At this stage, car leasing for individuals is not widespread in Russia. Consumers prefer to take out a classic car loan. This is due to the fact that there is still no stable trust on the part of clients in a transaction where the owner of the car is the lessor. But it is worth paying attention to these types of contracts. Today we will tell you what car leasing is, how profitable it is, and consider the risks of such a transaction.

Car leasing

Car leasing for individuals is a type of long-term lease with the right to buy the car at the end of the deal. The car is owned by the leasing company for the entire period of the contract. The lessee undertakes to make monthly payments, and when the last payment arrives, he has the right to buy the car, which will become his property.

Vehicle leasing is not as common as car lending. Many potential borrowers are frightened by the fact that the leasing organization is the owner of the purchased equipment. And he can pick up the vehicle if the terms of the leasing agreement are violated, for example due to overdue debt.

But credit institutions also have the right to sell a pledged truck or car to pay off the debt, despite the fact that it is owned by the borrower. In Russia, leasing transactions began to develop in 2010 in the retail market. Currently, leasing agreements account for no more than 3% of other types of car sales. Whereas in Europe, 70% of transport is purchased this way. Therefore, car leasing for individuals should be considered as an alternative to a loan.

Leasing agreement

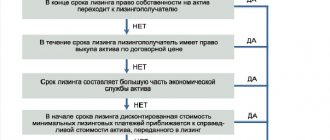

It is important to carefully study the leasing agreement before concluding a transaction. It is this document that regulates the relationship between the lessor and the lessee. It often includes unfavorable conditions, and therefore it is better to immediately ask questions to the lessor.

Let's consider what points in the contract you need to pay special attention to:

- Who will be the balance holder? Most leasing companies are ready to enter into an agreement both with and without the transfer of leased items to the balance of the lessee. In the latter case, the client will not have to deal with accounting and payment of property taxes, but leasing payments will increase.

- Insurance of the leased object. Usually, without exception, all leasing companies require insurance of the received property. The cost of insurance can be paid separately or already included in lease payments.

- Additional costs and responsibilities. It is very important to decide at the negotiation stage who will register the car with the traffic police, pay the state duty and incur other possible expenses, for example, paying for scheduled maintenance.

It is important to understand that leasing is a type of rental relationship. Until the end of the contract, the property remains the property of the lessor. If the client delays payment or violates the requirements for insurance or operation of the car, the leasing company can terminate the leasing agreement unilaterally and seize the car. In this case, she will not even need to obtain a court decision.

Also read: Differences between leasing and renting: the difference between transaction agreements + table with the main differences

What is car leasing

What is car leasing? Car leasing for an individual can be provided in two options: with and without vehicle purchase. The lessor sets a payment schedule that must be met. Also, leasing conditions for individuals include other documents similar to the loan agreement:

- transaction amount;

- down payment or security deposit;

- residual payment;

- terms and dates of payment.

You can lease a car without the right to buy. In this case, upon completion of the contract, the borrower has every right to lease a new car, thus saving time on selling the car and registration actions. The standard term of a car leasing agreement for individuals is 3 years, which actually allows you to constantly have a new car.

Leasing conditions for legal entities

Leasing for legal entities is a quick and convenient option for obtaining financing for the purchase of fixed assets. With its help, you can buy various property: cars, special equipment, equipment, real estate, etc. Moreover, obtain leasing approval for legal entities. persons is much easier than a loan. After all, until the end of the contract, the property remains the property of the leasing company.

Also read: Leasing or credit: which is better, pros and cons, terms and conditions

Most of the head offices of leasing companies are located in Moscow. But many of them have representative offices in other large cities, for example, St. Petersburg and Yekaterinburg. Moreover, the lessee organization can be located in almost any city.

Each leasing company independently develops leasing terms for LLCs and other legal entities. Let's consider the main parameters of leasing products that are typical for most companies:

- Leasing term is up to 5 years. Only for the leasing of real estate, as well as ships and aircraft, can a contract be concluded for a period of up to 10 years. The minimum leasing period is limited to 12 months.

- No restrictions on the maximum transaction amount. The transaction limit is limited only by the financial performance of the lessee. Although some companies set a contract limit of 120 million rubles for small and medium-sized businesses.

- Rise in price within 5 - 10% per year. The specific rate will be determined individually after a financial analysis. It depends on many factors, including the type of leased property purchased.

- Down payment - from 0%. But in most cases, the lessee must make an advance leasing payment in the amount of 10 - 50%.

