Legislation regarding wages

The Labor Code of the Russian Federation states that the employer is obliged to pay wages every half month and must familiarize the employee with the procedure for payments and accruals. At the same time, when paying employees the required funds twice a month, the employer must pay half the salary, although in practice many prefer to set a fixed amount or a percentage of the fixed salary and make payments in this way.

The laws of the Russian Federation annually establish the level of the minimum wage. Below this amount, the employer does not have the right to pay the employee, he also does not have the right to limit the maximum wage - all allowances, incentives, etc. must be accrued above the established minimum. Otherwise, the law does not limit employers; they have the right to independently determine:

- wage system;

- type of remuneration;

- salaries and tariff rates;

- order and amount of bonuses.

All decisions of the employer regarding wages must be recorded in the internal documents of the enterprise: internal labor regulations, employment contract, collective agreement, Regulations on bonuses, Regulations on remuneration and the like. Every employee of the enterprise must be familiar with these documents.

Back to contents

Is it necessary to review the wage regulations every year?

The wage regulations can be approved by the employer once and be valid without a time limit (indefinitely). The legislation does not establish any specifics for the validity period of such a document.

The need for an annual review of the regulations may arise in cases where the employer is developing new types of activities involving workers of various professions, for which a revision or addition of existing SOT and incentive payments is necessary, or working conditions are changing.

The employer and employees are interested in keeping their internal local acts up to date and must promptly initiate their revision, including the provisions under consideration.

We will tell you what to indicate in the order approving the wage regulations here.

Concept of salary and wages

You should also distinguish between wages and salary. Salary is the amount that is established for the employee according to the staffing table and constitutes, as it were, the main part of the salary, and the salary itself is what is accrued to the employee, taking into account all the required allowances and deductions, for example, such as:

- personal income tax;

- bonus for length of service;

- regional coefficient;

- bonuses based on the results of the billing period;

- additional bonuses due to a professional holiday or other reason;

- withholding funds that the employee did not hand over to the cashier on time or must compensate for material damage caused to the enterprise;

- social payments.

etc.

Back to contents

Main types of wages

The two main types of wages are basic and additional wages.

1. The basic salary is the salary that is accrued to the employee for the time actually worked, taking into account the quality and quantity of work performed, taking into account additional payments for work at night and overtime, as well as payment for periods of downtime that occurred through no fault of the worker. This type of payment is made at piece rates, salaries, bonuses and tariff rates

2. Additional wages are the following types of payments:

- payment for regular calendar holidays;

- payment for breaks at work for nursing mothers;

- payment of preferential hours for minors while performing public or government duties;

- payment of severance pay upon dismissal;

- other payments for unworked time provided for by labor legislation.

Back to contents

Types of wages by amount of labor and time

The two main forms of remuneration that are used in most enterprises are:

- time wages;

- piecework wages.

Some enterprises use a mixed form of remuneration.

Back to contents

Time salary

Time wages are wages for actual hours worked.

As a rule, such a system is used when there is no question of production, when it is impossible to determine the results of labor activity in any quantitative equivalent, for example, if we are talking about a manager.

The amount of wages for a time-based form depends on:

- tariff rate;

- actual time worked.

That is, if an employee’s salary is 5,000 rubles and the number of working hours per week is 40, but in one week he worked not 40 hours, but 20, his salary will decrease.

Tariff rates for time-based payment are determined by working time units and can be as follows:

- sentries;

- daytime;

- period.

Forms of time wages can be as follows:

- simple time-based - with this form, the established hourly rate of the employee, assigned to him by category (experience, position), is multiplied by the number of hours actually worked (taking into account an overtime premium if necessary);

- time-based-bonus - with this form of remuneration, earnings are calculated in the same way as indicated above, but a bonus is added to it, which is a certain percentage of the tariff rate.

Back to contents

Piece wages

Piece wages are wages for certain standardized indicators of output and time. When a worker produces a specific good or service (for example, the sale of a product) that can be counted in a digital equivalent, a piece-rate wage system is used. Payroll is calculated according to the rates established by the enterprise for work or services performed. In order to calculate prices, the worker’s hourly wage rate in accordance with his category is divided by the hourly production rate or multiplied by the time standard established at the enterprise in days or hours. Then this found price amount is multiplied by the amount of products produced by the employee and the resulting figure is paid to the employee.

Piece wages can have the following forms of remuneration:

- direct piecework - in this case, wages are paid on the basis of firmly established piecework rates, depending on the number of goods manufactured or services performed;

- piecework-progressive - the calculation procedure for this form is the same as indicated above, but if the employee exceeds the standard established by the enterprise, the payment increases;

- piecework-bonus - this form of remuneration provides for bonuses to the employee. And not only, for example, for exceeding the established norm, but also for achieving a certain quality: reducing production costs, waste-free production, production without defects, and so on.

