Who is a broker

Activities on the exchange are strictly regulated and only licensed participants are allowed to participate:

- brokers;

- dealers;

- registrars;

- depositories;

- settlement and clearing houses.

Each element of the system takes its place in the auction and is a legal entity.

Dealers carry out transactions at their own expense and in their own interests, and this requires highly qualified personnel, because trading on the stock exchange is associated with high risks. Registrars (or registrar holders) carry out regular registration of securities holders in the interests of the issuer. Depositories operate on the other side of the trade and record ownership of securities on behalf of shareholders. Settlement and clearing centers deal with monetary transactions: withdrawal, transfer, blocking.

Brokers occupy a special place - another professional participants in the trading process. The functions of a broker in stock trading are in many ways similar to the classic definition of this type of activity, which is to mediate between the seller and the buyer.

An ordinary investor cannot be allowed to trade on the exchange, because it imposes special requirements on its participants for the correct functioning of the entire system: without failures, market failures and other negative factors that are possible with free access.

It is with the broker that the trader enters into an agreement to enter the market. The investor himself will not be admitted, but according to the terms of brokerage services, all necessary operations for the purchase and sale of securities will be carried out by the broker on behalf of the investor. In turn, the broker and exchange will take a commission for each transaction.

Another necessary condition for trading is the presence of a trading terminal, where the trader creates his orders. The terminal is also provided by the broker, and if there is no access to the Internet, the broker can register an order via telephone - this is a historical method. Individuals and legal entities can act as clients.

Responsibilities

A broker has a lot of official responsibilities. Their number is approximately the same in each field of activity. There are no “easy” directions.

The average broker should:

- Acquire and sell goods in batches at auctions, cash markets or futures markets.

- Conduct purchase and sale transactions of securities, foreign currency and commercial services related to loans, execution of employment contracts and contracts, transportation, real estate transactions, and so on.

- Establish connections between the buyer and seller of goods, the client and the person who provides the services necessary for the customer.

- Responsible for the timeliness and ensuring the maximum benefit of the sale or purchase of goods, execution of an agreement for the provision of a certain type of service.

- Study external and internal market conditions, the reliability of securities, the requirements of both parties to the transaction for the process of acquiring or selling goods, providing various services, and executing exchange transactions (credit and foreign exchange) that have differences in the level of trust.

- Attend auctions, provide all the necessary information when preparing catalogs, set the price of goods in a timely manner and note its changes, as well as the transaction amount - do all this on behalf of the client.

- Conduct negotiations on the acquisition and sale of those goods that were never sold at auction.

- Organize the delivery of goods, determine its cost and draw up special documents for subsequent collection of compensation for transportation costs from the client.

- Perform settlement and analytical operations, register and draw up stock exchange documents.

- Provide clients with consulting services on issues that fall within the scope of their competence.

- Manage subordinate agents.

How to become a broker

Professional participation in auctions implies appropriate licensing. Becoming a broker is possible only after obtaining the necessary license from the Central Bank of the Russian Federation. Only a legal entity that requires an account for 5 million rubles and a completed training course with subsequent licensing can become a broker.

The broker's registration and subsequent analysis of his activities are already taking place on the exchange itself. On the exchange websites, lists of officially registered brokers are publicly available, so when concluding an agreement you can easily check the accuracy of the information and the qualifications of the brokerage company.

There are currently no university educational programs in brokerage in Russia, so this type of activity is chosen by representatives who have received education in such general fields as finance, economics, mathematical sciences, and banking.

The lack of highly specialized knowledge is compensated for in special additional courses at large companies and in the process of obtaining a license. In the absence of full access to exchange trading, small brokers often enter into subcontracting agreements with larger players.

Licensed version

Officially, you can kick yourself in the chest with your heel and proudly call yourself a broker only after a number of steps.

So:

— We register as a legal entity or individual entrepreneur. For beginners, an individual entrepreneur is more suitable, but if you plan to make this your life’s work, then it is better to immediately register an LLC so that you do not have to deal with reorganization later.

— We register with the tax service.

— We open an account or use an existing one, replenishing it up to the level of 5,000,000 rubles. You will be performing transactions with other people's money, so these funds are something like a guarantee card for clients.

— We are undergoing training. There are corresponding faculties, such as, for example, “economics”, “financial management”, both in universities and colleges. Another option is official courses conducted by a company that has the appropriate license, and therefore guarantees you a certificate.

The courses last on average from a week to several months, depending on your basic knowledge and the seminar program, their price varies from 5,000 to 20,000 rubles. There is an option for distance learning. You need to pass them not just for show and a paper about completion, because in the end you need to pass a state exam.

The broker exam consists of two stages.

- First, basic. Having passed it, you do not receive a certificate from the FFMS (Federal Service for Financial Markets), but are only admitted to the next level - to take a specialized exam.

- There are seven degrees of brokerage certificates, the most universal degree being 1.0 (brokerage, dealer, securities management activities). Once you receive it, you will be able to provide most brokerage services.

The exams are a two-hour test, for each you need to pay an average of 2,000 rubles. To successfully pass, you need to score 80 points out of 100. Exams are taken in accredited centers located in Moscow, St. Petersburg, Samara, Yekaterinburg and Tyumen.

List of accredited organizations. Source - Central Bank

Some centers offer on-site or remote testing, and a number of organizations also have partners in other regions of the country who are able to conduct testing on a specific schedule. By the way, you can also get training there.

— We are obtaining a license, which is currently issued by the Central Bank of the Russian Federation, or more precisely, by the Department of Admission and Termination of Activities of Financial Organizations. To receive the coveted document, you need to fill out an application, collect a package of documents, pay a state fee in the amount of 7,500 rubles and wait up to 30 working days.

