Count 94: basic information

Account 94 allows you to summarize the amounts of shortages and losses of goods, including monetary resources. It can also be used to determine the amount that in the future needs to be identified as a shortage or loss. Initially calculated amounts are not subject to qualification.

Shortage is a discrepancy between the actual goods available and the amount of valuables that are reflected in the reporting documents.

In practice, shortages are identified as a result of the following actions:

- inventory;

- acceptance of goods;

- document checks.

Account 94 belongs to the category of active accounting accounts. It summarizes information about the state and changes in values owned by the organization. In addition, the score 94 is synthetic. Information on it is recorded in monetary terms.

Debit and credit of account 94

The debit takes into account damage to property depending on its category:

- goods - at cost;

- fixed assets - at residual value;

- partially unusable goods - according to the amount of losses.

The loan reflects the write-off of shortfalls depending on their size. The amount is established by concluded agreements:

- permissible losses within the normal range - are counted towards the accounting of material assets;

- above the established limits in the presence of a specific person’s guilt – counting 73;

- above the permissible value and without a guilty person - counting 91.

Credit is reflected in the same amounts and amounts as debit. Everything that reflects the debit of account 94 is subject to write-off.

Should I expect help from the program?

Software products designed for accounting provide various opportunities for identifying shortages and closing turnover.

In 1C version 8.3, you can reflect the amount of shortages found during inventory using the document “Inventory of goods in the warehouse” by department and MOL.

After filling it out and posting it, you can “create based on” this document “Write-off of goods”. Here you need to manually select the product range, enter the quantity, and the program will enter the amount. You can learn this process using a video.

Write-offs within the norms and above, regardless of the presence of the culprit, will have to be done in any version of 1C in manual operations. In versions 8.2 and 8.3, to do this, you need to go to the “Accounting, Taxes and Reporting” menu, select the “Accounting” section and go to the “Manual Transactions” subsection. When creating an operation yourself, you need to register all the transactions and fill out all the required subaccounts.

For the 1C UPP 94 configuration, the account is closed by writing off the goods, but it is necessary to specify in the settings the cost estimation method “At planned cost”. Otherwise, the cost price may be calculated incorrectly due to skewed registers.

Postings to account 94

Standard postings are used based on the results of the inventory. Postings with the debit of account 94 include:

| Account credit | the name of the operation |

| Write-off of the residual value of fixed assets | |

| Write-off of the price of animals at livestock enterprises | |

| Lack of equipment | |

| Lack of investments in non-current assets | |

| Lack of materials | |

| Actual price of the lost item |

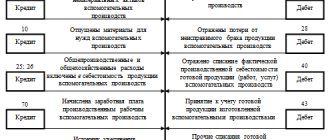

Production shortages are reflected in the following debit entries:

| Account credit | the name of the operation |

| 20 | Shortages of products that were identified in the main work in progress |

| 23 | Shortages of products that were identified in auxiliary work in progress |

| 29 | Shortage of products that were identified in unfinished service production |

Correspondence takes into account both the natural loss of valuables and damage to property in the presence of guilt of the financially responsible person. Moreover, postings allow you to take into account losses without the fault of a specific person.

Dt 73 subaccount “Compensation for material damage” Kt 94

If the perpetrators are not identified or the court refuses to recover from the perpetrators:

Dt 91 Kt 94

Shortages resulting from natural disasters are reflected:

Dt 02 Kt 01 – the amount of accrued depreciation at the time of write-off is written off;

Dt 91 Kt 01 – the residual value is written off.

Accounting for expenses for research, development and technological work

Organizations that carry out research, development and technological work on their own and/or are the customer of the specified work under a contract, record the costs of such work in accordance with PBU 17/02 “Accounting for expenses on research, development and development”. design and technological work”, approved by order of the Ministry of Finance of the Russian Federation dated November 19. 2002 No. 115n.

This provision applies to research, development and technological work:

· for which results were obtained that are subject to legal protection, but were not formalized in the manner prescribed by law;

· for which results were obtained that are not subject to legal protection in accordance with the norms of current legislation.

Research work includes work related to the implementation of scientific research, scientific and technical activities and experimental developments, defined by the Federal Law of August 23, 1996 N 127-FZ “On Science and State Scientific and Technical Policy.”

