Legal advice > Labor law > How to calculate insurance length using effective formulas

Everyone understands the importance of work experience, but almost no one thinks about insurance. At a certain point, there is a need to quantify the time frame of the insurance period. When making calculations, you need to operate not only with direct facts, but also take into account secondary nuances. Some events during the working period can significantly affect the determination of the insurance period.

Who counts and when?

Calculation of the insurance period is necessary mainly when receiving financial social assistance or sick leave payment.

Basically, the calculation is carried out at the moment when a person draws up documents to receive a certain type of social assistance upon reaching the required age, namely a labor or insurance pension.

Less often, calculations are required at work if a person was temporarily disabled, that is, on sick leave or maternity leave.

In accordance with the case of need, the organization that will deal with the manipulations is determined:

- In order to operate with numbers to determine the necessary data for a future pensioner, you need to contact the territorial pension fund. The pension fund operates in accordance with current legislation, therefore it provides only reliable information. The basis for this type of work is the data located in the personal registration system of citizens of the country.

- If you work at a private enterprise, all payments are handled by a representative of the specified institution. In a private enterprise, financial matters are often managed by an accountant. Less often, the insurance period is calculated by a personnel employee.

- If a person worked abroad under an official contract or is a citizen of another country, and wants to receive a pension benefit, sick leave or maternity leave on the territory of Russia, then it is worthwhile to be guided by international treaties. The documents clearly indicate all the nuances regarding the processing of payments under the labor code.

Thus, the calculation of length of service in accordance with insurance is required when a person reaches the corresponding position or age in relation to work activity.

Requirements for the procedure for calculating insurance experience

The legislation of the Russian Federation establishes certain requirements for the procedure for calculating the insurance premium. If they are not followed, the length of service may be calculated incorrectly or completely lost. How can this be avoided? Every HR employee should know how to calculate an employee’s insurance length and what requirements must be met.

Some of them are listed below:

- It is necessary to exclude from the work experience the time when a citizen of the Russian Federation worked abroad.

- The periods when a person worked for an individual entrepreneur and was a member of peasant farms and tribal communities should be taken into account. However, this can only be done if contributions were made for the person to the Pension Fund of the Russian Federation.

- All periods during which the citizen received a pension (labor or disability) must be excluded from the insurance period.

- Overlapping periods are not counted. As a rule, such a need arises if a person officially works in one place, but is registered, for example, as a hired worker with an individual entrepreneur. Only one part is excluded.

- Seasonal work must be included in the calculation of the insurance period.

- Those periods that relate to the recording of length of service are also counted.

Why calculate the insurance period?

The insurance period requires calculation when a person is about to retire or applies for sick leave. Depending on the purpose for which the calculation is carried out, the legal framework and processing rules are determined.

In certain cases, data on a particular type of activity, unemployment or informal employment is recorded or eliminated. In any case, the calculation principle will be different for each case and type of payment processing by the state.

For retirement

The insurance period for pensions is calculated in points

For the calculation of pension payments, the calculation scheme is individual, but has a clear structure, which is based on legislative documents.

The basis for the calculation is all the calendar frameworks prescribed by the law of the Russian Federation.

In this case, the calendar periods prescribed by law may vary due to certain working conditions:

- When calculating the insurance period, work during a certain season of the year is counted as 1 full calendar year.

- Starting from 2020, the insurance period is calculated in points, which are subsequently converted into monetary equivalent.

- Peculiarities in calculating the insurance period apply to those persons who work in accordance with contracts and licenses that represent non-standard activities.

- If the time of work in several places at the same time coincides, the person independently chooses where to get the data for calculation.

If there are no documents confirming a person’s employment, the testimony of several witnesses is taken as the basis. In this case, witnesses cannot prove the period of work, only the fact of activity.

This procedure is carried out in the event of force majeure situations in which documents were destroyed, but not through the fault of the applicant.

When applying, it is worth distinguishing between two different concepts: work experience and insurance experience. You can contact your pension fund for help.

For sick leave

When calculating length of service for sick leave, many nuances are taken into account

To determine the length of service for sick leave, there are revised rules that consist of many paragraphs, chapters and subparagraphs. This is a state instruction for calculation, which indicates all the nuances.

