At this stage, car leasing for individuals is not widespread in Russia. Consumers prefer to take out a classic car loan. This is due to the fact that there is still no stable trust on the part of clients in a transaction where the owner of the car is the lessor. But it is worth paying attention to these types of contracts. Today we will tell you what car leasing is, how profitable it is, and consider the risks of such a transaction.

Car leasing

Car leasing for individuals is a type of long-term lease with the right to buy the car at the end of the deal. The car is owned by the leasing company for the entire period of the contract. The lessee undertakes to make monthly payments, and when the last payment arrives, he has the right to buy the car, which will become his property.

Vehicle leasing is not as common as car lending. Many potential borrowers are frightened by the fact that the leasing organization is the owner of the purchased equipment. And he can pick up the vehicle if the terms of the leasing agreement are violated, for example due to overdue debt.

But credit institutions also have the right to sell a pledged truck or car to pay off the debt, despite the fact that it is owned by the borrower. In Russia, leasing transactions began to develop in 2010 in the retail market. Currently, leasing agreements account for no more than 3% of other types of car sales. Whereas in Europe, 70% of transport is purchased this way. Therefore, car leasing for individuals should be considered as an alternative to a loan.

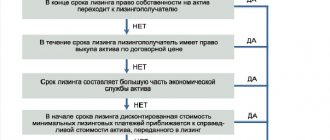

Types of leasing: with transfer of ownership and without transfer of ownership

| Comparative characteristics | With the transfer of ownership | No transfer of ownership |

| Full rights to use, dispose and own a car | Purchased after payment of ransom | Only the right to use is provided |

| What is included in the total cost of the contract? | · car cost; · cost of acquisition and transfer of transport from one party to the contract to another; · the cost of costs for the provision of services under a leasing agreement, · the so-called “rental” cost or profit; leasing company from the transaction · redemption price of transport | · cost of transport; · the cost of transferring (purchasing) a car to the lessee; · the cost of costs for the provision of services under a leasing agreement; · rental cost; car wear and tear cost |

What is car leasing

What is car leasing? Car leasing for an individual can be provided in two options: with and without vehicle purchase. The lessor sets a payment schedule that must be met. Also, leasing conditions for individuals include other documents similar to the loan agreement:

- transaction amount;

- down payment or security deposit;

- residual payment;

- terms and dates of payment.

You can lease a car without the right to buy. In this case, upon completion of the contract, the borrower has every right to lease a new car, thus saving time on selling the car and registration actions. The standard term of a car leasing agreement for individuals is 3 years, which actually allows you to constantly have a new car.

What is car leasing?

Buying a car on lease is the process of concluding an agreement between the lessor, the lessee and the current owner of the vehicle. The lessor is a bank or other financial institution. The lessee is the client making the purchase.

All three parties enter into a single agreement, which stipulates the nuances of the lease: the amount of payments, their quantity, the lease term, the possibility of purchasing the vehicle by the lessee, and much more. The section regarding violations of agreements is especially important. It determines the amount of the fine or penalty, as well as other measures taken against the violator.

An interesting feature of leasing purchases is that until the final payment by the lessee of the financial obligations under the agreement, the subject of the agreement (the car) is the property of the lessor. However, this does not prevent the client from using the vehicle.

Advantage for individuals

Buying a car on lease to individuals has its undeniable advantages:

- It is possible to exclude the down payment. A deposit may be used and can be returned upon completion;

- companies offer discounts on cars, trucks, and commercial vehicles of up to 30% through close cooperation with dealers;

- a government support project is provided, thanks to which a minimum discount of 10% is provided;

- the terms of the agreement are somewhat softer than in the case of lending. The monthly payment amount can be three times lower than for a similar loan;

- it is possible to include in the price of a car leasing service from the lessor, who will carry out maintenance, change and store tires, and additional equipment for transport can also be included in the price;

- the decision on the possibility of a transaction is made faster than with a car loan;

- the package of documents has been reduced. A car can be leased for individuals using a passport and driver’s license, but subject to confirmation of solvency certificates.

Rent, buy or lease

| Analysis | Leasing | Rent | Purchase |

| Requirements for the borrower | Over 18 years of age, positive credit history, proof of solvency, other documents | Capacity | |

| Speed of registration | Time required, approximately 3 working days | On the day of purchase | |

| Car provision period | Lease with option to buy at end of term | The contract is drawn up for a short period, up to 1 year. | Permanent contract |

| Responsibility | Repairs are carried out by the client, payments under the contract are not suspended or changed | Repairs are at the client's expense; rental payments are not made during the repairs. | Full responsibility |

| Own | The owner is a leasing company, at the end of the term you can buy the car | Not expected | + |

| Payment schedule | It is necessary to fulfill the conditions according to the schedule | No | |

| An initial fee | Various options - there are with and without an initial payment, there is an option with a deposit amount that is returned at the end of the term | + | Not applicable |

Differences between leasing and credit and rent

Renting is the temporary use of a car for a specific amount. Profits from such use go to the actual owner. A similar situation occurs with leasing. Only in the first case, the transport is returned to the owner at the end of the contract. The repurchase can be carried out at the market price. And in the case of leasing, the car has a new owner, but at the conclusion of the contract an initial payment is made.

When buying on credit, the car is the property and collateral in the bank. It also includes a down payment and equal monthly payments. In leasing, the owner is the company until the end of the payment period.

More profitable leasing or loan

A car leasing agreement for individuals is beneficial to both parties to the transaction. The leasing company retains ownership. As a result, the risks are significantly reduced. Thus, the lessor can set a low interest rate, also due to the loyal conditions, the monthly payment is quite small and the minimum requirements for the borrower.

