Dividends are part of the profit remaining after taxation, which is distributed among participants, shareholders. The amount of dividends is calculated and paid in a certain order and within strictly established periods. For more information, see How to determine the amount and procedure for paying dividends.

Dividends can be issued in cash or in kind, that is, other property. Moreover, shareholders can only be paid in cash. For LLC participants - both through the cash register and to a bank account. This procedure follows from Article 28 of the Law of February 8, 1998 No. 14-FZ and Article 42 of the Law of December 26, 1995 No. 208-FZ.

Accounting and taxation of dividends also have their own peculiarities. Read about them in detail in this recommendation.

Situation: is it possible to transfer dividends to an account that does not belong to the shareholder or participant

Yes, you can, but only in limited liability companies.

In joint stock companies, dividends in cash are paid only by bank transfer and only to the shareholder’s account. If the recipient does not have an account, then the money is sent by postal order. This is stated in Part 8 of Article 42 of the Law of December 26, 1995 No. 208-FZ.

But for limited liability companies there are no restrictions in the Law of February 8, 1998 No. 14-FZ. Therefore, an LLC may transfer dividends at the direction of a member to the accounts of third parties, such as a spouse, relative, or organization. To do this, the participant must write a statement. In it, indicate the recipient and his account details.

How is profit calculated?

Net profit is the profit that remains after paying all taxes. It is calculated as follows:

All expenses incurred are deducted from the enterprise's total income. This is how the financial result is obtained, that is, profit before tax, which is the basis for calculating tax.

After paying the tax, there remains a cleared amount that is at the disposal of the company - net profit. The company has the right to dispose of this amount at its discretion. That is, it can either use it to develop the business or pay dividends.

Where is the net profit figure recorded in the financial statements?

— In section 3 of the balance sheet “Capital and reserves”, profit appears in the line “retained earnings (uncovered loss)”. The balance sheet reflects all profits as of a certain reporting date. This line takes into account the amount of net profit not only for the last reporting period, but also for previous years, if it remained and was not distributed at the time.

— If you need to find out the amount of net profit for the reporting period, then refer to the financial results statement. Here, the net profit indicator for the reporting period (for example, for the reporting year) is shown in the line “Net profit or loss”.

If the company does not have net profit, then there can be no talk of paying dividends until the loss received by the company is covered by the profit received in subsequent periods.

What if errors were made in calculating profits?

According to accounting and tax legislation, the company, represented by the accounting department and the chief accountant, must make changes and correct the financial statements so that the net profit figure corresponds to reality.

— If, as a result of errors and violations, the net profit figure was underestimated, then, after making changes to the balance sheet and reporting, additional net profit should appear, which is also distributed among the founders according to their decision.

— If, as a result of errors and violations, the net profit was overestimated and dividends were already paid based on incorrect information, then after the errors are corrected, the net profit will be slightly underestimated. As a result, a situation will arise where the founders initially distributed more of the net profit to themselves. There is nothing wrong with this, because after a certain period the net profit will be smaller and the participants will distribute the profit in a smaller amount.

If errors were made in accounting and then corrected, then the founders and participants will still receive the due amounts of dividends. But the process may take time.

Net assets

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

This is the difference between a company's assets and its debts (liabilities). The difference between assets and liabilities is recorded in the final line of section 3 of the enterprise’s balance sheet. Conditions:

- In accordance with the law on LLCs, the amount of net assets must necessarily exceed the amount of the authorized capital. If the amount of net assets is less than the amount of the authorized capital, then the company is obliged, after a period of time, to reduce it to the amount of net assets. This entails difficulties and risks for the company, because many small businesses have the minimum amount of authorized capital allowed by law: 10 thousand rubles for an LLC. If a situation arises in which the size of net assets is less than this threshold amount, then, on the one hand, the company is obliged to reduce the amount of the authorized capital, and on the other hand, the amount of the authorized capital cannot be less than 10 thousand rubles.

- If a company allows this situation to happen long enough, it will be subject to sanctions up to and including liquidation. As for the payment of dividends, in accordance with Article 29 of the law on LLCs and Article 43 of the law on JSCs, a decision on the payment of dividends cannot be made if at that moment the value of the company’s net assets is less than its authorized capital. Therefore, it is imperative to monitor the size of your net assets.