- Possibility of completing a transaction without additional collateral. Only occasionally do leasing companies ask for business owners to provide guarantors, for example, if the company has only recently entered the market.

Advantage for individuals

Buying a car on lease to individuals has its undeniable advantages:

- It is possible to exclude the down payment. A deposit may be used and can be returned upon completion;

- companies offer discounts on cars, trucks, and commercial vehicles of up to 30% through close cooperation with dealers;

- a government support project is provided, thanks to which a minimum discount of 10% is provided;

- the terms of the agreement are somewhat softer than in the case of lending. The monthly payment amount can be three times lower than for a similar loan;

- it is possible to include in the price of a car leasing service from the lessor, who will carry out maintenance, change and store tires, and additional equipment for transport can also be included in the price;

- the decision on the possibility of a transaction is made faster than with a car loan;

- the package of documents has been reduced. A car can be leased for individuals using a passport and driver’s license, but subject to confirmation of solvency certificates.

What it is

The first step is to understand the concept itself, and only then consider the advantages and disadvantages of the product.

And so leasing or financial lease is a tool for raising funds for the purchase of machinery, equipment, real estate or other property. In this case, specific property is purchased for the client and then transferred to him for temporary possession on a lease basis.

You can often come across the statement that leasing is one of the types of lending. This is completely false. In fact, by its nature, leasing is still a rental, but in most cases, at the end of the contract, the client receives the right to buy the property.

Ownership of the car remains with the lessor until it is purchased. This does not allow the client to register it as collateral or sell it. You can rent out leased items, but you must obtain special permission from the lessor to do so.

Let's consider which parties appear in the leasing transaction:

- the lessor who finances the transaction using its own funds or borrowed bank loans;

- a lessee who undertakes to lease the property purchased by the lessor for a certain period of time with payment of an established fee for the service in the form of interest;

- the seller who supplies automobile equipment to the lessee;

- an insurance company with which the lessee signs a CASCO agreement in favor of the lessor.

The law allows the involvement of other parties in the transaction, for example, appraisers or banks. In practice, there is usually no need for this when car leasing, and leasing companies make do with a minimum number of participants in the transaction.

Rent, buy or lease

| Analysis | Leasing | Rent | Purchase |

| Requirements for the borrower | Over 18 years of age, positive credit history, proof of solvency, other documents | Capacity | |

| Speed of registration | Time required, approximately 3 working days | On the day of purchase | |

| Car provision period | Lease with option to buy at end of term | The contract is drawn up for a short period, up to 1 year. | Permanent contract |

| Responsibility | Repairs are carried out by the client, payments under the contract are not suspended or changed | Repairs are at the client's expense; rental payments are not made during the repairs. | Full responsibility |

| Own | The owner is a leasing company, at the end of the term you can buy the car | Not expected | + |

| Payment schedule | It is necessary to fulfill the conditions according to the schedule | No | |

| An initial fee | Various options - there are with and without an initial payment, there is an option with a deposit amount that is returned at the end of the term | + | Not applicable |

Car leasing for legal entities

Companies offer to lease almost any car from Russian and foreign manufacturers. The purchase of passenger cars, commercial vehicles, trucks, as well as passenger transport and various special equipment is allowed.

Also read: Where to get a car loan for legal entities or leasing - TOP 12 banks

In most cases, a contract can only be concluded for the purchase of a new car. Only some leasing companies offer financing for the purchase of a used car. Moreover, in the latter case, strict requirements for the machine will apply. In addition, the maximum contract period will be reduced. If a new car can be leased for 5 years, then for a used car the contract period will not exceed three years.

Important! All leasing companies purchase cars only from official dealers or partner car dealerships.

More profitable leasing or loan

A car leasing agreement for individuals is beneficial to both parties to the transaction. The leasing company retains ownership. As a result, the risks are significantly reduced. Thus, the lessor can set a low interest rate, also due to the loyal conditions, the monthly payment is quite small and the minimum requirements for the borrower.

To change the car, if it remains with the lessor, there is no need to sell; upon completion, you can lease the car again for a certain period, thereby continuing the long-term rental relationship.

Leasing of commercial transport, special equipment, and trucks is provided, which is not feasible in banks. In banking organizations, money can be obtained through a consumer loan, and in order for the amount to be sufficient, most likely, you will have to secure the loan with your own real estate as collateral.

An alternative is to lease a truck. But in this case, the amount of monthly payments will be higher and there is no possibility of obtaining ownership of the vehicle, as opposed to leasing.

