Concept and rates of income tax in 2020

Income tax (NDFL) is a tax paid on income received by all residents and non-residents of Russia.

The tax agent, i.e., calculates, withholds and transfers income tax from wages. person paying the income. Almost all income of a physicist is subject to taxation:

- wage;

- bonuses, allowances;

- remuneration received as part of the execution of civil contracts;

- winnings;

- income received in kind, etc.

Income tax rates depend on the status of an individual and the type of income:

| Tax rate | It applies to: |

| 13% | — income of residents of the Russian Federation; — income of refugees and citizens of the EAEU received while performing labor duties in the territory of the Russian Federation |

| 15% | dividends paid to non-residents |

| 30% | income from securities of Russian companies |

| 35% | — winnings in the amount of more than 4 thousand rubles; — interest on deposits in part of the excess of the amount of interest calculated on the basis of the Central Bank refinancing rate increased by 5%, etc. |

For more information about personal income tax rates, see the “Rate (personal income tax)” section.

When to transfer personal income tax when paying a monthly salary in two parts, find out in ConsultantPlus. If you don't have access to the system, get a free trial online.

Taxation of advances

The Labor Code establishes that all employers are required to pay wages at least every 15 calendar days. Therefore, in one month the employee must receive at least two payments: an advance payment and a final payment. In this case, the natural question is: when is personal income tax paid from a salary, and when from an advance payment?

Officials determined that the obligation to pay income tax on the advance portion of wages depends on the date of payment:

- If the advance payment is credited before the last day of the calendar month, then income tax on the advance payment is not paid to the budget.

- If the advance share is transferred on the last calendar day of the month, then income tax from individuals is withheld and paid to the Federal Tax Service in the general manner.

Please note that at the end of the month, all payments transferred in favor of hired specialists must be recognized as income. And income tax must be calculated on income amounts, that is, on both advance and final payment of wages. If the advance is transferred before the last day of the month, then ND from individuals does not need to be withheld from the advance itself. The tax liability will be calculated from the final settlement amount. But if the advance is credited to employees on the last day, then the fiscal payment will have to be withheld from the advance and credited to the budget. And when transferring salary balances, repeat the procedure.

What amounts are not subject to income tax?

The Tax Code of the Russian Federation does not contain certain benefits for personal income tax. But it provides for certain amounts:

- in the form of income that is not taxed at all;

For details, see this material.

- which are not taxed in the prescribed amount and are deducted from the income received (deductions). That is, the income received is reduced by the amount of the deduction and income tax is withheld from the balance.

There are deductions:

- standard (children's deductions);

- property (for the acquisition/sale of property);

- social (for treatment, training, pensions);

- professional (only for individuals performing work under GPC contracts, as well as individual entrepreneurs, self-employed persons, etc.);

- investment (for individuals who open investment accounts and also receive income from the sale (redemption) of securities traded on the ORS)

For details, see our section “Tax deductions for personal income tax in 2019-2020.”

Date of receipt of income

The date of receipt of income is the day when the object of personal income tax taxation arises. Determine it depending on the type of income. Conventionally, income from which personal income tax must be withheld by tax agents can be divided into two groups:

- income related to wages;

- income not related to wages.

The first type of income, in particular, includes:

- salary;

- bonuses;

- remuneration based on work results for the year;

- additional payments for performing work of various qualifications, when combining professions, when working overtime (night), on holidays, etc.

A complete list of payments that can be classified as income related to wages is given in Article 129 of the Labor Code of the Russian Federation.

The second type includes all other income, for example:

- dividends;

- income from civil contracts;

- material benefit;

- financial assistance, etc.

The dates of receipt of income for personal income tax purposes are shown in the table.

Procedure for withholding income tax from wages

Income in the form of wages is accrued once a month, on the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation). Accordingly, salary income tax must be calculated and withheld once a month. This provision is confirmed by letters of the Ministry of Finance of the Russian Federation dated September 12, 2017 No. 03-04-06/58501, dated April 10, 2015 No. 03-04-06/20406. An exception is the situation of dismissal of an employee, in which the calculation of his salary for the current month is made on the day of dismissal (last working day).

