What has changed in the rules for SZV-M

The unified form of monthly pension reporting in the SZV-M form is familiar to all accountants, without exception.

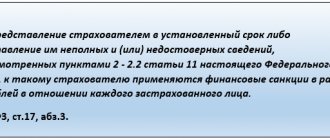

This report has been submitted to the Pension Fund of the Russian Federation for more than two years. However, as of October 1, 2018, officials approved a number of innovations in the procedure for preparing and submitting pension reporting. The key change is that the procedure for submitting reporting information to the Pension Fund has been adjusted. Now the report is considered submitted if an official notification is received from the Pension Fund of Russia about its acceptance. That is, if the organization submitted the report on time (by the 15th day of the month following the reporting month), but the notification was not received, then the SZV-M is considered not submitted. In this case, the institution faces a fine of 500 rubles for each insured person in an unaccepted reporting form.

Another important innovation: the Russian Ministry of Labor resolved disputes that lasted several years. In Letter No. 17-4/10/B-1846 dated March 16, 2018, officials approved that information on the sole founder of the company must be submitted to the Pension Fund. That is, if the organization does not have employees, and there is only one general director, who is the sole founder, then information must be submitted to him.

Let us recall that the current procedure, approved by Order of the Ministry of Labor dated December 21, 2016 No. 766n, was adjusted by Order of the Ministry of Labor of Russia dated June 14, 2018 No. 385n. The changes come into force on 10/01/2018.

Features of SZV-M adjustment

Any enterprise is obliged to make pension contributions to the Pension Fund. This rule also applies to activities.

Regardless of the employee’s form of work, payments must be made. Contributions to the Pension Fund are mandatory for all employees: employed, part-time or under contract. Since they receive official earnings, the employer must ensure timely payments to the extra-budgetary fund.

Data on employees is generated in the form of a report, which is sent to the fund. The document can be created electronically or on paper. The latter option can only be used by a company whose number of employees does not exceed 24 people. If the staff consists of 25 or more hired employees, then an electronic report is generated.

The form must be sent to the Pension Fund no later than the 15th of the month. This requirement was introduced in 2020. Previously, the need to submit a report arose before the 10th. The report is submitted on a monthly basis.

Pension Fund error codes

| Error code | What is the problem |

| 20 | The TIN control digits of an individual must be a number calculated using the algorithm for generating the TIN control number. |

| The TIN element of the insured person must be completed. | |

| 30 | The SNILS contained in the insurance certificate is indicated. |

| The full name contained in the insurance certificate is indicated. | |

| The status of the ILS in the “Insured Persons” register as of the date of the document being checked should not be equal to the value of “UPRZ”. | |

| At least one of the Last Name or First Name elements must be specified. | |

| 50 | The file being checked must be a correctly filled XML document. |

| The file being checked must comply with the XSD schema. | |

| The electronic signature must be correct. | |

| Element "Registration number". The number under which the policyholder is registered as a payer of insurance premiums is indicated, indicating the codes of the region and district according to the classification adopted by the Pension Fund. | |

| The taxpayer identification number must be indicated in accordance with the Pension Fund data. | |

| When providing information about insured persons with the “initial” form type, there should not be previously provided information with the “initial” type for the reporting period for which the information is provided. | |

| The period for providing SZV-M must be no earlier than April 2016. | |

| For all types of SZV-M forms, the reporting period for which the form is submitted must be less than or equal to the month in which the audit is carried out. |

Checking the report for errors

There are several basic rules to check your report for errors:

- The number of insured persons in your report must match the number of employees in the SZV-M report form;

- The fourth and fifth sections of the report are completed when submitting a document of the “Pension assignment” type. But data on employees planning to retire this year must be submitted in a general form based on the results of the reporting period;

- Use the software verification tool from the pfrf.ru website;

- A specialized validator from the mentioned site can also help.

In accordance with the Resolution of the Board of the Pension Fund of Russia, when checking a report for errors, five error codes may appear. We are interested in error 30, so let's look at why error 30 appears in SZV-STAZH.

What happens if you send corrections before notifying the Pension Fund

So, there are two ways to correct an error in reporting:

- on its own initiative, that is, when the institution independently identified an inaccuracy and sent corrective information to the Pension Fund;

- or the error was identified by the Pension Fund, then the inaccuracy must be corrected within 5 business days from the date of receipt of the notification from the Pension Fund.

IMPORTANT! The “5 working days” rule now applies only to those errors pointed out by regulatory authorities. It will not be possible to correct other defects. There will be penalties for “newly discovered” errors.

