What types of insurance are there? What are the basic rules for online insurance? What features does pension insurance have?

Hello, dear friends! Welcome to the HeatherBeaver online magazine. Insurance expert Denis Kuderin is in touch.

We are starting a series of articles on the topic “Insurance”. The publication you will read today is of an overview nature and is devoted to the basic concepts, rules and types of modern insurance.

The material will be of interest to everyone who is not indifferent to the issues of their own safety and the safety of personal property.

So let's get started!

How to earn passive income on websites

How to buy a website with income and receive from $10 to $3000, even despite the pandemic and its consequences. How much does a profitable website cost and how to start investing with 10,000 rubles or more in your pocket

More about the course

What is insurance?

The social and personal life of every citizen is constantly associated with certain risks. Every day we risk our health, money, movable and immovable property, and even life itself. From time to time you have to suffer losses.

Not everyone can compensate for losses at their own expense: this requires additional financial reserves. This fact formed the basis of the idea of joint compensation for property and non-property damage - this is how insurance arose.

Let us give a legal definition to this concept.

Insurance is a form of protection of the property interests of individuals and legal entities upon the occurrence of certain events at the expense of funds formed by insurance premiums.

The threat of damage always exists, but is not obligatory. Insuring yourself means protecting yourself and your property from unforeseen circumstances - accidents, illnesses, natural disasters, bankruptcy and other unpleasant things.

Basic concepts in the topic of insurance:

- Insurer is a private or public organization that provides insurance.

- The policyholder is the person who signed the insurance contract and pays the insurance premiums.

- Objects of insurance – property, health, life, finances, ability to work, etc.

- Insurance policy is a document confirming the fact of insurance.

- An insured event is a situation that results in the payment of the insured amount.

- Insurance indemnity is the amount that is paid to the policyholder in the event of an insured event.

Insurance can be compulsory or voluntary. In the first case, a citizen or legal entity is insured regardless of their wishes. Compulsory insurance falls within the competence of government agencies: the interests of not only the subject, but also society are taken into account.

Voluntary insurance is carried out, as is clear from the term itself, on a voluntary basis. The specific conditions and rules of such insurance are determined by the insurer.

Insurance has certain functions:

- Risk – redistribution of risks between participants in the insurance process;

- Investment – temporarily free insurance funds are invested in the economy, shares, real estate in order to preserve and increase funds;

- Preventive – part of the insurance savings is spent on preventing the occurrence of insured events (for example, measures are taken to reduce damage from fires and floods);

- Savings (life insurance) – part of the finances is accumulated in insurance funds according to the contract.

In civilized countries, insurance is used for social protection of citizens in the event of disability, illness and the occurrence of circumstances associated with old age.

The articles “Insurance Compensation” and “Insured Event” cover the topic in more detail.

Types of insurance - classification

The organizational and legal classification implies a distinction between non-state insurance, when the insurer is a private commercial institution, and state insurance. According to the order of organizing the insurance process, voluntary and compulsory insurance are distinguished. The types and conditions of insurance of the second type are determined by current legislation. However, the main classification is established by Chapter 48 of the Civil Code of the Russian Federation. It defines personal, property insurance, as well as liability and business risks insurance.

What is insurance - TOP 11 main types

Let's consider the main types of insurance, their features, functions and essence.

Type 1. Medical insurance

This is a form of protecting the interests of citizens in the event of loss of health. Insurance payments are aimed at compensating the costs of receiving medical care and other costs associated with improving health.

This includes expenses:

- to visit doctors and undergo medical procedures;

- for the purchase of medicines;

- for hospital stay;

- to receive dental care;

- for preventive measures.

In case of loss of health, workers and employees with insurance have the right to count on cash payments in the amount of full earnings for a period of incapacity for up to 4 months.

Health insurance can be compulsory or voluntary. In the first case, employers make regular contributions to an insurance fund managed by the state.

Voluntary health insurance reserves can be formed through contributions from the salaries of the employees themselves. Participants in such programs have the right to expect higher levels of medical care.

