Lump sum and royalty - what is it in simple words

Lump sum payment

is a one-time payment that the buyer (franchisee) pays to you as the franchise owner to gain the right to enter your franchise network.

In simple terms, the lump sum fee is the price for your franchise, your knowledge. This includes fees for using a trademark and a proven business model.

Royalty

is a regular payment (monthly or quarterly) that the franchisee pays for support in activities from the head office of the franchise network, that is, you and your support department (management company). Essentially, this is a payment for assistance in running the business after purchasing a franchise.

If we consider a franchise as a car, then the lump sum fee is the price of the car, and the royalty is the cost of service.

The franchisee takes care of his car, so he regularly undergoes technical inspections, diagnostics, updates the navigation system, etc. at your service center. Accordingly, every month he spends a certain amount on the maintenance of his “swallow”.

What it is

In simple terms, a royalty is a payment for the transfer by the copyright holder of unique rights to the possibility of using a trademark, logos, slogans, copyrights, original developments (know-how) for the purpose of obtaining commercial benefits by the franchisee.

Considering the calculation method, the classification provides for 3 types of periodic deductions:

- Percentage of turnover - the franchisee deducts funds based on a percentage of sales volume, which is determined based on the results of the subsidiary’s work for a certain period of time (most often 1 month).

- Margin percentage – payment is calculated from the difference between the retail price and the cost of the product. This type is beneficial to the franchisee, whose markup on goods varies within different limits, and he has the ability to regulate pricing.

- Fixed royalty is a current fee determined by agreement and having a certain percentage of turnover. Its value is determined by the price of the franchisor’s services, as well as the number of branches reporting to the head office.

In some cases, monthly payments for management and other services to the company that provides the franchise may be absent or of symbolically small value. Then the franchisor sets a large lump sum fee.

Another option is the absence of an initial payment when it comes to “soft” franchising. An entrepreneur receives a franchise package for free, subsequently paying a regular percentage based on the results of commercial activities.

Thanks to an increase in the interest rate, the franchisor has the opportunity to eliminate or reduce to a minimum the lump-sum fee, which becomes attractive to a large number of potential franchisees and contributes to the expansion of the franchise network.

For example, examples of franchises with no lump sum fee:

- Grocery store "Beans" from METRO Cash & Carry

- Ecco shoe store

- Fast food restaurant Grill House

- Sunlight Jewelry Store

- Casual clothing store CROPP TOWN

What is included in the lump sum fee

To begin with, let’s establish that the lump sum fee has a basis, a certain price frame, to which all sorts of “bells and whistles” are then added.

This basis, as a rule, includes a French book (instructions, description of business processes) and the right to use a trademark.

Add-ons can include anything that requires costs:

- development of a design project individually for the franchisee’s premises (costs for the designer);

- travel of a specialist to the franchisee’s city to assist in opening (costs of travel, accommodation, business trips);

- creation of a website for franchisees (development costs);

- primary delivery of goods (transportation costs and the goods themselves);

- etc.

To most accurately determine all additional expenses, you can conduct an analysis of competitors and compile a list of activities that they include in supporting franchisees. From this list you can put together your own list of events to support your partners.

Sometimes this is enough, but to be completely confident and create a truly effective support program, we recommend going step by step through the franchise structure and thinking about how you can help the franchisee at each stage of the activity.

Make a table showing the costs for each support item. This way you will determine the cost of services to support your partners.

What does royalty mean in franchising?

The word royalty itself is of English origin. It means the word “royal”, which translates as royal. This term referred to a tax in the 16th century that was levied for the benefit of the British Crown on people who mined coal.

The term can refer not only to monetary contributions, but also to rent, fees, or licensing fees.

Royalties in entrepreneurship are, in simple words, a mutually beneficial formula for cooperation between a beginner and an already established entrepreneur. At the same time, the franchisor offers not only a well-promoted name, but full business support.

A good brand ensures that its franchisee partner can take over a large portion of the market in its home region. He helps to hire staff, connects the entrepreneur with suppliers, and monitors all business processes. And for this, the franchisee pays a monthly royalty.

How to calculate a lump sum payment

First of all, you need to make a list of competitors

. Therefore, we type in the phrase “franchise catalogue” into the search engine (Yandex, Google) and follow the links. We choose our niche and look at competitors. It is better to enter data about competitors into a table in order to see the situation more clearly and not lose information. What you might need:

- name of the competitor's franchise;

- Contact details;

- franchise cost (lump sum);

- royalty amount;

- what the franchisee receives (if such information exists).