How to act before notifying the Pension Fund of the Russian Federation about an error in SZV-M? Self-identified inaccuracies can be corrected without a fine only if two conditions are met: the report with the error was submitted in a timely manner and accepted by the Pension Fund, and the organization independently sent corrective information to the Pension Fund of the Russian Federation before notification.

If you forgot an employee, you can avoid a fine only if you submit an additional report form before the 15th. If you do this later, you cannot avoid a fine.

Advice: generate and submit reports in the SZV-M form before the due date (15th day of the month following the reporting month). This way, the organization will have more time to correct inaccuracies and errors without applying penalties.

Results

You must fill out the report on form SZV-M very carefully. Errors discovered after the deadline for submitting a report can be quite costly for a company, especially if it has many employees.

Sources:

- Federal Law of April 1, 1996 No. 27-FZ

- Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n

- Order of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 No. 1077p

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Errors with code 10, 20

These are the most harmless mistakes that an insured can make. Therefore, if they are available, the report is still considered submitted.

If the SZV-M inspection protocol contains warnings with code 20, this means that there was:

- <or> the TIN of the insured person is incorrectly specified, which is checked using the TIN control number;

- <or> the TIN of the insured person is not indicated at all.

If the TIN of the insured person is indicated incorrectly

Despite the fact that the report was accepted by the Pension Fund, it is better to correct the incorrect TIN. To do this, you need to simultaneously submit two SZV-M forms: canceling (with the “cancel” type) and supplementing (with the “addition” type). In the first, indicate the data on an individual with an incorrect TIN, and in the second, indicate the data on him, but only correct ones. It is safer to correct all shortcomings before the end of the reporting campaign, i.e. before the 10th day of the next month (in 2020 - before the 15th day). If this is not done, then for each “erroneous” employee you will have to pay 500 rubles. fine (Article 17 of Law No. 27-FZ).

Note! It is quite possible that in order to correct the TIN, your Pension Fund branch will only need to receive one complementary form instead of two. This point should be clarified with fund specialists.

Example. The accountant of Retro LLC in SZV-M for December 2020 mistakenly swapped the last two digits in the TIN of Igor Semenovich Parfenov. It should be 760700613663, but he wrote down 760700613636. See below how the accountant corrected the error.

You can find out a person’s TIN at. Follow the “All services” link on the main page. From the proposed list of electronic services, select “Find out TIN”. Fill in the full name, date and place of birth, and passport details of the citizen. After submitting your request, you will receive his TIN. If the identification number is missing, it means the person did not apply to the tax authority to obtain it.

If the TIN of the insured person is not indicated

This situation is possible if the “physicist” did not provide his TIN. Therefore, the policyholder simply has nothing to record in the corresponding column of the form and leaves it blank. In accordance with paragraph 3, paragraph 2.2, Article 11 of Law No. 27-FZ, the TIN of the insured person in the SZV-M is optional and is indicated only if available. Therefore, even if the Pension Fund warns about the absence of such information in the report, nothing needs to be corrected.

Note! An employer does not have the right to demand a TIN from an employee just because he now provides such information to the Pension Fund. The list of mandatory documents for employment is defined in Article 65 of the Labor Code of the Russian Federation. And the TIN certificate is not named in it.

By the way, if the policyholder has data on the TIN of the citizens working for him, but does not indicate it in the report, then the Pension Fund of the Russian Federation will definitely reveal this when reconciling with the tax authorities. Then there is a high probability that the payer of contributions will be fined under Article 17 of Law No. 27-FZ for unreliability of the information provided (). Therefore, if information about the TIN is available, it must be included in the form. This is the requirement of clause 3, clause 2.2, article 11 of Law No. 27-FZ.

Errors with code 30, 40

If the policyholder received an inspection report from the Pension Fund of Russia with error code 30, it means that inaccuracies were made when indicating the full name and/or SNILS of the individual. They must be written down exactly as on the insurance certificate. In this case, the report is considered partially accepted, i.e. the program will allow employees with correct information to pass, but not those with incorrect information.

Notice! The TIN in SZV-M is optional, but the SNILS of the insured person must always be present (clause 2 and clause 3, clause 2.2, article 11 of Law No. 27-FZ). This is how the Pension Fund identifies a person. Therefore, indicate it without errors.

The fine for incorrect SNILS and/or full name is 500 rubles. for each employee (Article 17 of Law No. 27-FZ).

