Inventory control

This concept is used to define constant quantitative and grading accounting carried out in a warehouse. Without taking into account the goods placed in the warehouse, it is difficult to ensure their safety. For this process, a materials warehouse card is used, which is a form approved by law for recording the movement of materials of a particular type, size and grade in the warehouse. They are filled in for each item number of the material. They are managed by a financially responsible person, for example a warehouse manager or a storekeeper.

Before entrusting the warehouseman with the material reserves of the enterprise, as a rule, an agreement is concluded with him. It describes the types of work the employee performs and the extent of responsibility in the event of loss or damage to products stored in the warehouse.

Organization of warehouse accounting

A well-organized process of accounting for materials located in the warehouse is a very important and necessary segment of the organization’s activities. For efficient warehouse operation, two common accounting systems are used: batch and sort. But regardless of the fact which choice is made, financially responsible employees will keep records of the company's products in kind. This procedure is carried out through the use of incoming and outgoing commodity orders.

If we take into account the information contained in the manuals for accounting of a company's inventories, we can conclude that analytical accounting of inventory items is carried out through the use of the balance method or revolving invoices. With these approaches, accounting is carried out in the context of each storage location, as well as within them, recording item numbers, various product groups, synthetic and subaccounts.

Using cards

Warehouse accounting of materials, the basis for which are turnover sheets, in most cases involves the use of the two above-mentioned methods. This allows you to optimize warehouse operations and achieve higher levels of productivity.

In the first option, a warehouse accounting card is used, which opens for each type of inventory item stored in the warehouse. It displays quantitative and summary data, which, in essence, is the movement of materials. The basis for filling out such cards are primary accounting documents.

Keeping inventory records using cards also involves displaying balances on the first day and calculating turnover for the month. With the help of such documentation, turnover sheets are compiled for each warehouse separately. In addition, the data of those cards that are in the accounting department are verified with the documentation located in the warehouse.

It is also possible that the accounting cards are not kept in the accounting department. In this case, expenditure and receipt documentation is grouped by item numbers. Afterwards, with the help of these documents, the totals for the month are calculated, and data on expenses and income are recorded separately. This information is then displayed on the turnover sheet. Those balances that were displayed in these statements are compared with the balances recorded in the warehouse accounting cards.

Introduction

The warehouse is the central link in the logistics system of any modern enterprise. In any case, all inventory items arriving at the enterprise go to the warehouse, and their movement is reflected accordingly in warehouse accounting.

One of the main requirements for warehouse workers of enterprises and organizations today is the ability to work on a computer and the ability to fully maintain inventory records using specially designed software products. Therefore, even those specialists who have never worked on a computer before must now master the necessary techniques and methods of work.

Modern hardware and software allow you to automate almost all warehouse accounting operations: entering and processing primary documents, accounting for the movement of inventory, calculating warehouse balances, conducting inventories, etc. Based on the entered and processed data, generation and printing are carried out a wide variety of reporting forms.

The book offered to readers is designed to teach a wide range of specialists how to maintain warehouse records on a computer. In it, both the head of the logistics department of a large industrial holding and the storekeeper maintaining inventory records at a small enterprise will find useful information. First, it is proposed to recall the theoretical foundations of warehouse accounting, as well as the documentation used in it, after which a description of popular software products designed to automate warehouse accounting is given.

When studying this book, remember that all data used in the book is conditional, and examples of setting up and using the described software tools are general in nature. Also keep in mind the following: it is possible that in the process of studying the described applications you will find some discrepancy between the contents of this book and what you see on the monitor screen - this probability is due to the fact that software products are constantly being improved and refined. In any case, these discrepancies will not be of a fundamental nature.

Balance accounting

This form of warehouse accounting differs from the previous one. The key difference comes down to the fact that qualitative and total accounting in the context of inventory items is not maintained in the accounting department. Turnover statements, accordingly, are also not compiled.

With this type of organization of warehouse work, inventory accounting is carried out in the context of subaccounts, product groups and balance sheet accounts, which are used to record inventory items exclusively in monetary terms. Accounting is carried out by financially responsible persons. For this process, a warehouse ledger or appropriate journal is used.

As for accounting, it is responsible for receiving primary accounting documentation from financially responsible persons and subsequently checking the received data. When the reconciliation process is completed, those balances of materials that were recorded on the first day are transferred to the balance sheet.

