What are accounting entries

Accounting is an important part of a company's operations. And in order to keep records correctly, there are certain rules by which this must be done, namely with the help of records (account postings). That is, accounting entries are entries in accounting documentation (in a special electronic system or in writing) that reflect changes in the state of the company’s accounting assets. This record is a detailed description of the debited or credited object (records quantitative changes). Objects can be either monetary units or any other objects, goods, services, etc.

The very first accounting entry of a company when it is just being created is the accounting of the authorized capital. And accordingly, until the authorized capital is fully contributed by the founders, they will have a debt or, more correctly, accounts receivable. So, according to the rules, when making an entry in the accounting documentation - a posting, you need to simultaneously indicate:

- Account debit

- Account credit

- Amount

That is, the posting enters information into accounting for two accounts at once: debit and credit, but only one amount is indicated.

How is the purchase of services reflected in the enterprise?

Along with the purchase of goods, each enterprise constantly purchases services. These acquisitions do not have clearly defined material properties. They represent the actions necessary for the full functioning of all departments of the enterprise.

For example:

- Notary Services,

- office service,

- employee training,

- legal and audit services,

- and etc.

Example of receipt of services from a supplier in accounting

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.02 | Transfer of payment for services provided | Prepayment amount | Bank statement or payment order | |

| 44.01, 20.01, , , | 60.01 | Reflection of services | Cost of services excluding VAT | Certificate of completion |

| 19.03 | 60.01 | Allocation of VAT from the cost of services | VAT amount | Invoice, act of completed work, Purchase Book |

| 68.02 | 19.03 | Transfer of VAT amount for refund | VAT amount | Invoice, work completion certificate, Purchase Book |

| 60.01 | 60.02 | Offset of prepayment | Prepayment amount | Accounting information |

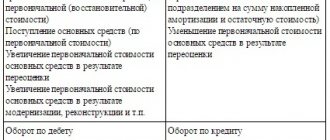

List of typical accounting entries

- Fixed Asset Accounting

- Accounting for authorized capital

- Accounting for rental transactions

- Cash accounting

- Accounting for taxes and fees

- Accounting for settlements with personnel

- Accounting for claims settlements

- Accounting for intangible assets

- Accounting for reserves for future expenses

- Accounting for deferred expenses

- Accounting for deferred income

- Closing financial performance accounts

- Off-balance sheet accounting

Order or contact us by phone 8 (499) 503-11-90

Sales of services: postings

The main difference between accounting for the sale of services and the sale of inventory items is the fact that the service is accepted at the time of its provision. In this case, the costs of its implementation are generated in production accounts (, ,) and transferred to the debit of the account. 90 on the date of provision without generating amounts on separate accounts, as, for example, when accounting for sales of inventory items on an account. ,:

| Operations | D/t | K/t |

| Revenue from the provision of services is reflected | 62 | 90/1 |

| The cost of the service has been written off | 90/2 | 20, 23, 29 |

| VAT on the cost of the service provided | 90/3 | 68 |

| Costs associated with performing the service are written off | 90/5 | 44 |

| Payment received | 51 | 62 |

When is it necessary to order the service of accounting entries?

As we have already written, accounting is an important aspect of the life of an organization, and, therefore, the obligation to make entries in the accounting documentation (entries). However, not every company (especially a new one) can boast of having a competent accountant who would properly conduct accounting. A similar situation can happen with an already existing company, for example, in connection with the change of an accountant and, as a consequence, his temporary absence; due to a reduction in personnel costs and outsourcing of accounting and for many other reasons.

Therefore, an organization may need accounting from a third-party firm that provides accounting entry services. provides clients with a full range of services for maintaining and setting up accounting records, which includes accounting entries. You can order the service of accounting entries only in the accounting complex.

Rasobi-Audit LLC has been providing accounting services to its clients for more than one year, because the company’s accountants have professionalism and many years of experience in the field of accounting. Our company will be happy to take care of all your worries regarding accounting. Trust your finances only to professionals!

Payroll accounting - minimum theory

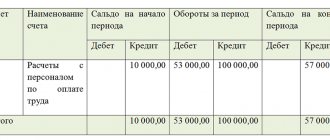

The payroll accounting account is accounting account 70 “Settlements with personnel for wages” . We will start by presenting the entire process of the payroll section in the following form:

- An employee works at the enterprise, performing his functions in accordance with his job description. And the company pays for the employee’s work

- The company pays monthly salaries to employees

- The company issues wages to the employee.

By this point, we already know the term payroll - this is the wage fund, which is the sum of all accruals for employees. It is customary to understand the term payroll as the sum of all employee accruals for the month. However, nothing prevents you from telling your payroll for six months or a year. Or the payroll of all sales representatives, accountants, and administrative staff.

The work of the payroll accounting section consists of two steps:

- Documentation of personnel information for employees: hiring and dismissal, vacation orders, registration of sick leave, absenteeism, all sorts of bonuses, assistance, etc.

- Direct calculation and payment of wages with printing of the results on: payslips, payroll and payroll.

To issue wages, a cash desk will be used if wages are issued in cash, or a bank if wages are transferred to people’s cards.

An employee's income is subject to tax. This tax is called “Individual Income Tax” (NDFL). Currently, this tax is considered a percentage of accrued wages and is 13%. The amount of calculated personal income tax is withheld by the company from the employee’s salary, thereby reducing the amount of money to be issued.

