Updated fuel consumption standards.

All types of fuel are written off based on their actual consumption, but not higher than the approved fuel consumption standards.

The consumption standards for fuel and lubricants in road transport are established by Methodological Recommendations put into effect by Order of the Ministry of Transport of the Russian Federation dated March 14, 2008 No. AM-23‑r (hereinafter referred to as Order No. AM-23‑r, Methodological Recommendations). According to these recommendations, the fuel consumption rate in relation to road transport implies the established value of the fuel consumption rate when operating a vehicle of a specific model, brand or modification. The standards are intended for calculating the standard value of fuel consumption at the place of consumption, for maintaining statistical and operational reporting, determining the cost of transportation and other types of transport work, planning the needs of organizations to provide petroleum products, for calculating the taxation of enterprises, implementing a regime of economy and energy saving of consumed petroleum products, conducting settlements with vehicle users, drivers, etc.

It is worth noting that from April 6, 2020, these standards have been updated for some cars and trucks (buses, vans) of domestic production and the CIS countries, which have been produced since 2008. Also, from this date, the new edition contains the maximum values of winter surcharges to fuel consumption standards for the constituent entities of the Russian Federation and their parts. The changes were made by Order of the Ministry of Transport of the Russian Federation dated 04/06/2018 No. NA-51‑r.

Are autonomous institutions obliged to apply the standards of fuels and lubricants established by Order No. AM-23-r? To be guided by Order No. AM-23‑r, the following is prescribed:

- Ministry of Justice - for the purpose of organizing the operation of vehicles (Letter dated September 21, 2009 No. 03-2609);

- Ministry of Finance - when determining the validity of expenses incurred for the purchase of fuel (letters dated January 27, 2014 No. 03-03-06/1/2875, dated January 30, 2013 No. 03-03-06/2/12, dated June 3, 2013 No. 03-03 ‑06/1/20097, dated 09/03/2010 No. 03‑03‑06/2/57, dated 01/14/2009 No. 03‑03‑06/1/6).

At the same time, it should be taken into account that the norms established by Order No. AM-23-r are advisory in nature, and failure to comply with the procedure provided for therein does not entail the application of administrative liability measures and budget coercive measures, orders to eliminate violations of budget legislation (Letter of the Ministry of Finance of the Russian Federation dated 13.12 .2013 No. 02‑10‑010/55111).

If Order No. AM-23‑r does not establish fuel and lubricant standards for a vehicle used in an institution, how to justify fuel consumption? In accordance with paragraph 6 of the Methodological Recommendations for models, brands and modifications of automobile equipment for which the Ministry of Transport has not approved fuel consumption standards, heads of local administrations of regions and organizations can put into effect by their order standards developed on individual applications in the prescribed manner by scientific organizations, carrying out the development of such standards using a special program-method. Before the adoption of a local act approving the standards, the institution can be guided by the relevant technical documentation and (or) information provided by the car manufacturer (letters of the Ministry of Finance of the Russian Federation dated July 11, 2012 No. 03-03-06/4/71, dated June 10, 2011 No. 03-03 ‑06/4/67).

What is fuel and lubricants

Fuel and lubricants is a generally accepted abbreviated name for a group of fuels and lubricants. These include:

- various types of fuel (diesel, gasoline, gas);

- special fluids for vehicles (brake, cooling);

- oils and lubricants (motor oils, transmission oils, various lubricants, etc.).

Fuel and lubricants can be used by both specialized transport enterprises and ordinary companies that have vehicles used for various needs.

Waybills are the basis for writing off fuel and lubricants.

Each fact of economic life is subject to registration with a primary accounting document. Primary documents serve as the basis for accepting the fact of economic life for accounting.

The main primary document for the purpose of accounting for the operation of official vehicles and the write-off of fuel and lubricants is the waybill. Properly issued waybills are accepted for registration.