Relocation of goods and materials

We have two types of documents available to us: “Demand-invoice” and “Movement of goods”. What is the difference? “Goods transfer” is used to move inventory (goods, materials, finished products and equipment) from one sending warehouse to another receiving warehouse.

The document is intended to reflect the movement of goods, materials, finished products and equipment between warehouses.

The document can be entered based on the document Receipt (act, invoice).

When entering a document, you must indicate the following details in the header:

- Sending warehouse - the warehouse from which goods, materials or products are transferred.

- Receiving warehouse - a warehouse to which goods, materials or products are received.

To reflect the movement of goods, materials or finished products, you must fill out the Goods .

On the Products , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of consignment goods, you must fill out the Items on consignment .

On the Products on commission , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of containers, you must fill out the Containers .

On the Containers , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of equipment, you must fill out the Products .

On the Products , the item, quantity, and item accounting accounts are indicated.

- Sender's Account, Recipient's Account - are filled in automatically when specifying an item based on the Item Account register.

To reflect the movement of goods from a wholesale warehouse (from a warehouse with the "Wholesale" type) to an automated point of sale (to a warehouse with the "Retail" type), you must fill out the Products .

On the Products , the item, quantity and account of the sender (the account of the goods in the wholesale warehouse) are indicated.

- The Sender Account field is filled in automatically when specifying an item based on the Item Account information register.

- The recipient's account cannot be changed.

The price from the Item Prices information register is taken as the selling price to reflect the product at retail.

To reflect the movement of goods from a wholesale warehouse (from a warehouse with the "Wholesale" type) to a manual outlet (to a warehouse with the "Manual outlet" type), you must fill out the Products .

On the Products , the nomenclature, quantity and account of the sender (the account of the goods in the wholesale warehouse) and the price of the goods at retail are indicated.

- Sender Account - filled in automatically when specifying an item based on the Item Account register.

- The price is filled in automatically when specifying an item based on the Item Price register.

- The recipient's account cannot be changed.

The price from the document is taken as the selling price to reflect the product at retail.

To reflect the return of goods to a wholesale warehouse (to a warehouse with the "Wholesale" type) from an automated point of sale (from a warehouse with the "Retail" type), you must fill out the Products .

On the Products , the item, quantity and accounting account of the recipient (account for accounting of goods in a wholesale warehouse) are indicated.

- The Recipient Account field is filled in automatically when specifying an item based on the Item Account register.

- The sender's account cannot be changed.

The valuation of a product for reflection in a wholesale warehouse is determined as the difference between the selling price and the trade margin for this product.

To reflect the return of goods to a wholesale warehouse (to a warehouse with the "Wholesale" type) from a manual retail outlet (from a warehouse with the "Manual retail outlet" type), you must fill out the Products .

On the Products , you can indicate the product nomenclature, quantity, and the recipient's accounting account (goods accounting account in the wholesale warehouse) and the retail price of the goods.

- The recipient's account is filled in automatically when an item is specified based on the Item Account register.

- The price is filled in automatically when specifying the item. The data is filled in based on the information register Item Prices.

- The recipient's account cannot be changed.

The valuation of goods for reflection in a wholesale warehouse is determined as the difference between the selling price and the trade margin.

The following printed forms are provided for the document Movement of Goods

- Movement of goods

- TORG-13 (Invoice for internal movement)

Batch accounting

Trade and warehouse in this case are organized in such a way that a specific batch of goods is stored separately. Moreover, for each of them the storekeeper writes out a batch card in two copies. A special book is used to register such cards. In this case, it is the number of the accepted batch that is the registration number in this book. After entering the necessary information, one copy is transferred to the accounting department, and the other remains in the warehouse and serves as a warehouse accounting register.

It is worth noting the fact that the inventory of one item is determined as a batch. This product must be supplied by one supplier. As for the number of deliveries, there may be several.

When filling out a batch card, the warehouse employee must indicate the date of preparation, its number, the time of filling out the receipt of goods, the type of transport, the supplier’s details, the number and date of the invoice, the name of the product, the place of departure, as well as the weight and grade.

