General information

If during the acceptance of commercial cargo (unloading a container or wagon) a shortage of goods is detected, a special document is drawn up - a statement of shortage of goods. The act is necessary to record the violation, which in turn will provide compensation for the company’s losses. However, the document itself does not talk about any payments - only about what is missing and about the carrier.

The act is filled out by a commission that consists of representatives of both parties: the supplier and the recipient. If this is not possible and the cargo arrived unaccompanied, the shortage report is filled out only by the recipients. Once completed, a copy is sent to the supplier by email or registered mail.

An example of drawing up an act for writing off fuel and lubricants

- At the beginning of the act, on the right or left (it doesn’t matter), a place is allocated for approval by the head of the company, the name of the enterprise and the date of drawing up the act are indicated.

- Next, in the middle, enter the name of the document and briefly indicate its meaning (in this case, it is “write-off of fuel and lubricants”).

- After this, the composition of the commission is entered into the act, indicating the positions of the employees, as well as their personal data.

- The next thing to note is the period for which fuels and lubricants are written off, as well as the make and state number of a particular vehicle.

- Below is the table. They fit into it

- fuels and lubricants subject to write-off,

their quantity (in liters),

- the norm of their consumption approved at the enterprise,

- actual consumption,

- price.

- Under the table, the direction of expenditure should be noted: in this case, these are “the needs of the organization,” as well as the documents attached to the act (the waybills are listed here in chronological order by number).

- At the end, the act should be certified by the signatures of all members of the commission with transcripts of autographs.

In those lines that remain blank, you need to put dashes.

How to compose correctly

There is an official accounting form for the act of shortage of goods - TORG-2 (for imported products - TORG-3). The form of this form consists of four sheets and is adapted to describe the shortage in as much detail as possible, which is both an advantage and a disadvantage. Not everyone is comfortable using such a sample. Therefore, if it does not suit your goals, you can create your own: the law does not prohibit this. The main thing is to create the right structure. If you want to create your own product shortage report template, follow the following scheme:

- The header of the document is reserved for the addressee’s details: the name of the company (or full name of the supplier) and the address to which the act should be delivered;

- After the header comes the name of the act and begins its factual part with a detailed description of what happened;

- At the bottom there are places for signatures of all commission members.

Who should draw up a fuel shortage report?

In order to properly receive the goods, you must be responsible about the procedure for receiving the consignment of goods.

If a defect or shortage of products is discovered, it is necessary to call the sender of the goods.

For this, there are generally accepted instructions that should be followed in order to subsequently avoid problems with inspection authorities. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form on the right.

Or call us by phone (Moscow)8 (812) 309-53-42 (St. Petersburg)8 ext.

196 (free call for all regions of Russia) It's fast and free! General information Usually the goods are accepted by employees who are financially responsible.

Such employees are approved by management and undergo special training. Sources:

- shortage upon dismissal

According to the rules

Collection of shortages from the driver (Volchkova M.)

The driver submitted to the accounting department a waybill dated 02/02/2012 N 90, which reflects the speedometer readings - 46,504 km.

On the same day, the commission took speedometer readings, during which a discrepancy was discovered between the actual speedometer data (46,132 km) and the data indicated by the driver in the waybill. Due to incorrect data in the waybill, the shortage of gasoline amounted to 64.13 liters in the amount of 1837.4 rubles.

Is it possible to hold an employee of an institution - a driver - accountable and recover the cost of gasoline from him? How to perform these actions?

We recommend reading: MFC printout from the traffic police

Gasoline was purchased using subsidies allocated to the institution by the founder to complete the task. The provisions on the financial liability of the parties to the employment contract are specified in section.

XI Labor Code of the Russian Federation. According to the provisions of Art.

How to fill it out correctly

The product shortage report sheet is filled out as follows: The header contains all the information to successfully find a supplier. The main part contains all the facts: the place of the “incident”, who is on the commission, the number of the invoice on which the cargo arrived. When delivering by train, the carriage number, or container number if the cargo arrived in it, is indicated. In short, it is necessary to identify the delivery vehicle as accurately as possible.

Next, indicate the shipper and recipient, departure and destination stations. Then they describe the fact of the shortage: what cargo and in what quantities is missing, what is the condition of the container seals (to detect unauthorized opening of the cargo on occasion). It would not be superfluous to refer to the contract for the act of shortage of goods (delivery agreement), or other document according to which the order was made, as well as calculate the cost of all missing goods (including VAT). It is most convenient to list items of goods in a numbered list or table.

At the end they write that the goods were unloaded and entered the warehouse for storage. Enter the name of the warehouse.

Rules for drawing up an act for writing off fuel and lubricants

There is no standard unified, mandatory sample act for write-off of fuels and lubricants. Organizations and enterprises have every right to choose one of two main methods:

- each time, as needed, compose a document in any form (but this is not very convenient),

- Based on your needs, develop a document template yourself (in this case, it should be approved in the company’s accounting policies).

