What is VHI and how does it work?

Voluntary health insurance is insurance that allows you to receive medical care in clinics that do not operate under the compulsory health insurance program. Roughly speaking, with a regular policy they go to a state clinic, with a VHI policy - to a paid one.

If compulsory insurance is regulated by law, then there is no separate document for additional insurance. That is, each insurance company sets its own rules and decides what conditions to include in the contract.

Typically, a policy is a constructor. That is, you are offered a basic service, and a set of additional ones for it. The base is the minimum service required at the clinic, and the list of possible options is limitless. This includes calling a doctor at home, emergency care, dentistry, and much more.

In Russia, voluntary health insurance is usually provided by employers; it is part of an attractive social package for employment. But is it worth getting an additional policy if you don’t have one at work and don’t expect it?

Algorithm for registration of VHI by an employer

The employer usually arranges voluntary health insurance in a corporate manner. The procedure is carried out in several stages, implemented after the head of the company, whose employees will be subject to insurance, selects a suitable insurer, in his opinion. Before concluding an agreement with an insurance company, it is necessary to put in order the internal regulatory and administrative documentation. The employer must issue an appropriate order to carry out the procedure, as well as develop a Regulation on VHI and sign additional agreements with the corresponding content to employment contracts with employees. After concluding an agreement with the insurer on behalf of the head of the company, employees are given insurance policies.

To apply for an insurance policy for voluntary medical protection, it is necessary to present a passport and a medical card for consideration by the insurer, if they indicate in the application form that they have a disease that increases the insurer’s insurance risk. Foreign citizens additionally need to provide a migration card and a certificate of registration with the federal migration service. When the employer issues a policy, he takes upon himself all documentary concerns.

Advantages of voluntary health insurance

The advantages here are the same as those of paid treatment over free:

- Service in private clinics with a higher level of comfort and technical equipment.

- No queues.

- Quality service. This includes the polite treatment of the staff and such little things as free shoe covers and other disposable consumables.

In addition, the patient pays for the VHI policy once, and then the insurance company reimburses the costs to the medical institution. This approach reduces the number of unnecessary examinations and prescriptions that doctors sometimes do in paid centers: the insurance company simply will not approve manipulations that are not part of the standard of treatment.

What you need to know when applying for a policy

If you are thinking about buying insurance or got a job where employees are provided with voluntary health insurance, and want to include relatives in the program, be sure to clarify a number of questions:

- List of diseases and conditions under which the policy is not issued. When preparing this article, I re-read the insurance rules of a dozen and a half companies. And everywhere they refuse to enter into a VHI agreement with HIV carriers and cancer patients, as well as people over 65 years of age and people with chronic diseases of the cardiovascular system. From the point of view of insurance companies, this is unprofitable.

- Rules for contacting a medical organization. According to the terms of the contract, it may turn out that before visiting the clinic you need to contact the insurance company, and the operator there will refer you to a doctor. And if this is not done, then the treatment will be at your expense.

- Clinics with which the insurance company works. The smaller the choice and the more modest the clinics, the more likely it is that doctors will not be able to carry out this or that examination or manipulation. Then you have to go somewhere else and spend your money.

In addition, carefully read all the insurance rules and the contract itself, which indicates which cases will be insured and which will not.

What insurance doesn't cover

All insurance companies have different conditions. It is possible that your contract for a certain price will contain something that is not in other contracts. But standard policies are the same in most cases. In addition to the already indicated cases of HIV infection and malignant neoplasms, they do not cover the costs of:

- Medicines. You will have to buy tablets with your own money.

- Preventative visits to the doctor. Let's say nothing bothers you, but you know that you need to visit the dentist and gynecologist every year or even twice a year. If you take care of yourself, the doctor will confirm that you are healthy. And this appeal will not be considered an insured event. The same can be said about visiting a doctor when you need to get a stamp on a certificate, for example.

- Pregnancy and childbirth. These events are not considered an insured event, and insurance companies and clinics have separate offers for medical support of pregnancy.

- Psychiatric help. You will talk about stress, burnout and depression with a psychotherapist at your own expense.

It’s easier to say when a basic policy works: when you got sick, you went to the doctor and were treated on an outpatient basis. Everything else, including hospitalization (in a comfortable room), is additional chips for additional money.

What you can’t get under VHI

In some situations, the VHI pole does not cover material losses. VHI does not apply to the following situations:

- Injury or injury caused by the insured to himself. This also includes unsuccessful suicide attempts.

- Consequences of taking alcohol or its substitutes, drugs and toxic substances. In this situation, we are talking about the deliberate intake of these substances. Treatment of poisoning with toxic substances that occurs due to negligence is covered by an insurance voucher.

- Radiation diseases, the appearance of which is associated with the explosion of a nuclear bomb.

- Treatment of SNID, VIL.

- Traumatic lesions, the appearance of which is provoked by natural disasters.

- Damage that occurred at the time of the commission of a crime by one of the parties to the agreement.

