First page design

- First of all, on the title page you must indicate the full name of the enterprise (in accordance with the registration documents), as well as the structural unit for which the statement is being drawn up (if there is one).

- Next, you need to enter the code according to the general classification of organizations and the number 70 in the “Corresponding account” column.

- Then the validity period of this statement is indicated, which must be at least 5 days from the moment of its signing (Regulation of the Bank of Russia No. 373-P dated 10/12/2011).

- It is imperative that the total amount accrued to employees for the calculated period be entered in the corresponding line of the first page of the payroll, both in digital and written form.

- After this, you must indicate the date of preparation of the payroll, as well as its serial number according to the internal document flow.

- The last thing that needs to be written on the title page of Form T-53 is the period for which the payment is made. Here you need to indicate specific dates.

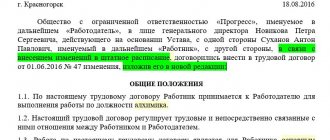

Now visually:

Filling out the cover page of the payroll (T-53)

The name of the organization is indicated on the title page. If the salary is issued to a specific structural unit of the organization, then its name is indicated in the next line. If wages are paid to the enterprise as a whole, then we put a dash.

The corresponding account is the account for accounting of settlements with personnel for wages - account 70.

Next, you need to indicate the period for which funds for the payment of salaries are cashed from the current account. Cash in excess of the established limit cannot be stored at the cash desk; in the evening all cash must be deposited at the bank. The exception is funds cashed for payment of salaries; they can be stored for 3 days, including the day they are received at the bank. Therefore, in the line “to the cashier for payment from.. to..” you need to indicate a three-day period, starting from the day the money is received at the bank.

Next, indicate the total amount of wages, in words and figures; serial number of the statement and date of preparation. The month for which wages must be paid is written as the billing period.

Filling out the second sheet

The size of the payroll directly depends on the number of employees working at the enterprise - the more there are, the longer this document will be. The number of payroll sheets must be indicated in the appropriate column.

- The first column of the main table of the statement is reserved for the serial numbering of employees.

- The second is for entering a personnel number (this data is stored in the personal cards of the organization’s employees).

- The third contains the full names of the salary recipients (it is better, in order to avoid possible confusion, to do this with a full decoding of the name and patronymic).

- In the fourth column, the enterprise accountant enters the amount of funds accrued for disbursement for each individual person (in numbers).

- In the fifth column, each employee must sign for receipt of wages.

- The sixth column is intended for entering references to documents for cash settlements (this could be powers of attorney, statements from employees, etc.) If there are no separate notes on employees, then this column can be crossed out.

In the line below the table, you must once again indicate in numbers and in words the total amount of funds accrued for issuance

Sample of filling out a payroll slip

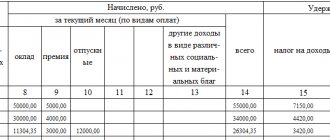

Initial data on working days, salaries and other payments of employees of LLC "Company" for August 2020:

| FULL NAME. | Days worked | Vacation, days | Salary according to employment contract | Bonus by order | Vacation pay |

| Ivanov I.I. | 23 | 50 000 | 5000 | ||

| Petrova P.P. | 23 | 30 000 | 4000 | ||

| Semenova S.S. | 13 | 10 | 20 000 | 3000 | 12 000 |

According to the schedule in August there are 23 working days. All employees pay personal income tax at a rate of 13%, there are no other deductions.

Let's fill in the document details.

We will calculate your salary and calculate the amount of tax to be withheld.

After calculating the amounts to be paid, the director of the company must make a record of transferring the statement to the cash desk for issuing funds to employees.

Having received the due salary, each employee signs next to his last name in the appropriate line.

Upon completion of the payment of the salary, at the end of the document the cashier will make a note about the amounts paid and put his signature. Since all employees received salaries, no record is made of the amounts deposited. After the check, the accountant also puts his signature confirming that all entries in the payroll sheet are correct

Director's visa on form T-53

Without the signature of the head of the company, the T-53 payroll will not be considered valid, therefore, after filling out all its points and before transferring it to the cashier for issuing wages, the company’s accountant is obliged to submit it to the director for signature.

And one more signature will need to be placed after all funds have been paid to employees. The chief accountant of the enterprise will have to check the payroll and, if there are no violations, also sign it.

Payroll slip

The unified form of the form is approved by Order of the Ministry of Finance of the Russian Federation No. 52. It has a special OKUD code 0504402.

