Registration of receipt order m 4 example of filling – ExpertZakona

Among the primary reporting documents that certify the receipt of goods and raw materials at the organization's warehouse, the receipt order is the main one. The M-4 document form is established by the State Statistics Committee, therefore documentation is maintained only according to the approved form, which is presented below.

Form M-4 receipt order (word)

Sample of filling out a receipt order M-4 (word)

2020 sample

This year, the form of the document has not changed at all compared to the previous year. An order in form M-4 is drawn up as shown in the figure:

- The document number is written (in the center).

- Then - the full name of the organization, as well as the structural unit.

- The corresponding OKPO code is written in the right corner.

- In the first table, all columns are filled in - date of arrival, code, warehouse number, information about the supplier and insurance company, the corresponding account, as well as the numbers of the accompanying and payment documents.

- The main table indicates all the data about the arrived product - name, how many pieces, amount with and without VAT, total amount.

- All empty lines are crossed out.

A detailed explanation of all columns is presented in the table.

| column name | filling rules |

| name of the company or structural unit | The full name of the company or individual entrepreneur at whose disposal the relevant goods or raw materials for production was received is indicated. It is important to indicate the name in full, as it appears in official documents, for example Limited Liability Company “Proxy” or Individual Entrepreneur Alexander Pavlovich Bondarenko. In the structural unit column we mean the internal department of the enterprise. Usually it is written as “warehouse”. |

| supplier information | The name of the supplier is written here as it is specified in the contract (abbreviations IP, LLC, etc. are allowed). Document numbers are transferred from the payment and accompanying document respectively. |

| account information | Details of the bank account on the basis of which funds are credited are provided. Accounting entries are also made for the same account. |

| information about goods received from the supplier | Basic information is a complete list of information about goods, raw materials, semi-finished products and other valuables that were received from the supplier. Enter the number, full name, parameters, grade, brand, in what units the goods are measured, and the quantity in these units. The cost per unit is indicated, which must exactly correspond to the contract. The cost without VAT is given, then the VAT itself for each product, after which the total cost is filled in. It is the receiving party that sends it to the supplier. |

| code by type of operation | This option does not always fit. It should be recorded only if the company has installed a special classifier that takes into account various business transactions. If this document is not maintained, it is permissible to simply put a dash. |

| supplier code | Here the situation is the opposite. This code is affixed in accordance with the classification of business transactions adopted by the organization that supplied the goods or raw materials. If such a document is not maintained, a dash is again added. |

| Insurance Company | In some cases, the supplier or receiving party insures the goods against various risks. Accordingly, in this case you need to write the full name of the insurance company, as it is indicated in the contract. If the goods were not insured, a dash is placed. |

| number of the accompanying document | In most cases, the accompanying document is the invoice for the goods. This can be either the actual invoice for the goods, or a consignment note, which, among other things, provides information about the delivery route. In this column you only need to enter the invoice number |

| payment document number | The document number confirming the fact of payment is indicated here. This is an order or requirement. |

| column 12 | The card number is entered in accordance with how it is described in form M-17 |

If precious metals and/or products made from them are being accepted, column 11 is also filled out in the table, which indicates the number of the technical passport for each unit of goods.

The form and example of a completed receipt order are presented below.

NOTE. The accountant is not required to print out the receipt order. It’s enough to simply compose it in the 1C program. You can do without a paper form of the document if acceptance and posting are formalized on the invoice or invoice of the supplier of the goods. A stamp is placed and its details are filled in, which are considered an analogue of the receipt.

Purpose

Issued to confirm all transactions related to the receipt of goods from the supplier, as well as materials subsequently used for the production of products. In accounting, it is determined that it is the receipt order that represents the main document, which reflects the fact of acceptance of goods for subsequent warehouse accounting.

At the same time, a receipt is issued in all cases when they receive:

- the actual product;

- raw materials for production processes;

- semi-finished products for further sale and/or use in production, as well as food preparation.

