What has changed in the new year

Several times already, the media of the Russian Federation have notified entrepreneurs about the impending closure of the imputation. But every time the latest news posted on news portals turned out to be not entirely reliable and UTII, after some transformations and tightening of the preferential regime, continued to operate.

Since 2020, changes have appeared again, significantly reducing the prerogatives previously available to those who are imputed. But it became known from reliable sources that the imputed system has been extended until 2021, albeit with significant reservations.

Changes to UTII since 2020 have occurred in several directions at once:

- new reporting requirements have appeared;

- the increasing coefficient has undergone transformation;

- fixed contributions have increased, the payment of which was previously the responsibility of the entrepreneur on imputation;

- With renewed vigor and persistence, individual entrepreneurs were reminded of the need to install online cash registers and even took measures to ease the financial burden of the costs of purchasing them.

For reference! The latest news, with a careful analysis of the requirements introduced by legislators, note that certain categories of legislators are very determined towards the loyal system created to boost private business back in 2003.

They believe that the measures that were relevant at that time, not only in 2020, but also much earlier, now simply prevent the state from receiving full taxes from individual entrepreneurs. In their opinion, starting from 2019, it is necessary not to introduce new things into the UTII, but simply to close it.

Recent news in the media gives a double interpretation of what is happening with the tax system that is convenient for people. On the one hand, the abolition of UTII has been postponed until 2021, and you can safely register it and then switch to another type of taxation.

Note! The opinions of financial analysts boil down to the fact that persistent recommendations to switch from imputation to a single tax and patent clearly indicate the gradual squeezing out of the bulk of those on it to other forms.

And the increase in fixed payments for the UTII form, the introduction of mandatory cash registers in order to tighten control over income received, are aimed at gradually increasing the tax burden. After all, some legislators have already considered that the sale of patents for certain types of activities will bring significantly larger sums to the treasury.

A detailed list of innovations that are worth paying attention to

The State Duma is confident that the system of benefits and concessions for private businesses has long been outdated. The figures that individual entrepreneurs pay in other countries, for example, in Europe, are compared, and all this is tried on for Russia. Not taking into account that the situation in the country is still unfavorable for private business, they are confident that the abolition of UTII (and for now, the changes made) will fill the state treasury. Hence the latest news that is being introduced in 2020. After all, a private business on imputation does not pay VAT, property tax and only makes a fixed payment.

The latest news trumpeting that the beneficial system has been left in force by a special Decree for three years has been declared non-compliant and can only exist if changes are made to it.

An example of innovation can be seen in the capital. In Moscow, the All-Russian Classifier and trade taxes are used, and the imputed tax has long ceased to exist. The permitted types of activities, however, have been expanded by the Moscow region, which in other aspects aligns the tactics with the actions of the Moscow government. This happened on legal grounds - regional authorities can, for their own reasons, add new activities to the list of permitted activities, as well as reduce the percentage of payments.

Important! Government restrictions, from different periods of 2020, prohibited trade in clothing and tobacco products, linens (bed, table and underwear), all types of perfumes, car tires, shoes, cameras and photographic accessories.

Entrepreneurs engaged in retail trade should pay attention to the list, which comes into force in March and December of the current year. This latest news suggests not only lobbying for the interests of big business, but also a ban on the imputation of profitable types of goods.

The second important innovation in relation to UTII, which was only briefly mentioned in recent news, is that the Federal Tax Service has additional powers to establish control over private small businesses.

Purchasing a cash register, which is a mandatory event for UTII subjects after the grace period for some categories has ended, is nothing more than total online control over the amounts received. This is such an important point for legislative structures that from 2020 there is even a tax deduction provided by the Government for the purchase of a cash register.

The latest news in the payment and tax reporting system draws attention to the increase in the K1 coefficient. The legislative decree that is adopted annually on this digital value has again increased the value of K1. 2020 was a pleasant exception. As in 2020, its value remained at 1.868, but since 2020 it has increased and now the amount of income is calculated using a new value of -1.915.

