Who submits the reports

Non-profit organizations are required to submit reports to the Ministry of Justice.

NPO reporting options:

- full;

- simplified.

Simplified reporting is a free-form statement about the continuation of the activities of an NPO. Submitted with a document confirming:

- that the founders and participants do not include citizens and organizations of foreign states;

- lack of foreign funding for the formation of NPO assets (money, property, property rights). Full list of foreign sources here;

- the amount of money and property received for the year is less than 3 million rubles.

Foreign sources according to Law No. 7-FZ “On Non-Profit Organizations” are:

- stateless persons and their representatives;

- foreign citizens and organizations, states, international corporations;

- Russian enterprises that received capital or property from the above sources, except for JSCs and their subsidiaries with state participation.

Accounting for non-commercial organizations - NPO reports. What reporting must NPOs submit?

Non-profit organizations include entities whose activities are not related to making a profit. In NPOs, income received as a result of the actions performed cannot be distributed among the founders, which is the main difference from commercial enterprises. Nonprofit organizations have many similarities to for-profit legal entities. They have their own balance sheet and charter, on the basis of which they carry out their activities, and can open bank accounts. NPOs are also allowed to have stamps, seals and emblems indicating their name. The activities of non-commercial entities are not limited to a certain period.

Accounting statements of non-profit organizations

NPO reports to the Ministry of Justice

Tax reporting of NPOs

Reporting for NPO employees

Reporting to Rosstat

Additional NPO reports and their deadlines

Non-profit organizations need to ensure timely submission of reports and correct completion of submitted documents. You should know that quite often errors in reports submitted to various government bodies become the cause of claims against an NPO, which may be accused of violating the law and suspend its activities. The NPO submits its first mandatory report on the 15th of the following month after registration with the Federal Tax Service.

Non-profit organizations, along with other enterprises and structures, need to prepare documentation for submission to regulatory authorities in the form of reporting - tax, accounting and statistical. NPOs also report on insurance premiums and submit special reports to the Ministry of Justice of the Russian Federation. In order to submit all the necessary documents in a timely manner and avoid problems with the law, non-profit entities must know what reports NPOs submit, the deadlines for their submission, and other aspects of reporting that require special attention.

Accounting statements of non-profit organizations

All subjects of non-profit activities are required to maintain accounting records for non-profit organizations and submit financial statements once a year in accordance with the general rules. When reporting to the relevant authority, they must prepare the following documentation for submission

• balance sheet of NPOs (form No. 1);

• reports confirming the targeted expenditure of funds (form No. 6).

Each document is filled out and executed in accordance with the established form; when drawing them up, the features and specifics of the organization’s activities are taken into account.

Some NPOs additionally submit a statement of financial results. It appears in the following cases

• the work of the non-profit organization brought it revenue;

• the report is necessary to assess the financial condition of the NPO.

If a report on financial results is not required, then income from the operation of the NPO is reflected in the document on the intended use of the funds received.

Accounting statements of non-profit organizations are submitted within 90 days after the end of the reporting period.

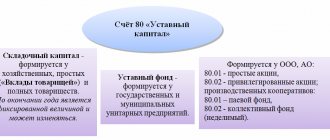

The balance sheet of NPOs is somewhat different from the balance sheet prepared by commercial enterprises. Thus, the “Capital and Reserves” section was replaced with “Targeted Financing”. It indicates the amounts of sources of asset formation, and also reflects the balances of target revenues. Also, some other lines in the NPO balance sheet have been replaced, which is due to the nature of the activities of non-profit enterprises.

The report on the targeted expenditure of funds indicates expenses for charitable purposes, various events, wages and other expenses necessary for the functioning of the organization. The amount of financial receipts - total and for specific items - various contributions, income from activities, cash balance at the beginning and at the end of the reporting period.

Important! Accounting reports are submitted annually, but do not forget that tax reports are submitted quarterly! The report to the Pension Fund SZV-M is submitted monthly! Monthly and quarterly reports are mandatory even for inactive (zero) non-profit organizations.

NPO reports to the Ministry of Justice

Subjects of non-profit activities provide NPO reports to the Ministry of Justice, indicating all the necessary information in forms approved by the Ministry of Justice of the Russian Federation. The submitted reports confirm that there are no foreigners among the NPO employees, and the organization does not have foreign sources of funding.