General provisions regarding counting:

- The invoice is made in accordance with time intervals, which are set in a calendar manner: 30 days - a month of insurance time for payments, 12 months - a year.

- If an employee has a coincidence regarding employment at several enterprises at the same time, then the person chooses which place of work to include in the calculation. The applicant is required to submit a corresponding statement.

- In the process of counting by day, it is worth considering that the start of accrual starts from the day that precedes the date indicated on the sick leave.

The special definition for payment does not include the period of time spent caring for a child, starting from the fourth child.

If the work book indicates several places of work with different length of service and intervals, then the calculation will be carried out in relation to each individual case, and only then summed up into the total length of insurance.

In accordance with the type of activity and length of service, the insurance period is also determined in the process of calculating sick leave. The amount can range from 60% to 100%. All the nuances regarding the calculation of sick leave payments can be found in the pension department.

What is insurance experience and what functions does it have?

The insurance period includes the total duration of time periods of labor and other activities that occurred during the deduction of contributions to the Pension Fund, and other periods equivalent to them, affecting the possibility of assigning pension payments on the basis of current legislative acts.

The value of this indicator is determined by the Federal Law regulating issues related to insurance pension contributions No. 400-FZ, adopted in December 2013.

The need to maintain the concept of insurance length and whether an employee has it is associated with determining the possibility of assigning an old-age pension. But in some situations, these payments may be accrued in previously established general cases.

Before the start of the pension reform, the minimum insurance period that allowed a person to complete his working career was set at 6 years. But with the beginning of amendments to domestic pension legislation, this criterion is expected to be raised to 15 years, with a gradual increase. Otherwise, the citizen has the right to apply only for a social pension. What rate of growth of the insurance period was established - one year for the past calendar year, starting from 2015.

The final value is planned to be achieved by 2024, after which the minimum insurance period will remain at this level.

However, a minimum amount of insurance experience has been established, which provides the opportunity to complete a working career at the previously assigned age mark, which after the completion of the pension reform in the Russian Federation is 65 years for the male half of the population and 60 for the female half.

The value of this indicator ranges from 42 years for the male contingent and 37 years for the female contingent, allowing you to retire two years earlier. But this possibility is not the only condition for the premature assignment of an old-age pension.

If a man aged 60 years or older or a woman aged 55 years or older loses his job, with no available job offers, the law provides for early termination of employment compared to the specified age marks.

Related article: Insurance length and how it is calculated for sick leave in 2020

Another condition, which presupposes the possibility of assigning a pension according to the age mark earlier than the general established period, provides for the presence of a special insurance period, which will be discussed below.

Counting procedure - step-by-step instructions

The calculation procedure is carried out in accordance with calendar periods, which are:

- 30 days are converted to a month.

- 12 months are converted to a year.

- When performing seasonal work, the time worked is counted as 1 year.

The calculation is carried out during work, sick leave or other activities. If the work or other activity is of a non-standard nature, namely, determined by work in communities that provide themselves with work independently in the field of natural economy and similar situations, then the insurance pension is calculated upon payment of contributions during the period of activity.

Formula

The calculation formula is simple: before calculating the insurance period, you need to collect all the papers, certificates, contracts confirming this or that type of activity. Be sure to take into account the work book entries. Add all periods together. Take into account the nuances regarding those periods during which no contributions were made to the insurance fund.

Counting example

When calculating the insurance period, take into account the nuances of those periods during which no contributions were made to the pension fund

The citizen worked in accordance with official employment for 20 years. During her work, she gave birth to two children, with each of whom she was on maternity leave for 3 years.

Then I started and worked in this direction for 7 years. At the same time, she was engaged in private entrepreneurship and officially worked for the last 2 years.

Calculation of insurance period:

- The insurance period when caring for a child is considered only for the first 1.5 years. In total, 3 years are not counted during the period of 2 decrees.

- During the period of combining an official place of work and an individual entrepreneur, the insurance period is not considered due to the lack of deductions.

