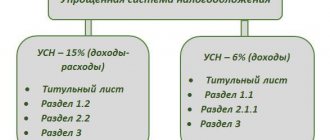

What are the tax rates for simplifiers?

The tax rate under the simplified tax system is established by Art. 346.20 of the Tax Code of the Russian Federation and for the general case of application of this system, depending on the object of taxation, is taken equal to:

- for the object “income” - 6% of the total value of income for the entire tax period;

- for the object “income from which expenses are deducted” - 15%.

For both objects of taxation, the use of reduced rates is permissible if a decision on this is made in the corresponding region of the Russian Federation.

IMPORTANT! From 2020, officials plan to increase rates under the simplified tax system to 8% for the object “income” and to 20% for “income minus expenses” for those taxpayers who have exceeded the established limits. Increased rates will be applied if income under the simplified tax system exceeds more than 150 million rubles, but up to 200 million rubles, as well as if the number of employees exceeds 100 - 130 people. See here for details.

Rates can be differentiated by categories of taxpayers, and in some cases, by type of activity. A taxpayer for whom a differentiated rate applies in the region where he carries out business activities does not need to prove his right to it or notify the tax authority about its application (letter of the Ministry of Finance of Russia dated October 21, 2013 No. 03-11-11/43791). The financial department, justifying its response, indicated that the differentiated rate is not a benefit, so there is no need to confirm the right to it with the fiscal authority.

The generally acceptable value of reduced rates is in the range:

- for the object “income” - from 1 to 6%, and their use has become possible only since 2020 (Clause 1, Article 2 of the Law “On Amendments...” dated July 13, 2015 No. 232-FZ);

- for an object “income minus expenses” - from 5 to 15%, and for the Republic of Crimea and the city of Sevastopol for the period 2017–2021 it may be even lower (up to 3%).

Some taxpayers may apply a zero rate. These include newly registered individual entrepreneurs operating in the production, social or scientific spheres (and from 2020, in the field of consumer services to the population), for the first 2 periods of work from the date of state registration as an individual entrepreneur, regardless of the chosen object of taxation.

If, calculated from the rate established in the region, the simplified tax system tax turns out to be less than 1% of the income received during the tax period, the taxpayer using the “income minus expenses” object becomes obligated to pay the minimum tax (clause 6 of article 346.18 of the Tax Code of the Russian Federation). Its amount will be equal to 1% of the income received during the period, even if the activity turned out to be unprofitable.

Read how to calculate the minimum tax under the simplified tax system here.

How to calculate the tax according to the simplified tax system for individual entrepreneurs using the simplified tax system of 6% in 2020? And again about the tax deduction!

Good afternoon, dear individual entrepreneurs!

Every year, a lot of questions arise on the topic of tax deduction of insurance premiums of individual entrepreneurs from the tax under the simplified tax system for individual entrepreneurs on the simplified tax system of 6% (“income”) without employees. Questions are constantly asked about how to correctly calculate tax according to the simplified tax system, how to correctly make a tax deduction, and so on and so on...

The flow of questions never stops =)

In this article we will look at several examples and calculate on a calculator so that all this is clear. And, I hope, I will immediately answer most of your questions.

To begin with, I would like to note that it is better to make mandatory contributions to compulsory pension and health insurance quarterly.

Yes, I know that these fees can be paid at once, for the whole year (they often do this). But the vast majority of individual entrepreneurs prefer to make these payments quarterly in order to evenly distribute the burden of individual entrepreneur payments throughout the year. The vast majority of programs for individual entrepreneurs on the simplified tax system offer to pay insurance premiums “for yourself” quarterly. Also, if you have an individual entrepreneur’s bank account, I also strongly recommend paying contributions “for yourself” quarterly, and only from the individual entrepreneur’s bank account.

You can read about how much and when you need to pay contributions for compulsory insurance “for yourself” in 2020 in this article:

Before moving on to specific examples, I will make a small clarification. In order not to write a long wording every time “mandatory contributions to pension and health insurance of individual entrepreneurs,” I will write “mandatory contributions” or simply “contributions for myself.” But what is meant is the mandatory contributions of individual entrepreneurs for pension and health insurance “for themselves.”

