Last year, 42.3 million square meters were put into operation in Russia. m of housing is 7.9% more than a year earlier. New Moscow is being especially actively built up. Moscow registration really means a lot: for example, it provides capital social benefits and payments in addition to federal ones.

A mortgage makes the dream of owning your own home more realistic and affordable. Of course, this is not an easy decision, because you will have to pay a piece of your salary for many years. But, on the other hand, no relatives with their own orders and the growing appetites of landlords.

But is it really possible to get a mortgage without all the money in the world? We figured out how not to overpay for mortgage housing and what support programs exist.

What is a mortgage at 6.5%

The most famous preferential mortgage program in Russia was approved in April. According to it, you will pay 6.5% per annum throughout the entire term of the contract, and the difference between this figure and the real interest rate on the loan will be compensated by the state.

For Moscow and St. Petersburg, Moscow Region and Leningrad Region, the program covered loans of up to 8 million rubles, in the regions - up to 3 million. In June, the bar was raised to 12 million and 6 million, respectively.

The minimum down payment is 20%. That is, under the program you can buy an apartment in Moscow worth up to 15 million rubles: 3 million is your down payment, 12 million is the loan amount.

You can take out such a mortgage loan until November 1, 2020, and only for housing in a new building. But 95% of apartments in new buildings fall under the criteria.

The program has already borne fruit. The average mortgage rate in the country fell to 7.4% - this has never happened in the history of the Russian Federation. And until the coronavirus crisis passes, the numbers will continue to go down.

In fact, the Central Bank lowered the key rate several times due to the epidemic. Banks calculate their loan rates from it. In addition, starting from July, compulsory home and life insurance for the borrower must be paid not by the clients themselves, but by banks. This will also help you win interest.

The sad news is that the program most likely will not be extended. And they don’t plan to expand it to the secondary market.

The program was originally conceived to help developers survive the crisis. Preferential rates were subsidized from the budget, and for many banks the budget has already been exhausted. Increasing momentum means inflating the mortgage bubble, which will sooner or later burst.

So how can it be even more profitable to get a mortgage today? In the situations listed below, you may be able to pay less than 6.5% APR.

Check to see if these options are right for you.

Should you take out a mortgage in 2019?

2019 is a good year for getting a home loan. The government continues to motivate citizens to have children by providing them with additional benefits. This year you can profitably take part in preferential lending programs. In addition, rates on bank loans are at their peak. The loan can be issued at 8-10% per annum. Young families with children can get a mortgage at 6%. Each bank has many promotions and programs.

Therefore, if you need a loan, you need to take it out this year.

Have two children – 6%

If you have at least two children and one of them was born after January 1, 2020, you can take out a mortgage at a rate of 6%. The same program is valid for families with disabled children, regardless of their number and date of birth.

The money can be used to purchase a house or apartment from a developer, or to refinance an existing mortgage loan.

The remaining conditions are the same as for a mortgage at 6.5%: the first payment is from 20%, for Moscow, Moscow Region, St. Petersburg and Leningrad Region they give up to 12 million, for the rest of Russia - 6 million.

If you buy an apartment for 15 million with a mortgage at 6% with an initial payment of 20% (3 million rubles) for 20 years, the monthly payment will be 85,972 rubles.

Don’t forget about maternity capital: families with one child are also included in this program. For the first child they will give 466 thousand 617 rubles, for the second – 150 thousand. These 616 thousand can be used for a down payment.

Basic requirements of banks

In order to receive approval for a large loan for an apartment or other property, the potential borrower must meet a number of banking conditions imposed on him and the property:

- A home loan is available if the borrower's age is within a certain limit.

- Only citizens of the country who are registered temporarily or permanently at a specific address have the right to receive a large loan in the Russian Federation.

- You can get a mortgage if you have a certain length of work experience, and also make a down payment.

- Mortgage loans are provided to borrowers with a positive credit history and the absence of large payments on other loans.

- To apply for a cash loan in Russia, you must provide the necessary list of documentation.

Additionally, if necessary, a co-borrower or guarantor may be required. In addition, if the borrower is not approved for a mortgage with a down payment for the purchase of a home, you can use collateral if you have expensive property in your property.

Important! Potential borrowers can take advantage of various lending programs, including government-backed mortgages, but such offers have additional conditions.