Warehouse accounting of materials, which uses the batch method, implies the reflection during the release of goods of the date of this action, the number of the consumable commodity document, the type of transport, the name of the recipient, the quantity and grade of products released. At the same time, the number of the batch card is indicated in the expenditure document.

When all the stocks of a particular batch are used up, the warehouse manager and merchandiser put their signatures on the card and transfer it to the accounting department, where it will subsequently be checked.

It is possible that during the inspection a shortage will be identified. In this case, warehouse accounting implies the following actions: the accountant, before the next inventory, writes off the shortage as distribution costs, but only on the condition that it was within the limits of natural loss. If the norms were exceeded, then the shortage must be recovered from those persons who are financially responsible for the products stored in the warehouse.

It is also worth considering the information that the batch warehouse accounting system includes drawing up a report for a completely consumed batch of goods and materials.

Warehouse accounting and warehouse document flow: how to organize it correctly and what software to choose

Proper warehouse accounting and document flow allows you to effectively conduct business in modern conditions.

Almost any trade or manufacturing organization has a warehouse - with large or small areas, with a wide or minimal range of goods, raw materials or supplies placed there.

In all cases, regardless of the scale of the enterprise, effective accounting of warehouse assets is necessary - let’s look at what it is and by what means it can be carried out.

Warehouse accounting: what is it and why is it needed?

Warehouse accounting is a set of procedures aimed at documenting various warehouse operations. The main ones include:

- acceptance of goods (raw materials, materials) from the supplier;

- product placement;

- movement of goods between warehouses (and other related departments);

- release of goods from the warehouse for one purpose or another (for shipment, for production).

These operations can be detailed in various ways. For example, goods acceptance usually includes:

- receipt of goods (raw materials, material) from the supplier;

- acceptance of goods for accounting;

- checking the goods to ensure that the actual delivery characteristics correspond to those stated in the accompanying documentation.

— warehouse accounting and product distribution in the SUBTOTAL service (LINK):

Thanks to accounting for warehouse operations, a business entity gets the opportunity to:

- over the current inventory (knowing what, where and in what quantity it is);

- over significant consumer statuses of the product (for example, its expiration dates);

- over the movement of goods to the warehouse, within the warehouse, between the warehouse and other departments (knowing what, where and in what quantity was received or released).

- Optimize (using data reflected in the accounting documentation for such operations):

- completeness of inventory in warehouses, on the sales floor (in production);

- sales volumes;

- schemes for organizing the storage of goods;

- procedures for interaction with suppliers;

- turnover of goods.

Accounting also helps to increase the transparency of operations - from the point of view of their adaptability to monitoring for unauthorized actions of employees, identifying and correcting mistakes they make.

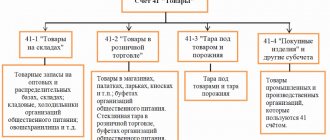

Warehouse accounting can be:

- nomenclature (when the object of accounting is a separate commodity item);

- varietal (when various categories (“grades”) become additional accounting objects, into which goods of different positions can be combined;

- batch (when even larger units (“batch”) are introduced into accounting, combining several categories of goods).

Of course, these accounting options can be applied alternately depending on the specific area of warehouse management (and thus complement each other). A small enterprise is characterized by areas with predominantly nomenclature accounting. The larger the business, the more plots appear with varietal and batch accounting.

— features of maintaining and organizing warehouse accounting at the enterprise:

Regardless of the type of accounting, enterprises use unified forms of documentation of warehouse operations. Their use is determined not only by the solution of the above tasks, which are related to the control and optimization of the warehouse, but also by the requirements regarding accounting (which all business entities in the status of legal entities are required to maintain).

Documentation in stock

Lists of warehouse documents used by Russian enterprises are mostly unified. This is due to the fact that most of these forms must comply with the requirements of Law No. 402-FZ on Accounting (LINK). The unified ones are just right, and there is no need to look for an alternative to them.

It can be noted that each warehouse document (a group of documents of the same type), as a rule, relates to a specific warehouse operation (or sequence of operations). Thus, in Russian warehouses they use:

- When documenting the receipt of goods :

- invoice from the supplier (the goods are received on its basis);

- receipt invoice - prepared by the business entity itself (used to register the received goods);

- consignment note - drawn up according to the unified form No. 1-T (used to document the acceptance and delivery of goods delivered on a particular vehicle);

- receipt order in form M-4 (used to record goods received directly to the warehouse and is issued, as a rule, on the basis of invoices);

- certificate of acceptance of materials in form M-7 (used in case of discrepancies in actual and declared delivery characteristics);

- acceptance certificate in the TORG-1 (used after a complete check of the declared characteristics of the delivery and certification of its compliance with the actual one);

- act of discrepancies in the TORG-2 (used if there were discrepancies).