So, let’s consider a specific example for an individual entrepreneur on the simplified tax system of 6% without employees

For example, an individual entrepreneur has a simplified taxation system (USN) of 6% and he works WITHOUT employees. It is important that without employees, since for individual entrepreneurs with employees the algorithm for deductions is different.

The individual entrepreneur has been operating for the first year, he has no reporting debts, taxes or contributions for previous years. The individual entrepreneur paid mandatory insurance premiums “for himself” for the first quarter of 2020 BEFORE March 31, 2018.

This is important, because if you pay these fees AFTER March 31, 2018, then the advance payment under the simplified tax system for the first quarter of 2020 CANNOT be reduced. But below, in the examples, the situation for those who were late is considered... Read and consider carefully.

Let the income of our individual entrepreneur from the example for the first quarter of 2020 be 400,000 rubles.

But first, let me remind you that mandatory contributions to pension and health insurance “for yourself” for individual entrepreneurs in 2020 are the following amounts:

- Contributions to the Pension Fund “for yourself” (for pension insurance): 26,545 rubles

- Contributions to the FFOMS “for yourself” (for health insurance): 5,840 rubles

- Total for 2020 = 32,385 rubles

- Also, do not forget about 1% of the amount exceeding 300,000 rubles of annual income (more on this below)

If these mandatory contributions are made quarterly, then the numbers above must be divided into four quarters:

- Contributions to the Pension Fund: 26545: 4 = 6636.25 rubles

- Contributions to the FFOMS: 5840: 4 = 1460 rubles

- Total for the quarter: 8096.25 rubles

So let's go back to our example

The individual entrepreneur received income of 400,000 rubles for the first quarter. And before March 31, 2020, paid mandatory contributions for the first quarter of 2020 in the amount of:

- Contributions to the Pension Fund: 26545: 4 = 6636.25 rubles

- Contributions to the FFOMS: 5840: 4 = 1460 rubles

- Total for the quarter: 8096.25 rubles

What will be the advance payment under the simplified tax system for the first quarter of 2018?

We calculate the advance according to the simplified tax system: 400,000 * 6% = 24,000 rubles

From these 24,000, our individual entrepreneur has the right to make a tax deduction for the amount of paid mandatory contributions to pension and health insurance for the first quarter:

24,000 – 6636.25 – 1460 = 15,903 rubles. 75 kopecks.

That is, we have made a so-called tax deduction from the advance payment under the simplified tax system and with a clear conscience we are reducing its size.

But please note that this scheme only applies if contributions to compulsory pension and health insurance were made strictly BEFORE March 31 of the current year. Of course, this rule also applies for the following quarters, only the deadlines for paying mandatory contributions will be different (see below).

What happens if I pay mandatory contributions to pension and health insurance after March 31?

You will NOT be able to make a tax deduction from the advance payment under the simplified tax system for the first quarter. That’s why I’m writing that the contribution must be made in advance, BEFORE the end of the quarter. But this does not mean that this amount, as they say, will “burn out.”

Read on and you will understand how to count correctly.

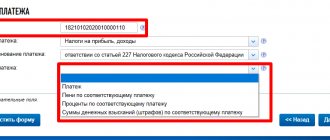

Where and how should I pay?

You can pay from an individual entrepreneur’s account or in cash using a receipt at Sberbank. The receipts and payment orders themselves can be generated in an accounting program (for example, in 1C or in popular online accounting for individual entrepreneurs). Therefore, I will not dwell on this issue in detail, since everyone keeps records in different programs and services.

Just remember that starting from January 1, 2020, these contributions must be paid not to the Pension Fund and the Federal Compulsory Medical Insurance Fund, as was the case in past years, but to the Federal Tax Service. Thus, under no circumstances use details from old payments and receipts for previous years. And in general, do not use old templates when paying taxes and contributions, as the KBK and the details of the Federal Tax Service may change...

And one more important point:

Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting in 2020, control this moment too. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

What if mandatory contributions are greater than the quarterly advance payment under the simplified tax system?

Indeed, such situations often occur.

For example, the advance payment under the simplified tax system for the first quarter amounted to 1,000 rubles, and the amount of mandatory contributions amounted to 8,096.25 rubles. Since the advance payment under the simplified tax system for the first quarter is less than the contributions, you don’t have to pay anything. According to the simplified tax system, of course.

