Civil liability insurance

Civil liability insurance is the obligation of one person to another to compensate for damage when the fact of such damage is recorded.

Such obligations will arise subject to certain omissions or actions that caused a violation of the benefits of a particular person. Civil liability insurance is developed and applied with the aim of maximizing compensation for damage of various types and severity. Insured civil liability makes the life of the average resident of a developed country calmer, more stable and safe. Contents Hide

- Civil liability insurance

- Mandatory liability insurance

- Vehicle owners liability insurance

- Liability insurance contract

- Liability insurance rules

- Liability Insurance Law

- Corporate liability insurance

- Manufacturer liability insurance

- Insurance programs

- Employer liability insurance

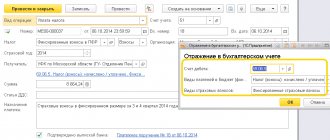

Upon the occurrence of an insured event, the Insurance Company undertakes to:

- Consider the written request for compensation for harm/damage received from the client, whose civil liability was insured, and the injured person and the documents submitted to confirm the event that occurred and the liability of the insured person.

- Conduct an examination of the claims made by the injured person, incl. conduct an inspection of the damaged property, involve independent expert organizations in assessing the harm/damage.

- Recognize the fact of the occurrence of an insured event, calculate the amount of insurance compensation, or send to the Policyholder and/or the Person whose liability is insured and the injured person a written refusal to satisfy the claim for payment of insurance compensation within 18 working days, counting from the date of receipt of all necessary documents.

- Pay the amount of insurance compensation specified in the insurance act no later than 5 working days following the day of approval of the insurance act.

Mandatory liability insurance

Compulsory liability insurance appeared relatively recently, a little over a century ago. The main function of the mechanism is to help the insured person compensate for damage caused to a third party due to an unfavorable combination of circumstances. Thanks to regular contributions from clients, the insurance company receives the necessary financial resources that allow it to take responsibility for compensation for damage in individual cases. In turn, the insured person also has the opportunity to compensate for the damage caused to the injured person without unexpected costs on a particularly large scale.

Features of MTPL abroad and in Russia

In Russia, MTPL insurance is regulated by the state, which sets tariffs, terms and amounts of payments that clearly do not correspond to modern conditions. At the same time, for violations of the requirements of the law on the mandatory purchase of a policy, purely symbolic fines are established, which can be paid at a discount.

In European countries, car insurance rules are similar, but have the following features:

| A country | Tariff for the year (euros) | Payment for equipment (euros) | Health benefit (euros) | Penalty for not having a policy (EUR) | Other |

| Germany | 1500 | 500000 | 2500000 | 2000 | Extension of the contract with the right to access the driver’s account |

| Sweden | 2000 | 800000 | 36000000 | 1500 | Formation of tariffs on market conditions. Sale of MTPL subject to purchase of CASCO |

| England | 1800 | 250000 | 4000000 | 3000 | Indication in the policy of all previous violations |

| Spain | 2200 | 1000000 | 30000000 | 2000 | Proceedings of road accidents by insurance companies without the police, if there are no victims |

| Italy | 2100 | 750000 | 25000000 | 3000 | Automatic detection of insurance policy from cameras |

| Denmark | 2500 | 1000000 | 10000000 | 4000 | Providing discounts to low-income citizens |

In almost all EU countries, the injured party, in addition to a one-time payment, receives a monthly disability benefit.

Thus, the MTPL policy is a guarantee for the car owner against large material costs in the event of an accident. And the availability of types of cooperation and terms of sale makes it possible to save a lot when purchasing.

Video on the topic of the article

Vehicle owners liability insurance

Liability insurance for vehicle owners is aimed at protecting the interests of the policyholder in accordance with the legislation of the Russian Federation.

An insured event is any situation that requires compensation for loss due to damage caused during the use of the vehicle by third parties.

Thanks to compulsory insurance, damage in road accidents is covered in most cases by insurance companies. The process is regulated by federal legislative act No. 40, which came into force on April 25, 2002.

Classification

Civil liability insurance is divided into voluntary and compulsory . With a voluntary insurance policy, an insurance policy is purchased only at the request of the policyholder. In turn, compulsory civil liability insurance is nothing more than legal coercion by the state to issue policies to citizens and legal entities.

But do not forget that Federal Law 225 on compulsory civil liability insurance is for our benefit. Its purpose is to protect the interests of persons who may suffer in emergency situations.

This category includes insurance:

- motor vehicle liability;

- in the field of tourism;

- hazardous industrial facilities;

- civil liability of the developer.

1) OSAGO

Compulsory motor third party liability insurance is familiar to all drivers. Under the MTPL policy, the insurance company compensates for damage caused by one driver to another.

However, there is a limit on the insurance payment . In 2016 , it was equal to 400,000 rubles for compensation for material damage and 600,000 rubles for damage to health.