Age

In order to receive a large loan, you must meet the lender's age criteria. As a rule, the following restrictions are present:

- The minimum age for registration is 20 years;

- the maximum limit is up to 65 years of age;

- if there is a pledge, the period can be increased from 20 to 86 years;

- If you are taking out a secured youth mortgage, then in a number of banks this program is available from the age of 18.

Age limits are determined by the time the last payment is made. In other words, at the time of closing the mortgage loan, the age of the borrower should not exceed the established limit.

Citizenship

Large cash loans are provided to citizens with the following number of restrictions:

- must have Russian citizenship;

- the borrower may be a resident of another state, but for lending, obtaining a Russian passport must take place at least a year before applying for a mortgage;

- all co-borrowers or guarantors must have Russian citizenship;

- If a citizen has been declared bankrupt within the last 5 years, the loan will be denied.

Some commercial banks operating in the Russian Federation provide loans to foreign citizens of neighboring countries.

Registration

To obtain a large mortgage loan, the borrower must be registered in the Russian Federation:

- having a permanent residence permit;

- temporary registration is allowed;

- registration must be in the region where the application to the bank is made.

In the absence of registration, the issuance of any loan, including a mortgage, will be denied.

Seniority

To receive a cash loan to purchase a home, the borrower must be officially employed:

- work experience in the last place from 1 year;

- total work experience of at least 3 years;

- In a number of banks, experience of at least 6 months is allowed.

If an application is made for a mortgage lending program using two documents or with collateral, then parameters such as the client’s work activity are not taken into account.

Down payment

Almost all mortgage lending programs require a certain down payment:

- the minimum payment amount is 10% of the value of the property;

- on average, banks request from 10 to 20% of payment;

- the borrower can contribute up to 50% of the down payment;

- under a number of programs with collateral in the form of existing real estate, such payment is not required.

The amount of the initial payment does not include insurance or payment for the procedure for assessing the market value of the property. These values, if necessary, can be included in the body of the loan. As a rule, lenders provide borrowers with amounts up to 80-90% of the value of the purchased property in order to limit their potential losses as much as possible.

Credit history

To receive funds for the purchase of expensive real estate, the client must meet such a parameter as a reliability rating:

- positive and not empty credit history;

- absence of current and closed serious delinquencies;

- timely repayment of loans taken;

- absence of bankruptcy of an individual over the last 5 years.

Lenders approve applications with a damaged or zero credit history only if there is a collateral when applying for a non-target mortgage secured by housing.

Borrower's solvency

This parameter is one of the key ones when considering an application for a mortgage loan to purchase a home:

- the borrower must have large income;

- stable official income is required;

- contributing no more than 30-45% of total income to pay for loans;

- absence of a high payment burden on current loans (more than 35-45% for all existing loans).

If the borrower, when receiving a loan, spends more than 50% of his income, then this is a significant risk for the lender that the funds will not be repaid on time, which is why the mortgage will be refused. Here, a guarantee or the presence of a co-borrower can increase your chances.

Required documents

When applying for a large cash loan to purchase real estate, you are required to provide the following package of documents:

- a general passport of the Russian Federation sample, and in addition another identification document (SNILS or TIN);

- if a co-borrower or guarantor is involved in the transaction, then they are also required to have a Russian passport;

- income certificate in form 2-NDFL (the document, if necessary, can be replaced with other proof of income);

- certificates of marriage, divorce and birth of children (if available), as well as the written consent of the spouse to obtain a mortgage;

- real estate insurance (in addition, banks request life insurance and the risk of job loss - the process is optional).

When applying for a mortgage loan, at the request of the lender, the documents can be supplemented with copies of the work record book, certified by the employer’s stamp. Providing falsified information about yourself, as well as false documentation, is not allowed. When purchasing a real estate property, title documents for the property are additionally submitted. Additionally, the creditor may request other securities.

Important! For men under the age of 27, it is mandatory to provide a military ID or registration certificate.

Become parents of many children - a subsidy of up to 450 thousand rubles

If after January 1, 2020, your third (or at least third!) child was born, then the state will help you pay off your mortgage. The subsidy for large families is 450 thousand rubles, and in 2020 9.5 billion will be allocated from the budget for this.

Taking into account the expanded maternity capital, more than 1 million rubles of a mortgage loan will be paid for you (450 thousand subsidies + 466 thousand 617 rubles for the first child + 150 thousand for each subsequent one). Not bad!

Betting Forecasts

Mortgage rates have been gradually declining over the past year. This was largely caused by a reduction in the key rate of the Central Bank of the Russian Federation. Experts believe that this trend will continue in 2020. By the end of the year, it is quite possible to expect offers with rates at the level of 7-8%.