You can check the correctness of SNILS on the website of the FSS of Russia. To do this, you need to enter an 11-digit number without spaces or dashes into the search form. However, this check will not provide any other data, such as full name, amount of pension savings, etc. An employer cannot independently find out SNILS via the Internet, for example, as an INN based on the full name and passport data of an individual, since this is confidential information.

To correct an erroneous SNILS, you need to submit a canceling and supplementing SZV-M on the same day. The first report cancels all incorrect information, the second one adds new information. Although local fund specialists note that it is enough to submit only the form with the “additional” type (read, for example,). So it is better to consult your Pension Fund branch on this issue.

Corrections must be completed by the 10th day (before the 15th day in 2017) of the month following the reporting month. If the policyholder does not make it on time, then penalties will be applied to him under Article 17 of Law No. 27-FZ.

An incorrect full name can be corrected in the same way. By the way, the last name, first name and patronymic must be entered in the nominative case. Otherwise the program will throw an error. But extra dots and spaces in your full name will no longer interfere with passing the SZV-M.

Note! If the policyholder incorrectly indicated both SNILS and full name and TIN for the same individual, then the fine will still be 500 rubles, since the sanctions are established by Article 17 of Law No. 27-FZ in relation to each insured person with false information, and not in regarding each deficiency.

The program will show an error with code 30 even if the SZV-M contains only the last name of the insured person, but not the first name.

Also, information on an employee will not be accepted if the status of his individual personal information in the “Insured Persons” register on the date of the document being checked is equal to the value of “UPRZ”. The value "UPRZ" is assigned to an insurance number when it becomes irrelevant (i.e. when it is discontinued).

Error code 50

These are the most dangerous mistakes. If they are in the inspection protocol, then the report has not been accepted (even partially). The SVO will need to be corrected and resubmitted for the same month.

Critical errors with code 50 include the following:

1. Incorrect policyholder registration number; it must contain codes that indicate that the company belongs to a specific region of the Russian Federation (the first 3 digits of the number) and the district of this region (the second 3 digits) in accordance with the classification of the Pension Fund of Russia.

On a note! The registration number is taken from the notification that the Pension Fund issues when registering as an insurer. But if you don’t have it at hand, you can find out the number using the electronic service “Business risks: check yourself and your counterparty.” To do this, in the search form, a legal entity will need to enter their OGRN or TIN, and an individual entrepreneur/peasant farm will need to enter their OGRN or TIN, or full name and region of residence.

2. Incorrect TIN of the policyholder; it must correspond to the number contained in the Pension Fund database.

3. Re-submission of SZV-M for the reporting period with the form type “source” in the case where the primary report for the same period was successfully accepted by the Pension Fund. In other words, for each month the policyholder can submit only one initial SZV-M form. And if he received a positive report, then the report was verified. In the event that something needs to be corrected in the information already submitted, canceling (with the “cancel” type) and/or supplementing (with the “additional” type) forms for the same period are submitted.

4. Indication of the reporting period earlier than April 2020. For the first time in 2020, SZV-M had to be completed in April. Therefore, there simply cannot be a report for a month earlier than indicated.

5. Indication of the reporting period later than the current month. That is, SZV-M cannot be imagined for the future. The deadline for reporting is the current month. It is not necessary to wait for it to complete. The form can be submitted early.

A few more serious errors of a purely technical nature, due to which SZV-M will not be accepted:

- incorrect filling of the XML document;

- the file does not comply with the XSD schema;

- incorrect electronic signature.

What to do if errors occur in SZV-M?

Today, there are several types of errors in SZV-M, which have their own code. Each code contains information about an error made by the accountant in the monthly report. For any inaccuracy, the system assigns a specific point, which must be taken into account when correcting the document. You can see more detailed information about possible errors in the table below.

| Error code | Protocol | Current status | How to fix |

| 10-20 | Positive | Report accepted | There is no need to fill out the form again. The SZV-M report was accepted by the PFRF with the existing inaccuracies or is fully consistent. It is possible that the identified errors are not significant and cannot be corrected. |

| 20-30 | Positive | Report accepted | It is required to correct the identified inaccuracies in the document and re-send the completed form, but only for those employees for whom the data was corrected. |

| 30-40 | Positive | The report was partially accepted | It is required to correct all incorrectly entered employee information in the form and resend the report immediately after correction. |

| 50 | Negative | Report not accepted | It is necessary to completely refill the report and resubmit it to the Pension Fund of the Russian Federation. |

Based on the data in the table, if the report on the SZV-M form contains code 10 or 20, then such a document will be accepted by the fund unconditionally and will not require any corrections or additional clarifications. This error code may indicate to the accountant that there are minor inaccuracies that will need to be taken into account when preparing the report next month.

