KBK for paying penalties on insurance premiums to the Pension Fund for individual entrepreneurs for themselves

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance in the Pension Fund of the Russian Federation for individual entrepreneurs for themselves (fixed amount, based on the minimum wage) | penalties | 182 1 02 02140 06 2110 160 |

| fines | 182 1 02 02140 06 3010 160 | |

| Penalties and fines on insurance contributions for pension insurance to the Pension Fund for individual entrepreneurs for themselves on income exceeding 300 thousand rubles. | penalties | 182 1 02 02140 06 2110 160 |

| fines | 182 1 02 02140 06 3010 160 | |

In FFOMS

Insurance premiums for individual entrepreneurs for themselves for 2020 in the amount of 1% on income over 300,000 rubles

For those individual entrepreneurs who keep track of their income and expenses (now expenses are also important) throughout the year, and do not count them when the tax period ends, you don’t have to wait until the end of 2020, but start paying fixed insurance contributions to the Pension Fund in in the amount of 1% of the amount exceeding the threshold of 300 thousand rubles. But there is no need to rush. It is enough to pay by December 31, 2017 (including weekends and holidays, in general in January 2020, although the issue is controversial and it is better not to risk it) the amount of fixed contributions established for all individual entrepreneurs. And the amount of 1% will need to be transferred no later than April 1 (including holidays - no later than April 2) 2020, in one amount or in any parts. Moreover, in 2020 the BCC for both fixed contributions is the same .

The minimum wage in mid-2020 increased to 7,500 rubles, therefore the maximum amount and the maximum amount of 1% of insurance premiums also increased in 2017. Let's calculate these values.

- The maximum amount of all fixed contributions to the Pension Fund for 2017: 187,200.00 rubles (8*12*7500*26%).

- From this amount you need to subtract mandatory fixed contributions to the Pension Fund in 2020 - 23,400.00 rubles.

- The maximum amount of individual entrepreneur contributions in the amount of 1% to the Pension Fund for 2020: 163,800.00

rubles.

Compare 1% of your income over 300 thousand rubles with the number in bold, and don’t pay extra.

In any case, it is convenient to focus on the maximum amount of 187,200.00 rubles, more than which an individual entrepreneur should not pay fixed insurance premiums for 2020. And if you still overpaid, you need to submit an application to offset the amount of overpayment against the payment of fixed contributions in future reporting periods, not to the Pension Fund of Russia, but to the tax office. If you need to return the money, you can submit an application for the return of overpaid fixed insurance premiums, also to the Federal Tax Service.

Attention! Contributions in the amount of 1% of the amount of excess income for 2020 are paid only for the payment of the insurance pension, and are transferred to the Federal Tax Service using the same KBK as for regular fixed contributions! And we don’t pay any 1% to the FFOMS!

KBC for paying penalties on insurance premiums to the FFOMS for individual entrepreneurs for themselves

| PENES, FINES | KBK | |

| Penalties, fines for insurance premiums for health insurance in the Federal Compulsory Medical Insurance Fund for individual entrepreneurs for themselves (fixed amount, based on the minimum wage) | penalties | 182 1 02 02103 08 2013 160 |

| fines | 182 1 02 02103 08 3013 160 | |

FILES

Major changes

According to the introduced changes, taxpayers will now pay all their assessments to the Federal Tax Service, and not to the Pension Fund and the Social Insurance Fund, as before. Special requirements will be imposed on filling out payment orders when transferring funds. The Mandatory Health Insurance Fund was also no exception.

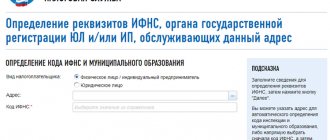

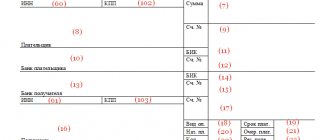

As already mentioned, a significant change affected not only the mechanism for calculating contributions to insurance funds, but also the procedure for paying accrued funds. Now, in order for the funds to be guaranteed to reach the budget of the Federal Tax Service, it is necessary that the payment order be filled out accordingly:

- in the “TIN” and “KPP” fields of the recipient, the details of the tax office are entered;

- in the “Recipient” field, enter the abbreviated name of the Federal Treasury authority, and the short name of the Federal Tax Service is written in brackets;

- in the “KBK” field, a budget classification code must be entered, including 20 characters: the first three digits are the budget revenue code, must have the value “182” - Federal Tax Service, while for the Pension Fund it was “392”;

- in the fields where the payer’s data is indicated, all details of the company that transfers the funds are entered;

- The important field is “Payment Name”. Here you will need to indicate which contributions are being transferred and for what period:

Payment order for the payment of FFOMS contributions for individual entrepreneurs for themselves KBK 18210202103081013160:

A few clarifications on the use of the CBC in the absence of hired employees

If an individual entrepreneur does not have employees, he must still pay contributions to extra-budgetary funds for himself. Mandatory payments include transfers to the Pension Fund and the Compulsory Medical Insurance Fund.