- The length of service is represented by the formula: (20-3) + (7-2) = 22 years of insurance experience.

There may be other special circumstances that will affect the total number of years of coverage.

Types of insurance experience and calculation of individual periods

The insurance period includes periods of 2 types:

- Labor, during which contributions to the Pension Fund were paid (Article 11 of Law No. 400-FZ). This includes periods of work or other income-generating activities carried out on the territory of the Russian Federation or outside it.

- Non-labor items of a certain list that are between working periods (Article 12 of Law No. 400-FZ).

Such non-work periods of time are:

- military and equivalent service;

For information on how to formalize the dismissal of an employee conscripted into the army, read the article “The procedure for dismissal in connection with conscription into the army (nuances).”

- stay on sick leave;

- parental leave for children up to 1.5 years (but not more than 6 years);

- periods of registration in the employment service in connection with unemployment;

- imprisonment for reasons subsequently found to be unfounded;

- time spent caring for a disabled person;

- periods of impossibility of employment for wives of military personnel or employees of Russian Federation institutions located abroad, at the husband’s place of service or work (but not more than 5 years);

- time of cooperation under a contract with the operational investigative service.

The length of each individual period is included in the insurance period based on its actual calendar period (Clause 1, Article 13 of Law No. 400-FZ). But in some cases, special accounting rules apply (clauses 6–7 of Article 13 of Law No. 400-FZ):

- Work that is seasonal and performed over a full season is considered to be performed for a full year. However, if other work took place in the same year, then their total duration cannot exceed 12 months.

- Work on the creation of copyrighted works is considered to have been carried out for a full year if the amount of insurance contributions paid from the income from these works for the year to the Pension Fund of the Russian Federation exceeds their fixed amount established by the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation...” dated July 24, 2009 No. 212-FZ . If the amount of the premium paid is less than their fixed amount, the number of months of insurance experience to be taken into account can be calculated in proportion based on the fact that the fixed amount of contributions corresponds to 1 year. In this case, the calculated length of service cannot be less than 1 month.

To learn about what social payments citizens can take advantage of during non-working periods, read the article “Compensation payments under the social security system.”

Which periods are counted and which are not?

In accordance with the laws of the Russian Federation, not all periods of activity of the person who applies for the calculation of the insurance pension are taken into account. In addition to the period of work under the contract, the insurance period also includes other periods of time in accordance with the person’s activities. The moments when the insurance period, on the contrary, is not accrued are determined.

Periods of enrollment/non-enrollment of insurance experience:

- If at the time of activity under the employment contract a pension for disability or temporary loss of ability to work was accrued, then this period is not included in the accrual.

- The period of military service.

- The time that was defined as caring for a child up to 1.5 years old is included in the accrual.

- Payments that a person received for unemployment have contributions to the insurance fund, so this period of time is taken into account.

- When a person participates in public works or activities that were paid officially with the withholding of the appropriate tax, a deduction is made.

- In connection with the move, which was provoked by the Employment Center in order to get a person a job, the time is taken into account in the insurance period.

- If a person was convicted and was in prison, and then acquitted, then the time of imprisonment will automatically turn into insurance period.

- Officially confirmed care for the elderly over 80 years of age and the disabled from childhood is included in this type of experience.

- If one of the spouses is military and resides in a region where the second of the couple cannot get a job, then accrual is made, but not more than 5 years.

- If the married couple is abroad and works at the consulate, then the accrual will be made.

All controversial points must be clarified. All activities must be officially documented, with a certain percentage deducted from benefits and wages.

Other periods counted towards the insurance period

- the period of military service, as well as other service equivalent to it, provided for by the Law of the Russian Federation “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families";

- the period of receiving compulsory social insurance benefits during the period of temporary disability;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- the period of receiving unemployment benefits, the period of participation in paid public works and the period of moving or resettlement in the direction of the state employment service to another area for employment;

- the period of detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, but not more than 5 years in total (the list of such organizations is approved by the Government of the Russian Federation);

- the period of operational work counted towards the insurance period in accordance with the Federal Law “On Operational-Investigative Activities”.

- the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation.

