Simplified tax system and criteria for its use

In order to be able to use one of the simplest tax regimes in their activities - simplified taxation, a legal entity or individual entrepreneur must comply with a number of certain numerical indicators (Article 346.12 of the Tax Code of the Russian Federation):

- The number of employees is no more than 100 people.

- The residual value of the fixed assets is no more than 150 million rubles.

Important! From 2021, it is allowed to exceed the limits on number and income and pay tax at higher rates. Read more about this here.

- The share of participation of other legal entities is no more than 25%.

- The limit on the simplified tax system for income received for the entire tax period (year) is not higher than 150 million rubles. (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

Other important criteria are (Article 346.12 of the Tax Code of the Russian Federation):

- Lack of branches.

- Failure to carry out certain activities (clause 3 of Article 346.12 of the Tax Code of the Russian Federation).

If at least one of the listed criteria is no longer met, the simplified tax system cannot be applied.

Conditions for the transition to the simplified tax system with UTII

The transition from UTII to simplified taxation is possible in the following cases:

1) voluntarily;

2) the organization has ceased its activities for which it applied UTII, including:

- if the UTII regime for such activities in the municipality has been abolished (clause 2 of Article 346.26 of the Tax Code of the Russian Federation);

- if the organization is recognized as the largest taxpayer (clause 2.1 of Article 346.26 of the Tax Code of the Russian Federation);

- if the organization began activities within the framework of a simple partnership agreement or a property trust management agreement (clause 2.1 of Article 346.26 of the Tax Code of the Russian Federation);

- if an organization opens a new business for which it does not intend to apply UTII, including in cases where the use of UTII is possible (letter of the Federal Tax Service of Russia dated February 25, 2013 No. ED-3-3/639).

Limit on the simplified tax system for 2020-2021 for those planning to switch to a special regime

If an organization plans to switch to the simplified tax system from next year, it needs to take into account that its revenue for 9 months of the current year is also regulated. The limit on the simplified tax system for 2020, exceeding which will not allow switching to a special regime from 2021, is 112.5 million rubles.

NOTE! The limit set for the transition to a simplified simplified tax system 2020-2021 is valid only for organizations. If an individual entrepreneur decides to switch to the simplified tax system, there is no limit on the amount of revenue for 9 months of the year preceding the transition to the simplified tax system.

Both limits (for income for 9 months and for the entire annual income) under the simplified tax system in 2020 do not provide for indexation depending on the value of the deflator coefficient (the coefficient for 2020 is 1). But starting from 2021, marginal incomes will be indexed, which means they will increase. The coefficient will be determined by the government.

Indexation is provided for in Art. 346.12 and 346.13 of the Tax Code of the Russian Federation, but for the period until 2021 it is actually frozen (Law “On Amendments...” dated 07/03/2016 No. 243-FZ).

Transition rules

As a general rule, organizations and entrepreneurs switch to the simplified tax system from the beginning of the calendar year (clause 1 of article 346.13, clause 1 of article 346.19 of the Tax Code of the Russian Federation). Special provisions are established:

- for newly created organizations (newly registered entrepreneurs). They have the right to apply the “simplified tax” from the date of registration with the tax authority (paragraph 1, paragraph 2, article 346.13 of the Tax Code of the Russian Federation);

- for taxpayers who are switching to the simplified tax system due to the abolition of another special regime - UTII. They can work on a “simplified” basis from the beginning of the month in which the obligation to pay the single tax ceased (paragraph 2, paragraph 2, article 346.13 of the Tax Code of the Russian Federation).

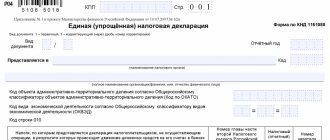

In each of the above cases, you must inform the tax authority about the transition to the simplified tax system within a certain time frame. To do this, you must submit a notification to the tax office at your location (place of residence). This procedure follows from paragraph 1 of Art. 346.13 Tax Code of the Russian Federation. The form of notification of the transition to the simplified tax system was approved by Order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829. However, if an organization or individual entrepreneur wants to switch to the simplified tax system in 2020, they will need to check themselves for compliance with certain conditions for the transition to the simplified tax system from 2020.