- Payment of dividends is not allowed until the authorized capital is paid in full.

The procedure for paying dividends is regulated by corporate legislation and the company's charter. The classic option is the annual payment of dividends based on the results of the financial year, when the financial statements for the previous year are prepared. In accordance with the law on LLCs, at the end of the year, the company must hold a regular annual meeting of participants and shareholders, at which the financial statements, the amount of net profit are approved, and then the owners of the company decide on the distribution of net profit.

How will net profit be distributed? This issue is within the competence of the general meeting of participants. The state does not interfere in the distribution processes; it controls the procedure from a taxation point of view, because at the moment the decision is made to pay dividends, the tax base for personal income tax arises.

Important:

- The results of the general meeting of shareholders or participants must be documented: attention is paid to this when conducting audits. Often decisions on the distribution of dividends and net profits are made orally and money is paid on this basis. Subsequently, this can lead to serious problems: if one of the owners, participants or shareholders considers that he has been deprived, then he has the right to go to court to restore his violated rights. If there is no document drawn up on paper, then it will be difficult for any of the parties to the conflict to refer to it.

- In the absence of minutes of the general meeting, accounting does not have the right to reflect business transactions or make entries for the accrual and payment of dividends. In accordance with the accounting law 402-FZ, facts of economic activity are recorded in accounting only on the basis of primary documents. In this case, the primary document is the decision of the general meeting on the payment of dividends, drawn up on paper.

Concept of dividends

Dividends or income from net profit refer to finances that are paid to LLC participants as a result of the distribution of profits that remained on the balance sheet after taxes. A person engaged in individual entrepreneurial activity has the right to dispose of earned funds at his own discretion - withdraw them from the account, make wire transfers or take them from the cash register. An individual entrepreneur has the right to perform these actions provided that taxes are paid and all contributions are paid.

A participant in a limited liability company has the right to payment of funds received from the business in the form of wages if he works under a contract in an LLC. A person can receive money in the form of dividends from the profits of an LLC if the company did not incur losses while carrying out its activities.

There will be no payments if the organization's work was not successful. Dividends are not allowed to be distributed to an LLC if a loan has been issued or there are outstanding losses for past years.

Income received as a result of the work of the company cannot be distributed in the cases established by the Federal Law “On LLC”, art. 29:

- Incomplete payment of the authorized capital.

- The company showed signs of bankruptcy at the time the decision to pay dividends was made.

- The value of the organization's net assets is below the reserve fund and authorized capital or will decrease after the decision of the general meeting on the payment of profits is made.

- Other cases provided for by law.

Dividends do not include some payments made by the owners of the company:

- Payments in a company subject to liquidation. Such amounts do not exceed the contribution to the authorized capital made by the owner of the LLC.

- Money paid to the founders in the form of the company buying out their shares.

- Payments to a non-profit organization for the implementation of statutory activities, if it is included in the circle of owners of the company.

Net assets represent the difference between the company's liabilities and assets according to accounting data. Assets are all property of the organization:

- Money.

- Inventories (finished products, materials, costs of work in progress).

- Financial injections.

- Fixed assets.

- Debt by debit and more.

Liabilities include debts, reserve funds for planned expenses, and accounts payable. An accountant is responsible for calculating the company's net assets. In the company's annual report, a whole section is dedicated to net assets. It focuses on the movement of changes in the value of the authorized capital and assets in the process of completed monetary transactions. If discrepancies are found in the value of net assets and authorized funds, the accountant analyzes the reasons that provoked this condition.

Regularity of dividend payments

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

In Art. 29 of the Federal Law of 02/08/98 No. 14-FZ and in Art. 42 of Federal Law No. 208-FZ of December 26, 1995 provides that the company has the right to pay dividends quarterly, once every six months or annually.

If company members, owners or shareholders want to distribute dividends more often than once a year, then they need to re-read the charter and find the section that states in what order and how often dividends can be paid. Often the texts of the charter are formed based on general principles and existing provisions: when creating a company, few think about how often they would like to distribute dividends. Therefore, if the charter states that dividends are distributed annually, then before making a decision to change the frequency, you need to make changes to the charter.

The period for payment of dividends is no more than 60 days from the date of the decision on payment. After its expiration, a shareholder who has not received dividends may regard this fact as a violation of his rights. He may go to court or influence the company in other ways, so you need to monitor the timing of payment.

