What does it mean to specify a payment in Sberbank?

According to current legislation, banks are required to verify the legality of payments and identify payers. For this purpose, payment orders have a separate column “Purpose of payment”, which indicates the agreement under which the payment is made, the nature of the payment (advance payment, payment for work and services performed), and other signs by which you can determine what the money is transferred for. If necessary, banks may request documents specified in the payment purpose for additional verification.

When making payments between legal entities, filling in this field is mandatory. When generating a payment order for goods and services, when making payments to the budget and extra-budgetary funds, when making a payment for a third party, etc.

If an individual transfers money from his or her account, you will need to enter information only if it is marked with a “Required” sign (red asterisk).

If the payer does not indicate the purpose of the payment, it will accordingly not be reflected in the payment receipt. Therefore, if controversial issues arise with the recipient of funds, it may be problematic to prove the fact of payment for a specific service or product.

Purpose of payment when transferring salary

When transferring salaries to employees, you will need to indicate in the payment purpose:

- type of income;

- the period for which it is paid;

- date and register number (when transferring salaries to a salary account);

- indication of VAT (without VAT);

- Full name of the employee and his personal account number (if the salary is transferred not to the salary account, but to a specific employee)

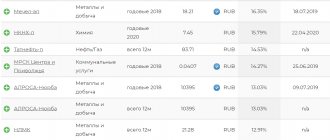

| Who is the salary transferred to? | Example of filling out field 24 “Purpose of payment” | Sample of filling out a payment order |

| To a specific employee on the card | “The salary for February 2020 is being transferred to Sergei Dmitrievich Stepanov to personal account 40817810416604007788” | |

| To a salary account in a bank (for all employees) | “Salaries for February 2020 are transferred according to register 10. The amount is 920,856 rubles. Without VAT" | Payment order to transfer wages to a card: sample for 2019 |

How to fill out the column?

There are no strict requirements for filling out the column; information is entered in any form, it must be sufficient for the bank to process the payment.

The column “Purpose of payment” in Sberbank online is located in the sections: Filling in details, Payment details, Confirmation. The information must contain the following data:

- What is the payment for, for example, payment for goods (felt boots), for work completed on building a house, repayment of debt, charity, etc.;

- Number and date of the document on the basis of which the payment was made, for example, agreement for the supply of felt boots No. 22 dated 05/01/2019, or loan agreement No. 42/37 dated 05/01/2019;

- When making a payment to a third party, it is indicated for whom the payment is being made, under what agreement, etc.

Specific information depends on where the transfer is made: to your account, to another individual at Sberbank, utilities are paid, or funds are transferred to another bank, etc.

In the Sberbank online system there is a limit on the number of characters. The column must contain no more than 210 characters, including spaces.

General requirements for filling out the field

The rules for filling out a payment order are prescribed in the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P “On the rules for transferring funds.” The document does not contain strict requirements for filling out the “Purpose of payment” field. The main condition is that the number of characters in this field, including spaces, be no more than 210.

If this amount is not enough to include all the necessary information, then the Bank of Russia allows for abbreviations and generalizations that will not lead to distortion of information or the formation of an incorrect opinion.

In addition, the Central Bank in the Regulations has compiled a list of details that are required for decryption

when generating a payment document:

- purpose of payment;

- name of goods, works or services;

- number and date of contracts and other commodity documents, if any;

- other information necessary for identification;

- VAT amount.

The rules for filling out the “Purpose of payment” field differ depending on who is sending the transfer – an individual or a legal entity

face.

Transfer to your account

At Sberbank, one person can open an unlimited number of accounts and cards; if necessary, clients can transfer money between their accounts without restrictions and without commission. In this case, the “Payment purpose” field is not filled in.

When filling out a payment order, the column is blank, so it can be left blank. If the payment amount is more than 50 thousand rubles, you can put “Transfer of own funds” in the column, this will simplify the bank’s verification of the transaction and the payment will be completed faster.

New procedure for filling out payment slips: changes

To begin with, let’s talk about the specifics of legislative regulation of the financial legal relations in question.

