The Federal Tax Service of Russia has launched such a pilot project as the personal account of the Federal Tax Service for individual entrepreneurs. Login and registration to a personal account, the functionality of the service, as well as the capabilities of the system are described in this article.

Filing reports, tracking invoices and monitoring payments remotely is convenient for individual entrepreneurs. Therefore, tax authorities created a personal account for individual taxpayers. Previously, there were only two types of accounts on the Federal Tax Service server - for individuals and legal entities. Businessmen could use the account for individuals, but the functionality of such a page was limited. Now entrepreneurs have the right to cooperate with the Federal Tax Service remotely.

What is LC NP IP on the Federal Tax Service website

A personal account is an Internet page on the Federal Tax Service website that contains the data of a separate individual entrepreneur. Everyone has their own, with an individual password to log into the system.

Personal account is available for individual entrepreneurs

Using the taxpayer’s personal account, the individual entrepreneur performs various actions:

- controls the calculation of taxes;

- pays taxes via the Internet;

- receives information in the form of notifications from the government on time. authorities, as well as documents in the form of extracts, receipts;

- through online communication, consults on various issues with representatives of the Federal Tax Service.

Features of the Federal Tax Service personal account for individuals

The personal account of a taxpayer of the Federal Tax Service allows a citizen to view his personal file located in the NI department. This means that you will no longer have to visit this organization to request a TIN, fill out a declaration or pay mandatory tax payments. Now you can use the created account, and you manage your business yourself. By replenishing your personal page wallet, you can make a tax payment. You can create and send a report on 3-NDFL. And also register in advance in the electronic queue if you still need to visit a Federal Tax Service inspector directly.

How to find out your TIN?

For all users of the NS website, it will not be difficult to independently request your TIN if you urgently need it, but it is not at hand anywhere. To receive it, you need to fill out a special form at https://service.nalog.ru/inn.do.

In the form, most of the data is required to be entered: full name, date of birth, passport with series and number. Fields not marked with an asterisk about the place of birth and the date of receipt of the passport can be left blank. But as practice shows, it is better to fill out the form completely. After entering the information, you will need to confirm the request.

If your code is registered in the system, then it will be displayed on the monitor. If the search is unsuccessful, then you will have to go to the Federal Tax Service for the TIN. There they will issue a TIN according to your passport.

How to get the details of the Federal Tax Service?

If you need to obtain NS details, just use the system page https://service.nalog.ru/addrno.do. The following data is entered into a fairly simple form:

- the taxpayer is determined (individual or legal entity);

- its address is indicated (full information must be entered in the drop-down menu);

- The Federal Tax Service code is selected from the directory.

After entering the data, click next. The system will check the information and provide information upon request.

How to make an appointment with the tax office?

In order not to spend a lot of time at the tax office waiting for an authorized specialist, you can issue a coupon right at home. You just need to use the application on the Federal Tax Service page (https://nalog-ru.com/order/), where you first need to give permission to process the provided data.

Then the system will ask you to fill out a simple questionnaire about the taxpayer and his contact information.

After entering the data, you need to select the day and time when it is convenient for you to visit the tax office. For convenience, the citizen is offered a range of 14 days. After selecting the desired time, you will be issued a ticket with a number and the appointment time.

Other possibilities

In addition to the considered features of the account and the NS website, in the Personal Account you get access to the following functions:

- control over accruals and payment of taxes;

- access to information about real estate and vehicles registered in the taxpayer’s name;

- viewing information about overpayments or debt on budget payments;

- the ability to create and print receipts and documents;

- creating a declaration and sending it for certification;

- viewing the status of the declaration verification;

- drafting and sending appeals to the Tax Service.

All this functionality will become available to those registered with the Federal Tax Service.

Who needs it

Do individual entrepreneurs submit a balance sheet or not - why is it needed?

A personal account, as mentioned above, is used today by all categories of entrepreneurs.