1000 - 8096.25 = -7096.25 (Negative value, we do not pay an advance under the simplified tax system).

And what? Will these 7096.25.5 rubles “burn out”?

No, they won't burn. They will carry over to the next quarter for deduction. You need to understand what we consider the cumulative total for 3, 6, 9 and 12 months.

For example, how will we calculate the deduction in the second quarter if the situation turned out that in the first quarter mandatory contributions were more than the advance payment under the simplified tax system?

quarter 2020

- Income 16,660 rubles;

- The individual entrepreneur paid mandatory contributions in the amount of 8096.25 rubles for the first quarter;

- 16660*6% =999.6 rubles, which is less than 8096.25 rubles. This means that our individual entrepreneur does not pay the advance according to the simplified tax system.

quarter 2020

- Income 300,000 rubles;

- The individual entrepreneur paid mandatory contributions in the amount of 8096.25 rubles for the second quarter;

- (16660+300,000)*6% =18,999.6 rubles; (we sum up the revenue from individual entrepreneurs for two quarters and calculate 6% of this amount)

- Let's sum up the mandatory contributions for the first and second quarters: 8096.25 + 8096.25 = 16192.5 rubles.

- We make a deduction: 18,999.6 - 16192.5 = 2807.1 rubles. you need to pay an advance according to the simplified tax system based on the results of the first half of 2020.

I hope I didn't confuse you =)

In general, I recommend that you do not calculate all this manually, but buy a good accounting program for individual entrepreneurs. Now there are a lot of solutions for such problems. Both programs for a regular computer and online services. All this is calculated automatically in the programs.

Let's consider another example for an individual entrepreneur on the simplified tax system of 6% without employees

First quarter of 2020

- The entrepreneur received an income of 60,000 rubles in the first quarter.

- I did NOT make contributions to compulsory insurance “for myself.”

- But I paid an advance payment under the simplified tax system of 60,000 * 6% = 3,600 rubles.

Second quarter 2020

- Income 300,000 rubles

- I paid mandatory contributions “for myself” immediately for the first and second quarters of 2020 in the amount of 16,192.5 rubles (must be paid strictly before June 30!)

How to calculate an advance payment under the simplified tax system for the first half of 2020?

We count:

- Let’s sum up all income for the six months: 60,000 +300,000 = 360,000

- We calculate 6% of this amount: 360,000 * 6% = 21,600

- From this number we subtract the mandatory contributions that the individual entrepreneur paid for six months. And we subtract the advance payment according to the simplified tax system, which the entrepreneur paid in the first quarter:

21,600 - 16192.5 - 3600 = 1807.5 rubles must be paid based on the results of the first two quarters (more precisely, for six months)

We calculate similarly for 9 months of 2020. I think that the scheme is clear, and you will need it to control accounting programs that calculate all this automatically. But, of course, you need to understand what algorithm is used to make the calculations.

And one more example.

Let's calculate the advance payment under the simplified tax system for 9 months of 2020

In order not to complicate the calculations, let's continue the example discussed above:

First quarter of 2020

- The entrepreneur had an income of 60,000 rubles in the first quarter.

- I did NOT make contributions to compulsory insurance “for myself.”

- But I paid an advance payment under the simplified tax system of 60,000 * 6% = 3,600 rubles.

Second quarter 2020

- Income 300,000 rubles

- I paid mandatory contributions “for myself” immediately for the first and second quarters of 2020 in the amount of 16,192.5 rubles (must be paid strictly before June 30!)

- I paid an advance payment under the simplified tax system in the amount of 1807.5 rubles (we just calculated this value when we calculated the advance payment under the simplified tax system for the six months)

Third quarter 2020

- Income 200,000 rubles

- Paid mandatory contributions “for myself” for the third quarter in the amount of 8096.2 5 rubles. That is, for 9 months our individual entrepreneur paid a total of 8,096.25 + 16,192.5 = 24,288.75 rubles for compulsory pension and health insurance

How to calculate an advance payment under the simplified tax system for 9 months of 2020? The same as how they counted for half a year.

- We sum up all income for 9 months: 60,000 + 300,000 + 200,000 = 560,000

- We calculate 6% of this amount: 560,000 * 6% = 33,600 rubles

- From this number we subtract the mandatory contributions that the individual entrepreneur paid for 9 months. And we subtract the advance payments under the simplified tax system that the individual entrepreneur made for six months:

33,600 – 24,288.75 – 1,807.5 – 3,600 = 3,903.75 rubles will need to be paid in advance under the simplified tax system for 9 months.

