Writing off money from an account without the owner's knowledge, stealing passwords and PIN codes, making easy money on the Internet and deposits at incredible interest rates, online casinos - all these are types of financial fraud. Criminals will speculate on your feelings, promise mountains of gold, disguise themselves as bank employees or government organizations in order to lure money. How to recognize a scammer and what to do if you were deceived?

Anyone can become a victim of criminals, and it doesn’t matter whether they use a bank card or prefer to pay in cash. Fraudsters know how to lure money online, through calls and SMS, on social networks and in offices. How do they do it?

Bank card fraud

To use your card for their own purposes, scammers need to know your card number, owner's name, expiration date, CVC or CVV number. They can install a skimmer on the ATM (a special device that is placed over the card acceptor at the ATM) and a video camera above the keyboard.

The CVC or CVV number is the three digits located on or near the cardholder's signature field. Learn more about how a bank card works.

It is enough to use such an ATM once and not cover the keyboard with your hand while typing the PIN code - and your money can be withdrawn, transferred to several accounts and cashed out. Your card details can be stolen even in a cafe or store. The attacker could be a merchant who gains access to your card for at least five seconds. Having photographed your card, he will be able to use it for payments on the Internet.

How to avoid getting caught

- Before withdrawing money from an ATM, inspect it. There should be no foreign objects on the card reader, and the keyboard should not wobble.

- When entering your PIN, cover the keypad with your hand. Do this even when paying with a card in a cafe.

- Connect mobile banking and SMS notifications.

- If you make purchases online, do not tell anyone the secret code to confirm transactions that comes to you via SMS.

- Try never to lose sight of your card.

I was robbed. What to do?

- Call the bank (the number is always on the back of the card or on the main page of the bank’s website), report the fraudulent transaction and block the card.

- Request an account statement and write a statement of disagreement with the transaction.

- File a complaint with the police department at your place of residence or send an appeal to Department “K” of the Ministry of Internal Affairs of Russia.

Read more about how criminals can steal your money in everyday life

Scammers promise too much

Most often, the attacker offers his victim mountains of gold. Suggestions like these can cloud your mind and make you stop thinking rationally. The best way to open your eyes is through leading questions. But if you are hooked, the scammer himself will bombard you with questions. The victim never searches for a dirty trick; she is literally blinded by dreams of fabulous benefits. Scammers wait until you are completely lost in your dreams so that they can then pull the trigger that sets the scam in motion. This person must also be a good actor, an active listener and a subtle psychologist, otherwise you are unlikely to believe him.

Cyber fraud

Let’s say you always withdraw money only at the bank’s cash desk, and don’t pay with a card at all. You feel safe. Suddenly you receive an SMS or letter supposedly from the bank with a link, a request to call back on an unknown number, or notification of an unexpected large win. Or they call on behalf of the bank and ask for personal information, card PIN or SMS confirmation number. Or they write on social networks on behalf of relatives or friends who suddenly got into trouble (got caught by the police, hit by a car, had their bag stolen) and ask to transfer a certain amount of money to an unknown account. In 99.9% of cases you are dealing with scammers. Viruses are most likely hidden behind the links, on the other end of the line there are deception specialists who, by hook or by crook, want to lure out the data they need, and on the other side of the screen there are attackers who play on your desires, feelings and care for loved ones.

How to avoid getting caught

- Do not click on unknown links, do not call back to dubious numbers. Even if the link seems reliable and the phone number is correct, always check the addresses with the domain names of the official websites of the organizations, and check the numbers in official directories.

- If you receive an SMS about funds being credited (and the message is similar to the usual bank notification), and then a call comes from an alleged bungler who credited you with money by mistake and asks you to return it, do not rush to return anything. This situation is more like a fraudulent scheme: most likely, the money did not arrive, the SMS was not from your bank, but an attacker called you. Check your account status, request an online bank statement, or call your bank before transferring money to someone.

- If you receive a “Confirm purchase” notification and a code, and then you receive a call, again from an “absent-minded” person, who says that he indicated your phone number by mistake and asks you to dictate the code to him, do not do this under any circumstances. Fraudsters are trying to trick you into giving you a code in order to deduct money from your account or sign you up for an unnecessary paid service.

- Do not share personal information with anyone, much less passwords and codes. Bank employees don’t need them, and scammers will have access to your money.

- Do not store card data on your computer or smartphone.

- Check the information. If you are told that you have won something or that money was accidentally debited from your card and you need to give your information to stop the transaction, end the conversation and call the bank back at the phone number listed on the back of your card.

- If you are told that family or friends are in trouble, try to contact them directly.

- Install an antivirus on your computer - both for yourself and for your relatives.

- Explain these simple rules to older relatives and teenagers.

There are many types of cyber fraud, each case has its own solution

I was deceived. What to do?

- Call the bank (the number is always on the back of the card or on the main page of the bank’s website), report the fraudulent transaction and block the card.

- File a complaint with the police department at your place of residence or send an appeal to Department “K” of the Ministry of Internal Affairs of Russia.

Scammers let you win first

The easiest way to gain the victim's trust is the classic lure with rewards. You have seen many times how thimblemakers allow “clients” to win in order to create excitement in random passers-by. Big scammers work big, and their domain is the casino gaming table. In addition to money, attackers allow themselves to manipulate the victim’s feelings or become dizzy with public recognition.