Along with this appointment, the receiver plays a big role in the case of registering goods for storage in a warehouse. It is on the basis of the data in this document that a material storage record card is compiled (form M-17 is approved by law).

Moreover, if goods or raw materials, technical materials are purchased, which will later be used for production purposes, then the receipt order is the only primary reporting document that confirms the fact of receipt.

Registration deadlines

There are cases of large volume deliveries of goods during the day. The legislation allows you to draw up one receipt document, and enter all goods into it as they are received until the end of the working day. However, these must be homogeneous goods (for example, raw materials or semi-finished products of a certain group).

NOTE. The order is issued only on the day the goods or raw materials arrive. Accordingly, it must be drawn up upon receipt before the end of working hours.

Thus, an order must be drawn up only in the event of further use of goods and raw materials for the production of new products . And if the company is engaged in their sale, then it is enough to simply use the invoices for the goods and affix the organization’s stamp.

Who can sign the document

Certification of the order with the signature of an authorized person is a mandatory requirement. Moreover, the signature of the financially responsible employee who has the right to accept the goods is affixed. If such a person is absent, the authority is transferred to another employee. In case of a long absence (business trip, vacation, etc.), a power of attorney may be drawn up to perform such actions.

The document is considered finally accepted after the signature is placed. Accordingly, no corrections can be made to it after this. And at the time of signing, all empty columns must be crossed out. Even small amendments will lead to the order becoming invalid, so a new one will have to be drawn up.

After this, the operation is reflected in the accounting documents, and the document itself is sent to the archive and is provided only at the request of the inspectors.

link:

Source: https://expertzak.ru/oformlenie-prihodnogo-ordera-m-4-prime.html

We come to the MPZ based on TORG-12 supplier

Let us say right away that it is not necessary to issue an M-4 receipt order for each delivery. After all, it is just an internal warehouse accounting document. Its presence is only an element of the document flow procedure adopted in the organization.

And its absence will not affect tax accounting in any way (for the purposes of income tax, VAT, tax under the simplified tax system), of course, if the inventories are accepted for accounting on the basis of any other documents. In particular, the consignment note itself in form No. TORG-12, according to which the goods were received, can act as such a receipt document. 47, 49 Instructions No. 119n.

In the TORG-12 consignment note received from the supplier, in the line “The cargo was received by the consignee,” the warehouseman must put his position, surname and signature. Instructions for the use and completion of forms of primary accounting documentation for recording trade operations, approved. Resolution of the State Statistics Committee dated December 25, 1998 No. 132.

Receipt order (form M-4). how to fill out in 2020 – Accounting

December 22, 2020 Materials

The receipt order form M-4 is filled out when materials arrive at the warehouse from the supplier. The order is filled out by the warehouse worker who accepted the valuables.

At the end of the day, the document is transferred to the accounting department and serves as the basis for making a credit entry in the materials accounting card M-17.

The receipt order form has a standard unified form M-4.

Fill it out in a single copy on the day the materials are received.

As an example, we filled out the M-4 order; you can fill it out using the link at the end of the article.

If several batches of materials are received from the same supplier during the day, then they can all be entered into one receipt order.

Sample filling

In the receipt order form M-4, you must indicate the name of the organization that received the materials, as well as the name of the structural unit in which the valuables will be listed (warehouse).

The form contains two tables that reflect all information about supplies and materials.

The first table indicates:

- date, month and year of filling out form M-4;

- if the operation is assigned a code, it must be written down;

- in the warehouse column write its number or name, meaning the warehouse to which the materials are received;

- for the supplier you need to indicate the name and code, if assigned to it;

- the insurance company must be indicated if the cargo is insured;

- the corresponding account will be filled out by the accountant at the time of posting for the posting of valuables;

- number of the document accompanying the materials;

- payment document number if the valuables have already been paid by the buyer.