Example

Persons with voluntary insurance, upon the occurrence of insured events, have the right to treatment in sanatorium-resort institutions or private medical organizations.

See the articles - “Compulsory health insurance” and “Voluntary health insurance”.

Type 2. Accident insurance

The purpose of such insurance is to compensate for damage caused by serious health problems. Employees of industrial enterprises, passengers of railway, water and air transport, military personnel and other categories of citizens are insured against accidents.

In a legal sense, there are three main types of accidents - death, long-term disability, disability (permanent disability). A typical example is a work injury caused by faulty equipment.

Read detailed material on the topic – “Accident insurance”.

Type 3. Property insurance

The object of insurance here is property interest. You can insure both private property of citizens and state property. Insurers are legal entities and individuals.

The insured amount cannot exceed the actual value of the property. Personal belongings, cargo, production equipment, buildings, animals and other types of property are insured against damage, loss, breakdown, and theft.

See the articles “Property Insurance” and “Cargo Insurance”.

Type 4. Car insurance

Insurance protection of vehicles. Protects the interests of citizens related to the repair and restoration of cars. Insured events are considered: accident, breakdown, theft, theft and damage caused by third parties during operation.

In the Russian Federation, two types of car insurance are practiced - compulsory state with uniform tariffs for everyone (OSAGO) and private (CASCO). In the second case, rates are set by private insurance companies.

More details in the publications “OSAGO”, “Auto Insurance” and “CASCO Policy”.

Type 5. Business insurance

Entrepreneurial activity is inevitably associated with high risks. In times of economic instability, the likelihood of unexpected expenses and financial losses increases many times over.

Business insurance is, first of all, protecting the enterprise from various types of losses.

An insurance contract will help compensate for:

- losses associated with forced downtime;

- losses caused by lost investments;

- expenses arising from outstanding loans;

- expenses for lost profits.

The objects of insurance are the finances of the enterprise, material resources and other attributes of entrepreneurial activity.

Type 6. Life insurance

Every person, regardless of his social status, income and age, risks his life every day. Insurance, of course, does not reduce risks and does not guarantee the preservation of life, but it helps to accumulate funds in case of an insured event.

This type of insurance is aimed at protecting the financial interests of the insured person or his relatives. If the policyholder survives (legal term) until a certain period (for example, until retirement), he has the right to receive at his disposal the amount accumulated as a result of the capitalization of his insurance premiums.

Read a detailed article on this topic - “Life Insurance”.

Type 7. Endowment insurance

A type of social insurance that provides payments to the client if he reaches a certain age or the occurrence of any event.

The condition for concluding a contract is the presence of a regular income. Regular contributions go to the insurance fund, which invests finances in order to multiply them.

The duration of insurance is determined on an individual basis. This may be the achievement of a pension by the policyholder or arbitrary periods from 5 to 40 years.

Type 8. Travel insurance

Travel insurance protects policyholders in the event of unforeseen circumstances that arise during travel or a business trip. Often such insurance is already included in the travel package, but if tourists travel independently, the document must be prepared themselves.

Objects of insurance – health, property, finances of the tourist. There is also protection against failure to leave, loss of luggage, and damage caused by third parties in the host country.

Read separate posts on visa insurance, as well as travel and international travel insurance.

Type 9. Deposit insurance

Method of state protection of bank deposits. Citizens and legal entities who have such a document can receive compensation in the event of termination of the activities of a financial institution.

In other words, if the bank goes bankrupt or its license is revoked, insured depositors will get their money back.

The deposit insurance system supports the stable operation of the banking system in the country and solves macroeconomic problems.

Read a separate article about deposit insurance.

Type 10. Real estate insurance

A type of property insurance that guarantees protection of real estate of citizens and legal entities in the event of fires, flooding, natural disasters, explosions, and illegal actions.

You can protect not only the house itself, but also the decoration of the premises, engineering equipment, furniture, plumbing and household appliances.

All the nuances and details are in the articles “Apartment Insurance” and “House Insurance”.

