What is account 10 used for in accounting “materials”

The chart of accounts establishes that account 10 takes into account objects that are defined in accounting in accordance with PBU 5 as materials.

Materials include material assets that are used in the form of inventory, raw materials for the production of finished products, provision of services, performance of work, for resale if necessary, for the implementation of the management process of a business entity.

If material assets are acquired for the purpose of resale on an ongoing basis, then they are goods and a different account is used to account for them.

Materials are accounted for on account 10 at the actual costs incurred for their acquisition or at accounting prices, depending on the methods chosen in the organization’s accounting policy.

Accounting can be maintained for each unit of materials, batch, or group. The company independently determines how to record them based on the characteristics of its activities, as well as in order to ensure control over their availability and movement.

Attention! Materials located in the company may not belong to it by right of ownership, then they are recorded on off-balance sheet accounts (002 and 003).

What records accompany the posting and write-off of inventories?

The sources of materials entering the company can be very different:

- purchase from a supplier;

- self-production;

- formation as a result of dismantling decommissioned equipment;

- making a contribution to the authorized capital, etc.

The order in which the receipt of materials is reflected in the accounts will largely depend on this:

- Dt 10 Kt 60 - posting of materials purchased from another business entity;

- Dt 10 Kt 71 - posting of materials on the advance report of the accountable person;

- Dt 10 Kt 75 - the contribution of materials to the authorized capital from the founder is taken into account;

- Dt 10 Kt 98 - materials transferred free of charge have been capitalized; in this case, the assessment should be made based on market prices.

- Dt 10 Kt 91 - materials remaining after dismantling the OS object or its write-off are taken into account.

Naturally, VAT on received inventories is taken into account separately.

Example 3

JSC "Alternativa" purchased 200 packages of paper for 150 rubles, their total cost was 30,000 rubles, including VAT in the amount of 4,576.27 rubles. During registration, the company’s accounting department will record on the accounting accounts:

- Dt 10.6 Kt 60 - 25,423.73 rub. — paper has been entered into the warehouse.

- Dt 19.3 Kt 60 — 4,576.27 rub. — reflects the amount of incoming VAT.

- Dt 68.2 Kt 19.3 — 4,576.27 rub. — tax accepted for refund.

- Dt 60 Kt 51 - 30,000 rub. — non-cash payment for delivery has been made.

Companies that have chosen alternative modes of settlements with the budget (for example, the simplified tax system) and are not VAT payers include the tax in expenses.

Materials can be sent from the warehouse in various directions, and therefore the entries on the accounting accounts may differ:

- Dt 20 (23, 25, 26) Kt 10 - write-off of raw materials and materials for production, for general production, general economic purposes; The basis for this is the requirements - invoices or limit-fence cards.

- Dt 10 Kt 10 - transfer of materials within the company without consumption during the production process from warehouse to warehouse, to division, from department to department. In these cases, documents reflecting internal movement are used.

- Dt 94 Kt 10 - attribution of oil and gas losses for various reasons. Most often, these are small deficiencies identified during the audit, if the perpetrators have not yet been identified. A write-off act must be drawn up.

- Dt 99 Kt 10 - attributing the cost of materials to losses in the event of a force majeure event, documented in a write-off act.

- Dt 91 Kt 10 - write-off of the cost of materials upon their sale.

***

So, inventory accounting is carried out on specially designated account 10 “Materials”, to which sub-accounts are opened, reflecting the grouping by type of materials. All operations related to the receipt and use of inventories are necessarily carried out on the basis of primary documents. Amounts of materials written off for production purposes reduce the taxable base for income tax.

Similar articles

- Nuances of postings debit 10 credit 10

- Transportation and procurement costs

- MPZ: synthetic and analytical accounting

- The concept and composition of inventories in accounting

- Accounting for working capital at an enterprise

The concept of raw materials and supplies in accounting

Materials are recognized as objects of human activity that are used mainly in one production process and fully transfer their value to the manufactured object.

Their useful life is less than one year. In accordance with the law, they are included in the working capital of the enterprise.

Raw materials are objects that are products of the mining industry or agriculture. They undergo a processing process and are fully used in the manufacture of finished products.

Materials are a product of the manufacturing industry, which is subsequently used to produce products, provide services, and perform work.

Materials are divided into the following groups:

- Raw materials and basic materials are the basis for the manufacture of finished products

- Semi-finished products of own production are an integral part of work in progress; they are not taken into account in account 10.