Often, enterprises, when drawing up the minutes of the general meeting, where decisions are made on the distribution of net profit and payment, immediately fix the payment schedule so that it is clear how the amounts will be paid.

In the case of a small business, the number of owners is small. Usually they are all physically present at the general meeting, where they make decisions on the distribution of net profit, payment of dividends and sign the minutes. If the text indicates a dividend payment schedule, and if part of it is paid later than 60 days, then having the signatures of the owners, it will subsequently be difficult for any of the shareholders to make claims regarding the timing of payment.

Rules and procedure for payment of income

The procedure for paying dividends to LLCs in 2020 is based on the restrictions established by the Federal Law “On LLCs” (Article 29). The provisions of the Federal Law require:

- Payment of the full amount of the authorized capital.

- Repayment of the share of the management company to a participant who has left the company.

- The excess of net assets over the amount of the authorized capital and reserve fund.

To receive dividends in an LLC, it is necessary to eliminate any signs of insolvency of the company.

The procedure for paying dividends in LLCs is regulated by the following legislative acts:

- Laws No. 208 of 1995 and No. 14 of 1998. Their provisions state that the decision on the payment of income from net profit is made at a general meeting of participants. The decision made is recorded in the protocol.

- The Tax Code of the Russian Federation, which stipulates the obligation of a limited liability company to independently calculate taxes for transfer to the state treasury.

- Letters from the Ministry of Finance of the Russian Federation fix the deadlines for paying taxes.

Important! The legislation of the Russian Federation allows dividends to be paid from profits in an LLC with property listed on the balance sheet if there are no funds in the accounts.

This method is impractical - you will have to pay additional taxes: on personal income and on added value.

At the legislative level, conditions are established for the payment of dividends to LLCs. The value of net assets must be equal to the authorized capital. The organization's working capital decreases when payments are made to the founders. Payment of income from the organization’s net profit is carried out according to a certain scheme:

- Summing up the year.

- Determination of net profit.

- Analysis of indicators for accrual of income for distribution.

- Calculation of net asset value. If it is less than the authorized capital, the profit is not distributed.

- Deciding on the payment of profit.

- Making an order for payment.

- Payment of taxes and payment of income.

The amount of dividends between participants should be distributed in proportion to the shares they contributed to the management company. But the charter does not contain a list of participants and the size of their shares. Consequently, it is impossible to distribute income in proportion to the contributed shares. The percentage of income and payments to each participant is fixed in the decision or in the constituent agreement.

Documents for paying dividends to LLC:

- The founder's decision to transfer income.

- Minutes of the general meeting.

- Order on accrual of income from profits.

Important! Persons who are members of a limited liability company have the right to receive their share of the profits not only in monetary terms, but also in kind.

The method of payment is not specified in the charter. The law does not require payments only in monetary terms. After the decision is made, the form of payment is indicated.

Forms of dividend payment from the director's point of view

— The classic option is payment in cash, cash or non-cash. If this point is important for owners, shareholders and participants, then it would not be superfluous to indicate in the minutes of the general meeting in what form and manner the dividends will be paid.

For owners who are accustomed to receiving dividends in cash from the cash register, there are subtleties and limitations. Our legislation and the documents of the Central Bank, which regulate cash transactions, do not allow the payment of dividends from cash proceeds received at the cash desk of the enterprise. Withdrawals can only be made from funds that were specifically received from the bank or from other amounts that were returned to the company's cash desk in various ways.

— Payment is not in cash, but in the form of property owned by the company (in the form of fixed assets, materials, finished products, accounts receivable, securities, claims). That is, any assets that are on the balance sheet of the enterprise and are recorded in the financial statements approved by the participants.

This issue is quite troublesome and more expensive from a tax point of view. According to the Ministry of Finance and the Federal Tax Service, the payment of dividends with any property other than money is recognized as a sale. From the point of view of Art. 39 of the Tax Code of the Russian Federation, sale is recognized as a change of owner of goods, works, and services. When paying dividends, for example, with fixed assets, the original owner was the enterprise, and the new owner becomes an individual. The status of this property changes, sales arise and, as a consequence, the tax base. If we are talking about the general taxation regime, then VAT and income tax appear. If we are talking about a simplified taxation system, then additional income appears here.