Type 11. Civil liability insurance

Compensation under such insurance is paid in the event that the policyholder causes property damage to a third party.

Example

Due to a broken faucet or a burst pipe in your apartment, material damage was caused to your neighbors. Insurance will help compensate for damage caused by your fault.

More detailed material on this topic can be found in the publication “Civil Liability Insurance”.

Life insurance

This type of insurance can be classified as long-term insurance programs. As a rule, the contract is concluded for a period of 5–10 years. Life insurance allows you to protect the most valuable thing a person has - his own life. Such insurance will be very useful in case of any serious injury, disability or various dangerous diseases. This service will also help support the financial condition of your family and friends in the event of an irreparable situation. Life insurance also allows you to accumulate a financial reserve in retirement or simply accumulate some capital to realize your aspirations.

Here it is worth describing in detail the 3 main types of life insurance.

- Endowment insurance - in this case, the number, frequency and size of contributions is mainly determined by the desires and capabilities of the insurer. Deductions are divided into two parts. The first goes directly to the insurance company itself, and the second is credited to the client’s account. A payment or several payments can be scheduled for a specific date and period. Regardless of the total amount of investments made, the insured person will receive them.

- Life insurance - in this type of insurance, the full amount of funds is paid in the event of the death or destruction of the policyholder. In special cases, the policyholder can stop making contributions, terminate the contract and receive the money in cash. Moreover, this form of insurance is considered cumulative, since the company not only takes funds for itself, but also accumulates them using capitalization. With regular contributions, the company, as a rule, guarantees a minimum payment to the policyholder, regardless of the profit that it itself received. But here it is worth considering that if at least one installment is not paid, then the compensation is actually lost.

- Term insurance is the most common and most affordable form of insurance. It is issued for a period specifically agreed upon with the company and allows you to accumulate savings. After the death of the policyholder (if it occurs during the insurance period), the insurance company undertakes to pay the agreed amount to relatives and friends. The contract can also stipulate various conditions for the payment of the insured person’s debts, for example, mortgages. An alternative to this is a renewable policy, which is more expensive, but provides an excellent opportunity to be virtually always insured.

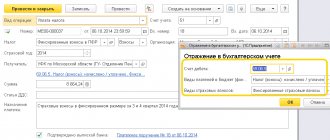

Features of online insurance

Modern information technologies allow you to insure yourself without leaving your apartment. In particular, cars, health, and property are insured via the Internet.

It is clear that you can only insure yourself online through the official websites of insurance organizations. The client is required to fill out the form according to all the rules and pay for the service. It is advisable to print the document and save it on your hard drive and external memory media.

A special calculator will help you calculate the cost of insurance depending on the time period and other terms of the transaction.

For the convenience of citizens, the “Unified Insurance Center” has been created: with its help, you can carry out almost all types of property and health insurance.

When choosing private companies, beware of scammers: pay attention to the company’s reputation and the design of the web resource. Legitimate organizations have a corresponding website, positive online reviews and long-term experience.

I recommend watching the video on the topic of the article.

Health insurance

Continuous human health insurance offers payments in cases of disability, the occurrence of any disease or injury of the insured person.

Such insurance is continuous due to the fact that the company, after signing the document, can no longer unilaterally terminate the contract. As for the policyholders themselves, they can be capable individuals or legal entities. The cost of all medical services is set by agreement of the insurance company and the medical institution. It is important to note that payment will be made only if the insured person applies for medical care. The amount of the insurance amount is determined based on the cost of the complex of medical services provided for in the contract.

As a conclusion, it is worth noting that all these types of insurance are voluntary and completely depend on the wishes of the individual client. However, their usefulness in various difficult situations should not be underestimated. After all, no one wants to be left alone with the problem that has arisen, and the insurance poles described above will help you in ensuring a calm life without unnecessary worries and worries.

Author: Alexey Piven

What determines the cost of insurance - 5 main factors

Any insurance involves purchasing a policy and making contributions. Amounts vary depending on objective and individual circumstances.

Let's consider the main factors influencing the cost of insurance.

