What is annual return, and how is it different from profit?

First, some general concepts.

Profit is the positive difference between funds received and funds spent. For example, in a month the company produced and sold products worth 400 thousand rubles. To produce the product, 300 thousand rubles were spent (on raw materials, equipment, transportation, employee salaries). The profit received was 100 thousand, and the profitability was 400 thousand.

If the difference between income and expenses is negative (the company spent more than it earned), this is called a loss. Do not confuse the concepts of “loss” (negative profitability) and “cost”. A cost is a flow of resources that does not reduce the capital of the enterprise and does not affect profits. For example, the cost of purchasing a building.

Income is money or other material assets that a person (legal or physical) receives as a result of the activities carried out. Examples:

- Salary.

- Receiving money from the sale of manufactured products.

- Receiving payment for the provision of services.

Income for the year is the amount received as a result of a person’s work for 1 calendar year.

If you want to calculate the average annual income over a period of several years, you need to sum the results for each year and then divide by the number of years.

Example:

- Task: calculate SRS for 5 years.

- In the first year, the SRS amounted to 500 thousand rubles, in the second - 400, in the third - 450, in the fourth - 540, in the fifth - 620.

We add up the obtained indicators: 500+400+450+540+620 = 2.510. We divide the result by 5 (number of years), and we get 502 thousand rubles (average total).

Regulation and accounting

The accounting department of a legal entity must keep strict records of annual income. The size is also given in a special declaration - invoice:

- for core activities - accounting accounts: from 701 to 709;

- for non-core activities - accounting accounts: from 721 to 729.

The total annual income (total) is recorded in a separate document - accounting account 571.

Maintaining the listed accounts without knowledge of accounting is a difficult task. To accurately take into account your total annual income, there are special forms for quick (simplified) filling out. You can enter information into them during the working period, and at the end of the year you can use them to calculate the balance.

How to perform the calculation?

The organization can roughly calculate the potential profitability. This is done with the aim of calculating the company’s projected development by the end of the year.

It is calculated in several steps:

- The total gross income is calculated. To do this, expenses (spent on the production of goods) are subtracted from revenue (received for the sale of goods).

- The total price of manufactured products for 1 year is determined.

- The gross profitability per 1 product produced is calculated.

- Third-party indicators included in the total annual income (from operations, profit on securities) are calculated.

- VAT, excise duty and other forms of fees and taxes that will have to be paid are subtracted from the gross profit.

Formula for calculating income

Next, it is calculated using the formula NX+C+LG+G, in which:

- NX – net export;

- C – consumer spending;

- LG – investments;

- G – funds spent on purchases.

For pensioners and the unemployed

This concept does not only apply to companies and individuals with jobs. Pensioners and the unemployed can also have income.

For the former, it is usually limited to a pension and various benefits. Pensioners can also work additionally and own real estate that they rent out. A small part of citizens of retirement age are also engaged in business - which is also included in the profitability for the year.

For the unemployed, the official annual income is limited to receiving benefits.

From property

If a citizen (or organization) owns property, this asset is used in calculating profitability for the year. Option two:

- If the property is rented out, the calculation uses the annual return minus the cost of the patent.

- If the property is sold, the calculation uses the sale price minus fees, realtor commission. How do realtors live?, and notary fees.

The relationship between income and marginal costs

To understand why marginal revenue can be useful, it is also worth familiarizing yourself with what marginal costs are. It also considers a special case of the relationship with prices, under so-called perfect competition (when the price of a product remains the same for any volume).

In reality, we are always talking about imperfect competition, in which, as the volume of goods increases, it is necessary to reduce the price, since demand is limited for each price level. It looks like this:

Here:

MR1 is the marginal revenue for the case of perfect competition, in which the price of the product remains the same.

MR2 is the marginal revenue for the case of imperfect competition, in which the price of a product decreases as volume increases.

ATC is the average cost per unit added.

MC is the marginal cost, which reflects the change per 1 unit added.

