Theory

Let's start with the very first question. What is leasing? Leasing is a form of lending that allows a legal entity to purchase fixed assets of an enterprise, while significantly saving on taxes. As well as other goods, both for individuals and legal entities.

Lessor is a company that leases equipment and other property under a leasing agreement.

The lessee - the company leases the goods under the contract.

The seller is the company from which the lessor buys the property being leased.

The subject of leasing is the property leased under a leasing agreement.

In essence, leasing is a long-term lease, both with and without the right to purchase.

The active use of leasing in Russia is due to tax benefits, as well as the fact that leasing allows for accelerated depreciation of equipment and property, and redistribution of VAT payment deadlines.

The subject of leasing is non-consumable things, enterprises, buildings, structures, equipment and other property.

This is what a classic leasing scheme looks like

How does the personnel leasing scheme operate in Russian practice?

The recruitment agency recruits highly qualified employees according to the requirements and wishes of the customer, taking into account their experience and length of service at the enterprise. Taking into account the fact that in the future employees will have access to confidential information of the employing company, their selection is carried out using special methods.

Hired employees in staffing firms become full-fledged employees. To formalize an official relationship, an employment contract is concluded between two persons.

Selection of an accurate action plan for the employer. This stage involves the conclusion of an agreement, which specifies the conditions - the employee’s salary, as well as the amount of the agency’s commission (standardly this is no more than 10% of the specialist’s salary).

One of the main points in the leasing agreement is the amount of work performed by the temporary employee with high quality and always on time.

Documentary evidence of the relationship between all leasing participants is drawn up. It is established by certain agreements:

- labor – concluded between the employee and the personnel service;

- agreement between the customer company and the agency.

In this case, there is no contract directly between the customer company and the employee, so the company has the right to refuse it at any time.

Specialists are in the service of the employer for a specified period of time.

Types of leasing.

Question: “What types of leasing are there?”

Depending on the terms of use of the leased asset. Leasing happens.

- Financial leasing (or financial lease) - the leasing period is comparable to the service life of the property and since upon completion of the contract, leasing has practically zero value, the leased asset can be transferred to the lessee for ownership, without additional payment.

- Operating leasing – (operational leasing or rent) the term of the operating leasing agreement, most often, is a multiple of the service life of the leased asset. At the end of the contract, the property must be returned to the lessor. Often the subject of the contract is already owned by the lessor. In this regard, the third party to the contract (seller) may be absent.

- Leaseback is a special case in which the lessee is the seller. This is essentially a form of loan secured by the fixed assets of an enterprise.

Advantages of buying a car on lease

The obvious advantages of car leasing are:

- The opportunity to buy not only a passenger car, but also a truck, as well as special vehicles. technique.

- To complete a transaction, a minimum package of papers is required.

- Requirements for clients are softer than in credit institutions.

- After the end of the contract, the car can be purchased or returned to the owner.

- The subject of the transaction can be returned early.

- You can start using the vehicle immediately after making an advance payment.

- Possibility to develop a flexible payment schedule.

In simple words.

Question: “What is leasing in simple words?”

Leasing is when you (the lessee company) contact the leasing company (the lessor). You agree that you will rent equipment or other property from them on such and such terms. The leasing company buys the equipment you require from a third company (seller) and leases it to you. This operation will allow your company to obtain tax advantages and use the necessary equipment and property without purchasing it.

Differences between leasing and outsourcing

Outsourcing and personnel leasing represent the transfer of certain property for use to other persons. Such property can be not only real estate, but also the labor resources of an enterprise. Thus, outsourcing and personnel leasing is the temporary placement of employees on the balance sheet of a company. But this is where all the similarities between these two concepts probably end.

As for the differences between staff leasing and outsourcing, there will be many more. We will describe only the main ones.

Leasing and legislation of the Russian Federation

Question: “How is leasing regulated by the laws of the Russian Federation?”

In our country, leasing is regulated by Articles 665-670 of the Civil Code of the Russian Federation, as well as by Law N 164-FZ “On financial lease (leasing)”

In accordance with the law, the leasing agreement must contain mandatory conditions, in the absence of which the agreement will be considered not concluded.

- Conditions about the subject of leasing;

- A condition about the seller of the leased asset or that the choice of the seller is made by the lessee;

- Condition on the lease term;

- Condition on price (amount of leasing payments).