Factor 1. Occupation of the insured person

The more dangerous the work, the higher the likelihood of an insured event. This means that rates increase proportionally.

Professional military personnel, police officers, vehicle drivers, firefighters, rescuers, high-altitude installers, and doctors, who daily risk contracting dangerous infections, have increased risks.

Factor 2. Gender

According to statistics, men after reaching 40 years of age are exposed to greater risks than women of the same age.

This is partly due to the increased predisposition of representatives of the stronger half of humanity to dangerous bad habits - smoking, drinking alcohol and drugs.

In addition, men more often work in hazardous industries and choose professions that are directly related to daily risk.

Factor 3. Age

The younger the policyholder, the lower the cost of the policy. This is natural, since healthy young people are less at risk of dangerous diseases.

The above does not apply to children under 18 years of age, for whom special insurance conditions are provided.

Factor 4. The volume of risks covered by the insurance package

The more insurance cases the policy provides for, the higher its cost.

It’s one thing to insure against illness, another thing to include additional risks in the document (robberies, terrorist attacks, injuries received during sports).

Factor 5. Health status

Your current health status directly affects the cost of your policy. If a person already has illnesses that are fraught with dangerous complications, the risk of an insured situation inevitably increases, and therefore, the price of insurance also increases.

Accident insurance

In this situation, the reason for insurance payments may be not only temporary or permanent disability, but even a simple injury received through negligence or an accident. Among the main advantages and advantages of this type of insurance policy, it is worth noting the small amount of required contributions and the ability to independently choose the insurance payment, which in most cases is tax-free. In this case, the following situations include accidents:

- various natural disasters;

- being injured by any vehicle (or while in it);

- electric shock;

- poisoning;

- strangulation;

- drowning;

- frostbite;

- attack by bandits or aggressive animals;

- burn or sunstroke.

But it is worth noting that this type of insurance cannot be obtained by disabled people, nervous or mentally ill people, pregnant women, HIV-infected people or simply seriously ill people.

Who offers the best insurance conditions - TOP 5 companies providing services

We present the five best insurance companies in the Russian Federation.

1) Ingosstrakh

The largest Russian insurance company, operating since 1947. Works with individuals and legal entities. Provides dozens of types of insurance, including health, life, property, transport, cargo, business risks.

The company's clients can receive a special card that provides special privileges - discounts on medical care, special banking services.

2) AlfaStrakhovanie

A company with a universal portfolio of insurance services. Protects the interests of businesses and individuals. Offers customers about 100 products. It operates not only in the Russian Federation, but also in neighboring countries.

The organization has 270 regional offices. The services are used by about 28 million private clients and 435 thousand companies.

3) Tinkoff Insurance

Subsidiary. Protection of real estate, personal property, transport, travel, health and life. You can insure almost everything here - a country house with a bathhouse, a vacation in New Zealand, a new car.

Despite its youth (founded in 2013), the company enjoys stable success due to its reliability and large selection of products.

4) Renaissance Insurance

Division of Renaissance Bank. CASCO and OSAGO insurance, protection of real estate, travel, health and finances. Offers insurance to citizens purchasing apartments with a mortgage. Compensation under such a policy is received by clients who have stopped paying loans as a result of disability, dismissal or other force majeure circumstances.

5) Ingvar

Founded in 1993. Provides protection to citizens, legal entities, and state-owned enterprises. The advantages include reliability, comprehensive customer service, and fulfillment of contract terms in the shortest possible time. The priority area of activity is cargo insurance in Russia, the CIS and around the world.

INGURU website ) and features of the companies:

| № | Company | Rating (indicators of reliability and solvency) | Peculiarities |

| 1 | Ingosstrakh | 4.2 | The oldest insurance company in the Russian Federation |

| 2 | AlfaInsurance | 3.9 | Priority area – business risk insurance |

| 3 | Tinkoff Insurance | 3.3 | Clients have access to a branded insurance card |

| 4 | Renaissance Insurance | 3.5 | Practices mortgage loan insurance |

| 5 | Ingvar | Not included in the rating due to narrow specialization | The main direction is cargo insurance |

Transport insurance

Of course, the most popular type of insurance is motor insurance. Moreover, in addition to mandatory civil liability, Casco and similar insurance options are often additionally taken out, which allow compensation for damage incurred in an accident, as well as damage to the car by third parties or theft of a car. The amount of such payments depends on the amount of insurance and, as a rule, amounts to the full cost of transport.