The following table of the M-4 receipt order is intended to reflect information about material assets:

- name of values;

- nomenclature number assigned to this name of materials;

- unit of measurement;

- quantity indicated in the accompanying documents;

- the quantity actually accepted by the storekeeper;

- price in rubles and kopecks, according to accompanying documents;

- total position amount excluding tax;

- the amount of VAT, if applicable;

- total position amount including tax;

- passport number, if the materials have one (if they contain precious metals);

- the serial number assigned to this name of materials in the warehouse card file.

Each name of material assets received at the warehouse must be entered into the receipt order table; based on the results of the completed M-4 form, the final value of the accepted quantity and amount is displayed.

The receipt order is signed by a representative of the transferring and receiving parties.

How to fill out a receipt order on form M-4?

To ensure that the management of the company and supervisory authorities do not have questions regarding the availability and consumption of goods and materials received by the company under purchase or sale agreements, the accounting department of the organization must issue receipt orders in the M-4 form.

This article discusses the features of using and filling out documents of this type.

What it is?

According to Article 9, Article 129 of the Federal Law, adopted on November 21, 1996, all business transactions carried out by the company must be formalized by drawing up primary documents. If an organization purchases materials used to produce goods, the primary document can only be a receipt order.

Legislative bodies are less strict about the acceptance of goods: to put them on the balance sheet, an invoice from the supplier with all the necessary stamps is enough. However, if the company purchasing the goods is engaged in more than just trading activities, drawing up an order is a mandatory operation.

The document is a list of materials or goods shipped by the supplier and accepted by the buyer after carrying out all the procedures established by the contract.

Its form is determined independently by management or the financially responsible person, however, if a document is drawn up according to a model that does not correspond to the previously adopted basic document, it may be declared invalid.

If there are no orders for materials in the enterprise’s document database, employees of the Federal Tax Service have the right not only to bring charges against management and the accounting service for non-compliance with certain provisions of the law, but also to withhold input value added tax from the company.

You can watch the generation of documentation in a specialized program in the following video:

Who fills out the document and when?

According to current legislation, the M4 form must be filled out by the financially responsible person responsible for accepting materials for production, strictly on the same day when the materials or goods were accepted by the customer and shipped to the warehouse.

The order must exist strictly in a single copy (copying the document is not allowed). If the supplier has shipped several batches of the same type of goods or materials in one day, the law allows the accounting service of the customer company to issue one document for the entire batch.

Rules and procedure for filling out

The form should include the following sections:

- Name of the organization and structural unit. At the top of the form, enter the name of the company that received the materials or goods into ownership; the “structural unit” column is also filled in (data about the unit that will be responsible for the posting of received objects is entered here).

- Information about the parties to the agreement. In the first table, the financially responsible person must enter information about the supplier of materials or services (code, name) and the insurance company (if there is one), indicate the numbers of accompanying and payment documents.

- Bank account information. The accountant must enter in a special column information about the account on the debit or credit of which transactions are made related to the entry of new property onto the balance sheet.

- Information about the purchased product. The second table consists entirely of quantitative and descriptive characteristics of the material arriving at the customer’s warehouse: in the first column you should indicate the item number of the material, its name, grade, brand and size;

- in the second - the unit of measurement;

- in the third - the number of accepted units of material or goods;

- further indicates the price for one unit established by the contract, the total cost excluding VAT, the amount of VAT and the final price that the customer company undertakes to transfer to the supplier.

Here you can find a free document and a sample of how to fill it out

If, according to a receipt order, the customer accepts precious stones and materials for balance, one more paragraph must be added to the document, in which the number under which the technical passport for each product is registered should be indicated.

When filling out a document for products or materials, you must remember that only the financially responsible person directly involved in the acceptance of the goods can sign. Making changes to the points of the form after signing is not allowed; it must be sent to the archive before being requested by the tax authorities.

If the supplier, along with the goods or materials, provides documents containing comprehensive information about the transferred property, it is allowed to replace the order with a stamp on the provided accompanying papers, the imprint of which must be filled in with the same details as in the M-4 form.

Source:

Receipt order M-4

Receipt order M-4 is the primary document confirming the receipt of goods and materials into the warehouse. Let's figure out when the M-4 form is used and consider an example of filling out an M4 receipt order. Here you can in excel.