Please note that we counted everything strictly, down to the penny. I did this on purpose so as not to completely confuse newbie entrepreneurs with rounding to whole rubles =)

But accounting programs calculate amounts rounded to whole rubles, according to the rules of arithmetic. So, don’t be surprised when the accounting program rounds the total amount to whole rubles.

I understand that calculating all this is quite tedious, even for an experienced accountant or individual entrepreneur. Therefore, I made a special calculator for individual entrepreneurs using the simplified tax system “Income”

Read the instructions for its use carefully and try it:

Watch the video, but just keep in mind that the video instructions show the amounts for mandatory payments in 2020.

What about the 1% that must be paid for revenues of more than 300 thousand?

Indeed, an individual entrepreneur is required to pay 1% of the amount exceeding 300,000 rubles per year for pension insurance.

Personally, I prefer to make this payment at the end of the year following the reporting year. And I will do it from January 1 to April 30, 2019.

It can also be deducted from the tax according to the simplified tax system, but only for the year in which 1% of the amount was paid, over 300,000 rubles per year. For example, I will pay 1% in 2020. This means that I will be able to reduce the tax under the simplified tax system only for 2020, since the payment was made in 2019.

If you pay 1% during 2020, you can reduce advance payments under the simplified tax system for 2020. Of course, if you exceed the annual income of 300,000 rubles in 2020. If you use accounting programs, they automatically calculate all this.

Please note that 1% of the amount exceeding 300,000 rubles of the annual income of an individual entrepreneur must be paid before July 1, 2020.

And when do you need to pay tax according to the simplified tax system for the 4th quarter (more precisely, “at the end of the year”)?

Indeed, if everything is clear and understandable in the first three quarters regarding the timing of advance payments under the simplified tax system:

- for the 1st quarter of 2020: from April 1 to April 25;

- for 6 months of 2020: from July 1 to July 25;

- for 9 months of 2020: from October 1 to October 25;

When should I pay tax according to the simplified tax system at the end of the year?

I answer: it must be paid no later than April 30, 2020, when you prepare a declaration under the simplified tax system.

Once again, everything is considered a cumulative total. Here we will already calculate based on the results of the year.

When do you need to pay quarterly contributions for compulsory pension and health insurance?

- for the 1st quarter of 2020: from January 1 to March 31;

- for the 2nd quarter of 2020: from April 1 to June 30;

- for the 3rd quarter of 2020: from July 1 to September 30;

- for the 4th quarter of 2020: from October 1 to December 31.

Important:

Don't wait until the last day to pay your taxes and fees. Taking into account all kinds of holidays and weekends, the money may simply get stuck in the bank and not reach its destination on time.

For example, you made a payment for insurance premiums on the evening of March 31, and the money was “stuck” somewhere in the bank for some unknown reason for several days. A technical glitch occurred and the payment was sent, for example, on April 1st. Accordingly, you will no longer be able to make a tax deduction from the tax under the simplified tax system for the first quarter. Therefore, it is better to pay all taxes and fees at least a week before the deadline.

A little advice:

In fact, all this is automatically calculated in accounting programs. They already have built-in calendars that will notify you about upcoming tax events and generate receipts for paying taxes and contributions. Form a declaration and KUDIR.... And so on and so forth.

Your task will be to accurately enter cash flow transactions into such programs. And the program itself will generate reports based on these operations.

Therefore, you MUST buy an accounting program for individual entrepreneurs and do not bother yourself with unnecessary information :) But nevertheless, you must understand how taxes and contributions are calculated.

And be able to check the correctness of their calculations. In fact, that is precisely why this short article arose.

Best regards, Dmitry Robionek

Dear entrepreneurs!

A new e-book on taxes and insurance contributions for individual entrepreneurs on the simplified tax system of 6% without employees is ready for 2020:

“What taxes and insurance premiums does an individual entrepreneur pay under the simplified tax system of 6% without employees in 2020?”

The book covers:

- Questions about how, how much and when to pay taxes and insurance premiums in 2020?