Advice! Quite often, an increase in the first coefficient entails a revision of the second, K2, which is determined by regional authorities. Since the territory in the Russian Federation is colossal, an entrepreneur needs to monitor possible transformations in the region of residence.

In some areas interested in business development, it may decrease slightly, but this is not a typical phenomenon. Information about this should be found on the official website of the regional Federal Tax Service.

Why does the K1 value change?

The basic profitability for each type of imputed activity is given in Article 346.29 of the Tax Code of the Russian Federation. For example, it is assumed that one employee in the field of household and veterinary services brings an income of 7,500 rubles per month. And one square meter of retail space allows you to earn 1,800 rubles per month.

In fact, these figures are far from reality, if only because prices for goods and services are rising due to inflation. To take into account the rise in prices, it was decided to introduce a correction factor K1 into the tax calculation formula. As a result, the imputed income calculated taking into account inflation will be higher. Accordingly, the tax to be paid to the budget will increase.

Create a UTII declaration

K1 UTII 2020 is 2.005 (approved by order of the Ministry of Economic Development of Russia dated December 10, 2019 No. 793). For comparison, here is its value in previous years:

- 2019 — 1,915;

- 2018 — 1,868;

- 2017-2015 — 1,798;

- 2014 — 1,672;

- 2013 — 1,569.

That is, the deflator coefficient for UTII has been steadily increasing over the past few years. But despite this, the authorities believe that revenues from imputation payers do not correspond to the actual income received. Therefore, with a high probability, the single tax regime on imputed income will be abolished from January 1, 2021.

Note! Initially, the coefficient was set at 2.009 by order of the Ministry of Economic Development of Russia dated October 21, 2019 No. 684, but by order No. 793 changes were made and the current value of K1 for 2020 is 2.005.

But for now, UTII payers have at least another year ahead. This means that we need to figure out how K1 (the coefficient that takes into account inflation) affects the amount of tax payable. Let's show this with a small example.

Tags for close monitoring

Previously, the hotel business and retail trade remained in a relatively stable state, but now they will also be affected by innovations. An increase in coefficient 1 (K1) will affect the amount of deductible income. The fact that the K2 coefficient in most regions has remained unchanged means that local authorities are not thinking about lowering them, although they have the right to do so by law. This means that the funds withdrawn are important for local budgets.

Fixed contributions have increased, which will have little impact on the finances of a single entrepreneur, but if there are employees, they can become a significant burden for running a business. So, with a declared income of 300 thousand rubles, mandatory payments will look like this:

- pension contributions 29 thousand 354 rubles. (in 2020 this amount was 26 thousand 545 rubles);

- for medical – 6 thousand 884 rubles. (in 2020 this amount was 5 thousand 840 rubles),

- income over 300 thousand rubles. + additional 1% on the amount exceeding the declared 300 thousand.

Interesting! Since 2020, the tax service has the right to block the current accounts of those who have not submitted advance payments on time. And although the upper income limit has increased, insurance for it still remains preferential, although it is likely that this rule will also change next year. Informed sources report that conversations about this are already underway.

From 2020, the rule on the payment of insurance premiums comes into force, for which special changes were made to the Tax Code of the Russian Federation. Now they are not tied to the minimum wage, but are calculated taking into account the amount of profit received. This innovation will also not please those who are staunch supporters of imputation.

The latest news about the blocking of an entrepreneur's current account on UTII after the expiration of a ten-day period suggests that repressive measures are being tightened, as well as the requirements for installing a cash register, which from July 1 will become mandatory for everyone.

UTII for individual entrepreneurs and legal entities: conditions of application in 2019

When calculating and paying UTII, the amount of income imputed to taxpayers is important. It is established by the Tax Code. In this case, the amount of income actually received does not matter.

