Companies that have decided to expand the scope of their own commerce may need help in implementing the work by opening divisions - a branch or representative office, for example, within another constituent entity of Russia. It pursues similar goals that serve the same purpose as the main campaign. Mainly, a separate division is endowed with a list of functions of the parent company, and in some cases partially. This is exactly how the regulations of the Civil Code of the Russian Federation are positioned.

- Application for registration of another separate division in form S-09-3-1

- Method 1: divisions do not have their own balance sheets

Based on the positions of the Tax Code, the Civil Code of the Russian Federation differs significantly. The Tax Code of the Russian Federation has identified both branches and representative offices, exactly like the OP. According to the legislation of the Tax Code of the Russian Federation, companies are obliged to register all new structures, according to their location. The term OP can be easily found in the regulations of the Tax Code of the Russian Federation. Often these are structures of organizations that differ in their place of residence from the head legal address. OPs will be able to be formed in other subjects of the country, cities or district urban districts belonging to another municipality. The key condition for recognizing structures as separate is the presence in them of at least one stable branch. An important condition is the presence of organized activities for a period of more than 1 month.

For a clear example, you need to look at the list of similar structures that have many divisions located in various constituent entities of Russia, as well as in various areas, but in one suburb, for example:

- retail food chains;

- financial structures.

OP can vary, and it is created for a variety of activities. But the process of re-registration under the Civil Code of the Russian Federation and the Tax Code of the Russian Federation is distinctive. According to the Civil Code of the Russian Federation, only structures of branches or representative offices can register, and according to the Tax Code of the Russian Federation - all separate divisions (mainly according to the location of property assets, and also according to the location of the cash register machine). For the tax authorities, the corresponding messages that, for example, a cash register or an immovable object are located within their territories will be enough. In general, this approach allows for tax control. If the owner of an enterprise intends to register an enterprise under the Civil Code of the Russian Federation (under the guise of a branch or representative office), then it is important for him to prepare for full re-registration in accordance with the current regulations. This means that you will need to use a comprehensive step-by-step guide that is associated with the registration actions of the OP in 2020.

What is the difference between a branch and a separate division?

The launch of structures for carrying out economic work is regulated in Article 48 of the Civil Code. Most legal entities that have current re-registration in the Russian Federation have the right to open their own representative office or branch, endowed with the necessary rights, property objects and ensures work in accordance with the law with approved regulations and data entered into the state register.

Before moving on to the differences between branches and separate divisions, it is necessary to look at the definitions.

According to the laws:

- structures of representative offices are territorial, remote OPs that imply the interests of the legal entity and ensure its security;

- branch structures are OPs of legal entities that are located at a distance from the main organizations on territorial grounds. They perform functions or certain tasks, and can be positioned as representative offices;

- separate divisions are those remote from the main organizations on territorial grounds - any divisions where SRMs are created for a period of more than 1 month.

If we comply with the Tax Code of the Russian Federation, then OPs must be recognized as geographically remote structures with the condition of being equipped with SRM (we are talking about stationary workplaces). Now, it is necessary to find out how the structures of branches differ from separate divisions, and what common features are characterized in the presented structural units of organizations?

Now, you should look at a detailed table of the differences between branches and separate divisions.

| Characteristics | Branches | Representative offices | OP of simple types |

| Functionality of departments | Providing all or partial functions of parent enterprises, including representation. | Representation, as well as protection of the interests of parent companies. | Remote fulfillment of labor obligations by specialists in accordance with the employment agreement. |

| Business Law | It is allowed to carry out commercial activities. | Commercial activities are not permitted. | Only mutual labor cooperation and commercial activities are not allowed. |

| Responsibilities for notifying the Federal Tax Service about the launch | Not provided. | Excluded. | It is important to send a notification to the Federal Tax Service within 1 month from the date of launch of the OP. |

| Responsibilities for making changes to the Unified State Register of Legal Entities | It is necessary to enter information about the branch into the state register. | It is necessary to enter information about the branch into the state register. | There is no need to enter information on the SRM into the Unified State Register of Legal Entities. |

| Regulations for the creation | The owners need to make a decision on the parent enterprises to launch branches. | The owners need to make a decision on the parent enterprises to launch representative offices. | The executive bodies of the parent enterprises are required to make a decision in accordance with the order on the creation of an OP under the guise of the SRM. |

| It is allowed to conduct independent accounting | It is allowed to carry out accounting jointly with the parent enterprises or in an independent form. | It is allowed to carry out accounting separately or jointly with the main organizations. | It is not allowed to carry out accounting; the balance sheet must be formed in a general form by the accountants of the parent enterprises. |

| It is allowed to open an account in banking institutions independently | It is allowed to open an account in banking institutions. | It is allowed to open an account in banking institutions. | It is not allowed to open separate current accounts. |

| It is allowed to independently conduct settlements with employees | It is allowed to ensure the issuance of remuneration to personnel “on the ground”. | It is allowed to ensure the issuance of rewards. | It is not allowed to provide settlement under employment agreements. |

Among the three available forms, branches are vested with the highest level of authority, followed by company representative offices, and ordinary representative offices that have at least one SRM close the chain. Determining the optimal selection of OP will directly depend on the specific task. You should consider a list of features for all forms inside a detailed table.

