Forms SZV-M and SZV-STAZH are mandatory reporting submitted to the Pension Fund of the Russian Federation to confirm work activity, length of service of working citizens and payment of deductions from income received. A new type of reports was approved in 2017 by resolution No. 3p dated January 11, 2020, issued by the Board of the Pension Fund of the Russian Federation. The regulatory document determines the strictly established form of the forms, the procedure and rules for filling out, and the frequency of reports. This information is submitted for each person working under a contract, conducting individual entrepreneurial activities or officially recognized as unemployed. When dismissing an insured person, the employer is obliged to transfer a copy (extract) of personalized accounting information filled out according to the SZV-M and STAZH certificate forms to the employee on the day of dismissal, along with the completed work book and other documents. (Law 27-FZ, paragraphs 2 - 2.3, 4, Article 11 (as amended on July 29, 2018).

Who is required to issue a copy of the SLA to a dismissed employee?

Each insurer (employer) who provides such information to the Pension Fund of the Russian Federation has the obligation to draw up and issue SZV (STAZH, M) certificates upon dismissal of each employee. These include:

- Organizations, individual entrepreneurs who have concluded an employment contract with an employee, licensing agreements (publishing or for the use of copyrighted objects), a civil law contract for the provision of services (performing labor functions), licensing agreements (publishing or for the use of copyrighted objects) and similar agreements and contracts.

- Organizations with a single participant - owner, director, founder (the only member of the organization submits reports for himself)

- Employment Center (for unemployed citizens).

In other words, SZV-STAZH is filled out and sent only by employers, that is, organizations that hired at least one employee during the reporting period. This eliminates the obligation for private lawyers, notaries, members of associations, etc. to submit reports.

Features of the formation of SZV-M for September 2020

- In SZV-M for September 2020, include only those persons whose payments are subject to pension insurance. If a purchase and sale or lease of property agreement has been concluded with an individual, then there is no need to enter data about it in SZV-M.

- Information in the SZV-M form for September 2020 is submitted for each insured person with whom employment contracts and civil employment agreements were concluded this month, continue to be valid, or have been terminated. The availability of payments for them does not matter. It does not matter how many days during September the agreement was valid. Even if we are talking about only one day, the employee must be included in the report. But if in the reporting period there were only payments, and the contract was not valid, there is no need to include such an employee in SZV-M.

- If employees are absent from work for any reason (long business trip, vacation, maternity leave), but their contracts are still valid in September, also include information about them in the report.

Useful information from ConsultantPlus - is it necessary to submit a zero report on the SZV-M form

Yes, you need to submit a SZV-M, regardless of whether you made payments to employees during the reporting month or not. We also recommend submitting Form SZV-M if the organization has only a manager with whom an employment contract has not been drawn up and who is its sole founder (read more...).

The procedure for issuing certificates

Information about work experience in the SZV-STAZH and SZV-M forms is transmitted personally to the employee. The procedure for filling out the SZV-STAZH does not indicate a strictly established procedure for issuing a certificate to a dismissed employee and registering the fact of receipt of this document. Therefore, the general rules of office work apply to the issuance procedure.

Most often, the employee confirms the fact of receipt of the documentation with his signature on the second copy of the document, which will remain with the employer. You can also create a book (journal) in your organization for registering SZV-STAZH certificates, which are issued to your employees upon dismissal. If the policyholder does not have the opportunity to personally deliver the documents on the day of dismissal, certificates with information about the length of service can be sent by registered mail.

Mandatory certificates

When parting with a subordinate, the employer must issue not only a work book, but also provide a number of certificates, for example, SZV-Experience and SZV-M.

SZV-Experience

The approval of the SZV-Experience form took place on January 11, 2020 based on the adoption of the resolution.

Its completion is required so that the pension fund can track the insurance coverage of workers. The form reflects the periods of work in a certain position, as well as the amount of accrued and paid insurance premiums. The employer is obliged to provide the document to the former subordinate in accordance with paragraph 4 of Art. 11 Federal Law No. 27, adopted in April 1996. It does not matter what was the basis of a citizen’s work: an employment contract or a civil law contract, the main thing is that insurance premiums are deducted.

The SZV-Experience certificate should be printed out in 2 copies so that the citizen can mark receipt, otherwise in the event of a controversial situation, the employer will not be able to prove that he has complied with the requirements of the current legislation.

To enter information into the SZV-Stazh forms, you can use an ink or ballpoint pen. The letters must be printed, and it does not matter whether they are handwritten or typed on a computer. Regarding colors, the ban applies only to red and green colors.

The help includes information:

- name and details of the policyholder;

- the time during which the resigning employee worked for the benefit of this organization.

