What is tax amnesty

A tax amnesty is a write-off of arrears for debts to the state budget and off-budget payments that were unpaid in previous years. These measures are designed to reduce the financial burden on individuals, including individual entrepreneurs. The decision to hold an amnesty was also influenced by the financial turmoil of previous periods, after which many businessmen need time to restore their activities and reduce their debt burden.

The state admits that some of the non-payments are hopeless in nature. The peculiarities of Russian legislation are also taken into account in terms of the statute of limitations for such violations.

It should be understood that the purpose of the event is to write off debts that physically cannot be paid due to the circumstances that have arisen. The actions of persons who deliberately evade transferring payments or hide property from foreclosure are contrary to the spirit and letter of the action and are not subject to amnesty.

Important! The Federal Tax Service warns that such promotions will not be regular, so you should not accumulate debt, hoping for write-off in the future.

What is the validity period of the tax amnesty?

Law on amnesty of tax debts from December 29, 2017. came into force, which became the starting point for launching mechanisms for the cancellation procedure for certain categories of citizens, including individual entrepreneurs, arrears.

The end date is not specified at the moment, because... It is unclear how much time tax officials will need to implement the law. According to experts, the procedure for writing off debts will take place at least throughout the current year (2020).

Who will have their debts written off in 2020?

The following categories of payers may be eligible for amnesty:

- legal entities can be “forgiven” debts on contributions to social funds and penalties on these contributions;

- for private practitioners - arrears on the same payments;

- for individuals (including individual entrepreneurs) - taxes (transport, property, income) and penalties on them;

- additionally for individual entrepreneurs - contributions for compulsory medical insurance, Pension Fund, Social Insurance Fund.

Government authorities will write off unpaid debts on insurance premiums that arose before January 1, 2017, and on taxes that arose before January 1, 2020, and penalties on these debts (even accrued after the specified period). All debts formed after the specified deadlines, penalties and fines on them must be paid in full.

When did the tax amnesty come into force?

Not everyone knows when the tax amnesty law will come into force. Many residents are confident that it will take months to develop it. However, in this case everything happened much faster.

State Duma deputies acted quickly. A press conference was held on December 14, and on the 21st the bill was adopted at a parliamentary meeting.

The initiative officially began to operate on January 1 of this year. The implementation of the law is only gaining momentum. It is possible that it will take at least a year to write off all current debts. However, some residents have already received information that they no longer have debts.

Categories of persons applying for tax amnesty

The official text of the law includes a list of persons who will have the right to write off tax debts. In 2020, this list includes the following categories of citizens:

- individuals;

- IP;

- individuals who were previously engaged in entrepreneurial activities;

- lawyers and notaries.

A prerequisite is the formation of debt before 01/01/2015. If we are talking about cancellation of insurance premiums, they must be formed before 01/01/2017.

Entrepreneurs (current and former) have the right to apply for write-off of overdue taxes directly related to their activities.

The list also includes pensioners and some categories of beneficiaries.

Which tax debts will be forgiven in 2020?

How and where to check the write-off

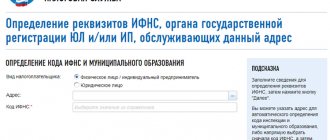

Full information about the availability of unpaid taxes and payments can be viewed in the taxpayer’s personal account on the Federal Tax Service website, where you can also check the write-off of arrears as part of the tax amnesty for individual entrepreneurs in 2020. Another way to obtain information is to personally contact your local tax office with the appropriate application. It is also advisable to inquire at the SSP branch about the availability of cases of debt collection, seizure of property and accounts. If they exist and there are sufficient legal grounds, you can apply to terminate the paperwork within the framework of the tax amnesty in order to avoid problems with obtaining loans, traveling abroad, etc.

Exemption from personal income tax

A tax amnesty has been announced for income received by citizens from January 2020 to 01/01/2017. This applies to those cases where the tax agent did not withhold personal income tax, and information about which was presented in the 2-NDFL certificate with attribute “2”. This document is a message to the Federal Tax Service that payments were made to the person, but the tax could not be withheld from him.

Not all income of individuals was included in the amnesty. These include:

- dividends and interest;

- remuneration for performing professional duties;

- material benefit defined by Art. 212 Tax Code of Russia;

- income in kind, including gifts;

- winnings and prizes.

What debts will be removed from individual entrepreneurs?