As previously noted, for the case of MR1, the entire area where profit is possible is limited by ATC and MR1 (since the price will exceed costs), that is, the green, yellow and purple zones.

However, it is important to understand that starting from a certain volume of goods, marginal costs will begin to exceed marginal revenue. This means that after the point where their values coincide (points Q1 and Q2), the so-called golden rule MC = MR , the real total profit from the entire turnover of goods will begin to decrease.

Therefore, once this point is reached, further growth in the production of goods or provision of services is considered to have no economic benefit. So in practice, the real profitable sectors are considered to be green for the case of MR2 and green and yellow for the case of MR1.

It is worth noting that graphical calculation is not always convenient, so they often resort to presentation in the form of a table, where for each volume of goods all calculated values are indicated, as well as the selling price. Then they simply look at where the smallest difference is observed between marginal revenues and marginal costs (with a positive sign). This volume is considered the most profitable.

What is Potential Annual Income?

Potential annual income is the value established by the regional government for levying tax on individual entrepreneurs. To put it another way, this is the projected (potential) amount of profitability that is used for business taxation. The actual profit of the organization does not affect this size.

For each region and each type of activity, its own potential annual income is established. This value may be revised annually.

Potential annual income is determined in two ways:

- If an individual entrepreneur operates without hired employees, the entrepreneur simply needs to find a rate for his region and his direction.

- If an entrepreneur has hired employees or has several taxable objects (transport, real estate), then the potential annual income can be further increased by regional authorities.

Calculation of potential profitability

Please note that, by law, the maximum potential profitability cannot increase:

- more than 3 times - forms of activity from paragraphs 9, 10, 11, 32, 33, 38, 42, 34 (clause 2., article 346.43 of the Tax Code of the Russian Federation);

- more than 5 times - in areas with a patent system, if they are carried out in cities with a population of over 1 million citizens);

- more than 10 times - areas of activity from paragraphs 19, 45, 46, 47 (clause 2, article 346.43 of the Tax Code of the Russian Federation).

Examples of determining miscellaneous income

It is known that the company sells bicycles for 50 thousand rubles. 30 pieces are produced per month. wheeled vehicles.

Total revenue is 50x30=1500 thousand rubles.

Average income is determined from the ratio of total revenue to the volume of products produced, therefore, with a constant price for bicycles, AR = 50 thousand rubles.

The example lacks information about the different costs of manufactured products. In this case, the value of marginal revenue is identical to average revenue and, accordingly, the price of one bicycle. That is, if the enterprise decided to increase the production of wheeled vehicles to 31, with the cost of the added benefit remaining constant, then MR = 50 thousand rubles.

But in practice, no industry has the characteristics of perfect competition. This model of a market economy is ideal and serves as a tool in economic analysis.

Therefore, expansion of production does not always affect profit growth. This is due to different dynamics of costs and the fact that an increase in product output entails a decrease in the price of its sale. Supply increases, demand decreases, and as a result, the price also decreases.

For example, increasing the production of bicycles from 30 pcs. up to 31 pcs. per month resulted in a reduction in the price of goods from 50 thousand rubles. up to 48 thousand rubles Then the marginal income of the company was -12 thousand rubles:

TR1=50*30=1500 thousand rubles;

TR2=48*31=1488 thousand rubles;

TR2-TR1=1488-1500= - 12 thousand rubles.

Since the increase in income turned out to be negative, therefore, there will be no increase in profit and it is better for the company to leave the production of bicycles at the level of 30 pieces per month.

What is included in total income?

Cumulative is the return for a specific period of time. This indicator combines all forms of profit, both in material (monetary) and intangible forms. If a person receives some property, then the official price is used when calculating the final amount.

Because this amount is taxable, it does not include tax-exempt payments. These are pensions, subsidies, payments to cover damage, social benefits.

This indicator can be used in various concepts:

- For individuals. In this case, the result consists of the sources of profit that an individual has - salary, pension, inheritance received, profit from business, borrowed funds, proceeds from the sale of property.