In addition to the vehicle itself, you can also insure the driver and passengers, all kinds of additional equipment, and in some cases, items of luggage. When you sign such an agreement, in the event of an insured event, you will be reimbursed for all costs of repairing vehicles damaged as a result of an accident, fire, criminal acts or theft. The specific payment amount mainly depends on the following factors:

- car cost;

- history of previous insurance policies;

- availability of anti-theft means;

- driving experience of the insured person;

- area where the garage or parking lot is located.

As a rule, the contract begins to enter into force immediately after the policyholder makes the first payment. Payment is made at one time or in several installments within the established time frame. But this is not the end of the types of insurance.

Useful on the topic:

- How to apply for compulsory motor liability insurance without additional services?

- How to choose CASCO? We buy a policy profitably

Insurance classifications, registration stages and payment calculations

In the Russian Federation, Chapter 48 of the Civil Code defines the following types of insurance:

- personal insurance;

- property insurance;

- liability Insurance;

- business risk insurance.

The basic scheme of the insurance act is as follows:

- the client informs the insurance company which insurance events need to be protected against. This is important, because among insurance companies there is also specialization - one office supports certain types of insurance, another - others;

- the cost and method of insurance are calculated;

- an agreement is concluded between the client and the office (in 2 copies);

- the client pays a fee and receives an insurance policy, which will be a document confirming the right of its holder to receive monetary compensation upon the occurrence of insured events specified in the contract.

How is the cost of insurance determined? Regarding cost, there is an inverse correlation. When an insured event is rare and unlikely (the insurance company regularly conducts statistical analysis), then by depositing a small amount of money, you can receive substantial compensation when an insured event occurs. And vice versa, when an insured event is almost commonplace (theft of a foreign car, for example), then the cost of insurance will be determined 1 to 1.

Also, different insurance cases have different costs when taking out a policy. Business activity insurance usually turns out to be the most expensive for the client. But this can protect the entrepreneur from possible bankruptcy. Insurance methods also affect both the cost of insurance and the amount of possible compensation:

- First risk system. It all depends on the insurance limit that each company has. That is, the insurer warns the client that in any case he will not be able to pay the client more than a certain amount when costs arise. For example, the insurance limit is 1 million rubles. If the damage from an insured incident amounted to 1 million rubles, then the client will receive that much. If the damage amounted to 2 million rubles, then the client will still receive only 1 million rubles within the office limit. But if the damage is estimated at 500 thousand rubles, then the amount of compensation is determined by the ratio specified in the contract. If it’s 1 to 1, then the client will receive 500 thousand rubles. If compensation is implied with a 20% premium, then the client will receive 600 thousand rubles.

- Prorated Reimbursement. This is an option that is beyond the 1 to 1 ratio in the direction of decreasing compensation. That is, only a third, half, three-quarters of the cost of damage is reimbursed. In this case, a certain minimum damage subject to insurance is stipulated. If the costs do not exceed this minimum, then such damage is not considered an insured event. This type of insurance is one of the most common due to its relative cheapness.

Insurance also differs according to other criteria:

- Paid in full or over a long period of time in small portions. The first option is good for protecting some material property. But the second is ideal when a person wants to somehow provide for himself if he becomes unable to work.

- For a specific period or for life. For the most part, the policy requires renewal when the client pays for the insurance again. Typical terms of insurance policies are one year, 3 years and 10 years. However, there is also an insurance service for the rest of the client’s life. Such insurance is again relevant to protect the client in case of possible loss of ability to work. Or the client takes out life insurance in the event of his death so that his relatives can receive monetary compensation. But it must be said that expensive insurance is almost always issued only for a certain period, they need to be renewed.