Periods of work according to the Labor Code

When calculating length of service under the Labor Code, not only the periods during which contributions to the Pension Fund of the Russian Federation were made are taken into account

In accordance with the Labor Code, various schemes are defined regarding the calculation of work periods:

- If a person was officially working in two places at the same time, then the person himself has the right to choose which place of work to take into account when calculating.

- Any type of activity in accordance with the Labor Code, if contributions were made to the pension fund.

- Seasonal work, as well as work that concerns the army and navy, are counted as a full calendar year.

In accordance with the type of activity regarding the Labor Code, points are also determined that are awarded in connection with other circumstances: maternity leave, caring for a disabled person, or a young child. There can be a lot of such periods. The main period provided for by the Labor Code is temporary incapacity for work, that is, sick leave.

Other activities

Any activity of a person during which contributions were made to the pension fund is included in the insurance period unconditionally. It is important to have the relevant documents that will become the evidence base in the process of applying for an insurance pension.

For example, residents of the southern regions of the country are engaged in subsistence farming, but at the same time make appropriate contributions to the pension fund. This means that the calculation will be carried out in accordance with these data.

This list may include other types of activities, in particular work abroad under an international or private agreement. The main thing is to correctly draw up the document in accordance with the legislative framework of the Russian Federation.

What is the difference between insurance experience and labor experience?

The concept of insurance length of service appeared in 2002, after the transition of pension legislation to this basis. To this indicator, in addition to the time spent performing official duties, are added equal periods included in the insurance period for calculating the pension.

The time periods during which the employee was employed with the execution of the corresponding contract earlier than the date indicated above are included in the length of service and are taken into account when assigning a pension benefit on a par with insurance benefits.

Like insurance, the specified length of service is divided into general and special according to similar principles. The special period includes years spent in harmful or dangerous production, or when working in the conditions of the Far North (equivalent natural zones).

You can learn more about the concept of insurance and work experience, their differences and types, here.

Related article: Is military service included in the insurance period?

Taking into account features and nuances

At the moment, the minimum threshold of insurance experience for calculating an insurance pension is 5 years

The insurance period is necessary for calculating the insurance pension. At the same time, there is a minimum threshold at which social assistance is accrued in connection with retirement. Since 2015, the pension is calculated if the insurance period is at least 5 years. Every year the age of this criterion is growing, and by 2025 they plan to introduce a period of 15 years.

If, upon reaching retirement age in a certain year, the required number of years is not accumulated, then not an insurance pension will be assigned, but a social one. This means that payments will be limited to the minimum rate. With an insurance pension, the amount of payments is determined by the salary from the last place of work. Here it is worth considering the number of years worked.

The insurance pension is also accrued if certain pension points are available. Today the coefficient should not be lower than 6.6, but every year it will grow. In 2025 it will be 30 points.

You can learn about the principle of accrual of pension points from the regional pension fund or at the enterprise. It all depends on who will calculate the insurance period in the future.

Even if a person worked abroad or for a private individual, was himself a private entrepreneur, but at the same time contributed the amount specified by law to the pension fund, then the accrual of insurance experience will be made in accordance with the amount of insurance payments.

The principle of calculating the insurance period depends on the length of service. The principle of calculations is determined by special acts that spell out all possible options regarding employment and work.

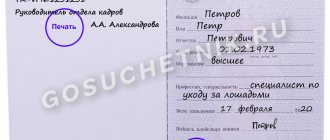

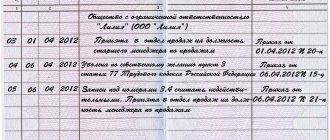

Calculation according to work book

Calculation in accordance with the document, which records all places of official employment, is very easy. You need to add up all periods of work in all areas - this will be an approximate insurance period.

It is worth taking into account special notes in the work book that relate to the type of activity.

Insurance experience is a broader concept than labor experience. It is usually much larger and includes many periods relative to human activity. A work book is one of the documents that confirms the existence of part of the insurance experience.

By adding up all the periods of work recorded in the work book and certificates from the place of work, you get a certain period of time. in accordance with it, the main points will be calculated, which are taken into account when determining the insurance pension.