What it is?

Car leasing (from the English lease) is a financial long-term lease of a vehicle (transfer for temporary use) from the lessor with its subsequent re-registration in favor of the entrepreneur. It is the possibility of obtaining ownership of the car after making contractual payments that makes leasing different from regular rent.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

When using a leasing scheme, the entrepreneur does not immediately become the owner of the car. Until the individual entrepreneur pays the entire amount stipulated by the contract, he will be considered its tenant. If the businessman stops fulfilling his financial obligations to make lease payments, then the car will remain the property of the lessor. All previously paid contributions will be counted as rent and will not be refunded by the individual entrepreneur.

Car leasing is one of the types of financial leasing, along with leasing of equipment and real estate. It is also often called car leasing. There are different types of this financial product:

- depending on the subject of the lease: leasing of passenger cars, trucks, passengers, etc.;

- depending on the lessee: entrepreneurs, individuals and legal entities.

What is leasing?

Leasing is a specific type of financial service that is used for the acquisition of fixed assets of an enterprise or very expensive goods by individuals.

If we translate economic formulations into simple language, then the machine needed to produce, for example, nails, can be bought by a bank or a specialized company, and then rented to you. While using it, you can pay its full price or buy it at the residual price after the contract ends. You can also continue to rent it. If the demand for nails has dropped and you no longer need the equipment, you do nothing. The owner takes the machine and looks for a new tenant for it or determines a different fate.

A machine needed to produce, for example, nails, can be bought by a bank or a specialized company and then rented to you.

Financial industry experts say that the main goal of leasing is to attract investment in fixed assets of an enterprise on more flexible and favorable terms than with the help of traditional loans or own funds. Leasing equipment is sometimes much easier than getting a loan or buying it with your own funds, withdrawing them from circulation.

Property provided for commercial lease is acquired by a leasing company (lessor), which transfers it to the lessee in accordance with Article 2 of the Federal Law “On Financial Lease (Leasing)” “for a fee for temporary use.” The lessee provides the necessary constituent and financial documents and makes an advance payment of 20-30% of the cost of the purchased property.

Throughout the entire leasing term, the recipient pays lease payments under the agreement. He not only pays the cost of the property, but also pays the insurance amount, the leasing company's percentage and the tax on the leased property. The total amount of these payments may be greater than the loan payments. Most often, a leasing agreement provides for the transfer of ownership of equipment to the lessee, in accordance with paragraph 5 of Article 15 of Law No. 164-FZ. In this case, the total amount of the contract includes the redemption value of the leased asset (Article 28 of Law No. 164-FZ). Source

The difference between leasing and credit

Leasing should be distinguished not only from a rental agreement, but also from a car loan. Here are the key differences between leasing and credit in tabular form.

Table Differences between leasing and credit

| Criteria | Leasing | Credit |

| Parties to the agreement | The leasing agreement involves the lessor, the lessee and the supplier | The supplier and individual entrepreneur take part in the purchase and sale agreement, the bank only finances the transaction |

| Registration of ownership of a vehicle (key difference) | The car is owned by the leasing company until it is purchased by the businessman | The car is registered as the property of the individual entrepreneur, but the right to dispose of it is limited, since the vehicle is the subject of collateral |

| Deadlines | The processing time for applications is shortened from 1 to 5 days | The processing time for applications from individual entrepreneurs can reach 15-60 days |

| Documentary proof of solvency | When concluding a leasing agreement, a minimum set of documents is required, since the risks of the leasing company are reduced due to the lack of ownership rights to the car from the individual entrepreneur | Banks are quite strict in choosing a candidate for a car loan and request an impressive set of documentation confirming his financial viability and stability of business indicators |

| Car registration, insurance | The lessee is engaged, but all his costs are included in the monthly payments of the individual entrepreneur | The entrepreneur himself is engaged in |

| Risks of accidental car death | Bears the leasing company | Bears IP |

| Terms of the contract | Can be up to 5 years, which reduces monthly payments | Usually does not exceed 3 years |

| Pledge | There is no need to pledge the car as collateral | The vehicle is registered as collateral; entrepreneurs are often required to provide additional liquid collateral |

| Payments | The lessee makes lease payments, reducing the redemption price of the car | The borrower makes monthly loan payments, including principal and accrued interest. |

Thus, leasing combines the advantages of rent and credit.

