Fixed Asset Accounting

A fixed asset (FA) that has entered into an organization of any form of ownership, including real estate, must be accepted:

- for accounting - on the date when the initial cost of the object was formed (clauses 4, 7 of PBU 6/01);

- for tax accounting - on the date of commissioning (clause 4 of article 259 of the Tax Code of the Russian Federation).

To complete these procedures, you need to create:

- act of acceptance and transfer of property (OS-1);

- inventory card (OS-6).

After this, depreciation begins in accounting and tax accounting. Although in essence they are the same thing, in practice they are different. In this material we will look at what depreciation is in accounting.

Accounting for depreciation of fixed assets on account 02

Why is depreciation charged on fixed assets of companies? There is only one answer: most OS objects are very expensive. If you write off their cost as expenses at a time, this will lead to a significant increase in the cost of production. Therefore, the cost of fixed assets is repaid through depreciation.

However, if the cost of fixed assets in accounting does not exceed 40,000 rubles. per unit, then the company can include them in the materials, having prescribed this in the accounting policy.

For clarity, we will give examples of depreciation calculation and posting to reflect this operation in accounting.

Example 1

Let’s say a company purchased an LG A09IWK split system in September at a cost (including installation) of 98,000 rubles. for installation in the main production workshop. According to the passport of the split system, the service life of the facility is 7 years. The company's accounting policy provides for a straight-line method of calculating depreciation.

Having received the certificate of acceptance and transfer of fixed assets, the company’s accountant determines that the useful life of the split system for accounting purposes. accounting period is 84 months (12 months*7). Consequently, the monthly depreciation amount for the object will be 1,166.67 rubles. (98,000/84)

It is also important to consider that:

- Depreciation on account 02 begins on the first day of the month following the month the split system was accepted for accounting;

- During the reporting year, depreciation of the split system is accrued monthly in the amount of 1/12 of the annual amount.

Depreciation calculation for the current year example is shown in the diagram:

The company's accounting records reflect the following entries:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| Monthly during the useful life of the split system | ||||

| 20 | 02 | 1 166,67 | Depreciation accrued on the split system | Accounting certificate-calculation |

Example 2

Let's give an example of determining the useful life of a laptop and posting depreciation and write-off in connection with a donation.

Let’s assume that the company purchased a laptop worth 60,000 rubles for the administration in December 2016. In January 2020, the decision was made to give it to a retiring employee. The company's accounting policy provides for a straight-line method of calculating depreciation.

We determine the useful life of the laptop. The passport and technical specifications do not indicate the lifespan of the laptop. At the same time, physically it can serve for a long time, but morally it can become obsolete much earlier than physical wear. You can determine the service life of a laptop using the classification approved by the Government of the Russian Federation No. 1 dated January 1, 2002.

Computer equipment with code OKOF 14 3020000 belongs to the second depreciation group with a useful life of two to three years. The company's accountant determined the useful life of the laptop to be 3 years or 36 months.

Please pay attention! Until 01/01/2017 the useful life of a fixed asset could be determined according to the Classification of fixed assets, approved. Government of the Russian Federation No. 1 dated January 1, 2002. This possibility was stated in paragraph 1 of the second paragraph of this classification.

However, everything has changed since 01/01/2017. Resolution No. 640 of 07/07/2016 declared clause 1 of the second paragraph to be invalid. The phrase “the specified classification may be used for accounting purposes” was removed.

In practice, in companies, in order to bring accounting and tax accounting of fixed assets closer together, the useful life was determined taking into account the classification of fixed assets approved by the Government of the Russian Federation. Since 2020, they do not have such an opportunity and must determine the useful life in accounting based on the requirements of clause 20 of PBU 6/01, namely based on:

Thus, according to the example, the following entries were generated in the company’s accounting for account 02:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 26 | 02 | 1 666,67 | Depreciation was calculated on the laptop for January 2020 (60000/36) | Accounting certificate-calculation |

| 02 | 01 | 1 667,67 | The amount of depreciation on the laptop is reflected | Certificate of acceptance and transfer of OS |

| 91.2 | 01 | 58332,33 | The residual value of the laptop is written off as other expenses not taken into account for income tax purposes. | Certificate of acceptance and transfer of OS |

Chart of accounts

To summarize information about depreciation accumulated during the operation of fixed assets, account 02 is used, which bears the same name - “Depreciation of fixed assets”. Accrued depreciation is reflected on the credit of this account, and the debit reflects the disposal of fixed assets (sales, write-off, transfer, etc.). This means that account 02 is passive, although it is not directly involved in the formation of the balance sheet liability. It only reduces the residual value of the fixed assets that are reflected in it. This is due to the fact that the balance sheet uses the so-called net valuation of fixed assets, and to correctly display their actual value, depreciation shown in account 02 is subtracted from the original amount. It corresponds with most accounts used to record expenses.