If we are talking about UTII, then the situation here is more subtle. Depending on what type of activity the enterprise transferred to UTII carries out, most likely, the property transfer operation will not fall under this type. That is, under a transaction of alienation of property and transfer of fixed assets, the enterprise will not be on UTII, but on the general taxation regime or on a simplified one, if there is permission to use the simplified tax system.

The distribution of dividends on UTII will be relevant only until the end of 2020. From January 1, 2021, this regime will be canceled.

Therefore, before deciding to pay non-cash dividends, be sure to clarify this issue with your accountants, auditors or lawyers so that you understand how much such dividend payment will cost the company.

Time frame for making a decision on the payment of dividends to the sole founder

The frequency of distribution of profits between participants established by clause 1 of Art. 28 of Law No. 14-FZ, shows that the payment of dividends does not depend on the fact whether the annual balance sheet is approved or not.

But at the same time, most often the founders prefer to receive income based on the results of the year, when the financial result is determined. Therefore, the issue of division of profits is brought up for discussion at the next meeting dedicated to reviewing the results of the LLC’s activities for the past year.

The annual meeting is held within certain deadlines, which the sole owner is obliged to observe when making similar decisions. According to Art. Law No. 14-FZ, the meeting is held from March 1 to April 30 of the year following the end of the year. But due to the pandemic and the difficult economic situation in 2020, this period was extended: the results of 2020 are summed up in the period from March 1 to September 30, 2020 (Clause 4 of Article 12 of the Federal Law of 04/07/2020 No. 115-FZ) . Read more about the date and timing of approval of annual reports in 2020 here.

Conclusion: if the only participant wants to make a decision on the payment of dividends, while simultaneously approving the annual report, he is obliged to take into account the deadlines established for the next meeting of the founders.

Distribution of net profit of previous years and payment of dividends from it

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

There are no restrictions or problems for the company, because all net profit can be distributed in accordance with the decisions of the owners. It is advisable to note this point in the minutes of the general meeting at which the decision on the distribution and payment of dividends is made. It is better to directly indicate: “based on the results of a certain reporting period, for 2020, such and such net profit was received. As of the reporting date, December 31, 2020, the enterprise also has retained earnings from previous years in such and such an amount.”

Next, a decision is made to distribute all the net profit that is reflected in the balance sheet: that which was received during the reporting period, and that which remained at the disposal of the enterprise from previous years. Indicate the numbers directly and reflect what share of net profit is used to pay dividends.

Accountant

The first thing the chief accountant must do is to reflect the company's debt to pay dividends to its shareholders, participants or owners. The amounts must be calculated and calculated for each participant. The wiring depends on the situation:

- the participant is employed in the company - Dt 84 Kt 70;

- the participant does not work in the organization or is a legal entity - Dt 84 Kt 75.

The posting reflects the accrual of dividends based on the decision of the general meeting. Without a paper version of the minutes of the general meeting, which confirms the decision on the distribution of dividends, this posting cannot be made. Therefore, the posting must be generated on the date of signing the corresponding payment protocol.

After the entry appears in the enterprise’s balance sheet, accounts payable arises as a liability to participants in the payment of dividends. Turnover in the debit of account 84 reduces net retained earnings, which is recorded in section 3 “Balance”. The source of payment of dividends is net profit, the economic meaning and legal nature of this operation is fully consistent with reality and does not contradict the law.

Forms of dividend payment from an accountant's point of view

— Let's consider the classic option, when dividends are paid in cash.

Dt 75 (70) is credited with personal income tax account 68, because in this case the enterprise that is the source of payment of dividends is recognized as a tax agent in accordance with Art. 226 Tax Code of the Russian Federation. The tax agent is obliged to withhold and transfer to the budget the withheld amount of personal income tax.

In accordance with Art. 224 of the Tax Code of the Russian Federation, the tax rate on income received by an individual in the form of dividends is set at 13% for residents and 15% for non-residents of the Russian Federation. Of the total amount due for dividends, part must be given to the state in the form of a tax - this operation is reflected in the first entry.

The remaining amount, 87%, is paid to the shareholder, participant, owner of the enterprise in cash, non-cash or through the cash register. Therefore, the posting is generated with correspondence: Dt 75 (70) and Kt 50 (51).