The amnesty will affect individual entrepreneurs to the greatest extent. Of all categories, the largest range of debts is subject to write-off, including both unpaid taxes on time and contributions to social insurance funds, as well as penalties on them. Additionally, the amnesty includes the termination of cases in the courts in these areas, the termination of office work through the activities of the bailiff service, the unblocking of bank accounts, and the cancellation of debits from the entrepreneur’s account. These actions are initiated by tax inspectors.

For taxes

Tax debts will be written off from an individual entrepreneur who falls under the amnesty:

- income tax (including all special regimes - tax regime, imputation, patent, personal income tax);

- VAT is written off, with the exception of import transactions - this case is not subject to amnesty, just like customs payments;

- transport and property taxes.

Also, debts on excise taxes and mineral extraction taxes will not be repaid.

For insurance premiums

The following debts are subject to write-off under the tax amnesty in 2020 for individual entrepreneurs:

- for non-payment of contributions to the Pension Fund, Compulsory Medical Insurance, Social Insurance Fund;

- penalties and fines on these contributions.

Unpaid fines and accrued penalties associated with failure to submit declarations on contributions to insurance funds falling within the established period of time are also subject to cancellation.

Tax amnesty: what debts of individual entrepreneurs will the state forgive

Tax amnesty for individual entrepreneurs

At a December press conference, the president announced that debts on taxes and insurance premiums totaling 15 billion rubles.

accumulated by 3 million individual entrepreneurs. The state decided to free entrepreneurs not only from debts incurred, but also from penalties and fines that arose in connection with their non-payment. It is also important that the 2020 tax amnesty will affect individual entrepreneurs who have ceased their activities. Federal Law No. 436-FZ dated December 28, 2017 recognizes the following as uncollectible and subject to write-off:

- Tax arrears, penalties and fines incurred by individual entrepreneurs as of January 1, 2020.

Exception: mineral extraction tax, excise taxes and taxes payable in connection with the movement of goods across the Russian border).

- Arrears on insurance contributions to state extra-budgetary funds of the Russian Federation in the amount determined in accordance with Part 11 of Art. 14 of Federal Law No. 212-FZ dated July 24, 2009, for periods expired before January 1, 2020, as well as debt for relevant penalties and fines.

Who is eligible for debt relief:

- IP;

- lawyers;

- notaries;

- other persons engaged in private practice in accordance with the law;

- persons who, as of the date of writing off the relevant amounts, lost the status of an individual entrepreneur or lawyer or ceased to engage in private practice.

Please note that the categories of self-employed people listed above are not eligible for the tax amnesty. It applies only to current and former individual entrepreneurs.

Open an account with Elba|Bank and use built-in accounting and reporting. Corporate card and electronic signature are free. Up to 5% on balance.

To learn more

What debts will be forgiven for individuals

Citizen taxpayers can expect to have the following debts incurred as of January 1, 2020 written off:

- arrears and penalties for transport tax (taxpayers are persons on whom vehicles are registered, recognized as an object of taxation in accordance with Article 358 of the Tax Code of the Russian Federation);

- arrears and penalties for property tax (taxpayers - individuals who have the right of ownership of property recognized as an object of taxation in accordance with Article 401 of the Tax Code of the Russian Federation);

- arrears and penalties for land tax (taxpayers - organizations and individuals who own land plots recognized as an object of taxation in accordance with Article 389 of the Tax Code of the Russian Federation, on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession).

The tax amnesty law does not clarify the non-refundability of amounts paid or collected after December 29, 2017. Therefore, you can also try to return debts for transport, land or property taxes that were paid after this date and that arose before January 1, 2020. To do this, you need to fill out an application and contact the tax authority.

How will individual entrepreneurs and individuals have their debts written off?

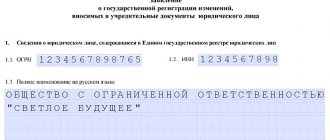

Specific explanations about the mechanism for writing off debts are given in Art. 11 and Art. 12 of the Federal Law of December 28, 2017 No. 436-FZ.

As for debts on insurance contributions to state extra-budgetary funds, the decision to recognize arrears and debts as uncollectible and to write them off is made by the tax authority at the place of residence of individuals and the place of registration of individual entrepreneurs.

Information on the amounts of arrears and debts transferred to tax authorities by extra-budgetary funds at the beginning of 2020 will be used to determine the amounts of arrears, penalties and fines.

The decision to write off arrears and debts on insurance premiums can be drawn up in any form, indicating the full name and TIN of the payer of insurance premiums of an individual (IP) and information about the arrears and debts on insurance premiums to be written off.

The decision to write off the debts of individuals is also made by the tax authority, without the participation of the taxpayer - at the individual’s place of residence (location of real estate owned by the individual, vehicles, place of registration of individual entrepreneurs) based on information about the amounts of arrears and debt for penalties and fines.

