Features of the Housing program in 2020

It is almost impossible for newlyweds to save the required amount of money to buy their own apartment or house.

The Housing program was created to help low-income residents of the country who do not have their own living space. The essence of the project is to subsidize part of the funds necessary for the desired purchase from the state.

Simply put, spouses buy housing using a bank mortgage, but part of the amount is paid by the state.

The loan amount under the program depends on the cost of the apartment, the presence or absence of minor children:

- 35% - in the absence of children;

- plus 5% for each child.

The advantages of the product are financial assistance, thanks to which the dream of purchasing real estate can come true. The offer is also suitable for a young family without children.

The downside is that apartments are provided from the municipal reserve. Before you step onto your own square meters, you will have to stand in line.

Characteristics of the “Young Family” project

Purchasing real estate using the program involves concluding a targeted banking agreement.

According to the terms of the document, the husband and wife pay one of two types of down payment:

15% of the price of the selected house or apartment;

10% if children have already been born in the family.

Important: If a baby is born in the family, loan payments can be deferred. Are the borrowers clients of the bank? They will receive additional bonuses.

The preferential component of the project is the acquisition of an object with a reduced interest rate, ranging from 5 to 9%, depending on the bank.

The offer is popular but is available on a first come, first serve basis. The project applies only to the purchase of housing under construction or finished housing.

Requirements for participants in government support programs

The selection of applicants takes place according to a number of criteria:

- A young family needs to document the fact that they do not have their own home. If living with relatives, have less than 14 square meters. m. per person;

- both family members must be Russian citizens under 35 years of age and officially married;

- spouses are required to have official income. Or one of them must document that he is able to fully provide for the needs of his other half.

Attention! The social credit is valid from 2020 to 2020. An application for financial assistance can be submitted until December 31. 2020. Those who managed to obtain a certificate can count on benefits in 2021.

An incomplete family consisting of a single mother or father raising a child can receive assistance from the state.

Where to go and what to do

If all the conditions are met, you need to formalize your desire to receive financial support from the state.

Step-by-step instruction:

- Fill out an application at the city or district administration.

- Wait for a response within 10 days.

- If the decision is positive, get in line.

- Collect the necessary papers, apply for a subsidy.

- Receive a certificate for participation in the preferential lending program and bring it to the bank.

- Sign the mortgage agreement.

They will open an account in the bank and after a while transfer the government funds. subsidy.

The bank will transfer the missing amount to the seller of the selected property after the purchase and sale agreement is executed.

How to get on the waiting list for the state program?

The family must meet the criteria of the Government of the Russian Federation of December 30, 2020 No. 1711:

- have citizenship of the Russian Federation;

- age up to 35 years at the time of application and at the time of receiving the subsidy;

- be registered in the queue for improvement of living conditions, in other words, recognized as in need of improved housing conditions, when for 2 people there should be less than 42 m², and for 3 people - up to 18 m² each;

- have documents confirming the level of income necessary to pay for the purchased housing in excess of the allocated subsidy.

To take part in the “Young Family” housing program in 2018, you must have a complete list of documents for placing on the queue, approved by Government Decree No. 889 of August 25, 2020 (Appendix No. 4 to the subprogram “Providing housing for young families” of the Federal Target Program “Housing” ).

So, what do you need to prepare from the papers to get a loan?:

- An application in two copies (one of which will remain in the applicant’s hands) with a request to include the family in the participants in the subprogram “Providing housing for young families” of the federal target program “Housing” for 2015-2020. Filled out by one of the spouses and contains the passport data of the spouses and data on birth certificates or passport data of children (a sample can be obtained from the local administration).

- Originals and photocopies of passports of each adult family member.

- Originals and photocopies of birth certificates for each child.

- Original and photocopy of the marriage certificate (for a complete family).

- Documents confirming that the family needs improved living conditions (check with the administration for specific requirements for a given region).

- Certificate from the housing department confirming that you are on the housing waiting list.

- Certificates of registration of all family members (extracts from the house register or information on Form 9 from the passport office/housing office).

- Documents proving that the applicant does not own housing, commercial real estate or land, namely:

- extract from the Unified State Register of Real Estate (USRN);

a certificate from the BTI about property registered before 1995;

- information from the Land Resources Committee based on data from 1995 to 1998.