Wages were calculated - 10,000 rubles. Personal income tax of 13% of the accrued amount will be equal to 1300 rubles. “In hand” (via bank or cash desk) the employee will receive 10,000-1,300 = 8,700 rubles.

What does the salary consist of? There are two main methods of calculating wages: time-based and piece-rate wages.

Piece wages . The essence of this system, as you guessed, will be the saying, “as you trample, so shall you burst,” namely, as much as you do, so much you receive. For each work performed, there are prices, standards, and indicators. This type of payment is common in agriculture, in production, among those workers who are directly involved in production: plowing, cleaning areas, etc.

Time-based wage system . With such a system, what comes first is not the result of the work done in quantity and quality, but the time spent at the enterprise. It is assumed that there are norms of time per month during which a person must be at the workplace and perform his job duties.

The standard working time per month can be expressed in hours or days.

The time-based labor system is based on the concept of wages. Salary is the base salary amount from which the entire calculation of remuneration begins.

If for a “piece-worker” the basic amount of his salary is prices, norms, indicators, then for a “time-worker” it is salaries.

It follows from a person’s obligation to be at the workplace “standard working hours per month” that the amount of the salary will be equal to its entire amount if the person “worked” all the time during the month. If a person missed work or was unable to go to work, then the full amount of the salary is recalculated in proportion to the days or hours worked.

The salary amount may be based on the number of days worked, or on the number of hours worked. All this is indicated in the employment contract that a person concludes with the company at the time of his employment.

Let’s say a person’s work rate in the month of April is 20 in days and 160 in hours. Let’s say a person’s salary is 10,000 rubles. and accounting system:

By day The man did not go to work for 6 days. Salary = (10000/20) * (20-6) = 7000 rub. Personal income tax = 7000*13% = 910. In hand = 7000 – 910 = 6090 rub.

By the hour The person did not work 12 hours in the current month. Salary = (10000/160)*(160-12) = 9250 rub. Personal income tax = 1203 rub. In hand = 9250 - 1203 = 8047 rub.

In addition to two basic charges (payment based on salary, payment based on piecework) and one personal income tax deduction, various allowances and deductions can be added to the salary.

Supplements are bonuses for something, additional amounts, etc. Allowances have their own calculation formulas. As a rule, this is either a fixed amount or a percentage of the salary.

Deductions are amounts that reduce wages. The most common deductions are alimony, payments under writs of execution, payment of cellular communications from a work phone in excess of the norm (i.e. at one’s own expense), deduction from reporting (the reporting person did not return the money to the cashier), etc.

Goods, finished products

To ship goods and products, a consignment note TORG-12 and transferred to the warehouse to the warehouseman. releases goods based on a power of attorney

If the organization has shipped products or goods and ownership has passed to the buyer, then the fact of sale is reflected in the accounting records with the following entry:

Debit 62 Credit 90.1 - revenue from the sale of products (goods) is reflected. Revenue is reflected together with VAT.

At the same time, it is necessary to reflect the write-off of the cost of goods (products) in the debit of subaccount 90-2 “Cost of sales”, income from the sale of which is recorded in subaccount 90.1.

Debit 90.2 Credit 41 (43,45,20...) - the cost of goods sold is written off.

The organization must charge VAT simultaneously with the sale. She must issue an invoice within five calendar days from the date of shipment of the goods.

Debit 90.3 Credit 68 “Calculations for VAT” - VAT has been charged.

Documentary confirmation

The provision of services is documented. It is recorded in the following accounting forms:

- agreement;

- act on the work performed (with signatures, seals, and other details of the contractor and the customer);

- invoice.

Postings for such transactions depend on the type of service. These include:

- transport;

- rental and storage;

- informational;

- communications;

- housing and communal services;

- KMM maintenance;

- medical;

- working with clients;

- educational and others.

Direct material costs do not include information, legal, auditing and other similar services. Accounting for the provision of services in this case is carried out as follows:

- — DT 90.2 KT 20

In the case of material costs, payments are calculated on the credit of accounts 20, 26, 43. In this case, calculations are carried out taking into account VAT in the amount of 18% of the final cost. To reduce the tax burden on an organization, the following taxation systems should be used: OSNO, UTII, simplified tax system.

Accounting for services provided is carried out only after the actual completion of the work. Income and expenses are taken into account in the process of acceptance of completed work by the customer. Upon completion of the work, a corresponding act is drawn up, which is confirmed by signatures, seals, and other details of the parties. This act is the main supporting document. It can be replaced by an invoice, a copy of the waybill, and various reports.

Legal basis for paid services

The legal basis for the provision of services is based on the concluded contract. In the new edition of the Civil Code of the Russian Federation, a separate chapter 39 is devoted to the contract for the provision of paid services. It regulates the relationship for those services whose result does not have a material expression (communications, information, medical, auditing, veterinary, consulting, training), with the exception of those falling under the scope of the chapters 37-38, 40-41, 44-47, 51.53.

In general, under the contract, the customer undertakes to pay, and the contractor, on the customer’s instructions, must fulfill his obligations. Some types of activities in the service sector are based on special regulations. For example, in the educational industry or in security activities.