EGAIS is a unified state automated information system designed to control the production and turnover of alcoholic products, including beer. All individual entrepreneurs and legal entities involved in the production, import and sale of beer are required to work through this system. Retail outlets are required to work through the service in terms of procurement. You can connect yourself on the official website of Rosalkogolregulirovanie, or by sending a connection request. There are penalties for working outside the system.

The production, purchase and wholesale sale of beer and beer drinks, as well as other alcoholic products, are subject to the strictest control by the state. Federal Law No. 171-FZ of November 22, 1995 (as amended by No. 289-FZ of August 3, 2018) requires legal entities and individual entrepreneurs to purchase and sell beer through EGAIS. You can register in the system on the official website of the Federal Service for Regulation of the Alcohol Market https://egais.ru/.

Purpose of the service

The unified state automated information system EGAIS was created to record the production and turnover of alcohol and alcohol-containing products, as well as ethyl alcohol, in the Russian Federation.

The circulation of low-alcohol drinks such as beer, cider, poire, and mead is also controlled, but only in terms of production and wholesale sales and purchases. In simple terms, thanks to this system it is possible to track the movement of each unit of goods from the moment of its production or import into the country until its sale to the final consumer. Reference! Ethyl alcohol used for the production of pharmaceutical products is not controlled by EGAIS.

The system also does not take into account the retail sale of beer and other low-alcohol drinks, such as mead, cider, and poiret. In addition, all sellers and buyers of alcohol-containing and alcoholic products are required to declare production volumes and turnover.

Connection to EGAIS

By January 1, 2020, producers and sellers of alcoholic beverages, including beer, were required to connect to the new information system. Newly created legal entities and individual entrepreneurs are required to register before the start of purchases or sales.

For organizations producing and trading beer, connection to EGAIS follows the same scheme as for everyone else.

Procedure

On the official website of the service, in the left side menu there are detailed instructions for connecting to the system for different categories of activity. They are somewhat different from each other. In any case, the following equipment must be purchased before registration:

- computer (or use an existing one);

- hardware crypto key – you need to write an electronic signature certificate onto it. A hardware key (smart card) is a compact storage medium containing a secure microprocessor and an operating system that controls the device and access to RAM and long-term memory. It contains a program (applet) that performs all the necessary cryptographic operations inside the device and without using external resources.

- online cash register.

Important information! Unlike sellers of strong alcoholic beverages, sellers of beer and other low-alcohol drinks do not have to purchase a 2D scanner to scan the barcode on the excise stamp.

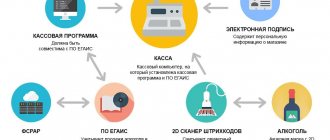

Rice. 1. General scheme for connecting to the Unified State Institute of Automatic Information System (EGIAS) for the purchase of beer by retail outlets.

To obtain an electronic signature certificate, you will need the following documents:

- SNILS;

- OGRN;

- TIN;

- passport;

- extract from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

After purchasing the equipment, you must complete the following steps:

- go to the official EGAIS website and follow the link “Login to your personal account”;

- Click “Read the terms and conditions and check their compliance.” At this stage, the conditions for access to your personal account on the website are checked;

- follow the system requirements and, if necessary, download distribution kits of system components and install them;

- upon completion of the verification, click “Go to your personal account”;

- enter the PIN code (GOST) of the hardware key issued during its purchase;

- Click the “Show certificates” button. The electronic signature certificate will be displayed in the window that opens;

- generate an RSA key. To do this, click on the certificate and select the “Get key” section;

- load UTM (universal transport module for transferring information between service sections) into your computer.

Reference! Before registering, importers and manufacturers of alcohol-containing products are required to send an application to the Federal Alcohol Regulation Agency, which will issue software for installation on a computer and then check the technical equipment.

How to properly connect to EGAIS and install UTM is described in detail in the video:

Hardware and software requirements

For uninterrupted operation of the service, individual entrepreneurs and legal entities involved in the purchase or sale of beer and beer drinks must have equipment that meets certain requirements.

Table 1. System requirements for organizations and individual entrepreneurs engaged in the purchase, storage and wholesale or retail sale of alcoholic products. Source: egais.ru

| Type of hardware or software | Characteristics |

| CPU | Frequency from 1.8 GHz, from 32 bits |

| Network Controller | Ethernet, RJ45 connector, 100/1000 Mbps |

| RAM | Minimum 2 GB |

| HDD | Minimum 50 GB |

| operating system | Windows or Linux |

| Required software | Java 8.0 and higher |

For manufacturers and importers, the requirements are significantly different. You can familiarize yourself with them by downloading the file in a convenient format.

Price

All EGAIS software for controlling beer trade is provided free of charge. No certification required. The equipment can be purchased from any company.

Requirements for business and its organization

Can an individual entrepreneur sell retail beer drinks?

Of course, there are no prohibitions on such activities in the current legislation. However, there are some requirements for organizing such a business and equipping a retail outlet. It should be immediately recalled that the sale of strong alcohol, wines and beer products in bulk is permitted only to legal entities. Individual entrepreneurs can sell beer and beer drinks only at retail if they do not have their own farm and are not official manufacturers of products (No. 171-FZ of November 25, 1995).