Loan agreements require additional services and commissions. To buy a car on credit with lower rates, you often have to take out life and health insurance and other additional insurance. Some banks charge fees for transferring funds or maintaining an account.

When leasing a car, the borrower can save up to 30% of the market value of the vehicle. This is due to the shady cooperation between leasing organizations and dealerships. A pawned car purchased on credit must be insured against the risks of theft and damage. The comprehensive insurance amount is included in the loan body or paid at the expense of the borrower; in most banking organizations this is a mandatory condition. Let's take the offer of Sberbank or VTB 24. Leasing can be issued without comprehensive insurance.

The lending institution will not service the vehicle. The borrower assumes all responsibility for the pledged car. While the leasing agreement may imply that the lessor assumes the technical side of car maintenance.

Before leasing, many people ask whether their spouse’s permission is required for such a transaction. Unlike secured loans, there is no need to obtain such permission. Thus, leasing should be compared with a loan. Both the first and second options can be beneficial. It all depends on current offers and market situations.

What doesn’t delight individual entrepreneurs and legal entities? 10 disadvantages of leasing

Every financial instrument has its drawbacks – leasing is no exception. The other side of the coin of this financial instrument shows the following disadvantages:

No. 1 Final overpayment

As in the case of loans for individuals and individual entrepreneurs, equipment or vehicles purchased through leasing will cost slightly more. The most profitable option is to buy a car with your own funds without contacting leasing companies.

No. 2 An individual entrepreneur is not an owner

Property taken under lease is not the property of a businessman or legal entity - it is transferred to him for use. This includes certain restrictions (for example, the vehicle cannot be sold or modified).

No. 3 Multiple conditions

In an effort to ensure the safety of their property (+ while receiving income), LPs prescribe many restrictions in the contract. One of the points of the agreement may be an indication of the maximum annual mileage of the vehicle. Practice shows that this figure is small, so getting a car on lease for a taxi is not so easy.

No. 4 Responsibility lies with the user of the property

An individual entrepreneur or LLC is not the owner of the leased property, BUT all responsibility for its safety and performance rests with them. It is in the interests of the business owner to take out insurance and carry out regular service and maintenance of the property. Keep in mind that all of this is an additional and very significant expense.

No. 5 Main players – banks and leasing companies

Lessors imperatively determine all the provisions of the contract - in fact, they not only dictate the terms of the program (rate of appreciation, payment period and size of the down payment), but also other points (payment scheme, restrictions on use, liability in case of failure to fulfill obligations, etc.).

No. 6 Wide possibilities of personal account

In a number of cases, lessors “build” the provisions of the contract in such a way that they have the right to terminate the agreement with a legal entity without returning funds previously paid to them and without transferring property. This can be done out of court and in the future it will be extremely difficult to challenge the actions of the LC.

True, for unilateral termination of the agreement, the businessman must commit serious violations - repeated culpability in road accidents, lack of documents confirming the passage of a technical inspection, etc.

No. 7 The need to make an advance payment

Not all private entrepreneurs and organizations have their own savings to make an advance payment under the contract. Its minimum amount is 10%, the maximum is 49% of the value of the subject of the agreement. However, remember, the higher the down payment, the lower the regular monthly or quarterly payments and the final overpayment.

No. 8 Mandatory insurance of the object of the agreement

The lessee enters into an insurance contract at his own expense (at the same time, lessors strongly “advise” to choose a specific insurance organization!). Insurance is an additional “safety cushion”, but still the costs associated with its registration and subsequent payments fall on the entrepreneur, increasing his financial burden. You cannot refuse insurance ; this is one of the mandatory conditions of cooperation.

No. 9 Superficial legislative regulation

Issues of leasing (especially returnable!) for both legal entities and individual entrepreneurs have been partially regulated at the legislative level. This leaves the freedom to choose the “further move” and determine the “rules of the game”, BUT only to the lessors. In fact, the businessman finds himself in a position where he does not take part in determining the conditions - he simply chooses the option for which there is less overpayment.

No. 10 Short terms of the contract

Typically, agreements are concluded for a period of 3 to 5 years - of course, it is beneficial for leasing companies to receive large payments. By defining a short period, they protect themselves from unscrupulous businessmen and reduce financial risks to a minimum.

However, if by the end of the contract the lessee decides not to pay the residual value of the property (i.e. not to buy the car), then he has the right to extend the previous agreement or enter into a new agreement.