- When documenting product placement :

- product label in the TORG-11 (reflects the main characteristics of the product and its quantity, needed when compiling inventory lists);

- materials accounting card in form M-17 (used to record the receipt and disposal of materials relative to their location).

- When documenting the movement of goods :

- invoice in form M-11 (used when documenting the movement of goods within various divisions of the organization);

- invoice in the TORG-13 (used when moving goods between the higher and parent structures of a holding or other corporate structure subordinating one business entity to another).

- When documenting the release of goods from the warehouse :

- invoice in form M-15 (used when sending goods to another organization or when selling them);

- invoice in the form TORG-12 (used when selling goods directly from the warehouse);

- act of write-off in form TORG-16 (applied if the product loses its consumer qualities and is subject to write-off).

An example of a practical scenario for using the specified documentation:

- The forwarder, who has delivered the goods from the supplier, gives the shipping documents to the person working at the receiving organization.

- A person from the receiving organization looks at these documents, draws up the necessary invoices, and registers them in the prescribed manner.

- The goods are moved to the warehouse, and a receipt is issued for them.

- An inventory of placed goods is periodically carried out by the inventory commission (using various inventories).

- Goods are moved from warehouse to production - and this is certified by the TORG-12 invoice.

The main documents indicated above (of course, the above list is not exhaustive) documents, therefore, reflect the fact of certain operations with goods as part of their movement in the warehouse (and in relation to the warehouse).

These actions are obviously performed by a person (or a machine, if the warehouse is robotic - but it is also programmed by a person, and he ensures that the machine reproduces typical human actions).

These actions (as well as the procedures for documenting them) take some time and require certain labor investments.

— how an individual entrepreneur can maintain warehouse records in the My Business service (LINK):

Accordingly, it is in the interests of an economic entity to minimize time and labor costs associated with:

- with the implementation of the operations themselves with goods within the warehouse;

- with documentation of these transactions in various accounting documents (as well as the practical use of such documents subsequently).

Automation of warehouse accounting contributes to the solution of these two problems. That is, the use of programs that:

- speed up and optimize the procedure for filling out and using accounting documents;

- determine (help determine) the best algorithms for carrying out warehouse operations (which warehouse workers are subsequently recommended or instructed to follow).

Obviously, the larger the enterprise, the more in demand there will be optimization - in at least two of these areas. And, accordingly, automation using special computer programs.

There are a huge number of these on the Russian (as well as on the world) market. Let's try to highlight the key criteria that you can focus on when choosing such solutions.

How to choose software for inventory automation

Basic criteria include:

- Of course, as such the functionality of .

The main features that a consumer expects from a modern warehouse automation program:

- adaptability to automatically filling out unified forms and other accounting forms (optionally, based on previously generated documents, accounting data, automated means of monitoring the movement of goods - barcodes, RFID tags);

- adaptability to quickly unloading warehouse documents in common file formats - for example, Excel;

- compatibility with external accounting modules (for example, 1C line programs);

- the ability to quickly send documents to recipients (both within the company and outside it);

- the presence of means of control over the various statuses of the product (“received”, “sent”), its quantitative characteristics (“many”, “little”, “out of stock”), consumer properties (“expiration date”);

- the ability to quickly search for the necessary data on the supplier;

- the ability to quickly search for the necessary data by product item, “grade”, “batch”;

- adaptability to remote control via the Internet;

- adaptability to the calculation of algorithms on the basis of which warehouse operations will be carried out;

- adaptability to planning purchases (vacation), minimizing overstocking;

- collection of statistics on warehouse operations, their analysis;

- availability of tools for automation;

- availability of an error monitoring system (when filling out documents);

- adaptability to tracking the physical movement of goods (if technical means of identification are available).

Representatives of SMEs may benefit from the solution offered by the My Warehouse service - LINK.

There are warehouse solutions that are best suited to retail. There are industrial ones. There are those that are designed specifically for logistics organizations whose warehouses are the main type of infrastructure.