Next, based on the data obtained, we analyze what competitors offer their potential franchisees

. Here it is important to pay attention to those very additional points - franchisee support.

Of course, the amount of the lump-sum fee depends not only on additional services. For example, it is worth paying attention to franchise packages. The size of the lump-sum contribution of different packages may vary, for example, depending on the number of residents in the locality.

In addition, you should take into account the popularity of the brand and the number of already opened and operating franchise outlets.

Therefore, you will need to conduct a competitor analysis and gather as much information as possible so that you have a complete understanding of why this competitor has a higher lump sum than another and vice versa.

After analyzing competitors, we move on to evaluating your additional services to support franchisees. You should roughly estimate how much each item costs.

Next, you conduct a comparative analysis between your services and competitors' offerings. As a result, you will arrive at an average acceptable lump sum payment.

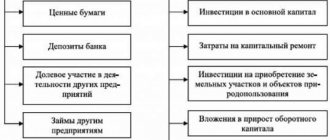

Objects covered by royalty

What is royalty and what objects does it apply to? From an economic point of view, periodic payments can be assigned for the use (rent) of the following types of intellectual property:

- A patent for any invention.

- A developed and registered program or operating shell for a computer.

- A certain sample artificially created for various purposes (for example, a conceptual solution for a future product).

- A chemical or biological formula, theorem or model for describing a phenomenon.

- A plan for mass sales in any area or a report on statistical data for products, production, etc.

- Any work of art (literary, artistic, musical) for which copyright has been issued (usually by a publishing house or recording studio).

- Registered trademark, trademark, brand.

- Franchise of the parent company.

- Any fundamentally new way of performing various tasks (know-how).

From the above list it is clear that royalties can be paid not only to companies, but also to any individuals if they have documentary evidence of ownership of intellectual property.

In business, there is another important concept of franchise royalties - “Free Royalty”, which means a one-time payment of a fee to the owner in accordance with the license agreement. There are no further encumbrances for the right to use a franchise, and royalty taxation for the franchisor is also required to be paid only once.

At the same time, it is from the point of view of taxation and incorrect accounting that royalties can carry risks for the parties to the agreement. A tax inspector may question the wisdom of paying royalties under a license agreement if, for example, franchise payments exceed the bottom line profitability of the business. In this case, there is a high probability of additional income tax being imposed.

Copyrights for intellectual property

Main characteristics of royalties

As we have already said, royalties are payments for support during the franchisee's activities. At the same time, you need to clearly understand what kind of support you will provide. When companies say “we will help our partners in everything”

- in essence, this means

“we have no idea how we will help

. There must always be structure.

To determine areas of support, you need to understand that royalties = money

. The franchisee pays you regularly out of his own pocket. Therefore, you need to create a support program so that partners want to pay you and are grateful for the functions that you have taken on.

Based on this, we can derive two main factors that characterize royalties: value and validity.

Royalty value.

The franchisee must understand that if even one element of support is removed, it will greatly affect his company's productivity and profits. For example, all quality franchises have technical support. The franchisee can contact the support manager with any question and receive from him a full, meaningful answer - instructions for action. Without this support, the franchisee will try to find information on the Internet or will search for a solution to the situation with his own mind on a whim - but all these ways are unknown, untested and can ultimately lead to a negative result. Accordingly, the franchisee will want to pay royalties because it is beneficial for his business.

Validity of royalties.

You cannot simply set a royalty of 5% of revenue and demand it from the franchisee.

You need to explain to the franchisee why it is profitable for him to pay you royalties. For example, your company provides services to individuals. You get clients through online and offline advertising. You cannot take charge of promoting the company offline, so you pass on detailed instructions to the franchisee. But you can help with online promotion. You know exactly how to set up a website and advertising on it, where is the best place to advertise, how much to spend on attracting clients, how to provide technical support for the website, etc. Therefore, you tell the franchisee “I will take on the online marketing function and will supply you with leads (applications from clients), for this I will charge 500 rubles per application

. And you explain the benefits of this for the franchisee - that he does not need to bother and look for specialists who will set up Yandex.Direct and Google Adwords for him, and the cost of these specialists will be the same amount. As a result, all franchisees agree and confirm that this format of interaction is convenient.