Leasing without down payment

A private individual, turning to the lessor, has the right to draw up an agreement without a down payment. Such offers are relevant in the leasing market. In this case, the company receives additional risks, so the borrower should take into account that registration under two documents is not provided in this case; it will be necessary to confirm their income. Sufficient information is the 2-NDFL document, a bank account statement and other standard pieces of paper specific to applying for a loan.

Comparison of car leasing for individuals with car loans + example

For clarity, I decided to give you an example of comparative calculations for a car loan and two types of car leasing, regarding one car.

From the first article about leasing, you know that there are two main options:

- Financial – with subsequent purchase of the vehicle. In relation to private individuals, the initial payment here usually ranges from 20 to 50%.

- Operational – without purchase of ownership (in fact, a type of long-term lease). In relation to private individuals, the initial payment here usually ranges from 10 to 50%.

The term of the contract is usually 12, 24 and 36 months, and the residual value of the car will be determined in each case separately (according to the make/model, contract term, condition of the car, etc.) and can reach ¼ of the amount of the cost of the vehicle.

As for monthly payments, their value starts from 5.5% (of the cost of the car), which includes wear and tear of the vehicle.

So, let’s take for example a KIA Sportage New car, worth 1.2 million rubles - let’s not waste time on trifles, we want to drive a good car, since we lease it. And we will choose an average financial period for it - 2 years.

If you take out this Korean beauty on a car loan, the calculations will be as follows:

- Advance payment – 20%, which equals 240 thousand rubles.

- The interest rate is 15.5% per annum, which will give a monthly payment amount of 46,775 rubles. (with kopecks).

- In total, the total amount you will spend with this option will be 1,362,613 rubles.

- The amount of overpayment is RUB 162,613.

If you lease the same car with the option to buy, the calculations will be as follows:

- The discount provided for such sales is 10%.

- Advance payment taking into account the discount – 216 thousand rubles.

- Monthly payments – 42,711 thousand rubles.

- In total, the total amount you will spend with this option will be 1,241,070 rubles.

- The amount of overpayment is RUB 41,070.

- Benefit compared to a car loan – 121,543 thousand rubles.

If you lease the same car without the option of purchasing, the calculations will be as follows:

- The discount provided for such sales is 10%.

- Advance payment taking into account the discount – 216 thousand rubles.

- Monthly payments – 13,662 thousand rubles.

- In total, the total amount you will spend with this option will be 543,899 rubles.

- Overpayment amount – 0 rub.

As you can see, car leasing is a very profitable option for purchasing a car or renting it for a long time.

Registration procedure

The application procedure is similar to regular lending. You must first decide on the car. Then contact the lessor with identification documents to obtain a preliminary decision. Within 3 days, specialists will check your credit history, create a request for a car and contact the borrower to finalize the transaction.

At this stage, it is necessary to fulfill the document requirements and provide them to the lessor. After which the company will invite the client to pay the down payment, sign documents and set a day when they can pick up the new car.

How to buy a car on lease

Purchasing a car on lease begins with choosing a model. It is the lessee who must choose the appropriate brand and configuration of the car, as well as decide on the seller. Managers of the leasing company can help with the choice and tell you about special offers. Sometimes you can buy a car at a significantly lower price thanks to promotions.

When a car is selected, you need to apply for leasing. This can be done on the official website of the leasing company.

Managers will contact the client, clarify all the necessary information, and also send a list of documents for concluding an agreement.

After receiving approval for the transaction, all that remains is to draw up a contract, make an advance payment and receive the car.

Basic provisions

Leasing is gradually gaining popularity in Russia, the main advantages are:

- low monthly payment;

- the ability to exclude the independent sale of a car by signing up for a new long-term lease;

- the opportunity to return the deposit amount;

- You don’t have to apply for an expensive comprehensive insurance policy.

Most clients prefer not to change the car, but to buy it back at the end of the contract, becoming the owner. There is also a convenient service provided by the leasing company, which can organize the registration and deregistration of the vehicle and provide maintenance.

List of documents for application

A legal entity will need to submit to the leasing company all title documents (Charter, OGRN certificates, TIN, decision on the appointment of a manager). You also need to attach copies of the passports of the manager, chief accountant, and in some cases, the founders of the organization. To make a decision on the possibility of concluding a transaction, a legal entity must submit financial statements for the last 1 to 5 reporting periods.

Note . Some companies have express leasing programs that allow you to arrange leasing without providing financial statements.