- Purchased semi-finished products are materials that have undergone pre-processing at other enterprises.

- Auxiliary materials - lubricants, containers, returnable waste, etc.

- Fuel is used as one of the sources of energy in economic activities.

- Spare parts are used for timely repair of equipment and other fixed assets.

- Construction materials - used in construction work and repair of buildings and structures.

- Household inventory - objects used in several production processes or in the management of an organization, classified as materials due to cost or short lifespan.

Accounting for materials in accounting: examples and postings

Materials accounting involves the interaction of the “materials area” with other areas of accounting. Each accounting area is designated by a specific accounting account. Therefore, our materials section (account 10) will interact with other sections (accounting accounts).

These interactions are not to say that there are a great many, but still quite a lot. I will give the most common accounting accounts with which the 10th “Materials” account interacts and for which transactions are generated.

These can safely include:

- accounting account 10 “Materials”. Yes, yes, I was not mistaken. We can move materials around warehouses, right?

- accounting account 20 “Main production”,

- accounting account 25 “General production expenses”

- accounting account 26 “General business expenses”

- accounting account 60 “Mutual settlements with suppliers”

- accounting account 71 “Settlements with accountable persons”

- accounting account 76 “Settlements with various debtors and creditors” (rarely)

- accounting account 91 “Other income and expenses” (rarely)

The main situations (events) of enterprises where the materials area is involved looks like this:

- Receipt of materials (MPR)

- Receipt of materials (MR) according to the advance report

- Moving inventories to warehouses

- Transfer of materials to production

- Write-off of materials

- Sales of materials (uncharacteristic, rare event for materials)

SPECIAL MOMENT . There is another important material issue to consider. The question itself is the situation: what should we do in accounting if we buy the same material, but suppliers have different prices for it?

The first answer is that we will have to create a new card in the “Nomenclature” directory for each material with a new price. In this case, the list will contain materials with the same names and, sometimes, there are quite a few of them. But that is not all. At the moment of transferring, for example, 50 pieces of a specific material into production, we will be forced to select the same material from the list in order to collect 50 pieces in total. This is inconvenient and time-consuming.

The second answer is that we use one material card, and the price on account 10 would be the average for each material. The average price formula looks like this.

AveragePrice = (Cost of all quantities of one material) / (Sum of all quantities of one material)

Along with the average price, there are two more types of accounting for the cost of inventory: FIFO. The first batch arrived is the first to be consumed by LIFO. The last batch arrived first and is consumed. These records are more difficult to use. However, computer programs take on the complexity of these calculations, and the user is asked to use one card (name) in the directory.

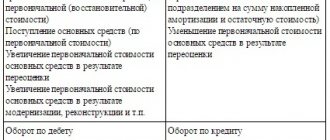

Account characteristics

To record information about the availability and movement of materials, account 10 is used in accounting.

This is an active account that has a debit balance characterizing the availability of materials on certain dates.

The receipt of materials is reflected in the debit of the account based on the primary documents received by the organization, and their disposal, including write-off to production, is reflected in the credit of the account. At the same time, the company prepares primary expenditure documents for disposal.

The final account balance is determined by adding the opening balance with the turnover on the debit of account 10, and subtracting from the resulting result on the credit of account 10.

Attention! In the balance sheet, information on account 10 is reflected in line 1210.

You might be interested in:

Account 02 in accounting: Depreciation of fixed assets

Write-off of materials for production

The transfer of materials and raw materials into production and their write-off as costs is reflected in the “Requirement-invoice” document, available in the “Production” or “Warehouse” sections. On the “Materials” tab, you need to indicate the materials, their quantity, and the accounting account (the latter can be filled out automatically or manually). The cost of materials when written off is calculated at the time the document is posted in accordance with the accounting policy established in 1C (FIFO or average cost):

On the “Cost Account” tab, you need to select the account to which the materials are written off and its analytics (sub-account):

If materials should be written off to different accounts or in different analytical sections (cost items, departments, etc.), you need to put o and indicate the write-off parameters on this tab in the columns that appear in the tabular section.

The “Customer Materials” tab serves only to reflect the processing of customer-supplied raw materials.

The document makes postings on Kt account 10 in Dt of the selected cost account. Printing of the demand invoice form M-11 and a non-unified form is available.

Watch our video on writing off materials in 1C using stationery as an example:

What subaccounts are used?

