What is leasing?

In Federal Law No. 164-FZ of October 29, 1998, the concept of leasing is interpreted as “financial lease”. This service is a form of lending that provides for the client to receive certain property for long-term use on the terms of the subsequent transfer of ownership to him. In this case, the recipient undertakes to pay the leasing company a certain amount monthly for using the property for personal purposes. In simple words, leasing is a cross between rent and a targeted loan for the purchase of property.

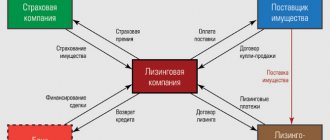

There are 3 entities involved in the leasing transaction, namely:

- Provider. This is a company that sells real estate or equipment. The supplier can be either a legal entity or an individual entrepreneur.

- Lessor or leasing company. This role is played by the organization that purchases the specified property from the supplier. As a rule, leasing activities are carried out by subsidiaries of commercial banks or specialized organizations that have the appropriate license and sufficient equity capital.

- Lessee. This is an individual or legal entity that receives a leased asset for a specified period and for a certain fee, with the possibility of subsequent purchase.

To understand the economic essence of leasing, it is necessary to consider this procedure using a specific example. If an enterprise or individual entrepreneur has a lack of own funds to purchase equipment, and obtaining a loan or lease is currently economically unprofitable or impossible, then a leasing company is involved. The client indicates the required property in the application, after consideration of which the lessor purchases the object from the supplier and leases it to the lessee.