Accounting for semi-finished products of own production and their evaluation

Semi-finished products of our own production are materials that have been processed at a completed technological stage. They can be used for subsequent processing at the same enterprise or can be sold to a counterparty for further processing.

At full-cycle enterprises, where raw materials go through several stages of processing or reprocessing, account 21 “Semi-finished products of own production” can be used to account for semi-finished products produced in each processing stage.

Semi-finished products of own production can be classified as work in progress (clause 63 of the Regulations on accounting and financial reporting No. 34n, approved by the Ministry of Finance on July 29, 1998). There are several methods of assessment:

According to the requirements of Article 319 of the Tax Code of the Russian Federation, the cost of semi-finished products of own production is determined based on the assessment of finished products. Therefore, in tax accounting only one assessment method is used:

- Direct costs of the enterprise.

The accounting policy must include a list of direct expenses (letter of the Ministry of Finance No. 03-03-06/4/78 dated August 26, 2010). For example, the list of direct expenses includes: material costs, labor costs, social contributions, accrued depreciation.

When calculating the cost of finished products, semi-finished products of own production are included in the calculation in the form of a complex item or are included in detailed cost items.

Results

Account 20 in accounting is one of the main accounts for reflecting information that is related to the production of products, performance of work, and provision of services. All applicable methods of reflecting such expenses should be provided for in the accounting policies for accounting purposes.

You can learn how to reflect expenses for main production in the balance sheet from the article “Main production in the balance sheet (nuances)”.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Account 21 in accounting

Semi-finished products of own production are accounted for on account 21 in correspondence with account 20 - when semi-finished products are used in own production, and with account 90 - when semi-finished products are sold to a counterparty:

The debit of account 21 reflects the receipt of semi-finished products and their surpluses discovered during inventory. The account credit takes into account the consumption of semi-finished products during transfer for subsequent processing, their sale or identification of shortages in the warehouse.

On account 21, analytical accounting can be maintained by storage location, by name, type, grade, and so on.

Account usage example

A factory producing lacquer miniatures uses the accounting method for semi-finished products. The production process includes the following stages:

- Workshop 1 – production of blank caskets;

- Workshop 2 – varnishing of surfaces using black and red varnish;

- Workshop 3 – final processing (sanding of painting, varnishing).

The factory uses the direct cost method, which in February of the last annual period amounted to 30,000 rubles. for cardboard, flour, 130,000 rub. for issuing wages, 10,000 rubles. - depreciation deductions.

According to the rules, the following posting options will be drawn up:

- Dt 20 Kt 10 (70, 69). The amount is the total amount of all costs - 170,000 rubles.

- Dt 21 Kt 20. Production of blanks for the production of main products.

- Dt 20 Kt 21. Write-off of the price of blanks that were put into the main production process. The transaction amount is the same.

- Dt 90 Kt 21. Write-off of the cost of workpieces.

Thus, this account is often used to display various transactions, which helps improve the quality of business activities.

Typical postings for 21 accounts “Semi-finished products of own production”

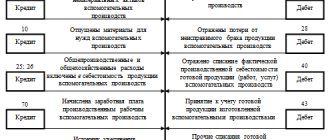

The main entries for 21 accounts used in accounting are shown in the table below:

| Account debit | Account credit | Operation description |

| 21 | 20 | Receipt of semi-finished products of own production |

| 21 | 23 | Receipt of semi-finished products manufactured by auxiliary production |

| 21 | 40 | Receipt of finished products for subsequent use as semi-finished products |

| 21 | 91.01 | Surplus semi-finished products identified during inventory were capitalized |

| 20 | 21 | Semi-finished products are sent to production for subsequent processing |

| 23 (25;26) | 21 | The cost of semi-finished products is included in the costs of auxiliary production (overall production costs; general business expenses) |

| 28 | 21 | Write-off of defective semi-finished products of own production |

| 91.02 | 21 | The cost of semi-finished products of own production, written off or sold, is reflected in other expenses |

| 94 | 21 | The identified shortage of semi-finished products is reflected |

Accounting for finished products (account 43): postings, example

Author of the article Olga Lazareva 15 minutes to read 3,974 views Contents Account 43 is used in accounting by enterprises in the production sector to reflect transactions with finished products.

This product is called a semi-finished product and is included in Dt 21 - Kt 21 reflects its disposal.

In the article we will talk about the specifics of using account 43, and also look at typical transactions and examples of operations with finished products. To reflect the receipt of finished products (GP) of our own production, we use Dt 43. When writing off finished products (expenses, defects, shipment, transfer, etc. .p.) make entries according to Kt 43. Acceptance of GP for accounting can be carried out in several ways.

Here are some of them: Debit Credit Description Document 4320, 23, 29 Receipt of SE from production to the warehouse of the enterprise (main/auxiliary/service production). Receipt invoice 4376 Receipt of SE as part of the enterprise Acceptance and transfer certificate 4380 SE accepted as a contribution to the authorized capital Protocol of the board's decision 4398 SE taken into account as a discount provided to the buyer Commodity invoice (understand how to keep accounting records 72 hours in advance)

Wiring Dt 43 and Kt 43, 20 (nuances)

Accounting Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > Tax-tax December 05, 2020 Debit 43 Credit 43 is a posting that does not affect the indicators in the general ledger. Movement within an account can only be traced in analytical summary statements. What internal posting to account 43 means, in what cases it is used and when it should not be used, we will tell you in our article.

Posting Debit 43 Credit 43 means changes in finished goods within account 43. But this movement does not affect the order in which account 43 balances are reflected in the balance sheet.