The family renovated the old house - now it is difficult to recognize it (before and after photos)

Note to dads: a special world and other ways to strengthen the bond with your son

“Fisherman of fishermen...”: it turns out that the heroes of the proverb are not friends at all (full meaning)

Fraudulent organizations

The most famous fraudulent organization in Russia is MMM. It worked on the principle of a financial pyramid: it promised huge interest on deposits, guaranteed profitability and paid the funds using money contributed by other investors. The top of this pyramid could really make money, and those who stood on the steps below lost their money. But now the situation has changed, the organizers of financial pyramids are simply scammers who collect money from people and disappear. It doesn't matter whether you are at the top of the pyramid or at the bottom, you can't make money on financial pyramids: if you invest money, you will certainly lose it.

Now financial pyramids are beginning to disguise themselves as microfinance organizations operating on the principle of network marketing, investment and management enterprises, and online casinos. They claim high interest rates on deposits and the absence of risks, guarantee income (which is prohibited in the securities market), and promise assistance to people with a bad credit history. They also ask you to deposit money immediately (preferably in cash) and bring a friend (sometimes for some kind of bonus) so that the scale of the pyramid increases and their (not your) profit grows.

How to recognize a financial pyramid?

How to protect yourself from deception

- The financial organization must have a license or be in the register of the Bank of Russia. Check the Directory of Credit Institutions and the Directory of Financial Market Participants.

- Check the company in the Unified State Register of Legal Entities of the Federal Tax Service of Russia.

- Request sample contracts and copies of documents. If possible, consult with a lawyer.

I invested and went broke. What to do?

- Make a claim and send it to the company by registered mail with notification. Or take it in person and make sure it is registered. Take a receipt so that the company does not accidentally lose your letter.

- If the company refuses to return the money, then collect all documents (from contracts to statements) and contact law enforcement authorities with a statement.

- Contact a lawyer and try to find other victims of fraud.

It is possible to withdraw money from circulation and the company into clean water. The main thing is to act and not be silent.

Attackers show their “shortcomings”

All scammers have well-developed speech skills. These people know that speech can be controlled just as effectively as body language. This technique is necessary to ensure a sense of familiarity between the “hunter” and the victim. A good con artist can spend hours telling you stories that expose his own fears and shortcomings. By doing this, he shows you that he can trust you. And even though most of these stories are greatly exaggerated or pure fiction, you already feel that you have found a common language with this person. Scientific research shows that we are more likely to trust other people if we see their imperfections.

Fans of the Spider-Man trilogy named the best and worst characters

“Food is my friend, not the enemy of my figure”: pregnancy changed my attitude towards food

Thanks to a conflict with a client, the barista got rich and became an Internet hero

Fraud in financial markets

Another type of scammers are pseudo-professional participants in the financial market who actively advertise their services for organizing trading on the Forex market.

You've probably heard stories of how ordinary people "on the street" made a fortune by buying and selling currencies on the Forex market. It sounds tempting, but don't rush to take risks. An individual with a small starting capital does not have access to the real Forex market, where mainly large banks sell and buy currencies. In order for an ordinary person to enter Forex, he needs to enter into an agreement with an intermediary, a Forex dealer, and trade through him.

Trading on the Forex market itself is a big risk, there are no guarantees, there is a greater chance of losing everything than hitting the jackpot. But the danger also lies in intermediaries: you can run into scammers who simply will not return your money. This option is likely: you are offered surprisingly low commissions, various bonuses (the amount in your account, for example, doubles). You can even enter into an agreement with a dealer via the Internet using electronic document management and seem to win a whole million! But you will not make a profit and will lose your investment.

From January 1, 2020, only licensed companies registered in the Russian Federation can carry out dealership activities in Russia.

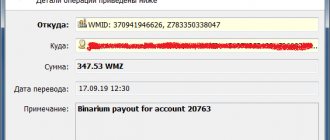

You should not mess with so-called binary options. Advertising on the Internet promises you unprecedented profits: open an account, place bets on the rise or fall of currencies or stocks over a certain period. If, after the stated time, your prediction turns out to be correct, you receive an impressive percentage of profit; if you did not guess correctly, you lose money. In reality, today there are no platforms on the Internet where such transactions can be carried out, so all promises of easy money on binary options are a scam. You will simply lose your money.

How to protect yourself from deception

- If you still decide to enter the Forex market, carefully study the law and the “Basic standard for conducting transactions in the financial market when carrying out the activities of a Forex dealer.”

- Check the Forex dealer you are going to work with - he must have a license. You can find out if it exists in the directory of financial market participants.

- If the company is registered not in Russia, but in offshore zones, be wary: most likely, these are scammers.

- Warn your elderly relatives that aggressive advertising of making quick money on the Internet will actually result in loss of money rather than profit.

- Better yet, don’t take risks, try to start the path of an investor on the stock exchange.

They say your name

The power of this trick is truly amazing. The victim completely loses his vigilance as soon as he hears his name coming from the lips of the swindler. Even if you don’t remember this person, he will assure you that he has known you since his student days. You will never accuse him of lying by saying, “I don’t know who you are.” It’s easier for you to convince yourself that once in the distant past your paths might actually have crossed. The name in this trick creates a feeling of comfort and serves as a distraction. And while you are immersed in the depths of your memory, a professional thief has already reached into your pocket.

I considered my role in “Friends” to be my curse: Jennifer Aniston's revelations

Dad's copy! Galkin's childhood photos show how much Harry looks like him

New rules in the world of beauty: natural curly hair is trending