The absolute liquidity ratio shows what share of current liabilities the company is able to pay off in the short term. For the calculation, you need to use balance sheet information: from assets - the amount of cash and short-term investments, from liabilities - current liabilities. The normal value of the indicator for Russian practice is from 0.2 to 0.5.

When raw materials suppliers consider entering into a contract with a specific manufacturer, they examine the dynamics of its quick ratio. What does such an analysis give them?

The absolute liquidity ratio (Cash ratio - CR) is a financial ratio that is calculated by dividing the amount of cash and short-term financial investments by short-term liabilities.

The basis for determining CR is the balance sheet of the enterprise. It shows suppliers what share of its short-term obligations the manufacturer will be able to cover with its absolutely liquid assets.

Reference! Absolutely liquid assets include cash on hand and in a bank account, demand deposits, and other short-term financial investments. The main criterion is the ability to quickly convert (within a day) into cash.

Cash Ratio shows what percentage of its obligations the company is able to pay off in the short term, that is, it demonstrates its ability to pay for raw materials in cash.

If the current ratio is important for investors, the quick ratio is important for banks, then CR is of decisive importance for resource suppliers.

Formula for calculating the coefficient

The absolute liquidity ratio (Kabl) is a financial indicator that is calculated on the basis of information from the enterprise’s balance sheet - data on cash (item 1250), short-term investments (item 1240) and current liabilities (item 1500).

Cable = (DS + Kfi) / TO, where

Kab – absolute liquidity ratio;

Kfi – short-term financial investments;

DS – cash;

TO – current liabilities.

Analysts recommend subtracting estimated liabilities and future income from current liabilities. In this case, the balance calculation formula takes the following form:

Cable = (st. 1240 + st. 1250) / (st. 1500 – st. 1530 – st. 1540)

Examples of indicator calculation

To understand what role Cable plays in assessing the short-term solvency of a company, you need to give examples of calculating the indicator.

Conclusion. has enough liquid assets to pay off current liabilities in the short term. It is capable of covering up to 30-40% of the claims put forward by creditors almost immediately. However, there is a downward trend in the indicator.

Figure 1. Dynamics of cables of PJSC Vympel Communications in 2014-2016.

The calculations made it possible to establish that the liquidity and solvency of a public corporation are maintained at a level sufficient for stable operation.

Conclusion! The public joint stock company "Novolipetsk Metallurgical Plant" ineffectively forms the structure of assets: there is an excessive amount of funds in the cash register, on the current account and in short-term investments, which makes them vulnerable to inflationary fluctuations. A particularly unfavorable value was observed in 2020: then the corporation could cover 120% of its current liabilities with highly liquid funds.

Differences from current and urgent liquidity

The ratio differs from the mentioned indicators in the composition of assets that can be used to calculate current liabilities.

The key difference is hidden in the word absolute. It takes into account only the most liquid assets.

In contrast, the current ratio is equal to the ratio of all current assets to the amount of debt for a short period.

Calculating the value of short-term liquidity involves dividing the amount of highly and medium-liquid assets by the value of short-term liabilities.

The differences between the indicators are presented in the table.

| Coefficient | Absolute liquidity | Current liquidity | Urgent liquidity |

| Included assets | The most liquid assets, such as short-term financial investments, deposits and cash | All current assets | All assets with high and medium liquidity |

What it is?

The nature of the indicator under consideration is best explained on the basis of ideas about absolute liquidity.

Absolute liquidity is understood as the total value of assets that an organization can easily and quickly use for current payments.

The greatest liquidity is in cash and short-term financial liabilities.

The more there are, the easier it is to solve the problem of current debts.

Therefore, an indicator is needed to study the possibilities of quickly repaying current debt.

The absolute liquidity ratio serves this purpose. It is understood as the ratio of the sum of the most easily used assets to the sum of short-term liabilities.

It is equal to the ratio of the value of cash and short-term investments in relation to the value of liabilities.

Factors influencing the dynamics of the indicator

An enterprise is a complex structure that consists of individual elements. It is constantly evolving under the influence of internal and external factors.

The indicator under study evaluates the ratio of highly liquid assets and short-term liabilities. From this it follows that its value is influenced by everything that determines their value.

Cash turnover is determined by the following:

- duration of the operation cycle;

- seasonality of business;

- terms of investment programs;

- operating leverage indicators;

- financial thinking of owners;

- situation on the commodity market;

- taxation;

- lending to suppliers and recipients;

- features of calculations;

- availability of loans and gratuitous financing.

By balance

A similar formula can be expressed using balance sheet lines:

Cal= p.1240 + p. 1250/s.1510 +s.1520+s.1530

The balance lines indicate the following:

- 1240 - financial investments;

- 1250 – cash;

- 1510 - borrowed funds;

- 1520- accounts payable;

- 1530 - deferred income.

How to calculate the absolute liquidity ratio?

How to calculate the value of the coefficient is clear from its essence and components.

Formula

It is calculated using a formula that can be written in different ways.