If the reason for drawing up the certificate was the termination of the employment contract, then column 14 “Information about the dismissal of the insured person” should not be filled out. The “X” icon should be indicated only if the date of termination of official duties coincided with the last day of the year.

If the reason for leaving the enterprise is not due to old age, then sections 4 and 5 should also be ignored.

SZV-M

Since May 2020, every employer is required to submit a report called SZV-M “Information about insured persons” to the pension fund department. This reflects information about citizens who have official employment contracts, as well as their monthly income subject to insurance contributions. That is, the report allows you to determine the length of insurance coverage for each person.

In accordance with the new rules, the SZV-M certificate should be provided to each employee:

- upon termination of employment relationships;

- when parting with the workplace due to reaching the age limit;

- monthly, after sending the report to the controlling agency.

You must take confirmation from your subordinate that you have received the document, for example, print 2 copies to keep for yourself with the worker’s signature.

The SZV-M certificate, issued to an employee upon termination of an employment relationship, is a copy of the report of the same name. In this case, information about other employees is deleted, since it is personal.

Column 3 must contain information about the type - “outgoing”, and column 4 - information about the employee.

There are a variety of accounting programs on the market that provide for the formation of SZV-M for a dismissed employee for an individual person.

Should an employee write an application to receive SZV-M and EXPERIENCE certificates upon dismissal?

The document in question is issued regardless of whether the employee requested the certificate orally or in writing. To avoid future complaints about violation of legal rights from a former employee, the employer is required to issue a certificate of SZV-experience upon dismissal along with a completed work book. But is it necessary to take a written statement from him?

The Labor Code obliges the employer, upon application from the employee, to issue a certificate of SZV-experience upon dismissal, along with copies of other documents related to labor activity (Article 84.1 of the Labor Code of the Russian Federation). At the same time, the Federal Law on Accounting in the Pension Insurance System No. 27-FZ specifies that on the day of dismissal, the employee is required to provide copies of documents confirming the information transferred to the Pension Fund (Clause 4, Article 11). A written statement from the employee is not required.

Reissue of information

The law provides for a former employee to apply for a certificate again. In this case, a written application is submitted to the head of the organization with a request to issue a duplicate of the SZV-STAZH certificate form, upon dismissal, issued to the employee along with the work book. The employer (insurer) is obliged to draw up and issue it to the applicant within 5 days.

Fines for SZV-M

If the report is submitted late or it includes incomplete (inaccurate) information, the violator may be fined 500 rubles. for each insured person (paragraph 3 of article 17 of Law No. 27-FZ).

For submitting a report on paper when you are required to generate it electronically, the fine will be 1,000 rubles. (paragraph 4 of article 17 of Law No. 27-FZ).

Instructions on the procedure for maintaining personalized records, approved. Order of the Ministry of Labor dated April 22, 2020 No. 211n establishes the conditions under which a fine can be avoided:

- Errors subject to correction were made in relation to persons included in the SZV-M with the “Initial” type.

- Errors were discovered and corrected by the policyholder himself or within 5 working days from the date of receipt of the notification from the Pension Fund.

Thus, if in SZV-M for September 2020 you forgot to reflect information on individual employees and submit an additional SZV-M form for “forgotten” persons after the deadline for submitting this report, you will not be able to avoid the fine (paragraph 4, paragraph 40 of the Instructions , approved by Order of the Ministry of Labor No. 211n).

Liability of the policyholder

Federal Law 27-FZ, the Code of Administrative Violations or the regulations of the Pension Fund do not provide for the employer's liability for intentional or unintentional failure to provide pension accounting information upon termination of employment relations. But this does not mean that the policyholder who did not issue SZV-M and STAZH certificates when dismissing an employee or who provided incorrect information will not be held liable.

Failure to provide personalized accounting information on the day of dismissal is a clear violation of the rights of an employee. For officials (managers) of organizations and individual entrepreneurs, punishment is imposed under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation - a warning or fines from 1 thousand to 5 thousand rubles. The fine for the organization is from 30 thousand to 50 thousand rubles.

It is important that administrative punishment for the employer is applicable only if SZV-STAZH and SZV-M were not issued to the employee. But if certificates are issued in a timely manner with erroneous or unreliably indicated information, the insured cannot be held liable under the law.

New personalized report for the Pension Fund of Russia

The new Form SZV-STAZH and the procedure for filling it out were approved by Resolution of the Board of the Pension Fund of January 11, 2020 No. 3p. SZV-STAZH with the “original” information type must be submitted annually for all employees. Submit a new report no later than March 1 of the year following the reporting year. Therefore, the new form for 2017 must be submitted to the Pension Fund for the first time no later than March 1, 2020. Based on this reporting, PFR units will begin to summarize information about the working hours of individuals, as well as the insurance premiums accrued and paid for these periods.