Limit on simplified tax system for 2020-2021 for existing companies

If the income of a simplified worker in any period of 2020 exceeds the established simplified tax system income limit of 150 million rubles, he loses the opportunity to work on the simplified tax system.

You must report the loss of your right to the simplified tax system to the tax office. How such a message is filled out is discussed in detail in the Ready-made solution from ConsultantPlus. Get free access to the system and proceed to the explanations and completed sample.

In 2021, the income limit will work a little differently. To apply the simplified tax system under general conditions, you will need to meet a limit of 150 million rubles, indexed by the deflator coefficient. If your income exceeds this amount, but is within 200 million rubles, you can remain on the simplified tax regime and pay tax at higher rates.

Read about how this will work in practice in our article.

If you decide to voluntarily switch from the simplified tax system to a different tax regime, read the message “Notification of leaving the simplified tax system is required.”

Annual revenue

In 2020, the annual revenue limit is 150 million rubles; this value has been established since 2020 and has not yet changed. This amount of revenue allows more companies to remain on the simplified tax regime, because since 2020, the annual income limit has increased by 2.5 times. Previously, the amount of income was indexed by the deflator coefficient, but in the period 2017-2020. it does not apply.

Simplified companies can conduct activities generating income of up to 150 million rubles, and not be afraid of losing the right to apply the simplified tax system. Please note that not all income received is included in the calculation.

Income included in the calculation:

- sales income;

- non-operating income;

- from the realization of rights to property;

- advances received.

Income excluded from the calculation:

- repaid loan;

- the deposit or deposit received;

- property received as a contribution to the authorized capital;

- from property received free of charge;

- funds received under an agency agreement;

- grants received;

- income from activities under a different taxation regime, when combining the simplified tax system with UTII or a patent.

Simplified people who want to stay on the simplified tax system, when approaching the income limit, try to reduce it. There are several ways to do this, but they are unsafe and well known to tax authorities, so they can easily figure out such fraud. For example, it is common to draw up two agreements with a counterparty - a sale and purchase agreement and a loan. That is, payment is transferred to you in the form of a loan, and next year they offset the requirements. In this case, the tax authorities can prove that the loan is fictitious, and if, taking it into account, the income exceeds the limit, the right to use the simplified tax system will be lost.

Results

When planning the transition to the simplified tax system, organizations must take into account the limit on the simplified tax system established in relation to income for 9 months of the year preceding the transition to this special regime. This limit of the simplified tax system for 2020 for an LLC is 112.5 million rubles. It will be indexed in 2021.

Existing payers of the simplified tax system (both organizations and individual entrepreneurs) must control the maximum amount of annual revenue, exceeding which entails a ban on the use of this special regime. The income limit of the simplified tax system for 2020 is 150 million rubles. In 2021, indexation will be in effect, as well as an increased limit of 200 million rubles, which will allow you not to immediately fall off the simplified tax system.

Income for determining the limits of the simplified tax system for 2020-2021 is determined by the cash method.

Sources:

- Tax Code of the Russian Federation

- Federal Law of July 3, 2016 N 243-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and medical insurance”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

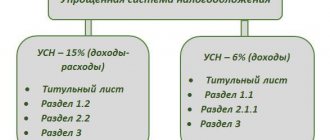

New single tax rates under the simplified tax system

As a general rule, if the object of taxation is income, the tax rate is set at 6 percent. The laws of the constituent entities of the Russian Federation may establish differentiated tax rates ranging from 1 to 6 percent, depending on the types of business activities and certain categories of taxpayers (clause 1 of Article 346.20 of the Tax Code of the Russian Federation).

If the object of taxation is income reduced by the amount of expenses, the tax rate is set at 15 percent. The laws of the constituent entities of the Russian Federation may establish differentiated tax rates ranging from 5 to 15 percent, depending on the types of business activities and certain categories of taxpayers (clause 2 of Article 346.20 of the Tax Code of the Russian Federation).

For companies that have exceeded the income limits by 50 million rubles and the average headcount by 30 people, increased single tax rates are applied.

New rules for writing off fixed assets from 2020

Since 2020, preferences have been introduced for simplifiers regarding the write-off of fixed assets. Thanks to Federal Law No. 325-FZ of September 29, 2019, simplifiers will be able to quickly write off expenses for the purchase of real estate.

