Where can I get a loan at a low interest rate?

Loans with different interest rates are available not only from banks. Modern MFOs are ready to offer trustworthy borrowers low interest rates on short-term loans with a long loan term.

According to the law “On microfinance activities and microfinance organizations” dated December 2, 2020, the interest rate on the day of using the loan amount cannot exceed 1%. Many companies are ready to adapt to new market conditions and offer microloans with low interest rates (from 0.3% to 0.85% per day).

Loans with low interest rates are available to different categories of borrowers. MFCs willingly lend to pensioners, because they are the most disciplined category of clients. People without official income can borrow money with minimal interest, since the IFC takes into account all types of income of an individual (social benefits, rental income, part-time work).

Our website contains all offers from microfinance organizations with the lowest loan interest rates. To check your chances of getting a favorable loan, just fill out a short questionnaire. The decision comes instantly, the money is transferred in a way convenient for the recipient.

How to borrow from a private person

Amounts of money for lending to individuals and legal entities can be obtained with the help of special microfinance organizations and investors. You need to select a suitable microfinance organization, leave an online application on the website or apply for a loan in person at the secretary’s office. After this, in a few minutes, the application will be reviewed by the investor, after which the borrower, first orally and then in writing, will be given personal lending options. It is possible to borrow money from a private person even if you have a bad credit history.

Features of lending

A service such as private lending has a number of advantages and disadvantages. Among the advantages of using such financial assistance:

- short terms for issuing large amounts;

- it is partially possible to regulate the monthly payment of the minimum amount towards an increase without penalties;

- helps repay third-party loans;

- business owners are provided with more flexible terms for refunds and installment plans;

- timely return guarantees improvement of CI;

- you can return the money by early repayment without penalties by changing the loan terms unilaterally;

- helps to avoid issuing credit cards from a bank with less favorable lending conditions;

- The minimum amount for urgent issuance with any credit history is 1000 rubles.

The disadvantages of receiving funds from a private lender are high accrued interest, the amount of which is regulated solely by the desire of the lender himself, and the terms of the agreement, which sometimes contain clauses that are extremely unfavorable for the borrower. Investors do not have loyalty systems, for example, the borrower cannot refinance the loan or arrange a deferred payment.

Low interest loan terms

Taking out a loan at a low interest rate for a long period of time from the IFC is much easier and faster than from a bank. There is no complicated verification of the client’s data, there is no need to collect certificates, provide collateral, or look for a guarantor. Microloans at a low interest rate without refusal are available to everyone , provided that the individual:

- has a valid passport of a citizen of the Russian Federation (in some cases SNILS);

- applying for a loan for the first time;

- I have already worked with microfinance organizations and have established myself as a reliable borrower.

Quick loans are issued for short periods: for example, for a week or a month. It is beneficial to borrow small amounts for several days. These are so-called payday loans.

Regular clients of MFOs can take advantage of special services: low interest rates and long loan terms. At the IFC, it is quite possible to get a loan of up to 100 thousand rubles for a year with the debt repaid in equal installments once a month.

A long-term loan has another advantage: the possibility of early repayment with payment of interest only for the actual period of use of the money.

⚠️ New borrowers can apply for a loan without interest. The service is available to people who borrow money from the company for the first time. The loan is issued for a period of 5-15 days, the available amount is from 1,000 to 15,000 rubles.

MFO offers

Microfinance organizations specialize in urgent loans. In most microfinance organizations, a passport and a contact phone number are enough to receive a loan. Lending terms:

- amount from 1000 to 50,000 rubles;

- loan term from 7 days to 6 months;

- interest rate from 0.5% to 4% per day of use of funds.

Some microfinance organizations, in order to attract new clients, make the first loan interest-free, but the loan amount will not exceed 10,000 rubles, and the term will not exceed 30 days.

Interesting! For regular clients, microfinance organizations create preferential lending conditions: the interest rate decreases, the loan amount increases.

For convenience, they may offer to transfer money to a card or consider the option of a longer-term loan. But it is worth considering that crediting money to the card is only possible if the account balance exceeds 3 rubles.