- For a legal entity. Includes the amount of revenue that was received during the reporting period.

- Family. It is the sum of incoming transactions that all family members receive. This calculation is used when determining whether a family is low-income. In this case, the average annual family income is calculated (salaries and other types of funds received are summed up, and then the result is divided by the number of relatives). If the amount is lower than the minimum established by the state, the family is considered poor.

- Monthly. It is calculated in cases where family solvency is determined (obtaining a loan, subsidies, compensation for utility bills).

When calculating, the following are summed up:

- Salary (received in person - with all allowances and minus fees).

- Benefits and forms of financial assistance.

- Maternity payments.

- Alimony.

- Pension.

- Scholarship.

- Insurance payments.

- Profit for doing business.

- Social payments.

- Interest on bank deposits.

- Profit received from the rental of property.

- Funds received from the sale of securities.

- Funds received from the sale of property.

- Received inheritance.

- Property received as a gift.

Calculation of funds

Only those funds that a person received for the sale of their own home are not taken into account if they were immediately spent on the purchase (reconstruction, construction) of a new home for living.

How to calculate national income, personal income and disposable income

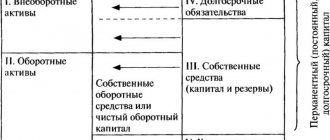

GDP is an important economic indicator that most fully characterizes the volume of the final product produced by the state in a given period.

But for all its importance, it does not allow us to answer the question about the amount of total income received by the population of a given country (employees, entrepreneurs, owners of securities, owners of real estate, etc.). In order to find the answer to this, it is necessary to calculate the national income of the country. As we have seen, not all components of GDP represent factor incomes that the population receives and disposes of. Depreciation charges are included in the cost of production and, being reimbursed from revenue, go into further circulation, but the enterprise cannot freely dispose of this part of the revenue. This element of cost, like all its other elements, has a strictly intended purpose - to compensate for the depreciation of fixed capital (buildings, structures, machinery and equipment). Therefore, depreciation charges cannot become income for the owners of production factors. If we subtract their sum from GDP, we get net national product . National income differs from net product only by the amount of indirect taxes.

NATIONAL INCOME = GDP – Depreciation charges – Indirect taxes

National income is thus the total income of all owners of factors of production.

is included in the national income . This concept reflects the totality of all gross income received by households in the current period. As was indicated at the beginning of our course, the state in a modern market economy plays a very important role, carrying out the function of redistributing income. Thus, it actively influences the formation of personal income.

TOTAL PERSONAL INCOME - the total sum of all gross incomes received by households in a country in an accounting period.

It should be noted that we are talking here not only about those households that, as owners of production factors, through their labor participated in the creation of national income, but also about those that did not participate in this process. Thus, households receive transfer payments from the state budget. These include payments from the social insurance system (pensions, benefits, scholarships, etc.), interest on government debt if households bought government bonds. Transfer payments from the government budget therefore lead to the generation of income, which, although not a factor, nevertheless contributes to an increase in the total amount of money that households receive.

The distribution of profits of joint-stock companies also influences the formation of income received by households. As we know, part of the profit is paid in the form of dividends to the owners of shares, represented by households. In addition, as a rule, firms pay pensions to employees from established pension funds (entrepreneurial transfers).

TOTAL PERSONAL HOUSEHOLD INCOME = National Income – Employee Social Security Contributions – Corporate Profits – Indirect Taxes + Government Social Transfers + Dividends + Entrepreneurial Transfers.

However, personal income is not completely at the disposal of households, since they pay personal (individual) taxes, which are a source of state budget revenue (income, land, transport taxes, property taxes, etc.).

TOTAL DISPOSABLE PERSONAL INCOME = Total Personal Income – Individual Taxes.

The issue of generating disposable income is of great practical importance for each of us. For example, an increase in personal taxes is a direct deduction from the personal income of the population, which reduces disposable income. But if this is accompanied by an increase in transfer payments to the population, then disposable income may not only not decrease, but even increase.