Thus, royalties should include support payments that provide value to the franchisee and that value can be justified.

Pros and cons of paying royalties

In practice, royalties have both advantages and disadvantages for both parties to the contract. The positive effect of the presence of regular payments for the franchisor is, undoubtedly, the formation of virtually passive income on an ongoing basis. Also, if the terms of the franchise established percentage payments on profit or turnover, the main copyright holder has the opportunity to control the work of the representative office in more detail.

For franchisees, royalties are fixed expenses, which at first glance is a negative quality. On the other hand, the franchisor’s interest in increasing its own profits by improving the work of franchisees becomes a guarantee of a kind of mentoring assistance and more detailed advice on organizational issues.

The main risks of royalty payments for franchisees are their unreasonableness. For example, the copyright holder company may not fulfill its obligations to support the representative office, but only collect additional payments. On the other hand, the cost of using a brand may not correspond to its real value, which is quite difficult for a novice entrepreneur to determine when signing an agreement. In this case, an inappropriate outflow of funds actually occurs.

Understanding the term royalty, what it is in simple words and how it is implemented in practice is a fairly important point for anyone who is considering the possibility of building a franchise business. It is worth remembering that after signing the agreement, it will not be possible to reduce the rate or get rid of regular payments to the copyright holder without terminating the agreement.

How to calculate royalties in a franchise

The royalty may be a fixed amount or a specified percentage of the franchisee's revenue or margin. Royalties can also be in the form of a percentage, but not less than a specific minimum amount.

To calculate royalties, you need to understand what you will include in this amount, that is, what support you will provide to the franchisee during operating activities.

Just like with a lump sum fee, we recommend going through the franchise structure and specifying all types of support for your partners in their daily work. This may include:

1. Work with marketing, that is, you can take on:

- setting up advertising campaigns (we include in the royalty the salary of a specialist in the number of hours he will spend on the franchisee’s advertising campaign);

- maintaining social networks (partially the salary of a designer, content manager, targetologist, etc.);

- development of advertising layouts (partial salary of the designer), etc.

2. Accounting and reporting (partially the accountant’s salary).

3. Support hotline for franchisees (manager’s salary is proportional between franchisees), etc.

Read more about franchisee support and the work of the management company in this article.

It should be noted that some franchises completely refuse royalties and receive money for business development only in the form of lump sum contributions. Read on to find out what this depends on.

Legislative justification for royalties

Royalty – what is it from a legal point of view? It must be said that this term is not used in Russian legislation, but Article 1235 of the Civil Code of the Russian Federation provides information about the possibility of periodic payments by an individual or legal entity for the right to use someone else’s licensed intellectual property. In this regard, a special license agreement is provided between the owner of the license and the person using it for his own purposes, and this document specifies the amount of deductions in favor of the former, usually in the form of annuity payments, in other words, the royalty rate.

In accordance with the Tax Code of the Russian Federation, such deductions are considered as passive income (rent) in favor of the owner of intellectual property, and tax is levied on such revenues in accordance with current legislation.

How the field of activity affects the lump sum and royalties

If we look at franchise catalogs, we will see a huge range of prices for franchises. At first glance it may seem that the owners are, but this is not so. At least not always.

In order to determine the size of the lump sum fee and royalty, you need to think about what you want from the franchise and how you can earn income. This is where the direction of your activity will play its role. Let's look into it in detail.

Lump sum fee for franchise services

If you have a franchise in the service sector

, then the only option for making money here is on your know-how (knowledge base).

You transfer your knowledge base at the first stage of interaction, immediately after purchasing a franchise. That is, the franchisee receives the main value of your product at the time of payment of the lump sum fee. Based on this, we conclude that the lump sum contribution in the service sector needs to be large

.

This is also due to the risks of franchising in the service sector. It often happens that a franchisee receives a business model from you, tests it for six months, and then says “that’s it, everything is clear here, I won’t learn anything new.”

and terminates the contract. Accordingly, you lose:

- franchisee (minus 1 point in the network);

- reputation (if this franchisee starts saying nasty things about you);

- royalties (no contract - no payments).

Moreover, there are cunning franchisees who go to terminate the contract through the court, demanding the return of the lump sum fee. To protect yourself, you need to take drawing up a franchise agreement very seriously.