Theoretically, it is possible to find a universal product - but the larger the organization, the more its business processes are tied to the industry specifics of warehouse operations.

And the greater in general will be the need for solutions that are best suited to a specific segment of economic activity.

- Adaptability to integrate warehouse software with other enterprise management automation tools.

It is quite obvious that warehouse automation is more effective, the deeper into the enterprise infrastructure various accompanying software and hardware tools for automating operations accounting are implemented - scanners, TSD, tags. The extent to which the warehouse program is adapted to integrate with such tools also plays a role.

Specialized multifunctional software products designed to solve basic problems specific to warehouse management form a separate category of solutions - WMS (Warehouse Management System, that is, software products that are warehouse management systems). In them, the specified functionality, industry specifications and adaptability to integration are fully implemented.

What should be additionally taken into account when organizing warehouse accounting

When implementing warehouse accounting automation programs in practice (and their subsequent application), it makes sense to pay attention to the following nuances that characterize this area of enterprise management:

- Using warehouse software (and accompanying automation solutions) requires certain qualifications from workers.

It is therefore necessary to ensure that they are trained in advance in how to work with the software - and best of all directly on the premises of the enterprise (to show employees clearly how the program works in relation to the warehouse operations they are familiar with).

- The implementation of warehouse software should be preceded by sufficiently long testing - moreover, in real conditions (again, in connection with the actual warehouse operations).

If the enterprise has traditionally used paper warehouse accounting (or computer, but not automated), then at first paper warehouse accounting operations will be carried out in parallel with electronic ones - despite the fact that the latter will not have legal force (since they may be accompanied by the preparation of documentation with errors) . And if it has not been used (there is no experience at all in its implementation), then it makes sense to temporarily postpone the production procedures until the program is tested (an exception is if the errors, due to the specifics of production, are not critical, and as a result of their commission, counterparties will not have claims).

- The enterprise staff (or the nearest outsourcer) must have a person who has an exceptional understanding of the “deep” settings of the warehouse program - and is ready to quickly respond to the situation if it “goes wrong” or works in an unpredictable way.

If there are failures in the warehouse program, one way or another, production will have to be suspended. It is best if the pause is minimal - but for this the right people must get to work quickly.

— warehouse accounting in 1C:

Source: https://onlain-kassy.ru/ispolzovanie/dop/skladskoj-uchet-dokumentooborot-sklada.html

How are warehouse journals used in sort accounting?

If this method of accounting is used, the storekeeper opens one or several pages in the product journal for each variety and name of product. A separate card can also be created. The number of pages depends on the volume of operations carried out for receiving and disbursing.

In the title of the card or magazine page, you must indicate the article, name, grade and other characteristics that distinguish a particular product. The remaining space on the page is used to reflect receipts, expenses and product balances.

A warehouse accounting book (magazine) is necessary to record data when processing each receipt or expenditure document.

Legislation allows the use of various forms of journals. An example is a commodity journal in form N MX-2. It must be maintained by a storekeeper or other responsible person. The basis for its completion are documents on the acceptance and issuance of inventory items previously deposited. Such a log contains the following data:

— the date when the inventory items were accepted for storage;

— the department that transferred the inventory to the warehouse;

— name, price, quantity, units of measurement of inventory items;

- number and date of documents that were used during the issuance and reception of products;

- storage.

In order for the goods to be accepted for storage and subsequently issued, it is necessary to certify the relevant documentation with the signatures of the storekeeper and the warehouse manager.

Various types of commodity journals will help to competently organize warehouse accounting of a quantitative type, in which the movement and balances of products are recorded, with the help of which inventory records are kept in storage areas, as well as their consumption is recorded. Such information can also be displayed in the form of statements.

List of main warehouse documents

Warehouse documents are a set of papers that record the arrival, movement and disposal of inventory items, which is necessary for the strict organization of accounting at the enterprise.

ConsultantPlus TRY FREE

Get access

If an organization (especially a manufacturing or trading one) uses a large number of inventory items, they must be stored in an orderly manner. Proper organization of warehouse accounting at an enterprise is the key to trouble-free operation and transparent accounting.

Why is it necessary?