Mandatory details and the procedure for filling out waybills are approved by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152 (hereinafter referred to as Order No. 152). According to this document, the mandatory details of the waybill include the following:

| Required details | Explanations |

| Name and number of waybill | The name reflects the type of vehicle for which the waybill is issued (passenger car waybill, truck waybill, etc.). The waybill number is indicated in the heading part in chronological order in accordance with the numbering system adopted by the vehicle owner |

| Information about the validity period of the waybill | Such information includes the date (day, month, year) during which the waybill can be used, and if the waybill is issued for more than one day - the dates (day, month, year) of the beginning and end of the period during which waybill can be used |

| Information about the owner (owner) of the vehicle | The name, legal form, location, telephone number, main state registration number of the legal entity are reflected |

| Vehicle information | Such information is indicated: – type of vehicle (passenger car, truck, bus, trolleybus, tram) and model of the vehicle, and if the truck is used with a car trailer, car semi-trailer – model of the car trailer, car semi-trailer; – state registration plate of the vehicle; – odometer readings (full kilometers) when the vehicle leaves the garage (depot) and enters the garage (depot); |

| – date (day, month, year) and time (hours, minutes) of the vehicle’s departure from its permanent parking place and its arrival at the parking lot; – date (day, month, year) and time (hours, minutes) of pre-trip control of the technical condition of the vehicle (if its mandatory implementation is provided for by the legislation of the Russian Federation) | |

| Driver information | The driver's full name is reflected, as well as the date (day, month, year) and time (hours, minutes) of the driver's pre-trip and post-trip medical examinations |

In addition to the listed details, additional details may be placed on the waybill, taking into account the specifics of activities related to the transportation of goods, passengers and luggage by road.

Currently, there are no unified forms of waybills required for use by state (municipal) institutions. Based on this, in order to determine the volumes of consumed fuel and lubricants that are subject to write-off, these institutions have the right to:

- use the forms of waybills (f. 0345001, 0345002, 0345004, 0345005, 0345007), approved by the Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machines and mechanisms, work in road transport” ( hereinafter referred to as Resolution No. 78) (Letter of the Ministry of Finance of the Russian Federation dated October 3, 2012 No. 02-06-10/4066);

- use independently developed forms of waybills, subject to the inclusion in them of the mandatory details provided for by Order No. 152 (Letter of the Ministry of Finance of the Russian Federation dated August 25, 2009 No. 03-03-06/2/161 “On the use of independently developed forms of waybills”). Moreover, it is advisable for institutions to consolidate the use of such forms in their accounting policies.

A waybill is issued for each vehicle used by a legal entity. The issuance of waybills is subject to registration in the appropriate journal. The official responsible for issuing waybills is obliged to issue a “ticket” before issuing it to the driver and register the issued document in the journal.

All changes (corrections) made to the waybill are confirmed by the signature of the driver and the person responsible for issuing the waybills.

Who is involved in drawing up the Act?

As for the employee who is directly involved in entering information into the document, he is appointed by the manager. As a rule, this responsibility is assigned to the chief accountant. An employee of the logistics department, who is responsible for all expenses of the company, can also draw up the act. In large corporations, specially appointed employees are engaged in drawing up write-off acts. Here the manager has the right to choose who exactly to entrust this procedure to.

Commission approval

The procedure for writing off fuel and lubricants, like any other property that is owned by an enterprise, begins with the creation of a special commission. There must be more than two people here. As a rule, the inspection group consists of employees who are appointed by the director using the appropriate order. Typically, the audit team includes representatives from various departments. There must also be an employee who is financially responsible for the property being written off. It is highly desirable that the chairman of the commission be appointed as the head.

Members of the inspection team, having received all the necessary documents, perform a reconciliation of expenses. Here they use certain norms that are enshrined in the organization’s charter. You also need to know that these standards may vary for different modes of transport. Naturally, they are all approved separately. If necessary, the commission carries out control visits in order to determine the real costs of fuel and lubricants as accurately as possible.

It is worth noting that if it is necessary to write off materials in a small company that is classified as a small business, there is no urgent need to create a commission. In this case, the director of the company has the right to independently register the write-off by filling out the appropriate act.

There are certain standards for each car. Based on them, responsible persons can calculate how much fuel is consumed at a specific distance. These standards were drawn up taking into account the quality of roads, climatic conditions, type of vehicle and other conditions under which operation was carried out. Typically, these norms are used in budgetary institutions and organizations that are taxpayers under the general system. In addition, managers have the right to make adjustments to the standards within certain limits. In such situations, decreasing or increasing coefficients are used. Adjustments are necessary to obtain truthful information in non-standard situations. For example, with frequent stops included in the route, more fuel is consumed. The same situation is observed in the cold season.