However, regardless of which option for drawing up the act form for writing off fuel and lubricants is chosen, you must adhere to certain rules in filling it out. In particular, it must indicate:

- Business name,

- date of document preparation,

- driver information,

- information about the make and license plate of the car,

- a complete list of write-off goods (indicating quantity and price).

In this case, information about write-off fuels and lubricants is best presented in the form of a table.

It is important to be very careful and even scrupulous when filling out the act; you must try to avoid mistakes and not enter false information into the document, which could lead to punishment from supervisory authorities.

What to pay attention to

The signed act is sent to the company’s accounting department, where the document is certified with a round seal and left for storage in the archive. The documents are kept for three years.

The act of shortage of goods is applied during acceptance, during the inventory of the enterprise, in the event of an accident resulting in the loss of goods: this is reflected in the title of the document and its factual part. If possible, the commission signing the act should consist of at least three people. Exceptions are allowed for individual entrepreneurs without employees.

Please note that an application for compensation of expenses associated with the shortage must be submitted no later than one month after certification of the deficiency report.

Why do you need an act for writing off fuel and lubricants?

The act relates to primary documentation and is of great importance for the accounting and tax accounting of the organization. It allows you to calculate the expenses incurred by the company on fuels and lubricants in order to subsequently deduct them from profit, thus reducing the tax base.

It should be noted that in addition to the write-off act, to carry out this procedure, you must have one more document: the driver’s waybill, which reflects in detail information about the fuel and lubricants spent, kilometers traveled, time spent on the road and other data.

Waybills must be issued at the beginning of the working day, after which drivers are required to submit them to the accounting department (with an advance report that records the expenditure of cash issued for fuel, as well as checks and receipts).

How to support the document

If possible, any additional evidence of damage to the cargo should be attached to the report:

- photos;

- video;

- written testimony of eyewitnesses, etc.

Information about these certificates must be included in the act. In the future, they can help to objectively determine the cause of cargo damage and the responsible party.

Such evidence is especially relevant when using the services of carrier companies.

In such cases, both the transporter and the supplier may be assigned as the culprit for damage to the delivered goods.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Act of shortage and/or misgrading of goods” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

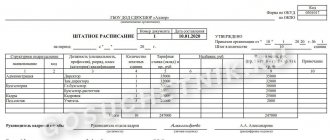

Sample audit report

Inventory assets are regularly described, recording the results in the protocol. The legislation of the Russian Federation proposes to consolidate the inventory result in a form ─ an audit report in the unified INV-3 format.

General information

The protocol, which contains information about the audit carried out, is regulated by the Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 (as amended on May 3, 2000).

According to the resolution, the audit report document is needed to reflect information about inventory items that are actually in the warehouse in the company at all stages of the movement of goods.

The protocol is drawn up in two copies, and the commission describes and verifies the actual presence of valuables. The members of the latter are selected and approved by the head of the organization.

The form consists of 4 pages, but in practice the pages are not numbered, and it turns out that only three are filled out. This can be seen in the example below.

But, according to information from the Ministry of Finance No. PZ-10/2012, the INV-3 audit report is not subject to mandatory registration. The form is filled out depending on the content of the order and the company’s accounting policy.

Back to contents

How to correctly draw up an audit report

Before inventorying inventory items, the manager issues a corresponding order or order for a future inspection, and INV-3 is an appendix to the document.

When checking the actual availability of goods and materials, a commission of 4 people participates: 3 people ─ the composition of the commission and the chairman. Inventory takes place in 4 stages:

- The audit participants sign a receipt located on the first page of the form.

- The financially responsible person checks the availability of goods in the presence of the committee using methods: counting, weighing, measuring and others, depending on the type of value.

- The information is entered into the table on page 2 of the protocol. The results of the inspection are compiled and recorded.

- Participants in the process, including the chairman and members of the commission, sign the completed form.

One copy of the act is sent to the accounting department, the second to the financially responsible person.

The INV-3 protocol is also compiled manually, without using a unified format. But when drawing up such a manual, it is based on the requirements that comply with Federal Law No. 402 of December 6, 2011. For example, the form of the audit report must contain the mandatory details for the inventory protocol, which correspond to clause 2 of Art. 9 Federal Law No. 402 dated December 6, 2011 (as amended on July 29, 2018):

- title of the documentation;

- date of registration and preparation of the form;

- the name of the organization that created the form;

- the name of the future procedure for which the act is used;

- in the tabular section ─ the name of the units of measurement used in accordance with OK 015-94 (MK 002-97) (as amended on June 1, 2018);

- positions and full names of participants in the procedure;

- signatures of inspection participants.

According to paragraph 3 of Art. 9 of this law, the act is drawn up directly during the procedure. According to paragraph 1 of Art. 13 Federal Law No. 402 of December 6, 2011 (as amended on July 29, 2018), the form must contain reliable information that is familiar to the members of the commission, the materially responsible person, as well as the chairman of the committee.