After the first two entries are generated, the accounts payable for the payment of dividends on account 75 or 70 is completely closed. After paying the tax and transferring it to the budget (third entry - Dt 68.NDFL, Kt 50 (51)), the company fulfilled all obligations to the owners of the company and to the state in terms of withholding and transferring the amount of income tax.

— Another option for paying dividends is payment from the property of the enterprise. If the general meeting decided to pay dividends by transferring fixed assets or materials to shareholders, then the disposal of these assets must go through 91 accounts. We reflect these operations like this:

1) Dt 75 (70), Kt 91.1. Here correspondence is made on the cost of fixed assets, materials, including VAT. VAT is taken into account in cases where property is transferred in companies applying the general tax regime.

2) Dt 91.2, Kt 68.VAT. Posting for the amount of VAT. Used when the general taxation regime is applied.

3) Dt 91.2, Kt 01 or 10 accounts. This reflects the book value of materials or the residual value of fixed assets.

Why 91 counts? These are other income and expenses of the enterprise, because the disposal of fixed assets, materials, that is, assets not intended for further sale, is carried out through the 91st accounts, and not through the 90th.

If dividends are paid by transfer of goods or finished products, then the disposal of these assets should be reflected in the sales accounts. Therefore, in this case the 90th count will be used. Here are examples of wiring:

- Dt 75.2 (70), Kt 90.1. The cost of goods and finished products is reflected, including VAT.

- Dt 90.3, Kt 68 VAT. Posting for the amount of VAT.

VAT arises if the general tax regime is applied. It may arise when paying dividends at an enterprise that continues to use UTII in 2020, depending on what is transferred. If goods intended for retail sale are transferred, then VAT does not arise, because such a transfer falls under the definition of retail sale, will be included in retail turnover and will be included in the type of activity that the enterprise uses on UTII.

- Dt 90.2, Kt 41 or 43. Write-off of the book value of goods or finished products.

When paying dividends in non-cash form, the company (the source of the payment) remains obligated to withhold tax because it is a tax agent. On the other hand, the company does not have the physical ability to do this. If the payment is made in kind, there is no money on which tax can be withheld. It is impossible to recover these amounts in any other way, especially if the founder, shareholder or owner are not employees of the company.

The source of payments - the enterprise (tax agent) is not able to withhold income tax on such dividends, therefore the company is obliged to send a notice within a month about the impossibility of withholding income tax to the tax office at the place of registration of the individual to whom the dividends are paid and at the place of its own registration . In this situation there will be no claims against the company. Having received such information, the tax authorities will independently contact the individual and demand payment of the due amount of tax.

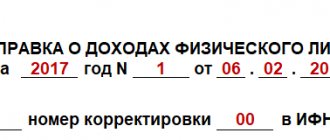

If a company pays dividends in cash (in cash or non-cash form), then it has the obligation to calculate tax, withhold it, transfer it to the budget and, at the end of the year, before March 1, submit information about the amounts paid in favor of individuals in form 2-NDFL, where you need to indicate the amount of dividends paid. The personal income tax rate is 13%; no additional taxes need to be paid on these amounts.

Contributions to extra-budgetary funds, in particular to the pension fund and the Social Insurance Fund, are not withheld from dividends paid. Since, in accordance with 212-FZ, the basis for calculating contributions in particular to the pension fund are:

- payments within the framework of labor relations,

— payments under GPC agreements providing for the performance of work or provision of services (contractor agreement and fee-based service agreement).

The chief accountant must be able to clearly identify payments to company employees. If money is paid on the basis of an employment contract and a person receives it for performing work duties, then these are payments within the framework of the employment relationship. They are subject to contributions to extra-budgetary funds.

Dividends cannot be classified as such payments, because they are paid to individuals regardless of how well or poorly they performed. Payment of dividends is the distribution of net profit that remains after paying all taxes. Even those company owners, shareholders and participants who are employees and often managers of the company receive dividends not for the results of their work, but for the results of the activities of the entire company, because:

1) the profit remained at the disposal of the company

2) net profit is the result of the activities of not only the manager

This means that the payment of dividends is not a payment within the framework of the employment relationship. That is why dividends are not subject to contributions to extra-budgetary funds. The FSS mentioned this several times in letters.