The simplest way to express it is like this:

To ab.liq.= Cash + short-term investments/current liabilities

Where K ab.liq. — absolute liquidity ratio.

By balance

A similar formula can be expressed using balance sheet lines:

Cal= p.1240 + p. 1250/s.1510 +s.1520+s.1530

The balance lines indicate the following:

- 1240 - financial investments;

- 1250 – cash;

- 1510 - borrowed funds;

- 1520- accounts payable;

- 1530 - deferred income.

What documents will be required for calculation?

To calculate the ratio, financial statements are usually used - a balance sheet drawn up in Form-1.

Other materials related to accounting operations may also be used.

Interpretation of the result

Analysis of the ratio allows you to assess the solvency of the organization, its problems and prospects.

To do this, some standards or regulations are required, which should be guided by when analyzing solvency.

Normative value

The optimal value is considered to be from 0.2 to 0.5. Other values indicate problems and necessary actions.

If below normal

It talks about the following problems and measures:

- if the value is below the standard range, the company is not able to pay obligations using its most liquid assets;

- if there is a shortage of the above assets, solvency should be analyzed more carefully;

- if the coefficient is 0, then this indicates an extremely critical state of liquid assets - they simply do not exist and the company cannot pay off its debts.

If above normal

An overestimated value of the indicator indicates:

- deviations in capital structure;

- irrational use of highly liquid assets;

- the need to study the use of capital.

What does his height indicate?

Growth indicates a change in the ratio of highly liquid assets and current liabilities in favor of the former.

More specific conclusions are drawn based on changes in the value of assets and liabilities. The company's solvency increases and its ability to make prompt payments increases.

If it has decreased, what does it mean?

A lower value of the indicator compared to the previous period indicates a decrease in funds that can be used to quickly resolve the problems of current debt. Other assets will be needed.

Absolute liquidity ratio (cash coverage) (Cal) [p.47]

Absolute liquidity ratio is the most stringent criterion of solvency, assessing what part of current liabilities can be repaid immediately, [p.48]

The methodology under consideration is based on the indicators that are most informative for the investor (as well as owners and management bodies): return on equity, ownership ratio, absolute liquidity ratio, [p.84]

Let two time intervals TI and T2 be given, which serve as the basis for comparative financial analysis. The enterprise in each period is characterized by a set of X =X],...,X,...,X (i=l,N) financial indicators constructed on the basis of financial statements. Such indicators include the autonomy ratio, intermediate liquidity ratio, absolute liquidity ratio, etc. In the TI period, these indicators have the values XH,...,XIN, in the Tg period - Xl,...-X2m. It is assumed that the system of indicators X is sufficient for reliable financial analysis. [p.382]

K2i - absolute liquidity ratio - (4736-Х 1-Х2-ХЗ- [p.43]

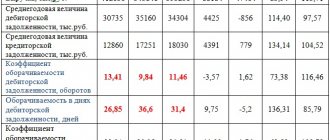

To assess liquidity and solvency in the short term, the following indicators are calculated: the current liquidity ratio, the intermediate liquidity ratio and the absolute liquidity ratio (Table 13.24). [p.310]

Absolute liquidity ratio 0.5 0.34 -0.16 [p.310]

These indicators are of interest not only for the management of the enterprise, but also for external subjects of analysis; the absolute liquidity ratio is of interest for suppliers of raw materials, the quick liquidity ratio for banks, the current liquidity ratio for investors. [p.310]

The absolute liquidity ratio (the rate of cash reserves) is determined by the ratio of cash and short-term financial investments to the total amount of short-term debts of the enterprise. It shows what portion of short-term liabilities can be repaid using available cash. The higher its value, the greater the guarantee of debt repayment. However, even with its small value, an enterprise can always be solvent if it is able to balance and synchronize the inflow and outflow of funds in terms of volume and timing. Therefore, any general standards and recommendations on the level of this indicator [p.310]

Traditionally, calculations begin with determining the absolute liquidity ratio, which is calculated as the ratio of the most liquid assets to the sum of the most urgent liabilities and short-term liabilities (the sum of accounts payable and short-term loans) [p.358]

Absolute liquidity ratio Coverage ratio Intermediate coverage ratio Maneuverability of operating capital Coverage ratio [p.402]

Absolute liquidity ratio - shows what part of the organization's short-term obligations can be immediately repaid using the client's funds. Characterizes the ability of a business entity to mobilize funds to cover short-term debt; the higher this ratio, the more reliable the borrower. [p.402]

Depending on the value of the absolute liquidity ratio, it is customary to distinguish [p.402]

The absolute liquidity (solvency) ratio (kj,,) is the most stringent criterion for the liquidity of an enterprise; it shows what part of short-term borrowed obligations can, if necessary, be repaid immediately from available funds [p.348]

Absolute liquidity ratio 0.17 0.26 0.2 0.38 0.38 5 [p.45]

Absolute liquidity ratio 0.447 0.684 0.526 1 5 [p.46]

Absolute liquidity ratio 0.999 2.339 1.383 5 5 [p.46]

State the procedure for calculating the absolute liquidity ratio based on balance sheet data. [p.273]