Choosing a broker

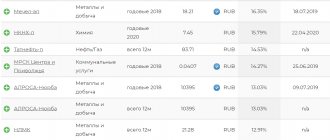

The investor has a wide list of brokers who provide assistance in trading. The first thing you need to check when choosing is the availability of a license, which can be viewed on the company’s website and confirmed on the stock exchange. An important component is the rating, because it shows the quality of the brokerage services provided. It would be a good idea to study reviews about the broker on the Internet and the company’s financial statements.

Before signing a contract for brokerage services, it is necessary to study all its nuances to ensure compliance with the developed strategy. Firms offer a variety of tariffs for all types of strategies:

- commission for transactions or for their volume;

- leverage.

For someone who is going to trade on a daily basis, it will not be very profitable to lose a percentage on the commission on each transaction.

An important point of brokerage activity is providing its clients with access to trading. This is done using trading terminals, the main ones:

- Metatrader;

- QUIK.

It is not enough to provide access, you also need to give the necessary instructions for use, or better yet, train. A trader can do all this on his own, but it is much better to get qualified help.

Trading terminals became widespread with the development of the Internet, and with the development of the mobile segment, it became possible to install terminals not only on desktop computers, but also on mobile devices: smartphones and tablets. If the trader does not have access to the Internet, the broker must be accessible via telephone contact.

Pitfalls of brokerage accounts that are important for everyone to consider ⚠

Often, advertisements for brokerage companies claim that by using their services you can get rich very quickly. Such videos show successful people who receive huge amounts of money in a short time without any problems. However, such advertising does not mention the risks of cooperation with brokers.

The main pitfalls of working with brokerage accounts that are important to know about:

- A significant part of a broker's income comes from commission. Therefore, by hook or by crook, such companies encourage clients to make as many transactions as possible, which will ultimately lead to an increase in the broker’s income;

- For clients who do not know which asset to prefer, brokerage companies offer paid analytics. This helps them increase↑ their own income;

- Most professionals agree that long-term investing should be used to achieve consistently high returns. At the same time, it is important to diversify the portfolio being formed as much as possible;

- It is incorrect to use technical analysis in the hope that it will help you understand where the value of a financial instrument will move next. In fact, such methods only allow you to determine the most appropriate moment to enter and exit the market;

- There are many scammers operating in the financial market who pretend to be brokerage companies. For this purpose, they even post fake licenses on their websites. Such companies offer to open a brokerage account, despite the fact that they do not have the right to carry out brokerage activities. Their main goal is to misappropriate funds from naive citizens. To avoid negative consequences, it is worth checking the authenticity of the license on the website of the regulatory authorities.

Reality confirms that brokerage companies are primarily interested in attracting clients and their funds. It is important to them that account holders carry out as many transactions as possible. This is explained simply: brokers’ income comes from commissions paid to them by clients.

How to trade on the stock exchange

The broker carries out all purchase and sale operations only on behalf of the client and at his expense. In Russia, a slightly different relationship has formed between a brokerage company and traders than in developed capitalist countries. There, the broker is limited only to his direct intermediary function and does not perform analytics for the client.

In Russia, companies provide a wider range of services. When choosing large companies, the investor has the opportunity to completely transfer trading into the hands of the broker, and only choose a standard strategy from those offered.

It turns out that in Russia brokerage firms are more focused on their clients. This is due, first of all, to the low level of financial literacy among the population, which gradually increases after the departure from the socialist system.

Leading players not only offer a choice of strategy, but also do a lot of work with traders to train them through seminars and webinars. Brokers are extremely interested in the successful trading of their clients, because their profits depend on this.

These circumstances further emphasize the importance of choosing the right intermediary company, because with a low level of qualifications, the bidding results are unlikely to be positive.

Despite significant analytical work, the main area of activity is operational. Clients first of all expect the correct performance of basic intermediary functions:

- execution of orders;

- proper reporting;

- tax calculation.

To start trading, the client must perform a number of actions that consolidate the relationship with the broker:

- Conclusion of a brokerage service agreement.

- Opening an account.

- Installation of a trading terminal.

In the future, trading takes place directly: the trader gives instructions through the trading system and orders are sent to the exchange. An important quality of a broker at the trading stage is the provision of margin leverage, that is, a borrowed amount to carry out a transaction. The amount of leverage increases as the investor's level increases, and the highest leverage is available to qualified investors who meet a number of conditions.

The opening of a short position is based on a similar principle. It consists in the fact that a trader sells certain shares before their value falls, and after the fall buys them back, making money on the difference in price. It is possible to sell shares if they are not on the trader’s balance sheet only with the help of a broker, who buys them at his own expense and provides them to his client. Having bought them back at a lower price, the investor returns the shares to the broker, keeping the proceeds for himself.

The broker's benefit lies in the established commission, but in return the broker does his best to promote successful trading. It is convenient that intermediaries take care of the preparation and withholding of income taxes from the sale of shares. When applying for a deduction, the broker will provide all the necessary supporting documents. As in any other service market, the consumer has the right to terminate the contract and sign with another broker.

Internship and self-education

Like many other companies, brokerage firms are always in search of smart specialists, so they often take on students and graduates for internships. This opportunity cannot be missed. An internship provides a good opportunity to look at the work of a broker from the inside. And in the best case scenario, get a job in this company.

Self-education is an important point in all professions. The financial industry is changing rapidly. A broker should be aware of all the trends in the industry. But knowledge alone is not enough. A good specialist knows how to put them into practice. A professional broker must be able to analyze, make non-standard decisions and see perspectives. He is always developing and working on himself.