A little about entrepreneurship

Individual entrepreneurs are the most common category of businessmen in Russia.

Entrepreneurs provide services and sell goods to consumers. For an entrepreneur, the most interesting option is to work individually. In modern working conditions, working alone is quite problematic, so a businessman hires employees. Employees who are officially employed receive social guarantees and can count on a stable salary. In this case, the question regarding the leader himself remains unclear. Let's take a closer look at the interaction of an entrepreneur with budgets. Definition 1

An individual entrepreneur is a person who carries out professional activities with the granting of legislative rights without forming a legal entity.

Let's look at the benefits of entrepreneurship in more detail.

Payments to the tax and extra-budgetary fund

An individual entrepreneur with hired employees will have to independently calculate tax and other deductions from salaries for each employee, the amount of which depends on the established salary.

| What? | Where? | How many? | At whose expense? |

| Personal income tax (personal income tax) | Tax service | 13% of salary | Deducted from the employee's salary |

| Contribution forming a citizen's future pension | Tax service | 22% of salary |

Entrepreneurs who deliberately reduce the official wages of employees and give the rest in envelopes can be understood, but they act against the law. It is not beneficial for employees to reduce contributions, because at least their pension depends on it.

Additional monthly expenses for individual entrepreneurs with hired employees are 30% of their salary.

The state has slightly eased the burden of the individual entrepreneur by providing, in some regimes, the opportunity to reduce the accrued tax by the amount of contributions for employees + fixed payments “for oneself”, but not more than 50% of the tax due for payment.

Benefits of Entrepreneurship

- The opportunity to do what you love;

- Stimulating self-employment;

- Creation of additional jobs;

- Formation of healthy competition;

- Receiving a stable income from daily activities.

Finished works on a similar topic

- Course work Salary of an individual entrepreneur 470 rubles.

- Abstract Salary of an individual entrepreneur is 230 rubles.

- Test work Salary of an individual entrepreneur 220 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

Let's consider the features of tax accounting for an entrepreneur.

Liability of individual entrepreneurs for non-payment of wages to employees

A long delay or non-payment of salaries to employees is an offense and entails administrative liability for individual entrepreneurs. Based on the law, the maximum period of delay in payment is 15 calendar days.

Lack of salary from an individual entrepreneur for more than 15 days is not a violation of the law.

If, after the specified time, the hired employee has not received the funds due to him, he has the right to file a statement about violation of the deadlines for issuing the money earned. If the individual entrepreneur does not respond to this document, the employee also has the right to:

- file a lawsuit;

- stop performing your work duties until the due amount is paid. At the same time, the subject is obliged to notify the individual entrepreneur in writing about the fact of termination of work, having received his signature from the entrepreneur as evidence of familiarization with the paper;

- send an application to the labor inspectorate.

An individual entrepreneur must also be prepared for the fact that an employee, subject to a delay in payment of wages, has the following rights:

- not be present at the workplace;

- take part in strikes.

Dismissing an employee for his dissatisfaction with the lack of salary or forcing the employee to write a letter of resignation of his own free will is illegal. The average salary of the subject is maintained for the period of his failure to fulfill his labor duties due to the individual entrepreneur's debt to him.

Taxes and entrepreneur

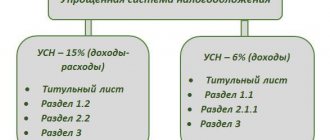

Every businessman, when opening his own business, should think about the system of tax accounting and control. For entrepreneurs, the most preferable system is the simplified tax reporting system, abbreviated as the simplified tax reporting system.

Note 1

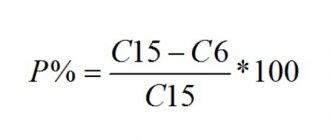

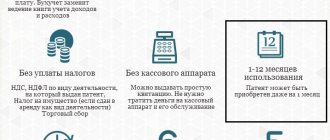

Entrepreneurs choose this system because tax accounting in this case is quite simple. An entrepreneur can choose an object of taxation, freeing himself from a large number of taxes and paying personal income tax.

The tax accounting period is one calendar year. Clear advantages include not only the absence of VAT payment, but also the reduction of bureaucratic procedures when generating a report.