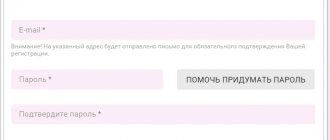

- Bank personal account details (you can provide a copy of the agreement for using the client’s personal account from the bank; depends on the requirements of the local municipality).

- Documents proving that the family is able to pay the average cost of housing in excess of the subsidy amount:

- a personal account statement from the bank indicating the availability of a certain amount of money;

- certificate of income from the place of work in form 2-NDFL;

- a copy of documents for purchase and sale or mortgage for purchased housing.

Submission of documents for participation in the “Young Family” program is carried out from January 1 to July 31 of the current year to the local administration.

Privileges for participants

The concept of privileges for participants includes:

- If a family member is disabled or a person suffering from epilepsy, tuberculosis, lung abscess or other serious illnesses, then such a family can receive residential real estate with an area twice the registration norm.

- Applicants registered as needing improved housing conditions before March 1, 2005.

- Those who, at the time of entry, live in houses previously described as dilapidated and unsafe.

- Large families have priority for receiving government support.

It is necessary to confirm the privilege with certificates about the composition of the family, about being placed on a waiting list for improving housing conditions, about recognizing the housing as dilapidated or in disrepair, and in case of illness - a certificate of disability or a certificate from a medical commission.

In addition, if there is a territorial program to support a young family, then its conditions depend on the characteristics of the region and can also be targeted.

List of main documents and certificates

The main list of papers required to obtain a social mortgage:

- passports of spouses;

- a statement written according to the model;

- marriage certificate;

- military ID of the head of the family;

- birth certificates of successors;

- certificates confirming income.

If the family has registered maternity capital, a mortgage loan without a down payment is possible. A certificate must be attached to the main package of documents.

What is needed to apply for a loan?

Bank selection

After receiving a housing certificate, you should contact the bank to apply for the remaining mortgage loan. What is the best way to take out a mortgage loan so that it is beneficial not only to the bank, but also to you? There are mortgage programs with interesting conditions. First of all, it makes sense to contact banks that operate their own mortgage lending programs for young families. These banks include:

- Sberbank;

- VTB 24;

- Rosselkhozbank;

- Gazprombank;

- Bank of Moscow;

- Moscow Regional Bank;

- Rosbank;

- Absolut Bank and others.

It should be borne in mind that the terms of lending to a young family and a simple mortgage may be practically the same , so you should study the terms of lending in other banks, especially since they are becoming more and more attractive.

Where is the best place to get such a loan?

Sberbank offers good mortgage conditions for young families: the down payment is 10% of the cost of the apartment if there are children, and 15% for a family without children. The loan is provided at reduced interest rates (you can find out whether it is possible to get an interest-free mortgage for a young family and what the bank rates are under the preferential program here, and in this material read about whether a married couple can get a mortgage without a down payment).

For participants in Sberbank's Young Family program, there is the possibility of deferring payments in the event of the birth of a child.

Submitting a certificate

The family that has received the certificate must, within two months, apply with it to a bank participating in the state program for providing housing for young families, where a special account will be opened for transferring social benefits for a specific transaction, confirmed by documents.

You can get a loan for an apartment there. The bank will issue the family an agreement for subsequent transactions.

Finding suitable housing

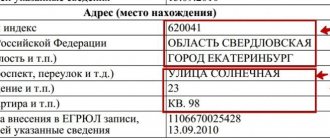

The selected living space must be located on the territory of the Russian Federation . Housing must meet all sanitary and technical standards; The area must comply with the standards of a particular region.

If the apartment does not meet the necessary conditions, then the administration commission will not issue a certificate of entitlement to a state subsidy, which means it will be impossible to obtain a mortgage for such housing.

What documents are needed?

For purchased real estate

If the real estate seller is a legal entity:

- Founding papers.

- The decision of the governing body on the sale of real estate, indicating the terms of the transaction: price, terms of completion, payment procedure.

- A document confirming the right of a representative to sign an agreement on behalf of the company.

- The company representative must have a passport with him.

If the apartment is sold by an individual:

- Certificate that the property is registered in his name.

- Certificate of privatization, agreement of gift, exchange or sale.

- Extract from the Unified State Register of Real Estate (from the local branch of Rosreestr).

- If the property is in shared ownership, then a notarized waiver of the primary right of purchase by the co-owners is required.

