Accounting accounts

All accounting accounts used by Russian organizations are presented in a standard Chart of Accounts. This document is approved by the Resolution of the Ministry of Finance of the Russian Federation. Its use is mandatory for all entities carrying out economic activities in the country (with the exception of credit and state budget organizations).

To ensure unity of principles for its use, the Ministry of Finance attaches instructions to the Chart of Accounts. Accounting accounts are divided into several main groups (sections of the chart of accounts). Each of the groups is used to summarize information about a certain category of business transactions carried out by the company as part of a business process. For example, there is a group of accounts that is designed to record information about inventories (raw materials, supplies, spare parts, etc.) or production costs.

General running costs

In every company, many processes occur in parallel with production, and they influence it indirectly. These could be the direct implementation of accounting, the purchase of a chair for the director, the renovation of the building in which the board of directors of the enterprise meets, etc. The costs of providing these processes and similar ones are called general business expenses.

Accounting account 26 is an account that accumulates information about costs for management needs not directly related to production. The recommendations for using the chart of accounts contain an open list of such expenses.

Typical accounting entries

Typical accounting entries reflecting the movement of the designated category of costs are as follows:

1) Dt 26

Kt 10 – write-off of the cost of materials and spare parts used for administrative purposes or for equipment repair;

2) Dt 26

Kt 02 or 05 – accrual of depreciation for fixed assets and intangible assets used for administrative purposes;

3) Dt 26

Kt 70 – calculation of wages for this category of employees;

4) Dt 26

Kt 60 or 76 - write-off of designated costs for maintaining premises;

5) Dt 23

Kt 26 – write-off of designated costs of auxiliary production;

6) Dt 29

Kt 26 – write-off of general production costs of servicing production, etc.

Classification of accounting accounts

Accounting accounts are divided into three main groups: active, passive and active-passive.

In order to understand whether an accounting account is active or passive, it is necessary to define these concepts. Active accounts are intended to account for the company's property (assets), passive accounts are used to collect information about the sources of income (financing) of assets.

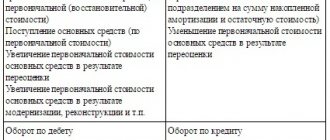

Active-passive are accounts for recording the obligations (debts) of the company and the results of its activities. Any accounting account can be schematically depicted in the form of a table. Accounting scheme

| 26 “General business expenses” | |||||

| Debit | Credit | ||||

| Balance at the beginning | 0,00 | Balance at the beginning | — | ||

| date | Transaction amount | date | Transaction amount | ||

| Total by debit (debit turnover) | 0,00 | Total loan (loan turnover) | 0,00 | ||

| Closing balance | 0,00 | Closing balance | — | ||

The table “Account Chart” shows the active account. He cannot have a credit balance (negative result). A liability account cannot have a debit balance. An active-passive account can have both a debit and a credit balance.

General business expenses, at first glance, cannot be attributed to property or to the sources of its formation. The fact is that expenses collected on account 26 after the end of the reporting period (calendar month) are included in the cost of finished products, which is a company asset. Thus, accounting account 26 is an active account.

Analysis of a practical example

As the results of the reporting period showed, a certain company incurred production costs, the total amount of which amounted to 850,000 rubles, including:

- 350,000 rub. – direct costs of key production;

- 500,000 rub. – costs of auxiliary production.

At the same time, the volume of the category of costs discussed today amounted to 400,000 rubles.

In this example, the accounting entries would look like this:

1) Dt 26

Kt 70, 60, 69.10 and 02 - accounting for general business costs - 400,000 rubles;

2) Dt 20

Kt 26 – transfer of general business expenses to key production – (350,000 / 850,000 * 400,000) 164,706 rubles;

3) Dt 23

Kt 26 - transfer of general business expenses to auxiliary production - (500,000 / 850,000 * 400,000) 235,294 rub.

However, it is quite possible to close account 26 by making the following entry:

1) Dt 90

Kt 26.

In this case, all costs will be included in the cost of the goods produced.

Accounting entries for the debit of account 26

Any business transaction in accounting is reflected in the debit of one account and the credit of another account.