Filling out a payment order is a procedure that has been carried out according to new rules since 2014. The main changes in the procedure for working with the document in question are:

- the ability to specify a larger number of values in attribute 101;

- if necessary, record OKTMO code in field 105;

- in the appearance of some new values in props 106;

- the need to fill out field 108 in accordance with the new procedure;

- in reducing the list of payments in field 110;

- in the appearance of a new detail in the payment order, namely the “Code”.

In many cases, the most difficult thing for a financier is filling out the “Purpose of payment” details in the payment slip. Let's consider how you need to enter certain information in this field in accordance with established standards.

Housing and communal services payments and more

When paying for housing and communal services, mobile communications, or making other payments using templates, the field can be left blank. In this case, the system independently identifies the recipient of the funds.

If the payment is made in favor of a legal entity for purchased goods or services, you will need to fill out the column.

The following information is entered:

- What is the payment for?

- Based on what agreement?

- For what period?

For example, “payment for services for high-speed Internet provision under contract No. 123 dated 05/01/1029 for the period from 05/01/2019 to 05/15/2019.”

When paying taxes, you will not need to fill out the column if you use the payment number indicated on the receipt.

When paying using the details, the type of tax is indicated in the purpose of payment, for example, “transport tax”, “land tax”. Even in the absence of information, banks will not return the transfer of payments to the budget due to lack of grounds.

Why is the “Payment purpose” field needed?

At first glance, the “Payment purpose” field is needed for approximately one purpose - it allows banks and the recipient of the money to understand why the transfer was received

. The presence of this field allows you to clarify the information and protect the sender. In fact, this graph has a little more functions:

- State authorities pay attention to the purpose of payment.

If, when transferring money to an individual, it is indicated that this is payment for services rendered, the tax service will begin to take a closer look at this person. If payments with such a purpose are repeated very often, then the Federal Tax Service may recognize through the court that the recipient is violating Russian legislation and is engaged in business activities without registering a legal entity or individual entrepreneur - in this case, he will be held administratively liable and forced to pay taxes and penalties. - information in the “payment purpose” field can help save money.

For example, if a person’s current accounts are blocked by a decision of bailiffs, they have the right to seize the accounts by a court decision or a decree of the tax authorities for non-payment or partial non-payment of taxes. All money that comes to the seized account will be automatically transferred to pay off the obligation. But if the purpose of the payment states that this is, for example, a childcare benefit for a child under 1.5 years of age, then the bailiffs do not have the right to withdraw this amount to pay off the debt - and the money will arrive safely to the recipient. - conducting commercial activities: the “payment purpose” field is especially important for legal entities, since without its indication the bank will not process the payment order.

In fact, everything that is indicated in the purpose of the payment somehow identifies the payment itself and distinguishes it from other payments - therefore, this information is used by the bank, the Federal Tax Service, and the payee himself.

Transfer to another person to Sberbank

When making a transfer to another individual whose account is opened with Sberbank, it is usually not necessary to fill out the column.

However, the recipient of the funds may need the column to be completed. For example, he is engaged in commercial activities and is officially registered as an individual entrepreneur. To ensure that the tax office does not have questions regarding receipts to the account when calculating the taxable base, it would be better if the column was filled in. You can justify the transaction as a “Private Commercial Transfer”.

Despite the fact that it is not mandatory to fill out the field, it is better to do this for transfers worth more than 25 thousand rubles, for example, you can write: “Private non-commercial transfer.”

Types of payments

Depending on who makes the payment, where and for what the funds are transferred, there are payments when it is not necessary to fill out the “Payment Purpose” and when the payment will not be made without entering the information.

It is not necessary to enter data for the following operations:

- Transfer funds from your account to your account;

- Transfer of funds to an electronic wallet account;

- Payment for mobile communications, housing and communal services;

- Repayment of debt under a loan agreement executed at Sberbank;

- Payment of taxes;

- Payment of traffic fines.

In these cases, the field is left blank or filled in at the discretion of the payer, in agreement with the recipient of funds. In any case, the bank will not return the payment due to incorrectly filled in data.