If desired, the amount of compensation can be significantly increased⇑ . To do this, you need to take out the so-called DOSAGO - additional motor third-party liability insurance . Such a document harmoniously complements compulsory motor liability insurance and works when damage in an accident exceeds the established limits.

Read about how to get MTPL insurance online here

2) During transportation

The transport company is always responsible for the safety of passengers and cargo. There are uniform standards that determine the limit of liability of a transport company. They concern air carriers, shipowners, railway workers and road transport companies.

An insured event is considered:

- damage to third parties as a result of an incident involving the carrier;

- delay in delivery of cargo due to the fault of the carrier or passengers;

- damage or loss of cargo;

- causing harm to the health and life of passengers.

Insurers are legal entities and individuals, owners or lessees of vehicles.

The insurer is exempt from payments if:

- the incident occurred due to the policyholder’s violation of the terms and conditions of transportation;

- the carrier violated fire protection standards.

3) From harming nature

This insurance means protection of the policyholder's liability from risks associated with harmful effects on the environment.

Such policies are purchased by owners of various dangerous enterprises:

- mines;

- power plants;

- tankers;

- chemical enterprises;

- factories for the production of toxic and explosive substances.

The insurer covers all expenses if a man-made disaster occurs due to the fault of the policyholder. Since the insured amounts in such situations can be very large, the price for insurance will be serious. That is why only large companies engage in natural risk insurance.

This activity is regulated by current legislation and environmental laws. In our country, protection against such risks is strictly mandatory. 300,000 in Russia , and all of them must be insured .

4) From defective products

Even the most modern technologies allow for the possibility of producing defective products.

The reasons for product defects may be:

- human factor:

- use of low-quality consumables;

- defects at the product design stage;

- violation of working conditions.

In such situations, damage is caused not only to the consumer, but also to the manufacturer, who suffers serious losses.

5) For professionals

For example, a lawyer guarantees a client that he will win his case in court and charges a fee for his services. But he fails. And the client suffers losses and sends a claim to the human rights defender.

In such a situation, it would be good if a prudent lawyer took out a civil professional liability insurance policy . The costs in this case will be borne by the insurance company.

6) For developers

In Russia this is a mandatory procedure. This insurance can help shareholders and investors get back the money they spent or even provide them with housing if their construction company goes bankrupt.

This law came into force in 2014 . Construction companies can now only charge clients upfront if they have a builder's liability insurance policy .

7) For violation of obligations

This is not a very common type of insurance. The policy is purchased by borrowers who are afraid of not repaying their loan on time. But insurance coverage is only part of the loan amount, usually no more than 80-90% .

Liability insurance contract

A liability insurance contract is the main document that regulates the relationship between the insurance company and the insured person. The basic principles for the formation of contractual documents in the field of insurance are prescribed in the law “On the organization of insurance business in the Russian Federation”, as well as in Chapter 48 of the Civil Code.

In fact, an insurance contract is a universal agreement signed by the insurer and the policyholder. Based on the agreement, the insurer is obliged to pay compensation upon the occurrence of an insured event. The policyholder, in turn, undertakes to promptly transfer contributions of the established amount to the insurance company.

Where can I get professional insurance?

Today in the Russian Federation this type of legal activity is not widespread, but due to the constant tendency for specialists to make mistakes, it is gaining momentum. Since this is a new direction in insurance, companies need to obtain a separate license to carry it out. Therefore, clients need to find an organization that meets these requirements to conclude an agreement.

Note! Since this area is not yet regulated by law, insurance companies themselves establish a list of documents necessary for drawing up contracts.

As for tariffs, in each case they are set individually, being a derivative of the consent of the client and the seller of the service. A boundary limit is not set; it is determined by the degree of risk of the customer’s activities. Since when drawing up a contract, the factor that the specialist himself initially assumes the presence of an error is taken into account, the cost of the service will be higher.

Related article: Features of tour operator liability insurance

On average, the policy price and the amount of insurance premium for voluntary professional liability insurance can be as follows:

- 300,000-3,000,000 - 0.3-3.0%, (RUB 2,700.00-90,000);

- 3,000,000-5,000,000 - 3-5% (90,000-250,000 rubles);

- 50,000 - 5-10% (RUB 250,000-1,000,000).

Note! The amount of annual contributions is influenced by such factors as the presence of insured events with the client, the list of risks, and the degree of danger of the official activity.

Liability insurance rules

The rules of liability insurance operate on the basis of the federal legislation of the Russian Federation. In fact, the rules are a list of conditions and norms on the basis of which the insurer enters into an agreement that ensures repayment of damage that the insured person causes to third parties. Under an insurance contract, it is possible to issue a policy not only to the policyholder, but also to another person. In the case of professional liability insurance for a specific person, his details are indicated in the insurance contract.