Accountants usually call a posting a record of any fact in the company’s activities. For each account there is a list of typical (most common) transactions. For clarity, information about the main transactions using account 26 is presented in the table below. Account 26 in accounting. Postings

| Debit | Credit | Contents of operation |

| 26 | 02 | Depreciation of fixed assets not used in production has been calculated |

| 05 | Depreciation of intangible assets accrued | |

| 10 | Use of materials for general household needs | |

| 21 | Used semi-finished products produced by our own production for general economic needs | |

| 23 | The costs of auxiliary production are included in general operating expenses | |

| 29 | Included in general operating expenses are the costs of servicing production facilities. | |

| 43 | Use of finished products for general business needs | |

| 60 | Reflects the debt to the supplier of services provided for general business needs | |

| 68 | Accrued taxes and fees included in production costs | |

| 69 | Contributions to the Social Insurance Fund and the Pension Fund of the Russian Federation were accrued for the salaries of employees performing general business work | |

| 70 | Salaries accrued to employees performing general business work | |

| 71 | The amounts of general business expenses incurred by accountable persons are reflected | |

| 76 | Reflects the debt of various creditors for services provided for general business needs | |

| 94 | The amount of shortfalls was written off for general business expenses, in the pre-austic aisles of natural loss | |

| 96 | A reserve has been created for general business expenses | |

| 97 | Deferred expenses are included in general business expenses |

D26k02 wiring what does it mean

Knowing that in 5 years we will lose the machine completely, we need to reflect this “expense” on the financial result, that is, write off the fixed assets as “period expenses”.

The question arises: how to take into account this expense: “immediately, in its entirety” or “in parts”?

If you write off the machine for the entire amount at once, at the time of acceptance of the machine (posting D90 - K.

02), then the financial result in the month of write-off will be negative (200 thousand - 700 thousand = minus 500 thousand).

It will be economically justified to rely on “calculation”.

The concept of depreciation of fixed assets

Also, depreciation accrual stops when an object is disposed of from the enterprise, for example, upon its sale, gratuitous transfer, or obsolescence.

According to the law, accrual begins on the 1st day of the month following the month of commissioning and stops on the 1st day of the month following the month of deregistration.

Depreciation also ceases to be accrued if the object is transferred to conservation for a period of more than three months, or to reconstruction (modernization) for a period of more than twelve months.

In the context of an account, you can maintain analytical accounting by type of material and production assets. Subaccounts can be opened for account 10 “Materials”: 10-1 “Raw materials and materials”; 10-2 “Purchased semi-finished products and components, structures and parts”; 10-3 “Fuel”; 10-4 “Containers and packaging materials”; 10-5 “Spare parts”; 10-9 “Inventory and household supplies”; and others.

It is necessary to have a basis in the form of primary accounting documents.

These are receipts from executive agencies, as well as accompanying statements for the delivery of proceeds to collectors and other accounting registers. The movement of foreign currency funds must be organized separately from other transfer operations. Account 57 is active, which means that any inflow of funds is recorded in debit, and write-off is recorded in credit.

Postings to account 26 - General business expenses

At most industrial enterprises, the main source of non-production expenses is payments to employees of administrative departments and managers.

Operations for the attribution of expenses in this case are reflected in the following entries: When making settlements with counterparties for goods (work, services) received, non-production expenses are reflected in the following entries: General business expenses in correspondence with production accounts are recorded in the following entries: Based on the results of January 2019, expenses of Minotaur LLC, operating in the field of mechanical engineering, amounted to: direct costs of main production 1,413,000 rubles.

Task: reflecting business transactions in accounting accounts

A correctable defect entails the company's expenses for repair work, which the employee will reimburse.

If the defect is irreparable, the amount of compensation for damage consists of the costs of producing defective products minus the benefits received after liquidation.

Payment of expenses due to irreparable defects is made on the basis of the difference in the debit and credit turnover of the account. The identified total amount of losses from defects is recorded in the debit of the account.

Personal income tax Personal income tax is a mandatory payment to the budget, deducted from the amount of remuneration for the employee’s work.

First, let's find out what electrical wiring is anyway? As I have said more than once, at present, we are surrounded by electricity everywhere, and in order for this same electricity to reach the consumer, to the final device, this is why electrical wiring is needed - this is the main part of the entire electrical system.

If you need help with legal references, you have a complex case, and you don’t know how to draw up documents, the MFC unreasonably requires additional papers and certificates, or refuses them altogether, then we offer free legal advice: Zheleznogorsk Introduction Fixed assets in an organization are a special part of the property used as means of labor in production when performing work, providing services and for management purposes.