Read in the article:

A receipt order in form M 4 is issued at the time of capitalization of inventory items coming from the counterparty or from processing. But at the same time, the quantity and quality of materials must be identical to the information given in the shipping documents.

As a rule, a receipt order M4 is issued for each delivery. But there are also cases where you can issue one order to receive several items of inventory and materials. Such cases include admission:

- Inventory and materials from one supplier using one invoice;

- homogeneous materials from one supplier using different invoices within one day.

Receipt order M 4 is drawn up in one copy by warehouse workers. The warehouseman and the person who delivered the goods and materials to the warehouse (in particular, the forwarder or driver) put their signatures on the document.

After filling out the M4 form, it is sent to the accounting department along with other shipping documents.

How to fill out a receipt order using form M-4

Goskomstat approved this form on October 30, 1997 by resolution No. 71a. Currently it is advisory in nature. The company has the right to develop and approve its own receipt order form. Moreover, its application must be reflected in the accounting policies.

Receipt order M4

- Receipt order M4 form download in excel

The document consists of a header, two tables with columns on the outside and a table on the back with totals.

In the header, indicate the document number according to the internal document flow, the name of the company that accepted the goods and its legal form, OKPO code and the structural unit that issued the order.

In the first table, indicate the date of receipt of inventory items, transaction type code, warehouse name, supplier name and code; an insurance company if you insure the cargo, corresponding accounts for accounting and analytical accounting, as well as the numbers of the accompanying and payment documents.

In columns where information is missing and is not required, put dashes.

Quote: Instead of a receipt order, you can issue a stamp. This will reduce document flow in the company. Read about it below.

The procedure for filling out the columns in the second table is given below.

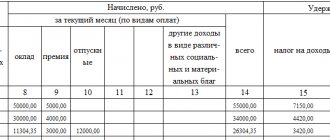

Table 1. Filling out the columns of the M-4 receipt order

| Column number | Content |

| 1 | name, grade, size of goods and materials |

| 2 | item number of goods and materials |

| 3,4 | units |

| 5,6 | quantity of goods and materials according to shipping documents in accordance with the actual |

| 7 | unit cost excluding VAT |

| 8 | total amount for goods and materials excluding VAT |

| 9 | total VAT amount |

| 10 | total amount for inventory items including VAT by line |

| 11 | number of the passport attached to goods and materials containing stones and precious materials. If absent, put a dash |

| 12 | serial number according to the warehouse card index cards |

The reverse side shows the total: the total number of goods and materials, the cost together and without VAT, the amount of VAT.

Sample of filling out a receipt order M4

For form M 4 “Receipt order” the sample filling is as follows. You can download it.

Sample of filling out a receipt order

Stamp instead of a receipt order

Receipt order M4 does not need to be issued. Replace it with a stamp to reduce paperwork. They put it directly on the supplier’s documents.

The stamp must contain all the necessary details. Enshrine its use in your accounting policies.

Sample stamp that replaces the M-4 form

Source:

Receipt order M 4

Despite the entry into force of Law No. 402-FZ “On Accounting,” forms of primary documentation that were previously considered unified and mandatory for use remain in demand to this day.

One of these forms is the M4 receipt order (hereinafter referred to as the M-4 order). It is actively used by small businesses to account for received materials. Moreover, Law No. 402-FZ itself does not prohibit doing this.

What kind of document is this?

and a sample of filling out a receipt order M4.

First of all, the form of this receipt order was approved by the State Statistics Committee of the Russian Federation in Resolution No. 71a of October 30, 1997. Today it is not mandatory for use, but its use is not prohibited by law.

In order to safely use the specified document for accounting purposes, you only need to approve it in the Accounting Policy.

This document formalizes the registration of materials that arrived at the enterprise from suppliers or from processing.

It is worth noting that this form is used only when receiving materials for which there are no claims to their qualitative or quantitative content, i.e.

if the actual data corresponds to the documents from the supplier. This is stated in paragraph 49 of the Methodological Instructions of the Ministry of Finance of the Russian Federation (order No. 119n dated December 28, 2001).