According to the information from the table, the protocol is an assessment of the work of the specialist who compiles and sends the SZV-M. It helps to identify the presence of errors in a document and warn about possible consequences that arise in relation to newly sent or supplemented reports.

Errors marked with codes 30 or 40 indicate that the accountant needs to re-send the report with corrected errors for certain employees on the list. Code 50, in turn, indicates the identification of a gross inaccuracy, which requires a complete rework of the report and its non-acceptance by the Pension Fund of the Russian Federation in the form provided.

Form

The SZV-M form was developed at the end of January.

Form SZV-M in Word(doc) 77 kb.

Form SZV-M in Excel (xls) 34 kb.

Example (sample) of filling out SZV-M:

Form SZV-M in Word(doc) 77 kb.

Form SZV-M in Excel (xls) 34 kb.

How to fill it out?

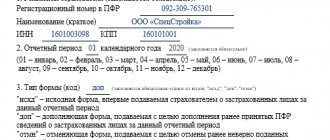

Registration number in the Pension Fund of Russia, INN and KPP (it is only for organizations, individual entrepreneurs are not needed) - you can also find out.

Employees' full names must always be entered in full.

Check your SNILS well, because for an error even in 1 digit there is a 500 fine. SNILS must be written as “123-456-789 01” (two dashes and a space in the middle).

Employees indicate their TIN only if they have a TIN. If you wrote the TIN in the 2-NDFL certificate, then you need to write it in the SZV-M, otherwise the fine is 500 rubles. If the employee does not have a TIN, then leave the field blank (without dashes).

Who to include?

You must include in the list any employees working under employment or civil contracts (even if they did not receive remuneration this month), as well as freelancers, part-time workers, etc. external, maternity leave, students, those on probation.

The founding director must also be included in the calculation.

You need to include any employees with whom the contract was valid during the reporting month. Those. if the employee arrived at the end of the month or quit this month, then he must be included in the calculation.

Zero

There cannot be a zero SZV-M even if there is only one founder and no one else - it must be included in the form.

Corrections

If you need to correct an error (for example, incorrect full name or INN or SNILS), then you need to submit two forms - o) and a supplementary one (in paragraph 3 “additional”). Only erroneous data is provided in the cancellation form. In the supplementary one, similar data is written down, only correct. These forms are submitted at the same time.

If you forgot to enter an employee, submit only the supplementary form (in paragraph 3 “additional”).

If an employee has changed her last name (got married, for example), then you need to enter the last name that is in SNILS (even if she has already changed her passport and the SNILS is old).

If you included an employee by mistake, submit only the cancellation form (in paragraph 3 “cancel”).

Before 2020, there were 2 weeks to correct errors. From 2020, this period has been reduced to 5 working days.

Deadlines

June 6 is the deadline to submit a canceling or supplementing SZV-M (PFR letter dated May 4, 2020 No. 04/406/1984).

The deadline for submitting new monthly reports to the Pension Fund is no later than the 10th (15th from 2020) of the next month. For example, the first report for April 2020 must be submitted by May 10.

| Month for which reporting is submitted | Submission deadline |

| December 2016 | from January 1 to January 17, 2017 |

| January 2017 | from 1 to 15 February 2017 |

| February 2017 | from March 1 to March 15, 2017 |

| March 2017 | from April 1 to April 17, 2017 |

| April 2017 | from May 1 to May 15, 2017 |

| May 2017 | from 1 to 15 June 2017 |

| June 2017 | from July 1 to July 17, 2017 |

| July 2017 | from 1 to 15 August 2017 |

| August 2017 | from 1 to 15 September 2017 |

| September 2017 | from October 1 to October 16, 2017 |

| October 2017 | from November 1 to November 15, 2017 |

| November 2017 | from December 1 to December 15, 2017 |

| December 2017 | from January 1 to January 15, 2018 |

* If the date of submission of reports to the Pension Fund falls on a weekend (or non-working) day, the deadline is postponed to the next working day

In advance

You can submit from the 1st (May) of the following month. However, the law does not prohibit submitting reports in advance (early). Therefore, the Pension Fund of Russia will begin accepting such reports on April 15. However, you need to submit such a report before the end of the month only if you are sure that you will not have another employee (any) before the end of the month. Otherwise, you will still have to submit an amendment or pay a fine of 500 rubles. for every new one.