An equally important advantage of lending from microfinance organizations is the ability to apply for a loan online in a simple form. You can borrow money within 15 minutes by choosing the most convenient method when filling out an online application:

- cash;

- to a bank card;

- to a mobile account;

- to an electronic wallet.

How to get a loan online? It is enough to go to the website of the microfinance organization selected in the rating and register; creating an account takes no more than 15 minutes. After completing the online application, an MFO employee contacts the bank client within half an hour. During the conversation, the terms of the loan are clarified and, if both parties agree to the terms, the client enters an SMS code to confirm the online application.

Loan selection service

Choose a loan according to your needs and capabilities

- Microloan

It is worth emphasizing that the credit history of the MFO is not checked either when filling out an application online or in the company’s office. You can get a profitable loan at a low interest rate in cash or on a card, even with a damaged CI.

Interesting! In your personal account, you can view the amount of debt on the loan, as well as repay the debt online.

Note! In the era of coronavirus, everyone is looking for additional opportunities to earn money. It’s surprising that you can earn much more using alternative methods, up to millions of rubles a month. One of our best authors wrote an excellent article about how thousands of people make money in the gaming industry on the Internet. Read an article with reviews about making money from games.

Who can take out loans with a minimum interest rate?

To take out a loan at a small interest rate, it is enough to have a passport of a citizen of the Russian Federation and registration in the country. An urgent loan of money is possible via the Internet.

Basic requirements for the borrower:

- The minimum and maximum age corresponds to the conditions of the MFO (usually 18-65 years).

- Valid Russian passport.

- Having a regular income.

- No problems with the law or criminal records.

- No arrears on existing loans.

- Legal capacity.

✔️ The region of registration and place of residence of a citizen does not matter. Registration may be temporary and may not coincide with your actual place of residence. Services analyze an individual’s data in different ways. Having a bad credit history is not a reason to be denied a loan.

Banks and their mortgage offers

There is a person with a registered individual entrepreneur and three children. Have a good credit history. Applications were submitted to Russian banks with such data. It’s interesting that there was a 5% difference between the best and worst offer—banks look at potential clients so differently.

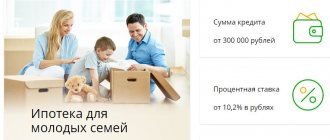

Mortgages from Sberbank are beneficial for families with small children

A family with three children and the condition that the child was born later than 2018 can take out a mortgage from Sberbank at 4.7% per annum . Of course, if we are talking about a mortgage in a new building. In our case, Sberbank approved a mortgage of 6.5 million rubles for the purchase of an apartment in a new building.

Sberbank has an excellent interface and a working online chat that helps with problems filling out the form. At the same time, the chat works around the clock. If a document is loaded that does not have a signature, artificial intelligence automatically finds the problem and reports any deficiencies. No seal - they write that the document was not loaded due to the lack of a seal.

A family with three children can take out a mortgage from Sberbank at 4.7% per annum.

Mortgage at Alfa Bank - the worst conditions

Alfa Bank offers its conditions regardless of what kind of relationship a person had with the bank previously. For example, despite the fact that the application was submitted by an Alfa Bank client with 12 years of experience, the conditions offered were the worst. 9.7% - this percentage is offered by one of the largest banks in Russia.

How to get a loan at a low interest rate?

To get a loan at a low interest rate online, you will need to have access to the Internet, a computer, and a mobile phone. The process for applying for a quick loan looks like this:

- you must select one or more companies from the list, having previously read the terms and conditions of the microfinance organization;

- fill out the online form (buttons “Get money”, “Apply”);

- indicate truthful and as complete information as possible in the application form;

- link a bank card or e-wallet to transfer money;

- wait for the IFC's decision;

- choose the most profitable loan from the approved questionnaires (if you filled out several requests);

- study the loan agreement, sign it by entering the code from the SMS.

✅ When forming the questionnaire, you must tick the boxes or enter a confirmation code indicating your consent to the processing of personal data of an individual.

Some organizations ask you to scan your passport or take a photo with a double page of the document. In some cases, you may receive a call from an MFO employee to make sure that the person is submitting the questionnaire voluntarily, and the money is needed for personal needs.