Deadlines for payment of income tax on accrued wages to the budget, in accordance with clause 6 of Art. 226 of the Tax Code of the Russian Federation are associated with the dates of actual payment of income. Personal income tax on wages is transferred no later than the next day after the day of its payment.

Due to the fact that Art. 136 of the Labor Code of the Russian Federation obliges organizations to pay wages at least 2 times a month (for the first and second halves), wages are actually paid twice:

- in the current month for its first half (advance);

- in the month following the billing month for its second half (final settlement).

From 10/03/2016 Art. 136 of the Labor Code of the Russian Federation limits the period during which the accrued salary must be paid: the payment date cannot be set later than the 15th calendar day occurring after the period for which the salary was accrued.

Do I need to pay personal income tax when paying an advance? If it is paid before the end of the month with which it is contacted, then it is not necessary. An advance is not yet a salary, but a payment towards the amount that will be calculated only on the last day of the month. The point of view that there is no need to transfer personal income tax on an advance payment is confirmed by letters from the Ministry of Finance of the Russian Federation dated December 15, 2017 No. 03-04-06/84250, Federal Tax Service dated April 29, 2016 No. BS-4-11/7893, dated May 26, 2014 No. BS -4-11/ [email protected]

The situation is special with an advance payment, the payment date of which coincides with the last day of the month (i.e., the day of accrual of income for this month). The tax authorities believe that personal income tax must be paid on such an advance. The courts can also support them (see the decision of the Supreme Court dated May 11, 2016 No. 309-KG16-1804).

For details about the advance, see here.

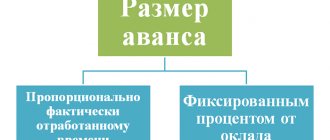

The rules for calculating advance payments are not strictly established. The amount of the advance payment is not calculated in accounting. The company itself has the right to decide how much it will be paid. This may be the full amount of wages accrued for the first half of the month, without deducting income tax from it, or the amount of wages reduced by the amount of personal income tax. The second option is preferable for the organization due to the likely possibility of the employee leaving work in the second half of the month. In this case, there will simply be no way to collect income tax not withheld from the income paid.

Read about the specifics of paying personal income tax when paying wages in installments in the article “How to pay personal income tax when paying wages in installments?” .

When to withhold personal income tax if your salary for December 2020 was issued on the 31st, read here.

For information on how to pay tax for different months on the same day, read the article “In field 107 of a personal income tax payment slip, you can indicate “MS”” .

Until when do you pay personal income tax on your salary?

The deadlines for paying personal income tax on wages withheld by a tax agent are specified in paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

In general, the transfer to the budget must be made the next day after the money is paid. If the personal income tax payment deadline falls on a weekend, it is postponed to the first next working day.

The organization must pay wages to employees at least twice a month (Part 6 of Article 136 of the Labor Code of the Russian Federation). When is personal income tax paid on wages for the first half of the month? When should you pay personal income tax on your salary if the wage system provides for weekly transfers of remuneration for work?

In order not to miss the transfer of personal income tax from your salary, we will provide the deadlines in one table:

| Type of payment | Personal income tax payment deadline |

| Advance (for the first half of the month) Transfer for the first, second, etc. weeks of the month, for part of the time worked | On the day following the day of payment of full monthly wages |

| Salary for the whole month | The next day after the date of income transfer |

| Calculation of severance | |

| Financial assistance, other one-time payments | |

| Payment of dividends, including “interim” ones |

An important rule should be added about material assistance: amounts provided to an employee as additional financial support are not always subject to personal income tax. In particular, you can do without withholding income tax if during the year the employee received financial assistance in an amount not exceeding 4,000 rubles. The grounds for such payments are provided in Art. 217 Tax Code of the Russian Federation. The same article states that the employer does not withhold personal income tax from an amount of up to 50,000 rubles paid in connection with the birth of an employee’s child. And according to the Explanations of the Ministry of Finance of Russia in Letter No. 03-04-07/62184 dated September 26, 2017, each parent has the right to a non-taxable limit, that is, in general, a young family can receive up to 100,000 rubles without paying personal income tax.

Algorithm for calculating income tax from wages in 2020 using an example

Let's consider the procedure for calculating and withholding income tax from wages.

Example.