- Examples for calculating taxes and insurance premiums “for yourself”

- A calendar of payments for taxes and insurance premiums is provided

- Frequent mistakes and answers to many other questions!

Find out the details!

Dear readers, a new e-book for individual entrepreneurs is ready for 2020:

“IP on the simplified tax system 6% WITHOUT Income and Employees: What Taxes and Insurance Contributions Do I Need to Pay in 2020?”

This is an e-book for individual entrepreneurs on the simplified tax system of 6% without employees who have NO income in 2020. Written based on numerous questions from individual entrepreneurs who have zero income and do not know how, where and how much to pay taxes and insurance premiums.

Find out the details!

Dear readers!

A detailed step-by-step guide to opening an individual entrepreneur in 2020 is ready. This e-book is intended primarily for beginners who want to open an individual entrepreneur and work for themselves.

This is what it's called:

“How to open an individual entrepreneur in 2020? Step-by-Step Instructions for Beginners"

From this manual you will learn:

- How to properly prepare documents for opening an individual entrepreneur?

- Selecting OKVED codes for individual entrepreneurs

- Choosing a tax system for individual entrepreneurs (brief overview)

- I will answer many related questions

- Which supervisory authorities need to be notified after opening an individual entrepreneur?

- All examples are for 2020

- And much more!

Find out the details!

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe!” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

What special tax rates under the simplified tax system are in effect in 2015–2021

After the Law “On Amendments...” of December 29, 2014 No. 477-FZ came into force in Art. 346.20 of the Tax Code of the Russian Federation, paragraphs were added. 3 and 4. In accordance with them, from the beginning of 2015 until the beginning of 2022, preferential tax conditions under the simplified tax system are provided for some taxpayers.

In paragraph 3 of Art. 346.20 of the Tax Code of the Russian Federation mentions that for the period 2017–2021 for taxpayers (all or some specific categories) of the Republic of Crimea and the city of Sevastopol, the rate for simplifiers who have chosen the base “income minus expenses” can be reduced to 3% (see changes in clause 3 of article 346.20, introduced by law dated July 13, 2015 No. 232-FZ).

To learn how to change the object of taxation under the simplified tax system, read the article “Procedure for switching from the simplified tax system of 6% to the simplified tax system of 15% .

The right to apply a 0% rate from 2015 to the end of 2020 was granted to individual entrepreneurs who first started their business no earlier than 2020 (Clause 4 of Article 346.20 of the Tax Code of the Russian Federation) and leading it in the social, scientific or industrial sphere (and from 2020 year in accordance with the amendments introduced by the law of July 13, 2015 No. 232-FZ, and in the field of consumer services).

This benefit is given to individual entrepreneurs for 2 tax periods (years) from the date of registration and is valid if the share of the entrepreneur’s income for the tax period for the type of activity for which a 0% rate is applied under the simplified tax system is at least 70%. The law of the region may establish other restrictions for the application of the zero rate individual entrepreneur.

If the 0% rate is justified, an individual entrepreneur is not required to pay the minimum tax calculated at a rate of 1% of income on the simplified tax system for the object “income minus expenses.”

Specific types of services that are subject to preferential taxation for such newbie individual entrepreneurs are established by the constituent entities of the Federation in the relevant legislative acts.

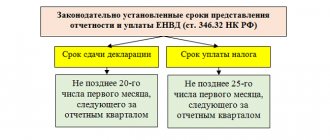

Simplified taxation system

^ Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period.

Reporting period Quarter Half year 9 months Tax period Year Organizations pay tax and advance payments at their location, and individual entrepreneurs - at their place of residence. 1 We pay the tax in advance No later than 25 calendar days from the end of the reporting period. Advance payments paid are counted towards tax based on the results of the tax (reporting) period (year) () 2 We fill out and submit a declaration according to the simplified tax system

- Individual entrepreneurs - no later than April 30 of the year following the expired tax period

- Organizations - no later than March 31 of the year following the expired tax period

3 We pay tax at the end of the year

- Organizations - no later than March 31 of the year following the expired tax period

- Individual entrepreneurs - no later than April 30 of the year following the expired tax period

If the last day of the tax payment (advance payment) deadline falls on a weekend or non-working holiday, the payer must remit the tax on the next working day.