- Concussions that appeared during combat operations (including in peacetime).

- Injuries that a person received while participating in strikes, rallies, and revolutionary actions of a mass nature. If you were not a participant in the rally, but were injured, the insurance company is obliged to compensate you for treatment. But you will have to prove that you are right in this situation.

How to understand whether it is worth buying a VHI policy

To find out whether it is worth buying a policy, you need to do a little:

- Calculate how much you spend on treatment.

- Find out what service packages you need.

- Check which insurance companies provide the policy and for what amount.

Last year, I didn’t spend much on treatment in commercial clinics and sought help mainly for preventive examinations (the table shows rounded data, prices are relevant for my region):

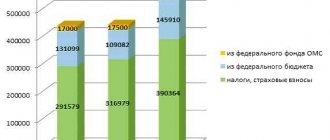

| Service | Cost, rub.) |

| Gynecologist appointment | 2 300 |

| Analyzes and examinations | 3 750 |

| Medical procedures and treatment | 4 540 |

| Preventative dental examination | 150 |

| Professional teeth cleaning | 3 000 |

| Massotherapy | 8 000 |

| Consultation with a therapist | 550 |

| Medicines | 4 724 |

| Total | 27 014 |

A calculator from one of the insurance companies calculated that the minimum policy, which would include dental services, would cost me 35,000 rubles per year. At the same time, I will also spend money on treatment, because all prevention, if you believe the insurance rules, will fall entirely on my wallet. That is, massage, teeth cleaning and medicine purchases - the most expensive items on my list - will remain outside of insurance.

You can purchase a policy that will cover these costs. But its price will be sky-high - under a hundred thousand rubles.

Out of curiosity, I called two more insurance companies, where honest employees directly said that for individuals, the VHI policy is unprofitable, and if you are worried about the risk of injury or illness, then it is more logical to conclude an insurance contract against accident or illness: it is several times cheaper .

How to save on voluntary health insurance - 4 simple ways

Every policyholder is occupied with pressing questions: is it really possible to save on VHI? Can a quality insurance program be cheap?

Voluntary insurance is a complex type of social protection. The cost of the policy depends on many factors. Even care at the same facility costs differently among different insurance companies.

And yet, ordinary citizens have a real chance of spending less on health insurance.

Tip 1. Play sports

Spending will be less if you lead a healthy lifestyle. Inexpensive insurance will allow you to conduct periodic preventive examinations in attached clinics in order to identify “weak spots” and potential diseases.

If you constantly keep yourself in shape, you will have to seek qualified help less and less often, which means that annual maintenance will become cheaper. This is not only beneficial for the wallet, but also has direct health benefits.

Tip 2. Avoid unnecessary expensive services

The quality of medical care does not always depend on price. The main thing is the level of doctors and the clinic itself. The more specialists of the highest category in the hospital, the more effective the diagnosis and therapy will be.

The staff of clinics attached to the insurance company is what you need to be guided by when choosing a VHI program. But expensive procedures (such as Chinese massage or physiotherapy with newfangled equipment) are not necessary to be included in the insurance.

Tip 3. Use the services of inexpensive medical institutions

The third tip is a logical continuation of the second. Expensive does not mean better.

Large departmental institutions can afford not to inflate prices for services, and the qualifications of doctors in such institutions are always at their best.

Tip 4. Participate in loyalty programs

Many insurers offer clients policies at a reduced price as part of various promotions and seasonal offers. If you track such events on the websites of insurance organizations, you can find economical options right now.

Watch a video on the topic of voluntary health insurance: myths and reality.

If you want to know more, read the publications “Travel Insurance” and “Accident Insurance”.

When does it make sense to buy a VHI policy?

Voluntary health insurance is beneficial in several cases:

- With the help of your employer, you connect your relatives to the insurance program on favorable terms.

- You get sick a lot and are treated in paid clinics.

- You have a lot of money and want to receive medical care with maximum comfort.

If this is not your case, then leave VHI for employers who think about their subordinates, want to be attractive to cool specialists and not lose people because they spent the whole day in line at the doctor because of a common runny nose.

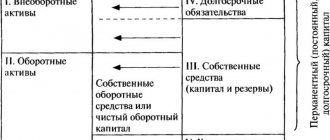

VHI subjects

Insurance relations within the framework after signing the contract are regulated by relevant regulations. Relationships of this type include several subjects:

- A client (policyholder) signing an agreement regarding the purchase of insurance services. The client is any individual (with full legal capacity) or legal entity. In some cases, a charitable foundation may act as the policyholder.

- The person for whom the insurance policy is issued. This is the party to the contract receiving insurance services. The policyholder and the insured person are often the same person, but it is possible to issue a policy for other entities.

- A company providing insurance services. A company engaged in the provision of insurance services on the basis of a license issued by the state.

- Medical institution. This could be a hospital, clinic or any other institution that is subordinate to the Ministry of Health. To provide insurance services legally, an appropriate agreement must be signed between the medical institution and the insurance company.