In this situation, should the borrower wait for interest rates to fall or apply for a mortgage now? It is impossible to give a definite answer to this question. But experts believe that there is little point in postponing getting a loan for the following reasons:

- Rates below 8% will be available only to certain categories of clients (for example, salary card holders).

- With a significant drop in rates, it is likely that demand will increase and, accordingly, real estate prices will rise.

- Thanks to government-supported programs, many can already get a better rate without any waiting.

- Waiting for a rate reduction is comparable to playing the lottery; it may not happen due to changes in the inflation rate or other factors in the economy.

Whether it is worth taking out a mortgage in 2020 depends on the conditions of the individual. If housing or its improvement is necessary and funds have already been collected for the down payment, then you should not delay applying for a mortgage loan. The main thing is to choose the optimal offer and you should definitely clarify the opportunity to take advantage of interest subsidies from the state.

Look for a house in the village – 3%

The rural mortgage program allows you to buy housing in rural areas - both primary and secondary. The main thing is that the housing has all communications: electricity, water, heating and sewerage.

Under the rural mortgage program, you can look at houses and apartments in cities, villages and towns with a population of up to 30 thousand people. There are special conditions for cities: mortgages work for houses in the private sector, but the city must be included in the rural development program. It is better to check the list of territories and cities with the local administration.

True, it’s definitely not possible to rent a house near a pond in the Moscow region. The program does not apply to urban districts and municipalities of Moscow, St. Petersburg and the Moscow region.

The first payment under the program is from 10%, you can use maternal capital for it. The maximum amount for the Leningrad region and the Far East is 5 million rubles, for other regions – 3 million.

The maximum payment period is 25 years. It is not necessary to register in new housing (but banks may impose such conditions). You are allowed to take out such a mortgage only once.

A house like this for 2.7 million rubles can be taken out on a mortgage for 10 years with a down payment of 10% (270 thousand rubles) and pay 23,464 rubles per month.

Loans are also provided for the construction of a house, or more precisely, for the completion of construction under a contract. It will take two years to complete the construction, but you can pay off the mortgage for up to 25 years. Finally, you can take out such a loan to repay loans opened before January 1, 2020.

Travel to the Far East – 2%

In the Far East, you can take out a mortgage at a fantastic 2% per year. Vladivostok, Yakutsk, Khabarovsk are actively being built and developed, so if you want cool views from the window, unbeaten exoticism and a comfortable remote location, you should think about an apartment in the Far Eastern Federal District.

Mortgages can be obtained by citizens of the Russian Federation under the age of 35. This is either a married couple or a single parent with a child under 18 years of age. Mortgages will also be given to participants of the Far Eastern Hectare program.

The down payment for housing under the Far Eastern mortgage program is from 15%, the maximum loan amount is 6 million. Lending for up to 20 years.

In the city you can only buy an apartment in a new building, in rural areas you can also buy secondary housing, as well as a cottage or townhouse. As part of the program, you will have to register in a new house or apartment.

What can you buy in Vladivostok for 6 million? For example, a 3-room apartment with an area of 75 sq. m with rough finishing and three balconies.

How much will you have to pay for it? With a rate of 2%, a down payment of 20% (1.2 million rubles) and a loan for 20 years, the monthly payment will be 24,366 rubles.

Join the army for free

If you stay for an extended term, you will be able to participate in the military mortgage program. For the first three years, the state will transfer small amounts to your account. This money can be used as a down payment.

What then? Until you leave the army, the state will pay your mortgage for you. The only negative is the limit: up to 2.5 million rubles. An example for Moscow is a modest studio:

In the regions you can find larger apartments - here, for example, a three-room apartment in Ryazan:

If you want housing more expensive than 2.5 million rubles, you can contribute the rest of your own. The mortgage amounts are not cosmic.

Become a public sector employee - with a subsidy

Mortgages are also offered for civil servants under special conditions. It can be taken, first of all, by employees of the Office of the President of the Russian Federation, the Security Council, law enforcement and legislative bodies, the court apparatus, the election commission, employees of the prosecutor's office, the Accounts Chamber, etc.

Specific mortgage terms vary by location. For example, police officers are given a mortgage after 10 years of service in the force, a confirmed need for improved living conditions and the availability of benefits. The program also applies to pensioners of the Ministry of Internal Affairs or family members of employees who died in the line of duty.

