Why entrepreneurs go into the shadows

The main reason is that the total tax burden may exceed the profitability of the business. It is more profitable for an entrepreneur to work in the shadows, otherwise his profit will become significantly less - he will give a significant part of the money earned to the tax authorities.

If you conduct business honestly, you will still have to pay taxes, but you will not have to spend money on “cash out”, through which the business hides income from the state. In addition, you will get rid of the risk of running into fines.

For example, if you make sweets to order, but work without an individual entrepreneur and do not pay taxes, you may be fined by the Code of Administrative Offenses of the Russian Federation, Article 14.1. Carrying out business activities without state registration or without special permission (license) in the amount of 500 to 2,000 rubles. If you do not issue checks, you will have to hand over the Administrative Code of the Russian Federation, Article 14.5. Sale of goods, performance of work or provision of services in the absence of established information or failure to use cash register equipment in cases established by federal laws from a quarter to half of the purchase price, but not less than 10,000 rubles.

About fines for small businesses in B2Blog

B2Blog is a publication for small and medium-sized businesses. Complex things are explained here in simple language and without water. The Beeline Business blog helps you understand Russian laws and explains the basics of marketing and personnel management.

Build your workforce wisely

Carefully study the Pareto Law - this judgment has long proven its validity.

The principle is based on the opinion that to solve any problem it is enough to put in only 20% of the effort, the remaining 80% of the labor costs cannot have a big impact. So, applied to the field of management, the Pareto Law states that 20% of employees produce 80% of the organization’s results. Treat the selection of employees competently and responsibly, and then, at minimal costs, the “right” people will allow you to achieve maximum results.

How to work “in white” and not go broke

It sounds paradoxical, but an honest business has a better chance of becoming successful, even if its costs increase. To do this, you need to optimize the business from all sides: reduce real expenses and increase income. Here are the rules that will help you withstand competition and work in accordance with state requirements.

Evaluate why your product is better than competitors' offerings

Find out what the real value of your business is and identify the advantages that will help you break away from your competitors. This way you will understand in which direction to develop.

What do we have to do:

- Conduct a SWOT analysis SWOT analysis. Using this technique, you can evaluate your business from the inside and outside: find out the company's strengths and weaknesses, and at the same time assess the opportunities and threats from the outside.

- Create a company development strategy. An analysis of Porter's five competitive forces will help here. The author of this technique, economist Michael Porter, believes that five factors influence business development: the threat of similar products from other manufacturers, the entry of new players into the market, the level of competition, the pricing policy of suppliers and consumer behavior. Assess how these threats affect your company and figure out which ones you can handle and which ones you can't.

- Think about what other products and services your customers need. This is a backup plan in case demand for your core product fluctuates. For example, an online tea store can add tableware to its assortment: teapots or bowls.

Choose an effective tax system

After bringing your business out of the shadows, you will have to pay taxes. If you do it right, you can legally save money.

What do we have to do:

- Determine which system is right for you. You have several options to choose from: a general tax system, a simplified tax system with rates of 6% and 15%, a single agricultural tax, a single tax on imputed income and a patent taxation system. Microbusinesses can choose between individual entrepreneurs and self-employment. If you're going to work alone, become self-employed. Entrepreneurs who hire employees or provide services that are subject to the patent tax system should choose an individual entrepreneur. For example, these are hairdressers and apartment renovation specialists.

- Find out what benefits you can receive. For example, IT companies accredited by the Ministry of Telecom and Mass Communications have their insurance premiums reduced. Residents of innovation centers or special economic zones can count on special conditions. Thus, Innopolis offers benefits for residents of the Innopolis SEZ: exemption from VAT, transport and property taxes.

- Choose suppliers with whom you have the same tax systems. If you work on a general system, and the supplier uses a simplified one, you will lose the value added tax deduction due to the inability to receive an invoice and the lack of input VAT.

About five taxation systems in B2Blog

Put your documents and accounting in order

Order is important both for tracking costs and for reducing the cost of the document collection process. If you document the maximum number of expenses, you will not lose income tax on them - this is relevant for those who work under the general tax system or a simplified tax system with a rate of 15%.

What do we have to do:

- Switch to electronic document management systems. The specific operator does not matter, there is roaming between them. You can even exchange documents electronically with foreign counterparties - for example, using Adobe Sign.

Keep management records

Don't confuse it with accounting. Management accounting shows what state your company is in and whether it is capable of generating profit. It helps you see the real picture of business and understand what decisions affect its profitability. It will come in handy if you are planning to attract an investor, notice a cash gap, or are arguing with your partners.

What do we have to do:

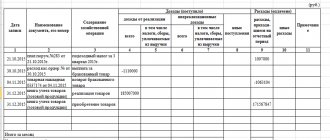

- Build a management accounting system. It can even be maintained in Google Sheets. Create a table with tabs that show income, expenses, and cash flows.

- Find what you can save on and what you can skip altogether. You may have to choose new partners with whom the work process will become less expensive.