- The consent of the spouse to the sale of joint property, certified by a notary, if the seller is married.

- Permission from the guardianship authorities if one of the co-owners of the property is a minor.

On the borrower himself

- Application in two copies.

- Spouses' passports and copies.

- Children's birth certificates and copies.

- Marriage certificate, if the application is not a single parent, and a copy.

- Certificates of income (or availability of about 40% of the loan amount for the down payment).

- A copy of the work record, certified by the employer.

- A copy of the employment contract (with additional agreements), certified by the employer.

- Original certificates in form 2-NDFL.

- Extract from the house register.

- Education documents.

- Certificate for the right to improve living conditions.

How to draw up a mortgage agreement?

A loan agreement is an agreement between the bank and the borrower, concluded and valid only in writing, made at the bank. The terms of the agreement are fulfilled in accordance with Article 819 of the Civil Code of the Russian Federation.

The loan agreement usually includes the following clauses:

- Names of the parties.

- Subject of the agreement: type of loan, its purpose, amount, terms of issuance and repayment of the loan.

- The procedure for granting a loan indicates what documents the borrower provides to the bank; term, form, procedure for the bank to issue funds to the borrower.

- The procedure for accrual, payment of interest, commissions and loan repayment; type of payment - annuity or differentiated, conditions for early repayment, loan commissions, fines, etc.

- Ways to ensure loan repayment.

- Rights and obligations of the parties.

Registration of a purchase and sale transaction

The main transaction with the bank takes place on the day the mortgage agreement is signed; When the borrower signs the contract, the purchase and sale agreement is immediately signed.

The seller comes to the bank with a ready-made package of documents, the buyer makes an advance in a safe deposit box, and the bank deposits the loan funds there. The seller receives the key to the locker after the Registration Chamber registers the transaction.

It is possible to transfer money to the seller's account , then the buyer receives the keys and submits the purchase and sale agreement for registration at the Registration Chamber.

The apartment is registered as the common property of all family members.

Banks supporting the state program

Where is it profitable to get a mortgage? The government's idea is being implemented in several banks with various preferential lending conditions.

| Name | Maximum loan amount in rubles | Maximum loan term | Percent |

| Sberbank | from 300,000 to 3 million rubles. | 30 years | from 8.5 |

| VTB bank | from 500000 | 30 years | from 5 |

| Rosselkhozbank | from 100000 | 30 years | from 10 |

| Alfa Bank | up to 50 million rubles | 30 years | from 8.09 |

| Gazprombank | from 100,000 to 6 million rubles. | 30 years | from 4.9 |

| Raiffeisen Bank | up to 12 million rubles | 30 years | from 5.69 |

Financiers warn that when studying banking services, it is worth considering all the conditions. A low interest rate is often possible if you qualify for additional options. For example, life and health insurance added to the compulsory insurance of a property.

Promotion from Sberbank “Young Family”

If you do not want to wait several years for a government subsidy, but want to get loans on the most favorable terms, you should apply for a mortgage from Sberbank of Russia. This company is a guarantor of reliability; it invariably occupies the highest positions in the rating of banks.

A plus is that there is a special program aimed specifically at young families, which is described here. It consists of providing special conditions:

- reduced interest rate (from 10.2% per year),

- small down payment (from 15%),

- the longest lending period is provided - up to 30 years, no commissions are charged and no premiums are established,

- documents on residential premises can be provided after the mortgage is approved (within 120 days after the bank’s decision).

- the number of co-borrowers is up to 3 people.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

Among the advantages, one can also note the possibility of using Maternity Capital as a down payment or to pay off a debt. If you are planning to purchase housing with the participation of MK, then you need to do the following:

- Select for yourself several options for real estate that you like, understand how much you will need. Remember that you will have to deposit at least 15% of it into the bank,

- Next, contact the Sberbank branch, ask the loan specialist for a list of documents required for collection, collect it and bring it for review,

- Fill out a mortgage application

- If it is approved, only after that do you finally decide on housing,

- You receive real estate documents, bring them to the bank,

- Sign the loan documentation,

- Register your rights to an apartment/house,

- Get a home loan from a bank.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

Let us emphasize once again that this is a personal promotional program from Sberbank; all families where at least one of the spouses is under 35 years of age can participate in it. They will check your solvency (income must be at least 25,000 rubles officially), the cleanliness of your credit history, and the absence of other existing debts.