A prerequisite is also the presence of a stationary premises (trade is prohibited in kiosks, stalls and mobile pavilions unless they are registered as catering points).

There are several other legal prohibitions:

- Sale of alcoholic beverages before 8:00 am and after 11:00 pm (unless more stringent restrictions are imposed by local authorities).

- Sales to minors.

- The location of the point in the vicinity of medical, educational and other cultural institutions, as well as trade in public places: at train stations, in transport, gas stations, etc.

- Sale of similar drinks that do not have accompanying documentation (bill of lading, certificate, etc.). Alcohol-containing drinks that do not have labels or excise stamps on their containers are not subject to sale.

In addition, all individual entrepreneurs selling beer must keep a sales ledger in a unified form. The use of cash register is not mandatory for all individual entrepreneurs, but it is necessary to provide customers with BSO (strict reporting forms or sales receipts) upon request.

Among other things, points selling beer must be equipped with the necessary equipment for reporting in the Unified State Automated Information System. This nuance deserves special attention.

How the service works

The work of EGAIS to control beer turnover consists of two main components:

- confirmation of product purchases by retail stores and catering establishments;

- control of wholesale sales of beer by manufacturers and importers.

Procurement registration

Regarding the purchase of beer, the work scheme is similar to the purchase of strong alcohol:

- The supplier, having produced the product, enters it into the program. When selling, he issues invoices and notes in the system which products were shipped to where and according to what documents;

- the buyer (store) receives invoices from the supplier through a special UTM module designed for data exchange between service sections. After receiving the goods, he checks it and sends a notification to EGAIS. In case of discrepancy, a replacement can be made at that moment;

- After receiving confirmation from the buyer, the goods are credited to his account and debited from the supplier's account.

Sales registration

In terms of controlling beer sales, the work concerns exclusively wholesale and proceeds according to the following scheme:

Rice. 2. Scheme of wholesale beer sales through EGAIS.

- the seller, having agreed with the buyer, for example with a store, on the sale of a batch of beer, creates a file with data on the sale and transfers it to EGAIS;

- the system records the sale;

- products are debited from the seller's account and credited to the buyer's account.

Features of draft beer accounting

Draft beer is taken into account on the server only in terms of wholesale sales and purchases. If it is sold in kegs and the keg is a consumer container, then accounting is kept in pieces. In this case, it can only be returned or written off in its entirety.

If a keg is only a transport container and is taken into account in production by liters, then in the system it should be taken into account in liters. Then partial write-off is possible.

As for documentation, in the case of selling beer in kegs to one buyer at a time as a packaged product, i.e. piece by piece and as bulk, i.e. in liters, only one waybill is issued. In EGAIS, you need to create two shipping documents with the same TTN number.

Write-off of balances

As required by law, until January 1, 2020, all sellers, producers and buyers of beer and other alcoholic products were required to bring the balances in the system into line with the real situation. At the moment, it is necessary to ensure strict compliance of balances.

Organizations and individual entrepreneurs when selling beer at retail must also write it off in the system. Since registration of sales in EGAIS is not required, two options are possible:

- sale of products through an online cash register connected to EGAIS, which at the end of the working day automatically generates a write-off act and transfers it to the server, and the product is debited from the seller’s account, regardless of whether it is sold in containers or on tap;

- keep records of sales, as with the sale of alcoholic beverages.

In case of damage, damage or loss, beer can be written off in EGAIS by drawing up a special act. To do this, it is necessary in the accounting program used by the organization:

- create a write-off act;

- select the name of the organization in EGAIS;

- indicate the write-off register and reason;

- fill out the “Products” tab;

- post a document;

- submit it for verification to EGAIS using UTM.

After confirmation, the status of the document should be “Posted in EGAIS”.

Purchase returns

If necessary, it is possible to register the return of alcohol to EGAIS. It is carried out through a cash register. For this:

- using the online cash register, a refund check is opened;

- the cash register transmits information to the server;

- the return is recorded and the position is returned to the seller’s balance.

Important information! Requirements for online cash registers are specified in Federal Law No. 54-FZ “On Cash Register Equipment”.

Individual entrepreneur fine for selling beer without EGAIS in 2020

Bookmarked: 0

Selling alcoholic beverages is a profitable business. Not only large players, but also individual entrepreneurs are trying to make money in this way. The latter are allowed to sell only beer, cider, mead and other drinks with an alcohol content of no more than 6%. Starting in 2020, the rules for the sale of such products have become stricter. What is the fine for individual entrepreneurs for selling beer without EGAIS, and what are the requirements for selling this drink?

Based on Federal Law No. 171-FZ dated November 22, 1995, individual entrepreneurs have the right to trade low-alcohol products. This includes a favorite drink of many - beer. This law also establishes restrictive measures on the sale of alcohol-containing products. Only organizations can sell strong alcohol (Article 16 of Federal Law No. 171-FZ).

The only exception is entrepreneurs who are agricultural producers. They have the right to sell the products of their own winery.