Behind this may be a well-thought-out policy aimed at limiting the growth of extremely high incomes and supporting low-income segments of the population (pensioners, large families, disabled people, etc.).

At the same time, if the increase in taxes, which restrains the increase in disposable personal income, is due to irrational, unjustified spending of funds (for example, swelling of the bureaucratic apparatus), then the increase in taxes on the population in this case will not have a positive effect and its consequences will become negative.

How do households manage their disposable personal income? They allocate one part of it for personal consumption (C), the other for savings (S; English saving), which are defined as income minus consumption.

In the table we present the procedure for calculating the macroeconomic indicators we considered.

| Index | Calculation formula |

| GDP | GDP = Sales - Intermediate products = Wages + Interest + Rent + Owner's income + Indirect taxes + Profit + Depreciation = C+I+G+X |

| National income (NI) | ND = GDP – Depreciation – Indirect taxes = Wages + Interest + Rent + Owners’ income + Profit |

| Total personal income (CI) | LD = ND – Social insurance contributions for employees – Corporate profits – Indirect taxes + State social transfers + Dividends + Entrepreneurial transfers |

| Disposable personal income (DPI) | RLD = LD – Individual taxes = C + S |

Source: Economics.

Fundamentals of economic theory: textbook for grades 10–11. for educational organizations. Advanced level: in 2 books. Book 2 // Edited by: Ivanov S. I., Linkov A. Ya. Publisher: Vita-Press, 2020 Why is the System of National Accounts needed? If you want to get information about the level of production and welfare in a particular country, the sectoral structure of its economy, and the price level, then be sure to refer to statistical data. What is Gross Domestic Product (GDP)? Gross domestic product is the market value of all final goods (material goods and services) produced in the territory of a given country over a certain period. What is Gross National Product (GNP)? The economy of any country is part of the world economy, and many firms invest their capital in foreign enterprises. The difference between real GDP and nominal GDP We have already indicated that the volume of GDP, as well as all related macroeconomic indicators, is calculated in current prices at which created goods and services are sold. In this case, the value of nominal GDP is determined. GDP and quality of life Is it possible to measure the quality of life of people in a particular country using per capita GDP? Can we say that with an increase in the size of a country's GDP and national income, the population of any country always becomes more satisfied with the quality of their life? Gesell's monetary system How to limit the speculative activities of banks What is the ruble backed by? The reason for the high rates of GDP growth after 1998: the depreciation of the ruble Tags: gdp national income system of national accounts

Principle of taxation

Individuals are required to pay Who and in what cases must pay income tax? Income tax (NDFL). More often, personal income tax is paid not by the citizen himself, but by the official employer, who automatically withholds a set percentage from the salary. The citizen receives a “net” salary, from which personal income tax has already been deducted and paid.

Legal entities are taxed according to a different principle - depending on the chosen form of taxation.

Property income is also taxed separately. The fee is fixed and amounts to 13%. It is paid upon the purchase and sale of real estate.

So that the tax authorities know about the amount of incoming funds, declarations are provided. They are filled out annually at the end of the reporting period and submitted to the regulatory authorities (local tax inspectorate offices).

The information should include:

- Accounts and the amount of funds in them that are opened in banks outside the Russian Federation.

- A citizen has securities, bonds, shares and other issuers that are issued by other states.

- Available real estate outside the territory of the Russian Federation.

Unrealized gains and losses under US GAAP.

According to US GAAP, unrealized gains and losses are reflected in the income statement:

- (a) for debt securities classified as trading securities (ie held for sale); And

- (b) for all investments in equity securities (other than investments that result in an increase in ownership interest that has a material effect on the investee).

The category of trading securities includes debt securities that are purchased for the purpose of selling them, rather than holding them to receive interest and principal payments. In addition, in accordance with US GAAP, unrealized gains and losses are recognized in other comprehensive income for debt securities classified as available for sale.

Available-for-sale debt securities are securities that are not considered to be held to maturity or held for sale.