How to pay dividends in 2020?

Let's consider the procedure for paying dividends for an LLC

02/19/2018Russian tax portal

Author: Tatyana Sufiyanova (tax and duties consultant)

2020 has ended and based on its results, each company has the right to distribute net profit (after paying all taxes) among the founders. As we know, when creating a company, each participant in a limited liability company contributes his share to the authorized capital. Payment for the share is made in money, securities, other things or property rights or other rights with a monetary value.

When the profit of an enterprise is distributed, each member of the LLC receives a part of this profit in proportion to his share contributed when registering the company. And this kind of income is called a dividend. In other words, dividends are the income that members of an organization receive when distributing profits remaining after taxation.

It is necessary to determine the amount of net profit of an LLC only based on accounting data.

Frequency of profit distribution and receipt of dividends

The company has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among participants.

Documents for profit distribution:

1) Decision of a single participant (if the company has only one founder);

2) Minutes of the general meeting of company participants;

3) Order on the accrual and payment of dividends based on the results of the year.

The decision to determine the part of the company's profit distributed among the participants must be made by the general meeting of the company's participants. The portion of LLC profits intended for distribution among the founders is distributed in proportion to their shares in the authorized capital of the company.

The charter of the enterprise may establish a different procedure for the distribution of profits between participants.

Term and procedure for payment of dividends

The payment period is determined by the charter of the LLC or a decision of the general meeting of participants. The period should not exceed 60 days from the date of the decision on the distribution of profits between the company's participants. If the payment period is not determined, the specified period is considered equal to 60 days from the date of the decision on the distribution of profits between the company's participants.

Formula for determining the dividend amount

In order to correctly calculate the amount of dividends for a specific founder, it is necessary to multiply the amount of net profit by the percentage share of this founder in the charter capital of the company.

For example, two individuals are founders of an organization (limited liability company), whose shares are: Ivanov I.O. – 25%; and Severinov I.P. – 75%. Let’s say the company’s net profit, which is distributed at the end of 2020 among participants, amounted to 263,000 rubles. The dividend calculation will be as follows:

1. For Ivanov I.O. = 263,000 x 25% = 65,750 rubles.

2. For Severinov I.P. = 263,000 x 75% = 197,250 rubles.

Reason: Article 28 of the Federal Law of 02/08/1998 No. 14-FZ (as amended on 12/31/2017) “On Limited Liability Companies”.

Tax on dividends

The tax, its amount and tax rate depend on who acts as the founder.

1) Individuals - tax residents of the Russian Federation - must pay personal income tax at a rate of 13%.

2) Individuals who are not tax residents of the Russian Federation must pay personal income tax at a rate of 15%.

3) Russian organizations - it is necessary to pay income tax at a rate of 13%. Please note that if a company that pays dividends works, for example, under the simplified tax system, it is obliged in this case as a tax agent to pay income tax. For example, this company was founded by two individuals and one Russian organization. It turns out that two participants (citizens) need to pay dividends and pay personal income tax, and one – the organization – needs to pay dividends and pay income tax.

4) Foreign companies – it is necessary to pay income tax at a rate of 15%.

5) A profit tax rate of 0% is also applied. This rate applies to the founder – organization. As stated in sub. 1 clause 3 art. 284 of the Tax Code of the Russian Federation, 0% is applied to income received by Russian organizations in the form of dividends, provided that on the day the decision to pay dividends is made, the organization receiving dividends has continuously owned at least 50 percent of the contribution for at least 365 calendar days ( shares) in the authorized (share) capital (fund) of the organization paying dividends or depositary receipts giving the right to receive dividends in an amount corresponding to at least 50 percent of the total amount of dividends paid by the organization.

It should be remembered that when calculating personal income tax for an individual, tax deductions cannot be taken into account. If we are talking about dividends, then tax deductions do not reduce the amount of the tax base.

Tax payment deadline

1. If personal income tax has been accrued and withheld, then it should be transferred on time - no later than the day the dividends are received.

2. If income tax has been calculated and withheld, it must be remitted on time - no later than the next day after the dividends are paid.

Insurance premiums and dividends

Insurance premiums are not charged on the amount of accrued and paid dividends. The fact is that such payments are not payments under employment or civil contracts.

