Count 50: basic information

Account 50 is the active accounting account. An increase in the resource account on it is reflected as a debit, and a decrease as a credit. For example, if funds from an accountable person are deposited at the cash register, then debit entries will be generated on the account, and if a certain amount of funds is withdrawn from the cash register for transfer somewhere, then account 50 will be involved in credit entries.

Account balance 50 is debit. It is calculated by adding debit turnover to the opening balance and subtracting credit turnover from it. The ending balance shows the balance of funds in the cash register on a specific date.

Cash resources on hand are assets. The cash balance at the reporting date is reflected in the enterprise's balance sheet in the asset category (line 1250). When preparing annual financial statements, most business accountants try to bring account balance 50 to zero.

Accounting is carried out in both national and foreign currencies.

Count 50

Cash is the financial resources of an organization that have 100% liquidity.

They are stored in the cash register, on settlement, foreign exchange, current and special accounts, letters of credit, check books, transfers in transit and monetary documents. Cash payments are made with suppliers and creditors (workers and employees) through the enterprise's cash desk in cash. Cash desk is a place for conducting cash transactions, determined by the head of a legal entity. Cash transactions are operations for accepting cash, including their recalculation and issuance of cash[1].

The most important legal act for accounting for cash transactions is the Directive “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” (hereinafter referred to as Directive N 3210-U).

Look at the consultant’s website + this law.

Cash transactions are documented using cash documents.

Cash documents are prepared:

- chief accountant;

- an accountant or other official (including a cashier), determined in the administrative document - the manager (in the absence of a chief accountant and accountant).

The following documents are available for recording cash transactions:

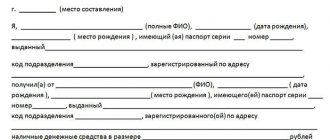

- receipt order - is drawn up when money arrives at the cash desk (Appendix A)

- expense order - drawn up when issuing money from the cash register (Appendix B)

- cash book for summarizing information about the company's cash transactions;

- a book of accounting for cash received and issued by the cashier (form 0310005) to record the movement of cash between the senior cashier and the rest of the company's cashiers during the working day;

- payroll for recording wages and other payments issued to employees.

The receipt of funds into the cash register and their withdrawal from the cash register are formalized accordingly with incoming and outgoing cash orders.

Cash is received by the organization's cash desk in the following cases:

- from bank accounts of the organization;

- from customers (sales revenue);

- from the sale of property;

- from accountable persons (return of unused amounts);

- in payment for monetary documents;

- from employees of the organization (repayment of loans, compensation for damage);

- from the founders (contribution of authorized capital), etc.

Acceptance of cash by a legal entity, individual entrepreneur, including from an employee, is carried out using cash receipt orders.

To record the availability and movement of funds at the organization's cash desk, active account 50 “Cash” is used. Balance (balance) shows how much money is in the cash register on a certain date; debit turnover shows how much money came to the cash register for a certain period. Loan turnover shows how much money was spent over a certain period.

The following subaccounts can be opened for account 50 “Cashier”:

50.1 “Cash of the organization”;

50.2 “Operating cash desk”;

50.3 “Cash documents”, etc.

Subaccount 50.1 “Cash of the organization” takes into account the funds in the cash register. If an organization carries out cash transactions with foreign currency, then sub-accounts are opened to account 50 “Cash” for separate accounting of the movement of each cash foreign currency.

Subaccount 50.2 “Operating cash desk” takes into account the availability and movement of funds in the cash registers of commodity offices (piers) and operational areas, stopping points, river crossings, ships, ticket and baggage offices of ports, train stations, etc. This sub-account is opened by organizations if necessary.

Subaccount 50.3 “Monetary documents” is intended for accounting for postage stamps, state duty stamps, bill stamps, paid air tickets and other monetary documents. Cash documents are accounted for in account 50 “Cash” in the amount of actual costs for their acquisition.

And one more important nuance: cash payments between legal entities under one agreement should not exceed 100,000 rubles. That is, when working as an accountant, it is better for each PKO and RKO order to draw up an agreement so that the bank does not find fault. Violation of this condition is subject to administrative liability in the form of a fine.