Cost of extended policy

A logical question arises: how much does extended insurance cost? Few people want to pay extra after the costs of a mandatory policy. It should be noted that, unlike compulsory motor liability insurance, there are no tariffs established by law for additional insurance.

The cost of DoSAGO is influenced by a number of factors, the main one of which is the amount of insurance coverage. To determine the maximum insured amount, the company takes into account the following indicators:

- insurance period under compulsory motor liability insurance;

- technical characteristics of the car (year of manufacture, engine power, type of vehicle);

- the liability limit chosen by the insurer;

- the age of the motorist and his driving experience.

On average, you will have to pay for a policy per year:

- 1000-2000 rubles – with a limit of 300-500 thousand rubles;

- 3000-6000 rubles - if the limit varies between 500 thousand - 1.5 million rubles. This is the most popular option among car owners;

- 12-18 thousand rubles - with the maximum possible additional coverage under the DSAGO program of 3 million rubles.

The price of the policy depends not only on the amount of coverage, but also on the age of the driver, his experience, the type of vehicle, as well as on the number of people allowed to drive the insured car. When calculating the cost of a compulsory motor liability insurance policy, all these indicators are also taken into account, however, the rates for compulsory insurance are established at the legislative level.

Liability Insurance Law

In accordance with federal law, liability insurance is distinguished as a separate segment of insurance. At the same time, the Civil Code of the Russian Federation considers liability insurance to be one of several branches of property insurance. The subject of liability insurance is compensation for damage caused by a guilty individual or legal entity. In the most common cases, harm is caused to health, life, property or the environment. Harm often occurs in the production process, as well as in the course of other activities or as a result of inaction.

Corporate liability insurance

The subjects of corporate liability insurance are companies that work with equipment, substances or other potential sources of high-level hazards. As a rule, such organizations in the course of their activities use strong poisons, explosives or flammable substances, atomic or electrical energy, as well as all kinds of mechanisms and equipment.

The enterprise is always responsible for damage caused by such a source. The exception is cases where harm occurred due to the deliberate intent of the injured party, as well as in cases where it is not possible to prevent and foresee such actions.

How to buy?

You can purchase an MTPL policy in two different ways:

- visiting an insurance company branch;

- purchasing a policy on the company's website.

Insurance organizations do not have the right to refuse to purchase a policy to any car owner. But often citizens have to deal with the fact that company employees do not have forms or the computer does not work. This usually happens in a situation where you need to buy insurance for an old car. Under such conditions, you can complain about the company to the RSA or the Central Bank.

Manufacturer liability insurance

Product liability insurance is considered an innovation in the Russian insurance product market. Not only manufacturers, but also sellers bear responsibility to consumers and other third parties. An insured event is considered to be damage caused to health, life, and property during the use of a product sold with a defect or other defects. Responsibility is also provided for failure to fulfill the obligations imposed on consumers and producers of goods by the legislation of the Russian Federation. In its simplest form, this type of insurance is known as quality liability.

Pros of buying a policy

Every car owner should understand what a compulsory motor liability insurance policy is and why it is needed. It is represented by compulsory insurance, which has the following advantages:

- if a citizen gets into an accident, he is not obliged to independently compensate for the damage or repair his car if he is not the culprit of the incident;

- Receipt of payments under the policy is guaranteed, so you do not have to independently collect money from the person responsible for the accident;

- road safety is improved, as drivers try to follow traffic regulations and drive carefully to save time and money.

Due to such advantages, insurance is considered a popular service. OSAGO is a mandatory policy, so if the driver does not have this document, he will be held accountable by the traffic police.

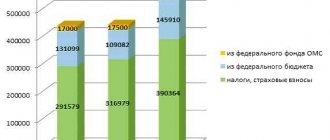

Insurance programs

A striking example of an insurance program in the Russian Federation is the basic compulsory medical insurance program approved by the Government. The document was developed as part of a program guaranteeing free medical care to citizens of the Russian Federation. The document formulates the main responsibilities and rights of insured persons who receive free medical care throughout the Russian Federation. The program also lists the volumes and types of medical care that a citizen has the right to receive throughout the entire territory of the state, without regard to linkage to a specific subject of the federation in the event of the onset of a disease. The document also sets out general requirements for compulsory medical insurance programs operating at the territorial level.

Employer liability insurance

Employer's liability insurance is part of every company's conscientious attitude towards its contractors and partners. Hired employees deserve special attention. The company’s responsibilities include compliance with every clause of the contract and the creation of safe working conditions. Recorded violations of an employment contract often lead to the filing of claims with subsequent payment of compensation for the harm caused. The main reasons for the emergence of a new type of insurance are considered to be the rapid development of business and the formation of a complex corporate structure of enterprises.