Order M-4 serves as the basis for warehouse, tax and accounting of materials. In particular, in paragraph

Source: https://buchgalterman.ru/blanki/prihodnyj-order-forma-m-4-kak-zapolnit-v-2018.html

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

Standard intersectoral form No. M-4

Approved by a resolution of the State Statistics Committee of Russia

dated 10.30.97 No. 71a

Receipt order M 4

Despite the entry into force of Law No. 402-FZ “On Accounting,” forms of primary documentation that were previously considered unified and mandatory for use remain in demand to this day.

One of these forms is the M4 receipt order (hereinafter referred to as the M-4 order). It is actively used by small businesses to account for received materials. Moreover, Law No. 402-FZ itself does not prohibit doing this.

Application of this order

As stated earlier, receipt order M4 is used to register materials, which include:

- various raw materials;

- purchased semi-finished products;

- materials (basic and auxiliary);

- components and spare parts;

- fuel and containers;

- construction materials, and other similar assets, which, on the basis of PBU No. 5/01 “Accounting for inventories”, are recognized as materials.

However, form M-4 is used not only when materials are received by an enterprise from a supplier (i.e., under sales and purchase agreements, exchange, and for other reasons) or from processing.

With the help of such a receipt order assets are registered that:

- received as a contribution from the founders to the authorized capital;

- joined the organization free of charge;

- purchased by an accountable person;

- manufactured in-house;

- identified during the audit as surplus, etc.

In other words, for any reason for the receipt of materials, an M-4 order must always be issued! But only if there are no discrepancies in their quality and quantity.

As for the application of this document at enterprises, it can be used by legal entities of any form of ownership and legal form, including budgetary structures. But entrepreneurs decide for themselves whether to use the M-4 order in accounting or not.

The fact is that Resolution of the State Statistics Committee of the Russian Federation No. 71a dated October 30, 1997. applies only to organizations. This normative act does not apply to entrepreneurs.

But if they decide to use the document to simplify tax accounting or for warehouse accounting purposes, then they should approve the use of the specified form in the Order.

If you have not yet registered an organization, then the easiest way is

This can be done using online services that will help you generate all the necessary documents for free:

- for individual entrepreneur registration

- LLC registration

If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue, which will completely replace an accountant in your company and save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online.

- Accounting for individual entrepreneurs

- Bookkeeping for LLC

It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO. Everything happens in a few clicks, without queues and stress. Try it and you will be surprised

how easy it has become!

General provisions for registration

First of all, the specified document is filled out in one copy by the person responsible for receiving materials and then transferred to the accounting department for further accounting of assets along with the documents accompanying them. And for the purposes of warehouse accounting, an accounting card is opened for received materials, which reflects all incoming and outgoing transactions for this asset.

The documents received by the accounting department are checked and if there are no disagreements, the appropriate entries :

D account 10 “Materials” (if accounting is carried out directly through this account) To account. 71 “Settlements with accountable persons”, account 60 “Settlements with suppliers”, etc. – depending on the reason for the receipt of assets.

is signed by the person accepting the materials and the person handing them over.

The document is drawn up on the day the materials are received or within other deadlines that are provided directly at the enterprise, but no later than the deadlines established by current legislation.

In case of receipt of homogeneous shipments that arrive from the same supplier several times during the day, it is allowed to draw up a general receipt order M-4 for all such deliveries that took place on that day. But at the same time, for each separately received batch of such materials, notes are made on the back of the M-4 form.

At the end of the day, these entries are all checked, counted, and a total is derived from them, which is now entered into the receipt order.

It is worth noting that instead of an M4 order, a stamp may be affixed . It is placed on any document accompanying the materials (on an invoice, invoice, etc.) and is equal in its force and consequences for the accounting process to a receipt order.

However, such a stamp can replace an M4 order only on the condition that:

- it contains all the details of the receipt order;

- all these details must be filled out;

- the stamp must bear the next number of the M-4 form.