What is leasing - definition

The financial term “leasing” comes from the English word “leasing” and is literally translated as “rent”.

Indeed, when performing leasing transactions, the property is transferred for temporary use, but unlike a classic lease, the user has the right to subsequently purchase the leased object for permanent possession.

This is the main fundamental difference between leasing and rent: there are other nuances that we will definitely talk about in our article.

The official definition is as follows:

Leasing is a type of investment activity aimed at the owner transferring his property to individuals or legal entities according to an agreement.

The property is transferred by the lessor for a certain period of time for a fee agreed in advance and with the right of subsequent repurchase of the property by the lessee. All conditions for the transfer of property, its insurance and service life until full redemption are specified in the leasing agreement, which is signed by both parties.

It should be said that leasing does not always end with the purchase of the property: sometimes the recipient returns it to the owner, as in a regular lease.

Objects and subjects of leasing

Let's consider what objects (or items) can be leased:

- equipment;

- structures;

- building;

- enterprises;

- transport;

- other property in which the recipient is interested.

Almost any owned property can be leased or leased. The exceptions are plots of land, natural objects, as well as property for which the law provides for a special nature of treatment (for example, weapons).

In our country, leasing of equipment and cars is especially popular.

Many companies at the initial stage of their activities come to the conclusion that it is more profitable for them to take out property on credit with subsequent redemption than to buy it through a one-time purchase and sale transaction.

This allows you to reduce costs and purchase equipment and machinery in the shortest possible time.

Read about how to lease a car for legal entities in our separate article.

Leasing subjects:

- lessee (also known as client - an individual or legal entity interested in receiving the leased asset);

- lessor (bank, company, commercial or public organization);

- insurer (company that insures the transaction);

- supplier (equipment seller, manufacturer, dealer).

It happens that the lessor also acts as a supplier of property, but more often it is a commercial bank, a credit institution or the leasing company itself. The lessor can be not only a legal entity, but also an individual leasing personal property.

An insurance company is an optional but desirable participant in leasing operations. Typically the insurer is a partner of the recipient or lessor. It is involved in order to insure property, transport, financial and other types of risks associated with the transaction.

Practically all large credit organizations carry out procedures of this type, but not directly, but through specially created “subsidiaries” - subsidiaries.

Typically, the first part of the name of such divisions coincides with the name of the parent company (bank). Example - Avangard-Leasing, PromSvyazLeasing, VTB Leasing, etc.

Practical meaning

What is the practical meaning of leasing? It's simple: the recipient does not pay immediately, but makes payments within the period established by the contract, while the property actually becomes the property immediately after making the down payment.

It is clear that the transaction is completed only if there is mutual benefit between the recipient and the lessor. Leasing agreements are variable and varied, and debt repayment schedules are flexible.

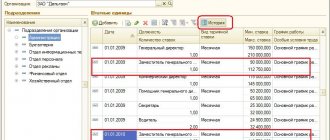

There are the following types of payments:

- regressive payments - payment monthly with a decrease in the amount;

- annuity payments - with the same amount of payments;

- seasonal payments - tied to the seasonal characteristics of the recipient's business.

Equipment taken into use can be immediately put into operation, but until it becomes your property, property tax is not deducted from it - this is another advantage of leasing operations.

Advantages of leasing

The question “What are the advantages of leasing?”

For legal entities

Purchasing a company's fixed assets in the form of leasing allows you to reduce the company's tax burden and accelerate property depreciation. In particular.

- Leasing payments are expenses and reduce the tax base for income tax.

- It should also be noted that accelerated depreciation with a coefficient of 3 leads to a decrease in the property tax base.

- Leasing also allows you to increase the amount of VAT refundable.

For individuals

For example, when purchasing a car

- Leasing is easier to arrange, since it does not take a long time to collect various documents.

- No collateral, guarantee or clear credit history required

- Leasing companies are required to cover all costs and fees associated with vehicle registration, because they are the owners.

- The lessor usually takes care of some of the car maintenance and repairs.

Leasing for individuals

For individuals, purchasing a car on lease is also available. If we talk about leasing a car for individuals in simple words, then this method brings maximum benefits when purchasing expensive foreign-made cars. But according to data at the beginning of the year, ordinary Russians most often buy budget cars in 2020. This applies not only to small settlements, but also to large cities such as St. Petersburg and Moscow.