Back to contents

Time wages – when to use them

In most cases, the employer tries not to complicate, but to simplify everything for himself.

Time wages are used where there are problems with determining the specific amount of work that an employee has performed. In this case, the calculation is based on the time that was worked by him.

Important! The amount of paid labor depends on two additional factors - working conditions and the qualifications of the employee.

Payment to employees is calculated on the basis of a tariff system (rates by day or hourly). But specialists, as well as employees, receive it a little differently - it is calculated based on official salaries.

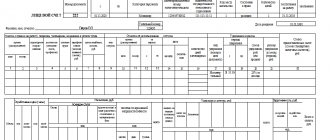

The primary document for calculations is a time sheet, where many things are noted: work time for the week, the time when the worker was absent, as well as the reasons for absence.

Important! You rarely see this system in its pure form anywhere. Most entrepreneurs prefer piecework wages.

Part-time salary

According to the law, a part-time worker is the same employee of the enterprise as the main employee: he signs the same employment contract, he is subject to internal labor regulations, labor safety standards and job descriptions, he has the same rights and obligations as all other people who work in the same enterprise as him. Therefore, with regard to wages, a part-time worker has the same rights as the main employee, with the exception of one nuance: according to the law, the number of working hours of a part-time worker should not exceed half of his working hours at the main place of employment. Consequently, if the enterprise has established time-based wages, the part-time worker will receive wages for the hours actually worked, that is, less than the main employees of the enterprise in the same positions.

If the enterprise has established a piece-rate form of remuneration, the salary of a part-time worker may ultimately be even higher than the salary of the main employees - the legislation does not directly allow this, but the Labor Code states that the employer has the right to independently establish the form of remuneration at his enterprise . This remuneration option is somewhat risky, because if the main employees compare salaries and find out that it is clearly not in their favor, they can file a complaint with the labor commission, and the employer will have to prove the legal grounds for their decision.

Back to contents

Piecework wages - when applied

Today, many commercial organizations prefer piecework wages (hereinafter for simplicity - SOT). This form of payment can be found where productivity comes first, because the more production, the higher the salary.

However, this form of remuneration is not possible in all professions. There are a number of positions where this is not possible. For example:

- accountants;

- administrative and economic staff;

- personnel officers.

In all of these professions, it is simply impossible to find and calculate certain indicators.

Interesting!

It is with piecework SOT in production that many questions arise.

Straight

The meaning of direct COT is to pay at a predetermined level of prices per unit of product or service.

This payment scheme is the reason for creating interest in increasing one’s own productivity, but not in the quality of products. In addition, there is a point with the rationalization of the use of resources.

This system is often combined with the issuance of bonuses for meeting and exceeding production targets.

Important!

Direct piecework COT, as a rule, is considered quite simple and quite effective.

Piece-bonus

According to this SOT, the employee, in addition to salary, is paid a bonus for performance above the targets. A bonus is assigned to an employee taking into account a number of indicators, which are listed below:

- increase in production volume;

- increasing labor productivity;

- improving the final quality of products;

- rational use of materials and raw materials.

As a rule, it is this kind of COT that allows you to motivate employees to improve the quality and increase the quantity of the finished product.

Piece-progressive

Work under this scheme is paid at the basic piece rate, but when performing a super task - at an increased level of this type of rate.

For example, the norm can be considered to be the production of about one hundred products in one month. Then for each subsequent product they pay at a higher rate.

Example

. At a furniture factory, the norm was set at one hundred products in one month. It was also indicated there that they pay five hundred rubles for one product. For each product that has crossed the line of the norm, they pay an increased rate of eight hundred rubles. Avdeev produced one hundred and ten products in a month. It turns out that his salary was as follows: 100*500 + 10*800 = 58 thousand rubles.

Indirect piecework

Here, the employee’s salary level directly depends on how the employee he served worked.

This system is used for support personnel involved in a number of technological processes - we are talking about adjusters, adjusters and assistant craftsmen.

This COT will force employees to improve their ability to work with machines, increase productivity, and also teach them how to properly use available resources.

Chord

The most unusual form of payment among all others on this list. It is used when the amount of data is known in advance. According to them, a certain amount of money is assigned for a specific period of work.

Interesting! No matter how many people complete the task, the amount will not change. The scope and deadline are subject to discussion.

As a rule, the use of such SOT allows you to pay for the order after all the work has been completed. For large orders, as always, an advance payment is required. If the work is completed prematurely, they give a bonus.

Important!

Lump sum wages can be found on construction sites and repair work.

As a rule, chord HPS in enterprises is used quite rarely due to a decrease in the quality of the final product, disruption of the technical process, etc.