The field is required to be filled in when making the following types of payments:

- Repaying a loan from another bank. You will need to indicate the number and date of the loan agreement, full name. borrower. For example: Repayment of debt under a loan agreement concluded with Ivan Ivanovich Ivanov No. XXX dated 01/01/2019;

- Interbank transfers. For example: Debt repayment, Donation;

- Payments to government bodies and organizations;

- Social Security contributions;

- Payment for goods and services. For example: Payment for goods under contract No. XXX dated 01/01/2019. Payment for repair work under contract No. ХХХ dated 01/01/2019 and acceptance certificate No. ХХХ dated 01/01/2019.

When creating a payment order, you should take into account that the bank has the right to request documents specified in the purpose of the payment, therefore it is not recommended to enter incorrect information.

If a large amount of money is transferred, the bank may request additional confirmation. You will need to call the Call Center operator and confirm the transaction.

Purpose of payment: return of excessively transferred funds

When receiving funds sent by mistake, the sender can write a letter to the recipient asking for a refund, indicating his own details.

The recipient organization or individual, having discovered that the payment was erroneous, notifies the bank in writing. The notification must be sent to the bank no later than 10 days from the date of receipt of the statement with the funds credited to the account. The next step will be processing the return.

If the bank has the right to write off money from an account without acceptance, it will transfer funds received by mistake without a special order. If this is not possible, the recipient will be required to issue a payment order. The “payment purpose” field must indicate: return of erroneously transferred funds.

Service codes

When conducting a transaction using the details of the recipient of funds, the payer must find a counterparty online in Sberbank. This is not always convenient, troublesome and takes a lot of time. The name of the recipient of funds and his details are entered in the search line, then the desired company is selected from the generated list.

You can use the templates that are included in the system, but they exist for a limited circle of recipients of funds: traffic police, mobile communications, housing and communal services, etc.

In order to make a payment quickly and easily, the payer can use a QR code. It is located on the receipt and is a square with the following signs:

This is a quick response code that allows you to complete the transaction with maximum comfort and speed. All users who have a camera on their smartphone can use the payment code.

Payment using a QR code is made from the Sberbank online mobile application.

Procedure for performing the operation:

- Select the “Payment by barcode” option in the main menu of the mobile application;

- Place your phone near the code and scan the image.

- The mobile device screen will display information about the transaction, information about the recipient, and a completed payment receipt.

- Enter the necessary additional information, for example, when paying for housing and communal services, enter meter readings and the payment amount;

- Complete the operation by clicking “Pay”;

- Confirm it using the code.

Filling out the “Purpose of payment” field by an individual

The “Payment purpose” field can have different names. For example, in Sberbank.Online, when sending money from a private person to another person, the field is called “message to recipient”. True, in Sberbank this field appears only if the recipient of the transfer is a client of Sberbank

, otherwise you won’t be able to write a message.

If the client pays taxes, fees or others, all the necessary information is entered automatically.

Filling out the “Purpose of payment” field will help you avoid many problems. For example, a relative sends you money for education. If the amount is large (depending on the internal control rules for AML/CFT of each bank), then a bank employee may ask to clarify the purpose of the transfer

and any other documents.

Provided that the purpose of the transfer is indicated, the bank will see that the money was sent for a reason, but for a very specific purpose. But this still does not mean that the payment will be processed: transfers over 600 thousand rubles are always verified. Settlements on real estate, the amount of which exceeds 3 million rubles, are also subject to verification.

If a person wants to pay tax

, then the payment purpose must include the name of the tax and the payment period. The same applies to paid educational programs or clubs. In this case, the purpose of payment must indicate the child’s full name, the name of the club and the payment period.

But there are situations when a person simply pays for some goods or services

, for example, ordered in an online store. In this case, the purpose of payment should indicate: “Payment for order No. ХХХ dated ХХ.ХХ.ХХХХ. Amount XXXX,XX rubles, including VAT in the amount of XXX,XX rubles / excluding VAT.” The exact procedure for filling out the “payment purpose” field can be clarified with the seller.