The difference between a car loan and leasing

Leasing and car loans are very similar. However, these are completely different transactions. To judge their profitability and make the final choice, you need to know how they differ.

| Peculiarities | Car loan | Leasing |

| Application review period | The solution will be known within 15-60 days | The answer is given within 1-5 days |

| The need to provide property as collateral | The purchased car serves as collateral. Additionally, the financial organization may require the provision of other liquid property as an encumbrance. | No deposit required. |

| Participants of the agreement | Only the car supplier and the entrepreneur appear in the sales contract. The bank is refinancing the transaction. An additional agreement is concluded with him. | Leasing involves the conclusion of a tripartite agreement. It includes the supplier, the lessor and the lessee. |

| Making payments | The borrower is required to provide funds monthly. Some of them go to pay off the principal debt, the other goes to pay off interest. | Payments are made that reduce the redemption price of the vehicle. |

| Deadline for settlement with financial institution | Typically, money is loaned for no more than 3 years. | The agreement can be concluded for a period of up to 5 years. The longer the agreement is in effect, the lower the monthly payments. |

| Registration of insurance and official registration of the vehicle | All actions must be performed by the entrepreneur himself. | The manipulations are carried out by the lessor, but the costs will be included in the monthly payments. |

| Risk of vehicle loss | The entrepreneur is responsible. | Responsibility rests with the leasing company. |

| Registration of car ownership | The entrepreneur immediately becomes the owner of the vehicle. However, the ability to control the car is significantly limited. It acts as collateral. | The car is owned by the leasing company. Re-registration occurs at the time of redemption. |

| Confirmation of solvency | The bank carefully selects a candidate for a car loan. This is done in order to reduce risks. The potential borrower is required to provide a large package of documentation. With the help of papers, the financial viability and stability of the business is confirmed. | If a leasing agreement is drawn up, the package of documents is minimal. The car is not transferred to the ownership of the citizen. Therefore, the risks for the financial organization are significantly reduced. |

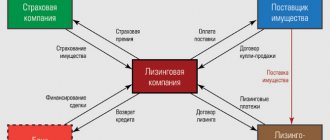

Who provides leasing?

Participating in the leasing scheme are:

- entrepreneur – recipient of vehicles for commercial use;

- supplier – car manufacturer or official dealer;

- lessor – binds the first two parties to the transaction;

- insurance company – issues CASCO or MTPL at the request of the lessee.

Leasing services on the Russian market are provided by two types of companies:

- Organizations affiliated with banks (for example, VTB-Leasing, Sberbank-Leasing, etc.) - the fact that such companies are often formed on the basis of banks is associated with the need for significant financial resources.

- Independent leasing companies - they are usually intermediaries between the bank and the lessee.

Pros and cons of this lending method for individual entrepreneurs

The use of leasing services allows entrepreneurs to attract third-party resources to develop their own business. The ability to reduce your own costs is of paramount importance for small businesses . According to experts, the main advantage of leasing is that there is no need to collect a voluminous package of documents, look for guarantors or use your own property as collateral . The requirements of leasing companies regarding the level of solvency of clients are significantly lower than the requirements of banking institutions.

Leasing companies provide their clients with relatively lenient loan repayment terms. In the event of financial difficulties and a delay in making the next payment, the parties can agree on a new procedure for repaying the loan. Compared to banking institutions, such organizations use penalties much less frequently.

Entrepreneurs using leasing loans have the opportunity to significantly reduce their tax burden. Payments aimed at repaying the loan are included in the company's expenses and are invested in the cost of manufactured products. This approach allows you to reduce the amount of tax on profits received. It should also be noted that the VAT tax is evenly distributed over a period of time equal to the duration of the contract. In this case, the tax authority does not take into account the fact who owns the property rights to the acquired asset.