Important! To the old, pre-existing electronic services for individuals and legal entities, which have been in operation for more than one year, the Tax Service of the Russian Federation has added one more service: “LK IP”.

An entrepreneur can use his personal account to remotely contact the tax office. The level of employment among entrepreneurs is always high. They can’t afford to waste time on frequent trips to the tax office. There was an urgent need to develop a way to relieve the burden on business representatives, including all categories of business representatives. The one provided on the Federal Tax Service website dealt with this best.

For individual entrepreneurs, as well as for individuals, it was decided to simplify the possibility of doing business. From now on, if you have a personal identification document, an individual entrepreneur spends much less time checking documentation with government agencies. Tax reporting is sent to LC online. An electronic signature expands the functionality of your account.

Relevance and necessity

Functions and capabilities of the service

Not all entrepreneurs and small business representatives are aware of the real capabilities of the Russian Tax Service website. There you can not only search for background information and get current news regarding the taxation system. Entrepreneurs can register a personal taxpayer account on the website. It greatly facilitates working with documents and helps save time. An honest taxpayer will not have to go to the Federal Tax Service office and stand in queues to resolve every issue.

What opportunities does an account in the personal account of an individual entrepreneur provide:

- Informing the client about the presence of a debt, penalty or unpaid fine.

- Remote submission of an application, appeal or complaint to the Federal Tax Service.

- Control of account status.

- Printing of documents (receipts, invoices, notices, etc.).

- Paying off outstanding bills.

- Receive a statement of completed financial transactions for a specified period.

- Independent introduction of changes and adjustments to the register of individual entrepreneurs.

A full overview of the cabinet's capabilities can be found here:

Registration and login to your personal account

The remote method of registering online in your personal account is perceived as the most optimal option. Otherwise, you have to collect a package of documents and go directly to the tax office.

Registration number in the Pension Fund of the Russian Federation for individual entrepreneurs - how to find out and why it is needed

After logging in and registering in your personal account, you can follow the link to the page requesting registration data. Move the cursor down to reach the third section. The procedure for submitting documents is explained here. The main attention is paid to the “Remotely” item, where two types of application submission are offered.

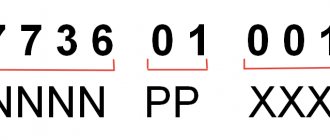

To register an individual entrepreneur, select form 21001 on the Federal Tax Service website. Fill out items requesting passport data, contact numbers, and email of the taxpayer. You will also be asked to enter a combination of several numbers. You need to come up with it yourself and be sure to remember or write it down for reliability. A digital code will protect your personal account from hacking.

Note! An individual entrepreneur is not completely exempt from going to the tax office. He will need to do this in order to deliver the documents. But he can submit the application electronically, which will save him from having to visit the Federal Tax Service several times.

Tax office: personal entrepreneur

After sending the application and subsequent submission of documents, three days are allocated for their consideration. During this time, the entrepreneur pays a state duty in the amount of 800 rubles. Without payment, the application may be rejected.

Authorization on the service involves the use of several systems. For example, a system for creating an electronic signature. It allows you to exchange documentation with the Federal Tax Service and transfers all tax document flow online. Or use the JaCarta Smart Card system, which has an electronic signature. You can also use Rutoken EDS 2.0, which also contains an electronic signature. Authorization on the service takes place using an INN and password.

Important! Ordinary taxpayers using the login and password received from the inspection can register an individual entrepreneur’s personal account on the Federal Tax Service website.

The final action is a visit to the Federal Tax Service:

- with a passport;

- the original document of registration of the taxpayer as an individual entrepreneur;

- original TIN or notification of registration.

Registration

To register with an electronic signature, you must:

- Obtain a key certificate. This is done at the official center. The key is transferred to the media. They keep it on a disk or smart card;

- The key is connected to the computer on which the entrepreneur will work with the individual entrepreneur’s personal account. The correct connection is checked;

- Open the “Go to IP Personal Account” window;

- Place an electronic signature under the agreement that opens on the screen;

- Enter personal data into the profile form;

- Enter your email address;

- By clicking on “Next”, check the correctness of the entered data;

- Create and enter a password;

- Activate the individual taxpayer’s personal account via the link received in the email.