Before choosing your own branch structures or OPs, it is important to determine a list of goals and objectives. Opening an OP is the simplest procedure, which means that the list of rights of such structures is much lower than that of a branch or representative office.

What should a separate division be like for an organization to have the right to the simplified tax system?

Article 346.12 of the Tax Code of the Russian Federation prohibits the use of a preferential simplified taxation system for organizations that have branches (the requirement for the absence of a representative office has already been abolished). Of course, the question arises - how to register a separate division so that it is not recognized as a branch, and at the same time the organization retains the right to the simplified tax system? To understand this, you will have to refer to the provisions of three codes: Tax, Civil and Labor:

- The Tax Code (Article 11) gives the concept of a separate division of an organization as “... any territorially separate division from it, at the location of which stationary workplaces are equipped.” However, the Tax Code of the Russian Federation does not provide a description of the types of separate divisions.

- The Civil Code (Article 55) characterizes a separate division only in the form of a representative office and a branch . That is, from these provisions it is also unclear what other separate divisions, besides a representative office and a branch, can be.

- The Labor Code (Article 40) indicates that “... a collective agreement can be concluded in the organization as a whole, in its branches, representative offices and other separate structural units .” Thus, only here can one see that separate divisions can be something other than a branch and representative office.

As a result, we are dealing with some elusive concept of another separate division, therefore, when creating such a division, we must simply avoid the criteria that characterize it as a branch or representative office. These characteristics in the law are more than meager:

- a representative office is a separate division of a legal entity located outside its location, which represents the interests of the legal entity and protects them;

- a branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of representative offices;

- representative offices and branches are not legal entities, and information about them must be indicated in the Unified State Register of Legal Entities, and therefore in the organization’s charter.

It is no coincidence that we understand this issue in such detail, because non-compliance with these requirements (sometimes implicit) can deprive an organization of the opportunity to work on the simplified tax system, and unexpectedly. For example, the manager believes that the created separate division is not a branch, so the organization continues to work on a simplified system, although it no longer has the right to do so.

In such cases, the organization will be recognized as operating under the general taxation system from the beginning of the quarter in which a separate division with the characteristics of a branch was created. And the loss of the right to simplification leads to the need to charge all general taxes: profit tax, property tax, VAT, and it is with the latter that the most problems can arise. VAT must be charged on the cost of all goods, works and services sold for the current quarter, and if the buyer or customer refuses to pay it additionally, then the tax will have to be paid at their own expense.

Package of documents for registration of a separate division

Let's say the organization decided to create an OP. Before starting the registration procedure, owners will need to ensure the preparation of a list of certain document flow.

At this point, the company owner needs to take the following actions:

- Decisions on the launch of separate structures are made by the organization’s management committee - boards of directors, observers, and shareholders.

- According to this decision, the management committee provides, under the guise of a protocol, and issues the necessary decrees to open the structure of the unit.

The decrees show:- names of launched structures;

the purposes of their opening, for example, documented minutes from shareholders (with numbers and dates);

- location of structures;

- management personnel who are appointed and removed from positions by the decision of the relevant management committees of the company's head office, for example, the verdict of observers, as well as shareholders;

- information on delivery dates for registration of structures.

- Based on the order, an internal local act is created - Regulations on separate structures (branches or representative offices).

They fix:- the level of legitimacy and rights of newly created structures;

type of work;

- functionality;

- administrative apparatus;

- other thematic aspects.

- In addition, orders are grounds for making amendments to constituent documents for branch and representative structures.

They can be formatted as:- special documentation that must be attached to already regulated charters or founding agreements, for example, edition No. 1;

newly created edition of the constituent documentation.

The documentation package must be signed by the management of the main organizations.

Once the necessary documentation has been collected, you should move on to the next stage.

Can an individual entrepreneur have a separate division not provided for by law?

Another sign of a separate division of an organization is the presence of jobs created for a period of one month or more. Such places must be stationary. The absence of appropriate places indicates that a separate division has not been created by a legal entity.