How to make a budget for a month

As a rule, the main part of the salary is paid not on the first day of the month, but on the 5th, 10th or 15th. Therefore, it will be more convenient to plan a budget not for a calendar month, but for the period from paycheck to paycheck, for example, from March 10 to April 9.

Income

First, you need to record all financial receipts in order to understand how much you have. All sources of income should be taken into account: salary, bonus, part-time work, money from renting out an apartment, and so on. If your income is unstable, it makes sense to form a budget when you know exactly how much you have, for example, on the day the money is received on the card.

Expenses

The items of expenditure that cannot be avoided should be entered first. This list will look something like this:

- Groceries (including lunches at work if you eat in the canteen).

- Communal payments.

- Directions

- Mobile connection.

- Internet.

- Household chemicals.

Naturally, the list of mandatory payments will be different for each person and each family. Tolls may be replaced by gasoline costs. People with chronic diseases will take into account the costs of medicines. The same list will include loan payments, kindergarten fees, and so on. At the same time, the traditional trip to the cinema on Saturdays and similar expense items are not mandatory.

Make it a rule to put money into a “stabilization fund” every month. This can be a fixed amount or a percentage of income.

The amount remaining after deducting mandatory expenses can be dealt with in two ways:

- You allocate money for entertainment, clothing and various amenities.

- You divide the remaining amount by the number of days in the month.

With the first method, everything is clear: you determine that you will spend 3,000 rubles on cinema, the same amount on clothes, and so on. The second method is worth considering in more detail.

Let’s say you have 15,500 rubles left, and there are 31 days in the month. This means that you can spend 500 rubles daily. At the same time, mandatory expenses are already taken into account in the budget, so this money is intended only for pleasant expenses or force majeure circumstances. Accordingly, if you spend more than this amount per day, then you will go into the red, and at the end of the month you will have to tighten your belt. If you don’t spend anything, then within two weeks you’ll save up 7,000 rubles, which you can spend on something big.

The money remaining at the end of the financial period can be spent or put aside. The first way is pleasant, the second is rational.

Additional formulas for calculating gross income from sales of goods

1. Formula for calculating gross income based on total turnover:

Inhalation = STov × RNats / 100,

Where:

RNats is the estimated trade margin, which is calculated according to the formula:

RNat = Tovn / (100 + Tovn),

Where:

Tovn - trade markup (%)

The formula for calculating gross income based on total turnover is used provided that all groups of commodity values have the same markup percentage. If its size changed during the billing period, it is more advisable to use other formulas.

2. Formula for calculating gross income for the assortment of remaining product values:

Inhalation = (Tno + Tnp – Tnv) – Tnk ,

Where:

TNK - markup at the end of the billing period (credit balance of account 42).

3. Formula for calculating gross income for the range of goods sold:

Inhalation = (STov1 × Medium1 + STov2 × Medium2….. STovN × MediumN) / 100,

Where:

STov(1...N) - trade turnover for a certain group of goods;

Average (1...N) - the average percentage of markup for each group of commodity values.

This method of determining the amount of gross income is used subject to keeping records of commodity values by groups of goods with the same markup percentage.

Unrealized gains and losses under IFRS.

According to IFRS, unrealized gains and losses are reflected in the income statement:

- (a) for all investments in equity securities, unless the company's decision to invest cannot subsequently be reviewed; And

- (b) for debt securities, if those securities do not fall within other measurement categories or if the company makes a decision, which cannot subsequently be revised, to recognize gains and losses on those securities in the income statement.

These debt and equity investments are considered to be measured at fair value through profit or loss (FVPL, fair value through profit or loss).

[Cm. IFRS paragraph 9:4.1.4]

Also, in accordance with IFRS, unrealized gains and losses are reflected in other comprehensive income:

- (a) for debt securities held as part of a business model whose objective is achieved both by collecting contractual cash flows and by selling financial assets; And

- (b) for investments in equity securities for which, at initial recognition, the entity makes an election, which cannot be subsequently revised, to recognize gains or losses on those securities in other comprehensive income.