Examples of transactions on 21 accounts

Example 1. The cost of semi-finished products includes only the cost of raw materials and materials

Let's say VESNA LLC produces parts that are used in its own production. In January 2020, 150 parts were manufactured. The costs included:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products are valued at the cost of raw materials and materials. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69); 02 | 1 430 000 | Costs (wages, social contributions, depreciation) for the production of finished products are reflected | Payroll. Depreciation calculation |

| 21 | 20 | 1 200 000 | Semi-finished products are received into the warehouse | Shift production report |

| 20 | 21 | 1 200 000 | Semi-finished products transferred to production | Requirement invoice |

Example 2: Semi-finished products are valued at direct costs

Let's look at the previous example: VESNA LLC produces parts that are used in its own production. In January 2020, 150 parts were manufactured. Costs include:

- Raw materials and materials - 1,200,000 rubles;

- Salary and social contributions - 980,000 rubles;

- Depreciation charges - 450,000 rubles.

Semi-finished products of own production are valued at direct costs: raw materials and materials; salary; social contributions; accrued depreciation and so on, according to accounting policies. Generated postings:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 20 | 10 | 1 200 000 | The cost of raw materials and materials written off for the manufacture of parts is taken into account | Requirement invoice |

| 20 | 70 (69) | 980 000 | The amount of salary and social contributions is reflected | Payroll. |

| 20 | 02 | 450 000 | Accrued depreciation reflected | Depreciation calculation. |

| 21 | 20 | 2 630 000 | Receipt of semi-finished products of own production to the warehouse (1,200,000 + 980,000 + 450,000) | Shift production report |

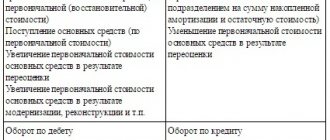

Account characteristics/description:

Account 21 “Semi-finished products of own production” is intended to summarize information on the availability and movement of semi-finished products of own production in organizations that maintain separate records of them. In particular, this account can reflect the following semi-finished products manufactured by the organization (with a full production cycle): pig iron in ferrous metallurgy; raw rubber and glue in the rubber industry; sulfuric acid at nitrogen fertilizer plants in the chemical industry; yarn and raw materials in the textile industry, etc.

In organizations that do not maintain separate records of semi-finished products of their own production, these values are reflected as part of work in progress, i.e. on account 20 “Main production”.

Analytical accounting of the account is carried out by individual items (types, grades, sizes, etc.) (sub-account “Nomenclature”), storage locations for semi-finished products (sub-account “Warehouses”) and batches (sub-account “Parties”). Each name is an element of the “Nomenclature” directory. Each storage location is an element of the “Warehouses (storage locations)” directory.

To maintain analytical accounting for the “Warehouses” and “Batches” subaccounts, you must make the appropriate settings for the accounting parameters (menu “Enterprise” - “Setting up accounting parameters” - “Inventories”).

“Transfer of semi-finished products to main production for further refinement”

ENTRY: Debit 20.01 “Main production” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Entering initial balances: semi-finished products of own production”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 000 “Subsidiary account”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Entering initial balances

in the “Enterprise” menu, type of business transaction: “

Finished products and semi-finished products (accounts 43, 21)”

“Production of semi-finished products from our own main production at planned cost”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Adjustment of the cost of semi-finished products of own production (main) for the difference between the planned and actual cost”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″

“Production of semi-finished products of our own production at the planned cost. According to the accounting policy, the organization produces products without using account 40 “Product Output”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 20.01 “Main production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Production of semi-finished products from our own auxiliary production at planned cost”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 23 “Auxiliary production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Adjustment of the cost of semi-finished products of own production (auxiliary) for the difference between the planned and actual cost”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 23 “Auxiliary production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Regular operation

in the menu “Operations — Closing the month” type of business transaction: “

Closing accounts 20, 23, 25, 26″

“Inter-branch receipt of semi-finished products of own production from a separate division allocated to a separate balance sheet”

ENTRY: Debit 21 “Semi-finished products of own production” Credit 79.02 “Calculations for current operations”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Advice on inventories included

in the “Warehouse” menu

“Surplus of semi-finished products of our own production, identified as a result of inventory. Recognition of other income"

ENTRY: Debit 21 “Semi-finished products of own production” Credit 91.01 “Other income”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Receipt of goods

in the “Warehouse” menu

“Transfer of semi-finished products of own production to auxiliary production for further refinement”

ENTRY: Debit 23 “Auxiliary production” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Write-off of semi-finished products of own production to general production expenses”

ENTRY: Debit 25 “General production expenses” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Write-off of semi-finished products of own production to general business expenses”

ENTRY: Debit 26 “General business expenses” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Write-off of semi-finished products of own production to correct defects”

ENTRY: Debit 28 “Defects in production” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Production report for the shift

in the “Production” menu

“Inter-branch transfer of semi-finished products of own production to a separate division allocated to a separate balance sheet”

ENTRY: Debit 79.02 “Calculations for current operations” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Inventory advice note outgoing

in the “Warehouse” menu

“Inter-branch transfer of semi-finished products of own production to a separate division allocated to a separate balance sheet”

ENTRY: Debit 79.02 “Calculations for current operations” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Inventory advice note outgoing

in the “Warehouse” menu

“Sales of semi-finished products of our own production”

ENTRY: Debit 91.02 “Other expenses” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Sales of goods and type of business transaction: “ Sale, commission”

“Transfer of semi-finished products of own production transferred free of charge”

ENTRY: Debit 91.02 “Other expenses” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”

“Write-off (liquidation) of semi-finished products of own production as a result of natural disasters, fires and other emergency circumstances”

ENTRY: Debit 91.02 “Other expenses” Credit 21 “Semi-finished products of own production”

Which document 1 will be made in 1c:Accounting 2.0/1c:Accounting 3.0

: —

Operation (accounting and tax accounting)

in the menu “Operations — Operations entered manually”