A similar situation occurs when paying a tax or bill for someone else.

. In accordance with Russian law, any adult has the right to manage their savings as they wish, including paying the bills of others. But in this case, in the purpose of payment it is necessary to indicate for whom the money is being transferred; if available, you can indicate the account/order number or other explanations.

Very often this method is used by individual entrepreneurs, managers and owners of enterprises - they have the right to contribute their own funds to their activities as an interest-free or interest-bearing loan or temporary assistance

.

The “Purpose of payment” field should also be filled in when making mandatory payments in favor of other people. For example, if a person is required to make alimony, rent or other payments. When specifying a specific destination, the recipient will not be able to say that the money was not transferred

(as opposed to the usual transfer from card to card without explanation).

Possible problems

When creating a payment order, the payer may encounter various problems that must be taken into account in advance so that the payment is processed by the bank in a timely manner. The most popular are:

The text does not fit in the column. The system will not allow you to enter information exceeding 210 characters in the “Payment purpose” field. The way out is to reduce the text to the required size; it is possible to reduce the entire text, but without losing its meaning. Unacceptable symbols. The most common invalid characters are "" or an em dash. In order for the system to skip the payment, you will need to replace the symbol with another one or eliminate the symbols altogether when entering information. The payment assignment does not go through. The system usually accepts the payment purpose, even if there are errors. Therefore, if the wording does not pass, then clarification is required (you must include the contract number, date, etc.)

If the payer has not filled out a field that is required when generating a payment, the system will not allow him to enter data further until the error is corrected.

When an error is discovered after sending an order for execution, you must immediately inform the support team about the need for revocation. In your personal account you can check the status of the order. If it is “Processing”, a revocation is possible; if its status is “Executed”, then the payment has been completed and it is impossible to return it.

What should I write in field 24?

In order for the non-cash transfer of funds to be carried out successfully, the order to the bank for its execution should reflect the intended purpose of the requested payment, the list of goods/services/works to be paid, the date of execution of the business contract or product document, the amount of VAT, as well as other information indicated at the initiative of the payer himself. .

The purpose of the transaction is always written in field No. 24 of the payment order, specially designated for these purposes.

The purpose of the requested payment specified in the client order clearly and accurately reflects the meaning of the relevant transaction, which is considered necessary for its proper execution.

The time and order of execution of a payment order are stipulated by regulations, but a financial institution can execute a transaction ahead of schedule if this transfer is ordered by the client frequently and regularly.

The purpose of the payment, always reflected in field No. 24 of the payment order, implies the indication of the following information, which together characterize the essence of the operation being performed:

- The meaning of the transaction. Predetermined by the specifics of the requested payment. It is formulated briefly, clearly and unambiguously. This could be, for example, payment for work performed, services provided, goods supplied, as well as other settlements with counterparties under concluded contracts. In addition, business entities regularly make non-cash transfers related to issuing salaries to employees, paying off current obligations to the budget, and making other necessary payments.

- Specific documentary basis for carrying out the payment transaction provided for by the client order. The payment order usually indicates the date of execution and the registration (serial) number of the business agreement or other document that is the basis for the non-cash transfer of a certain amount of money. Such grounds may include an invoice for payment, a completed delivery note, an acceptance certificate for work performed, an employment agreement (contract) with an employee, as well as other documents drawn up and executed properly.

- List (details) of paid services/works/goods. The purpose of the payment being made contains at least an abbreviated description or listing of everything that is payable under this order (for example, wages, cargo transportation, information services). If the space of the filled field allows, it is allowed to indicate a complete list or a more detailed description of paid items.

- The type of transfer being made. This may be final payment, full payment, partial payment, additional payment to the previously paid amount, advance payment, partial/full prepayment under a supply/contract agreement.

- Other information indicated in field No. 24 of the payment order as necessary or at the discretion of the payer. Alternatively, the maximum period for making payment under a business agreement or additional information when paying tax may be reflected.