Closing an individual entrepreneur through your personal account

You can also use the individual taxpayer’s account to close the individual entrepreneur through the taxpayer’s personal account on the website nalog.ru. This is a convenient service that simplifies the procedure, since the businessman does not have to go to the tax authority. To close a company through your personal fee payer account online, you need to:

- Log in to your personal page in a convenient way.

- In the services block, click on the orange button labeled “All”.

- Select the section State registration of individual entrepreneurs.

- In the window that opens, select the Individual Entrepreneurs tab and click on the button that says stop.

- Fill out the application in form P 26001 in a new tab.

- Confirm your consent to the processing of personal information, select the type of application - P 26001.

- Now the businessman chooses the method by which he will send the documentation to the Federal Tax Service: independently or by Russian post, by email in electronic format with or without digital signature.

If an entrepreneur chooses the method of electronic sending without an electronic signature, by Russian post or independently, then he will have to pay a state fee of 160 rubles. When sending the form in electronic format through a personal account with an electronic signature, you do not need to pay a state fee.

- Now fill out form P 26001:

- Enter personal information: email, OGRNIP.

- The portal automatically identifies the organization.

- Choose the method in which the businessman will receive the closure documentation: in person, by mail, or to an authorized person.

- Next, the service will automatically check the entered information.

- Now the entrepreneur can download the completed application in .xls format and pay 160 rubles here if the payment option is selected.

After this procedure, the businessman waits for a package of closure documents, in particular, an extract from the Unified State Register of Individual Entrepreneurs, which will indicate that the person has been deregistered from tax registration as an individual entrepreneur.

If a businessman has chosen the option of closing using an electronic digital signature, then instead of the state duty payment point, you will need to attach an additional package of papers, and then click on the “Submit” button. The set of documents includes:

- a scan of all pages of the passport, TIN, USRIP certificate with a registration note;

- the application is already ready;

- documentation from the Pension Fund of the Russian Federation, which confirms the fact of submission of all reports and payment of insurance contributions.

A document from the pension is not required, since the Pension Fund of Russia can send the paper to the tax authority themselves. But it’s better to play it safe and attach the document in advance.

Functionality of the taxpayer's account

Important! The main functions of the Federal Tax Service website include a number of options provided to individual entrepreneurs registered in personal accounts.

How to find out OKATO IP by TIN: what is it and why is it needed

It's about giving them the opportunity to:

- send appeals to the Federal Tax Service, file complaints, make requests and other similar actions;

- receive information on tax debts, deductions and other payments made through your personal account or directly to the Federal Tax Service;

- get acquainted with information about various taxation systems in order to choose the most optimal version for yourself and submit an application for its connection;

- conduct budget calculations, make payments according to reporting periods;

- receive information regarding unspecified payments;

- get acquainted with the data on the status of documents sent to the Federal Tax Service for verification or confirmation;

- receive statements of payments made, data on reconciliation reports, and other documentation;

- have access to the SME business navigator portal (form business plans, pay for premises, perform other operations);

- make changes to the Unified State Register of Individual Entrepreneurs, receive an electronic extract from the Unified State Register of Individual Entrepreneurs.

In addition to the main functions in the personal account, each individual entrepreneur has access to functionality containing many services with specifics to choose from for each individual entrepreneur.

Important! Some additional services cannot be used if there was no electronic signature when registering for the service. You can exchange official documentation online only with a signature.

Registration of a taxpayer’s personal account with the Federal Tax Service of Russia using an electronic signature

ES - registration of a taxpayer’s personal account.

A special ES key can be purchased at the certification center of the Ministry of Telecom and Mass Communications of the Russian Federation. Then fill out an electronic application to authorize the connection from the input tab of the Federal Tax Service account. Your details from the electronic signature will be read automatically and loaded into specific lines of the application. After these steps, you will be asked to create a secret code and log in using your electronic signature.