Note 2

This means that the entrepreneur does not have to worry about the thorough compliance of the documentation and the occurrence of a fine.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Industry Dependence

The earnings of entrepreneurs also depend on the industry in which they develop their business. Some are simply impossible to get into, for example, banking. The best bankers earn seven-figure sums monthly, but this niche is occupied and it is not possible to get there. The same oil and gas market has long been divided among the powers that be. To assess and provide specific figures, it is better to turn to other industries.

of 100 to 500 thousand per month is considered normal . There are cases when this mark is exceeded, but this is rare for the industry in question. Its main advantage is that it will never be completely occupied; today every person can start their own small business.

So-called startups have become very popular. A startup is a newly opened company that is in the process of exploring various markets and developing. Many owners of such businesses receive millions of dollars, thanks to the development of modern technologies and the Internet. By the way, they make money not only from their startups, but also from the subsequent sale of their well-promoted business. There have been cases when mobile application developers received tens of millions of dollars for selling their “brainchild”.

A little about the simplified tax system

Unfortunately, not all entrepreneurs can use the simplified system. So a businessman who carries out insurance or legal activities, banking activities, or has a pension fund cannot use this system. Microfinance enterprises and pawnshops also cannot operate under this tax system. In addition to the presented types of activities, there are others that do not have the right to apply the simplified tax system. Let's move on to those entrepreneurs who are already using it.

Businessmen who are already using the simplified tax system should refuse to expand their enterprise. When opening a branch, the entrepreneur will have to change the tax system. If losses occur, the entrepreneur registered with the simplified tax system cannot refuse to pay the tax. It will be minimal, but must be paid in full and on time.

Some partners may refuse to cooperate with the entrepreneur. The reason for this is the simplified tax system, which allows you not to pay VAT. Let's take a closer look at the formation of an entrepreneur's salary.

Profit calculation: which entrepreneurs earn the most

As part of the work to create patent taxation standards for individual entrepreneurs, regional parliamentarians calculated the profitability of various types of small businesses. It is most profitable, according to legislators, to sell in stalls, run public catering facilities, and provide medical and funeral services.

In Moscow, the average annual income from one small catering outlet with a hall of up to 50 square meters is 3 million rubles. In the Yamalo-Nenets Autonomous Okrug, you can earn 1.55 million rubles a year from the same business. But in the Belgorod region, it is not so easy to rise in public catering: civil servants estimate the profitability of one item at 50 thousand rubles. A small store of a similar area in the Yamal-Nenets Autonomous Okrug will bring its owner 2 million rubles a year, and a street stall - 450 thousand. The situation is exactly the opposite in Belgorod - here a tent is estimated at 363 thousand rubles, and a store - 73 thousand. In the capital, the price is slightly less : income from a non-stationary facility is fixed at 2.7 million rubles per annum, and a small trading floor should bring 2 million. Funeral services in Belgorod promise much more income than in Moscow or the Yamal-Nenets Autonomous Okrug - 3 million rubles per year, at 600 and 172, 8 thousand rubles in the other two regions, respectively. The situation is similar with car maintenance and repair . If in Yamal the marginality of such a business will be calculated based on 225 thousand rubles per year, in Moscow - from 600 thousand, then in Belgorod we are talking about 3 million.

Article on the topic TOP 20 most profitable types of small businesses

Private medical practice will be equally profitable in almost all central regions. The income of a licensed doctor here is several million a year. But in the north and south – several times less. Thus, the profit of a doctor in the Krasnodar Territory is estimated at 400 thousand rubles per year, and for a group of three people at 675 thousand. Earning money from cleaning residential premises will be the same everywhere: for example, in Moscow, the average city income of a housekeeper is estimated at 300 thousand rubles, and in Krasnodar - 150.

the activities of private detectives are considered amazingly profitable - 3 million rubles per year. An estimate of 1 million rubles is offered in Belgorod. Parliamentarians of the Yamalo-Nenets District and Krasnodar Territory believe that lone detectives per year are unable to collect orders for more than 345.6 and 100 thousand rubles, respectively. The profit of a private interior designer does not vary so much: from 200 to 600 thousand rubles, depending on the region. But in the case of apartment renovations, the situation is more differentiated. In Krasnodar, a private worker earns approximately 330 thousand rubles a year, in Moscow – 600 thousand, in Belgorod – 100 thousand, and in the Yamal-Nenets Autonomous Okrug – 225 thousand.

the profitability of the business of Moscow rentiers , regardless of the type of real estate and its size, at 1 million rubles. But in regions the rates vary. For example, Belgorod authorities assume that you can earn 3 thousand rubles on one square meter of residential real estate, and 10 thousand rubles for commercial real estate. As a rule, renting out retail and office space actually turns out to be much more profitable than selling apartments.