Make friends with banks and the Federal Tax Service

Otherwise, you may be accused of money laundering. Banks consider Bank of Russia Regulation No. 375-P dated March 2, 2012 “On the requirements for the rules of internal control of a credit organization in order to combat the legalization (laundering) of proceeds from crime and the financing of terrorism” as suspicious transactions that do not have a clear economic purpose , they may be wary if you ask for the transaction to be completed as quickly as possible or refuse to give out your TIN or bank account number.

What do we have to do:

- Make sure that transactions comply with 115-FZ. For each payment, you must have documents that will help justify its legality. If the bank has suspicions that you are trying to legalize illegal income, it has the right to refuse Federal Law No. 115-FZ “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” to allow you to carry out the transaction.

Upgrade your marketing

Without marketing, customers are unlikely to learn about your company, and there is no talk of sales growth at all. To earn more, use modern promotion tools.

What do we have to do:

- Use search engine optimization. SEO will bring potential buyers to you from search engines. Often these are already hot clients who are ready to make a deal.

- Create accounts on social networks. Start with your and Instagram pages. To do this, you can hire an experienced SMM specialist, but if there is no free money, entrust the maintenance of the pages to a freelancer.

- Launch contextual advertising. This method is suitable for beginner businessmen who need to get clients as quickly as possible.

- Use marketing tools. For example, arrange promotions. It is more pleasant for the consumer not only to buy a jar of honey, but also to receive a wooden spoon as a gift.

About managing online advertising in B2Blog

Collaborate with freelancers

This way you can legally reduce your tax burden. Individual entrepreneurs and self-employed people pay taxes for themselves, and you only need to transfer their remuneration on time.

What do we have to do:

- Use document management and payment automation services. They take care of the closing documents and help you quickly pay for freelancers’ services.

Don't waste time on routine

Automation minimizes the likelihood of failures. The less manual labor, the less chance that someone will make a mistake somewhere.

What do we have to do:

- Automate processes. To reduce costs, first tackle those associated with the production of the product.

- Use ready-made project management systems. Instead of reinventing the wheel, try using Agile or Scrum.

Monitor how your employees work

Here you need to act in two directions: control the work of subordinates and invest money in their training.

What do we have to do:

- Check whether you are incurring losses due to employees. Sometimes it turns out that subordinates steal without a twinge of conscience. For example, drivers waste gasoline, justifying it with low wages. Proper control over the work of employees helps reduce business losses.

- Create a clear motivation system. The main principle of good KPIs is that they increase business efficiency and its profits. These indicators must be transparent so that the employee understands how the results of his work affect the amount of the bonus.

- Invest in staff development. Qualified employees are the engine of business. You should not save on training; these expenses will come back to you in increased profits.

About how to control employees, in B2Blog

Be prepared for things to go wrong

No entrepreneur is immune from a bad streak in business. Even if competitors have lured customers away or you have seasonal activity with fluctuating profits, you will still have to pay taxes.

What do we have to do:

- Create an emergency fund in advance. If income falls, you will have available funds to pay taxes.

- Go into manageable debt to the budget. This is one of the cheapest options. Until you have enough money to pay overdue taxes, the Federal Tax Service will block the Tax Code of the Russian Federation, Article 76. Suspension of transactions on bank accounts, as well as electronic money transfers of organizations and individual entrepreneurs to the accounts of your company, the amount of debt.

Read B2Blog

Doing business online

When considering the question of how to run a business and do it successfully, one cannot ignore the sphere of Internet projects, where startups are multiplying at an unimaginable speed and where the primacy in earning money is gradually shifting. And it’s not just about Forex trading or web programming. Many quite familiar areas are relevant online today: tutoring via Skype, tailoring, online printing, shops, representative offices of certain companies.

A wide variety of services and goods are offered - almost everything you need can be bought and received via the Internet: buy food and furniture, order a tour and book a ticket, pay a bill and enroll your child in school, download books and films, send a gift and order flower delivery by courier.

The distinctive features and approaches to doing business on the Internet are not much different from offline projects, but there are some nuances.

Key points of the project on the network:

- Creating a website with the correct domain name, promoting it and attracting visitors to it. Only a visited resource will provide an opportunity to attract customers, sell a service/product, develop a business and make a profit.

- Choosing a relevant niche and narrow specialization - there are a large number of projects operating on the network, so to create a successful business it is advisable to create a unique offer.

- Attracting professionals to implement tasks - even if the owner (or the only employee) of the company is well versed in his business, you cannot do without specialists in the field of Internet business, marketing and advertising. Beginners can get help at first, but with further training and experience they can then cope on their own. But rarely does learning all the intricacies of web programming pay for the effort and time spent if the project is working in a different direction.

- Simplicity for customers - be it purchasing a product or service, reading and perceiving information, learning or entertainment. On the network, no one will spend a lot of time and effort on implementing a task; the user will simply go to another resource.

- Keep your competitors in sight - analyze their approach and proposals, implement successful developments, and try to avoid their mistakes. You need to focus on the best - those who have achieved great heights in similar matters.

- A high level of service and technical support, which is important regardless of the area of work.

- Patience and work - starting to run your business from scratch, you should not expect instant millions in profits. Hard work in the right direction will ensure smooth growth, which is much more important for a strong company than a sharp jump and equally sharp declines in profit, popularity, and the number of customers.