When buying a car on lease for an individual entrepreneur, the pros and cons become quite significant. The main advantage of this method of acquiring an asset is the ability to speed up the process of compensation. For this purpose, a threefold acceleration factor is used. This means that by the time the car becomes the personal property of the company, its residual value will be significantly reduced. This factor will allow the company to significantly reduce the amount of property tax.

Leasing is a real help for small businesses, since the service is provided on more favorable terms than a car loan

Despite all the above advantages, leasing loans have a number of disadvantages. One of these disadvantages is the need to spend your own funds in the form of a down payment. The amount of investment in the acquisition of an asset by an entrepreneur varies from ten to thirty percent. The final value depends on the type of object being purchased and the terms of the agreement. The recipient of the asset must necessarily insure the value received. This factor can significantly increase the cost item, which can become a certain difficulty for companies with a small financial turnover. It is also necessary to highlight the fact that such transactions must be certified by a notary office. The amount of the duty provided for by law is equal to one percent of the transaction amount.

Conditions for purchasing a car and necessary documents

Each lessor offers excellent leasing conditions. However, there are a number of common characteristics for entrepreneurs:

- good credit history;

- age from 21-23 years;

- break-even activity;

- work in the market for at least 6 months to a year;

- Some leasing companies set restrictions on the types of activities of individual entrepreneurs.

Individual entrepreneurs must provide the leasing company with the following set of documentation:

- certificate of entry into the Unified State Register of Individual Entrepreneurs;

- certificate of registration;

- tax returns with a mark from the Federal Tax Service on their acceptance;

- certificate of availability of current accounts;

- financial statements (simplified form);

- certificate of credit obligations of an individual.

Is it possible to arrange leasing for individual entrepreneurs?

In the financial market, you will be able to find offers that allow individual entrepreneurs to buy a car on lease. However, a potential client must meet a number of requirements. Thus, cooperation is carried out with individual entrepreneurs over the age of 21. Some companies have raised the minimum age to 23 years. Credit history must be positive. It is necessary to operate as an entrepreneur for at least 6-12 months. Cooperation is carried out with individuals whose business has demonstrated sustainability. The income must be sufficient to make monthly payments.

Leasing to an individual entrepreneur is provided for a car that meets the requirements of the financial organization. The company willingly enters into contracts if the subject of the agreement is a new car. Purchasing used vehicles is also acceptable. However, the machine must meet the requirements. The period of operation should not be more than 5 years. The vehicle needs to be overhauled. The financial institution reserves the right to request a valid contract for car servicing at a car service center.

If the car was manufactured abroad, you will need to provide papers confirming the fact of customs clearance. The chance of a positive decision increases if the vehicle is under manufacturer’s warranty throughout the entire period of the leasing agreement. If all the above requirements are met, an individual entrepreneur can buy a car on lease.

Step-by-step registration instructions

Briefly, the scheme for obtaining car leasing can be presented as follows:

- A businessman selects a car according to his preferences.

- Contacts the leasing company with an established set of documentation.

- The leasing company assesses the solvency of a potential client.

- If the application is reviewed positively, a leasing agreement is signed.

- The lessee buys the vehicle from the car dealer and transfers it to the entrepreneur for use.

- Every month, the individual entrepreneur transfers payments to the leasing company in the form of rent and gradually compensates for the costs incurred by the lessor.

- After making the last payment, the car is re-registered as an individual entrepreneur.

Car leasing for individual entrepreneurs on the simplified tax system

Most entrepreneurs work in Russia under a simplified special regime, which is why individual entrepreneur leasing programs on the simplified tax system are so in demand. A car is leased on the simplified tax system on a general basis.

The differences lie in the set of documents that should be provided to simplifiers. Since they do not keep accounting records, and their tax accounting is quite simplified (basically, only income without expenses is required), it is difficult for them to confirm their financial solvency.

Also, individual entrepreneurs using the Simplified Taxation System cannot confirm their income for the quarter, since reports are submitted only once a year.

Therefore, in order to reduce its risks, the leasing company may impose increased requirements on them. For example, making a larger down payment or increasing the interest rate on the program.