At the same time, current legislation does not prohibit the simultaneous use of both such a stamp and an M-4 order at an enterprise.

If during the delivery of materials discrepancies with the supplier’s data were found, then instead of a receipt order, an act of form M-7 is drawn up.

Step-by-step filling instructions

Upon receipt of materials, the materially responsible person (hereinafter referred to as the storekeeper) issues a receipt order, indicating:

- serial number of the form and the date of its preparation;

- name of the organization and department receiving the materials;

- Next, indicate the name of the supplier and, if available, the insurance company. The insurance company is indicated only when the cargo is insured. Otherwise, either a dash is placed in this column, or it remains empty;

- As for encodings - “Operation code”, “Supplier code”, etc. - these columns are rarely filled in by representatives of small businesses, since they usually do not approve the internal classifier of such codes. Therefore, in these columns they either make a dash or leave them empty;

- then the storekeeper enters the number of the accompanying document in the column of the same name. The data is taken from the invoice.

As soon as filling out this tabular part of the order is completed, the storekeeper proceeds to the descriptive part :

- the exact name of the received materials, its grade and other characteristics are taken from the accompanying documents - certificates, etc.

- the item number is indicated either by the accounting department based on analytical accounting data, or by the storekeeper - according to warehouse accounting data;

- the code and name of the unit of measurement of materials can be taken from the All-Russian Classifier of Units of Measurement. And the units themselves are initially indicated in the invoices for materials;

- The quantity of materials received is recorded in fact and simultaneously according to the supplier’s documents. The indicated numbers must match;

- all cost indicators are also taken from the accompanying documents. First, the price per unit is indicated, excluding VAT, and then the cost of the entire delivery is indicated, also excluding VAT. Further, VAT on the entire delivery and the total cost of the shipment together with tax are indicated separately;

- in the column “Passport number” the details of this document are written only when delivering materials that contain stones or precious metals. Such a delivery is usually accompanied by a passport;

- in the column “Order number according to the warehouse card file” the number of the M17 accounting card, which is registered for this type of materials, is indicated.

All these columns are filled in in one document for several types of materials, if they were received by the enterprise under one invoice. That is why at the end, on the reverse side of the M4 receipt order, the total is summarized only by cost indicators.

If materials were received using different invoices, then a separate receipt order is created for each delivery.

The exception is delivery made during the day, of homogeneous goods and from one supplier. In this case, a general receipt order is issued.

As for such columns as “Corresponding account” and “Payment document number”, they are usually filled out by the accounting department based on its data.

The order is signed by the storekeeper and by the one who brought the materials from the supplier, from processing, or hands them over to the warehouse upon receipt for other reasons.

Step-by-step instructions for registering a receipt order in 1C are presented in the following video lesson:

Source: https://www.DelaSuper.ru/view_post.php?id=10956

Features of the design of the M-15 consignment note

M-15 for the release of materials to third parties. It is also compiled when transferring customer-supplied raw materials for processing. Invoice M-15 for outsourcing of materials: form (Excel) Write out form M-15 in two copies. Based on one, materials are released from the warehouse, the second is transferred to the recipient. You can find a free M-15 invoice in excel below. Fill out your details, save and then simply enter information about the products - you will save time. forms M-15: Excel Get the form for free! Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

A password to access the service will be sent to this address. By registering in the MyWarehouse service, you accept the terms of the offer agreement.

Invoice m-15 for the release of materials to the side

Here is their total price.

- Column 10 contains the price excluding VAT.

- Column 11 contains data on allocated VAT.

- Column 12 - total cost of materials including VAT (i.e. the amount from the previous columns).

- Column 13 includes the materials inventory number.

- Column 14 indicates the material passport number (if any).

- Column 15 contains the entry number on the warehouse registration card.

After filling out the table below, you need to indicate in words the data on the quantity of materials released from the warehouse, as well as their full cost and VAT. Finally, the invoice must be signed by the accountant, the employees responsible for the release of materials from the warehouse, and the recipient.