Another important point that will help avoid such situations is that there is no need to transfer the entire business model to the franchisee. Leave some functions to yourself, for example, Internet marketing. This way, the franchisee will stick with you because they understand the value of being in your franchise network. There should be such support on your part so that the franchisee understands that it is easier for him to cooperate with you than to go free.

Royalty on franchise services

If we are already talking about support, then we should talk about calculating the cost for this support. In general, royalties are of two types (main):

- fixed amount;

- percentage of revenue/profit.

There are various modifications such as fix + %, etc., but the basic options look exactly like this.

So, we have already established that royalties = support. In the service industry, this support will act as an anchor to retain franchisees. Therefore, there should be a royalty in the franchise of services.

As for the type of royalty, you should start from the ability to track the franchisee’s income. If your company has a serious accounting system that cannot be bypassed, then you can set royalties as a percentage of revenue/profit

.

If the franchisee can find some workarounds and hide at least part of the income from you, set a fixed royalty amount

.

Lump sum fee for a product franchise

If you have a product franchise,

then the value of your business is the product. This is where you can earn additional income through a franchise. Here, a popular and justified option for earning money is centralized delivery of goods. What to do in this case with the lump sum and royalties?

As a rule, the lump sum fee in product franchises is set small. So, if the net monthly profit of your business is 200 thousand rubles, then you can make a lump sum contribution of 300-500 thousand rubles.

This is due to the fact that you will earn money not from the sale of the franchise itself, but from subsequent deliveries (we’ll talk about this later in the article).

By the way, you can use a stepped lump-sum payment model here. For the first 10 franchisees you can make a lump sum contribution of 100 thousand rubles, for the next 10 partners - 200 thousand rubles. etc.

Advantages of the step model:

- there are many applications at the first stage of franchise sales, there is plenty to choose from;

- Many franchise outlets quickly appear - the popularity of the brand is growing;

- the brand is popular, the reviews are good - the franchise is sold even with an increase in the lump sum fee.

Disadvantages of the step model:

- at the beginning of sales, when the lump sum fee is low, there will be a lot of applications - you will have to carry out a strict selection in order to create a team of truly high-quality partners (poor selection - unhardworking and unmotivated partners - low franchisee performance - bad reviews - bad reputation of the franchise and brand).

Royalties in a product franchise

Royalties are established in order to:

- recoup the costs of supporting franchisees (managers' salaries, telephone communications, etc.);

- receive additional income from the franchise for the development of the company and the entire franchise network.

If you plan to earn additional income from centralized supplies of goods and understand that this income will cover the costs of maintaining the management company, then you can do without royalties at all. This is a very common practice for product franchises.

If you still want to split the payments, you can set a royalty. For product franchises, a royalty as a percentage of revenue/profit is recommended. This is due to the fact that the financial indicators of commodity companies are very strongly tied to software (accounting for supplies, balance, etc.). Accordingly, the franchisor can always track the real cash flow indicators of its partners (if it has full access to the franchisee’s software).

It is worth noting that if you have established a royalty, the franchisee must understand what he is paying for. Otherwise, your partner may decide that you are simply making money off of him (lump sum, royalty, and even a markup on the product). Therefore, be extremely careful in monetary matters so that your franchisees do not start looking for ways to circumvent payments.

Thus, the scope of activity greatly influences the size of the lump sum and royalties. This must be taken into account.

A little about franchising

Photo from the site f.sravni.ru

A franchise is one of the types of small business in which a brand (franchisor) gives another person (franchisee) the opportunity to conduct business under its trademark. Such cooperation is, first of all, a business relationship, and therefore is subject to accompanying monetary payments.

Franchising has quickly gained popularity among all forms of entrepreneurial legal relations, and is often found both in our country and abroad. A high success rate was achieved due to the undeniable advantages of this type of business.

Franchising cooperation allows you to obtain the following benefits:

- Using a popular brand name.

- There is no need to develop a strategy for the operation of the enterprise.

- There is no need to create a PR campaign and other marketing elements.

- Automatically obtaining a target audience group.

- Starting a successful business in the market of your city.

- Opportunity to conquer a vacant market niche.

- Absence of risks related to bankruptcy of the organization at the initial stages of development.

Franchising allows you to protect start-up businesses from many risky processes that may arise when starting your own business, for example, individual entrepreneurship. To start working on a franchise, the parties sign an agreement that specifies the responsibilities of the franchisee and the amount of mandatory payments. Information is also provided on what benefits and business models the franchisor provides for use. You can find out more about the processes of operating a franchise enterprise here.