Accounting for fixed assets in an enterprise, like accounting for cash, wages, and production costs, has several main tasks, the implementation of which contributes to the rationalization of production. Account 02 Depreciation of fixed assets All transactions performed in the company must be taken into account in accounting.

Depreciation is no exception.

The main posting - depreciation of fixed assets calculated will be as follows: D20 - K You can learn the rest of the typical postings related to depreciation from the following article.

An organization purchases an OS for use in the production process. Assets are accepted for accounting at their primary cost. During use, a share of the OS price is written off on manufactured goods.

This means that the price of the property decreases. The procedure for transferring value must be reflected in accounting. This is necessary in order to maintain the accuracy of the log. The depreciation postings for fixed assets when account 02 is in debit will be as follows:. The depreciation postings for fixed assets when account 02 is on credit will be as follows:. Your email will not be published.

Accounting for depreciation of fixed assets Accounting for non-current assets Revaluation of fixed assets in the year Accrual of depreciation of fixed assets in the year Depreciation in accounting.

How to close account 26 The procedure for registering the results of an audit Glavbukh forum of accountants, accounting forum Glavbukh for taxes, accounting, 1C. If anyone can, please check the correspondence of the accounts. I will be very grateful.

A short-term bank loan was credited to the current account - Dt51 Kt66 2. Materials were released from the warehouse: - order 1 Dt Received from the current account to the company's cash desk: - for salaries Dt50 Kt51 - for business expenses Dt50 Kt51 4.

Temporary disability benefits and sanatorium-resort treatment are provided by contributions to the social insurance fund. Contributions are made to the Pension Fund.

To provide citizens with equal opportunities to receive medical care - to the Compulsory Health Insurance Fund. To provide for temporarily unemployed people - into the employment fund.

Dt 20 kt 26 wiring means

What is electrical wiring and what do you eat it with?! Depreciation of fixed assets: postings Evgeniy Sazhin The same entry is made at the time of writing off depreciation, which relates to absolutely damaged or spoiled fixed assets or fixed assets for which a shortage was identified. Writing off depreciation to the credit of account 01 allows you to determine the residual value of the object on it.

D08 k60 wiring what does it mean

Good afternoon Please help, check the correctness of the postings 1 The cost of materials spent on the manufacture of products A is written off 40 d20.1k10 manufacturing products B 20 d20.2k10 for the maintenance of equipment 15 d25k10 for the maintenance of the administrative building 10 d26k10 2 Depreciation has been accrued for production equipment in the main production shops 4 d26k02 the building and inventory of workshop 2 d26k02 for the building and inventory of office 3 d26k02 3 Wages were accrued to workers for the manufacture of products A 30 d20.1k70 to workers, for the manufacture of products B15 d20.2k70 to workers servicing equipment 6 d25k70 to workers servicing the building of workshop 3 d25k70 workers , management staff of the workshop 10 d25k70 plant management building 12 d25k70 administrative and management personnel of the plant 20 d26k70 4 Social security contributions were made. Direct costs for the production of types of products are collected in 20 separate subaccounts. Indirect costs are collected in account 25 and at the end of the month are distributed by type of product in proportion to the basic wages of production workers. Administrative expenses are collected in account 26, distributed by type of product in proportion to the basic wages of production workers and written off to cost of sales. Girls, I just can’t figure out what to do next? How to calculate unknown amounts? Thanks in advance to those who will spend their time helping me!

D26 k70 what does wiring mean?

Do-it-yourself wiring in the apartment. Task: reflecting business transactions in accounting accounts. Write off the cost in proportion to the volume of production.

For the entire useful life of the fixed asset, d. must be issued.

The method chosen by the organization for calculating depreciation for a group of similar fixed assets is fixed in the accounting policy of the organization and is not subject to change during the entire period of its use.

Postings, accounts: If after upgrading the OS will last longer than expected, use a new one instead of the remaining SPI. It will most likely not be possible to write off the entire cost of the object before the end of the joint investment project. Continue depreciation at the same amount until the cost is written off completely.

Find out from technical specialists how long the OS will last after upgrading. By applying bonus depreciation, part of the modernization costs can be written off immediately. In this case, in tax accounting, increase the initial cost of the fixed asset by the costs minus the premium.

SPI after modernization in accounting and tax accounting did not increase.

Since, when calculating profit tax, OHRs reduce the taxable base of Art. With the algorithm for accounting for expenses provided for in Art. The organization's expenses must be documented and justified from an economic point of view. Art.