A cosmetologist or hairdresser working at home in Krasnodar can earn 330 thousand rubles a year, in the north 225 thousand, in Belgorod 100.6 thousand, and in Moscow we are talking about 900 thousand. It is equally unprofitable in the regions and in Moscow to be a cook, sports coach, taxi driver, watchman, nanny or station porter . The annual profit from services nowhere exceeds the capital’s 300 thousand rubles per year or 25 thousand per month.

The Moscow Department of Economic Policy and Development of Moscow says that the rules for calculating profitability are the same in all regions. The figures are based on the average wages and profits of individual entrepreneurs in each region of the country. Based on the data provided, regional authorities will begin selling tax patents as early as January 1, 2013. Individual entrepreneurs will be able to buy a patent, the price of which is 6% of average profit, at the beginning of each year and not pay income tax of 13%. But not everyone will benefit from the offer. For example, , a Moscow rentier will have to pay 60 thousand rubles a year for one apartment. In the case of standard income tax, the amount corresponds to a monthly profit of 38.5 thousand rubles. Purchasing a patent will only be profitable if you have a higher level of income. for a Krasnodar cosmetologist will cost 19.8 thousand rubles. Such conditions are suitable for a specialist earning more than 152.4 thousand rubles per year. The profitability of the business of a Belgorod undertaker , whose patent will cost 180 thousand rubles, must exceed 1.39 million rubles to profitably enter the program.

Municipal authorities expect that patenting will help defeat the shadow sector of small businesses. First of all, we are talking about the illegal rental housing market. However, to join the program, all rentiers will have to register as individual entrepreneurs, which most private owners prefer not to do. In Moscow, the patent system has been in effect for 4 years, but during all this time, only 9.5 thousand people out of 200 thousand city businessmen were interested in the proposal of the capital authorities. According to the city hall, taxes were paid in advance by 5 thousand taxi drivers, 2 thousand landlords, five nannies and four cleaners.

Continued: The most profitable small business →

The income of entrepreneurs in Russia has fallen to a minimum in 20 years

The share of entrepreneurial income in the structure of all cash income of the Russian population in the second quarter of 2020 decreased to 3.5%, according to Rosstat data. This is the lowest quarterly indicator since at least 2000. More details on RBC: www.rbc.ru/economics/03/08/2020/5f23d56a9a7947c85ff90bb6?utm_source=yxnews&utm_medium=desktop

The share of entrepreneurial income in the structure of all cash income of the Russian population in the second quarter of 2020 decreased to 3.5% , according to Rosstat data. This is the lowest quarterly indicator since at least 2000.

Overall, real disposable income in April-June , the period that bore the brunt of the pandemic crisis, fell by 8% year-on-year, the biggest drop since 1999 .

At the same time, social payments from the state (pensions, benefits, scholarships, etc.) in the second quarter provided 21.8% of the population’s cash income , which is slightly less than the result of the first quarter of 2020 (22.1%), but overall the share of social transfers remains historically high.

And no one in the Russian government is horrified by the fact that every fifth Russian produces nothing. does not sell, does not build, etc., i.e. does not participate in the economy as a creative link, but is only an expendable part for the country . Every fifth!!! This is crazy for the economic policy of any country. By the way, 21.8% does not include civil servants, because... they do not receive social benefits, they receive a salary.

The question is: how many people remain in the country who are representatives of business (the driving force of the economy of any country)?

Over 20 years, income from entrepreneurship decreased by 4.2 times from almost 15% to 3.5%. This means that tax revenues to the budget from entrepreneurs have also decreased to a minimum. At the same time, social payments have more than doubled. In such conditions, where does the state get money for social payments?

The answer is obvious - from the sale of oil, gas and other resources. This is how Russia “came off the oil needle.” By 2050, most countries in the world plan to abandon technologies that require the combustion of hydrocarbons, which will reduce global oil and gas consumption by at least half. Already in the 2030s, Europe plans significant reductions in hydrocarbon consumption. During this time, small businesses in Russia will shrink even further, and the aging population will demand even greater social payments from the budget. This means that there is a further increase in taxes, retirement age and poverty for the main part of the population.

The most important thing is “not to stop and not to slow down”, to set “ever more ambitious goals” because “There’s no more time to rock up.”

By the way, few people remember that for the first time the words “there is no more time to build up” were used by Putin in the article “Russia at the turn of the millennium” already in 1999. Since that time the country has been rocking.