Mandatory payments for cooperation are:

- Royalty.

- Lump sum payment.

Despite the fact that payments are made in the same area, they have significant differences and are paid at different times.

Other payments in the franchise - who needs them and why

In addition to lump sum fees and royalties, there are payments that are directly related to the support that your management company will provide to franchisees.

Such payments include:

- Marketing fee

- you take on the work with customer acquisition channels and the franchisee transfers you an advertising budget, which you will distribute among advertising campaigns.

- Sale of goods

- you can be the sole supplier of goods for your franchisees. Most often, this option is used when the management company is directly the manufacturer of the product, or when the business owner has already established relationships with the supplier and ordering the product through the management company is more profitable.

Example : The 220 Volt company included a personal brand in its product line. They, through their suppliers in China, have created personal branded products and sell them in their stores. In addition, franchisees also purchase products from other popular brands from the Parent Company because it is cheaper. In total, the “220 volt” franchisor receives a markup of approximately 30% from other brands and up to a 3000% markup from his personal brand.

- Sale of consumables, inventory, equipment

- just like with goods, you can supply consumables, inventory, equipment. This can be either your desire or your need. For example, sometimes consumables of a specific brand and specification can only be purchased in the franchise owner's city.

How to get rid of royalties?

Royalties are a direct benefit to the brand when distributing a franchise.

- Most often, royalties are one way or another included in the contractual relationship between the entrepreneur and the brand owner.

In some cases, monthly payments may be eliminated for a short period of time. For example, when a franchise owner predicts rapid growth in demand in his niche. He needs to capture most of the regions as quickly as possible, and he removes the obligation to pay royalties for a given period. - The second case is a young or new franchise. Such projects may have a small lump sum fee and no royalties. True, as in the first case, the conditions for owning a franchise may change over time, if this is provided for in the contract.

- Finally, technically, you may not pay monthly fees at all, but the brand owner will still receive his percentage.

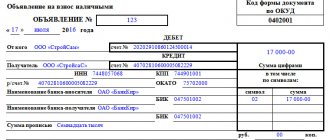

When are lump sum fees and royalties paid?

Since the lump sum

This is the price for your product, your franchise, then the franchisee must transfer the payment

immediately after the start of your cooperation

. There are several options that can be considered starting points for a relationship. Let's look at them in more detail:

- Concluding a franchise agreement is the most logical and, perhaps, the most obvious starting position for cooperation. You enter into an agreement with the franchisee, which states that your partner must transfer the amount of the lump sum contribution within several business or calendar days.

- If you have any doubts about the intentions of a potential franchisee, then you can request part of the lump sum payment in advance, even before concluding a franchise agreement. For example, if:

- a potential partner is too intrusively trying to find out information that you consider core and even secret (corporate secret) and would not like to share data with a third party with whom you are not yet completely confident in cooperation;

- you suspect that this is a representative of a competitor and he is simply trying to extract secret information from you;

- a potential partner has expressed a desire to enter into a franchising agreement, but first wants to get to know your company from the inside so that you can give him a tour.

In these cases, you can offer the potential franchisee to enter into a letter of intent

, under the terms of which the franchisee pays part (for example, ⅓) of the lump sum fee in advance, and only after that, you lift the veil of corporatism a little. This will ensure that the potential franchisee is truly serious about joining your franchise network.

Some may say that without a tour of the company it is impossible to make a final decision; it’s like buying a “pig in a poke.” But in reality, the information needed to make a decision to collaborate is, for the most part, public. Even the financial plan is public information. This is more than enough. But an obsessive interest in the intricacies of work that has not yet begun - this should alert you. In this case, you should correctly convey to the potential partner that it is not necessary to study all this information at the stage of preliminary negotiations.

As for the payment system itself. Opening a new company is a rather expensive task. Therefore, many franchise owners allow the lump sum payment to be paid in installments, that is, in installments

, for 2-3 months. This is normal practice and can be applied to all of your franchisees, or individually to some based on negotiations.

Now let's talk about paying royalties

. Everything is simple here - the franchisee transfers a set royalty amount to your bank account monthly or quarterly. The payment amount can be fixed or as a percentage of the partner’s revenue for the reporting period.