Dividend reporting

1. If personal income tax was paid, you must submit a 2-personal income tax certificate at the end of the year (as is done when paying wages for employees).

2. If income tax has been paid, you must fill out and submit an income tax return. The declaration must be submitted no later than the 28th day of the month following the expired reporting period in which dividends were paid.

Accounting entries for dividend payments

Debit 70 Credit 51 – payment of dividends to the current account to the founder (employee).

Debit 75 Credit 51 – payment of dividends to the current account to the founder (who is not an employee).

Debit 70 Credit 68 – personal income tax is withheld from the amount of dividends paid to the founder (employee).

Debit 75 Credit 68 – personal income tax is withheld from the amount of dividends paid to the founder (who is not an employee).

Debit 75 Credit 68 – income tax is withheld from the amount of dividends paid to the founder (organization).

Restrictions on profit distribution

An enterprise does not have the right to make a decision on the distribution of its profits among the participants of the company:

– until full payment of the entire authorized capital of the company;

– before payment of the actual value of the share or part of the share of a company participant;

– if at the time of making such a decision the company meets the criteria of insolvency (bankruptcy).

Dividends for an entrepreneur

An individual entrepreneur does not need to distribute profits or pay profits to himself. The fact is that the individual entrepreneur himself is the owner, who has the right to dispose of his profit as he needs.

Post:

Comments

Nina

February 10, 2020 at 8:50 am

could I take away the divertenta???????

How much taxes do you need to pay before you get a net profit?

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

Here you can compare different tax regimes. Under the general taxation regime, the profit tax rate is 20% of the profit received by the company as a whole from financial and economic activities. Let’s compare this, for example, with the rate provided for the simplified tax system with the tax object “Income minus expenses.” The general rate is 15%. The price of dividends in the first and second cases is different, because in order to distribute dividends under the general taxation regime, you need to pay 20% to the state, and under the simplified taxation regime - only 15%.

If we talk about UTII, it is difficult to say how much interest you need to pay in order to distribute dividends, because the amount of tax on UTII does not depend on revenue, income, expenses, but depends on the financial result. Knowing the amount of this tax, seeing the result of financial and economic activities, it is also possible to calculate the tax burden. It will not exceed the amounts provided for the general taxation regime.

Thus, if a company is under special tax regimes (STS, UTII), the tax burden when paying dividends is significantly lower than for situations where the company is under a general taxation regime.

Frequency of dividend payments

Russian corporate legislation provides for several options for paying dividends: quarterly, half-yearly and year-end. If the managers of your company are interested in the option in which dividends will be paid quarterly, then the chief accountant must warn them about the risks that arise in this regard.

1) The charter must provide for quarterly distribution of profits and payment of dividends. Each fact of distribution of net profit and direction for payment of dividends must be recorded and recorded on paper; there must be a decision of the general meeting.

2) Let us recall that dividends are the distribution of net profit remaining after paying all taxes. With quarterly payments, a situation may arise that based on the results of the 1st, 2nd and 3rd quarters, the company constantly distributed profits, but at the end of the year received a loss.

In this case, payments that were made during the year, based on the results of the first quarter, half a year and 9 months, will be reclassified by the tax authorities as payments from net profit. They will need to pay not only personal income tax at a rate of 13%, but also contributions to extra-budgetary funds at a cumulative rate of 30%, because at the end of the year there was a loss, and the amounts paid cannot be dividends.

The accounting department should voice this idea to shareholders so that they understand that if they want to pay themselves dividends more often than once a year, then they need to ensure that the company ends each year with a profit. Otherwise, there will be an additional tax burden on the enterprise and directly on shareholders.

3) Since the net profit that remains with the enterprise is the property of this company and the property of the shareholders, then the shareholders, participants, owners of the enterprise can dispose of this money as they please. In particular, a decision may be made on a disproportionate distribution of net profit.

For example, an LLC has two owners, each of whom owns 50%. They may decide on a disproportionate distribution, for example, in the ratio of 90 and 10. However, the amount in excess of its share will no longer be recognized as dividends, because dividends are part of the net profit to be distributed in accordance with the share that belongs to the shareholder, owner or participant.