For individual entrepreneurs, no rules have been established for the isolation of commercial activities in any form.

In this regard, an individual entrepreneur is free from legislative regulation in this area. Consequently, a private businessman has the right, at his discretion, to create any structures and workplaces in any location and for any period of time. At the same time, he can call such structures whatever he wants.

For example: “Representative office of IP Smirnova A.A. in Ryazan" or "Rostov firm IP B.B. Shubina."

The scope of activity and scope of powers of such a division (within the framework of the legislation of the Russian Federation) depend solely on the will of the individual entrepreneur.

Such a division of the entrepreneur will be regulated by the relevant legislation upon the fact of carrying out activities in a specific area. But from the point of view of the law, this will be the activity of an individual entrepreneur, and not a separate structural unit.

Registration of a separate division in 2019-2020: step-by-step instructions

Legal entities are required to report the launch of separate structures to the tax authorities within a period of up to 30 days as soon as the relevant approvals have been accepted, for example, from the date of the meeting at the meeting of shareholders. Based on the legislation, newly created structures are obliged to go through the stage of becoming registered with the tax authorities and be entered into the state register of the Unified State Register of Legal Entities.

The tax service carries out registration actions of the OP. Owners apply to those tax inspectorates to which their units belong, according to territorial characteristics (municipalities).

In order to successfully re-register branches or representative offices with the tax inspectorate, you must ensure that documentation is submitted according to the list below:

- copies of decisions of bodies for management and creation of EP;

- copies of the approved provisions on the OP;

- copies of constituent documentation and their amendments (special documents or new edition);

- supporting documents on state registration of the main organizations;

- copies of orders on reassignments to management personnel, which include the chief accountant of the newly opened structures;

- copies of payment orders or bank statements indicating that the state duty for state registration has actually been paid, and payment documents are certified by the appropriate seal and signature of the owners of the credit institution;

- extracts from the Unified State Register of Legal Entities for major organizations;

- applications for re-registration with amendments using forms P13001 (for adding amendments to the charters), as well as P13002 (for amendments to the Unified State Register of Legal Entities).

The listed copies of documentation must be certified by a notary. If the OP conducts direct work on rented premises, then it will be necessary to ensure the availability of an appropriate copy of the agreement on the rental premises. It is allowed to submit documentation in electronic formats through the necessary communication channels as a scanned copy. In such a situation, they are required to be certified with digital confirmations in electronic format.

The re-registration procedure is carried out by tax authorities 5 days after the documentation package is presented or sent to the north through interactive services. Documentation that will confirm the registration of units will receive a message from the owners.

During the registration period, the OP will not be assigned a TIN, but a code with the necessary reasons for formation (KPP) will be issued. In documentation, divisions will begin to use the TIN of the main organizations. However, they will not be considered individual legal entities.

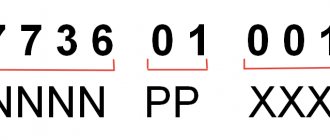

Application for registration of another separate division in form S-09-3-1

The applications themselves require forms on single sheets. Representatives of organizations will not have any difficulties during the period of filling out documents.

The application must indicate:

- TIN/KPP of the main organizations;

- their names;

- code in the tax service;

- OGRN of the main organization;

- total number of open units;

- Full name of the managers, and also their Taxpayer Identification Number;

- list of contact information (including telephone numbers, addresses and email);

- company seal.

If applications are submitted not with the individual participation of the director, but in the direct presence of his representatives, then information with his data should be displayed in the documentation. In addition, the authority of the representative must be officially confirmed. Most often, an official form of trust is used for these purposes.

Applications must be submitted with two copies. The second option is to present a copy of the application, on which tax officials will leave a corresponding mark indicating the date of acceptance for processing.

forms S-09-3-1

- Form C-09-3-1 application for opening a separate division can be found here.

- You can use the online service for filling out documents and download the completed application form S-09-3-1 using the link.

Branches and representative offices

There are two forms of a separate unit (SU):

- Branch.

- Representation.

In the first case, the EP performs the functions of the organization. In the second, he represents and protects her interests. The OP does not act as an independent organization - it acts as established by the head of the parent organization. The company's documents include information about all OPs created by it.

The Tax Code of the Russian Federation does not contain the concepts of “branch” and “representative office”. Only general - a separate division. The representative office does not conduct business activities. This is its main difference from a branch, for which a separate bank account is opened. The representative office is more dependent on the parent organization.

The signs of an OP, regardless of whether it is a branch or a representative office, are territorial isolation and the presence of a workplace. The OP is usually located in another city. Located in premises rented for at least a month.