What value of the absolute liquidity ratio is optimal [p.276]

Absolute liquidity ratio - 0.2 Inventory coverage ratio SOS - 0.4 [p.279]

What is the procedure for calculating the absolute liquidity ratio [p.280]

Using the Balance Sheet, determine the amount of liquid assets taken into account in calculating the absolute liquidity ratio at the beginning of the year [p.282]

The absolute liquidity ratio, the most stringent criterion of solvency, was almost three times at the beginning of the year and more than 1.5 times less than the recommended values at the end. Based on the results of this analysis, we can say that the company in the near future can repay no more than 13% (A = 0.13) of short-term debt. [p.328]

The first group is liquidity ratios. The absolute liquidity ratio (K) characterizes the organization’s ability to repay current short-term liabilities [p.355]

Absolute liquidity ratio [p.363]

The absolute liquidity ratio increased slightly during the reporting period, which indicates a reduction in the future payment capabilities of the enterprise. [p.302]

The absolute liquidity ratio (the rate of cash reserves) complements the previous indicators. It is determined by the ratio of liquid funds of the first group to the entire amount of short-term debts of the enterprise (III section of the balance sheet liabilities). The higher its value, the greater the guarantee of debt repayment, since for this group of assets there is practically no danger of loss of value in the event of liquidation of the enterprise and there is no time lag for converting them into means of payment. The value of the coefficient is considered sufficient if it is 0.20-0.25. If an enterprise can currently repay all its debts by 20-25%, then its solvency is considered normal. At the analyzed enterprise (Table 24.15), at the beginning of the year the absolute liquidity ratio was 0.32 (5040/15,700), and at the end - 0.25 (5505/22,000), which corresponds to the norm. [p.642]

It should be noted that the level of the absolute liquidity ratio itself is not a sign of poor or good solvency. When assessing its level, it is necessary to take into account the rate of turnover of funds in current assets and the rate of turnover of short-term liabilities. If pla- [p.642]

Absolute liquidity ratio 0.32 0.25 0.25 0.15 [p.653]

Absolute liquidity ratio 0.25 and above -20 0.2-16 0.15-12 0.1-8 0.05-4 Less than 0.05-0 [p.668]

In each class, six coefficients, three liquidity (solvency) coefficients and three financial stability coefficients are subject to a 20-point assessment. The greatest importance is attached to the absolute liquidity ratio, i.e. the ability of the enterprise to pay off all creditors for short-term obligations in the near future, using free cash and quickly salable assets. At the same time, the authors interpret absolute liquidity in a broader way compared to international standards. Quickly realizable assets, according to the authors’ interpretation, are receivables with a maturity date of less than 12 months. Of course, this is a stretch. But in this aspect, to establish the rating, we will accept the proposed classification. The authors consider the value of the absolute liquidity ratio equal to 0.5 to be sufficient for inclusion in class I and evaluate this value with 20 points - the highest rating. [p.41]

Absolute liquidity ratio Shows what part of the current debt can be repaid as of the balance sheet date Cash + Quickly marketable securities [p.165]

A private indicator of solvency includes a) absolute liquidity ratio [p.259]

The absolute liquidity ratio is equal to the ratio of the value of the most liquid assets to the amount of the most urgent liabilities [p.268]

K15 - absolute liquidity ratio (calculated as the ratio of cash to short-term debt). Optimal value > 0.3 [p.539]

The absolute liquidity ratio is calculated as the ratio of absolutely liquid assets to short-term liabilities [p.161]

Absolute liquidity (solvency) ratio. It shows what part of the company’s short-term obligations can be repaid immediately, i.e., at the expense of available funds [p.444]

Based on the described classification of current assets, it is possible to calculate liquidity ratios (indicators of indicators in Table 3.8 are used in the formulas) current liquidity ratio (km), quick liquidity ratio (lb), absolute liquidity ratio (la) [p.299]

The most stringent criterion of solvency is the absolute liquidity ratio, which shows what part of short-term debt obligations can be repaid immediately. There are no more or less reasonable guidelines on the normative value of this coefficient, since cash management, in particular determining the optimal balance of funds in the account and in the cash register, especially in the conditions of the formation of full-blooded market relations, is unlikely to be standardized. Nevertheless, practice shows that the value of cl6 usually varies from 0.05 to 0.15 (this means that on average 10% of current accounts payable should be secured by highly liquid assets)2. [p.300]

The absolute liquidity ratio (Kabsl) is calculated taking into account the most highly liquid assets - cash according to the formula [p.266]

Absolute liquidity ratio 2. Intermediate (critical) liquidity ratio 3. Real critical liquidity ratio 4. Current liquidity ratio 5. Real current liquidity ratio 6. Current assets, thousand rubles. (p. 290) 7. Current liabilities (lines 610 + 620 + 630 + 660) 8. Absolute excess (+) or failure to cover (-) short-term liabilities with current assets (clause 6 - clause 7) 00 (A 492 + 7076 314 + 10341 +0.055 +0.07 +0.071 [p.233]