The following subaccounts can be created for account 10:

- 10/1 “Raw materials and materials” - it records raw materials and the main types of materials that form the basis for the production of main products. Here you can also keep records of materials for auxiliary and technological purposes, as well as agricultural products intended for processing.

- 10/2 “Purchased semi-finished products and components, structures and parts” - this takes into account the cost of semi-finished products and components that are purchased for the production of products and require further refinement.

- 10/3 “Fuel” – this takes into account the availability and movement of fuel and lubricants for the company’s vehicles and equipment.

- 10/4 “Containers and packaging materials” - here all types of containers are recorded, as well as materials for their manufacture or repair.

- 10/5 “Spare parts” - here the accounting of spare parts intended for the repair of existing equipment, vehicles and other mechanical means is made;

- 10/6 “Other materials” - production waste, trimmings, shavings, etc. are taken into account here. Materials that were formed during the liquidation of the OS can also be taken into account here. The main thing is that the materials accounted for in this subaccount are not used as basic materials, fuel, spare parts, etc.

- 10/7 “Materials transferred for processing to third parties” - this takes into account materials that were transferred to third parties for the manufacture of products from them;

- 10/8 “Building materials” - the subaccount is used in developer organizations to account for materials used during construction and installation;

- 10/9 “Inventory and household supplies” – the account records the cost of tools, inventory, and household supplies;

- 10/10 “Special equipment and special clothing in the warehouse” - is intended to account for special equipment, equipment, special clothing, etc., which are stored in the warehouse.

- 10/11 “Special equipment and special clothing in operation, etc.” – designed to account for special equipment, equipment, workwear, etc., which are used in production.

Attention! An organization can open other sub-accounts necessary for proper accounting. Analytical accounting can be carried out by types, types, sizes, grades of materials, etc.

Subaccounts

Count 10 has a number of second order counts. Let us briefly describe what each of them takes into account:

- 1—property that forms the basis of the product produced by the organization (unprocessed raw materials, auxiliary materials, etc.);

- 2 - purchased components. Moreover, they must become an integral part of the product;

- 3 — fuel (including technological, household and lubricants);

- 4 - containers used for storing, packaging and transporting products. These can be various boxes, bags, containers, storage boxes, etc.;

- 5 - spare materials. These include spare parts for cars, machine tools and other technological equipment;

- 6 - returnable production waste. Everything that during the manufacturing process of a product was not included in its final composition, but retained its material value;

- 7 - materials for processing. Industrial waste that can only gain value if recycled;

- 8 - building materials (if construction is not the main activity of the organization);

- 9 - household equipment. Any devices that are not directly part of the organization’s technological turnover;

- 10 - tools and workwear in storage;

- 11 — tools and clothing in use.

Which accounts does account 10 correspond to?

Account 10 can correspond with the following accounts:

From the debit of account 10 to the credit of accounts:

- Account 10 - when transferring materials between warehouses;

- Account 15 - when purchasing materials using accounts 15, 16 in accounting;

- Account 20 - when registering materials from the main production;

- Account 23 - when registering materials from auxiliary production;

- Account 25 - when recording materials that arose during the implementation of general production expenses;

- Account 26 - when recording materials that arose during the implementation of general business expenses;

- Cch. 28 – when registering irreparable defects as materials;

- sch. 29 - when receiving materials from service farms;

- sch. 40 - when adjusting the actual cost;

- sch. 41 - when converting goods purchased for resale into materials;

- sch. 43 - when converting finished products into materials;

- sch. 44 - when recording material that arose when incurring sales expenses;

- sch. 60 - upon receipt of materials from suppliers;

- sch. 66 - upon receipt of materials in the form of short-term trade credits or loans;

- sch. 67 - upon receipt of materials in the form of long-term trade credits or loans;

- sch. 68 - regarding fees or taxes attributable to the cost of materials;

- sch. 71 - upon receipt of materials from accountable persons;

- sch. 75 - when the founders contribute shares with materials;

- sch. 76 - upon receipt of materials from other suppliers, inclusion of the cost of services in the price of materials, etc.

- sch. 79 - upon receipt of materials from branches or head offices;

- sch. 80 - when making contributions from partnership participants in materials;

- sch. 86 - upon receipt of materials as targeted funding;

- sch. 91 - upon receipt of materials during the disassembly of OS objects;

- sch. 97 - adjustment of the cost of materials charged to deferred expenses;

- sch. 99 - when registering materials arising due to emergency circumstances.