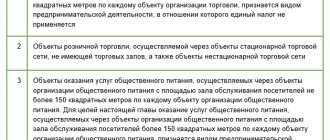

According to paragraph 2 of Art. 346.26 of the Tax Code of the Russian Federation, UTII applies to the following types of business activities:

- retail;

- public catering;

- veterinary services;

- domestic services;

- repair, maintenance and washing services for motor vehicles;

- parking services;

- distribution, advertising placement;

- services for the temporary use of trading places and land plots;

- temporary accommodation and accommodation services;

- services for the transportation of passengers and goods by motor transport.

To be able to apply UTII, an entrepreneur must meet certain conditions.

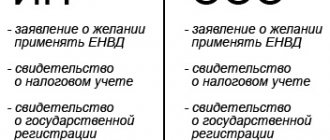

Conditions for individual entrepreneurs on UTII:

- the average number of employees for the previous calendar year is no more than 100 people;

- the tax regime has been introduced on the territory of the municipality;

- the activity is not carried out within the framework of a simple partnership agreement and within the framework of a trust management agreement;

- the type of activity being carried out is mentioned in the local regulatory legal act;

- Leasing services for gas and gas filling stations are not provided.

Conditions for LLC on UTII:

In addition to the conditions that apply to individual entrepreneurs, the following restrictions additionally apply to legal entities in the event of a transition to UTII: the share of participation of other legal entities is no more than 25%; the taxpayer is not one of the largest; the taxpayer is not an educational, health and social security institution in relation to the provision of public catering services.

Calculation and deadlines for submitting declarations

The tax base for UTII is an important indicator involved in the calculation form. It is calculated using a separate formula.

The base profitability K1, multiplied by K2, multiplied by 3 and also by the physical indicator is added to the base. The three here is the number of months in a quarter of the year, and the physical indicator can be viewed using a special table, since it is determined by the main type of activity. K1 is a value legally established by federal legislation, designated in 2020 as 1.915 (new value), K2 is a regional coefficient and you need to find it out at your place of residence.

The tax amount is the tax base calculated using this formula and multiplied by the tax rate. The Federal Tax Service reminds that in the first quarter an entrepreneur must pay no later than April 25 of the current year, in the second - no later than July 25, in the third the payment limit is December 25, and the fourth - in the coming year, until January 25. Tax returns must be submitted by the 20th day of the month following the reporting quarter.

An important point of the coming year is the mandatory installation of an online cash register before July 1st. From now on, not only its availability will be strictly checked, but also the correctness of reporting. The relatively significant amount for some individual entrepreneurs that they are forced to spend on the purchase of a cash register can be partially reimbursed by using the tax deduction provided by the government.

How to calculate UTII

It will be easy for an individual entrepreneur to calculate taxes without the help of an accountant.

The formula is as follows: Tax base x tax rate (15%) = UTII amount in 2020 for individual entrepreneurs

Tax base = basic profitability x physical indicator for 1 month x K1 x K2

K1 and K2 are coefficients established by the state. Indicator K1 is a deflator specified by the Ministry of Economy, K2 is determined by local authorities. In 2020, the K1 coefficient is 1.868; its increase in 2020 increased the amount of tax compared to the previous year.

The K2 coefficient has a limitation. It can be from 0.005 to 1. This indicator reduces or leaves the tax amount unchanged. If at the end of the year the authorities did not change the K2 coefficient, then for the next year it remains the same as in the outgoing year. K2 may include subcoefficients, the value of which depends on various nuances in the work of an individual entrepreneur - work schedule, seasonality, etc. The multiplied subcoefficients make up the K2 coefficient.

In cases where local authorities have not established the K2 indicator, it is taken as one by default.

You can find out the values of K1 and K2 on the websites of the Federal Tax Service of the Russian Federation or contact the Federal Tax Service of the Russian Federation at the place of registration.

The amount of UTII can be reduced by reducing the number of employees working on temporary duty, reassigning them to another activity. You can use part of the sales area as utility rooms. It is also possible to significantly reduce the tax by combining it with a simplified taxation system.