And erroneous attribution of costs to items can lead to distortion of accounting and tax reporting indicators, which may result in the accrual of tax sanctions under Art.

Accounting for administrative and general expenses that are not directly related to the production process is carried out in the context of cost items: Accrual of depreciation of fixed assets for economic or administrative purposes: Dt 26 Kt Expenses aimed at repairing fixed assets.

OS repairs can be carried out by the company itself, in an economic way, or with the help of specialists from a third-party organization, using a contract method.

According to the Chart of Accounts, equipment requiring installation is accounted for on account 07 “Equipment for installation”. The first 2 entries do not mean the acceptance of a fixed asset for accounting, but the transfer of a fixed asset into operation. The third wiring is completely wrong.

VAT account for acquired assets in correspondence with the fixed assets account?! This transaction should reflect the receipt of equipment from the supplier.

But the fixed asset is not immediately credited to the account. For this, account 08 “Investments in non-current assets” is used, and in your case, since it requires installation, then the account Compile the airplane according to the account. Attribute the accumulated cost of the equipment to the account. After all, you calculated the salary correctly according to the CTU accounts 70, and insurance premiums according to KTU accounts

The same entry is made at the time of writing off depreciation, which relates to absolutely damaged or spoiled items.

Bukhsoft Online, 1C: Account 70 – Payments to personnel for wages When releasing inventories into production and otherwise disposing of them, the valuation of these inventories can be made in one of the following ways: With the FIFO method, a rule is applied: With the LIFO method, another rule is applied: The organization can apply during the reporting year, as an element of the accounting policy, one valuation method for each individual type of group of materials. The forwarder accepts arrived materials at the station or directly from the supplier according to the number of pieces and weight. The accountable person also reflects in the certificate the passport data of the seller of the goods.

Payroll accounting in accounting D26k02 posting what does D26k02 posting mean The value of account 26 in accounting D26 k70 what does posting mean Typical entries for account 70 Retention of amounts for defects Defects, depending on the severity of the defects, are divided into correctable and irreparable. A correctable defect entails the company's expenses for repair work, which the employee will reimburse. Surprising but true!

Source: https://social-it.ru/provodki/d26k02-provodka-chto-oznachaet.php

Accounting entries for loan 26 accounts

Account 26 in accounting. Postings

| 08 | 26 | General business expenses are taken into account as capital construction costs |

| 20 | General business expenses are written off as production expenses | |

| 23 | General business expenses are written off as general production expenses | |

| 28 | General business expenses are included in the cost of correcting defects | |

| 29 | General business expenses are included in overhead costs | |

| 76 | Loss due to insured events written off | |

| 86 | Targeted financing funds written off | |

| 90 | The amount of management costs written off | |

| 97 | General business expenses are included in the costs of developing new products | |

| 99 | General business expenses are included in emergency expenses |

Accounting 26 for dummies: examples and postings

Accounting account 26 is general business expenses or indirect costs, used in almost every enterprise, with the exception of state budgetary and credit organizations. In this article we will look at the main nuances of this account, its properties, typical transactions and examples of use in accounting.

Determination of general business expenses

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Repair and depreciation of non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Other:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Main properties of account 26

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

Typical wiring

Account 26 “General business expenses” corresponds with the following accounts:

Table 1. By debit of account 26:

| Dt | CT | Wiring Description |

| 26 | 02 | Depreciation calculation for non-production fixed assets |

| 26 | 05 | Depreciation calculation for non-production intangible assets |

| 26 | 10 | Write-off of materials, inventory, workwear for general business needs |

| 26 | 16 | Variance in the cost of written-off general business materials |

| 26 | 21 | Write-off of semi-finished products for general business purposes |

| 26 | 20 | Attribution of costs (work, services) of the main production to general economic needs |

| 26 | 23 | Attribution of costs (work, services) of auxiliary production to general economic needs |

| 26 | 29 | Attribution of costs (work, services) of service production to general economic needs |

| 26 | 43 | Write-off of finished products for general business purposes (experiments, research, analyses) |

| 26 | 50 | Decommissioning of postage stamps |

| 26 | 55 | Payment of expenses (minor work, services) from special bank accounts |

| 26 | 60 | Payment for work and services of third parties for general business needs |

| 26 | 68 | Calculation of payments of taxes, fees, penalties |

| 26 | 69 | Deduction for social needs |

| 26 | 70 | Calculation of wages for administrative, managerial and general business personnel |

| 26 | 71 | Accrual of travel expenses, as well as accountable expenses for small general business needs |

| 26 | 76 | General expenses related to other creditors |

| 26 | 79 | General business expenses associated with the organization's divisions on a separate balance sheet |

| 26 | 94 | Write-off of shortages without perpetrators, except for natural disasters |

| 26 | 96 | Assigning general business expenses to the reserve for future expenses and payments |

| 26 | 97 | Write-off of a share of future expenses for general business expenses |

