Last modified: January 2020

When the specifics of an enterprise’s activities require frequent movements of employees to solve assigned tasks, the problem of optimal organization arises so that the traveling nature of the work does not slow down the work process with additional reports and approvals. When hiring a new employee whose position requires frequent travel, it is worth immediately fixing the terms in the contract and other documents, establishing the rules for compensation and accounting for movements.

Legislative norms

The need to indicate in the contract with a subordinate the conditions of work of a traveling nature is stated in Art. 57 Labor Code of the Russian Federation. Establishing the traveling nature of work as an integral part of a person’s permanent activity frees one from the need to register each fact of the trip. A similar rule is fixed in the provisions of Art. 166 of the Labor Code.

To find out whether it is appropriate to mention traveling work in the clauses of the contract, we proceed from the provisions of the Labor Code defined in Art. 168.1.

The content of the article explains when employees have the right to count on compensation for travel expenses made as part of their work duties:

- regularly on the road;

- frequent travel outside the office;

- field conditions;

- participation in expeditions.

The same article establishes the obligation to properly formalize the rules of a special work regime, with a list of positions that require frequent travel being fixed in the collective agreement and internal regulatory documents. Despite the lack of clear criteria for traveling, it is customary to define what traveling work is by the presence of distinctive features.

Insurance premiums and personal income tax are not paid on compensation

Compensation for the traveling nature of work is not subject to either insurance contributions or personal income tax on the basis of subparagraph 2 of paragraph 1 of Article 422 of the Tax Code of the Russian Federation, subparagraph 2 of paragraph 1 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents in production and occupational diseases.”

Like any other expense in tax accounting, compensation expenses must be documented.

The Russian Ministry of Finance wrote exactly the same thing in letter dated January 17, 2019 No. 03-15-05/1909. The main idea of which is that the amounts of compensation paid to employees in connection with the traveling nature of the work are not subject to insurance premiums and personal income tax, provided that such expenses are documented.

If we follow the position of the Russian Ministry of Finance, an employee’s expenses for business trips do not need to be subject to insurance premiums and personal income tax if such expenses are provided for in the company’s documents. Firstly, the condition regarding the traveling nature of the work must necessarily be provided for in a collective agreement, agreement, local regulation or employment contract. Secondly, each expense must be supported by a document.

If the company does not have the necessary local acts or the employee does not provide supporting documents, the accountant will not be able to take these expenses into account. The Federal Tax Service does not recognize these expenses and will assess additional taxes and, accordingly, fines and penalties. According to officials, which is quite logical, there are no documents confirming the expenses of employees - there is no compensatory nature of these payments.

Expenses for payment of compensation to employees whose work is traveling in nature are recognized as expenses for ordinary activities as of the date of approval of the advance report. This is provided for in paragraphs 5 and 16 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n.

Until the employee submits an advance report and it is approved by the director, the funds issued to the employee are considered an advance. These amounts must be reflected in accounting as an employee’s receivables according to the rules of paragraphs 3 and 16 of PBU 10/99 “Organizational Expenses”.

Travel by employees whose permanent work is traveling in nature is not considered business trips. This is stated in Part 1 of Article 166 of the Labor Code of the Russian Federation. Accordingly, daily allowance standards cannot be applied to this work.

Distinctive characteristics of the traveling nature of work

To determine the traveling or mobile nature of work, differences must be sought in the regulations established back in Soviet times. With a mobile nature, frequent movements are provided not for an individual employee, but for the entire enterprise, when hired personnel work away from their place of permanent residence.

If the work is of a traveling nature, then the job description instructs the employee to make constant trips, not due to the occurrence of some events, but for the purpose of performing the duties for which the employee was hired. You should learn to distinguish who can be assigned this type of work - the question is in the essence of the duties performed - trips “on occasion” and to fulfill work obligations.

Since the law limits the rights of the employer to require frequent travel from certain categories of citizens (pregnant workers, women with young children), when hiring for a position that requires traveling around the country, general labor legislation must be observed.

It is necessary to include a clause mentioning travel in the following situations:

- Responsibilities involve the need for ongoing business travel within the service region.

- When working in a territory or facility remote from the office.

An example when it is necessary to include a mention of the specifics of the work in the contract would be the registration of a driver in a company car or a legal adviser to participate in court; sales managers also often spend most of their time in meetings with clients.

Since Russian legislation does not have clear standards and regulations for determining the need for this version of the regime, the employer is given the authority to independently decide when and in what cases to include the required clause in the contract with the employee. However, if business trips are expected due to the non-traveling nature of the work, they must be reflected in the reporting accordingly.

Signs of a traveling character and suitable professions

Work functions are performed outside the workplace. For example, when an employee, in order to fulfill his duties, must move from place to place within one or several localities. This could be setting up equipment, installing equipment, delivery, installing windows, insurance, etc.

The place of direct work is located quite remote from the place of registration of the company.

The employee is in no way tied to a specific workplace. He performs his duties in different places. For example, courier, delivery driver, media correspondent.

The employee is constantly traveling by order of management or in accordance with the job description. For example, a traveling salesman or sales representative, an affiliate network manager, a retail outlet controller, etc.