You might be interested in:

Postings for payment of dividends to the founder in accounting

According to the credit of the account, it corresponds with the debit of the following accounts:

- sch. 08 - when writing off materials for preparation for operation of non-current assets, capital construction, etc.;

- sch. 10 – when transferring materials between warehouses;

- sch. 20 - when releasing materials to main production;

- sch. 23 – when releasing materials to auxiliary production;

- sch. 25 – when releasing materials for general production needs;

- sch. 26 – when releasing materials for general business needs;

- sch. 28 - when releasing materials to correct defects;

- sch. 29 – when releasing materials to subsidiary farms;

- sch. 44 - when releasing materials for sales expenses;

- sch. 45 - for the amount of shipped materials, the revenue for which has not yet been recognized in accounting;

- sch. 76 - upon disposal of materials to another counterparty;

- sch. 79 - when transferring materials to branches or head offices;

- sch. 80 - when paying off a partner’s share with materials;

- sch. 91 - when writing off the cost of materials upon their disposal;

- sch. 94 - when a shortage of materials is detected;

- sch. 97 - when assigning the cost of materials to future expenses;

- sch. 99 - when writing off materials for emergency circumstances.

Receipt of materials in 1C 8.3

Receipt of materials is reflected in the standard document “Receipts (acts, invoices)”. The document is available in the “Purchase” section. When receiving materials, as well as when goods arrive at an enterprise, you should select the document type “Goods (invoice)” or “Goods, services, commission” (in the latter case, materials are entered on the “Goods” tab).

The accounting account is set automatically if the “Materials” type was specified for the item, or they are selected manually:

The document makes accounting entries in Dt account 10, and also, for an organization that is a VAT payer, in Dt 19.03 (“VAT on purchased inventories”). Printing of a receipt warehouse order (M-4) is available.

How to register the receipt of materials in 1C, see our video:

Accounting entries for the account

With a score of 10 the following entries can be made:

| Debit | Credit | Description |

| Materials receipt transactions | ||

| 10 | 10 | Transfer of materials from warehouse to warehouse |

| 10 | 15 | Materials accepted at discount prices |

| 10 | 20 | Accepted materials manufactured by the main production facilities |

| 10 | 20 | Return of unused materials to the warehouse |

| 10 | 23 | Materials manufactured by auxiliary production forces have been accepted into the warehouse |

| 10 | 28 | Accepted irreparable marriage |

| 10 | 29 | Materials produced by subsidiary farms have been accepted for accounting |

| 10 | 41 | Goods purchased for resale are used as materials |

| 10 | 43 | Finished products are transferred to the warehouse for use as materials |

| 10 | 44 | Return of materials issued for sales support |

| 10 | 60 | Receipt of materials from the supplier to the warehouse |

| 10 | 66 | Receipt of materials for short-term trade credit or loan |

| 10 | 67 | Receipt of materials for long-term trade credit or loan |

| 10 | 71 | Receipt of materials from an accountable person |

| 10 | 73 | Receipt of materials from personnel |

| 10 | 76 | Receipt of materials from other creditors |

| 10 | 79 | Receipt of materials from the head office or branch |

| 10 | 75 | Receipt of materials as a contribution to the authorized capital |

| 10 | 86 | Receipt of materials in the form of targeted financing |

| 10 | 97 | Receipt of materials from deferred expenses funds |

| 10 | 99 | Receipt of materials due to emergency or force majeure circumstances |

| 10 | 91 | Additional valuation of materials, proceeds from the sale or dismantling of an asset |

| Material write-off operations | ||

| 08 | 10 | Write-off of materials for preparing non-current assets for operation |

| 14 | 10 | Materials have been marked down |

| 20 | 10 | Materials transferred to main production |

| 23 | 10 | Materials transferred to auxiliary production |

| 28 | 10 | Materials transferred for correction of defects |

| 29 | 10 | Materials were donated to the needs of subsidiary farms |

| 44 | 10 | Materials were transferred for the needs of preparing main products for sale |

| 79 | 10 | Materials transferred to the head office or branch |

| 91 | 10 | Write-off of the cost of materials upon disposal or sale |

| 94 | 10 | Shortage of materials identified |

| 97 | 10 | The cost of materials is charged to deferred expenses. |

| 99 | 10 | Loss of materials written off due to emergency or force majeure circumstances |

Accounting for materials at accounting prices using accounts 15, 16 (postings, example)

If to account for materials, not the actual cost price is used, but the accounting price, then the accounting department uses additional accounts 15 and 16. Inventory and materials are entered into the debit of account 15 at the actual cost, and into the debit of account 10 at the accounting price. The difference between the actual and accounting price is called a deviation and is reflected in account 16. The excess of the accounting price over the actual price is reflected in the credit of account 16, the excess of the actual price over the accounting price is reflected in the debit of account 16. The wiring is shown in the table below.