In addition, the company's intangible assets are also assets subject to depreciation. To account for their depreciation, a separate account 05 is used. The principle of its application does not differ from account 02; it is also passive and corresponds with the accounts on which expenses are recorded.

Analytics should be carried out in the context of all fixed assets that are on the organization’s balance sheet. This is exactly how it is defined in the order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, which approved the current chart of accounts.

Disposal of fixed assets - postings and examples

To do this, monthly entries are made in accounting to write off part of the cost of fixed assets as depreciation.

In all of these cases, equipment or other fixed assets that have become unusable should be written off.

OS have different useful lives (USL). Often, the SPI is prescribed by the manufacturer in the technical passport of the fixed asset. If the deadline is not specified in the documentation, the owner of the OS has the right to independently determine the deadline.

Example: the price of equipment is 100,000, its resource is 1000 products. This month, 100 products were produced, 10% of the object's resource. This means that the amount of depreciation for this month will be 10% of the cost - 10,000.

This process is gradual and continues throughout the entire useful life. To account for it, the accountant makes monthly entries in specially designated accounting accounts.

Depreciation can be stopped only if the equipment is idle for at least three months and if the facilities are modernized for a period of at least 12 months. Amounts are accrued from the month following the month the facility was put into production and are not accrued from the month following the removal of the equipment from production.

The method is not advisable to use for equipment subject to rapid obsolescence, since the proportional write-off of its cost does not ensure the proper concentration of resources necessary for its replacement. Manufacturing equipment is characterized by a decrease in productivity as the number of years of operation increases.

Let’s assume that after 3 years, that is, after 36 months, management decided to sell the machine at a price of 250,000 rubles. without VAT. The amount of depreciation accrued by this time is 1,260,000 rubles. (36 months x RUB 35,000.00). Let's reflect the operation in accounting:

- The object was sold to the buyer - D 62 K 91.1 for RUB 295,000.00. (RUB 250,000.00 + RUB 45,000.00).

- VAT allocated from the transaction - D 91.2 K 68.2 for 45,000.00 rubles.

- Accumulated depreciation is written off - D 02 K 01 by RUB 1,260,000.00.

- The value (residual) of the object was written off - D 91.2 K 01 for RUB 140,000.00. (RUB 1,400,000.00 – RUB 1,260,000.00).

Basic postings

Accountants usually record transactions related to depreciation of fixed assets with the following entries:

| Debit | Credit |

| 08 “Investments in non-current assets” | 02 “Depreciation of fixed assets” 05 “Depreciation of intangible assets” |

| 20 "Main production" | |

| 23 “Auxiliary production” | |

| 25 “General production expenses” | |

| 26 “General business expenses” | |

| 29 “Service industries and farms” | |

| 44 “Sales expenses” | |

| 91 “Other income and expenses”, etc. |

Accounting for depreciation for tax purposes

Tax accounting uses linear and non-linear methods of calculating depreciation with subsequent reflection in expenses.

An example of calculating amounts to be included in expenses

The organization bought equipment worth 270,000 rubles. The useful life is determined to be 5 years. The accounting department of the enterprise makes calculations:

- Annual depreciation rate: Ng = 270,000 / 5 x 100% = 54,000 rubles;

- Monthly norm: Nm = 54,000 / 12 = 4,500 rubles.

Conclusion: the company takes into account the amount of 4,500 rubles in monthly expenses.

Under special circumstances, tax accounting may apply increasing coefficients established by Art. 259.3 Tax Code of the Russian Federation. The opportunity to accelerate the write-off of property with a factor of 2 arises when operating equipment in conditions of increased aggressiveness, shifts, and energy output.

When using equipment purchased on lease, an enterprise can apply a multiplying factor of no more than 3. The provision is used for the non-linear method.