To change the car, if it remains with the lessor, there is no need to sell; upon completion, you can lease the car again for a certain period, thereby continuing the long-term rental relationship.

Leasing of commercial transport, special equipment, and trucks is provided, which is not feasible in banks. In banking organizations, money can be obtained through a consumer loan, and in order for the amount to be sufficient, most likely, you will have to secure the loan with your own real estate as collateral.

An alternative is to lease a truck. But in this case, the amount of monthly payments will be higher and there is no possibility of obtaining ownership of the vehicle, as opposed to leasing.

Loan agreements require additional services and commissions. To buy a car on credit with lower rates, you often have to take out life and health insurance and other additional insurance. Some banks charge fees for transferring funds or maintaining an account.

When leasing a car, the borrower can save up to 30% of the market value of the vehicle. This is due to the shady cooperation between leasing organizations and dealerships. A pawned car purchased on credit must be insured against the risks of theft and damage. The comprehensive insurance amount is included in the loan body or paid at the expense of the borrower; in most banking organizations this is a mandatory condition. Let's take the offer of Sberbank or VTB 24. Leasing can be issued without comprehensive insurance.

The lending institution will not service the vehicle. The borrower assumes all responsibility for the pledged car. While the leasing agreement may imply that the lessor assumes the technical side of car maintenance.

Before leasing, many people ask whether their spouse’s permission is required for such a transaction. Unlike secured loans, there is no need to obtain such permission. Thus, leasing should be compared with a loan. Both the first and second options can be beneficial. It all depends on current offers and market situations.

Popular vehicle leasing programs

Financial organizations use various programs with loyal long-term rental conditions to attract customers. On the territory of the Russian Federation, offers are popular that guarantee the client various benefits. These include:

- no advance payments or minimum down payment;

- the amount of payments equal to the cost of the car without additional extra charges;

- low requirements for the client, that is, lack of confirmation of solvency;

- accelerated deadlines for drawing up a lease agreement and transferring a vehicle for use by the client.

Each of these programs is designed for a different group of individuals. For example, the absence of confirmation of solvency is necessary for those who have unearned income or use “gray” business schemes.

Leasing without down payment

A private individual, turning to the lessor, has the right to draw up an agreement without a down payment. Such offers are relevant in the leasing market. In this case, the company receives additional risks, so the borrower should take into account that registration under two documents is not provided in this case; it will be necessary to confirm their income. Sufficient information is the 2-NDFL document, a bank account statement and other standard pieces of paper specific to applying for a loan.

Registration procedure

The application procedure is similar to regular lending. You must first decide on the car. Then contact the lessor with identification documents to obtain a preliminary decision. Within 3 days, specialists will check your credit history, create a request for a car and contact the borrower to finalize the transaction.

At this stage, it is necessary to fulfill the document requirements and provide them to the lessor. After which the company will invite the client to pay the down payment, sign documents and set a day when they can pick up the new car.

Procedure for registration of leasing

To quickly arrange leasing and eliminate the possibility of misunderstandings in the future, the client of the leasing company needs to follow the following procedure:

- Find a suitable lessor and the most favorable terms of the agreement.

- Soberly assess your financial capabilities and reconsider your decision.

- Submit an application to the lessor.

- Receive a reasoned response from employees of the organization.

- Provide the leasing company with the required documents.

- Enter into a contract.

- Make a down payment (if there is a corresponding condition in the contract).

- Carry out a technical inspection and sign the vehicle transfer certificate.

It is worth noting that the leasing company independently searches for a car supplier and negotiates with him the conditions for providing the vehicle. If the supplier is the seller of a new car, a tripartite agreement is concluded at the stage of signing the documents.

After receiving the transaction object, the client will receive the relevant documents:

- PTS for cars;

- a copy of the transaction agreement;

- an act recording the transfer of the car;

- payment schedule;

- maintenance certificate;

- insurance policy;

- a copy of the purchase and sale document;

- a copy of the vehicle registration certificate;

- car keys;

At the discretion of the leasing company, the client may receive additional papers.

It is important to know: when the lessor purchases the object of the agreement, the property can be obtained on credit. For this reason, under these circumstances, the charges on the credit account will ultimately be paid by the customer.

Payment receipts will contain the following amounts:

- rent;

- insurance fee;

- repayment of loan costs;

- lessor's income;

- car repair.

While the car does not belong entirely to the lessee, he is not required to pay taxes on it, since actual ownership is assigned to the leasing company.

After completing the transaction, the client will be obliged to pay funds for the use of the vehicle according to the payment schedule. Only after paying the balance of the cost can the motorist become the full owner of the car.

Basic provisions

Leasing is gradually gaining popularity in Russia, the main advantages are:

- low monthly payment;

- the ability to exclude the independent sale of a car by signing up for a new long-term lease;

- the opportunity to return the deposit amount;

- You don’t have to apply for an expensive comprehensive insurance policy.

Most clients prefer not to change the car, but to buy it back at the end of the contract, becoming the owner. There is also a convenient service provided by the leasing company, which can organize the registration and deregistration of the vehicle and provide maintenance.

Is it possible to get a lease with a bad credit history?

Most lessors can enter into transactions with clients whose credit history is not in perfect condition. Thus, a motorist with a bad history may well find a company that will agree to formalize an agreement with him.

The most important circumstance for a leasing company is that the driver has no debts and has a source of stable income. For this reason, the client should confirm his solvency with additional income. It is also worth taking into account that when leasing, organizations do not require collateral or guarantee.