NOTE! In 2020, changes were made to the budget classification codes for transferring payments to the Pension Fund and compulsory health insurance! The payment to the Pension Fund is divided into two different BCCs, the numbering of some subtypes in the codes has been changed (registers from 14 to 17).

Payment of contribution to the Pension Fund

The fixed contribution amount depends on whether the individual entrepreneur’s income exceeded the limit provided for in Article 14 of Federal Law No. 212 of June 24, 2009, namely 300 thousand rubles. The amount is calculated based on the minimum wage.

- If the income is within this value, you must indicate KBK 392 10200 160 in the payment order.

- If income is declared in excess of the maximum amount, then a fee is calculated for the excess amount, which must be paid according to KBK 392 10200 160.

Payment of penalties and interest to the Pension Fund of Russia

If the payment was late, then for each missed day a penalty and a late fee will be charged. They need to be paid according to various BCCs, depending on the amount of income: it is taken into account whether the income “fits” into the limit of 300 thousand rubles established by law.

1. Income does not exceed the limit of 300 thousand rubles:

- penalties – KBK 392 1 0200 160;

- fine – KBK 392 1 0200 160.

2. Income exceeds the established limit:

- penalties – KBK 392 1 0200 160;

- fine – KBK 392 1 0200 160.

Payment of contribution to the FFOMS

Payments to the compulsory medical insurance fund are credited to the federal budget in a fixed amount depending on the minimum wage according to BCC 392 1 0211 160.

Insurance premiums for individual entrepreneurs for themselves for 2020 in the amount of 1% on income over 300,000 rubles

The New Year holidays will end, the weekend associated with Defender of the Fatherland Day will be successfully celebrated, International Women's Day in March will also bring a lot of joy, and then the annual reporting period will begin for individual entrepreneurs, which, however, must be completed before the May holidays. Only then, as a rule, individual entrepreneurs will finally calculate their income for 2020 according to all tax regimes that they used.

And if the entrepreneur’s total annual income turns out to be above 300 thousand rubles, then the amount exceeding this threshold must be paid insurance premiums in the amount of 1% by April 1, 2020 So, there is very little time left.

However, you do not necessarily have to transfer the entire amount; the law also sets an upper limit. We will calculate the amount of insurance premiums required for payment.

- Maximum amount of contributions to the Pension Fund for 2020: 154,851.84 rubles (8*12*6204*26%).

- From this amount, you need to subtract fixed contributions to the Pension Fund for 2016 for all individual entrepreneurs - 19,356.48 rubles, which should have already been paid.

- The maximum amount of contributions in the amount of 1% to the Pension Fund for 2020: 135,495.36 rubles.

If your calculated 1% on the amount of income for 2020 over 300,000 rubles turns out to be more than the above amount in bold, then until 04/03/2017 you in any case must pay only 135,495.36 rubles and not a penny more! If you suddenly overpaid, you need to submit an application to offset the amount of overpayment against the payment of fixed contributions in 2020 not to the Pension Fund of the Russian Federation, but to the tax office. If the overpayment is significant and you need money, you can write an application for a refund of overpaid insurance premiums.

Attention! Contributions in the amount of 1% of the amount of excess income for 2020 are paid only for the payment of the insurance pension, and are transferred to the Federal Tax Service under a separate KBK - only for contributions for 2016! We don’t pay anything to the FFOMS!

Updated BCC table for OPS - comparison 2017-2020.

The table contains links to articles of Federal Law-400 dated December 28, 2013, ranking the working conditions of employees.

| Payment Description | KBK-2017 | KBK from 04/23/2018 (from April 23) |

| PENALIES on additional tariffs based on an assessment of working conditions | ||

| Clause 1 Part 1 Art. | 182 1 0210 160 or 182 1 0200 160 | 182 1 0200 160 |

| pp. 2-18 part 1 article 30 | 182 1 0200 160 or 182 1 0210 160 | 182 1 0200 160 |

| PENALIES for additional tariffs that do not take into account working conditions | ||

| pp. 2-18 part 1 article 30 | 182 1 0200 160 or 182 1 0210 160 | 182 1 0210 160 |

| Clause 1 Part 1 Article 30 | 182 1 0210 160 or 182 1 0200 160 | 182 1 0210 160 |

| PENALTIES based on tariffs taking into account the assessment of working conditions | ||

| in accordance with clause 1, part 1, article 30 | 182 1 0200 160 or 182 1 0210 160 | 182 1 0200 160 |

| paragraphs 2-18, part 1, article 30 | 182 1 0200 160 or 182 1 0210 160 | 182 1 0200 160 |

| PENALTIES based on tariffs without taking into account the assessment of working conditions | ||

| in accordance with Federal Law-400 dated December 28, 2013 (clause 1, part 1, article 30) | 182 1 0200 160 or 182 1 0210 160 | 182 1 0210 160 |