The form is drawn up monthly and contains information about all accruals in favor of employees for the billing month. The sample salary slip reflects not only the official salary calculated on the basis of the time actually worked, but also all additional payments, compensations and payments due as remuneration for work. For example, bonuses, additional payments for night shifts, part-time payments and other types of payments.

To calculate wages and reflect them in the income statement, the following accounting documents are used:

- Management orders (on enrollment, dismissal, transfer, vacations, substitutions, etc.).

- Time sheets.

- Tariff rates, official salaries, unified tariffs according to the staffing table.

- Sick leaves, certificates from medical institutions, calculation notes for vacations or upon dismissal.

- Other similar documents.

In simple terms, RV is used for payroll. The accountant reflects the amounts due to a specific employee in the billing period for the time actually worked, taking into account the official salary or tariff rate.

Corrections in payroll

In general, according to the rules for filling out a payroll form T-53, the cashier, before starting to issue funds on the payroll, is obliged to check whether everything in it is drawn up correctly.

If any errors are found, then this document must be returned to the accounting department for revision.

But sometimes situations arise when, for some reason, it is no longer possible to reissue the payroll. In this case, inaccurate information must be carefully crossed out, the correct information must be written on top, and the correction must be certified by the signatures of all the same employees who signed the initial version of the statement. Here you need to indicate the date of correction. If everything is done in accordance with these recommendations, the document will not lose its legal force.

What is a payroll slip?

The salary slip (form T-53), registered in OKUD under No. 03010111, is recommended by the fiscal authorities for registration when issuing wages to employees.

The payroll statement, filled out by the accountant and signed by the director, is handed over to the cashier to issue cash to the employees of the enterprise according to the list specified in it. The salary slip, the form of which may consist of several pages (depending on the number of employees), is issued for a period usually not exceeding three days. After this period is completed, the T 53 salary sheet (which should be downloaded in advance) is closed by the cashier and handed over to the accountant for verification.

A step-by-step algorithm for processing the payment of wages from the cash register is described in the Ready-made solution from ConsultantPlus. Get free access and go to the material.

The pay slip differs from the pay slip in that it only indicates the amount to be paid, i.e. already minus the necessary deductions. When receiving funds, each employee signs in a specially designated column. If for some reason the employee indicated on the list does not receive the amount due, then the cashier writes an o next to his name in the “signature” column - these funds will be returned back to the cash desk.

See also the article “Primary document: requirements for the form and the consequences of its violation” .

Salary statements of sample T-53 are registered in a special journal, which is maintained throughout the calendar year, and then stored in the company for 5 years. Each statement has a serial number by which this primary cash document is recorded in the journal.

Do you have any questions about payroll calculations or primary documentation that is requested by the inspection authorities to confirm its calculation? Go to our forum and ask them! For example, using this thread you can clarify what documents must be used to confirm the payment of wages in cash, as well as those transferred to employee cards.

How to close a payroll

This stage is the final one. After the payroll has expired (five days), the cashier must formalize its closure. Moreover, this must be done even if wages were not issued to all employees. To close the statement you need:

- Write the word “deposited” opposite the names of those employees who did not receive the money due to them according to this statement;

- Count the funds issued and those that were deposited. Enter this information on the last sheet of the statement;

- Confirm the statement with a signature;

- Write out a cash order. In it you need to write the amount of funds issued, then enter the order number in the statement.

After this entire procedure has been completed, the statement must be submitted again to the accounting department.

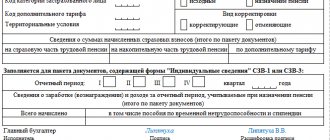

Filling procedure

It can be compiled in either paper or electronic form. The electronic payment document must be signed with an electronic signature. The filling procedure is regulated by Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014.

Next, we will tell you how the salary sheet is formed; you were able to download the form earlier.

First of all, the title page is filled out: all organizational details of the institution are indicated (name, INN/KPP, OKPO). It is also necessary to indicate the total amount paid, indicate the billing period, number and date of the PO. The head and chief accountant put their signatures in the title part.

The tabular part is formed from the following information data:

- serial number;

- employee position;

- Personnel Number;

- FULL NAME.;

- salary (rate) according to the tariff;

- the amount of time worked according to the time sheet;

- deductions and accruals carried out for each employee;

- signature column.

The bottom lines indicate the total amounts for all employees: how much money was paid and how much was deposited. It is also noted who made the salary payment, the name and initials of the responsible employee - the accountant, as well as the date of verification of the payment document.

The terms for issuing funds are limited - no more than five working days. In the event that the employee has not received wages within the specified period, the amount is deposited, and the corresponding mark is placed in the notice.