NPO reporting to the Ministry of Justice, the deadlines for its submission are as follows:

• Form No. 1 – the document contains information about the leaders of the non-profit organization, as well as the nature and specifics of its activities;

• Form No. 2 – it provides data on the targeted funds and property used;

• Form No. 3 – the report reflects all funds and property received by NPOs from international and foreign companies and enterprises, from foreigners and stateless persons. You can fill it out by visiting the official portal of the Ministry of Justice.

All these NPO reports to the Ministry of Justice have the following deadlines for submission - until April 15 of the year following the reporting period.

Some non-profit entities do not submit reports to the Ministry of Justice on certain forms in the following cases:

• the organization did not receive funds from foreign companies or foreign persons;

• the founders or employees of the NPO are not foreigners;

• during the reporting period, the organization received revenues totaling no more than 3 million rubles.

In this case, instead of the first two forms, an application is filled out, which has a free form and meets the requirements of the legislation of the Russian Federation.

!Important. Submitting reports to the Ministry of Justice confirms the NPO’s intention to work this year. In the absence of correctly submitted reports, the Ministry of Justice initiates the forced liquidation of the NPO and there is a risk of disqualification of persons registered in the Unified State Register of Legal Entities, in accordance with Federal Law 129.

Unlike the fiscal tax service, the Ministry of Justice does not fine non-profit organizations, but acts in the following order.

- The NPO receives an order to submit reports at its legal address. I advise you to always keep track of the legal address of the NPO.

- If the NPO has not submitted reports within 30 days, a forced liquidation mechanism is initiated, and the Ministry of Justice makes an appropriate decision.

- After 10 days, an entry about the upcoming liquidation appears in the Unified State Register of Legal Entities.

- It is published in the newsletter for 3 months. The NPO must have time to eliminate all shortcomings within this period. At this stage, submitting reports is more difficult; it takes about a month.

- After publishing the newsletter within 30 days, the NPO is deleted from the Unified State Register of Legal Entities. At this stage, nothing can be done.

If you have received an entry in the Unified State Register of Legal Entities, we advise you not to tempt fate anymore. Consider concluding an agreement with professionals in the field of non-profit organizations, for example with Us. Save the NGO and not get into this situation again.

You can read more about reports to the Ministry of Justice in a separate article, this is really important.

Tax reporting of NPOs

Non-profit organizations must also submit reports to the federal tax service. The reporting form of NPOs to the tax service may differ from one entity to another depending on the chosen taxation system.

Main tax regime

Non-profit enterprises using the main tax system submit the following list of documents to the tax office

• VAT declaration – submitted strictly in electronic form, via digital signature, before the 25th day of the month following the reporting period. This report must be submitted every quarter. In the absence of an object subject to VAT, non-profit enterprises submit reports consisting of a title page and the first section;

• income tax return – a non-commercial entity engaged in business is a payer of income tax. For each reporting period, reporting is provided, which must be submitted within 28 days after the end of the quarter. A full report for the tax period is submitted by March 28 of the year following the reporting year. If an NPO does not carry out entrepreneurial activities, then it provides a report to the tax service, but not a zero one. Target revenues should be deciphered in SHEET 7.

• reporting on property taxes – in the course of their activities, NPOs pay taxes on the property they have on their balance sheet. Quarterly, non-commercial entities transfer payments and provide their calculations in the appropriate form. Non-profit organizations that do not own fixed assets are exempt from filling it out. Deadlines for NPOs to report on property taxes – the declaration is submitted within 30 calendar days after the end of the reporting period;

• land tax - if a non-profit organization has a land plot at its disposal, it fills out the corresponding declaration before February 1 of the year following the reporting period;

• transport tax report - the form is filled out if the NPO has a vehicle on its balance sheet, it is also submitted before February 1.

Also, subjects of non-commercial activities submit some other documents:

- The average headcount of an organization (when an NPO is created) is until the 20th day of the next month after registration, even if there are no employees.

- Data on the average number of employees is provided to the tax office annually by January 20 by organizations.

- 6-NDFL (Personal Income Tax) - quarterly, until the 30th of the next month, even if there are no employees.

- 2-NDFL - annually before April 1, certificates of employee income drawn up in a certain form are submitted. If there were no employees, it is not necessary to submit.

- Calculation of insurance premiums for employees is quarterly until the 30th, even if there are no employees.

Reporting to the simplified tax system

Non-profit organizations operating under a simplified taxation regime submit such reports to the tax office

• Declaration under the simplified tax system - must be filled out and submitted by a non-profit enterprise that is under a simplified taxation regime. Reporting deadlines for non-profit organizations - documentation is submitted by March 31 of the year following the reporting period.