Important! There are no strict limits regarding the number of employees in a remote office. A branch with only one employee is also an OP.

The organization is responsible for its OP, even if the charter says nothing about it. Can an individual entrepreneur open an additional branch in another city?

In 2020, no amendments were made to the law regarding the OP. It is unlikely that anything will change in the future. OP can only be opened by a legal entity. Moreover, if it does not work according to the simplified tax system. An individual will not be able to register an individual entrepreneur, which is one of the disadvantages of an individual entrepreneur. However, this does not mean that an entrepreneur does not have the right to open an additional office in another city.

Important! A legal entity is allowed to open representative offices in other cities. An individual entrepreneur does not have such a right. To open, you will need to register with local government agencies.

Where to pay taxes and submit reports

OPs perform work in accordance with their own purposes, established by official representative offices. The functionality, type of work, qualifications of authority and enforcement are determined by the main representative offices and are enshrined in the regulations on the EP. Also included here is accounting in two variations.

Method 1: divisions do not have their own balance sheets.

In such a situation, offices cannot have independent accounting departments and current accounts. Most settlements with the counterparty, including employees with their salaries, are carried out by the accounting departments of representative offices. However, departments have the right to issue, for example, commodity and accompanying documents, but they can only be accepted for consideration in the main accounting departments.

Method 2: divisions have an independent balance sheet.

The presented method involves creating an accounting office and maintaining records within departments. They include settlement accounts with creditors and will be able to ensure settlements with the counterparty independently. Information on accounting records in the represented structures must be taken into account in the general regulations of the representative office. OPs provide accounting in accordance with the rules of the accounting policies of parent organizations.

How can an individual entrepreneur run a business in another area?

An individual entrepreneur who wants to conduct business in another city cannot establish a representative office or branch there. The requirements for this person who has completed such an expansion are determined by which taxation system applies to him.

Depending on the taxation regime, the individual entrepreneur determines the structure and nature of its activities.

If you plan to work on a patent, you should obtain the appropriate document for the region. It is necessary to contact the Federal Tax Service with an application for registration in a given area, as well as for the issuance of a patent. In the future, you will need to pay a fee for this patent.

In the case of using UTII, after starting operations in a new region, no later than 5 days, you must register with the local Federal Tax Service as a UTII payer. For this purpose, an application of appropriate content should be submitted. In the future, you will need to pay tax in this particular area, as well as submit a declaration.

In all other cases, including the most common option - simplified activities, as well as work according to the standard scheme - the entrepreneur does not need to take any action. He does not submit documents to tax authorities in another locality. At the same time, he pays taxes only where he was originally registered.

Where to pay taxes for separate divisions: table

| Taxation | Payment at the location of the OP | Payment to the location of the head of the company | Comments | |

| VAT | transferred by taxpayers | — | + | Clause 2 of Art. 174 Tax Code of the Russian Federation |

| transferred by tax agents | — | + | Clause 3 of Art. 174 Tax Code of the Russian Federation | |

| Personal income tax | +* | + | clause 2 art. 226 Tax Code of the Russian Federation * Not every department has the right to transfer personal income tax for “physics” | |

| Insurance fee | compulsory pension, medical form, social insurance | +/- | +/- | OPs have the right to pay the insurance premium when:

When the OP is located outside the Russian Federation, the fee is paid by the parent companies. |

| accident and occupational disease insurance | +/- | +/- | ||

| Income taxes | federal funding | — | + | clause 1 art. 288 Tax Code of the Russian Federation |

| regional budgets | + | + | clause 2 art. 288 Tax Code of the Russian Federation | |

| Unified taxes under the simplified tax system | — | + | clause 6 art. 346.21 Tax Code of the Russian Federation | |

| UTII | — | + | clause 1 art. 346.28 Tax Code of the Russian Federation | |

| Taxes on property assets of companies | +/- | +/- | OPs pay taxes when property assets are allocated to separate balance sheets. When real estate objects are located outside the OP and parent companies, taxes are paid according to the location of the objects. | |

| Transport taxes | According to vehicle registration places | clause 5 art. 83, paragraph 1, art. 363 Tax Code of the Russian Federation | ||

| Land taxes | According to the location of the land plot | clause 3 art. 397 Tax Code of the Russian Federation | ||

| Pollution fee | According to the location (registration) of pollution sources | clauses 19 and 20 of the Procedure approved by order of Rostechnadzor dated 04/05/07 No. 204 | ||

The procedure for opening a separate subdivision of an individual entrepreneur

A separate division is usually opened in other regions in which the entrepreneur wants to get new customers and increase profits. At the same time, the opening process is described in detail in Article 23 of the Tax Code of the Russian Federation.