Salary during maternity leave

According to labor legislation, women are entitled to leave during pregnancy: 70 days before childbirth and 70 days after, while the number of days before or after childbirth may vary, but the total number - 140 - remains unchanged. In case of complicated childbirth or the birth of more than one child, the leave is extended by several more days.

Salary during maternity leave - those same 140 days - must be paid to the employee according to the average earnings (for the last calendar year) or a scholarship if the employee was an apprentice (student).

Moreover, even the unemployed who are registered with the employment service have the right to benefits, since these funds are paid from the Social Insurance Fund. If an unemployed person has not worked anywhere for more than two years before registering, or has never worked anywhere at all, the benefit is paid from the minimum wage.

In addition to the payment of earnings, state benefits are also provided for registration for pregnancy, the birth of a child and for caring for a child up to the age of one and a half years.

Back to contents

Salary for less than a month

In order to calculate wages for employees who have worked less than a full month, you need to know how the wages of these employees are paid: at an hourly rate, daily rate or monthly rate.

1. When paying at an hourly rate, the established hourly rate is multiplied by the number of hours actually worked. If a bonus is paid, it is multiplied by the established standard of hours and then divided by the number of hours actually worked.

2. When paying at the daily rate, similar payments are made at the hourly rate, only multiplied by the number of days worked. The bonus, if any, is calculated in the same way.

3. When paying at a monthly rate, you first need to calculate the average daily earnings: the established salary must be divided by the number of working days in the month. The resulting average daily indicator is multiplied by the number of days actually worked in the month. The premium is calculated in the same way.

It should be noted that when an incomplete month has been worked, bonuses are usually not awarded, but the employer has the right to establish other standards at his enterprise.

If the enterprise uses a piece-rate form of remuneration, wages are calculated depending on the employee’s production rate for the billing period.

Back to contents

Material motivation of employees

Well, okay, we agreed on the salary with the applicant, and he was hired. Now the worst thing you can do is pay him the agreed amount without any adjustments. Even if this amount is quite large, it very soon ceases to motivate. They quickly get used to any money, and even more so to big ones. Sooner or later the moment will come when the employee declares that he will not care about the previous payment. Therefore, salary is not as important as its direct dependence on labor results. To put it simply: if you worked well, you got more. I worked so-so - less. No one will rush if it does not affect the salary.

Therefore, we need a system of material motivation - both positive and negative:

- awards for good work. Can be linked to a sales plan. If the manager fulfills the plan, he receives a bonus. Exceeded it several times - its size adequately increases. You can also award bonuses based on the performance of the department as a whole. If a department excels, all its employees, including the manager, receive bonuses. There is no need to indulge - it is enough to do it once a quarter;

- percentage of sales. The holy of holies (and at the same time, the pain) of all sales managers. The idea is as simple as a Christmas tree: a person receives a fixed salary (usually small) and a certain share of the amount of closed transactions. This percentage varies depending on the specifics of the activity and can range from 5 to 50%. There is a direct motivation here: sold more, earned more;

- profit bonuses. They are successfully used everywhere: from Soviet-style industrial enterprises to small online stores. The idea is this: if the company makes a profit at the end of the month, then the money is distributed among all employees. Also, as in the previous paragraph, employees have fixed salaries. And at the end of the month a bonus is added to them, for example, 50% of this same salary. If the salary is 30 thousand rubles, then with a bonus of 50 percent the calculation will be 45 thousand. Minus 13% income tax;

- fines, where would we be without them? Negative motivation is also necessary. Just remember: direct fines are prohibited by law. They can punish you for this if the employee complains to the right place. Especially if the salary after the fine falls below the minimum wage. Therefore, you need to punish skillfully. A reason is required: violation of labor discipline, mistakes in work, and so on. It is necessary to take an explanatory note from the person and prepare an order for deprivation of the bonus. And before that, draw up a violation report with the signatures of witnesses (at least 2 people). Only a fine issued in this way will be considered legal. Everything else is from the evil one and can be challenged in court.

Projects of salary forms

Since today's legislation provides for the payment of wages strictly twice a month, no more and no less, which may not be entirely convenient for both employees and employers, drafts of other forms of remuneration are periodically submitted to the State Duma.

For example, in many countries around the world there is an hourly wage. It is believed that such a norm is more conducive to developing the potential of the country’s economy, and workers perform their job duties better when they know how to evaluate a unit of their working time. It is difficult to introduce such a norm on the territory of the Russian Federation, although projects have been discussed since 2000.

Also, a bill requiring weekly wages was also discussed several times. Experts believe that in this way the turnover of funds will be significantly increased, which will have a beneficial effect on the economic situation as a whole.

Was the information interesting or useful?

Yes122

No32

Share online