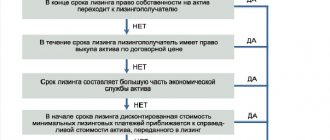

Advantages and disadvantages

For simplified entrepreneurs, purchasing a car under a leasing scheme has both general advantages and some advantages associated with the use of this special regime. The positive points include:

- the ability to quickly obtain for use a car necessary for business activities, taking into account the limited working capital (this is especially true for special regimes);

- simpler execution of a leasing agreement compared to lending: no requirements for collateral and guarantors, less stringent requirements for annual turnover and lifespan of the business;

- there is no need to draw up a business plan calculating the payback of vehicles, as for banks;

- the possibility of signing a long-term contract and reducing the amount of monthly leasing payments;

- The execution of a leasing agreement is much faster than a credit agreement;

- Getting a car on lease is one of the forms of tax optimization.

But with many advantages, the leasing scheme for individual entrepreneurs also has its pitfalls, including:

- the need to make an advance payment of 10 to 40% of the cost of the car;

- lack of ownership of the car (hence, it cannot be sold if necessary);

- the possibility of early termination of the leasing agreement (for example, in case of violation of the technical inspection deadlines, after accidents, etc.);

- Leasing companies include VAT in the payment, which increases payments, while individual entrepreneurs do not have the right to compensate for their VAT costs.

What is car leasing

What is car leasing? Car leasing for an individual can be provided in two options: with and without vehicle purchase. The lessor sets a payment schedule that must be met. Also, leasing conditions for individuals include other documents similar to the loan agreement:

- transaction amount;

- down payment or security deposit;

- residual payment;

- terms and dates of payment.

You can lease a car without the right to buy. In this case, upon completion of the contract, the borrower has every right to lease a new car, thus saving time on selling the car and registration actions. The standard term of a car leasing agreement for individuals is 3 years, which actually allows you to constantly have a new car.

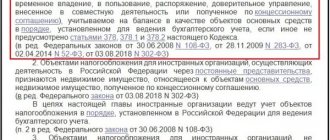

VAT refund

Buying a car on lease is quite popular among legal entities and individual entrepreneurs on the general taxation system. This is due to the fact that lease payments include VAT and the company has the right to claim it as a deduction. From a tax perspective, this scheme is quite profitable.

Entrepreneurs on OSNO have the right to take into account input VAT in leasing payments and issue a refund from the budget if the total input VAT exceeds the output VAT in the invoices issued by the entrepreneur’s clients.

VAT refunds for individual entrepreneurs using a simplified tax regime or other special regimes are not allowed. An individual entrepreneur using the “STS Income-Expenses” can take into account leasing payments in full (including VAT) as expenses and reduce the tax base due to them. For individual entrepreneurs on “STS-income”, leasing payments made do not in any way affect the amount of tax, since it is paid from revenue.

Documents for registering a car for leasing

- Russian Federation passport. Registration must be permanent.

- Driver license.

- Certificate of income.

- A copy of the work book or contract.

“Leasing for individuals involves a fairly flexible approach to assessing the capabilities of the borrower. For example, the Europlan company is considering not only 2-personal income tax, but also other possibilities for confirming the lessee’s income. We take into account the availability and cost of real estate and previously purchased vehicles.

Non-residents can lease a car, unlike a car loan, which is given only to citizens of the Russian Federation.

The age of the lessee is from 20 to 65 at the time of completion of the leasing agreement. Permanent registration - any region of presence of Europlan (75 offices throughout Russia),” said Europlan JSC.

Car leasing is the best way to purchase a new car on comfortable terms for ownership and use for a certain period.

Europlan also added that the company has corporate discounts for almost all brands, due to which the cost of cars for customers is lower than recommended. However, the discount size is usually higher in premium brands. Leasing can seriously help in solving the issue of car maintenance: the leasing company handles the search for the car, insurance, organization of technical inspection, registration and much more.

How are payments made?

The procedure for making payments under the leasing agreement is determined by the contract. Typically, the car payment is divided into two parts:

- advance payment;

- monthly or quarterly payments, including compensation for the lessor’s costs for purchasing a car, additional costs (for insurance, registration, etc.), as well as a certain premium for leasing a vehicle.

Payments are made from the individual entrepreneur's bank account or in cash when submitting a payment order to the bank.