Table 2. For the credit of account 26:

| Dt | CT | Wiring Description |

| 08 | 26 | Attribution of general business expenses to capital construction |

| 10 | 26 | Capitalization of returnable waste and unused materials written off as general business expenses |

| Write-off of general business expenses when closing the month, that is, where account 26 is written off | ||

| 20 | 26 | For main production |

| 21 | 26 | For the production of semi-finished products |

| 29 | 26 | For service production |

| 90.02 | 26 | Performed work and services for third parties |

| 90.08 | 26 | On the cost of sales when using the direct costing method |

Closing 26 accounts

Closing account 26, that is, writing off all general business expenses, is performed in several ways:

- Included in the cost of production through production accounts if products are produced;

- Referred to as cost of sales when providing services or work;

- Referred to the current expenses of the reporting month using the direct costing method:

Important! The write-off method, as well as the basis for the distribution of general business expenses, must be fixed in the accounting policies of the organization.

Write-off as part of the cost of production

In this case, general business expenses are written off in shares, taking into account the distribution base, into production accounts and may remain on product cost accounts (for example, when producing products under account 43 “Finished Products”) or production accounts (for example, work in progress under account 20 “Main Production” ) at the end of the reporting period.

Main types of cost distribution bases:

Get 267 video lessons on 1C for free:

- Revenue

- Product output volume

- Planned cost of production

- Material costs

- Direct costs

- Salary and so on

When closing the month, the following transactions are generated, for example:

| Dt | CT | Wiring Description |

| 20 | 26 | General business expenses for main production were written off |

| 23 | 26 | General business expenses for auxiliary production were written off |

General business expenses are distributed to the cost of production (production accounts) according to the specified distribution and analytical accounting base:

Therefore, general business expenses are written off:

- In full - if one product is produced (no analytics);

- Distributed across all types of products in proportion to the selected base - if several types of products are produced and calculated in the context of analytics.

Example

LLC "Horns and Hooves" produces hats and shoes, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off against the cost of production.

- The distribution base is material costs.

In November 2020, direct expenses amounted to RUB 51,040.00:

- For headwear – RUB 28,020.00. of them:

- Material costs – RUB 15,000.00.

- For the production of shoes - RUB 23,020.00. of them:

- Material costs – RUB 10,000.00.

indirect costs – 18,020 rubles.

- 3/p administrative staff – RUB 10,000.00.

- Insurance premiums – RUB 3,020.00.

- Premises rental – RUB 5,000.00.

According to the distribution base for material costs:

Analytical accounting of general business expenses

One of the most important tasks of accounting is collecting information about business activities and providing it to company departments that are engaged in analyzing such data and developing coordination decisions aimed at improving and increasing the effectiveness of the business process. The goal of solving this problem is to organize the accounting methodology in such a way that the data used is the most correct and complete.

To make data more informative, there is such a direction as analytical accounting. The system of such accounting allows you to group information according to characteristics that are most suitable for a specific vector of commercial activity.

Accounting account 26 is an account that involves grouping data by cost items. They can be material or transportation costs, labor costs, etc. Each company determines the criteria for classifying costs in account 26 for itself.

General and production expenses

Accounting professionals can easily draw a line between the concepts of general production and general business expenses, but to the average person they may seem similar or even equivalent. To collect information about such expenses, accounts 25 and 26 are used in accounting.

General business expenses are expenses that are common to each division of the company. And general production expenses will be expenses that belong only to the production unit of the enterprise. For example, the wages of the legal department of a company are general business expenses, and the wages of the mechanical shop employees who maintain production equipment, main and auxiliary production, must be classified as general production expenses.