Samokhina L.A. works as a salesperson at Alternativa LLC. Her salary is 30 thousand rubles. per month. Samokhina has 3 dependent children and she wrote an application for a standard deduction.

Tax-free deduction amounts will be:

1,400 rub. – for 1 child;

1,400 rub. – for the 2nd child;

3,000 rub. - for the 3rd child.

The amount of tax to be withheld for January 2020 is: RUB 3,146. ((30,000 – 1,400 – 1,400 – 3,000) *13%)

Having paid the salary, Alternative LLC is obliged to transfer the tax withheld from the salary.

Let's consider the procedure for transferring income tax from wages to the budget.

Date of receipt of other income

The date of receipt of income not related to wages depends on the form in which the income was received: monetary, in kind, in the form of material benefits, offset of similar counterclaims, debt write-off, per diem.

1. Cash income . When receiving income in cash, the date the income is received is the day the money is paid to the person. In this case, payment means:

- receiving cash;

- crediting money to the bank account of the income recipient (third parties on his behalf).

Such rules are established by subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

An example of determining the date of receipt of cash income not related to wages for calculating personal income tax

In March, Alpha LLC provided financial assistance. The accrued amount of financial assistance was paid to employees only on June 15.

Material assistance is income not related to wages. The income receipt date is June 15th.

2. Income in kind . When receiving income in kind, the date of receipt of income is the day of transfer of income in kind to a person (subclause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

An example of determining the date of receipt of income in kind, not related to wages, for calculating personal income tax

Alpha LLC builds housing by contract. The terms of the collective agreement stipulate that its employees standing in line for improved housing conditions pay 30 percent of the cost of the apartment. The organization carries out the rest of the work on the construction of apartments at its own expense.

This part is recognized as employee income received in kind. This is income not related to wages. The day of receipt of income in kind will be the date of signing the apartment acceptance certificate

3. Material benefit . A special procedure is provided for income in the form of material benefits. The dates for receiving such income vary depending on the type of material benefit:

- if a material benefit arises from the acquisition of goods (work, services, securities) at a price below market value, the date of receipt of income in the form of a material benefit is the day of acquisition. In some cases, a person can pay for securities after the transfer of ownership rights to him - then the date of receipt of income in the form of material benefits will be the day of payment for the securities;

- if a material benefit arises from receiving borrowed funds at low interest or without interest, the date of receipt of income in the form of a material benefit is the last day of each month for the entire period for which the loan (credit) was provided to the person.

Such rules are established by subparagraphs 3 and 7 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

4. Settlement of counterclaims of the same type . In this case, the date of actual receipt of income will be the day of the offset (subclause 4, clause 1, article 223 of the Tax Code of the Russian Federation).

5. Writing off debt from the organization’s balance sheet . If a person receives income as a result of writing off a bad debt from the organization’s balance sheet, the date of receipt of income will be considered the day the debt was written off (subclause 5, clause 1, article 223 of the Tax Code of the Russian Federation).

6. Travel expenses . If an employee received income upon reimbursement of travel expenses, the date of receipt of such income is the last day of the month in which the advance report for the business trip was approved (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation).

Transfer of income tax in 2019-2020

Currently, there is a single deadline for paying personal income tax on all forms of wage payment. The organization is obliged to transfer personal income tax to the budget no later than the day following the day of actual payment of wages, taking into account the postponement due to weekends and holidays (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation).

A special deadline for transferring personal income tax is established for sick leave and vacation pay. The withheld tax must be transferred to the budget no later than the last day of the month in which such payments were made.

See also: “[NDFL]: When to pay from wages, sick leave and vacation pay?” .

In the payment order for the transfer of personal income tax from wages, in field 101 “Payer status”, indicate the number 02, corresponding to the status of the tax agent.

When processing payment orders, it should be taken into account that by order of the Ministry of Finance of the Russian Federation dated October 30, 2014 No. 126n, the requirement to fill out field 110 “Payment Type” was canceled.

You can view the BCC for personal income tax in the article “Deciphering the BCC in 2020 - 18210102010011000110, etc.”