Payments can be made according to different schemes: differentiated, annuity or decreasing.

Accounting

There are two schemes for obtaining a car for use:

- when it remains on the balance sheet of the lessor;

- transferred to the balance of the lessee.

Depending on this, the car is included in the appropriate depreciation group. Accounting is carried out in accordance with the “Instructions on reflection in accounting” dated 1997, PBU6/01 and PBU10/99.

Individual entrepreneurs using the Simplified Taxation System include leasing payments as expenses based on the date of their payment.

Leasing a car for individual entrepreneurs without a down payment

The advance payment serves as additional insurance for the lessor against an unscrupulous lessee. It is an additional guarantee of the financial solvency of the individual entrepreneur and that he will comply with the terms of the contract.

Offers to lease a car without a down payment are quite rare, especially due to the difficult economic situation and rising prices for cars. Typically, companies approve leasing without a down payment only if the subject of the agreement is highly liquid. Increased requirements are imposed on individual entrepreneurs who are applicants for leasing:

- stable financial condition (an individual entrepreneur with zero turnover is unlikely to receive approval);

- for newly opened individual entrepreneurs such programs are not available;

- the possibility of providing additional security in the form of collateral or surety.

Car leasing for individual entrepreneurs in taxi

One of the most popular programs for individual entrepreneurs is car leasing for taxi work. Many individuals today work as taxi drivers and are forced to pay a lot of money to rent a car. With a leasing scheme, an entrepreneur has the opportunity to reduce his financial costs, and after making all payments, become the owner of the car (with a regular lease, a businessman will not have this opportunity).

The demand for taxi car leasing has forced many leasing companies to develop special programs. Thus, many of them offer individual entrepreneurs to purchase a car that is already ready for taxi work with a yellow factory paint job and from among the popular models: Peugeot 301 or 408, LADA Largus or Granta, Renault LOGAN, etc. Some cars are additionally equipped with a technological complex for working in a taxi (video recorder, equipment for accepting orders and payments by cards, etc.).

True, according to reviews from entrepreneurs themselves, these programs usually have less favorable conditions and high leasing payments.

Here are leasing programs that allow individual entrepreneurs to rent a taxi car.

Table Taxi leasing offer for individual entrepreneurs

| Company | Down payment | Deadlines | Price increase rate | Peculiarities |

| Europlan | 15-49% | 13 months-3 years | From 0% (including dealer discount) | Transaction approval within 2 days, work on the market for a year, issued only for new cars |

| CityFinance | 25% (advance from 35% with a minimum set of documents) | Up to 5 years | From 5% | Amount from 300 thousand to 3 billion rubles, work with individual entrepreneurs who have been working for less than a year |

| Salt | Individually | From 6 months up to 5 years | Individually | We offer a comprehensive solution for leasing cars designed for taxi use and equipped in accordance with all legal requirements. You can choose an economy, business or comfort class car. |

| Carcade leasing | From 0 to 50% | From one year to 5 years | From 0% | The choice of cars for leasing is unlimited |

It has become quite popular among individual taxi drivers because it offers a comprehensive technological offer adapted for taxis (the cars are already equipped with everything necessary at the leasing stage), and also because of its loyal attitude towards potential lessees. But the appreciation rate and the cost of the cars offered here are quite high.

The requirements for individual entrepreneurs to obtain a taxi car leasing are standard. They must operate on the market for at least 6 months to a year, have no current arrears on credit or other financial obligations, and demonstrate break-even activity. But there are some nuances:

- to work in a taxi, you need to register OKVED code 49.32.11 in the registration documents of the individual entrepreneur;

- for a car that will be used in a taxi, you must obtain a permit (it is valid only in the territory of the region in which it was issued);

- The taxi driver must have the necessary knowledge in the field of transportation and be able to provide first aid;

- The individual entrepreneur must have a Russian license and at least 3 years of driving experience.

Conditions for purchasing a car on lease for individuals

The question of whether leasing is given to individuals can be answered in the affirmative. Currently, citizens can lease a car without making an advance payment. This opportunity is not provided in all companies and is provided under certain conditions.

