There are a lot of directions to choose from; the investor’s task is to choose the most profitable and effective one, which is sometimes quite difficult to do.

There are many investment options. According to experts, even by investing a small amount in a potentially profitable project, you can stay in the black. Small deposits can guarantee significant income in case of correct calculations and qualitative growth of the company in the market.

But the risks do not go away. A businessman is forced to fight for the existence and development of his “brainchild”.

Forex

Advantages of making money by investing in Forex:

- Ease of investing. To start earning money, just a few dollars are enough. USA, no licenses or large start-up capital required.

- Choice. You can invest money in dozens of currency pairs, cryptocurrencies, securities and stock indices, and commodity assets. Withdraw profits at any time.

- Availability. You can earn money anywhere in the world, at any time of the day or night (except weekends). All you need is stable internet, a reliable broker and knowledge. And if you have not yet chosen a broker, then take a look at the IAFT rebate service page, where you will find a list of TOP brokers who offer their clients optimal trading conditions.

- Active and passive income. Dozens of technical and fundamental analysis tools are available to you for free. Do you want to earn passive income? Invest in social trading, PAMM accounts, create an affiliate network or invest in trading advisors who will earn money themselves.

Invest your money in professional traders who have been showing stable profits for several years now.

The Role of Savings in an Income Investment Portfolio

Remember that saving money and investing money are two different things. Even if you have a widely diversified portfolio of investments that brings in a lot of money each month, it is important to have enough savings in FDIC accounts that are insured in the event of an emergency. The amount of cash you have will depend on any fixed payments you have, your level of debt, your health and your liquidity outlook.

To begin to understand this requires starting with saving and investing, and then keeping track of how much needs to be saved? To fully appreciate the importance of a savings plan to complement your cash portfolio.

ROI Formula (calculation of return on investment)

There are several formulas for estimating the ROI index.

Let's start with the simplest and most popular one, which is used by most internet marketers and online business owners. It can also be used for Yandex Direct: ROI=(income - cost)/investment amount*100%

By subtracting the cost from the profit, we get the final profit, that is, our real earnings. The ratio of the final profit to the amount of investment shows how many times the former is greater than the latter. For convenience, in the last step we multiply by 100%. If the resulting number is less than 100, then the investment does not pay off. If we add the period to the previous calculation , we get the second calculation formula, which is used by financiers:

ROI(period)= (Amount of investment by the end of the period + Income for the selected period - Amount of investment made) / Amount of investment made

To be precise, this formula calculates the return over the period of ownership of the asset. By applying the calculations in practice, you can find out how much the volume of cash deposits has grown by the end of the period under review.

Since you and I need to calculate Return On Investment in the direction of medium and small businesses, the two formulas given above will be sufficient. We will talk exclusively about the return on investment for online advertising, in particular Yandex Direct.

Next I will show an example of calculation using the first formula.

What allocation should you consider for an investment portfolio?

What percentage of an investment portfolio should be divided among these asset classes (stocks, bonds, real estate, etc.)? The answer comes down to personal choice, preference, risk tolerance. Asset allocation is personal.

The simplest allocation of investments to investments would be:

- 1/3 of assets in dividend payments that meet the criteria;

- 1/3 of assets in dividend payments that meet the criteria;

- 1/3 of the real estate assets, most likely in the form of direct ownership through a limited liability company or other legal structure, to protect yourself if sued. You can use this portion of your portfolio as a 50% down payment and borrow the rest on top so you can essentially own double the property.