The procedure itself is not very complicated and takes minimal time. First, it is necessary to create direct jobs and register them with the tax authorities. And at the place where a new unit is opened, the entrepreneur must provide a passport and a written statement indicating the purpose - opening a new unit.

Article 23. Responsibilities of taxpayers (payers of fees, payers of insurance premiums)

The law allows the option of creating a branch and its subsequent registration. It must be legalized no later than a month after opening, otherwise penalties may be applied in the form of financial penalties and penalties.

The unit will be registered with the Federal Tax Service within a week after submitting the documents. If the open branch is subsequently moved to another locality, then before that it is necessary to close the old enterprise.

Separate divisions are subject to registration not only with the tax office, but also with the Pension Fund and the Social Insurance Fund. These authorities must be completed by those who have an open bank account from which payments to employees are made.

You can not register only when there is not a single workplace. And when closing a division, you must submit the relevant documents to the tax office within 3 days.

"Separate" status

Before answering the main question - can an individual entrepreneur have a separate division?

– let’s give a general definition of who an individual entrepreneur is.

According to the law, this is any individual who:

- wants to conduct commercial activities;

- must register itself with the tax office accordingly.

Let us say right away that a person registered as a businessman is not equated to a legal entity. This:

- different concepts;

- miscellaneous documentation;

- different business opportunities.

Let us define a separate division. It refers to a certain structure that is related to the main organization. In other words, these are branches, representative offices or other parts of the company that report directly to the head office. They cannot conduct completely independent activities, since all decisions are made by the general management. This follows from Article 55 of the Civil Code of the Russian Federation.

The Tax Code provides an additional definition of a separate division and also describes its main distinguishing features. Article 11 states that:

- the structural unit must be located in a separate building; it cannot be located in the same place as the head office;

- in the “isolation” there must be stationary workplaces, that is, established for a period of more than 1 month.

Even one employee who works in a remote office, but on a permanent basis, can be considered a separate unit. For example, an in-house correspondent for a publication who works in another country.

legal information

The Civil Code of the Russian Federation defines two types of separate divisions - branches and representative offices. Based on this, these branches will not be considered separate legal entities, but will carry out their activities in accordance with the constituent documents of the main company.

The management of such departments can be carried out through a designated manager - by. The Tax Code indicates that such an institution submits reports not at its location, but together with the main office.

By its very nature, the enterprise becomes isolated automatically. Next, management must collect the necessary package of documents and submit it to the relevant control authorities.

The Labor Code also makes adjustments - each separate department must have a stationary workplace. Therefore, when working from home, even under an employment contract, from the legal side, the unit will not be considered separate.

The moment the unit starts operating is the date of its registration. Preparing premises, equipment and creating jobs cannot be the beginning of an activity.

When creating divisions, this fact must be recorded in the constituent documents. All actions must be within the framework of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs.”

If you do not register such an object with the tax authority, you may receive fines. Penalties of 10 to 20 percent of revenue are applied here. You can liquidate a department by filling out the appropriate application.

Registration required

If a separate division of an individual entrepreneur has at least one place to work for at least a month, it must be registered. In addition to registering a company, it is also necessary to employ workers in accordance with the norms of the Labor Code.

At the same time, warehouses that only store raw materials or production equipment, and also that do not have permanent employees, cannot be considered a separate enterprise. ATMs, terminals and other devices also cannot be considered separate. In addition, remote employees also do not count.

Should a new department register an individual entrepreneur? When opening a separate division, it is necessary to emphasize that the organization does not have the status of a representative office or branch. At the same time, it is necessary to clarify the availability of a stationary place and a permanent worker.

If all the conditions are present, then within a month the division must be opened and registered with the tax and other structures. Moreover, taxes will be paid at the place of registration of the main company and taking into account its taxation system. It could be or.

Separate division: create and register

Contents A newly created LLC quite often does not have its own or rented office and is listed only at its legal address.

This may be the home address of the manager (founder) or an address with postal and secretarial services. While no real activity is being carried out yet, and correspondence intended for the LLC, especially from official bodies, arrives in a timely manner, this situation is normal.

But, sooner or later, the LLC begins to operate, which means it must “materialize” somewhere in space. You can get answers to any questions about registering LLCs and individual entrepreneurs by using the free consultation service on business registration: Sometimes the nature of the activity allows you to conduct business from home or with the help of remote workers, but if the LLC opens a store, warehouse, office, production facility or in some other way begins to operate at an address different