It is important to calculate how much the vehicle will ultimately cost. An advance payment for individuals is an opportunity to ease the financial burden when gradually purchasing a vehicle. And the larger the advance amount, the lower the subsequent payments will be.

Unlike installment plans, leasing, even for a month, involves a certain overpayment.

Such a transaction is always concluded on a paid basis, even if we are talking about individuals. Its size depends on the price of the car, the period of validity of the agreement and some other factors.

Leasing can be arranged not only in Moscow, but also in other regions of the Russian Federation, provided that a branch of the selected company is present there. For individuals who do not have the opportunity to make an advance payment, almost all transaction schemes are suitable, except for leaseback, when the owner of the property is also the borrower.

A potential client of a leasing company is subject to quite a thorough check. To complete a transaction, you must confirm your solvency and have a positive credit rating.

Truck leasing for individual entrepreneurs

The cargo transportation market now continues to grow, despite the crisis in many sectors of the economy. Therefore, leasing of trucks for individual entrepreneurs is done quite willingly by lessors.

Thanks to leasing, you can get a truck of domestic or foreign production for use. Manufacturers often develop special demand-stimulating programs that make it possible to purchase a car at a discount using leasing. The down payment is usually 15-20%, and leasing terms are 12-48 months.

Some leasing companies offer the purchase of used trucks, but under more stringent conditions. So, the down payment in this case can reach 20-50% of the price of the car. Its age is also limited (the truck cannot be older than 3-5 years) and the country of manufacture. Some leasing companies refuse to finance the purchase of Chinese trucks.

If an entrepreneur has already decided on a specific brand of car, then he can apply for leasing directly to the manufacturer, where he can be offered the most favorable terms of cooperation. For example, if you want to buy a KAMAZ, you can contact KAMAZ-Leasing. The following terms of cooperation are offered for individual entrepreneurs:

- leasing term up to 5 years;

- price increase – from 3%;

- down payment – 10-20%;

- minimum package of documents, application review from 1 hour.

Using a similar scheme, you can purchase MAN trucks from, Scania trucks from Scania Leasing, Volvo trucks from Volvo Finance Service Vostok.

But sometimes better truck leasing deals can be found from independent leasing companies (conditions are listed below).

Table Taxi leasing offer for individual entrepreneurs

| Company | Down payment | Deadlines | Price increase rate | Peculiarities |

| Sberbank Leasing | From 15 to 20% (20% for domestic cars) | From one year to 5 years | Individually | You can get a car with a total cost of up to 24 million rubles. Brands financed: Daewoo, DAF, Ford, Hyundai, Isuzu, Iveco, MAN, Mercedes-Benz, Renault, Scania, Volvo, GAZ, KamAZ, Ural |

| VTB Leasing | From 15 to 49% | From 11 months to 5 years | From 0% | Applies to cars Hyundai, Isuzu, MAN, Mercedes-Benz, Ford, Iveco, Volvo, Renault, Scania, MAZ, KamAZ, Ural, KrAZ, GAZ, etc. |

| RESO-leasing | from 20% to 50% | 12-48 months | Individually | Subject of leasing: trucks with a title (costing from 300 thousand rubles). |

| Carcade leasing | From 9 to 50% | From one year to 5 years | From 0% | The choice of repayment scheme in decreasing or equal payments, the selection of cars for leasing is not limited: Mercedes-Benz, Renault, Scania, Isuzu, Iveco, MAN, GAZ, KamAZ |

The requirements for an entrepreneur's business are standard: stable profit margins, good credit history and no arrears. Individual entrepreneurs must have permits to engage in cargo transportation.

Nuances

Thus, before deciding to use a leasing scheme, an entrepreneur should take into account the following nuances:

- the businessman receives the right to use the car for the entire period of the contract, but he has no right to dispose of it (he cannot sell it, rent it out, etc.);

- The individual entrepreneur does not have the right to remake or tune it;

- Issues of car insurance, repairs and technical inspection will be decided by the lessor (individual entrepreneurs do not have the right to choose a company on their own);

- the car will not become the property of the individual entrepreneur until he has made all the payments stipulated by the contract.