The workplace itself often changes location. For example, this happens when building roads. Or, when a company provides services to partners directly in their offices, which are located at different addresses.

Professions in which work is of a traveling nature include the following:

- workers of all professions engaged in the construction, repair and maintenance of highways;

- couriers or delivery managers;

- manager-consultants for installation and configuration of equipment or software;

- Affiliate network managers serving and monitoring retail outlets;

- insurance and sales agents;

- service employees;

- fitters and shipping track technicians;

- traveling crew workers;

- divers;

- blasting instructors;

- car drivers, forwarders;

- media correspondents, etc.

Thus, the employee's main responsibilities must involve constant travel. Almost every company has couriers. And all companies involved in trade have managers for working with retail stores. There may also be a lot of traveling workers in companies that provide consulting, legal, insurance, accounting, information, maintenance, and IT services.

How to register

When the need arises for proper paperwork and reporting, it should be taken into account that traveling activities practiced at the enterprise for specific positions should be reflected in the following documents:

- A collective agreement or an internal act of an enterprise establishing the rules for the movement of employees in the performance of duties (this can be an order or the publication of a regulation, another version of the regulations) indicating specific positions and professions. The regulatory act specifies the rules for preparing documentation reflecting reports on business trips.

- Employment contract upon hiring.

Since the titles of positions that will require frequent travel around Russia or business trips around the world may change, it is recommended to include clarifications in the regulations of the enterprise, rather than a collective agreement. Changes to the collective agreement are more difficult to negotiate.

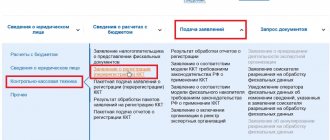

Download Traveling nature of work in an employment contract (sample) (65.5 KiB, 276 hits)

Since there are no clear regulations for formalizing the traveling nature of work in an employment contract, a sample will help in the formulation, or they can use their own formulations, confirmed by regulations in force throughout the enterprise.

Business trips with a traveling nature of work are recorded in the time sheet as the employee’s working time, regardless of his actual location away from the office or production.

Regulations on the traveling nature of work

Since the Labor Code of the Russian Federation does not provide clear instructions for registration, organizations have to correlate their actions with the current general legislation related to the issue of travel within the framework of their main work activities.

Download the Regulations on the traveling nature of work (example) (46.5 KiB, 196 hits)

The main provisions on the registration of seconded employees can be found in RF PP No. 749, adopted in 2008 in relation to persons sent on business trips. Thus, when determining the procedure for formalizing further traveling work, one should proceed from the contents of this document.

A reference to the need for frequent travel is given in the employment contract with a specific employee, and is also contained in the internal documents of the enterprise.

If an employee has already been hired before, but the nature of his work activity does not require frequent travel, an additional agreement is signed, on the basis of which the rest of the enterprise services apply the new standards for recording working hours in the worksheet.

When issuing an internal regulatory document, it is important to ensure that all important points are contained:

- A list of positions (professions) that require frequent travel to meet the needs of the company.

- Rules for preparing documentation for such employees and mandatory reporting.

- Issues of compensation for expenses spent on travel, additional compensation in addition to those established by law (allowances, surcharges).

What documents do I need to submit for an employee to travel?

The hiring of an employee begins with the receipt of an application addressed to the head of the company, indicating the position, the start date of work, and the personal signature of the individual. You will also need:

- Passport of a citizen of the Russian Federation;

- SNILS and TIN of the candidate;

- Education document;

- Military book;

- Employment history.

Then:

- Draw up an employment contract in 2 copies;

- Introduce the employee against signature;

- Draw up an order for appointment to a position in the T-1 form;

- Fill out a personal card for a new employee (form T-2);

- Record the fact of employment in the work book.

How to properly draw up an employment contract can be read in our article here.

Important! Don’t forget that the traveling work schedule should be specified in the employment contract and indicated in the order for employment.

Employer's actions

In order for internal regulations to optimally organize the work process that involves employee travel, the following measures must be taken by the enterprise management:

- Make sure that all contracts for employees with a traveling nature of work contain a reference to a special work procedure.

- Fix in a separate local document a list of professions where the above nature of employment is acceptable, and also indicate which positions and responsibilities require this type of travel arrangement.

- Introduce document flow rules for persons who frequently move around the country.

- Allowances and the procedure for calculating payments are specified in the collective agreement, or included in employment contracts, or adjustments are made to contracts of both types.

What kind of work is correct to call traveling?

There are two ways to register work outside the office (except for remote employees): business travel and traveling nature of work.

Art. 166 of the Labor Code of the Russian Federation states that work trips are trips on official business of a certain duration on the instructions of the employer to solve an established task. We emphasize: trips are occasional and with the purpose of fulfilling a specific assignment.

If an employee always works on the road, such trips are not recognized as work trips.

Accordingly, traveling includes activities that involve frequent or constant performance of work tasks outside the office or work premises. In other words, the employee’s work functions are implemented during travel.

Traveling refers to activities that involve frequent or constant performance of work tasks outside the office or work space.