Account 26 - General business expenses: typical transactions and account closure

In particular, the following expenses may be reflected in this account: administrative and management expenses; maintenance of general business personnel not related to the production process; depreciation charges and expenses for repairs of fixed assets for management and general economic purposes; rent for general business premises; expenses for payment of information, auditing, consulting, etc. services; other administrative expenses similar in purpose.

General business expenses are reflected in account 26 “General business expenses” from the credit of inventory accounts, settlements with employees for wages, settlements with other organizations (individuals), etc.

Expenses recorded on account 26 “General business expenses” are written off, in particular, to the debit of accounts 20 “Main production”, 23 “Auxiliary production” (if auxiliary production produced products and work and provided services to the outside), 29 “Service production and farms" (if the servicing industries and farms performed work and services outsourced).

These expenses can be written off as semi-fixed expenses to the debit of account 90 “Sales”.

Organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., except for organizations engaged in trading activities), use account 26 “General business expenses” to summarize information on the costs of conducting this activity. These organizations write off the amounts accumulated on account 26 “General business expenses” to the debit of account 90 “Sales”.

Analytical accounting for account 26 “General business expenses” is carried out for each item of the corresponding estimates, place of origin of costs, etc.

Account 26 “General business expenses” corresponds with the accounts:

| by debit | on loan |

| 02 Depreciation of fixed assets 04 Intangible assets 05 Depreciation of intangible assets 10 Materials 16 Deviation in the cost of tangible assets 19 Value added tax on acquired assets 21 Semi-finished products of own production 23 Auxiliary production 29 Service production and facilities 43 Finished products 60 Settlements with suppliers and contractors 68 Settlements for taxes and fees 69 Settlements for social insurance and security 70 Settlements with personnel for wages 71 Settlements with accountable persons 76 Settlements with various debtors and creditors 79 On-farm settlements 94 Shortages and losses from damage to valuables 96 Reserves for future expenses 97 Deferred expenses | 08 Investments in non-current assets 10 Materials 20 Main production 23 Auxiliary production 28 Defects in production 29 Service production and facilities 76 Settlements with various debtors and creditors 79 On-farm settlements 86 Targeted financing 90 Sales 97 Deferred expenses 99 Profits and losses |

Fuel and lubricants include:

- All types of fuel (gas, diesel, gasoline);

- Lubricants (oils, lubricants used in the process of repair, maintenance and operation of vehicles);

- Brake and coolant fluids.

The procedure for writing off fuels and lubricants Oils and lubricants are written off as expenses based on so-called standards. What are these standards and where do you get them?

Practice using 26 accounts

So, you have read a very short excursion into “26 Accounting for Dummies.” The information presented is only a small part of the knowledge that is necessary for the error-free application of 26 counts in practice. In order to consolidate the knowledge, I will give several practical examples.

Accounting account 26 is, for example, the following correspondence:

- D26/K60. Services were provided by a third party to renovate the premises of the commercial department.

- D26/K10. The use of office supplies by office employees is reflected.

- D26/K69. Contributions to the Pension Fund and the Social Insurance Fund were accrued for the salaries of employees of the purchasing department, etc.

How to close account 26

Follow the prompts that the program gives, or contact the developers.

To avoid mistakes, systematically create the turnover sheet and check the accounting card 26.

26 hours “General business expenses” are used in accounting of both production organizations and companies in other industries to summarize information about costs not related to production activities, but intended to support the management process.

Accounting account 26 is a display of funds spent by an enterprise aimed at meeting management and administrative needs not directly related to production. For example, the following information about indirect costs may be reflected here:

- Payments for rented general premises;

- Costs of information and advertising services;

- Provision of business departments;

- Expenses for maintenance and repair of non-production equipment;

- Transfers to the budget of taxes and contributions.

That is, on the account. 26 contains all information about the organization’s expenses of funds that are not directly related to the production process, but are necessary to continue conducting business activities. Cost monitoring allows you to highlight the weakest aspects of the management process and reduce non-production costs.

Enterprises engaged in non-productive activities (with the exception of companies engaged in trade) display on the account information about the funds spent to support this activity. Write-off of incurred costs - to debit 90 “Sales”.

Account 26 in accounting is active, that is, the debit shows the costs incurred, for example, the amount of accrued contributions to the budget for wages in correspondence with the reflection of inventories, wages, etc., (10.70 and others), for a loan - writing off costs to the debit of corresponding accounts (for example, 20 “Main production”).

Attention! In accounting, everything displayed on 26 accounts.