Postings for accounting materials at accounting prices

The table below shows the main entries for accounting for receipt of materials (materials and materials).

| Debit | Credit | Operation name |

| 60 | 51 | The cost of the supplier's goods and materials has been paid |

| 15 | 60 | The cost of inventory items is taken into account according to supplier documents excluding VAT |

| 19 | 60 | VAT allocated |

| 10 | 15 | Inventories are capitalized at the accounting price |

| 15 | 16 | The excess of the book price over the actual cost is written off |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Let's consider this option for accounting for materials using a specific example.

Account balance sheet

The balance sheet reflects information about the receipt and expenditure of inventory items in warehouses. The document indicates the beginning balance and the ending balance. Accounting for this category is carried out both in physical and in value terms.

If we talk about the balance sheet for warehouses, then a separate document is generated for each of these warehouses. Only after this the data obtained for each warehouse is compiled into a general document for the organization. This document is the basis for maintaining records of materials. All data entered into the electronic database is also reflected in warehouse cards. It is according to the latest documents that the enterprise reports on materials.

Allowed simplifications

The applicable accounting policies and procedures are flexible. Depending on the prevailing circumstances and the requirements of the time, the necessary changes are made to these documents at the government level.

Thus, in 2020, some changes were made, according to which small businesses and non-profit organizations received the right to use simplified accounting methods, including accounting for materials.

These assumptions are given by the Ministry of Finance of the Russian Federation in order to enable this category of business entities to develop better. However, in order to be able to apply the presented preferences, they should be fixed in the accounting policies.

Thus, the Ministry of Finance of the Russian Federation allows:

- valuation of purchased goods and materials at the seller's price;

- simplified write-off of those inventories that are used for management needs;

- now the designated categories of business entities have the right to write off the cost of business and production equipment at a time;

- From now on, the initial cost of OS can be formed by including only the price that was paid to their supplier, as well as the costs of their installation. Other costs incurred in the process of purchasing an OS should be classified as expenses;

- Now it is possible to abandon the formation of a reserve fund designed to cover losses in the event of a decrease in the value of goods and materials.

Manufacturing in-house

Finished products or part of them can be capitalized as materials for another type of production. In this case, when transferring materials to the warehouse, a demand invoice is drawn up.

To do this, you can use the unified form No. M-11, which was approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. Or you can develop your own form of demand invoice. The main thing is that it contains all the necessary details. Fix the choice in the accounting policy by order of the manager.

This follows from the provisions of paragraph 57 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, Article 9 of the Law dated December 6, 2011 No. 402-FZ and paragraph 4 of PBU 1/2008.

Determine the cost of materials made independently based on the actual costs associated with their production. The costs for the production of materials are formed in the same order as the costs for finished products. Such rules are provided for in paragraph 64 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, paragraph 7 of PBU 5/01, as well as the Instructions for the chart of accounts.

If you use all the finished products as materials, then you don’t have to credit them to account 43 “Finished Products”, but immediately charge them to account 10 “Materials”. This procedure is provided for in the Instructions for the chart of accounts. If you choose this option, it must be fixed in the accounting policy for accounting purposes.

Reflect the receipt of materials manufactured in-house by posting:

Debit 10 (15) Credit 20 (23, 21)

– materials produced in-house have arrived at the warehouse.

This procedure is established by the Instructions for the chart of accounts (accounts 20, 21, 23).

An example of reflecting in accounting the receipt of materials produced in-house

The auxiliary workshop of Proizvodstvennaya LLC produces parts that are fully used in the main production as materials. The accounting policy of the organization stipulates that manufactured parts are immediately credited to account 10 without being assigned to account 43.

During the reporting period, the following expenses were incurred in the manufacture of parts:

- materials – 100,000 rubles;

- salary, including contributions for compulsory pension, social and medical insurance, as well as for provision in case of accidents and occupational diseases - 65,100 rubles;

- depreciation of fixed assets - 2000 rubles.