( Video : “Write-off of gasoline using fuel cards”)

Rules for drawing up an act for writing off fuel and lubricants in 2020

As already mentioned, there is no unified form for drawing up this act. Many people refuse to draw up a document in free form, as it is inconvenient. Companies prefer to develop their own templates for these purposes. Computer typing is usually used for filling out, although information can also be entered by hand. In this case, you need to pay attention to the readability of the text. You should try to make your handwriting as legible as possible.

Do not forget that entering false information can lead to serious problems. Troubles can arise not only for the employee who draws up the document, but also for the responsible persons. If the act contains false information, supervisory authorities may punish the head of the organization. The process of filling out the document can be considered step by step:

- In the corner of the page there should be a statement indicating that the write-off is carried out with the consent of the manager. The details of the manager, company name, and date of compilation are also indicated here.

- The title of the document is written in the center, which should briefly convey its essence.

- The members of the inspection committee are listed below. If its chairman is appointed as a director, this must also be reflected in the document. Not only the names of the commission members are indicated, but also their positions.

- It is noted in connection with which fuels and lubricants are written off, for example, “Operation of a ZIL vehicle.” The period of use of the equipment is also noted here; accordingly, write-off will occur during this period. Not only the make of the vehicle is indicated, but also its license plate number.

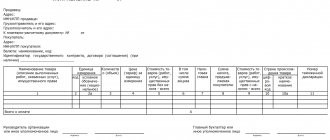

Next, complete information about the materials being written off is entered. Of course, you can describe each of the consumables on a new line, but for greater convenience it is recommended to use a table for this. The first column indicates consumables that are written off. The following columns are intended to display the rate and actual consumption of fuel and lubricants, their cost. A note is also made as to whether there were savings or none. In addition, information about the distance traveled by the vehicle is entered into the table. There are situations in which some lines are left blank. You need to know that you cannot leave them empty in order to avoid illegally entering any additional information. It is recommended to put dashes here.

( Video : “Fuel decommissioning: is it beyond the norm? / Fuel decommissioning: according to the norm or without?”)

Below the table you need to write the reason for the expense. As a rule, when writing off fuel and lubricants, it is indicated that these are the needs of the enterprise. It was said above that a waybill must be attached to the act. It also needs to be mentioned. So, all attached documents are entered under the table. If there are several of them, they are entered according to the date of issue. Their numbers are also indicated.

The final stage of registration of the act is the signing of autographs by members of the commission. Do not forget that if at least one signature is missing, this document will be considered invalid. In addition to the inspectors, the driver must also sign with a transcript. This way he will confirm that all the information specified in the document is correct.

Accounting for fuel and lubricant costs when calculating income tax.

In accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for the purpose of calculating income tax, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation). In this case, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred. expenses (including customs declaration, business trip order, travel documents, report on work performed according to the contract).

It is also worth noting that any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Based on paragraphs. 11 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include the costs of maintaining official transport (road, rail, air and other types of transport).

Expenses for fuel and lubricants can be included in the calculation of the income tax base only if they are made from funds received from income-generating activities and are aimed at its implementation.

Expenses for fuel and lubricants incurred by an autonomous institution at the expense of subsidies allocated from the budget are not taken into account when determining the base for corporate income tax on the basis of paragraphs. 14 clause 1 art. 251 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated July 11, 2012 No. 03-03-06/4/71).

Accounting for fuel and lubricants in tax and accounting

Below are answers to the most common questions when accounting for fuel and lubricants:

| Is it allowed to write off fuel and lubricants completely without rationing? | Allowed. Tax and accounting legislation does not impose any special requirements. But if the rules are not applied, then to the tax office you will have to explain the volume of fuel reflected in the reports. We also recommend taking into account fuel and lubricants in the same way for both types of accounting: either use rationing here and there, or not use |

| How to ration fuel? | With the simplified tax system there are 3 options:

|

| Is it possible to revise fuel rationing during the year? | Allowed if there is a reason for it. For example, the fuel consumption of a new car exceeds the original limits. The basis for revising the norm must be recorded in an order issued by the head of the organization |

| Is it possible to use different rates of fuel consumption for winter and summer periods? | There are no legal restrictions. By order of the head of the company, periods are approved, which are divided into winter and summer, and expenditure rates are fixed for each period. |

| Is it allowed to deduct excess amounts from a driver’s salary? | If the driver is proven guilty, yes. For this purpose, a commission is created, according to Art. 247 Labor Code of the Russian Federation. You need to ask the driver to indicate the reasons for exceeding the norm. If guilt is confirmed, an order is issued within a month after calculating the damage caused to the company. The amount of the penalty for violation cannot be more than one average monthly salary (according to Article 248 of the Labor Code of the Russian Federation). If the damage is exceeded or there is a delay in issuing an order, the amount can only be recovered through the court |

Design rules

Before drawing up a write-off act, you should create a commission for the enterprise with a minimum composition of 2 people. One of them must be the financially responsible person. The remaining members of the commission must be employees of various departments. It is important to identify which of the participants will be the chairman of the commission and which members, and issue an order on its appointment.