According to customer reviews, leasing conditions are not particularly different from bank lending. Similarly, you need to confirm solvency, make an advance payment, and so on.

An important feature is the following: the car is listed on the lessor’s balance sheet, which means there is no need to pay transport tax. But other contributions (including CASCO) will still fall on the shoulders of the recipient.

As a result, for an ordinary person, leasing and a car loan are practically no different. In both cases, the car will be confiscated for non-payment of payments, and previously made payments will not be returned.

Nuances

Question: “What nuances need to be taken into account when leasing?”

The Convention on International Financial Leasing, ratified by Russia, does not provide for the mandatory right of redemption.

The lessee may initially be the owner of the equipment it leases.

Land plots and other natural objects cannot be an independent subject of a leasing agreement, according to the legislation of the Russian Federation.

The property provided for rent, under a leasing agreement, is the property of the lessor.

The term leasing is not used in international financial reporting standards. There are two concepts: financial lease (called leasing) and operating lease (called lease).

Disadvantages of leasing a car

Of course, all services have their drawbacks in one way or another.

Leasing is no exception. • The vehicle does not belong to the buyer for several years until the amount of payments is repaid. That is, if the buyer violates the terms of the contract, the lessor has the right to return the vehicle.

• Car leasing is often more expensive than a loan. Given equal price conditions, leasing is an unprofitable service regarding the financial side of the issue. This does not apply to situations where car dealerships provide discounts to lessors.

• The car leasing agreement may stipulate a certain technical maintenance service, which sometimes may not be entirely convenient for the buyer. This concerns the financial and territorial part of the issue.

• Although leasing, unlike a loan, does not imply the transfer of ownership of the car initially, it does require the investment of personal funds (as a down payment).

• Registration of ownership of a vehicle in a leasing scheme is carried out twice: first from the seller to the lessor, and then directly to the buyer. This means an additional expense that is covered by the buyer.

Consumer leasing.

Question: “What is consumer leasing”

Consumer leasing is also widespread in world practice. Relatively recently in Russia it became possible to buy property in the form of leasing for individuals. This service is mainly developing in the car sales market and the housing market. However, this has not yet become widespread in our country. According to experts, about 30% of all car sales to individuals in Europe and the USA are leased. In our country this figure does not yet reach 10%. This is due to several factors.

- High cost of leasing as a product

- Lack of ownership rights for leasing, although this is both a minus and a plus.

- Lack of tax benefits for individuals.

What cars can be bought on lease?

Let's look at what you can buy on lease. In fact, the choice is wide: from a small car to a heavy wheeled special. technology. At the same time, it is absolutely not necessary to purchase an expensive new car.

For example, there are a number of large companies that allow their clients to buy:

- used domestic and imported cars;

- cars confiscated and subject to the sale of collateral.

Commercial passenger cars and trucks can also be purchased on lease, it all depends on the needs of a particular client.

It should be noted that purchasing cars on lease for taxi and cargo transportation services is becoming widespread.

Federal programs

Question: “Are there leasing support programs?”

At the same time, the situation is gradually changing. The government has launched several federal programs aimed at developing leasing for individuals. For example, this one.

- Federal Housing Program Development

Here is a video in which the head of this federal program talks about how it works

- There are also several leasing programs for individuals, created with the support of the Russian government and major automakers. You can find out more about these programs at your nearest bank. There they will help you with paperwork and tell you what percentage you will pay when buying a car under a leasing agreement. Remember, a car is not a luxury, but a means of transportation, although of course it depends on how much it costs and how often you drive it.

Leasing agreement

The leasing agreement is always drawn up in writing. This requirement is contained in the legislation of the Russian Federation. The document specifies all the conditions under which you will interact with the lessor. It is almost impossible to simply change the conditions for leasing a car after signing an agreement. Therefore, assess all the risks and your capabilities in advance.

The contract sets out specific points, namely:

- Full characteristics of the car, indicating the configuration.

- The period within which the company must purchase the vehicle.

- Availability/absence of advance payment.

- Monthly payment amount.

- Duration of the contract and the possibility of its extension.

- Possibility of transferring the car into your ownership.

- Availability/absence of insurance.

- An indication of who will repair the car.

- Rights and obligations of the lessor and recipient.

As for early termination of the contract, this condition is also stated in the document. It is more profitable for you, as the recipient, to fix this point, since in case of termination you will not have to pay interest for the remaining lease term.