Does not apply:

— to unfinished research, development and technological work, as well as to research, development and technological work, the results of which are taken into account in accounting as intangible assets;

— in relation to the organization’s expenses for the development of natural resources (conducting geological studies of subsoil, exploration of developed deposits, preparatory work in the extractive industries, etc.);

— costs for preparation and development of production, new organizations, workshops, units, costs for preparation and development of production of products not intended for serial and mass production;

- costs associated with improving technology and production organization, improving product quality, changing product design and other operational properties carried out during the production process.

Expenses for research, development and technological work are reflected in accounting as investments in non-current assets on account 08, subaccount 8 “Performance of research, development and technological work.”

Analytical accounting of expenses is carried out separately by type of work, contracts (orders).

The cost accounting unit is the inventory item.

An inventory object is considered to be a set of expenses for work performed, the results of which are independently used in the production of products (performance of work, provision of services) or for the management needs of the organization.

Expenses for research, development and technological work are recognized in accounting if the following conditions are met:

— the amount of expense can be determined and confirmed;

— there is documentary evidence of the completion of work (acceptance certificate for completed work, etc.);

— the use of work results for production and (or) management needs will lead to the receipt of future economic benefits (income);

— the use of the results of research, development and technological work can be demonstrated.

If at least one of the above conditions is not met, the organization's expenses related to the implementation of research, development and technological work are recognized as other expenses of the reporting period.

Also recognized as other expenses of the reporting period are expenses for research, development and technological work that did not produce a positive result.

If expenses for research, development and technological work in previous reporting periods were recognized as other expenses, then they cannot be recognized as non-current assets in subsequent reporting periods.

Expenses for research, development and technological work include all actual expenses associated with the implementation of these works.

Expenses for carrying out research, development and technological work include:

— the cost of inventories and services of third-party organizations and persons used in performing the specified work;

— costs of wages and other payments to employees directly involved in performing the specified work;

— contributions for social needs;

— the cost of special equipment and special fittings intended for use as test and research objects;

— depreciation of fixed assets and intangible assets used in performing the specified work;

— costs for the maintenance and operation of research equipment, installations and structures, other fixed assets and other property;

— general business expenses, if they are directly related to the implementation of these works;

— other expenses directly related to the implementation of research, development and technological work, including testing costs.

Dt 08 Kt 10,70,69,60,76,02,05,26, etc.

Expenses for research, development and technological work are subject to write-off as expenses for ordinary activities from the 1st day of the month following the month in which the actual application of the results obtained from performing the specified work in the production of products (execution of work, provision of services), or for the management needs of the organization.

Dt 20, 23 Kt 08.8

Write-off of expenses for each completed research, development, and technological work is carried out in one of the following ways:

linear method;

a method of writing off expenses in proportion to the volume of products (works, services).

The period for writing off expenses for research, development and technological work is determined by the organization, independently based on the expected period of use of the results of research, development and technological work, during which the organization can receive economic benefits (income), but not more than 5 years. In this case, the indicated useful life cannot exceed the life of the organization.

Write-off of expenses for research, development and technological work in a straight-line manner is carried out evenly over the accepted period.

When writing off expenses in proportion to the volume of products (work, services), the determination of the amount of expenses for research, development and technological work to be written off in the reporting period is made based on the quantitative indicator of the volume of products (work, services) in the reporting period and the ratio the total amount of expenses for specific research, development, and technological work and the entire expected volume of products (work, services) for the entire period of application of the results of a specific work.

During the reporting year, expenses for these works are written off as expenses for ordinary activities is carried out evenly in the amount of 1/12 of the annual amount, regardless of the method used to write off expenses.

There is no change in the accepted method of writing off expenses during the period of application of the results of specific work.

In the event of termination of the use of the results of specific research, development or technological work in the production of products (performance of work, provision of services) or for the management needs of the organization, and also when it becomes obvious that economic benefits will not be received in the future from the use of the results of this work, the amount of expenses for such work, not attributed to expenses for ordinary activities, is subject to write-off as other expenses of the reporting period on the date of the decision to stop using the results of this work.