Fuel consumption standards, sample

The commission's task is to reconcile actual fuel costs with the standards established by the company. It should be noted that for each type of transport separate standards must be established, which must also be separately approved.

The responsibilities of the commission members include determining the relevance of the applied standards and their compliance with actual parameters.

To do this, they organize joint trips with drivers, during which they record control data on the distance traveled and compare them with the amount of fuel with which the vehicle was filled before the operation. Members of the commission also keep records and analyze information from waybills.

Fuel write-off report, sample

What should be reflected in the act

There is no unified form for the write-off act, so it can be drawn up in any form. It is convenient to develop a document template at the enterprise that will be used when documenting such operations. The approved sample act for writing off gasoline must contain the following information:

- name of the business entity;

- date of document execution;

- information about the driver of the vehicle whose fuel has been consumed and is subject to write-off;

- transport information;

- a list of materials being written off indicating identification characteristics, quantity and cost.

“Bonus” fuel: how to take into account

As a rule, when buying a car, the new owner receives not only the car itself, but also a certain amount of gasoline in the tank. If this is specified in the purchase and sale agreement, the accountant will be able to capitalize the fuel and lubricants without any problems. If fuel is not mentioned in the contract, then different approaches are used. When there is not very much gasoline, it is simply not taken into account, and the countdown of receipts and write-offs of fuel and lubricants begins with the first refueling.

If the tank is almost full, then first determine the volume using the same methods as for inventory. Then they arrange either a free receipt or identification of surplus.

In the case of gratuitous receipt, the cost of fuel is recorded as the debit of account 10 and the credit of account 98 “Deferred income”. Subsequently, when writing off, entries are made to the debit of the “cost” account (20, 26 or 44) and the credit of account 10 “Materials,” as well as the debit of account 98 and the credit of account 91 “Other income and expenses.”

In tax accounting, fuels and lubricants received free of charge are taxable income (subclause 8 of Article 250 of the Tax Code of the Russian Federation).

If an organization shows surpluses identified during inventory, then in accounting they should be included in income and posted as a debit to account 10 and a credit to account 91. In tax accounting, it is also necessary to generate income on the basis of subparagraph 20 of this article.

The opposite situation is also possible, when an organization sells a car, and with it the fuel in the tank. Here it is best to include a separate clause in the purchase and sale agreement, where the volume and price of gasoline should be indicated. This will make it possible to show the implementation of fuels and lubricants separately from the implementation of the machine. From a legal point of view, everything will be correct, because no license is required to sell fuel. In the absence of a special clause in the agreement, the disposal of gasoline must be carried out as a debit to account 91 and a credit to account 10. Such expenses cannot be reflected in tax accounting, since the value of gratuitously transferred property does not reduce taxable income (sub. 16, Article 270 of the Tax Code of the Russian Federation).

When renting out a car, the fuel tank is also fully or partially filled. Here, as in the situation with the purchase and sale, you have to figure out how to take such gasoline into account.

Sometimes organizations simply agree that the lessor transfers a certain amount of fuel, and the lessee, at the end of the lease period, undertakes to return the same amount along with the car. In this case, ownership of fuel and lubricants remains with the lessor, and the transfer of fuel is not reflected in the accounting records.

But this option is not entirely correct for the tenant, because in fact he uses the gasoline received and, as a result, must make certain entries in the accounting registers. For this reason, most companies still show the transfer of fuel and lubricants from the lessor to the lessee.

The most common way to reflect such a transfer is implementation. First, the lessor sells fuel to the lessee, and after the end of the contract, the lessee sells the same amount to the lessor.

Another option is a commodity loan. Here the lessor acts as a lender, and the tenant acts as a borrower. Both options are completely legal, and the accountant can only choose the one that is most convenient in a particular situation.