The decision to write off arrears and debt on penalties and fines is drawn up in any form and must contain the full name, TIN of the individual or individual entrepreneur, information about the amount of arrears, debt on penalties and fines to be written off.

Now many questions arise about the timing of debt write-off. The tax amnesty law does not establish them. But individual entrepreneurs and individuals can speed up the process by contacting the tax authority with an application to write off the debt.

It is important to clarify that the tax amnesty is not a basis for the return of paid amounts to bona fide taxpayers.

All the most interesting things about business are on our Telegram channel. Join us!

Where to contact

You don’t need to go anywhere to write off your debt—the recalculation is done without the participation of the debtor. It should be understood that the law does not establish a time limit for the removal of debts, and the end date of the event is also not defined. The territorial fiscal authorities create the schedule for writing off debts for individual entrepreneurs independently. To reduce the risk of errors and misunderstandings, the following procedure is recommended if you intend to legally pay off unpaid debts on time:

- Check in the taxpayer’s personal account whether there are debts on taxes and fees that arose before the specified date and fall under the amnesty.

- If in doubt, clarify the question with your Federal Tax Service.

- Write an appeal to the tax authorities with a request to reconcile the debt and write it off as part of the amnesty.

Following these steps will minimize the risk that the debt, or part of it, will not be repaid. To further reduce the risk, the tax authorities should initiate a debt reconciliation as of the date of application.

Important! If the taxpayer independently paid debts and penalties subject to amnesty before they were written off by state fiscal authorities, then this money is not refundable.

Debts on insurance premiums after the specified date were transferred to the Pension Fund, and to clarify their fate, you should contact the Pension Fund. The need for this appeal is reinforced by the fact that, as practice has shown, many errors have arisen during such transfers, which can lead to additional monetary losses. These errors must be identified (reconciled) and the Pension Fund administration must be contacted with a request to correct the problems.

Tax amnesty for individual entrepreneurs, as a measure of support for individuals who find themselves in difficult situations as a result of crisis phenomena in the economy, is aimed at helping those businessmen who, due to circumstances, were unable to pay taxes and insurance fees. It should be understood that the amnesty applies only to those debts that are declared or identified by state fiscal authorities before the specified deadlines. Those unscrupulous entrepreneurs who hid their income and hid from taxes will not be able to take advantage of the amnesty to come out of the shadows and write off the debts that arose in recent years.

When and how debts will be written off: explanations from the Federal Tax Service

The debt cancellation procedure is quite simple and does not require the presence of the entrepreneurs themselves or the provision of a package of documents by them.

Debts will be written off at the tax authorities at the debtor’s place of residence. In order for a person to officially receive a write-off of overdue payments, he does not need to apply anywhere. Representatives of the state structure will do everything.

If you want to speed up the process, you can contact the tax authority. To start the procedure, you need to fill out an application at the service at your place of registration. There you can also be provided with information about when your debt will be written off. The application is usually processed within 1 month.

The essence of the tax amnesty is to provide justice for entrepreneurs who have not been able to succeed in business. Also, writing off debts will save money that the state spends on unsuccessfully collecting overdue payments.

Write-off of tax debts of individuals

Amnesty for individuals who are not individual entrepreneurs is regulated by clauses 1, 3 and 4 of Art. Law No. 436-FZ. Here the arrears on three taxes must be written off as hopeless for collection: transport, property tax for individuals and land. The “cut-off date” is the same as for entrepreneurs - January 1, 2020. That is, all debt for these three taxes that was formed before this date must be written off along with penalties and interest accrued on it. Moreover, penalties are written off for the entire time, up to the date of acceptance of the write-off.

At the same time, as noted above, in terms of the “tax amnesty” Law No. 436-FZ does not contain a clause on the non-refundability of amounts paid or collected after December 29, 2020. So if an individual after this date paid (or was collected from him) a debt on transport, land or “property” tax that arose before 01/01/2015, then the paid (collected) amount can be returned or offset against the fulfillment of other tax obligations. To do this, you must contact the tax authority with a corresponding application. As in the case of the “entrepreneurial” amnesty, the decision on write-off is made by the tax authority either at the place of residence of the individual or at the location of the corresponding taxable object (car, apartment, land plot). The decision is made in any form, indicating information about the taxpayer and the debt being written off. At the same time, the legislator also did not establish a deadline for making such a decision by the tax authority. This means that if for some reason the debt needs to be written off quickly, the taxpayer will have to initiate a reconciliation of payments in the manner described above.