For information on filling out other payment order details when paying taxes, see the section “Details for paying taxes and contributions in 2019-2020”

Important! Violation of the deadline for transferring income tax (even for one day) is punishable not only by penalties, but also by a fine in the amount of 20% of the late paid amount (Article 123 of the Tax Code of the Russian Federation).

For more information about sanctions for violating the deadlines for transferring personal income tax, read the material “What is the liability for non-payment of personal income tax?”

Tax agents

The obligation to pay income tax is assigned to legal entities and individual entrepreneurs who have hired personnel. In this case, they act as tax agents, so they must:

- charge tax monthly (with an accrual total);

- withhold the required amount when paying staff;

- make timely payment of personal income tax to the budget.

All of the above requirements are regulated by paragraphs. 3 and 4 tbsp. 226 Tax Code. In this case, funds received by the payer from other organizations are not taken into account in the calculation.

Salary

According to Art. 136 of the Labor Code of the Russian Federation, the tax agent is obliged to issue wages every 15 days. But deductions to the personal income tax budget are made only once during this time - after the final calculation of the amount of the employee’s remuneration. And then almost immediately the tax is withheld and paid (see table).

| Payment method | When to pay personal income tax on salary in 2018 | |

| Cashless | Funds are credited to a bank card | On the day of transfer |

| Spot | 1. The cashier of the enterprise hands out the money personally | No later than the date following the day of issue |

| 2. Funds are received from the bank | On the day of receipt | |

These deadlines are established in paragraph 6 of Art. 226 Tax Code of the Russian Federation. However, there are special rules. If you have any difficulties, ask our experts on the forum.

Results

The deadline for transferring personal income tax from salary depends on the date of actual receipt of income. Since 2020, this deadline has become the same for all forms of salary payment: no later than the day following the day of its actual issuance, taking into account the possibility of postponement due to weekends. An exception is established for sick leave and vacation pay, the deadline for paying tax on which corresponds to the last day of the month of their payment.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Payment for rest and illness

Since 2016, when accruing vacation pay and temporary disability benefits to an employee, the deadline for transferring personal income tax has become the last day of the month in which such funds were provided.

EXAMPLE accrued to K.V. Ivanov received vacation pay in the amount of 37,000 rubles, which were transferred to his account on February 8, 2018. The enterprise is obliged to pay income tax to the treasury no later than 02/28/2018.

Also see “Personal Income Tax Payment Deadline”.

How to transfer personal income tax from vacation pay in 2020

Workers go on vacation every year, and accordingly the company pays vacation benefits. The company deducts taxes from the money paid, including on personal income.

Paragraph 2, paragraph 6, art. 226 of the Tax Code of the Russian Federation Federal Law No. 117 of 08/05/2000 (as amended on 10/11/2018) informs citizens that the transfer of personal income tax from vacation pay in 2020 is withheld until the last date of the month in which funds were paid for vacation. The personal income tax duty rate is regulated by clause 1 of Art. 224 Tax Code of the Russian Federation:

- for Russian resident employees ㅡ 13% from both salaries, other contributions, and vacation benefits.

- non-residents ㅡ 30%.

Who pays personal income tax on vacation pay?

The legislation of the Russian Federation informs through clause 1 of Art. 226 of the Tax Code of the Russian Federation, that income duty calculated from vacation funds is deducted and withheld:

- legal entities;

- individual entrepreneurs;

- notaries, lawyers in private practice;

- additional offices of Russian enterprises located abroad.

Personal income tax funds are deducted if the employer accrued vacation pay in the current month. If the latter were not paid, then there is nothing to withhold the duty from.

In addition to the “classic” vacation funds, there is an allowance, or compensation, for unused vacation. Such payments are also subject to income tax. It is calculated according to the same scheme, but is paid as personal income tax on earnings ㅡ until the end of the next day after the transfer of vacation money.

The procedure for transferring personal income tax from vacation pay in 2020

There are two ways to pay money for vacation, which are applied at the legislative level. For example:

- cash;

- transfer to a bank card or account.

In order to correctly transfer personal income tax funds calculated from vacation money to the budget, there are three rules:

- funds are paid from the amount that the worker was given for the active part of the rest. Usually the vacation is divided into 2-3 parts, and if the worker went on vacation for the first time, then the tax is calculated from this amount;

- when more than one worker goes on vacation, the total amount of duty for each worker for the current period is paid to the budget;

- The 2020 law that personal income tax is transferred before the last date of the month, and not on the day the benefits are paid, came into force on January 1, 2018, so the established deadlines are now in effect.