Most often, subsidies are given for the purchase of housing. The money can be used to pay off principal or interest.

But even if the documents are reviewed and a positive decision is made, you will have to wait for payment from the budget. This could drag on for months, if not years.

Less often, banks provide loans to government employees on preferential terms. For example, they may reduce the down payment or interest rate.

Is it worth taking in 2020

Every person thinking about buying a home will have to decide for themselves whether to take out a mortgage in 2020. Rates are currently at a relatively low level, but there is a possibility that they will decrease. However, no one excludes the possibility of rising real estate prices due to increased demand.

Before deciding whether to take out a mortgage loan, you need to answer a few questions for yourself:

- Is there a need to improve living conditions? If a person lives in a rented apartment, then it is reasonable for him to think about buying his own property as quickly as possible. Likewise, it makes sense to consider mortgages for families with children living in small apartments. If you have housing and good conditions there, you can easily try to save up on your own.

- Is there enough money available for a down payment? Without a down payment, it is difficult to find a mortgage loan and the terms will be far from optimal, and taking a consumer loan for these purposes is too risky. If you don’t have an amount of at least 10-20% of the estimated cost of the property, then you should just start saving and only then think about a loan.

- How difficult it will be to make your monthly mortgage payment. You can calculate the approximate size of the regular contribution using the calculator on bank websites. If it does not cause any special problems and paying for it does not lead to a significant decrease in the quality of life, then it makes sense to think about a mortgage. In other cases, you will first have to find a way to increase income.

- Is it possible to save up for an apartment on your own in 3-5 years? If the answer to this question is yes, then you need to think about whether it makes sense to overpay for using borrowed money. Despite the low rates, the overpayment will still be high.

In most cases, if a person is thinking about a mortgage, he will answer these questions positively and should try to get a home loan in 2020. There is no point in waiting for a strong reduction in rates. Against this backdrop, demand and prices for real estate will increase. All savings will eventually be lost.

But before making a final decision, a potential borrower needs to analyze a number of points:

- How responsibly does he approach the fulfillment of obligations under loan agreements? If in the past a person often made delays, then it will be difficult for him to avoid them this time. But with a mortgage, because of them, there is a risk of losing the collateral and losing very large sums.

- Do you have any serious health problems? If you have them, you should not take out a large loan. Insurance, even if it is issued, will not cover all cases. For example, due to health problems, the borrower may lose his job and lose funds to pay off the debt.

- Is there an action plan or safety net in case of job loss or other income problems? According to statistics, they happen once every 10 years or more often in almost every person. You should always have a reserve of funds for 2-6 months to pay for the loan and other necessary expenses.

How to get some money back from buying a home

If you buy a home, the state will return you 13% of its cost. The amount is calculated to be no more than 2 million rubles per person. Thus, if you buy an apartment in shared ownership with your spouse and both pay taxes, you can return 260 thousand rubles.

How it works? You either pay personal income tax on the difference between income and deductions, or, if you have already paid taxes, return part of the amount from the budget.

But the rule only applies if you receive a “white” salary and pay 13% personal income tax. If you are a simplified individual entrepreneur or do not pay taxes, the deduction will not be returned to you.

There is also a deduction for mortgage interest. The limit here is 3 million rubles. It is calculated in the same way.

What if it becomes difficult to pay?

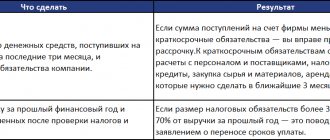

If you find yourself in a difficult life situation, you can avoid paying your mortgage for up to six months - without penalties from the bank and even without its consent.

What is a difficult life situation?

■ You lost your job and registered with the employment service;

■ Became unable to work for 2 months or more;

■ You have a disability of group I or II;

■ Your income has decreased by 30% or more compared to your average income over the past 12 months, and your monthly mortgage payment must be more than 50% of your average income for the previous two months;

■ Your income has decreased by 20% or more, and the number of dependents in your care has increased (a child was born, you need to care for a relative with a disability, etc.), and your monthly payment amounted to more than 40% of your income.

How to arrange a mortgage holiday? You need to write an application to the bank and provide documents that confirm one of the conditions above. Payments will be deferred.

As a result, getting a mortgage at a low rate in Russia is not so difficult. If you have been thinking in this direction for a long time and are approaching one of the options, now is the time to address the issue and take advantage of government support.

( 25 votes, overall rating: 4.48 out of 5)