If the form is compiled manually on a PC, then the template is approved by the head of the enterprise. For further inspections, this approved form is used.

INV-3 is compiled either on paper or electronically.

Back to contents

Audit report form

The protocol recording the inventory results is available on official sources. But in order not to look for them, you can download the audit report that meets the requirements of the Legislation of the Russian Federation here.

document “Audit Act Form” (doc, 28 KB) document “Audit Act Form” (xls, 40 KB)

Back to contents

audit report

How to fill out an audit report

To complete the INV-3 form, it is better to study an example of an audit report. But step-by-step instructions and compliance with the requirements of the accounting law will make the process of filling out the form easier.

Back to contents

The audit report form is filled out in three ways:

- Manually. The form is printed out, then filled out with a pen with blue, black or purple ink.

- The template is downloaded and designed on a PC, and then printed.

- Combined method.

The form is filled out and stored electronically. In this case, the same document is sent to the folder of the accounting department and the financially responsible person.

Registration of INV-3 includes compliance with a number of rules:

- Before the inventory, members, the chairman of the commission, and the financially responsible person are required to fill out a receipt confirming their familiarization with the documentation and responsibility. The receipt is on the first page of the template.

- When filling out the INV-3 form, the following details must be filled out: organization and structural unit. But if the company does not have additional offices and warehouses, then the last field is left blank without putting a dash.

- In field No. 9 “Passport number”, enter the corresponding number if this value relates to precious metals or stones.

- Column 10 is filled in in quantitative terms.

- According to paragraph 3 of Art. 9 Federal Law No. 402 of December 6, 2011 (as amended on July 29, 2018), the protocol is not only drawn up during the inspection process, but also drawn up at the same time, immediately after recalculation and other measurements.

- According to Art. 29 Federal Law No. 402, the completed form is stored in the archive for a period of at least five years.

- Amounts and other numbers are written in words.

After filling out the form, members of the commission, including the chairman and the financially responsible person, indicate their full names and sign the documentation. And after comparing it with the statement, the form is signed by the accountant.

Back to contents

In order to correctly fill out the INV-3 form, you should carefully study the sample audit report. This will facilitate the procedure for recording the results of checking the actual availability of inventory items in the organization’s warehouses.

audit report

Back to contents

What to pay attention to

When checking the availability of goods and valuables at the enterprise for the current period, the financially responsible person and the composition of the commission need to take into account a number of features of the procedure and filling out INV-3. Five features of the inventory procedure and filling out an inventory report:

- When checking, sometimes they use an audit form drawn up in their own hand. But the form contains the details from the unified form. But there are exceptions ─ budgetary organizations, for which the unified INV-3 format is required to be filled out.

- A commission approved by the head of the enterprise or another person who initiated the audit participates in the audit.

- The recording protocol is an appendix to the corresponding order. Therefore, without the announcement and writing of the latter, the act has no legal force.

- Identified inventory items that are not taken into account by accounting are also included in the inventory list.

- If goods are discovered that have become unsuitable for further use, an appropriate protocol is drawn up with a list of found goods and materials.

The form, which records the results of the inventory of the enterprise's inventory, is mandatory to be filled out only by budget-funded enterprises, and the rest - at the discretion of management.

When filling out the form, participants must rely on the legislation of the Russian Federation. Therefore, you should first review the completed protocol templates.

It is also worth using a unified form, as the required details are indicated there.

Back to contents

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Act on shortage and (or) misgrading of goods”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Certificate of discrepancy upon acceptance of goods

0 In accordance with the supply agreement, the supplier-seller undertakes to transfer, within a specified period, the goods produced or purchased by him to the buyer for use in business activities ().

The quantity, range and quality of such goods are determined by the contract.

But a situation is possible when, upon acceptance of goods, a discrepancy is revealed with the data in the accompanying documents or the terms of the concluded contract.

In this case, the buyer draws up a statement of discrepancy when accepting the goods in terms of quality or quantity.

We will tell you how to draw up such an act in our consultation and provide a sample of how to fill it out. A report on discrepancies upon acceptance of goods is drawn up by a commission created for this purpose, which includes representatives of the buyer and a representative of the party that transferred the goods to the buyer (for example, a carrier).

It is advisable to include a representative of the supplier in this commission. It is assumed that a discrepancy report upon acceptance of goods is drawn up at the moment such a discrepancy is detected upon acceptance of goods. However, it is possible that such a discrepancy will be revealed later. This will not affect the order in which discrepancies are activated.

At the same time, it must be taken into account that the discrepancy report will be the basis for subsequent filing of a claim with the supplier or carrier in connection with or identified.

And if the contract does not provide for the buyer’s right to make a claim in connection with the subsequent identification of discrepancies, and such a discrepancy could have been established upon acceptance, it is unlikely to be able to recover losses from the supplier or carrier if discrepancies are discovered late.