Payment methods:

- Receipt for cashless payment

- Through the client bank

Procedure and deadlines for submitting a tax return The tax return is submitted at the location of the organization or the place of residence of the individual entrepreneur.

- Organizations - no later than March 31 of the year following the expired tax period

- Individual entrepreneurs - no later than April 30 of the year following the expired tax period

“On approval of the form of the tax return for the tax paid in connection with the application of the simplified taxation system, the procedure for filling it out, as well as the format for submitting the tax return for the tax paid in connection with the application of the simplified system

Peculiarities of applying rates under the simplified tax system “income” in 2019–2020

When choosing the object of taxation of the simplified tax system “income”, the rate, unless otherwise established in the region, will be equal to 6%.

Since 2020, in accordance with the law of July 13, 2015 No. 232-FZ, simplified tax rates for the object “income”, upon approval of the relevant laws by the constituent entity of the Russian Federation, can be reduced and set in the range from 6 to 1%. In order to find out what rate for the simplified tax system “income” is established in the taxpayer’s constituent entity for the current year, he needs to familiarize himself with the relevant current local law.

In the Republic of Crimea and the city of Sevastopol, which have the right to apply special reduced rates, for the object “income” the laws of the regions for the period 2017–2021 set a rate equal to 4% (Law of Crimea dated October 26, 2016 No. 293-ZRK/2016, law of Sevastopol dated 02/03/2015 No. 110-ZS). In Sevastopol, for taxpayers involved in crop production, fish farming, education, healthcare, etc., a rate of 3% is established.

Read more about the special regime of the simplified tax system for the object “income” in the material “Sitted tax system income in 2020 - 2020 (6 percent): what do you need to know?” .

Peculiarities of applying rates under the simplified tax system “income minus expenses” in 2019–2020

On the simplified tax system, the tax rate for the “income minus expenses” object chosen by the taxpayer, unless otherwise established in the region, is 15%.

Subjects of the Federation, by their law, can establish reduced rates (but not lower than 5%) for various groups of taxpayers. In order to find out what rate under the simplified tax system “income minus expenses” is established in the taxpayer’s constituent entity for the current year, he needs to familiarize himself with the relevant current local law.

In the Republic of Crimea and the city of Sevastopol, which have the right to apply special reduced rates, for the object “income minus expenses” the regional laws set a rate equal to 10%. In Sevastopol, for certain categories of taxpayers, the tax rate is 5%.

For more information about the special simplified taxation system with the object “income minus expenses”, read the article “STS “income minus expenses”” .

Taxation in Crimea in 2020

If you are going abroad, I advise you to get an international travel sim card, Drimsim. For just 10 euros you can get incoming/outgoing calls and internet for the entire duration of your stay in the country.

You can get a bonus of 7 euros for inviting friends.

Profit One of the most popular tourist destinations for Russians in the summer is Crimea.

It is important to always stay in touch, and even more important to know how much it will all cost. In this article we will consider the following issues: Mobile operators in Crimea have roaming.

- As you may know, in the recent past the FAS obligated telecom operators to cancel roaming in Russia. So this requirement does not apply to Crimea and Sevastopol. Well-known Russian telecom operators operate in Crimea on slightly different principles than in other Russian cities. Most likely, this is due to the notorious sanctions regime, and companies are simply trying to protect themselves from possible inclusion in sanctions lists. For example, for the territory of Crimea, the cellular operators Beeline, Megafon and Tele-2 do not have any additional options. On the peninsula, you will not have tariffs and various convenient options that operate without problems in the rest of Russia.

Subscribers of the listed companies upon entering Kerch will be subject to internal roaming, due to which telephone conversations and Internet use will cost much more. Additional service packages that are valid in other regions of the country are also valid here. There are also local mobile operators in Crimea : Krymtelecom, Win Mobile, Sevmobile (purely Sevastopol operator), Volna.

The Krymtelecom network also operates throughout Crimea.

Currently, active work is underway on the peninsula to increase cellular coverage and increase Internet capacity.

Firstly, it is very expensive - tariffs are the same as in international roaming. Many complain about bills of thousands of rubles even for infrequent

Results

The tax rate under the simplified tax system is determined by the type of taxable object chosen by the taxpayer. In general, this is 6% for the “income” object and 15% for “income minus expenses”. Local authorities have the right to reduce rates down to zero for newly registered entrepreneurs.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.