[Cm. IFRS paragraph 9:4.1.2A.]

These debt and equity investments are considered to be measured at fair value through other comprehensive income (FVOCI, fair value through other comprehensive income). The accounting for these securities is similar to the accounting for available-for-sale debt securities under US GAAP.

Even when unrealized gains and losses from holding securities are excluded from a company's net income (profit and loss), they are included in other comprehensive income and are thus part of the company's comprehensive income.

Typical accounting entries

Let's look at the order of reflecting operations using an example. Task input data:

- During the current month, LLC “Steel” sold metal profiles worth 5 million rubles.

- The cost of production amounted to 3 million rubles.

- During the activities, a defect amounting to 20 thousand rubles was discovered;

- The labor inspectorate assessed a fine of 40 thousand rubles.

- Management decided to sell part of the equipment for the amount of 1 million rubles.

Task - reflect the transactions in accounting and determine the result of the activities of Steel LLC for the month. As part of this example, several blocks of postings will be generated, the first of which will show what the results will be directly from sales:

- D 62 K 90.1 5 million - revenue is reflected;

- D 90.3 K 68 1 million - VAT reflected;

- D 90.2 K 43 3 million - cost is taken into account.

The amount of VAT is determined by the following formula: VAT = Revenue × (20/100), where 20 is the VAT rate from 2020. The second block of postings will reflect other income and expenses:

- D 91.2 K 28 20 thousand - scrap written off;

- D 91.2 K 76 40 thousand - losses from the fine are reflected;

- D 76 K 91.1 1 million - amount received from the buyer of the equipment.

And in the third block, all operations are balanced:

- D 90.9 K 90.2, 90.3 4 million - Cost and VAT accounts are closed;

- D 90.1 K 90.9 5 million - the Revenue account is closed;

- D 91.9 K 91.2 60 thousand - account closed Other expenses;

- D 91.1 K 91.9 1 million - the Other income account is closed.

In addition, at the end of the reporting period, the balance on accounts 90 and 91 is transferred to account 99 “Profits and losses”, that is, the final financial results are formed. To summarize, we note that for the economy as a whole, the key role is played by the correct calculation of income/expenses in business activities. This is due to the fact that organizations are the main taxpayer, that is, the filling of the state budget depends on them. Below you will also find a video with useful information on the topic of income and expenses.

Gross profit - what is it? Calculation formula.

The income of the enterprise should be summed up, the costs incurred should be subtracted from them, and thus the gross profit will be determined. For example, income comes from the sale of goods, and expenses are the costs of their creation, or their cost. Having found the difference between the first and second, it will be possible to find out what the amount of gross profit is from the type of activity of the company, which is the main one. The amount of gross profit for other types of activities is determined in the same way. It is noteworthy that in the field of trade, gross profit is determined by finding the difference between the price and cost of the product. In the field of industrial production, it is more difficult to calculate this indicator, since many costs are included in the cost. The effectiveness of several enterprises is most often compared precisely by their gross profit. You can also keep track of which type of activity in one company is the most effective, thanks to the gross profit indicators for each of the types of activities performed by the company. The creditworthiness of enterprises is calculated by bank employees also according to this criterion. But the owners of the company themselves are more interested in the net profit indicator.

Gross profit calculation formula: VP = BH - I (C + OZ), where:

VP - Gross profit BH - Net sales income I - Costs C + OZ - Cost + Operating costs

Net profit, concept and calculation formula.

All actions and operations of the company in a certain period of time are reflected in the net profit indicator. It is calculated by subtracting from the gross profit the costs that must be incurred by law. These costs include taxes, penalties and other expenses. Gross profit, after the above costs have been deducted, becomes the basis on which dividends are calculated to the owners of the company. The net profit value demonstrates the company's performance, which should be reported on the balance sheet.

Net profit calculation formula: PE = FP + VP + OP – SN, where:

PE – net profit,

FP – financial profit,

VP – gross profit,

OP – operating profit,

CH – amount of taxes.

Video on the topic: ebitda indicator