Dt 91.2 Kt 08.8

Accounting for intangible assets

The concept of intangible assets

To accept an object for accounting as an intangible asset, the following conditions must be simultaneously met:

a) the object is capable of bringing economic benefits to the organization in the future, in particular, the object is intended for use in the production of products, when performing work or providing services, for management needs;

b) the organization has the right to receive economic benefits that this object is capable of bringing in the future (including the organization has properly executed documents confirming the existence of the asset itself and the rights of this organization to the result of intellectual activity or a means of individualization - patents, certificates, other security documents , an agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization, documents confirming the transfer of the exclusive right without an agreement, etc.;

c) the possibility of separating or separating (identifying) an object from other assets;

d) the object is intended to be used for a long time, i.e. useful life exceeding 12 months or normal operating cycle if it exceeds 12 months;

e) the organization does not intend to sell the object within 12 months or the normal operating cycle if it exceeds 12 months;

f) the actual (initial) cost of the object can be reliably determined;

g) the object’s lack of material form.

Intangible assets include , for example, works of science, literature and art; programs for electronic computers; inventions; utility models; breeding achievements; production secrets (know-how); trademarks and service marks.

The composition of intangible assets also takes into account business reputation that arose in connection with the acquisition of an enterprise as a property complex (in whole or part thereof).

Intangible assets are not: expenses associated with the formation of a legal entity (organizational expenses); intellectual and business qualities of the organization’s personnel, their qualifications and ability to work.

The accounting unit for intangible assets is an inventory item.

The inventory object of intangible assets is recognized as a set of rights arising from one patent, certificate, agreement on the alienation of the exclusive right to a result of intellectual activity or to a means. A complex object that includes several protected results of intellectual activity (a movie, another audiovisual work, a theatrical performance, a multimedia product, a single technology) can also be recognized as an inventory item of intangible assets.

Closing Account 94

Account 94 is closed on credit with the same amounts and values provided for by debit. Write-off depends on the actual cost of goods:

- main costs – debit account 20;

- the employee’s fault – debit account 73;

- absence of the culprit – debit of account 91;

- force majeure circumstances – debit account 99.

Account 94 does not include valuables that were damaged as a result of natural disasters. Before closing the account, a shortage is established and the reasons that led to the discrepancy between the actual quantity of goods and the values in the accounting documentation are identified. The calculated amounts are written off either to the culprit or to the organization itself.

Write-off when identifying the culprit of the shortage

If the losses exceed the standard indicators established for natural loss, and also if theft has occurred and the specific culprits of “this outrage” are identified, then the cost of the shortage is withheld from the salaries of these culprits:

| Debit | Credit |

| 73-3 “Settlements with personnel for other operations” - “Settlements for compensation for material damage” | 94 |

Let's make a small deviation from the 94th account. There may be cases when an amount is recovered from the identified culprits that is greater than the accepted cost of stolen or damaged property. For example, the perpetrators must compensate for damage in the amount of the market value of goods and materials. Then it turns out that the amount of damages compensated is greater than the deficiency written off as debit to account 73 on account 94. Where should the resulting difference be put? It is written off to the credit of account 98 “Deferred income”. That is, the following transactions are made:

| Debit | Credit |

| 73-3 | 98 |

When collecting a shortage from the culprit, the amount of recovery is debited from the 98th account to other income:

| Debit | Credit |

| 98 | 91 “Other income and expenses” |

For clarity, let's give an example. Let’s say the theft of goods is detected at an actual cost of 12,000 rubles. The court ordered the culprit to compensate for damages at the market value of the goods, which is 15,000 rubles.

If a shortage is identified, the enterprise accountant makes the following entry:

| Debit | Credit | Sum |

| 94 | 41 "Products" | 12 000 |

According to the court decision, the guilty employee is obliged to compensate 15,000 rubles, which is reflected in the credit of the 73rd account:

| Credit | Sum |

| 73-3 | 15 000 |

After the court decision, from account 94 the shortage in the amount of 12,000 rubles is transferred to account 73:

| Debit | Credit | Sum |

| 73-3 | 94 | 12 000 |

Thus, our 94th account is “reset to zero”, but on the credit of the 73rd account there remains a balance of 3,000 rubles.

These 3,000 rubles are income that can be taken into account in the future, as they are collected from the culprit from his wages. And until repayment they will be accounted for in account 98:

| Debit | Credit | Sum |

| 73-3 | 98 | 3 000 |