- Territorial criterion. There are policies that are only valid within the country. And there are those who preserve it at the international level. A typical example is insurance in the tourism industry, when travelers take into account in advance such unpleasant moments as injuries, illnesses, thefts, accidents, etc., that may happen in another country.

But there are incidents that all insurance companies do not consider as a reason to pay compensation:

- fraud and other illegal actions related to insurance (if it is proven that the client specifically contributed to or organized an insured event in order to receive money; forgery of insurance documents);

- the client lost funds in gambling;

- financial costs that the client is forced to bear in order to free the hostages (for example, ransom).

Let us consider point by point the main types of insurance acts in accordance with the Civil Code of the Russian Federation.

Personal insurance

Almost all relevant companies deal with this type of insurance, since it is very popular and, in principle, necessary. This type of insurance includes several insurance options:

- life insurance of the client , when after his death (no matter what the reason) a third party receives a cash payment. The third party can be anyone, not just relatives of the deceased. For example, many banks, when issuing mortgages, require clients to insure not only the mortgaged property, but also life and health;

- health insurance . If in the USA it is extremely developed, then in the Russian Federation it is somewhat less (the main example is compulsory medical insurance). Its essence is that the client makes relatively small regular contributions to the account of the insurance company engaged in this type of insurance, and if an insured event (illness) occurs, the treatment will be fully or partially paid for by the company. Moreover, the more expensive the policy, the more expensive medical services are included in its scope;

- insurance in case of an accident . This may include domestic and work injuries, car accidents, force majeure in the wild, etc. At the same time, this includes not only compensation for material damage, but also payments in the event of harm to the client’s health or death (but these are separate compensations that are not related to life and health insurance);

- pension insurance. It is divided into two levels - mandatory state pension insurance for all citizens and additional, when the client regularly makes some deductions from income in order to have a pension insurance policy that will increase the size of the pension in the future; Additional pension insurance can be provided by both private companies and government agencies;

- endowment insurance is, in fact, simply the purchase of a policy, with the help of which, upon reaching a certain age, you can receive a cash payment, insurance against aging, so to speak, because the insured event here is age;

- Travel insurance is a type of insurance that includes insurance against negative force majeure, life and health insurance, and insurance of the client’s personal movable property, which he will take with him on his trip. It is travel and travel abroad that is the distinctive feature of this insurance. Obtaining a policy under this item can cover all costs associated with force majeure abroad - the departure of rescuers, the evacuation of tourists and their property, treatment, etc.

Property insurance of any kind (material, intellectual and business).

Here we can highlight:

- insurance protection of movable and immovable property against any physical damage (flooding of an apartment, destruction of a car in an accident, damage to cargo during transportation, etc.);

- insurance protection of movable and immovable property against theft or raider seizure;

- insurance protection of intellectual property against unauthorized use/appropriation;

- insurance protection of business from any negative phenomena of a changing economy and market conditions.

The contract may also stipulate specific conditions for the same physical damage. Statistics show that clients insure their material property against illegal actions (car theft, arson, robbery) and man-made (car accidents, etc.) and natural (floods, etc.) disasters.

Liability Insurance

Any serious company or individual entrepreneur, regardless of the field of activity, purchases a policy of this insurance protection. The bottom line is that if a specialist accidentally (namely, accidentally, unintentionally) makes a mistake in his professional work, then directly or indirectly the parties affected by this will be paid compensation through insurance. Main examples:

- driver services for passenger, livestock, and clothing cargo transportation;

- services of medical workers (an example where liability insurance is mandatory);

- operation of enterprises that are potentially hazardous to the environment (also mandatory);

- services of legal specialists;

- insurance against non-compliance by the employer with working conditions that meet safety regulations;

- Most enterprises producing goods for the end consumer are also insured.

Business insurance

A separate type can be called insurance of business and associated risks. The insured event under the contract can be almost anything.

In general, all risks under business insurance contracts can be divided into:

- associated with a stop or disruption of the production process;

- related to market conditions and the behavior of counterparties.