Depreciable and non-depreciable property

Not all fixed assets are subject to wear and tear. PBU 6/01 states that the following property does not wear out:

- values that are not used and conserved for mobilization purposes;

- OS whose consumer properties do not change over time, namely: land plots, museum values and natural objects (reservoirs, forests, etc.).

In addition, non-profit organizations do not calculate the depreciation of their fixed assets, because they do not have entrepreneurial activities, and therefore do not need to attribute the cost of fixed assets to expenses. Thus, depreciation of a land plot is not considered in accounting, as well as other similar natural objects. Therefore, no postings or accruals are needed in this case.

Equipment depreciation: determining the deduction rate

Equipment is included in fixed assets for objects with a service life of more than a year. The cost of short-term or one-time use objects is taken into account as expenses at one time, when the equipment is transferred into production. Short-term use equipment is not registered as a fixed asset.

The cost of equipment is written off based on the annual deduction rate. An amount equal to 1/12 of the annual deduction rate is accepted monthly as expenses. The determination of the norm depends on the useful life during which the equipment is involved in the activity and generation of business income.

Accounting policies and depreciation methods

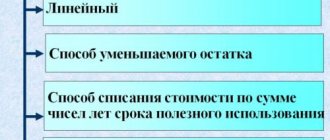

Depreciation can be calculated in one of four ways provided for by PBU 6/01:

- in a linear way;

- reducing balance method;

- write-off of the cost of fixed assets based on the sum of the numbers of years of useful use;

- write-off of the cost of fixed assets in proportion to the volume of products (works).

The Federal Law on Accounting states that the organization must reflect the chosen accrual method in its accounting policies. It should indicate in the description not only exactly how depreciation is calculated, postings and subaccounts used, but also how the useful life of the asset and the annual amount of depreciation are determined. Other articles on this will help you, now we are interested in accounting entries and how depreciation is calculated. Let's look at them with an example.

Methods for calculating depreciation

1. Straight accrual method (linear)

assumes that the functional utility of an asset depends on the time of its use and does not change throughout its useful life, i.e. A constant amount of depreciation is charged over the entire useful life of the asset.

With this method, monthly depreciation deductions are made in the same amounts throughout the entire useful life of fixed assets.

When applying the linear method, the amount of depreciation accrued for one month in relation to an object of depreciable property is determined as the product of its original (replacement) cost and the depreciation rate determined for this object.

When applying the linear method, the depreciation rate for each item of depreciable property is determined by the formula:

K = (1/n) x 100%,

where K is the depreciation rate as a percentage of the original (replacement) cost of the depreciable property;

n is the useful life of a given depreciable property item, expressed in months (years).

Example.

An object worth 120 thousand was purchased. rub. with a useful life of 5 years. The annual depreciation rate is (1/5)x100%=20%.

The annual amount of depreciation charges will be:

120,000 x 20%: 100% = 24,000 (rub.)

2. Reducing balance method.

With this method, the annual amount of depreciation charges is determined by the residual value of the fixed asset item at the beginning of the reporting year and depreciation rates calculated based on the useful life of this item and the acceleration factor established in accordance with the legislation of the Russian Federation.

For movable property that constitutes the object of financial leasing and is classified as the active part of the operating system, in accordance with the terms of the leasing agreement, the acceleration factor cannot be higher than 3. Example.

The initial cost of the object is 100,000 rubles; useful service life - 5 years; annual depreciation rate - 20%; increasing factor - 2.

Depreciation calculation:

1st year: 100,000 x 40% (20 x 2) = 40,000 rub. (residual value - 60,000 rubles);

2nd year: 60,000 x 40% = 24,000 rub. (residual value -36,000 rub.);

3rd year: 36,000 x 40% = 14,400 rubles. (residual value -21,600 rub.);

4th year: 21600 x 40% = 8640 rubles. (residual value -12960 rub.);

5th year: 12960 x 40% = 5184 rubles. (residual value -7776 rub.).

After depreciation has been calculated for the last year, the fixed asset retains a residual value that is different from zero (in this example, RUB 7,776). Typically, this residual value corresponds to the price of the possible capitalization of materials remaining after the liquidation and write-off of fixed assets.

3. Depreciation method based on the sum of the numbers of years of useful life.

This method is also accelerated and allows depreciation payments to be made in the first years of operation in significantly larger amounts than in subsequent years. This method is used for fixed assets, the value of which decreases depending on their useful life; obsolescence sets in quickly; the cost of restoring an object increases with increasing service life. This method is advisable to use when calculating depreciation on computer equipment and communications equipment; machinery and equipment of small and newly formed organizations whose load on fixed assets falls on the first years of operation.