There is a common practice, like rental holidays, only for royalties. This means you can:

- exempt franchisees from paying royalties for the first 1-3 months;

- reduce the payment amount for the first 1-3 months of the partner’s activity.

Royalty system

Royalties are a flexible payment system that is most common in licensing and franchising practice, as it allows licensees and franchisees to make more affordable periodic remuneration payments (usually as a percentage) to rights holders.

Payments under the royalty scheme are paid throughout the duration of the contractual legal relationship and are calculated from the royalty rate and the royalty base.

The royalty rate refers directly to the interest itself that the licensee or franchisee must pay to the copyright holder.

But the royalty base (the amount from which the royalty rate is calculated) may mean different amounts, so it is necessary to clearly indicate the royalty base in the agreement.

The licensee or franchisee must be very aware of how royalties are calculated and what indicators they depend on.

This is where the catch often lies in licensing and franchising contractual structures, as a result of which a misunderstanding of the terms of the contract by one of its parties leads to problems in the execution of the contract and, as a result, to legal disputes in the future.

World practice mainly follows the path of minimizing the risks of the copyright holder and interest is calculated, as a rule, based on the volume of products sold (the base can be calculated both from the amount of revenue for a certain volume of goods, and based on physical sales indicators).

However, other methods for calculating the royalty base can also be used and it is impossible to list them all within the framework of this article, since the principle of freedom of contract allows absolutely any economic or production indicators to be used as the royalty base.

Let's just say that the most popular and profitable way for the licensee or franchisee is to determine the royalty base based on the profit indicators.

Royalties are not always percentage-based royalties. For example, the copyright holder can assign royalties not as a percentage of the volume of sales of goods, but in the form of fixed amounts charged from the sale of each individual unit of product.

That is, the royalty system is a system of periodic payments that can be expressed either as a percentage or as a fixed amount of any indicators taken as the royalty base. It is frequency that is the defining feature of the royalty settlement system.

How are royalties formed?

There is no specific algorithm for generating royalties. Each company calculates and sets the payment itself. Even if a company contacted an agency when packaging a franchise, there is no guarantee that this agency did not recommend setting royalties at the same rate as its competitors.

However, in large network companies, as a rule, nothing happens “at random”. And the royalty is really calculated based on the needs of the company and the capabilities of new franchisees.

Alas, this does not always happen. There are examples when the royalty is billed as a completely disproportionate payment, simply because the franchisor wants to make good money from it every month.

Therefore, we can make two recommendations. Firstly, always pay attention to the size of the royalty and take into account which month you will need to pay it, as well as what you will receive from it. And, secondly, do not hesitate to directly ask the franchisor why the royalty is set in this particular volume. Of course, if this information is important to you.

What is royalty?

Royalty is a regular remuneration paid for the use of certain forms of property, for example, natural resources, both material property, or copyright, and intellectual property.

If we explain royalties in simple words, we can draw an analogy with rent .

Here are some examples :

- A music lover (who is this?) has downloaded his favorite tracks, or simply listens to them on the radio. For each playback or download of a track from the official resource, the performer receives a royalty.

- The writer wrote a novel, which the publishing house released for sale. For each copy of a book sold, the writer receives a royalty - a fee. In that case, of course, if such an agreement was concluded between him and the publishing house.

- An entrepreneur decides to open a cafe of a certain brand. He enters into an agreement for the right to use the brand with the parent company, undergoes training there, and then conducts business in the cafe independently, regularly paying royalties.

All of the above is possible only because the use of intellectual property protected by copyright or any other licensed products is prohibited by law.

Royalties are paid for the use of franchises, logos, creative assets, land, brands, stamps and much more.

Types of royalties

There are several types of royalties, the main difference is the amount and calculation method:

- Payments from turnover . The entrepreneur’s revenue is analyzed, and a certain part of it is paid to the brand owners. A way in which the brand owner exercises control over business activities because he is interested in the result.

- Payments from profits . The interest is calculated to the owner based on the markup established by the entrepreneur.

- Fixed payment . It depends on the scale of the entrepreneur’s activities, and does not depend on income. So for one mobile tray with pies the brand owner will receive 1 thousand rubles, for two - 2 thousand rubles, and, say, for a pie stall - 5 thousand rubles.

- There are also combined options, when certain items are paid according to turnover, and to this is added a fixed payment for using the brand.