Let's consider standard debit postings:

- Debit 50 credit 62 -10,000 rub. -buyers paid at the cash register for the goods received.

- Debit 50 credit 51-50000 rub. money was received from the current account, the PKO supporting document, and the counterfoil of the cash receipt.

- Debit 50 credit 71-1500 rub. the unused amount was returned under the reporting person.

- Debit 51 credit 50-1500 rub. money was deposited into the organization's current account from the cash register.

- Debit 57 credit 50- 5200 rubles. The collectors took the cash proceeds. For now, the money will hang on account 57, and as soon as the money is credited to the organization’s current account, the following posting is made:

- Debit 51 credit 57

- Debit 71 credit 50-6000 rub. money was issued for reporting, for a business trip, for the purchase of household supplies

- Debit 70 credit 50-51000 rub. issuing wages according to the payroll sheet, i.e. according to this sheet, 5 working days are allotted for issuing wages, i.e. the organization can hold the money for 5 working days. If there were employees who did not receive salaries, then these amounts are deposited and handed over to the bank.

- Debit 73 credit 50-5000 rub. issuing a loan to an employee of an organization. Account 73 is called “settlements with personnel for other operations”

Let's post these amounts in (aircraft) in the account scheme 50.

From the account we see that at the beginning of the period there were 55,000 rubles in cash on hand. The debit turnover amounted to 61,500 rubles (10,000+50,000+1500) and shows how much income there was for a certain period, for example, a month. The loan turnover of 68,700 (1,500+5,200+6,000+51,000+5,000) rubles shows how much cash was spent was for the period. The closing balance (calculation formula = 55000 + 61500-68700) 47,800 rubles shows how much money we have left.

Below are the document forms (Appendices):

Appendix A-PKO:

Appendix B -RKO

Analytics and subaccounts

Analytical accounting for account 50 is carried out in the context of additionally opened sub-accounts:

- 50.1 “Cash of the organization” - used when accounting for the movement of cash resources in the cash desk of the enterprise;

- 50.2 “Operating cash desk” – used to account for funds in operating cash desks;

- 50.3 “Cash documents” – reflects the value of documents stored at the cash desk. These could be tickets, stamps, etc.

The number and composition of subaccounts may change based on the specifics of the organization’s accounting policies.

How are settlements with buyers and customers accounted for?

50 “Cash desk” is widely used by companies to display all cash movements when carrying out business activities.

50 account in accounting is a collective summary of information about all mutual settlements made with counterparties in cash. It contains information about the receipts and expenditures of funds for transactions in Russian rubles or foreign currency (when carrying out foreign economic activities), such as:

- Mutual settlements with counterparties-suppliers;

- Mutual settlements with customers;

- Remuneration of employees, settlements with accountable persons;

- Repayment of loans and borrowings;

- Payment of taxes and contributions to the budget, etc.

- 50.01 - displays complete information about all mutual settlements carried out in cash using the company’s main cash register.

- 50.02 “Operational cash desk” - displays information about cash flow in operational cash desks, which are installed separately from the company’s main cash register (for example, in stores).

- 50.03 “Monetary documents”: this contains information about available paid stamps, vouchers, tickets and other monetary documents.

Attention! Subaccount documents are displayed in the amount of actual costs. - 50.04 “Foreign exchange office”: the sub-account is intended to fulfill the conditions of the current legislation of the Russian Federation on separate accounting of mutual settlements in foreign currency.

Account 50 in accounting is active, that is, the debit shows the receipt of cash in the organization (payments from customers, returns of suppliers, etc.), the credit shows the expenditure of the company’s available funds (calculations for employee wages, payment for purchased goods and materials, returns buyers, etc.).

When making cash settlements, the company must set a limit on the cash balance (with the exception of individual entrepreneurs and companies related to small businesses). Proceeds in excess of the limits are transferred to the bank for crediting to the current account in person or through collection. An exception is the days when employees payroll.

Attention! If there is no established limit, it automatically takes on a zero value; the entire cash balance must be transferred to the bank daily.