- The VAT amount is stated separately. The wording “excluding VAT”, “not subject to VAT”, “including VAT” is allowed. If the corresponding payment is transferred to the tax office, it is recommended not to fill in the VAT field at all.

It is obvious that the wording of the purpose of payment, reflected in the corresponding field of the order for non-cash transfer of money from a client account, takes into account the specifics of the transaction, its basis, as well as the recipient of the funds being paid.

As you know, a payment order can be issued for a variety of purposes - settlements with suppliers/contractors, payment of wages to employees, settlement of tax obligations, making payments in favor of a third party, and other needs.

Sample filling when paying for a third party

If any third party is involved in the settlements between the supplier (recipient of money) and the buyer (payer of money), the wording of the purpose of payment in the corresponding order must contain a clause about for whom exactly this payment is being made.

In the same field of the payment, information about the document that is the basis for the non-cash transfer of funds should be reflected.

It is also necessary to mention VAT (its presence/absence).

In addition, it is recommended that the payment slip indicate a document according to which a third party (third party) makes payment for the buyer directly included in the supply agreement.

Such a documentary basis may be an assignment agreement/letter.

It is important that the buyer notify the recipient (supplier) in advance of his intention to make the proper payment from a bank account owned by a third party.

Such notification is often issued in a separate letter.

Learn more about filling out a payment form for a third party.

How to fill out correctly when transferring salaries?

The specifics of this transfer include the following features of the wording of the payment purpose:

- The essence of the payment being made is the payment of wages to the employee.

- The basis for the transfer to be executed is an employment contract (the date of its execution and registration/serial number are indicated).

- Name – wages for a certain period.

- Type of payment - advance payment, final payment, additional payment.

- Availability of VAT – without VAT.

- Other information – paid period, other data.

Sample of filling out a salary slip.

When paying taxes

If a business entity transfers money to the budget (for example, pays a tax), the wording of the purpose of payment in the corresponding order will not have much significance.

For targeted payment of money to the budget, greater priority is given to filling out other fields of the payment slip - payment basis (106), OKTMO (105), KBK (104).

If fields 104/105/106 are filled out correctly, and erroneous information is indicated in field 24, the payer does not need to correct the purpose of the payment by sending a clarifying letter to the tax service.

The transferred amount will in any case reach the recipient.

When transferring for goods

If a business entity pays a counterparty (supplier of goods), the wording of the purpose of payment in the order must contain the following information:

- Type of payment made. This may be a partial/full prepayment, final payment or, alternatively, a commission.

- Generalized description of purchased goods/services/works subject to payment.

- Date/number of the supply agreement, delivery note, invoice for payment, or other document that is the basis for the transfer of funds.

- If there is VAT, its amount/rate is indicated. If there is no VAT, no VAT.

How to correct if it is indicated incorrectly?

Filling out the payment purpose field in an order to the bank to transfer funds is usually not difficult for the account owner. However, sometimes such wording is inaccurate and contains errors and unreliable information.

It also happens that information about the purpose of a payment transaction is displayed in another field of the payment card that is not intended for this purpose. Or, in field No. 24, instead of the purpose of payment, other data is erroneously indicated.

One way or another, there are certain rules governing the procedure for correcting errors in a payment order, including when the purpose of payment is filled out incorrectly.

The most favorable scenario is to make changes to the payment order before it is executed by the bank.

Accordingly, it is always necessary to start by identifying the error.

If the payment order was sent with an incorrectly specified purpose, then clarification is necessary.

How can I clarify the tax value?

The following algorithm for making corrections and clarifications is used:

- Send a letter to the recipient of the funds notifying them of the error, indicating the incorrectly completed payment purpose.

- Receive a response letter from him containing the correct wording of this detail. Certify the correspondence with your own signature.

- Transfer a copy of the received notice to the payer's (sender's) bank. The document is returned with a proper receipt stamp.

- These copies with proper marks are transferred to the recipient's bank.

- Wait for the necessary changes to be made.

Sample letter of clarification

letters to the tax office to clarify the purpose of payment.