Important! If the NPO has no income, sheet 6 is still filled out - target income.

NPOs using the simplified system do not pay VAT, income and property taxes, as well as some other payments. But there are exceptions for enterprises leasing property and in some other cases, which must be clarified with the tax authorities.

When submitting NPO reports 2020, non-profit entities, along with other enterprises, bear full responsibility to the federal tax inspectorate for the information provided in the documents.

Important! The use of the simplified tax system does not exempt you from submitting quarterly: 6-NDFL, Calculation of insurance premiums, Calculation to the Social Insurance Fund and monthly SZV-M to the Pension Fund of the Russian Federation. All of the above reports are submitted even by non-profit organizations.

Reporting for NPO employees

All NPOs also provide regulatory authorities with reporting on contributions paid by the organization for its employees.

Reporting on insurance premiums

All non-profit organizations are required to timely submit reports to the Social Insurance Fund and the Pension Fund of the Russian Federation. NPO reports 2019 on extra-budgetary funds are submitted according to rules common to enterprises of all types of activities.

Non-profit organizations must fill out the following documents:

Reports to the Federal Tax Service - calculation of insurance premiums (DAM). Provided quarterly until the 30th.

Reports to the Social Insurance Fund - form 4-FSS are submitted to the social insurance fund of the non-profit organization. It can be presented in electronic format or on paper, but the deadlines for submitting reports to the Social Insurance Fund differ.

• submitted electronically by the 25th of the next month;

• on paper must be submitted by the 20th of the next month;

If a non-profit organization does not have permanent employees during the reporting period, then it must submit zero NPO reports to the social insurance fund. The deadline for its submission is until the 20th day of the month following the reporting period.

Reports to the Pension Fund of the Russian Federation - reports to the Pension Fund of the Russian Federation are submitted on paper or in electronic form.

- SZV-M - monthly to the Pension Fund of Russia until the 15th of the next month, even if there are no employees.

- SZV-STAZH - annually until March 1, even if there are no employees.

According to the innovations, starting from 2020, non-profit entities must fill out and submit the SZV-M form to the Pension Fund every month when reporting for employees. This is reporting that provides information about the insured persons indicating their SNILS.

According to the written explanation of the Russian Pension Fund, a zero monthly SZV-M is surrendered even in the absence of employees with the indication of the head of the non-profit organization.

In addition, non-profit organizations applying reduced tariffs must fill out additional subsections in the RSV and 4-FSS forms.

Reporting to Rosstat

Subjects of non-commercial activities, along with other legal entities, must promptly submit statistical reports to Rosstat, indicating the necessary information. The deadlines and rules for submitting the required documents are determined by the legislation of the Russian Federation, and in case of failure to submit reports, administrative liability is provided. All NPOs are required to submit a balance sheet to Rosstat.

Subjects of non-commercial activities must submit the following documents to state statistical bodies:

- financial statements submitted to the Federal Tax Service by April 1 of the year following the reporting period;

- Form No. 1-NPO - the report indicates information about the activities of a non-profit enterprise; it must be submitted before April 1 of the year following the reporting period;

- form No. 11 (short) - the document indicates information about available fixed assets, their quantity and movement. The form must be submitted once each year by April 1st.

- 1-SONKO - Information about the activities of a socially oriented non-profit organization. The form must be submitted once each year by April 1st.

Other reports are also submitted to local Rosstat offices. The final list of documentation included in the statistical reporting of NPOs is determined depending on the specifics of the organization’s activities. Before submitting reports, you must first check with local statistics offices which forms should be submitted to a particular non-profit organization.

Important! It is possible to check additional reports for your organization on the statistics website, here is the link. For non-profit organizations, the list of additional forms can be quite large.

Socially oriented non-profit organizations submit Form 1-SONKO to Rosstat, which provides all the necessary information about the activities of the socially oriented NPO. Form 1-SONKO must be submitted by April 1 of the year following the reporting period.

Non-profit organizations that, in the course of their activities, help solve social problems are considered socially oriented. SO NPOs include entities that provide social protection for individuals, nature protection, as well as objects of cultural or architectural value, and animal protection. Also, such organizations provide legal assistance to individuals and legal entities. They are engaged in charity work and activities in various fields - cultural, scientific, educational and others.

Additional NPO reports and their deadlines

Also, every non-profit organization must submit every year to the social insurance fund the documents necessary to confirm the main type of its activity.