Specifics of working with the account

Transactions are recorded only on the basis of documentary evidence. Typical forms used to reflect movement on a count of 50 are:

- cash receipt order – confirms the receipt of funds (regardless of the type of receipt);

- expense cash order - used to formalize the issuance of money from the cash register;

- cash book - all incoming and outgoing cash orders are recorded in it.

These forms allow you to document the movement of funds in the cash register. To maintain accounting for account 50, other accounting registers are used:

- turnover balance sheet;

- journal-order;

- statement of account 50.

All of the listed registers duplicate information.

The company has the opportunity to establish accounting in accordance with its accounting policies. You can use only one of the specified registers, especially since, if necessary, the software product can generate any of the specified documents.

How is account 51 used in accounting?

Account 51 is active. An increase in an account is shown as a debit, and a decrease as a credit. For example: if sales revenue is credited to the company’s account, then debit entries on account 51 will be used, and if services, raw materials or debt to counterparties are paid from the current account, then account 51 entries will be made on credit.

The account balance is debit. It shows the cash balance that belongs to the company at the reporting date. Since monetary resources are the assets of the enterprise, the final account balance is reflected in the balance sheet asset, in particular, in line 1250.

The main document confirming the status of the account is a bank statement.

The balance of account 51 cannot be negative. If the company has no money, then the balance is zero; if it does, then the balance is greater than zero. If the bank has provided an overdraft, then it should be reflected as accounts payable, but not as a positive balance.

Account characteristics

Synthetic accounting of settlements with persons to whom accountable amounts have been issued is organized on account 71. To answer whether this account is active or passive, you need to remember that its balance can be located either as a debit or as a credit. Thus, account 71 is an active-passive account with a double balance.

The balance at the beginning of the period in the debit of the account reflects the debt of the company's accountable persons for the money issued to them for established purposes. The account credit balance records the company's debt to the employee for expenses incurred at his own expense in the interests of the organization.

The debit of account 71 reflects the issuance of money for the purposes established by the enterprise or reimbursement to the employee of expenses approved by management that were previously made at his expense.

The credit of the account reflects the approved expenses of the accountable person, which are accepted by management, as well as the return of unspent funds to the cash desk or withholding them from the salary of the accountable person, if they are presented with an application for this method of repaying the debt.

To determine the ending balance, you must use the following algorithm:

- If the opening balance on account 71 is in debit, then you need to add the debit turnover on the account to it and subtract the amounts for the selected period on the loan. If you get a positive value, then the balance at the end will be a debit. Otherwise, it is reflected in the credit of the account.

- If the opening balance on account 71 is located in the credit of the account, then the turnover on the credit of the account should be added to it and subtract the total amount of movement on the debit of the account for the period under review. If the total value is greater than zero, it must be reflected as a credit to the account. A negative amount must be reflected in the debit of the account.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

Postings to account “71.01”

By debit

| Debit | Credit | Content | Document |

| 71.01 | 50.01 | Issue of cash from the organization's cash desk to an accountable person in rubles. | Cash withdrawal |

| 71.01 | 50.02 | Issue of cash from the operating cash desk to an accountable person in rubles. | Cash withdrawal |

| 71.01 | 50.03 | Issuance of monetary documents from the organization's cash desk to an accountable person in rubles. | Issuance of monetary documents |

| 71.01 | 51 | Transfer of funds from the organization's current account to an accountable person in rubles. | Debiting from current account |

By loan

| Debit | Credit | Content | Document |

| 000 | 71.01 | Entering initial balances: settlements with accountable persons in rubles. | Entering balances |

| 07 | 71.01 | Inclusion in the cost of equipment requiring installation, expenses of the accountable person in rubles. | Advance report |

| 08.01 | 71.01 | Inclusion in the cost of the land plot of expenses of the accountable person in rubles. | Advance report |

| 08.02 | 71.01 | Inclusion in the cost of the natural resource management facility of the expenses of the accountable person in rubles. | Advance report |

| 08.03 | 71.01 | Inclusion in the cost of the construction project of the expenses of the accountable person in rubles. | Advance report |