| paragraphs 2-18, part 1, article 30 | 182 1 0200 160 or 182 1 0210 160 | 182 1 0210 160 |

| INTEREST on increasing tariffs taking into account special assessments | ||

| Clause 1 Part 1 Article 30 | 182 1 0200 160 | |

| paragraphs 2-18, part 1, article 30 | 182 1 0200 160 | |

| INTEREST on increasing tariffs without taking into account special assessments | ||

| Clause 1 Part 1 Article 30 | 182 1 0210 160 | |

| paragraphs 2-18, part 1, article 30 | 182 1 0210 160 | |

| CONTRIBUTIONS | ||

| From annual income up to 300,000 rubles. | 182 1 0210 160 | 182 1 0210 160 |

| From an annual income of more than 300,000 rubles. | 182 1 0210 160 | |

What is KBC and why is it necessary?

KBK or budget classification code is the same payment details of the regulatory authority as TIN or KPP. This code should be indicated in the payment order so that the funds sent to the insurance fund actually reach the recipient and are distributed for their intended purpose. It is on the basis of this detail that the distribution of received amounts is carried out.

If the BCC is indicated incorrectly, then the transferred amount will still be considered paid, however, it may remain undistributed and the payer will have arrears. To solve this problem, a company representative will have to contact the regulatory authority with a payment order and write a corresponding application for the redistribution of the received amount. Only after this will penalties and arrears on contributions be eliminated.

The payment procedure is further complicated by the fact that the recipient of the funds will also change and now companies and individual entrepreneurs will have to transfer funds to the tax authority, and not to extra-budgetary funds.

Formulas for calculating penalties for insurance premiums

Since 2020, insurance premiums paid by employers are divided into 2 groups, each of which has its own rules, containing:

- in the Tax Code of the Russian Federation - for payments to compulsory health insurance, compulsory medical insurance and compulsory health insurance for disability and maternity, sent to the accounts of the Federal Tax Service;

- in the Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance...” - for contributions for injuries, the curator of which remained the FSS.

The rules for calculating penalties for each of these groups are given, respectively, in the Tax Code of the Russian Federation (clause 4, article 75) and Law No. 125-FZ (clause 6, article 26.11). Both documents establish the amount of interest accrued in relation to one day of the delay period and link it to the refinancing rate in effect during this period (from 2020 it is equal to the key rate).

This share (equal to 1/300) applies to the entire period of delay in the case of contributions subject to:

- Tax Code of the Russian Federation and their payer is an individual or individual entrepreneur;

- Law No. 125-FZ.

Penalties in this case are calculated as follows:

Dz * 1/300 * St,

Where

Dz - the number of days of delay (they will also include the day of payment of the delayed amount);

St is the key rate.

If the rate changes during the period, the calculation will be the sum of two products obtained taking into account the differing rates.

For legal entities in relation to contributions subject to the Tax Code of the Russian Federation, this formula is valid only during the delay period not exceeding 30 calendar days. If it lasts longer, starting from the 31st day, the share of the refinancing rate doubles, and then the formula for calculating penalties will look like this:

Dz * 1/150 * St.

If the refinancing rate remains constant, this will lead to the formation of the amount of penalties by adding two products calculated taking into account different shares of the rate. If the rate changes during the delay period, an additional product will begin to participate in the calculation, taking into account the changed value of the rate.

How much should I pay?

In 2020, the fixed payment for yourself is calculated based on the minimum wage in force on January 1, i.e. 7500 rubles. The increase in the minimum wage from July 1 to 7,800 rubles did not affect the calculation of contributions.

Individual entrepreneurs’ contributions in 2020 for their insurance were:

- For retirement according to the formula (minimum wage * 12 * 26%) = 23,400 rubles ;

- For health insurance according to the formula (minimum wage * 12 * 5.1%) = 4,590 rubles .

In total, if an entrepreneur works for the full year 2020, then the mandatory amount to be paid will be 27,990 rubles . If the year is incomplete, then the amounts are recalculated accordingly, taking into account full months and calendar days of an incomplete month (letter of the Federal Tax Service dated February 7, 2020 No. BS-3-11 / [email protected] ).

As of January 1, 2020, the individual was already registered as an individual entrepreneur. He was removed from tax registration on July 5, 2020, having worked a full six months plus five days. The income received this year did not exceed 300,000 rubles.

The amount of contributions for an incomplete year in this case will be 12,014.52 rubles for pension insurance and 2,356.69 rubles for medical insurance, for a total of 14,371.21 rubles.

The entrepreneur was registered on July 3, 2020. How many contributions will he need to pay if the individual entrepreneur plans to work until the end of the year, and the expected income is 380,000 rubles? It turns out that the work period in 2020 will be five full months and 29 calendar days.

Based on the income received, the entrepreneur will have to pay:

- 11,574.19 rubles for pension insurance;

- 2,270.32 rubles for health insurance;

- 800 rubles additional contribution of 1% on income over 300,000 rubles.

Total, 14,644.51 rubles.