Filling out a report in paper format or in the 1C program

The procedure for filling out the SZV-STAZH form is determined by the Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017. No. 3-p (Appendix 5).

Periodic information is filled out and transmitted to the Pension Fund electronically. Organizations with no more than 25 employees may provide a completed form in paper format.

When dismissing an employee, the SZV-STAZH certificate is filled out on a separate form or printed on paper after filling it out in 1C.

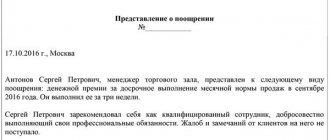

Example document

The SZV form of experience upon dismissal, a sample of filling can be seen in the figure below:

The presented sample of writing SZV-STAZH during the dismissal of a worker for reasons that are not related to retirement shows how to fill it out correctly. It is best to fill out this certificate through an Excel file. The sample is current for 2020 and its incorrect completion or failure to issue will entail certain consequences (a fine will be imposed).

Thus, the execution of a certificate of dismissal of an employee is drawn up in accordance with a certain sample, procedure and is certified based on the basic principles of documentation. Using the sample it will be quite easy to write the necessary information. Of course, when filling out there will be certain nuances that each employee must take into account. Providing important information will help the Pension Fund to monitor the accuracy of listing the length of service of employees.

General rules

The document establishes general rules for filling out the SZV certificate form - length of service upon dismissal in paper forms:

- Information is entered with a ballpoint pen or ink of any color except green and red.

- The form must be filled out legibly, in block letters, without blots. Errors cannot be corrected, painted over, pasted over or crossed out on a line of the form. The form with errors is filled out again.

- All sections must be filled in capital letters.

- It is allowed to enter information using a computer (computer aids) subject to the requirements for ink color.

- All information is entered based on the documents of the employer (the policyholder):

— Information about income (salary, bonuses, incentives and other payments and remuneration) accrued to the employee, as well as withheld insurance premiums, is filled out based on accounting data.

— Information about the period of work is filled in on the basis of the employer’s personnel records.

The SZV-experience certificate during dismissals is filled out only for the dismissed employee. The form should not contain information about other employees.

Step-by-step filling: information about the policyholder (section No. 1)

Certificates SZV-M and Experience upon dismissal (termination or termination of the contract) are filled out on paper, then the document is drawn up in two copies. In this case, one form, after registration, is issued directly to the employee, and the other is stored in the organization in the manner prescribed for documents confirming the work experience of citizens. There is no need to send a copy of the certificate for the dismissed employee to the Pension Fund office.

General sections of the SZV-STAZH certificate form when dismissing employees are filled out in the same order as periodic reporting:

1. In the “Registration number” column, the number assigned to the policyholder (employer) by the Pension Fund of the Russian Federation should be entered in full.

2. TIN line: to indicate the taxpayer number, there are 12 empty cells in the form. When filling out the TIN of an individual entrepreneur, one number is entered in each cell.

3. TIN of organizations (legal entities) consists of 10 digits. The numbers are indicated on the form, starting from the first cell. The remaining empty cells are crossed out with a single line.

4. Checkpoint line: filled in by organizations. Individual employers leave the cells empty.

5. Column “Name”: indicate the short name of the legal entity registered in the constituent documents. For individual entrepreneurs, enter the entrepreneur's last name, first name and patronymic in full.

6. In the “Information Type” column, the cell opposite “original” is marked with an “X”.

7. In the “Reporting period” column, you must indicate the year of dismissal of the employee in a four-digit number format. This is the main feature of filling out the top lines in the SZV-STAZH certificate upon dismissal (a sample of the filling is shown below):

When and to whom is required to report on SZV-STAZH

The RSV-1 report has been replaced by the alternative form SZV-STAZH, which is required to be submitted to organizations of all legal forms, individual entrepreneurs, in the case of hiring employees. The current reporting was approved by Resolution of the Pension Fund of the Russian Federation 11.01.17 No. 3n, which also established the procedure for its preparation.

The report is submitted annually, for the first time in 2020 and subsequently for subsequent reporting periods:

- no later than March 1 of the year following the reporting year;

- within 3 days, provided that the employee submits a retirement application to the accounting department;

- within 1 calendar month upon liquidation of the employer.

You can transfer prepared information using the SZV-STAZH form immediately as soon as all the information has been collected and verified by an accountant, without waiting for the deadline to expire. During the inspection process by the Pension Fund of Russia inspector, the company will receive confirmation of the successful completion of the report, or a notification of the necessary adjustment of the employee’s insurance data.