When writing off the cost by the sum of the number of years of its useful life, the annual amount of depreciation charges is determined based on the original cost of the fixed asset and the annual ratio, where the numerator is the number of years remaining until the end of the service life of the object, and the denominator is the sum of the number of years of the service life of the object.

Example.

An item of fixed assets was purchased at a cost of 350 thousand rubles, with a useful life of 6 years. The sum of the numbers of years of service life is 21 years (1+2+3+4+5+6). In the first year of operation of the specified object, depreciation may be charged in the amount of 6/21 or 28.05%, which will be approximately 98.18 thousand rubles; in the second year – 5/21 or 23.8% (83.3 thousand rubles); in the third year – 4/21 or 19.09% (66.82 thousand).

Accounting

Depending on the nature of the use of a fixed asset, depreciation accrued on it is included either in expenses for ordinary activities, or in other expenses, or in capital investments. In this case the wiring is carried out:

Debit 20 (23, 25, 44...) Credit 02 – depreciation has been accrued on fixed assets used in the production of goods (performance of work, provision of services) or in trading activities;

Debit 08 Credit 02 – depreciation was accrued on a fixed asset used in the creation (modernization, reconstruction) of another non-current asset;

Debit 91-2 Credit 02 - depreciation has been accrued on a fixed asset used in other types of activities (for example, on a leased fixed asset, if leasing property is not the main activity of the lessor, or on a non-production object).

Such postings must be made monthly (clause 21 of PBU 6/01).

conclusions

Accounting for depreciation of fixed assets consists of reflecting monthly deductions to account 02 in correspondence with cost accounts (sales or production).

When a fixed asset is deregistered, accumulated deductions are also written off.

Accumulations in account 02 may change if the value of the object changes as a result of revaluation; in this case, accruals are recalculated. Additional accrued depreciation is reflected in additional capital, and reduced depreciation is included in other income.

Used OS

Situation: how to calculate depreciation in accounting for fixed assets that were used by the previous owner?

An organization can charge depreciation on fixed assets that were in use by previous owners, taking into account the period of their operation by the previous owner.

PBU 6/01 does not contain special rules for calculating depreciation for objects that were in operation by previous owners. At the same time, the organization has the right to determine the useful life of this object based on its expected service life. This period can be determined based on an assessment of the technical condition of the object, taking into account its actual wear and tear. Such rules are established by paragraph 20 of PBU 6/01.

For accounting purposes, an organization can determine the useful life of fixed assets according to the Classification approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. This document does not give the organization the right to reduce the useful life in comparison with the periods established for a particular depreciation group. In this case, state in the accounting policy that when commissioning fixed assets that were in use by previous owners, their useful life is determined taking into account the period of their operation by the previous owner.

Characteristics of account 02

To account for the amounts of calculated depreciation of fixed assets, account 02 “Depreciation of fixed assets” is used. It is passive, i.e., the calculated depreciation amounts on it are shown as a credit, and their write-offs are shown as a debit.

The account has the following structure:

- Initial loan balance - shows the amount of accumulated depreciation at the beginning of the billing period;

- Debit turnover - shows the amount of depreciation written off due to disposal of fixed assets, sale, etc.;

- Loan turnover - shows the amount of accrued depreciation;

- Final loan balance - shows the amount of accumulated depreciation at the end of the billing period.

The final balance is determined using the following algorithm: credit turnover is added to the initial balance and debit turnover is subtracted.

You might be interested in:

Accounting policies of organizations: why they are needed, approval deadlines, samples for 2020

For reliable and complete reflection of information, analytical accounts are opened for each asset object.

The balance of this account is not reflected directly in the balance sheet. The balance on it reduces the balance on account 01.

Attention! Account 02 is closed only when an asset is completely written off from the balance sheet - upon sale, liquidation, etc. Until this point, the balance should always be there and show the amount of wear and tear on the asset at the current time. The account is closed by writing off the balance to account 01 or 91.

OS is not used in activity

Situation: is it necessary to charge depreciation in accounting for a fixed asset that is registered but is not actually used?

As a general rule, if property is accounted for on account 01 (it is a fixed asset), then regardless of whether it is used in the organization’s activities or not, charge depreciation on it. An exception, in particular, is the conservation of a fixed asset for a period of more than three months and other cases.