Most often, damage that can be caused in the following situations is insured:

- stoppage or reduction of production due to changes in market conditions;

- bankruptcy;

- Unexpected expenses;

- dishonest fulfillment of obligations by the counterparty, including non-payment under the contract;

- legal costs;

- expenses related to an accident or natural disaster;

- transporting dangerous goods or working with hazardous materials;

- other circumstances.

In business activities, insurance is used quite often - in cases where possible losses are significant and critical for the financial condition of the insured person and their occurrence cannot be predicted.

Insurance reduces the necessary reserves for unexpected expenses and helps protect the business from too large one-time losses.

The insurance contract may include any conditions that do not contradict the law , therefore, in practice, by agreement of the parties, a person can be protected from almost any risk that could cause material damage.

It is important for the policyholder to determine the main parameters of the contract:

- object of insurance: property risks associated with personality, tangible and intangible property, professional activity;

- the amount of insurance compensation;

- whether the damage will be compensated in whole or in part;

- whether minor damage that will not significantly impact the insured person’s regular budget is subject to compensation;

- the procedure for paying compensation: lump sum or in installments over a certain period;

- beneficiary.

The higher the probability of any risk occurring and the higher the amount of compensation, the more expensive the insurance will be, regardless of the insurance system and the terms of the contract.

More information about the classifier of types of insurance in Russia

This is a system of directions and types of insurance, which has a tree-like expression. That is, several additional directions may come from one main type of insurance. New items are periodically added to the classifier. The last update was in 2012, when insurance for hazardous production facilities (hazardous production facilities) was added to the system.

The main regulator, the Central Bank of the Russian Federation, is responsible for statistical collections and control over the insurance market. Insurer companies do not have the right to provide insurance services in areas not directly indicated in the classifier. There are also some types that must be provided by insurance companies.

Liability Insurance

Liability insurance is used in many areas where professional error can cause significant damage - in medicine, among carriers, and businessmen.

Liability insurance includes:

- driver liability insurance;

- carrier liability insurance;

- insurance of the employer against harm to the health of employees;

- professional liability insurance for medical workers, lawyers, notaries and representatives of other professions. Erroneous actions that lead to damage to clients and third parties are insured. Professional liability in some industries is required to be insured ;

- insurance of goods manufacturers. In this case, any damage caused by goods produced by the insured person can be insured;

- insurance of enterprises whose activities are associated with increased danger to the environment or people;

- other types of liability insurance (civil liability insurance for homeowners, animal owners, hunters and other persons).

Under a liability insurance agreement, compensation may include both damage caused to the property of third parties, as well as treatment costs, moral damages, and various expenses of persons not directly affected - for example, for the loss of a breadwinner.

Only damage caused unintentionally or damage that could have been foreseen and excluded can be insured.

Read more about hazardous facilities liability insurance. Information on compulsory carrier liability insurance can be found HERE. Everything about beneficiaries in insurance: //insur/pay-insur/vygodopriobretatel.html

Insurance concept

Insurance is a process of relationship between the insurer and the policyholder, in which one of the parties assumes the function of compensating for risks, and the second participant pays contributions in advance to create an insurance fund. One option is accumulative insurance, in which insurance premiums accumulate and then, upon reaching a deadline (for example, a certain age), are returned to the policyholder.

In world and Russian practice, various types of insurance and compensation for losses incurred are used:

- the first risk, in which the policyholder is reimbursed for the entire amount of insurance premiums paid, not exceeding the amount of damage;

- proportional payments subject to a deductible, in which compensation is made in part, starting from a certain amount of losses.

The policyholder independently chooses the payment option, taking into account the likelihood of risks and the cost of insurance.

All relations in the field are formalized by contracts indicating:

- payment procedure;

- a complete list of insured events;

- total amount;

- validity period;

- frequency and amount of insurance premiums;

- additional conditions (franchise, inheritance, transfer of rights, and so on).

Before concluding an insurance contract, you need to understand the types and capabilities of the system.