The Master's accountant made the following entries in the accounting:

Debit 23 Credit 10 – 100,000 rub. – materials used for the production of parts are written off;

Debit 23 Credit 70 (69) – 65,100 rub. – salaries were accrued to the employees of the auxiliary workshop, including contributions for compulsory pension, social and medical insurance, as well as for provision in case of accidents and occupational diseases;

Debit 23 Credit 02 – 2000 rub. – depreciation of fixed assets of the auxiliary workshop has been accrued;

Debit 10 Credit 23 – 167,100 rub. (RUB 100,000 + RUB 65,100 + RUB 2,000) – reflects the actual cost of manufactured parts.

Accounting and control

A company can organize accounting in two ways.

Option #1.

First, write out a paper document. For example, a request for an invoice for the movement of goods and materials. Then the responsible persons carry out the transfer and complete the execution of the primary document. And only then are they transferred to the accounting department. The responsible accountant enters the data into the program.

Option number 2.

An accountant or warehouse worker enters information about the movement of inventories into a specialized accounting program. Then it prints out the document and submits it to the responsible persons for signature.

Regardless of the chosen accounting option, do not forget about errors. However, accounting indicators must always correspond to actual data. Therefore, it is necessary to organize systematic checks. It is recommended to carry out monthly reconciliations of SALT data with actual warehouse accounting indicators.

Instruct the responsible accountant to carry out counter reconciliations with financially responsible persons. These can be not only MOLs for warehouses, but also for all departments where inventories are stored. Correct any errors found in accounting in accordance with current standards. It is advisable to carry out control activities before the closing of the reporting period.

Contract of sale

If materials are supplied for a fee, you will receive from the supplier or shipper:

- payment documents (bills, invoices, invoices, etc.);

- accompanying documents (specifications, certificates, quality certificates, etc.).

This is stated in paragraph 1 of paragraph 44 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

When you receive materials, check whether the data in the accompanying documents corresponds to those provided for by the terms of the contract (range, quantity, prices, method and terms of shipment, etc.). Also make sure that all amounts in the settlement documents are calculated correctly.

In this case, reflect the actual cost of materials in the amount:

- payment to the materials supplier;

- transportation and procurement costs;

- costs of bringing materials to a state in which they are suitable for use (including toll processing).

Such a list is established in paragraph 68 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If you reflect the receipt of materials on account 10 at the actual cost of each unit, then make the following entry:

Debit 10 Credit 60 (76)

– the receipt of materials is reflected at actual cost, taking into account transportation and procurement costs.

This follows from the provisions of paragraph 80 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and the Instructions for the chart of accounts (accounts 10, 60, 76).

An example of reflecting in accounting the receipt of materials under a purchase and sale (supply) agreement. The cost of materials is formed on account 10

LLC "Proizvodstvennaya" received the materials necessary for the production of products. The cost of materials was 118,000 rubles. (including VAT – 18,000 rubles). Delivery of materials cost 59,000 rubles. (including VAT – 9000 rubles). The materials have been entered into the warehouse. The organization accounts for materials on account 10 at actual cost (without using accounts 15 and 16).

The Master's accountant made the following entries in the accounting:

Debit 10 Credit 60 – 150,000 rub. (RUB 118,000 – RUB 18,000 + RUB 59,000 – RUB 9,000) – reflects the receipt of materials, taking into account delivery costs;

Debit 19 Credit 60 – 27,000 rub. (RUB 18,000 + RUB 9,000) – input VAT included;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 27,000 rub. – VAT is accepted for deduction upon receipt of a correctly executed supplier invoice;

Debit 60 Credit 51 – 177,000 rub. (RUB 118,000 + RUB 59,000) – paid for materials including delivery costs.

Reflect the receipt of materials at accounting prices with the following entries:

Debit 15 Credit 60 (76)

– the receipt of materials is reflected in the assessment provided for in the contract with the supplier or other documents;

Debit 15 Credit 60 (76)

– transport, procurement and other similar expenses are taken into account in the actual cost of materials;

Debit 10 Credit 15

– materials are capitalized at the accounting price.

Reflect deviations between the accounting price and the actual cost using the following entries:

Debit 16 Credit 15

– the excess of the actual cost of materials over their book price is reflected;

Debit 15 Credit 16

– the excess of the accounting price of materials over their actual cost is reflected.

This follows from the provisions of paragraph 80 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and the Instructions for the chart of accounts (accounts 10, 15, 16, 60, 76).