The organization may not start using the main tool immediately. In this case, it is accepted for accounting in a separate subaccount to account 01, which may be called, for example, “Fixed assets in stock.” This procedure applies to all fixed assets: movable (acquired, created, requiring installation) and real estate (from the moment of filing documents for state registration of ownership). This follows from subparagraph “a” of paragraph 4 of PBU 6/01, paragraph 20 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n and the Instructions for the Chart of Accounts.

Depreciation in accounting must be calculated starting from the month following the month in which the property was accepted for accounting as a fixed asset (clause 21 of PBU 6/01). Thus, after reflecting the received property on account 01, the organization must begin to depreciate it. This must be done regardless of whether the organization has started using this object or not.

Reflect the amounts of accrued depreciation on account 02 “Depreciation of fixed assets” in correspondence with expense accounts. Select an account for accounting expenses depending on the reason why the fixed asset is not used (production necessity, technological features, planned delay in operation).

Accrue depreciation as part of expenses for ordinary activities (accounts 20, 08, 23, 25, 44...).

For the convenience of generating and tracking information on the amounts of accrued depreciation for fixed assets that are not used in activities, open a separate sub-account for account 02 “Depreciation of fixed assets”. It may be called, for example, “Depreciation of fixed assets in inventory.” In accounting, reflect depreciation on these objects by posting:

Debit 20 (23, 25, 44, ...) Credit 02 subaccount “Depreciation of fixed assets in inventory” - depreciation has been accrued on fixed assets that are not yet used in activities.

At the beginning of actual operation, write off the amount of accrued depreciation:

Debit 02 subaccount “Depreciation of fixed assets in inventory” Credit 02 subaccount “Depreciation of fixed assets in operation” - the amount of previously accrued depreciation was transferred to the subaccount for depreciation of fixed assets in operation.

This procedure is based on the provisions of paragraph 21 of PBU 6/01, paragraphs 9 and 18 of PBU 10/99.

An example of reflecting in accounting depreciation of fixed assets that are not actually used

One of the activities of Alpha LLC is the hotel business. In March, the organization purchased furniture for a room on the fourth floor at one of the hotels. The cost of the headset is 118,000 rubles. (including VAT – 18,000 rubles). The first reservation for the room was received in May.

For accounting and tax purposes, the useful life of the furniture was set at six years (72 months). According to the accounting policy, depreciation on fixed assets is calculated using the straight-line method.

The accountant calculated the annual depreciation rate for furniture as follows: (1: 6 years) × 100% = 17%.

The monthly depreciation amount was: (RUB 118,000 – RUB 18,000) × 17%: 12 months. = 1417 rub.

In the Alpha working chart of accounts, the following subaccounts are approved for account 01 – “Fixed assets in stock”, “Fixed assets in operation”. To account 02 – “Depreciation of fixed assets in operation”, “Depreciation of fixed assets in inventory”.

The accountant made entries in the accounting.

In March:

Debit 08 Credit 60 – 100,000 rub. (RUB 118,000 – RUB 18,000) – the cost of the purchased furniture set is taken into account;

Debit 19 Credit 60 – 18,000 rub. – input VAT is taken into account on the cost of the purchased furniture set;

Debit 01 subaccount “Fixed assets in stock” Credit 08 – 100,000 rub. – the cost of the purchased furniture set is reflected as part of fixed assets;

Debit 68-2 Credit 19-3 – 18,000 rubles. – accepted for deduction of input VAT on purchased furniture.

In April:

Debit 26 Credit 02 subaccount “Depreciation of fixed assets in inventory” – 1417 rubles. – depreciation was accrued on furniture for April.

In May:

Debit 01 subaccount “Fixed assets in operation” Credit 01 subaccount “Fixed assets in stock” – 100,000 rubles. – the furniture set is transferred to the composition of fixed assets actually used;

Debit 02 subaccount “Depreciation of fixed assets in inventory” Credit 02 subaccount “Depreciation of fixed assets in operation” - 1417 rubles. – the amount of previously accrued depreciation was transferred to the subaccount for accounting for depreciation on fixed assets in operation;

Debit 26 Credit 02 subaccount “Depreciation of fixed assets in operation” – 1417 rubles. – depreciation was accrued on furniture for May.

In tax accounting, the accountant also began calculating depreciation in April.