Going through the registration process on the IFTS portal using electronic signature is simple, but to do this you must comply with the following technical conditions:

- OS Windows XP or higher.

- Browser used: Internet Explorer 8.0 or higher.

- Software: Crypto PRO CSP 3.6 and later, must be licensed.

- Drivers for eToken, RuToken or other key media.

- The root certificate must also be installed .

If all this is observed, then you will receive an electronic signature and can easily register on the IFTS portal using this qualified key.

What data can be viewed in LC

In addition to sending documents to the tax service through your personal account, you can view the receipt of extracts from the Unified State Register of Individual Entrepreneurs and other important operations. An individual entrepreneur can clearly see all the information related to running a business. If necessary, make changes and track your finances.

In particular, in the LC an individual entrepreneur has access to:

- change data in information about individual entrepreneurs;

- see the operations that are carried out when calculating the budget;

- see and work with statements of transactions for budget calculations;

- view reconciliation reports with the Federal Tax Service;

- if the tax service sends information about debt, overpayment by an individual entrepreneur, the entrepreneur sees this data in the taxpayer’s personal account for the Federal Tax Service on the same day. The same thing happens with the message about the upcoming tax payment;

- see general information on taxation systems used by individual entrepreneurs;

- What is important is the ability of an individual entrepreneur to see in the personal account information about documents previously sent to the tax office. Make timely edits and add missing data.

LC - quick access

Registration of a taxpayer’s personal account with the Federal Tax Service of Russia through the State Services website: instructions

In order for you to have access to the Federal Tax Service account through State Services, you must first register on this website using this link . Click “Register” and follow further instructions. Then enter the IFTS portal using the link that was published above and click “Log in using the State Service (ESIA)” .

Login through the State Services website

You also have the opportunity to log in using SNILS, phone or mail. Now use all the features of your personal account, see whether your payments have gone through, whether there are any debts, and so on. It is worth noting that before registering with the Federal Tax Service, you can get a demo page to familiarize yourself with all the functionality of your personal account.

Demo page

To get a demo account, do the following:

- In the login form, enter all zeros “login” any combination of letters or numbers “password”

- Using such actions, you log into the personal account of a non-existent user. All functionality, existing sections and menus will be available in it.

Now evaluate the capabilities of the tax payer’s personal account. In fact, this is very convenient, since you do not need to visit the Federal Tax Service office to find out some information on taxes. All you have to do is go to your personal account, find the page you need and track payments, debts, and so on.

What to do if you forgot your password

Situations where a password is lost or forgotten happen all the time. On the Federal Tax Service website, the personal account of an individual entrepreneur becomes inaccessible due to the loss of the password. The user needs to request a new password. To do this, he needs to present to the service a certain list of documents, including:

- passport or other identity document;

- original or certified copy of individual entrepreneur registration certificate;

- TIN.

LC is an advantageous offer that you can’t refuse

Password regeneration is carried out by an inspectorate working with individuals. You need to go there and make a request. If a ban on entering the Inspectorate of the Federal Tax Service or Individual Entrepreneur is displayed when using an electronic password, you will have to visit the center where the key was issued.

Creating a personal account for an individual entrepreneur on the Federal Tax Service website turned out to be beneficial for many reasons. At one time, the tax service took into account all the critical aspects associated with the work of individual entrepreneurs and gave them the opportunity to carry out many current transactions, including financial ones “through their personal account.” In turn, this greatly increased the efficiency of their work.

How to access

Every entrepreneur who has an appropriate entry in the Unified State Register of Enterprises can use it. However, no one is automatically granted access to the Personal Account. To obtain it you need:

- visit the territorial Federal Tax Service;

- present your passport, TIN and certificate of registration as an individual entrepreneur;

- wait for the employee to issue a password;

- activate your personal account upon first login.

However, full functionality is available only to those who have an electronic signature.