All documentation must be prepared and submitted by April 15 and include

• application for confirmation of the main type of activity of the NPO;

• a certificate confirming the main type of activity of the organization;

• explanatory note to the balance sheet or a copy thereof.

Non-profit organizations send a letter to the territorial body of the Ministry of Justice to continue their activities. It is presented personally by the head of the organization or by proxy, and can also be sent by mail. There is no specific deadline for submitting the letter, but it must be sent every year.

There are also separate requirements for non-profit organizations that are foundations. They must report every year on the use of their property and must publish the reports. At the same time, the legislation does not determine specific terms of publication and its type, therefore, once a year, an NPO must publish such a report in the media or on its official website. You can also print a special brochure.

Charitable organizations are also required to provide additional reports. So they submit reports on their activities to the Ministry of Justice, which should contain the following information

• information relating to the financial and economic aspects of the organization's activities. They must confirm that the NPO engaged in charity complies with the requirements stipulated by law in relation to the property and funds of charitable organizations;

• list of personnel of the governing body of the charitable organization;

• information that details the content and composition of charitable programs and events compiled and conducted by this organization, including a list of programs and their description;

• data on the results of the charitable activities of a non-profit organization, information on violations of the law identified during inspections, and measures taken to eliminate them.

A report on the activities of a charitable organization is submitted once a year to the territorial branch of the Ministry of Justice of the Russian Federation by March 31 of the year following the reporting period.

Separately, there are reports submitted by a non-profit organization that performs the functions of a “foreign agent”.

Such an NPO is required to submit the following reports to the regulatory authorities:

• documents indicating the specifics of the activities of the NPO and the management team of the organization. Such a report is submitted once every six months before the 15th day of the month following the end of the reporting period;

• reporting on funds and property, their intended purpose and expenditure. This includes indicating funds and property received from foreign organizations and citizens. Such reporting is submitted every quarter by the 15th day of the month following the end of the reporting period;

• auditor's report, which is drawn up based on the results of an audit of accounting or financial statements. It is submitted once a year until April 15th.

The list of reports submitted by non-profit organizations is quite impressive. In addition to the main reports common to all NPOs, additional reports are submitted, the list of which depends on the type of activity of the organization and some other aspects.

The main task of non-commercial entities is to correctly fill out and timely submit all required documents. To avoid errors and inaccuracies leading to violations of legislation and administrative liability, it is necessary to clarify the list of reports and the deadlines for their submission in the territorial offices of government bodies. It is also necessary to strictly follow the instructions for filling out documentation offered by regulatory services.

I think everything.

Still have a question? Call!

8-495-0034571 (MSK), 8-812-6290003 (St. Petersburg), 8-968-8783899 (across Russia).

Or write public comments below, we will answer everyone.

Suddenly we forgot something. Or you want to become our happy client!

NPO reporting forms

NPO reporting forms were approved by Order of the Ministry of Justice of the Russian Federation No. 170 of August 16, 2020. The forms OH0001, OH0002, OH0003, OR0001, SP0001, SP0002 and SP0003 have been established.

Different forms of NPOs submit different forms of reports.

- Non-profit organizations

of any form, who have received property from domestic sources, hand over:

- Form N ОН0001 – report on the activities and composition of managers;

- Form N ОН0002 – report on the expenditure of funds received from donors.

- If the NPO received foreign capital or property, then form N OH0003 on the amount of funds received is added to the reporting to the Ministry of Justice.

- Cossack societies

submit form GRK003. The form contains the total and fixed number of members of the Cossack society who have accepted obligations to perform state or other service (Order of the Ministry of Justice of Russia dated October 13, 2011 No. 355 “On approval of the procedure for maintaining the state register of Cossack societies in the Russian Federation”).

And also OH0001 and OH002 or a message about the continuation of activity. These forms are published on the information portal of the Ministry of Justice. There is no need to submit it in paper form.

- State companies

publish on the Internet on their official website an annual report on the implementation of the state company’s operating strategy. The publication takes into account the requirements of legislation and state secrets. The report is published before May 1 of the next reporting year.

- Political parties

Once every three years they submit an application to continue their activities. Indicate the number of members, the location of the governing body, similar information about regional branches (clause 2 of Article 27 of the Federal Law “On Political Parties”). Information on the number is provided in the form of a copy of the protocol of election results, certified by the election commission of the appropriate level.