By collaborating with one microcredit organization on a regular basis, there is a chance to receive subsequent loans instantly.

MFOs willingly approve the maximum loan limit for people with an ideal credit history, even if the borrower contacted the company for the first time.

How to avoid becoming a victim of a scammer

If you need to borrow money from individuals, you should carefully choose a moneylender and study their principles for issuing a loan. Often, lucrative offers to receive cash contain a fraudulent scheme, for example, if a moneylender offers to reduce the annual rate for making an advance payment, with the condition that the larger the amount of the advance payment, the lower the rate. The second most common scheme is that after the first loan is successfully processed, subsequent ones are issued by default.

How to check a potential investor

There are several ways to make sure that a moneylender or investor is honest:

- find real customer reviews not only on the lender’s website, but also on third-party sites;

- check the presence of the investor’s name or the name of a microfinance organization on blacklists of unscrupulous moneylenders in the city, region or at the federal level;

- make an appeal or request to the Ministry of Internal Affairs in the city regarding the presence of microfinance organizations in the register of fraudsters.

Advantages of obtaining low-interest loans from microfinance organizations

Our service for selecting microloans helps people get low-interest loans from reliable microcredit organizations that operate in accordance with Russian legislation and have been verified by specialists.

Based on needs, borrowers can apply for small loans with a short term or a large loan (50-100 thousand rubles) with a long term (from several months to 1 year).

When collaborating with any company from the list, the borrower receives the following benefits:

- Efficiency. You can receive the required amount on your card within 1 hour.

- Anonymity. MFOs do not require certificates or guarantors. Relatives and friends will not know about a person’s financial difficulties.

- Work 24/7. You can receive a money transfer from a lender even at night.

- Minimum package of documents. You only need to have a passport.

- Loyal attitude towards any category of the population. Loans with low interest rates are available to people without official income and with poor CI.

- Participation in the loyalty program. Regular customers receive each subsequent loan at a lower interest rate, fill out a simplified form, and the money is credited to the card instantly, regardless of the time of day.

- Transparent terms. The interest rate is specified in the agreement, and you can monitor the status of the loan in your personal account.

- Several repayment options. MFCs offer different ways to deposit money quickly and without commission.

What repayment methods are there?

It’s easy to get a loan at a low interest rate on your card within a short time. It is also fundamentally important to repay the debt to the creditor on time. This is necessary to maintain preferential conditions in a particular IFC. It is also worth avoiding the accrual of penalties for delays and not getting on the “black list” of unreliable debtors.

Microcredit organizations offer several options for quick loan repayment:

- In cash at the company's representative office.

- Through your personal account by debiting from a bank card.

- From electronic wallets Yandex, QIWI.

- Using the Webmoney system on the IFC website.

- Through payment systems Contact, Zolotaya Korona, Unistream, Leader.

- Through self-service terminals.

- Transfer via Russian Post.

- At the cash desk of any bank.

⚠️ Before making a loan payment, it is important to find out the cost of the money transfer service and the duration of the operation. The longest way to deposit money is through a bank, mail and payment systems. If the payment does not reach the MFO account on time, additional interest will be charged from the first day of delay. Instant transfers are possible from electronic wallets and bank cards.

Calculator

After paying the loan in full, we recommend ordering a loan repayment certificate. It may be paid, but thanks to this document you can avoid additional charges and possible litigation with a microcredit company.

Which method of receipt is better to choose?

A loan with a minimum interest rate can be obtained in several ways. Most people prefer to receive money on a bank card. This is the easiest way to transfer money.

IFCs transfer loans to debit and credit cards. The payment system can be any: Visa, MasterCard, Mir or Maestro. Both registered and non-registered cards are accepted.

If it is inconvenient for a client to receive money in this way, he can choose an electronic wallet for crediting, a money transfer through the Contact system, take cash from an MFO representative office, or order courier delivery of cash (the service is available in major cities of Russia).

A microloan with a small interest rate is an affordable offer from reliable microfinance organizations. Thanks to our service, you can apply for a profitable loan in a few clicks and use it at your discretion.