As a result, of the 90 received, only 50 rubles are dividends; personal income tax must be paid on them at a rate of 13%, and contributions to extra-budgetary funds do not need to be paid. An amount of 40 rubles is recognized as payment from net profit. Personal income tax is withheld from it at a rate of 13%, and contributions are paid to extra-budgetary funds at a cumulative rate of 30%.

How to calculate net profit for dividend payment

Before talking about calculation methods, it is important to determine what a company's net profit is. The answer to this question will depend on what tax regime the company applies. For companies on OSNO, net profit is all profit received at the end of the period, minus income tax. Those business entities that apply special regimes must determine the amount of net profit as the profit remaining in the company after paying unified taxes to the budget (STS, Unified Agricultural Tax, UTII).

In addition to the very fact of profit, in order to justify the calculation of dividends, the following conditions must be met (Article 29 of Law No. 14-FZ of 02/08/1998):

- The company should not be in the process of bankruptcy, or signs of bankruptcy should not appear after the payment of dividends;

- The authorized capital must be paid in full;

- At the end of the reporting period, a positive result was achieved, since if there is an actual loss, dividends are not paid;

- The company's net assets should not be less than the amount of its authorized capital and reserve fund, or should not become less than this amount after payment of dividends.

How to determine net profit from dividend payments? As a result of activities in an organization, a profit can be made (revenues exceed expenses) or a loss (revenues are less than expenses). If a company makes a profit, it is subject to taxation. The amount of assets that remains at the disposal of the company after paying all taxes is its net profit. And it is this amount or part of it that the organization’s participants (shareholders) have the right to pay in the form of dividends. Payment of dividends for previous periods is allowed if profits were not previously distributed.

Example

For 2020, Aurora LLC, operating at OSNO, has the following performance indicators:

Profit Income tax (20%) Net profit 250000 250,000 x 20% = 50,000 250 000 – 50 000 = 200000 The authorized capital of the LLC is 150 thousand rubles, a reserve fund was not created, the value of net assets is 490 thousand rubles.

If the entire amount of net profit is used to pay dividends, the size of net assets will remain higher than the authorized capital (490,000 - 200,000 = 290,000). Thus, net profit at the end of 2019, from which dividends can be paid, will be 200,000 rubles.

The amount of net profit is reflected in the financial statements of the organization, namely in the “Statement of Financial Results” on line 2400.

The main document for the calculation of dividends is the minutes of the meeting of participants or the decision of the sole founder, on the basis of which the accounting department will be able to reflect the fact of distribution of profits and accrual of dividends in accounting.

Dividends will be calculated in proportion to the share of each participant in the company.

Let's continue with the example. At the end of 2020, Aurora LLC received a net profit of 200,000 rubles. The general meeting of founders decided to distribute all this profit among the participants in proportion to their shares in the management company.

Dividends for 2020 Share in the authorized capital Dividend amount Samokhin A.I. 45 % 200,000 x 45% = 90,000 Ulyanov D.V. 35 % 200,000 x 35% = 70,000 Petrenko A.M. 20% 200,000 x 20% = 40,000

Participants may decide that only a portion of the net profit should be distributed among them, or not distribute it at all.

Federal Law “On Limited Liability Companies” No. 14-FZ dated 02/08/1998 (Article 28) determines the ability of companies to pay dividends once a quarter, six months or a year. The chosen company option should be approved in the organization’s Charter. Having made a decision on the distribution of net profit, the company must make the payment no later than the expiration of 60 days from the date of signing the protocol (or the decision, if there is only one participant in the company).

How to reduce your tax burden with dividends

If the company’s employees are also its founders, then part of the income can be paid to them in the form of dividends. Only 13% income tax will need to be withheld from the amount issued; you will not have to pay contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

It is not possible to reduce income tax through dividends. Since, in accordance with the Tax Code of the Russian Federation, dividends are not recognized as expenses when calculating income tax.

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

Taxation of income

Dividends for participants who are individuals are subject to income taxes. The recipient of dividends will be subject to income tax if he is a legal entity.

Limited liability companies are sources of income for individuals. The company is positioned as a tax agent that individually determines the amount of income tax for each founder. The tax base is not the total amount of income from profit, but the difference between its value and the amount of income received by society.

Tax is withheld after the transfer of income from profits to the founders. Personal income tax is sent to the budget before the founders receive their share in the bank.