An example of reflecting in accounting the receipt of materials under a purchase and sale (supply) agreement. Materials are capitalized at a book price that is less than their actual cost

Proizvodstvennaya LLC received 100 cans of paint at a price of 1,180 rubles. (including VAT - 180 rubles). Costs for delivery of materials amounted to 29,500 rubles, including VAT – 4,500 rubles. The materials have been entered into the warehouse. The accounting policy of the organization provides for the use of accounts 15 and 16. The accounting price of incoming paint is 1200 rubles.

The total cost of the received paint was 118,000 rubles. (RUB 1,180 × 100 pcs.), including VAT – RUB 18,000. (180 rub. × 100 pcs.).

The Master's accountant made the following entries in the accounting:

Debit 15 Credit 60 – 100,000 rub. (118,000 rubles – 18,000 rubles) – the receipt of materials from the supplier is reflected;

Debit 15 Credit 60 – 25,000 rub. (RUB 29,500 – RUB 4,500) – the cost of delivery of materials from the supplier is taken into account.

The actual cost of the incoming paint included the costs of its delivery. Therefore, the actual cost of the entire batch of paint was: 100,000 rubles. + 25,000 rub. = 125,000 rub.

Debit 19 Credit 60 – 22,500 rub. (RUB 18,000 + RUB 4,500) – VAT on purchased materials is taken into account, taking into account delivery costs;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 22,500 rub. – VAT is accepted for deduction upon receipt of a correctly executed supplier invoice;

Debit 10 Credit 15 – 120,000 rub. (RUB 1,200 × 100 pcs.) – materials were capitalized at the accounting price;

Debit 16 Credit 15 – 5000 rub. ((1250 rub. – 1200 rub.) × 100 pcs.) – a deviation is reflected due to the excess of the actual cost over the book price;

Debit 60 Credit 51 – 147,500 rub. (RUB 29,500 + RUB 118,000) – payment was made to the supplier for received materials and to the transport company for delivery of materials.

An example of reflecting in accounting the receipt of materials under a purchase and sale (supply) agreement. Materials are capitalized at a book price that is greater than the actual cost

Proizvodstvennaya LLC received 100 cans of paint at a price of 1,180 rubles. (including VAT - 180 rubles). Costs for delivery of materials amounted to 29,500 rubles, including VAT – 4,500 rubles. The materials have been entered into the warehouse. The organization's accounting policy provides for the use of accounts 15 and 16. The accounting price of incoming paint is 1,300 rubles.

The total cost of the received paint was 118,000 rubles. (RUB 1,180 × 100 pcs.), including VAT – RUB 18,000. (180 rub. × 100 pcs.).

The Master's accountant made the following entries in the accounting:

Debit 15 Credit 60 – 100,000 rub. (118,000 rubles – 18,000 rubles) – the receipt of materials from the supplier is reflected;

Debit 15 Credit 60 – 25,000 rub. (RUB 29,500 – RUB 4,500) – the cost of delivery of materials from the supplier is taken into account.

The actual cost of the incoming paint included the costs of its delivery. Therefore, the actual cost of the entire batch of paint was: 100,000 rubles. + 25,000 rub. = 125,000 rub.

Debit 19 Credit 60 – 22,500 rub. (RUB 18,000 + RUB 4,500) – VAT on purchased materials is taken into account, taking into account delivery costs;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 22,500 rub. – VAT is accepted for deduction upon receipt of a correctly executed supplier invoice;

Debit 10 Credit 15 – 130,000 rub. (RUB 1,300 × 100 pcs.) – materials were capitalized at the accounting price;

Debit 15 Credit 16 – 5000 rub. ((1300 rub. – 1250 rub.) × 100 pcs.) – a deviation is reflected due to the excess of the accounting price over the actual cost;

Debit 60 Credit 51 – 147,500 rub. (RUB 29,500 + RUB 118,000) – payment was made to the supplier for received materials and to the transport company for delivery of materials.

When you have received materials not as your property, but temporarily, reflect their receipt on the balance sheet in account 002 “Inventory assets accepted for safekeeping.” For example, you can reflect the receipt of reusable packaging that needs to be returned to the supplier.

In this case, reflect the materials at the cost specified in the contract. There is no need to reflect them at actual cost, because these materials do not belong to you. Reflect the receipt of materials for safekeeping as follows:

Debit 002

– the receipt of materials for safekeeping is reflected.