- Religious organizations

received money or property from domestic, international and foreign organizations, foreign citizens, stateless persons. Such NPOs submit (clause 2 of Article 25 of the Federal Law “On Freedom of Conscience and Religious Associations”) a report in the form OR0001.

- Non-profit organizations – foreign agents

submitted to the Ministry of Justice:

- a report on the money and property received, their intended distribution, purposes of expenditure or use (Form N SP0001).

- report on the actual use of money and property (Form N SP0002).

- information about programs that are planned to be implemented in Russia (Form N SP0003).

Simplified tax system as a tax regime for non-profit organizations

The simplified taxation system, as its name implies, implies a simpler and more convenient type of tax reporting for representatives of small and medium-sized businesses. Today, participants in the “simplified tax system” are relieved of the burden of the following types of taxes:

- income tax;

- property tax;

- VAT (value added tax).

Each organization using the simplified tax system has the right to choose one of two tariffs for calculating the amount of tax:

- 6% "Income". Tax is imposed on all income of an enterprise that is considered as such in accordance with tax legislation.

- 15% “Income minus expenses.” Only the difference between the income part and the costs of carrying out activities is subject to taxation. If income is equal to or less than expenses, then at this tariff 1% of the total income of the organization is transferred to the budget.

Important! In the case of NPOs, targeted funds that were received by the organization and used in accordance with their purpose are not considered income (Part 2 of Article 251 of the Tax Code of the Russian Federation). Therefore, any non-profit organization is obliged to keep separate records of income and expenses of targeted funds.

In other words, contributions, donations, grants and various targeted subsidies are not taxed.

One of the features of non-profit organizations using the simplified tax system is that there is no need for an accountant, as in accounting in general. The head of a non-profit organization has the right to take responsibility for preparing accounting and tax reporting. It is precisely this feature of the simplified taxation system that appealed to representatives of the non-profit sector.

It is beneficial for a non-profit organization to use the simplified tax system if:

- Works and services (including paid ones in relation to family members) are provided on the territory of the Russian Federation.

- The organization has property (movable or immovable) that is used to carry out advisory activities and is listed on the balance sheet as fixed assets. Such property must have a value of over 40 thousand rubles and be used for its intended purpose for more than a year.

In addition, there are additional advantages for NPOs in terms of using the “simplified language”: (click to expand)

- the number of reports produced is reduced from 41 to 34 throughout the calendar year;

- it is possible to produce reporting without using an electronic signature, which can cost the organization approximately 5 thousand rubles per year;

- an organization can freeze its activities if for a certain time neither income nor expenses appear in the accounting;

- any contributions to a non-profit organization will not be subject to value added tax (VAT).

Reporting principles

Reports are prepared on the basis of actual organizational and accounting data.

The reports reveal ongoing processes and results of completed projects of the organization without unnecessary details. To clarify, the regulatory authorities themselves will conduct an audit.

Reports are prepared in the form specified in Order No. 170 of the Ministry of Justice.

Reports are submitted to the territorial division of the Ministry of Justice to which the NPO belongs.

Reports are submitted within the period established by law.

Consequences of overdue reporting to the Ministry of Justice

There is a misconception that the Ministry of Justice does not fine NPOs. Believe me, this is not true, there are fines up to the exclusion of NPOs from the Unified State Register of Legal Entities. Without submitting reports, the Ministry of Justice does not receive confirmation of the continuation of activities. On this basis, the Ministry of Justice forcibly liquidates such a non-profit organization, and disqualifies the director and possibly the founders recorded in the Unified State Register of Legal Entities for 3 years. Disqualification prohibits participation in legal entities, opening new ones and requires leaving or liquidating others in the Unified State Register of Legal Entities in which the person is also present. The data ends up in the general federal database and forever complicates the lives of such individuals.

Be vigilant - submit reports on time! If something doesn’t work out for you, we will always come to your aid!

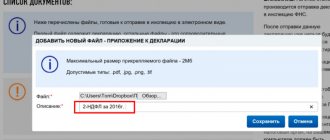

Reporting methods

- Personal delivery of the report.

- Sending by mail.

- Sending by email. Possible with an electronic digital signature of the head of the non-profit organization and the accountant.

- Publication of reports and results of activities on the official website of the Ministry of Justice of Russia.

- Publication of reports in the media or on your own website on the Internet (with the exception of personal information about participants and managers of NPOs).

Reports submitted by NPOs to the Ministry of Justice

One of the government bodies to which NPOs are required to report on the work done is the Russian Ministry of Justice. The preparation of such reports has two main goals:

- Information about the activities of NPOs in general for the past calendar year.