Let us remind you that now writing off the cost of purchased real estate as expenses is possible if, in addition to payment and commissioning, there is the fact of filing documents for state registration (clause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation, clause 3, article 346.16 of the Tax Code of the Russian Federation).

Starting from 2020, in order to recognize expenses in the form of the cost of fixed assets, there is no need to wait for the submission of documents for state registration of property rights (clause 3 of Article 346.16 of the Tax Code of the Russian Federation as amended by Federal Law No. 325-FZ).

How to calculate the increased single tax rate?

For the first time, the bill introduces a smooth mode of departure from the simplified tax system. This applies to those payers who exceed the income limit by no more than 50 million rubles or the average number of no more than 30 people.

Such an excess is no longer fraught with an automatic transition to a general taxation system.

EXAMPLE No. 1.

at the end of 9 months of 2020, it exceeded the revenue limit by 20 million rubles and amounted to 170 million rubles.

Let’s assume that at the end of 2020, the company’s revenue amounted to 190 million rubles.

Starting from July 1, 2020 (i.e. in the 3rd quarter of 2020, when the limit is exceeded), the company will apply a rate of 8% (object “Income”). For the 4th quarter of 2020, the company will also apply a rate of 8%.

The single tax under the simplified tax system at the end of 2020 should be calculated using the following formula:

Single tax under the simplified tax system at the end of the year = Taxable base for 6 months? 6% Taxable base for the 6th quarter? 8%

At what rate will the company pay a single tax next year?

If the limits are exceeded, but by no more than 50 million rubles (that is, the income is in the range from 150 million to 200 million rubles), then the company will pay a single tax under the simplified tax system at an increased rate of 8%. Advance payments for the single tax will be calculated at the same rate. Under the conditions of example No. 1, the company will pay a single tax at a rate of 8%.

The company will be able to return to regular single tax rates provided that the limits on income and number of employees are met. For example, if at the end of the tax period the company’s income does not exceed the limit of 150 million rubles, then at the end of the tax period the single tax under the simplified tax system is calculated at a rate of 6%.

In case of overpayment of the single tax in connection with the payment of advance payments at a rate of 8%, the amount of the overpayment will be counted against future payments under the simplified tax system. Despite the fact that this rule is not spelled out in the draft law, the general procedure for offset (refund) of overpaid tax applies here.

Now let's change the conditions of the previous example.

EXAMPLE No. 2.

at the end of 9 months of 2020, it exceeded the revenue limit by 20 million rubles and amounted to 170 million rubles.

And at the end of 2020, the company’s revenue amounted to 240 million rubles.

Starting from October 1, 2020 (i.e. in the 4th quarter of 2020, when the limit for applying the simplified tax system was exceeded), the company loses the right to use the simplified tax system and pays taxes in accordance with the general taxation regime.

When will the company be able to return to the simplified tax system again? If desired, the company can again apply the simplified tax system, but not earlier than a year after leaving the simplified system and subject to compliance with the limits for the transition to this regime.

That is, if a company left the simplified tax system in 2020, then it will be able to return to this regime no earlier than 2022.

At the same time, the limits for switching to the simplified tax system will remain the same. If a company decides to apply the simplified tax system starting from 2020, then it must submit a notification to the tax office about the transition to the simplified tax system no later than December 31, 2020.

The notification is submitted in the form approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] , or is submitted via telecommunication channels in an electronic format approved by order of the Federal Tax Service of Russia dated November 16, 2012 No. ММВ- 7-6/ [email protected] Having decided to switch to the simplified tax system, the company at the end of the year must complete a number of transition procedures (for example, transfer unclosed advances to income under the simplified system in December 2019).

For example, if a company used the accrual method of income tax in 2020, then it is necessary to highlight expenses paid but not recognized in tax accounting in 2020 (due to the absence of a “primary” payment from the counterparty).

In order to switch to the simplified tax system from 2020, the company’s income (from sales and non-operating income without VAT and excise taxes) for 9 months of 2019 should not exceed 112.5 million rubles, the cost of its fixed assets as of October 1, 2020 should not exceed 150 million rubles, and the average number should not exceed 100 people (Article 346.12 of the Tax Code of the Russian Federation).

Let us remind you that the average number is calculated in the manner specified in Rosstat Order No. 772 dated November 22, 2017.