When a room has been allocated for storage purposes and responsible persons have been appointed, it’s time to move on to the most difficult part - document management. If the first two actions are rather organizational, then the last one is accounting. It is obvious that accounting, warehouse management and other types are always closely related.

Let's consider these questions:

- what applies to warehouse documents;

- in what situations each of them is used;

- where can I get the template?

Let's start right away with the last point. The list of main warehouse documents and their forms is contained in Appendix 2 to Order of the Ministry of Finance of Russia No. 52n dated March 30, 2015. But they are mandatory only for budget organizations. Private firms have the right to develop their own forms, although using ready-made ones is not prohibited. Download them in the table.

Accounting stages and their documentation

A warehouse worker will have to deal with many forms. Let's build a logical sequence based on the stages of accounting.

Table. List of warehouse documents.

| Accounting Component | What is this | Samples of warehouse documents | Why are they needed? | Number of copies |

| Admission | Packing list | TORG-12 | Find out complete information about incoming goods and materials | Two: one - from the seller, the second - from the buyer |

| Invoice for issue of materials to the side | M-15 | Receive goods and materials from another address | ||

| Receipt order | M-4 | Record arrival | One with the signatures of the storekeeper and the forwarder | |

| Deed of variance | TORG-2 | Document discrepancies in quantity and quality | Four: for the seller, the buyer, the transport company and in the application to the claim | |

| Receipt from the cash register | Fiscal receipt | Confirm the purchase | Two: one for the buyer, the second for the Federal Tax Service | |

| Warehouse list, act, certificate | Others | Prove the fact of arrival of goods and materials if received in another way | ||

| Actual accounting | Party card | MX-10 | Take into account goods of the same name or arrived by the same vehicle | Two: one remains in the warehouse, the second goes to the accounting department |

| Material accounting card | M-17 | Consider materials by grade and type | One | |

| Internal movement | Request-invoice | M-11 | Confirm the movement of inventory items within the organization (between departments) | Two: one remains in the issuing department, the other goes to the warehouse |

| Inventory | Inventory order | INV-22 | Initiate a check indicating the reason | One - for the chairman of the inventory commission |

| Inventory list | INV-3 | Reflect the actual availability of inventory items | Two: one is for the MOL, the other goes to the accounting department | |

| Collation statement | INV-19 | Record deviations from accounting indicators | ||

| Inventory record sheet | INV-26 | Submit your results | Two: one remains in the warehouse, the second goes to the accounting department | |

| Storage | Certificate of acceptance and transfer of goods and materials for storage | MX-1 | Register acceptance under a storage agreement | In accordance with agreement |

| Log book of inventory items deposited for storage | MX-2 | Confirm that the bailor has no claims | One | |

| Disposal | Limit fence card | M-8 | Reflect the issue of materials if there are limits | Two: one remains in the warehouse, the other goes to the receiving department |

| Invoice for issue of materials to the side | M-15 | Transfer goods and materials to another address | Two: one - from the seller, the second - from the buyer | |

| Request-invoice | M-11 | Confirm the movement of inventory items within the organization (between departments) | Two: one remains in the warehouse, the other goes to the receiving department | |

| Packing list | TORG-12 | Provide complete information about incoming inventory items | Two: one - from the seller, the second - from the buyer |

Why are some shapes the same?

The table shows that the same forms are used for admission and departure. The difference is that the warehouse invoice TORG-12 and the invoice for the release of materials on the M-15 side are filled out by different sides. Upon receipt, this function is assigned to the sending party; upon departure, this function is assigned to the warehouse employees.

The same applies to the requirement-invoice M-11. When moving internally, it is registered in the department, when leaving - in the warehouse.

What does “security” mean in warehouse accounting?

Let us turn to Article 912 of the Civil Code. It makes it clear which warehouse documents are securities. These include:

- double warehouse receipt;

- each of its parts separately;

- simple warehouse receipt.

All of them are evidence of acceptance of goods for storage, handed over to the owner of these goods and materials. In the future, the owner can take out loans against them or give goods as collateral.

Source: https://ppt.ru/forms/sklad/perechen-osnovnykh-skladskikh-dokumentov

How is inventory markdown carried out?

Trade and storage are inevitably associated with such phenomena as obsolescence of goods, as well as a decrease in demand for them or loss of quality. These problems cannot be ignored and the markdown process is used to effectively solve them. To complete it, you will need an act of depreciation of material assets.