- Informing about specific situations on which the received invested funds were spent.

In general, there are three forms of reports submitted to the Ministry of Justice:

– №ОН0001,

– No. ОН0002,

– No. ОН0003.

Moreover, it is worth noting that the first and second forms are mandatory for all NPOs. Regarding the last form, it is necessary to clarify that it is simplified and must be provided by those NPOs that comply with the following conditions:

– the founders/managers/participants of the organization do not include foreign citizens and legal entities, as well as stateless persons;

– during the reporting period there were no financial/property receipts to the NPO budget from citizens/organizations of a foreign state;

– total revenues to the budgets of NPOs did not exceed 3,000,000 rubles based on the results of the past year.

This form is submitted in conjunction with the Notice of Continuation and is acceptable for all types of non-profit organizations.

Forms for all reporting forms can be downloaded from the official website of the Ministry of Justice of the Russian Federation.

Report submission deadline

Domestic NPOs without foreign participants and foreign capital receipts submit or publish reports once a year. This condition is stated in Law No. 7-FZ of 01/07/1996 “On Non-Commercial Activities”. Reports are submitted by April 15 of the following reporting year.

Every six months, foreign NPOs submit or publish a report on the personal composition of their managers. Once every three months - a report on the targeted expenditure of funds received from the parent company. Foreign NPOs must undergo an audit once a year.

Non-profit organizations are required to publish annually on the Internet or in the media a message about the continuation of their activities.

NPOs are required to publish on the Internet or in the media the same information about their activities that they provide to the Ministry of Justice:

- domestic NPOs – once a year;

- foreign NPOs – once every six months.

Accounting statements of non-profit organizations for 2020

Accounting is the responsibility of all non-profit organizations (Article of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ). Based on the accounting data, annual accounting statements are formed, consisting of:

• balance;

• report on the intended use of funds.

If an NPO receives significant income from business activities, without which it is impossible to assess the financial condition of the company, then the accounting statements of the NPO are supplemented with a statement of financial results.

The specifics of the activities of NPOs influence the form of the balance sheet and the formation of other reports. Thus, in the 3rd section of the balance sheet, NPOs reflect not capital and reserves, but the balances of target revenues, and for funds it is mandatory to publish reports on the use of their property.

Common errors in reporting

Errors in reporting most often occur during its preparation:

- incomplete package of documents;

- wrong data. The information in forms OH0001 and OH0002 differs from the information in the departmental register;

- there is no completed form OH0002 for the activities carried out mentioned in the form OH0001 or the departmental register;

- in paragraphs 1 and 2 of form OH0002, information about received funds is entered instead of disclosing items of expenditure;

- disclosure of expenditures of non-earmarked funds without indicating sources of income;

- unfinished design: unstitched, unnumbered pages.

Common mistakes on a given topic.

Mistake #1. The report in form OH0003 is an independent document and is required to be submitted for all non-profit organizations. This report is submitted together with the notice of continuation of activity and is required to be submitted subject to the following conditions:

– the founders/managers/participants of the organization do not include foreign citizens and legal entities, as well as stateless persons;

– during the reporting period there were no financial/property receipts to the NPO budget from citizens/organizations of a foreign state;

– total revenues to the budgets of NPOs did not exceed 3,000,000 rubles based on the results of the past year.

Mistake #2. There is no liability for late reporting by non-profit organizations. In case of failure to submit annual or quarterly reports on time, the organization will be subject to tax liability in the form of a fine .

Reporting to the Pension Fund

Form RSV-1

All organizations that have employees must report to the Pension Fund on the results of the first quarter, half a year, nine months and calendar year in the RSV-1 form. If the average number of employees exceeds 25 people, you must report electronically. The same rule applies to newly created or reorganized companies (clause 10, article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

For NPOs, reports must be submitted to OSNO within the following deadlines:

- for a year - until February 15 (on paper), February 20 (electronically) of the next year;

- for the first quarter - until May 15 (on paper), May 20 (electronically) of the current year;

- for the six months - until August 15 (on paper), August 20 (electronically) of the current year;

- 9 months before November 15 (on paper), November 20 (electronically) of the current year.

Form SZV-M

From 2020, in addition to RSV-1, employers must also submit monthly reports (no later than the 10th day of the next month) to the Pension Fund for employees using the new form SZV-M (Federal Law dated December 29, 2015 No. 385-FZ).