To calculate the total amount of duty on a worker’s income, the amount of vacation pay is multiplied by 13% or 30%, depending on whether the worker is a resident of the Russian Federation). The result obtained is the amount to be paid for taxation.

Deadline for transferring holiday pay tax in 2020

Until this year, the duty on the income of individuals was deducted on the date the employee accepted vacation pay:

- if the worker accepted funds in cash, then on the date of payment of funds for the vacation;

- if the employee was paid by bank transfer - to a bank card or current account - then on the date of receipt of funds upon receipt.

Article 223 of the Tax Code of the Russian Federation explains the definition of the date of receipt of money in fact: “... the day when the worker received the funds, and not the date when the employer sent the money.”

In 2020, the timing of the transfer of tax funds has changed. Now employers have the right to transfer tax funds to the budget at the end of the month in which vacation money was paid.

You cannot deduct personal income tax before payment or at the time of transfer of funds and fill out the payment form during these periods. Thus, the deadline for transferring personal income tax from vacation pay in 2020 is the last date of the month in which the benefit was paid. If there were no funds sent in the current month, then there is nothing to calculate from, so the money does not go to the budget.

Rules for determining the date of payment of tax on vacation pay

Management calculates the total amount of vacation money and pays personal income tax on payments according to two criteria:

- the deadline for transferring vacation pay is no less than three days before the start of the vacation;

- tax payments ㅡ until the last date of the month when vacation money was paid.

Using this information, the date of payment of income tax is calculated according to the appropriate schemes. Three examples:

- If an employee goes on vacation on April 1, the employer pays benefits no later than March 28. Accordingly, the funds were sent in March, so personal income tax must be paid until March 31 inclusive.

- If an employee goes on vacation at the beginning of March, and receives vacation pay on February 28, 2020, then the employer sends the duty on February 28, the day the money is issued to the employee.

- The worker begins to rest in mid-July and money for vacation is allocated in July - this means that the personal income tax amount must be paid by July 31.

Since the legislation of the Russian Federation provides for the payment of income tax before the end of the month when the employer transferred money for vacation, it is possible to deposit funds into the budget before the end of the month. That is, it is also possible to pay the duty according to the old rules - on the day the employee actually receives vacation pay.

How to fill out a payment order correctly

Correctly filling out the payment form is half the success of transferring funds to the budget. If you make mistakes, you will have to correct the document, which takes time. Accordingly, the time frame for transferring tax funds is reduced.

The 2020 payment order form contains mandatory details, without which the form is invalid:

- account number of the Federal Tax Service or the Federal Treasury;

- name of the recipient's bank.

If the specified fields are not filled in or there is an error in the design, the payment will not go through and the company is obliged to deposit the money again. Errors in other fields are acceptable: the funds will be credited to the recipient's account. The situation is corrected by clarifying the payment.

According to Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017), payment orders are filled out according to generally established rules.

- The duty on income, calculated from money for vacation, is paid by the tax agent, so code 02 is indicated in line 101.

- Line 102 indicates the checkpoint owned by the Federal Tax Service, where the funds are sent. If the payment form is filled out by an individual entrepreneur, then the businessman indicates the number 0.

- Line 61 indicates the TIN belonging to the Federal Tax Service, where the money is transferred.

- Be sure to indicate the KBK code belonging to the current transaction ㅡ transfer of personal income tax funds from vacation pay.

- To fill out line 106, use clause 7 of Appendix No. 2. The Appendix indicates the codes for the reason for transferring funds.

- The amount is indicated in numbers, deciphered in parentheses in words.

These are the main rules that must be followed when filling out a payment order. After filling in the details fields, the sender signs and decrypts the signature at the bottom of the payment. When filling out the form on a PC, the completed form is printed and signed. After the procedure, they take it to the bank and send the funds.

Income tax is paid on the income of individuals, regardless of the type of income. The taxation of vacation funds has its own peculiarities and is therefore paid and calculated separately from personal income tax on wages or maternity leave.