It must be drawn up and signed in two copies. This is done by responsible persons representing a special commission. One copy remains with the warehouse manager (it must be stored), the second is sent to the accounting department. In some situations, one copy may be attached to the delivery note. This is done for the subsequent transfer of this document to an organization engaged in the sale of discounted goods, or for the purpose of returning it to the manufacturer.

And how do we work?

The characteristics of warehouse loading and unloading operations depend on what kind of cargo needs to be handled and what kind of transport to serve. The level of mechanization of the simplest processes has a strong influence on work. Acceptance of goods for quality is one of the most important moments of the entire complex associated with the receipt of items at the warehouse.

How exactly to control the flow of material assets is decided by analyzing information about the quantity and quality of items in the warehouse. Practice shows that often the data in accounting systems is incorrect and incomplete, which leads to management errors and losses for the company. Technological operations that take place during the logistics of goods are associated with unplanned changes in quantity and quality. Cargo can be stolen, damaged, lost; there is the concept of “excessive loss.” Personnel may make mistakes, form batches incorrectly, or ship goods incorrectly. All this leads to shortages, mis-grading, and excess volume.

When accepting goods, it is very important to carefully evaluate the incoming goods, regularly comparing the values with the stated list. Therefore, accompanying documents, usually invoices, must be drawn up for any positions. Documenting each step is the most effective method of obtaining accurate data on the warehouse situation.

Warehouse management systems

One of the key tasks of any business is automation and optimization of all internal processes of the enterprise. This will save time and improve the quality of service.

The warehouse is no exception. In order to speed up various processes related to the receipt and consumption of goods, a warehouse accounting program is used. It may have a different appearance and structure, but the functions of such software remain unchanged.

We are talking about the following possibilities:

— distribution of products in the warehouse by storage cells, batches and responsible persons;

— the ability to dynamically recalculate warehouse balances;

— tracking of cargo along traffic routes;

— use of various methods of determining the price of a product;

— inventory and subsequent generation of up-to-date reporting according to its results;

— formation of receipt and warehouse orders;

— revaluation of goods due to the influence of various factors that shape its value;

— warehouse management.

A well-designed warehouse accounting program allows you to establish the efficient operation of a transit warehouse, as well as general purpose warehouses. It is also practiced to use an electronic analogue of a warehouse accounting card, which has all the latest filters. We are talking about tracking information in the following areas:

— currency used to pay for the goods (according to the matching sheet, statement of surplus and shortage, statement of actual availability, etc.);

— batch of products, shelf life, expiration date of certificates;

— various types of operations with inventory items;

- special purpose;

- re-grading;

— financially responsible persons;

— operations of staffing and dismantling of material assets in the warehouse.

As a rule, such automated warehouse accounting is modified by the developer taking into account the individual characteristics of a particular client’s business.

How to organize document flow in a warehouse?

The requirements for organizing warehouse accounting are regulated by the Methodological Guidelines for Accounting for Inventory and Inventory (Order of the Ministry of Finance of the Russian Federation No. 119n dated December 28, 2001). According to the document, recording of information on the movement of materials is carried out on the basis of primary documents, and should promptly reflect reliable data on warehouse operations.

There are special programs and services to automate document flow in a warehouse. For example, “Scan-Archive” or “1C-EDO”.

Where to start document flow in a warehouse?

To get started, read these documents.

- Resolution of the State Statistics Committee of the Russian Federation No. 71a of October 30, 1997. Forms of primary accounting documents are recommended here. From January 1, 2013, it is allowed to use independently developed and recorded in the accounting policy forms of documents used in warehouse accounting, but with the condition that such forms will contain a full list of mandatory details provided for by the accounting law of December 6, 2011 No. 402 -FZ (information of the Ministry of Finance of Russia No. PZ-10/2012).

- Order of the Ministry of Finance of the Russian Federation No. 119n dated December 28, 2001. The document defines the requirements for officials performing warehouse accounting - an agreement on full financial responsibility must be concluded with the warehouse manager, storekeeper, or other employee who is assigned such duties.

What is an “accounting object”?

This concept includes:

- raw materials used to produce products or various kinds of semi-finished products;

- auxiliary materials and spare parts used to ensure the operability of production facilities, to meet technological needs and processes;

- containers for finished products;

- fuels and lubricants;

- purchased semi-finished products, etc.