Principles and foundations of good management

Business Management Basics

A good leader, whose business is developing in the right direction thanks to competent management, is distinguished by the following features:

- Decency. The relationship between a boss and his subordinates should be based on a personal example: employees should see that the boss is himself interested in the development of the company;

- Ability to develop a winning strategy and use all opportunities to achieve results;

- Creating a strong team;

- The ability to inspire people, including by example;

- Creating a flexible, change-ready organization;

- A well-thought-out system of leadership, motivation, and rewards.

How to start a business

First of all, to start your business, you need to prepare the foundation, for this you need the following components:

- Determination. Many people think that to get started you need an idea, start-up capital, or skills and connections. But the most important factor is determination. You must determine that you need to open your own business and follow through. You must be prepared that you will encounter many obstacles and difficulties on your way. This is one of the main factors that is present in all advice to businessmen.

- Idea. Any business, first of all, is built on an idea. Since we determined above that there are a lot of types of business, without a well-formed idea you will rush between several types without starting further actions. It is the idea that will answer the question of how to create a team of like-minded people.

- Planning. You must have a clear plan that you will follow. You must set short-term goals for yourself, by completing which you will achieve the main one. Without clear goals, you will not have strong progress as well as growth of your business. Any discrepancies with the plan must be suppressed, otherwise you risk losing the progress of development and slowing down.

- Knowledge. When choosing a niche in which you will build your business, you should consider how quickly it is developing and how capable you are of developing in this area. You must be a professional in your field. Many businessmen, before starting their own business, go from a simple employee to a director in order to study the process from beginning to end. If you do not have the required amount of knowledge in this area, you should like it anyway, because you will most likely be doing this business for a long time.

- Team. You can run a small business alone, but if you plan to grow your business to a large size, you must assemble a competent team that will be ideal for you in terms of ideas and perseverance.

Stages of starting your own business

It is not always easy for a novice entrepreneur to adapt to a new field, especially when many questions remain regarding the organization and running of his business. There are various business strategies and guidelines that can help bring almost any business to a profitable point.

You can start by writing down your ideas on paper. An abstract goal that is not recorded in writing may be forgotten and not implemented. You need to come up with several specific ideas so that you can choose, understanding what your soul is about. This is important if there is no clear desire in a certain area, but only the intention to open your own business.

Each idea must be analyzed to understand the demand for the niche. All methods are suitable for this, from searching on the Internet to asking relatives and friends. Based on the results obtained, you can choose the most interesting and promising idea.

The next step should be capital assessment. If there is a shortage of funds, you need to know in advance where to get the missing amount. The financial side of creating a business is one of the fundamental ones.

Many people neglect such a moment as planning. A business plan helps you see the real picture before starting your business. It is necessary to record all organizational issues, methods of promotion, cost of services or goods, planned income, and unforeseen expenses. Basically, a business plan is necessary so as not to keep a lot of information in your mind and not get lost in your thoughts; notes help to structure the process.

Moving on to active actions you need to:

- create a marketing strategy;

- register an organization;

- choose a place;

- find workers.

Interesting! You can classify your own business based on the number of employees. This number is different for each country. In Russia, if the number of employees does not exceed 100 people, it is considered a small business, in the UK this number can reach 250 people. Small businesses are a little different from standard entrepreneurship. It has no growth potential and specializes mainly in providing services.

Process management of small and large businesses

Managing an organization based on business processes provides the following benefits:

- Standardization. All types of activities that lead to the same result are allocated to one group and are subject to common strategic control standards. For example, interaction with customers for small businesses is allocated to the “Product Sales” group, which is managed by the “Procedure for attracting customers and selling products” document.

- Improvement. The organizational foundations of business management imply the use of a control loop for any business process and regular improvement of activities.

- Automation. Competent small business management often includes the use of specialized information systems. Typically, they include tools for visual modeling of business processes, simulation modeling, execution of business processes, and performance monitoring.

What is involved in running a business?

Strategic business management based on network competence includes certain types of activities. All business processes are segmented into several groups.

| Process type | Description |

| Industrial | Leads the organization's activities to the goal of creation. |

| Managerial | Planning and control over the execution of other business processes. |

| Auxiliary | Provide the organization's processes with the necessary resources. |

The basics of managing any business involve administering the groups of processes described above.

The entrepreneur himself and his personality

First of all, the future entrepreneur must not only learn the basics of doing business, but also evaluate his own abilities and opportunities to succeed in his chosen field. You need to understand that the founder is responsible for the results of the company’s activities. It is necessary to quickly and clearly make the right management decisions for the company to stay afloat and prosper in any environment.

Launching your own retail business requires much more time than working “for someone else” - worries about your own brainchild worry the businessman constantly and without breaks or days off. But in order not to “burn out”, you need to learn to control the ratio of work and rest. You shouldn’t take on all the tasks in the company. The basics of a small business depend on the personality of the person studying the secrets of entrepreneurship, but correct prioritization allows him to focus on the main thing, and not be scattered on routine tasks and unimportant goals.