| 08.04 | 71.01 | Inclusion in the cost of a non-current asset (equipment) of the expenses of the accountable person in rubles. | Advance report |

| 08.05 | 71.01 | Inclusion in the value of an intangible asset that has not been put into operation, the expenses of an accountable person in rubles. | Advance report |

| 10.01 | 71.01 | Acceptance for accounting of raw materials and supplies received from the accountable entity in rubles. | Advance report |

| 10.02 | 71.01 | Acceptance for accounting of purchased semi-finished products, components, structures and parts received from an accountable entity in rubles. | Advance report |

| 10.03 | 71.01 | Acceptance for accounting of fuel received from an accountable person in rubles. | Advance report |

| 10.04 | 71.01 | Acceptance for accounting of reusable collateral containers and packaging materials received from the accountable entity in rubles. in organizations engaged in production activities or provision of services | Advance report |

| 10.05 | 71.01 | Acceptance for accounting of spare parts received from an accountable person in rubles. | Advance report |

| 10.06 | 71.01 | Acceptance for accounting of other materials received from the accountable person in rubles. | Advance report |

| 10.08 | 71.01 | Acceptance for accounting of construction materials received from an accountable entity in rubles. | Advance report |

| 10.09 | 71.01 | Acceptance for accounting of inventory and household supplies received from the accountable person in rubles. | Advance report |

| 10.10 | 71.01 | Acceptance for accounting of special equipment and special clothing received from an accountable person in rubles. | Advance report |

| 20.01 | 71.01 | Inclusion in the costs of the main production of the amount of expenses incurred by the accountable person in rubles. | Advance report |

| 23 | 71.01 | Inclusion in the costs of auxiliary production of the amount of expenses incurred by the accountable person in rubles. | Advance report |

| 25 | 71.01 | Write-off as general production expenses the amount of expenses incurred by the accountable person in rubles. | Advance report |

| 26 | 71.01 | Write-off for general business expenses the amount of expenses incurred by the accountable person in rubles. | Advance report |

| 29 | 71.01 | Inclusion in the expenses of service industries and farms of the amount of expenses incurred by the accountable person in rubles. | Advance report |

| 41.01 | 71.01 | Acceptance for accounting of goods received from an accountable person in rubles. | Advance report |

| 41.02 | 71.01 | Acceptance for accounting of goods at a retail outlet received from an accountable person in rubles. (retail, accounting at acquisition cost) | Advance report |

| 41.04 | 71.01 | Acceptance for accounting of purchased items received from an accountable person in rubles. | Advance report |

| 44.01 | 71.01 | Write-off as distribution costs the amount of expenses incurred by an accountable person in rubles in organizations engaged in trading activities | Advance report |

| 44.02 | 71.01 | Write-off of expenses incurred by an accountable person in rubles for business expenses in organizations engaged in industrial and other production activities | Advance report |

| 50.01 | 71.01 | Receipt of cash to the organization's cash desk from an accountable person in rubles. (return of unspent amounts previously issued for reporting) | Cash receipt |

| 50.02 | 71.01 | Receipt of cash to the operating cash desk from an accountable person in rubles. (return of unspent amounts previously issued for reporting) | Cash receipt |

| 50.03 | 71.01 | Receipt of monetary documents to the organization's cash desk from an accountable person in rubles. | Receipt of cash documents |

| 51 | 71.01 | Receipt of funds to the organization's current account from an accountable person in rubles. (return of unspent amounts previously transferred to the report) | Receipt to the current account |

| 60.01 | 71.01 | Payment to the supplier by an accountable person | Advance report |

| 70 | 71.01 | Deduction from the employee's salary of unspent accountable amounts in rubles. | Operation |

| 73.03 | 71.01 | Reflection of the debt of the accountable person for unspent amounts previously transferred to the report | Operation |

| 91.02 | 71.01 | Inclusion in other expenses not related to the main activities of the expenses of the accountable person in rubles. | Advance report |

| 97.21 | 71.01 | Inclusion in deferred expenses of the accountable person's expenses in rubles. | Advance report |