How is the table of information about the periods of work of a dismissed employee filled out (Section No. 3)?

Information about the dismissed employee is recorded line by line in a table of 14 columns.

- Column “P/n” - enter the number “1”.

- Columns two to four include the surname of the dismissed employee, his first name and patronymic in full, without abbreviations.

- Column 5 “SNILS”: the insurance number is indicated in accordance with the pension certificate.

- “Employment Period” Column: The “Start” column indicates the period of employment from the beginning of the calendar year on January 1 or the date of employment if the employee was hired in the current year. “End of period”—the date of dismissal is entered. If the employee has worked for a full year, the first and last days of the reporting year are indicated.

Information from the second to fifth columns is entered once. If you need to indicate two or more periods for a dismissed person, the information is entered in separate lines, starting from column No. 6.

Information about special conditions for performing labor functions

Sections of the table from No. 8 to 13 are filled in with codes in accordance with the Classifier attached to the Procedure for issuing SZV-M certificates (see sample SZV-STAZH certificate upon dismissal):

- Column 8: codes “RKS”, “MKSR” and others are entered if during a given period the employee performed labor functions in the Far North or other special territorial zones.

- Column 9 and its clarifying Nos. 12 and 13 are filled out only if there is documentary evidence of work experience that gives the right to early assignment of a pension to this employee.

When is the “Calculation of Work Experience” section completed?

Column No. 10 is filled out for a certain type of working conditions: expeditions or work in other field conditions (code “FIELD”), seasonal work (“SEASON”), diving work (code “DIVER”), labor duties in leper colonies (code “LEPRO”) "), work while serving a criminal sentence in a penal institution (code "UIK104").

Column No. 11 contains additional information that affects the calculation of length of service - work under unpaid contracts, parental leave, additional days of vacation, periods of downtime due to the fault of the employee, suspension from work, etc.

Column 14: o is entered if you quit on December 31. The following sections numbered “4” and “5”, located below the table, are not filled out in the certificate intended for the resigning employee.

At the bottom of the form (see sample SZV-STAZH certificate), when an employee is dismissed, the date of filling out the document is indicated. Typically, this is the date the employee leaves. Next, the position is indicated, the signature of the head of the organization (entrepreneur) is deciphered, the signature of the head and the seal of the organization are affixed.

How is the SZV-STAZH certificate generated upon dismissal in 1C?

The procedure for filling out a digital “extract” of experience is much faster than filling out a paper form - all basic information is transferred by simple copying. Below are instructions on how to make a SZV-STAZH certificate upon dismissal and hand over a paper copy if this type of reporting in an organization is filled out only in 1C:

- On the “PFR” program tab, select the line “SZV - EXPERIENCE” in the list of reports.

- Open the section for generating the SZV-STAZH report and create a new report.

- Using the “Selection” search, fill out a report only for the dismissed employee.

- Write a report and display a form for printing the document (the “Print” button).

- Select and print SZV-STAZH. The second generated document (EFV-1) is not printed and is not issued to the employee.

- One of the printed copies is given to the employee, on the other the employee puts a personal signature confirming receipt of the certificate.

A form in 1C is created separately for each calendar year worked. Thus, employees who worked in the organization in 2017 and 2018 should receive 2 SZV-STAZH reports for each year.

Form and procedure for passing SZV-STAZH in 2020

The SZV-STAZH form was approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p. The report form can be downloaded here.

The decree does not provide for the submission of a zero form.

Read more about this in the material “SZV-STAZH - is zero reporting submitted?”

NOTE! If the company employs only a manager—the only founder—then the SZV-STAZH form must also be drawn up for him and submitted to the Pension Fund.

For a sample of filling out the SZV-STAZH form for 2020 and the nuances of filling it out, see the article “How to fill out the SZV-STAZH form for 2019 for submission in 2020?”

The report includes information about employees with whom employment or civil law contracts were in force in the previous year, regardless of whether wages were accrued to them:

- FULL NAME.;

- SNILS;

- period of work in the reporting year;

- information about working conditions;

- information about the employee's dismissal.

Employers have the right to submit a SZV-STAZH report to the Pension Fund of Russia both on paper and in electronic form. But a paper version of the report will be accepted only if the employer has 24 employees or fewer. If information is issued for 25 or more people, then only an electronic report format certified by an electronic signature is available (Clause 2 of Article 8 of Law No. 27-FZ).

When sending reports electronically, be sure to ensure that you receive a receipt from the Pension Fund for accepting the reports.

We explained why this needs to be done in the material “An important change in reporting to the Pension Fund from October 1, 2020.”