What does document flow in a warehouse include?

Warehouse accounting document flow includes:

- accounting using receipts and expenditure documents reflecting the receipt and issue of materials;

- internal warehouse accounting, reflecting the transfer of materials between two or more warehouses or divisions of one business entity (based on the invoice requirement);

- accounting registers into which the person responsible for this area of work must promptly enter all the necessary information on the movement of storage objects.

Check how well you understand the issue of document control. Take the test! Pass the

Movement of storage objects

Thus, goods and materials arrive at the warehouse with a set of documents from the supplier - a bill of lading, a TORG-12 form, an invoice and other documents accepted from the counterparty.

Based on invoices, values are received at the warehouse: a receipt order M-4 is drawn up, a warehouse accounting card M-17 is created for each item.

In the future, form M-4 serves as the basis for carrying out incoming transactions in accounting, and the data on M-17 cards is verified with accounting data at the end of the month.

The release of goods and materials into production is carried out on the basis of invoice requirements (form M-11), limit cards (form M-8) with recording of movements in cards M-17.

How to keep records of material assets?

Balance or quantitative-total methods

The balance method involves maintaining documentary records in the warehouse in quantitative terms, and in accounting - in total terms. The quantitative-cumulative method involves (both in warehouse documents and in accounting documents) indicating information on quantity and amount simultaneously.

The business entity must indicate the method and method of accounting used in its accounting policy.

Depending on the method used, document flow in an enterprise’s warehouse differs according to the principle of maintenance and the “primary” forms used.

Varietal method

With the grading method, accounting is carried out exclusively by the name of the storage item and its grade, regardless of their cost and date of receipt at the warehouse.

Accounting is carried out on the basis of materials accounting cards issued for each storage position and registered in the register (form M-17). Cards are maintained throughout the year. In this method of filling out accounting documentation, there is no way to track the cost of received inventory items, and they are written off at the unit price, or at the average cost determined by the FIFO method.

Batch method

The batch method is based on separate storage and accounting of each batch of goods and materials received at the warehouse with one receipt document.

With this method, accounting is carried out using batch cards (form MX-10), issued for each batch of materials accepted for storage in 2 copies. One of them is used in warehouse document flow, and the second, with the entered primary accounting data, is sent to the accounting department.

The incoming part of the batch card reflects the data specified by the supplier in the primary document, and the outgoing part contains information about the write-off of materials sold. The card is closed after the release of the entire volume of materials received as part of the batch, and with the act of consumption of the goods and materials, it is sent to the accounting department.

How to write off issued materials in the warehouse document flow?

Write-off of issued materials in the warehouse document flow is carried out on the basis of:

- limit-salary card (form M-8) – when issuing inventory items of one item to an external recipient or to a warehouse of a business entity;

- requirements-invoice (form M-11) – for a one-time issue of materials (generated in 2 copies – for warehouse document flow and for the recipient of materials);

- invoice for the release of goods and materials to the third party (form M-15) – is issued when transferring materials to an external recipient or to a dedicated and separately located division of a business entity;

- consignment note (form TORG-12) – used when selling materials to an external counterparty.

Source: https://zen.yandex.ru/media/id/5dd67d3c3676ed2b9e74ed7c/kak-organizovat-dokumentooborot-na-sklade-5e2ef1d03d5f6900ad42b44d

Current programs

To effectively organize warehouse operations, various software can be used. But one of the most popular options is “1C Warehouse Accounting”. This software has certain advantages, which attract many companies that integrate this program into the operation of their warehouses.

The key functions are as follows:

— quick and timely accounting of material assets, their arrival and movement;

— accurate maintenance of all warehouse documentation;

— timely and convenient maintenance of a warehouse journal (cards);

— availability of all necessary tools for correct inventory taking;

— presentation and processing of the warehouse system.

Using this software, you can qualitatively cover several areas of an enterprise’s economic activity. We are talking about managing sales rules, inventory, finance, purchasing and delivery of goods. The main advantages of 1C include ease of use of the program, the possibility of its correction taking into account the needs of a particular organization and full compliance with Russian legislation.

If you wish, you can use other programs: “Super Warehouse”, “Product-Money-Product” and others.